Global eDiscovery Market By Offerings (By Services (Document Processing and Administrative Support, Shared Services, and Others), Solutions (Forensics and Collections, Processing and Hosting, Data Analytics and others)), By Organization Size (Large Enterprise and SMEs), By Deployment Mode (On-Premise, Cloud-Based), By End Use Vertical (Government and Public Sector, Legal, BFSI, Media and Entertainment, Healthcare and Life Sciences, Retail and Consumer Goods, IT and Telecommunications, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2025

- Report ID: 20436

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

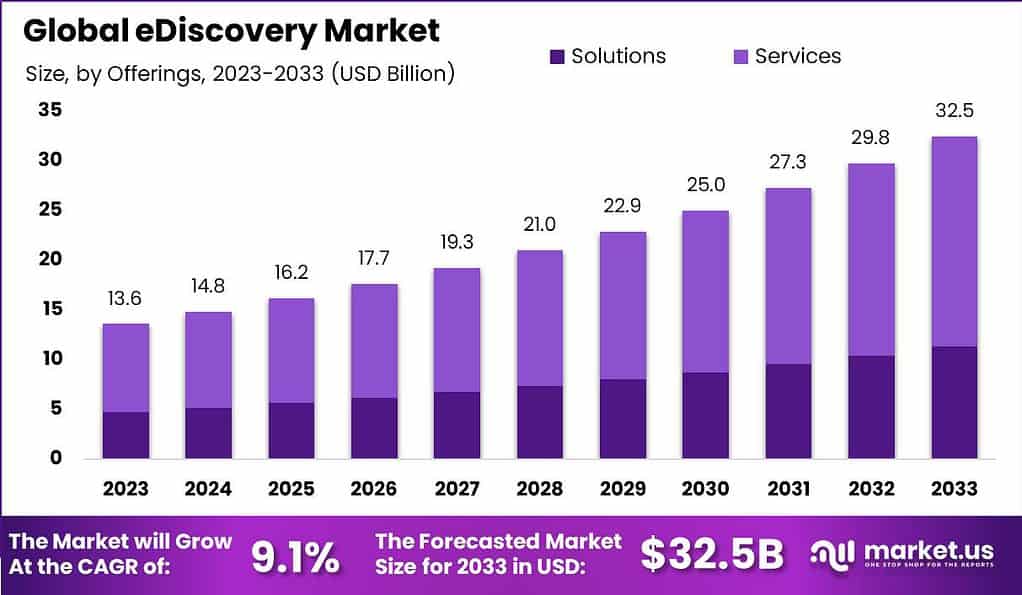

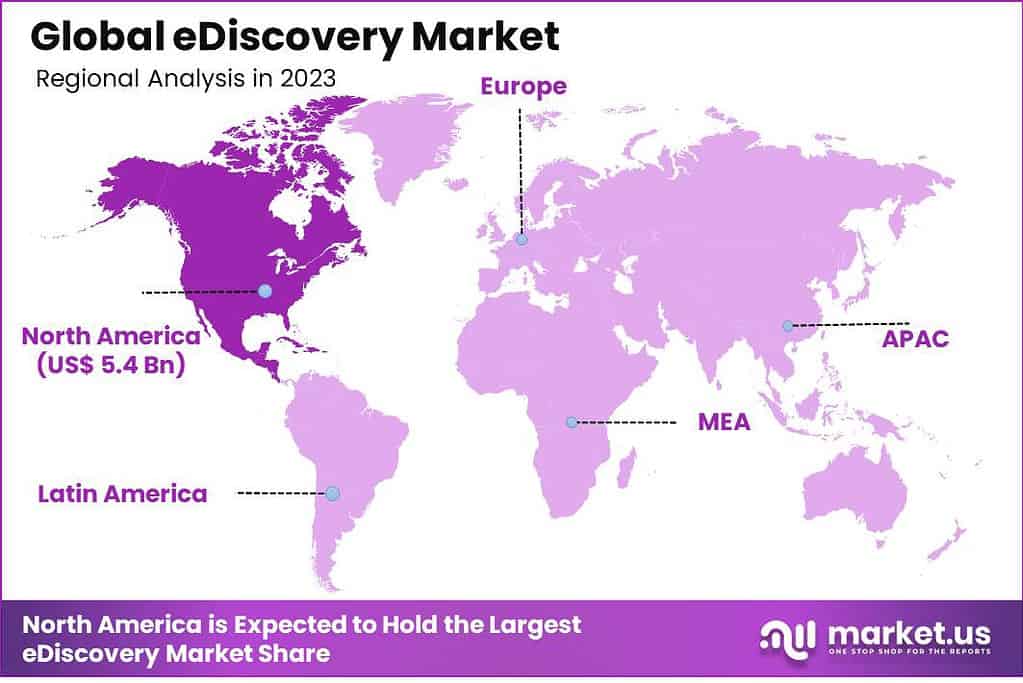

The Global eDiscovery Market size is expected to be worth around USD 32.5 Billion By 2033, from USD 14.8 billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.9% share, holding USD 5.4 Billion revenue.

