Global eHealth Market By Product Type (Health Information Systems (Population Health Management, Patient Engagement Solution, Electronic Medical Record, and Electronic Health Record), mHealth (Monitoring services, Healthcare Systems Strengthening Services, Diagnosis services, and Others), Telemedicine, E-Prescribing, ePharmacy, and Computerized Physician Order Entry), By End-user (Providers, Payers, and Patients), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 99737

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

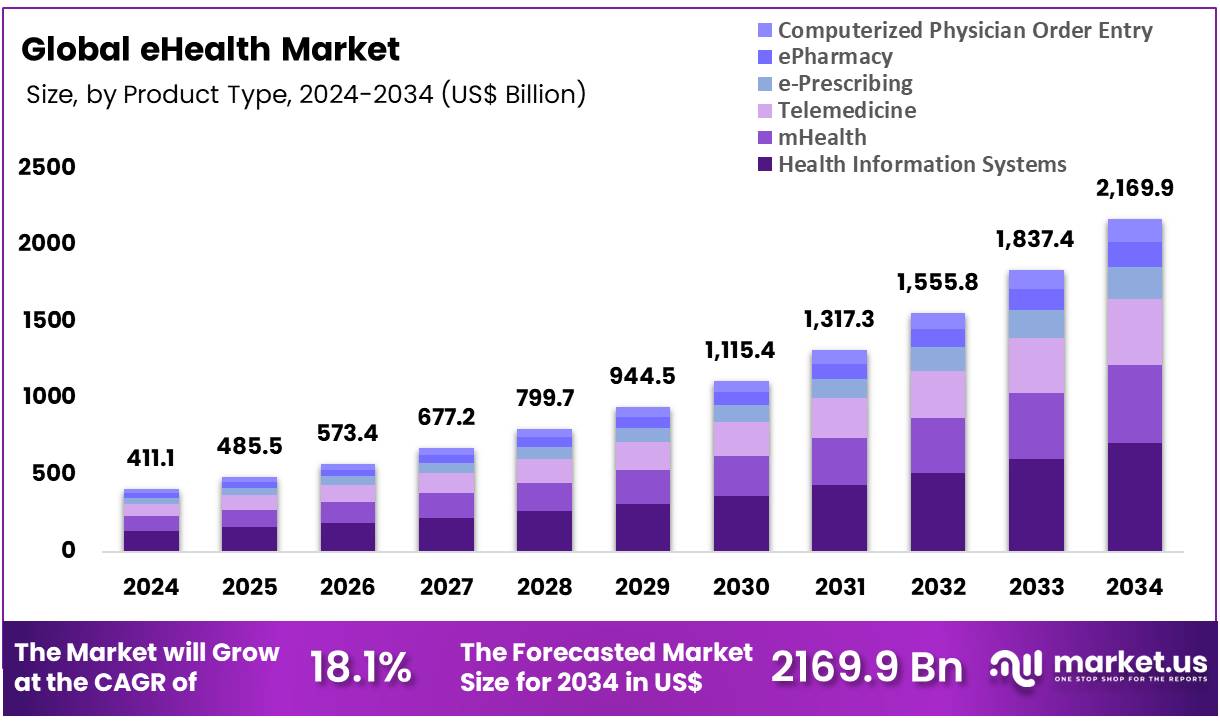

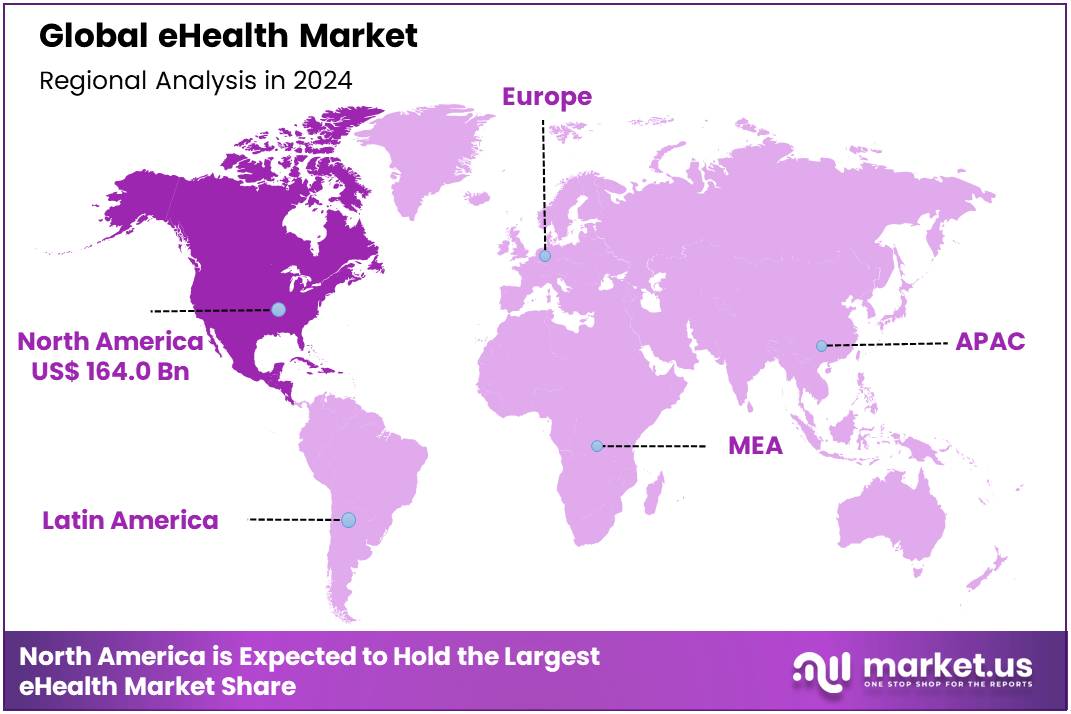

Global eHealth Market size is expected to be worth around US$ 2169.9 Billion by 2034 from US$ 411.1 Billion in 2024, growing at a CAGR of 18.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 164.0 Billion.

Rising consumer demand for personalized and accessible healthcare is a primary driver of the eHealth market. As patients become more engaged in managing their own wellness, they are increasingly turning to digital solutions that offer convenience, real-time data, and direct communication with healthcare providers.

The World Health Organization (WHO) reports that a majority of its member states have adopted a national eHealth strategy, signaling a global movement toward integrating technology into healthcare delivery. This widespread institutional support, combined with the increasing penetration of smartphones and wearable devices, creates a robust environment for eHealth applications that provide everything from telehealth consultations to remote patient monitoring and wellness tracking.

Growing strategic collaborations and technological innovation are shaping key market trends. Major technology and medical companies are partnering to build comprehensive digital health ecosystems that leverage artificial intelligence (AI), big data, and cloud computing.

