Global Educational Technology (EdTech) Animation Market Size, Share, Industry Analysis Report By Animation Type (2D Animation, 3D Animation, Mixed Media Animation), By Delivery Mode (On-demand Learning, Live Classroom Sessions, Hybrid Learning), By Application (K-12 Education, Higher Education, Corporate Training, Others (Government and Public Sector, etc.)), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160907

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Technology Adoption Statistics

- Engagement and Effectiveness Statistics

- Usage and Challenges

- Quick Market Overview

- Role of Generative AI

- US Market Size

- By Animation Type

- By Delivery Mode

- By Application

- Emerging Trends

- Growth Factors

- Benefits of Market

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

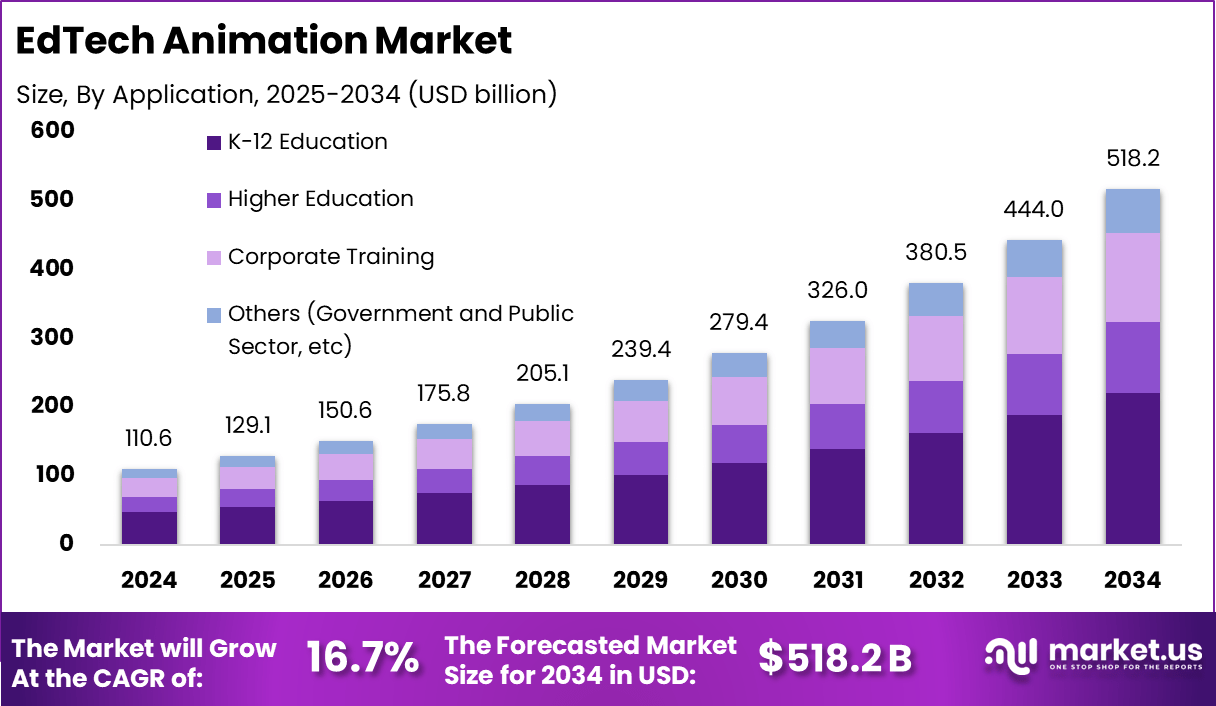

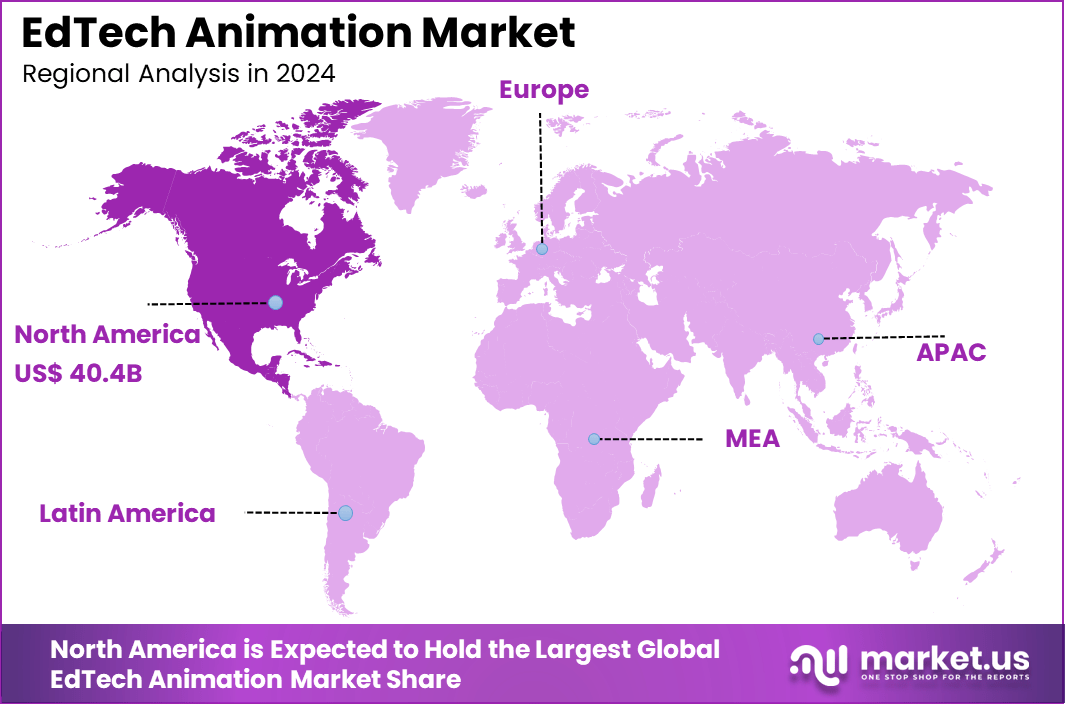

The Global Educational Technology (EdTech) Animation Market generated USD 110.6 billion in 2024 and is predicted to register growth from USD 129.1 billion in 2025 to about USD 518.2 billion by 2034, recording a CAGR of 16.7% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.6% share, holding USD 40.4 Billion revenue.

The Educational Technology (EdTech) Animation Market is experiencing significant growth, driven by the increasing integration of animated content in educational settings. Among the various applications of animation in education, animated educational videos have emerged as the leading segment, particularly in K–12 education.