The global eDiscovery market is experiencing significant growth, driven by the increasing complexity of digital data and the need for efficient legal and compliance solutions. Several factors are propelling the demand for eDiscovery solutions. The exponential growth of electronically stored information (ESI), coupled with stringent legal and regulatory requirements, has necessitated the adoption of advanced tools for data collection and analysis.

Technological advancements play a crucial role in the adoption of eDiscovery tools. The integration of artificial intelligence (AI) and machine learning (ML) into eDiscovery processes has enhanced the ability to sift through large datasets, identify relevant information, and streamline legal workflows. These technologies not only improve accuracy but also significantly reduce the time and costs associated with traditional discovery methods.

As per the RAND Corporation, most Fortune 1000 companies currently allocate between USD 5 million and USD 10 million per year for e-discovery expenses. Furthermore, projections suggest that annual data creation and replication will soar to around 50 zettabytes (equivalent to 50 trillion gigabytes) by 2020, amplifying the demand for e-discovery solutions.

According to research conducted by Deloitte, it is anticipated that by the end of 2024, more than 70% of eDiscovery projects will make use of technology-assisted review (TAR) tools. This signifies a substantial reliance on advanced technology to facilitate the review and analysis of electronic documents for legal processes.

Furthermore, a study by Exterro has highlighted that by 2024, it is estimated that over 75% of law firms will have implemented a bring-your-own-device (BYOD) policy specifically for eDiscovery purposes. This trend underscores the legal industry’s shift towards more flexible and technology-driven approaches to work, allowing professionals to use their personal devices for official purposes.

In addition, research conducted by Relativity points out that by the end of 2024, over 70% of eDiscovery projects are projected to involve data from cloud-based applications and storage systems. The growing reliance on cloud technologies reflects the legal sector’s adaptation to the digital age, where data is increasingly stored and managed in cloud environments.

Key Takeaways

- The eDiscovery market is anticipated to reach a substantial value of USD 32.5 billion by 2033, with a steady compound annual growth rate (CAGR) of 9.1% from 2023 to 2033.

- Regulatory requirements and the complexity of modern litigation contribute significantly to the demand for eDiscovery services, especially among Fortune 1000 companies allocating between USD 5 million and USD 10 million annually for e-discovery expenses.

- In 2023, the services segment held a dominant position in the eDiscovery market, capturing more than a 65% share.

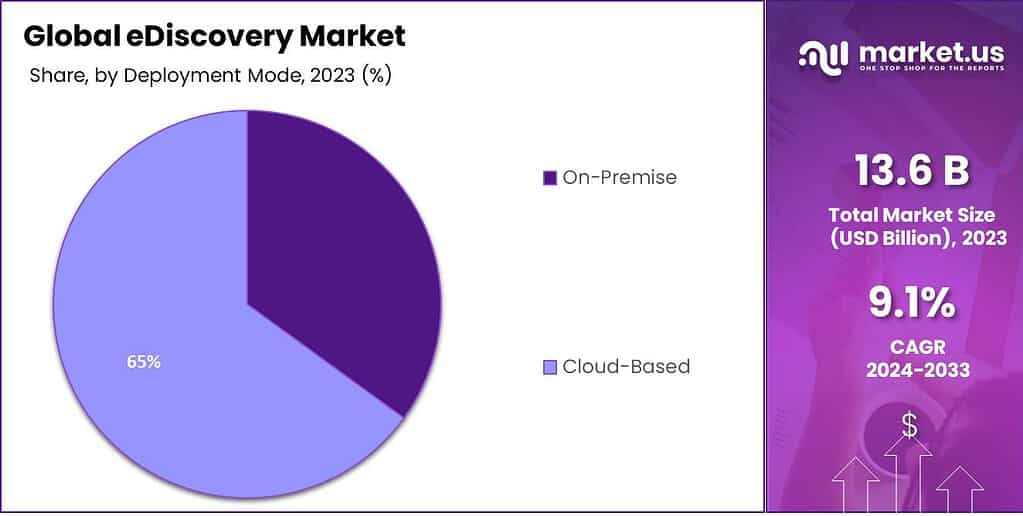

- In 2023, Cloud-Based deployment held a dominant position in the eDiscovery market, capturing more than a 65% share.

- In 2023, Large Enterprises held a dominant position in the eDiscovery market, capturing more than a 70% share of spending.

- The banking, financial services and insurance (BFSI) sector held a leading 35% share of the eDiscovery market in 2023 based on end use vertical segmentation.