This is exemplified by the collaborative initiative announced by Samsung Electronics at the Samsung Developer Conference 2023, where they partnered with institutions like the MIT Media Lab and Brigham & Women’s Hospital to develop technologies for improving patient wellness. Furthermore, a 2024 survey found that over 70% of C-suite healthcare executives across five countries prioritize improving operational efficiencies and productivity gains, a goal that eHealth technologies are uniquely positioned to address.

Increasing government support and a focus on interoperability are creating significant opportunities for market expansion. Governments and regulatory bodies are actively promoting the adoption of digital health solutions to improve care delivery and reduce costs. For instance, the US government’s push for electronic health record (EHR) interoperability is enabling a more seamless exchange of patient data between different healthcare systems.

According to a 2024 report from the European Commission, 100% of EU Member States now provide some form of online access for citizens to their health data, a clear sign of progress in digital infrastructure. This emphasis on interconnected systems, along with the rising use of digital tools to manage chronic conditions, ensures that the eHealth market will continue to grow and evolve as a foundational component of modern healthcare.

Key Takeaways

- In 2024, the market for eHealth generated a revenue of US$ 411.1 Billion, with a CAGR of 18.1%, and is expected to reach US$ 2169.9 Billion by the year 2034.

- The product type segment is divided into health information systems, mhealth, telemedicine, e-prescribing, epharmacy, and computerized physician order entry, with health information systems taking the lead in 2023 with a market share of 32.8%.