Around 64% of schools worldwide have either introduced new technologies or upgraded existing ones to include animated content, showing widespread integration of this tool into classrooms and online learning environments. Several factors are contributing to the expansion of the EdTech animation market. The integration of mobile-friendly educational animations has become standard, as learners increasingly access content on various devices.

The main reasons this market is growing include its proven ability to improve learning performance, especially for students who struggle with traditional teaching methods. Studies show that animations can enhance understanding significantly, with an impact factor of 0.7 for learners without prior knowledge of a subject. Advances in technology such as virtual reality and augmented reality make lessons more interactive, leading to retention rates that can be as much as 75% higher compared to classic teaching tools.

According to exploding topics, Corporate EdTech is valued at $27.5 billion. Since 2020, EdTech use in K-12 schools has risen by 99%. Over 70% of colleges plan to start at least one online undergraduate program within three years. Digital learning is the leading strategy for corporate skill development. Since the rise of digital education, demand for educational animation has grown sharply.

Short, focused animations that last only a few minutes have become popular for capturing and holding attention. Educators have reported that lessons featuring animated content boost comprehension by up to 58%, especially in subjects that require visualizing complex ideas. This trend is not limited to schools but extends into higher education and corporate training, showing broad appeal across learning levels.

Top Market Takeaways

- By animation type, 3D animation dominates with 54.6%, driven by immersive and interactive learning experiences.

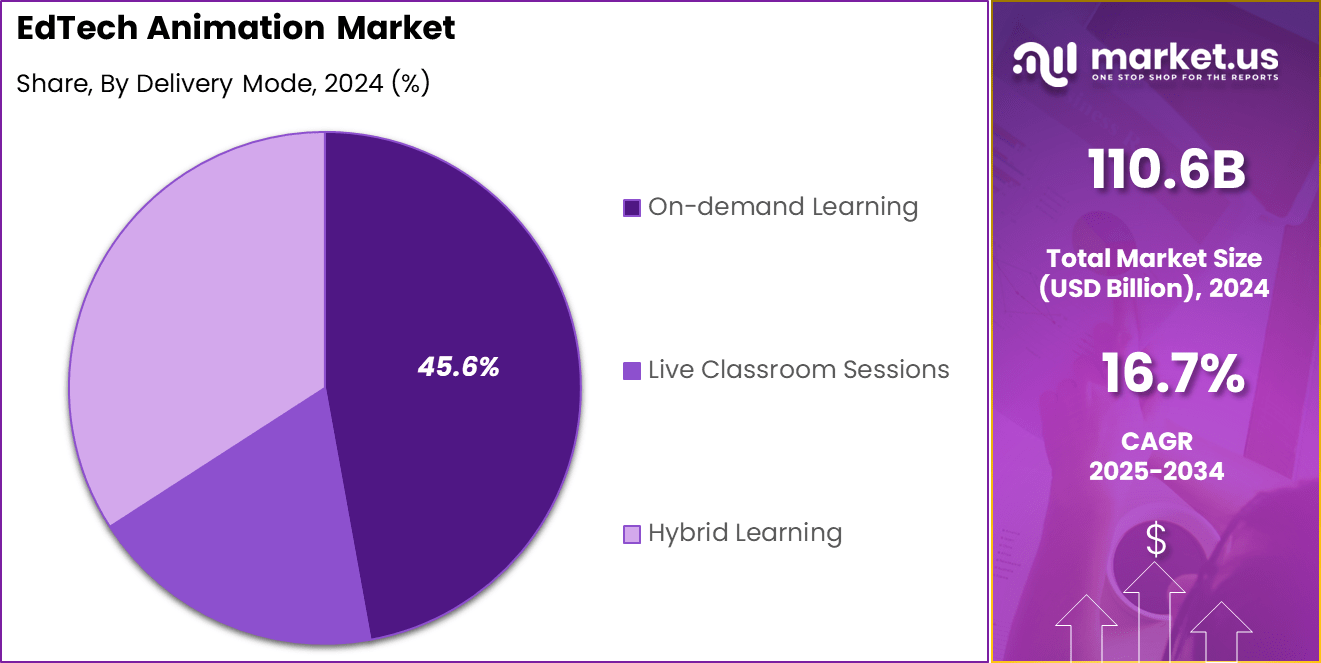

- By delivery mode, on-demand learning accounts for 45.6%, reflecting the growing preference for flexible, self-paced education.

- By application, K-12 education leads with 42.6%, highlighting the strong adoption of animated learning tools in schools.

- North America contributes 36.6%, supported by advanced EdTech infrastructure and early integration of digital content.