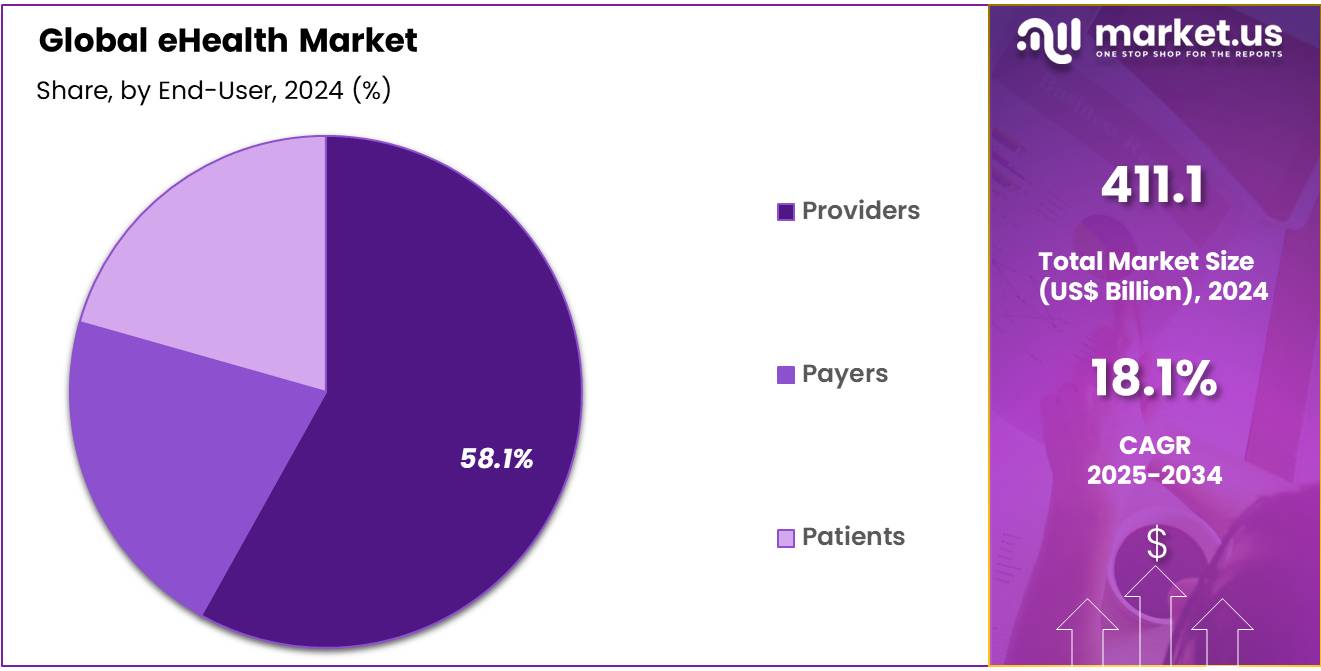

- Considering end-user, the market is divided into providers, payers, and patients. Among these, providers held a significant share of 58.1%.

- North America led the market by securing a market share of 39.9% in 2023.

Product Type Analysis

Health information systems represent the largest product type in the eHealth market, holding a 32.8% share. This growth is largely driven by the increasing adoption of electronic health records (EHR) and electronic medical records (EMR) systems in hospitals and healthcare facilities. These systems streamline patient data management, improve the accuracy of diagnoses, and facilitate better coordination among healthcare providers.

The global push for improving healthcare efficiency, reducing medical errors, and enhancing patient outcomes is expected to sustain the growth of this segment. Government regulations, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act, which incentivizes the adoption of EHR systems, are further bolstering the expansion of health information systems.

Additionally, the growing demand for data-driven healthcare and the integration of artificial intelligence (AI) and big data analytics into health information systems is anticipated to drive the next phase of growth in this market. Healthcare providers are increasingly investing in advanced information systems to meet the rising demands for personalized medicine, patient-centric care, and real-time decision-making, making this segment crucial for the future of the eHealth market.

End-User Analysis

Providers dominate the end-user segment of the eHealth market with a 58.1% share. This dominance is driven by the increasing shift towards digital healthcare solutions among hospitals, clinics, and other healthcare providers. The need for efficient healthcare delivery and improved patient care is expected to propel the adoption of eHealth technologies, including telemedicine, e-prescribing, and health information systems. Providers are increasingly turning to digital tools to manage patient information, facilitate remote consultations, and improve treatment outcomes.

The growing pressure on healthcare systems to reduce costs while improving care quality is likely to lead to further adoption of eHealth technologies. Furthermore, the COVID-19 pandemic significantly accelerated the use of telemedicine and other digital health solutions, pushing providers to expand their eHealth capabilities.

The integration of AI and machine learning into healthcare workflows, along with advances in patient monitoring technologies, is expected to drive growth in this segment. As healthcare providers seek more efficient and accessible ways to deliver care, the demand for eHealth solutions will continue to rise, solidifying the role of providers as key players in the eHealth market.

Key Market Segments

By Product Type

- Health Information Systems

- Population Health Management

- Patient Engagement Solution

- Electronic Medical Record

- Electronic Health Record

- mHealth

- Monitoring services

- Healthcare Systems Strengthening Services

- Diagnosis services

- Others

- Telemedicine

- E-Prescribing

- ePharmacy

- Computerized Physician Order Entry

By End-user

- Providers

- Payers

- Patients

Drivers

The rising consumer demand for convenient and accessible healthcare is driving the market.