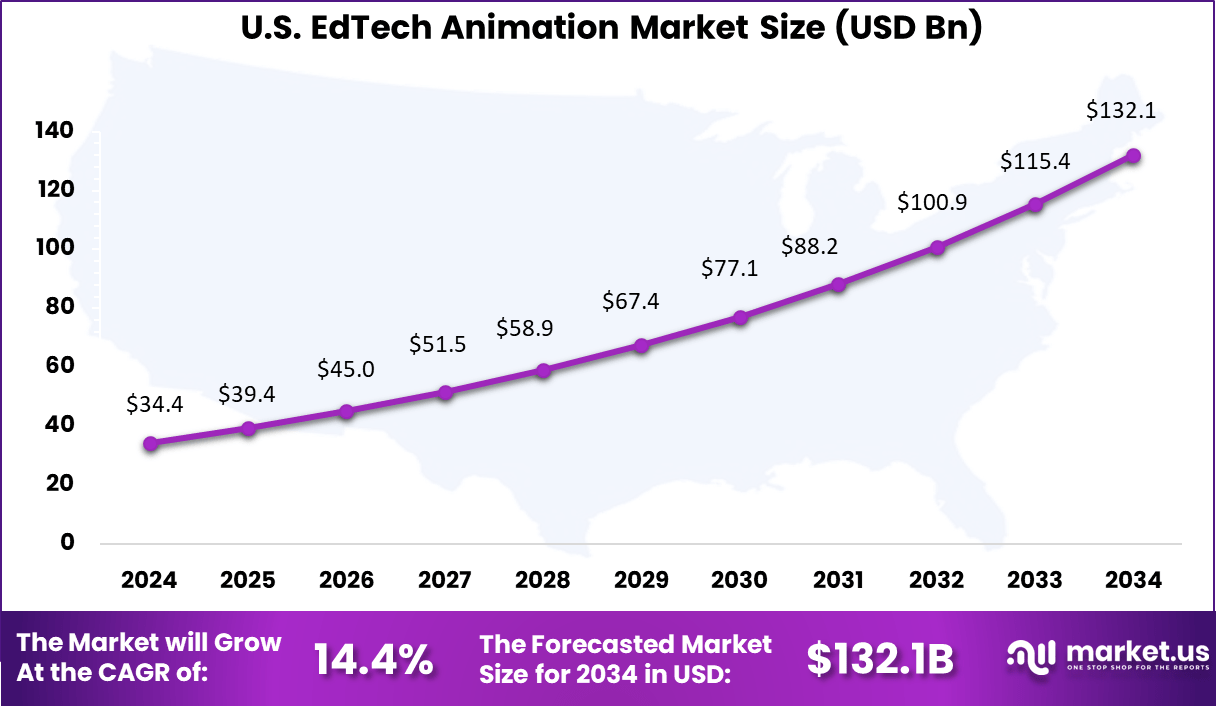

- The US market reached USD 34.40 billion and is expanding at a steady CAGR of 14.4%, underscoring its leadership in deploying animation for digital education.

Technology Adoption Statistics

- Video content: Video-based materials hold over 40% market share in the digital education content market (2024), reflecting strong demand for visual and interactive learning tools.

- Artificial Intelligence (AI): In 2024, teachers reported multiple benefits from AI integration:

- 42% saved time on administrative tasks.

- 25% improved personalized learning delivery.

- 18% achieved higher student engagement.

- VR/AR in education: The global AR/VR in education market is projected to reach $28.05 billion by 2032. A 2022 McGraw-Hill survey found that 86% of educators identified improved student engagement as the top benefit of AR adoption.

Engagement and Effectiveness Statistics

- Learner retention: EdTech platforms enhance information retention by 25%-40%, compared to traditional methods. Research also shows that learners forget nearly 70% of new material within 24 hours under traditional training, while animation-based storytelling improves retention by simplifying complex ideas.

- Gamification engagement: Around 84% of learners report higher engagement when using gamified EdTech solutions. The gamification in education market is forecasted to reach $40.8 billion by 2035, demonstrating long-term demand for interactive, game-based learning models.

Usage and Challenges

- Teacher adoption: Around 79% of teachers report using EdTech tools daily. However, regional gaps exist – such as in the UK, where many educators feel undertrained in technology use.

- Interoperability issues: A 2024 U.S. survey found that 68% of teachers believe their Learning Management Systems (LMS) lack proper integration with other learning apps, leading to disrupted instruction.

- Bridging the digital divide: While EdTech broadens access, challenges persist. Affordability, limited internet availability, and weak digital infrastructure continue to hinder adoption in rural and low-income regions.

Quick Market Overview

The increasing use of several technologies supports the rapid adoption of educational animation. Technologies like 3D animation and motion capture make the content visually rich and realistic without demanding costly setups. Artificial intelligence also helps produce customized animated content faster. The rise of affordable smartphones and faster internet, growing over 13% annually in developing regions, allows more learners to access animations anywhere.

Education providers and businesses prefer animated content because it provides clear benefits. Animation caters to different learning styles, making lessons accessible to a wider range of students. It also helps improve academic outcomes and reduces gaps in understanding among learners. For businesses, animated training material is flexible and scalable, offering a cost-effective way to train large groups consistently while keeping learners engaged.

Investment in educational animation remains strong despite some market adjustments. In countries like India, after facing funding dips, investments surged by 96% in early 2024, reflecting renewed confidence. Most financial support focuses on platforms that offer mobile-friendly, curriculum-aligned animation content, particularly in STEM subjects and skill development areas where animated lessons are highly effective.

Organizations adopting animated educational tools report several gains, including better learner engagement, improved knowledge retention, and enhanced reputation for innovation. Animated content reduces costs related to traditional training methods such as travel and facilities. Short, animated learning modules help professionals retain information better by over 50%, making training more efficient and accessible.

Role of Generative AI

Educational technology animation is reshaping learning by making lessons more visual and engaging. Generative AI has become a key factor in this transformation, with around 58% of university instructors using it daily to create personalized learning paths and assist students in understanding complex topics.

These AI tools not only generate content but also adapt animations in real-time, responding to student interactions and emotions to create a more immersive and effective learning experience. The human touch in this technology comes from the enhanced storytelling it enables, making lessons feel less mechanical and more relatable to learners of all ages.

US Market Size

In the US, the EdTech animation sector stands out with a 14.4% CAGR. Up to 91.6% of North American EdTech adoption takes place in the country, led by strong investments in AI, AR/VR learning platforms, and cloud-based animation resources. Experts have documented dramatic improvements in both student retention and engagement as online programs, school curriculums, and professional training centers integrate animated content.

On-demand and adaptive systems have become the norm in US classrooms, where 81.6% of EdTech spending is focused on K-12 education. With greater funding and technology literacy, American institutions continue to push the boundaries of animated education, cementing the US as a leader in the sector.

In 2024, North America leads the EdTech animation market with 36.6% share, reflecting the region’s robust digital infrastructure and strong investments in learning technologies. The market’s growth has benefited from wide adoption in education, corporate training, and medical visualization.

US-based platforms and experts have driven standards, piloting adaptive animation technologies and content personalization at scale. School districts and universities throughout the region prioritize visual storytelling and interactive education, with 80% of institutions deploying a mix of new and traditional resources to maximize learning outcomes.

By Animation Type

In 2024, 3D animation is at the forefront of the educational technology animation market, with 54.6% share. What makes 3D animation essential is its ability to immerse learners in visually rich environments, helping explain complex concepts with more clarity than traditional methods.

Schools and educational platforms continue to choose 3D formats because studies show up to a 35% increase in comprehension in STEM subjects when animated visualizations are used. Demand for 3D animators is also rising, fueled by technological advances that enable responsive and lifelike experiences for both teachers and learners.

Adoption is gaining momentum in higher education and professional training, where hands-on demonstrations and realistic simulations promote retention and skill development. Many educators have reported a 42% improvement in information retention when using managed animations, especially for hard-to-grasp scientific concepts.

By Delivery Mode

In 2024, On-demand learning occupies 45.6% of delivery modes in the EdTech animation market. Learners, teachers, and institutions favor on-demand access because it lets users study at their own pace and revisit content as needed.

Recent research shows that 64% of schools have adopted either new or hybrid technologies to support these flexible approaches, underscoring the rising popularity of on-demand platforms. These solutions also drive higher engagement – student interaction increases by 67% when they can control playback and access tailored microlearning animations.

The market’s shift to mobile-friendly and adaptive learning tools means that students increasingly rely on on-demand animated content at home, school, or on the go. Data confirms that users retain up to 40% more information when given the freedom to engage with animated modules on their own schedule. As a result, on-demand animated learning is becoming the favored method for K-12, universities, and continuing education alike.

By Application

In 2024, K-12 education makes up 42.6% of EdTech animation use. This segment has benefited from enormous investments aimed at closing learning gaps and building foundational skills. Over 70% of K-12 schools globally now integrate animated content in subjects ranging from science to social studies.

Interactive animations have proven especially powerful for primary and secondary students: mathematics comprehension alone can rise by 35% with animated content. Teachers report that animated videos and games increase both mastery and engagement, with assessment scores improving by 15-30% across diverse subjects.

Emerging Trends

Emerging trends in educational animation emphasize customization and inclusivity. AI-powered animation tools have grown more accessible, enabling educators with limited technical skills to develop visually rich educational content.

Markerless motion capture and virtual reality integration are making educational animations more realistic and interactive, with immersive learning environments becoming a norm in many institutions. Around 64% of schools have upgraded their technology to include such tools, reflecting a growing preference for animated content as a way to convey complex concepts simply and memorably.