The ehealth market is experiencing significant growth, primarily driven by a powerful consumer-led shift toward convenient, on-demand, and easily accessible healthcare services. Patients today expect the same level of digital integration and convenience from their healthcare providers that they receive from other service industries. This demand, combined with the increasing penetration of high-speed internet and the ubiquity of smartphones, makes digital health solutions an ideal way to receive care. The ability to consult with a physician from home, monitor health data remotely, and manage prescriptions digitally addresses a critical need for modern consumers.

According to data from the American Hospital Association (AHA), while telehealth utilization has declined from its pandemic peak, it remains significantly higher than pre-pandemic levels. For instance, in the last quarter of 2023, over 12.6% of Medicare beneficiaries received a telehealth service, demonstrating the sustained adoption and integration of these services into mainstream care. This continued consumer embrace of digital solutions for routine and follow-up care provides a powerful impetus for the market.

Restraints

Data privacy and cybersecurity concerns are restraining the market.

A significant restraint on the market is the ever-present threat of data breaches and the inherent privacy concerns associated with the handling of sensitive patient information. As ehealth solutions become more integrated into the healthcare ecosystem, they create a larger digital footprint of patient data, making them a prime target for cyberattacks. A single breach can expose millions of patient records, leading to financial penalties, legal liabilities, and a devastating loss of consumer trust.

According to a report from the US Department of Health and Human Services (HHS), 2023 set a new record for the number of data breaches, with more than 133 million records exposed. This figure includes a breach that alone affected more than 11 million individuals, the largest single healthcare data breach reported that year. This persistent threat requires companies to invest heavily in robust cybersecurity measures and compliance protocols, which can be a significant cost burden and a deterrent to patient adoption.

Opportunities

The integration of ehealth solutions for chronic disease management is creating growth opportunities.

The market is presented with significant opportunities from the accelerating trend of using ehealth solutions to manage chronic diseases. These long-term conditions, such as diabetes, heart disease, and hypertension, require continuous monitoring and patient engagement, which traditional in-person care models cannot always provide efficiently. Digital tools like remote patient monitoring devices, mobile apps, and telehealth platforms enable patients to track their health metrics from home and share real-time data with their care team. This allows for proactive interventions, personalized care plans, and a higher level of patient accountability.

For instance, the US Centers for Disease Control and Prevention (CDC) reports that approximately six in ten adults in the United States have a chronic disease. This large and growing patient population represents an immense opportunity for ehealth solutions to improve outcomes and reduce healthcare costs by preventing acute episodes and hospitalizations.

Impact of Macroeconomic / Geopolitical Factors

The digital health sector is facing a complex macroeconomic environment and geopolitical risks that directly affect its growth and operations. Venture funding for digital health companies, which reached a peak in recent years, experienced a significant decline, reflecting broader investor caution. Furthermore, geopolitical tensions are complicating international operations, as many countries are implementing data localization policies that can increase infrastructure costs for companies operating across borders. Despite these challenges, the market’s long-term outlook remains positive, driven by strong government and international support.

The World Health Organization (WHO), for example, is actively supporting member states with digital health strategies, and in the US, the Federal Communications Commission (FCC) provides over $500 million annually to its Rural Health Care Program, which helps provide telehealth services to underserved areas. This continued public sector commitment ensures the industry’s sustained growth and the expansion of its reach to new populations.

Latest Trends

The adoption of AI and machine learning for predictive analytics is a recent trend.

A significant trend in 2024 is the rapid integration of artificial intelligence (AI) and machine learning (ML) into ehealth solutions for predictive analytics and personalized health insights. These advanced algorithms can analyze vast datasets from electronic health records, wearable devices, and patient-reported outcomes to identify patterns, predict disease progression, and recommend personalized interventions. This technology moves ehealth beyond simple data collection and into a proactive, preventative model of care.

According to data from the American Medical Association (AMA), the use of health AI by physicians has seen a substantial increase. A late 2024 survey showed that nearly two-thirds of physicians, 66%, reported using health AI in their practice, marking a 78% jump from the 38% of physicians who said they used it in 2023. This trend signifies a major shift toward using technology not just for convenience, but for enhancing clinical decision-making and patient outcomes.

Regional Analysis

North America is leading the eHealth Market

The North American eHealth market held a dominant 39.9% share of the global market in 2024. This leadership is a direct result of the region’s sophisticated digital infrastructure, favorable regulatory policies, and a high consumer adoption rate of technology in daily life. The US government, through agencies like the Department of Health and Human Services (HHS), has been a key driver, actively promoting and expanding telehealth services. This is evidenced by the sustained high usage of telehealth services for Medicare beneficiaries, a trend that began during the pandemic.