Growth Factors

Growth in EdTech animation is propelled mainly by the rising need for flexible, personalized, and engaging education. Technology adoption in this sector is increasing at double-digit rates, fueled by advancements that reduce production time and costs without compromising quality.

Students taught with animations show notably better retention and understanding, with effectiveness measures reaching around 0.7 effect size for those with lower prior knowledge. These benefits encourage wider use of animation as an essential learning medium. Furthermore, the corporate and healthcare sectors also drive demand for animated content, applying it to training and patient education with significant increases in adoption.

Government-led investments play a critical role in advancing EdTech animation. Many governments have boosted funding to improve digital infrastructure in schools, including smart classrooms and high-speed internet access. These investments aim to close technological gaps and ensure broader access to digital learning resources.

For example, initiatives provide grants and tax incentives to support the development of AI-enabled educational tools, fostering innovation in personalized learning. These efforts also emphasize skill development aligned with future industry needs to prepare students better for evolving job markets. The focus on research and innovation further supports the creation of advanced technologies like quantum computing and biotechnology applications in education.

Benefits of Market

- Enhanced Engagement & Retention: Animated content significantly improves student focus, comprehension, and knowledge retention. Advances in interactive and dynamic animation further strengthen learning outcomes.

- Personalized & Accessible Education: With the integration of AI and cloud platforms, learners can access customized pathways and a wider range of educational resources, ensuring inclusivity and accessibility.

- Increased Efficiency: AI-driven automation accelerates the creation of high-quality animations, reducing production costs and making animated educational content more widely available.

- Innovative Storytelling: VR, AR, and advanced rendering technologies introduce immersive storytelling methods that capture emotional and intellectual engagement, making lessons more impactful.

Key Market Segments

By Animation Type

- 2D Animation

- 3D Animation

- Mixed Media Animation

By Delivery Mode

- On-demand Learning

- Live Classroom Sessions

- Hybrid Learning

By Application

- K-12 Education

- Higher Education

- Corporate Training

- Others (Government and Public Sector, etc)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand for Immersive Learning Experiences

The demand for immersive and engaging learning experiences is a powerful driver for EdTech animation. Modern learners, especially students, prefer interactive and visually stimulating content instead of traditional methods. Technologies such as virtual reality (VR), augmented reality (AR), and 3D animation help make complex topics easier to understand and retain.

For example, animated lessons provide vivid visual explanations of abstract scientific concepts, which increases student engagement and learning effectiveness. This shift towards immersive education has encouraged e-learning providers to integrate animated content as a core element of their offerings.

The use of animation facilitates multi-sensory learning by combining visuals, movement, and sound. Many educational institutions and corporate training programs now rely on animated content to improve learning outcomes, making educational animation an essential and growing market segment worth billions globally.

Restraint

High Production Costs and Complexity

One significant restraint holding back the widespread adoption of educational animation is the high production cost and complexity involved. Creating quality animated content requires considerable investment in skilled animators, sophisticated software, and equipment.

Typically, a short educational animation can cost thousands of dollars, putting it out of reach for many schools and smaller educational businesses with tighter budgets. Moreover, the complexity of advanced animation tools creates a steep learning curve for educators and content developers.

Not everyone has the technical expertise to produce or customize animations, requiring additional training and resources which add to costs and slow adoption. This, combined with budget constraints across many education systems, particularly in developing regions, limits rapid integration of animated learning.

Opportunity

Expansion in Emerging Markets and Mobile Learning

An exciting opportunity for EdTech animation lies in expanding to emerging markets, especially in Asia, Africa, and Latin America. These regions are experiencing faster internet penetration and mobile device adoption than developed economies.

Mobile learning platforms, combined with bite-sized animated lessons, are opening access to quality education for millions who previously faced barriers like limited infrastructure or literacy challenges. Animated content effectively bridges language and literacy gaps by making learning more visual and intuitive.

This creates a growing demand for localized educational animations tailored to diverse cultural and linguistic communities. Consequently, EdTech companies that develop mobile-optimized, accessible animated content can capture large untapped markets and drive significant growth in educational technology adoption worldwide.

Challenge

Resistance to Adoption and Integration

Despite the benefits, a key challenge for educational animation is resistance from institutions and educators in adopting and integrating new technology. Some educators remain skeptical about animation’s educational value, often viewing it as entertainment rather than a serious instructional tool. Additionally, integrating animations smoothly into existing curricula can be difficult due to lack of standards or alignment with educational frameworks.

Furthermore, some schools face technical limitations such as insufficient hardware or unreliable internet connection, particularly in rural or underfunded areas, hampering the use of animated content. To overcome this challenge, animation providers need to demonstrate clear, measurable learning improvements and provide easy-to-use solutions compatible with diverse learning environments.

Competitive Analysis

The EdTech Animation Market is driven by prominent digital learning platforms such as BYJU’S, Coursera Inc., Chegg, Inc., and upGrad Education Private Limited. These companies integrate animated content into online courses to enhance engagement, simplify complex concepts, and support interactive learning. BYJU’S and upGrad focus on localized, curriculum-aligned animation, while Coursera and Chegg emphasize professional upskilling and academic learning.

Global technology and platform providers including Google LLC, Microsoft, Blackboard Inc., and edX LLC contribute with cloud-based animation tools, virtual classrooms, and AI-assisted learning features. Their solutions support hybrid education models, enabling schools, universities, and corporate learners to access high-quality animated content across devices.

Specialized and regional players such as Design Barn Inc., Edutech, Instructure, Inc., and Udacity, Inc. focus on gamified learning, interactive modules, and skill-based animation content. Their offerings enhance student engagement, knowledge retention, and experiential learning. A growing number of other participants continue to expand the market with creative content, multilingual support, and immersive animation experiences.

Top Key Players in the Market

- Design Barn Inc.

- BYJU’S

- Blackboard Inc.

- Chegg, Inc.

- Coursera Inc.

- Edutech

- edX LLC

- Google LLC

- Instructure, Inc.

- Microsoft

- Udacity, Inc.

- upGrad Education Private Limited

- Others

Recent Developments

- In September 2025, Coursera announced multiple AI-powered innovations at its Coursera Connect annual event. Key launches included “Role Play,” an interactive AI-driven skill-building activity for real-world job scenarios; expansion of “Course Builder,” an AI tool for scalable course creation; AI-graded questions for efficient assessment; and AI-powered peer review to boost learner motivation and feedback quality.

- In June 2025, BYJU’S experienced financial distress, leading to the sale of US assets Epic and Tynker amid bankruptcy proceedings. Epic was sold for $95 million and Tynker for $2.2 million, both at heavy losses compared to their prior acquisition costs. Despite this, BYJU’S announced plans for a strategic relaunch called “Byju’s 3.0” to recover and innovate.

- In June 2025, Udacity released several new free courses aimed at career advancement in emerging technologies including Generative AI, Machine Learning, Data Science Interview Prep, and Virtual Reality Interview Preparation. These courses are designed to upskill learners rapidly and increase employability in tech domains.

- In March 2025, Microsoft launched several new education-focused products including Project Spark and Copilot+ PCs, enhancing AI-powered personalized learning. Features such as Copilot Agents, advanced Learning Accelerators like Math Progress, and an improved Reading Coach were introduced to improve student engagement and educator productivity globally.

Report Scope

Report Features Description Market Value (2024) USD 110.6 Bn Forecast Revenue (2034) USD 518.2 Bn CAGR(2025-2034) 16.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Animation Type (2D Animation, 3D Animation, Mixed Media Animation), By Delivery Mode (On-demand Learning, Live Classroom Sessions, Hybrid Learning), By Application (K-12 Education, Higher Education, Corporate Training, Others (Government and Public Sector, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Design Barn Inc., BYJU’S, Blackboard Inc., Chegg, Inc., Coursera Inc., Edutech, edX LLC, Google LLC, Instructure, Inc., Microsoft, Udacity, Inc., upGrad Education Private Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Design Barn Inc.

- BYJU'S

- Blackboard Inc.

- Chegg, Inc.

- Coursera Inc.

- Edutech

- edX LLC

- Google LLC

- Instructure, Inc.

- Microsoft

- Udacity, Inc.

- upGrad Education Private Limited

- Others