Data from the Office of the Assistant Secretary for Planning and Evaluation (ASPE) indicates that in late 2023, over 12.6% of Medicare beneficiaries received a telehealth service, demonstrating a strong, ongoing preference for virtual care. This robust ecosystem of supportive policies and consumer readiness for digital health tools, particularly for remote patient monitoring and telemedicine, solidifies North America’s position as a market leader.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific eHealth market is anticipated to experience the fastest growth during the forecast period. This is largely a result of rapidly improving digital infrastructure, a vast and aging population, and significant government initiatives aimed at expanding healthcare access through technology. Countries like India and China are at the forefront of this digital transformation. The World Health Organization (WHO) has highlighted the substantial burden of noncommunicable diseases in the region, which is driving the need for more efficient and cost-effective healthcare delivery.

Furthermore, governments across the region are proactively investing in eHealth infrastructure. For instance, in 2024, China’s total expenditure on research and development (R&D) exceeded 3.6 trillion yuan, a portion of which is dedicated to health technology. Similarly, India’s Ayushman Bharat Digital Mission is actively creating a digital health ecosystem to connect patients and providers nationwide, demonstrating a clear commitment to leveraging technology for public health.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the ehealth market are primarily driving growth through the strategic integration of advanced technologies, such as artificial intelligence and machine learning, to improve data analytics and patient care. They are also heavily engaged in strategic collaborations, mergers, and acquisitions to expand their portfolios and gain access to new therapeutic areas and market segments.

Companies are further focusing on developing comprehensive, scalable platforms that can be easily adopted by a wide range of healthcare providers, from large hospital systems to individual clinics. This combination of innovation and business development is crucial for maintaining a competitive edge.

ICON plc, a leading global contract research organization, has solidified its position in the market by providing a full suite of services that support the entire drug development lifecycle. The company offers specialized imaging services through its dedicated business unit, which leverages a global network of imaging experts, advanced technology, and streamlined processes to support clinical trials across various therapeutic areas.

ICON’s strategy involves continuously investing in its technology platform and acquiring companies that complement its service offerings, enabling them to provide a seamless and comprehensive service to pharmaceutical and biotechnology clients worldwide. The company’s focus on operational excellence and end-to-end solutions makes it a key partner for many of the world’s largest and most innovative life science companies.

Top Key Players

- ZS

- Veradigm LLC

- Telecare Corporation

- Set Point Medical

- Medtronic

- Medisafe

- iCliniq

- IBM

- Fujitsu

- Epocrates

- Eli Lilly

- American Well

Recent Developments

- In January 2024, Eli Lilly launched LillyDirect, a digital platform aimed at making it easier for patients to access treatments for conditions like obesity, diabetes, and migraine. The service connects patients with telehealth providers and offers educational resources, reducing administrative barriers and simplifying the process of obtaining prescriptions.

- In October 2023, ZS unveiled its ZAIDYN Connected Health platform, which harnesses artificial intelligence to help healthcare organizations, pharmaceutical companies, and insurers identify unmet needs, enhance patient engagement, and drive better clinical outcomes through actionable data insights.

- In March 2023, Fujitsu introduced a secure cloud platform to centralize and manage healthcare data, supporting organizations in their digital transformation efforts. Under its Uvance “Healthy Living” program, the platform standardizes electronic medical records into HL7 FHIR formats, ensuring smooth integration and efficient management of health data across systems.

Report Scope

Report Features Description Market Value (2024) US$ 411.1 Billion Forecast Revenue (2034) US$ 2169.9 Billion CAGR (2025-2034) 18.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Health Information Systems (Population Health Management, Patient Engagement Solution, Electronic Medical Record, and Electronic Health Record), mHealth (Monitoring services, Healthcare Systems Strengthening Services, Diagnosis services, and Others), Telemedicine, E-Prescribing, ePharmacy, and Computerized Physician Order Entry), By End-user (Providers, Payers, and Patients) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ZS , Veradigm LLC, Telecare Corporation, Set Point Medical, Medtronic, Medisafe, iCliniq, IBM, Fujitsu, Epocrates, Eli Lilly , American Well. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ZS

- Veradigm LLC

- Telecare Corporation

- Set Point Medical

- Medtronic

- Medisafe

- iCliniq

- IBM

- Fujitsu

- Epocrates

- Eli Lilly

- American Well