- North America takes center stage in the eDiscovery market, commanding a substantial 38.9% share of the industry.

- 40% increase in the use of technology-assisted review (TAR) in eDiscovery is projected from 2022 to 2024. This means lawyers will rely more on technology to help them find important documents for cases.

- About 55% of legal experts expect to see more predictive coding and continuous active learning (CAL) in eDiscovery by 2024. Predictive coding helps in predicting which documents are relevant, and CAL is a method that keeps improving as more documents are reviewed.

- The use of data from mobile devices in eDiscovery is expected to rise by 35% between 2022 and 2024. This means information from phones and tablets will become more important in legal cases.

- Approximately 60% of legal professionals anticipate that there will be more data to look at for eDiscovery by 2024. This could make their work more challenging as they have to sift through larger amounts of information.

- By 2024, it’s expected that over 60% of legal firms will use cloud-based eDiscovery solutions. This is an increase from about 45% in 2022. Cloud-based solutions make it easier to store and access data from anywhere.

- The use of artificial intelligence (AI) and machine learning (ML) in eDiscovery is projected to grow by over ~30% annually between 2022 and 2024. These technologies can help automate the review of documents and make the process faster and more accurate.

- It’s estimated that by 2024, over 50% of legal departments in Fortune 500 companies will have dedicated eDiscovery teams or personnel. This shows the increasing importance of specialized teams to manage the complexities of eDiscovery.

By Offerings

In 2023, the Services segment held a dominant position in the eDiscovery market, capturing more than a 65% share. This segment’s leadership is primarily driven by the increasing complexity and volume of data involved in legal and regulatory matters.

Services such as document processing and administrative support are essential for efficiently handling large datasets, ensuring that they are prepared and organized for legal review. These services reduce the workload on legal teams by providing crucial pre-processing work, including data indexing, conversion, and quality checks, which are vital for speeding up the legal review process.

Additionally, shared services within the eDiscovery realm have become increasingly important. These services offer scalable resources that can adapt to fluctuating demands, a common scenario in legal proceedings. By leveraging shared services, organizations can access specialized skills and technologies without the need for significant capital investment, making eDiscovery processes more cost-effective and efficient. This flexibility and cost efficiency are key reasons why the Services segment continues to outpace other areas of the eDiscovery market.

Moreover, the evolving nature of regulatory environments and the global increase in litigation activities demand robust support services that can handle diverse and complex legal requirements. As organizations face more international legal challenges, the need for comprehensive service offerings that can manage cross-jurisdictional data concerns becomes crucial.

This has led to enhanced growth in the Services segment, reflecting its critical role in supporting organizations through intricate legal landscapes. By providing expert services tailored to specific legal and regulatory needs, this segment remains at the forefront of the eDiscovery market, driving its expansion and innovation.

By Deployment Mode

In 2023, the Cloud-Based segment held a dominant market position in the eDiscovery sector, capturing more than a 65% share. This segment’s prominence is largely due to the scalability, flexibility, and cost-efficiency that cloud-based solutions offer.

As legal firms and corporations face increasing amounts of data to manage and analyze, cloud platforms provide an agile environment where resources can be adjusted based on demand without the need for heavy initial investments in infrastructure. This adaptability is crucial during large-scale litigation or multiple simultaneous legal cases.

Additionally, the cloud-based model supports remote collaboration more seamlessly, which has become essential in a rapidly evolving work landscape that increasingly favors remote and hybrid work setups. Legal teams spread across different geographies can access, share, and work on documents simultaneously without compromising security or efficiency. This capability is particularly valuable in complex cases involving multiple stakeholders.

The ongoing improvements in cloud security measures and compliance with stringent data protection regulations have also increased trust in cloud-based eDiscovery solutions. Data security in cloud environments has seen significant advancements, with providers now offering encrypted storage and data transit, alongside regular security audits. This has alleviated many of the concerns previously associated with cloud deployment, encouraging more firms to transition from traditional on-premise models to more flexible cloud-based eDiscovery solutions.

By Organization Size

In 2023, the Large Enterprise segment held a dominant market position in the eDiscovery sector, capturing more than a 70% share. This leadership stems primarily from the extensive legal and compliance requirements that large organizations face across multiple jurisdictions.

Large enterprises typically engage in more complex and frequent litigation and regulatory inquiries, which necessitates robust eDiscovery systems to manage, search, and analyze vast amounts of data effectively. Their substantial financial resources allow them to invest in comprehensive eDiscovery solutions that can handle the scale and complexity of their legal needs.

Furthermore, large enterprises often operate in highly regulated industries such as finance, healthcare, and telecommunications, where the stakes for compliance are particularly high. This environment drives the demand for advanced eDiscovery services that include forensics, data processing, and analytics capabilities. By leveraging these services, large organizations can mitigate risks associated with non-compliance and enhance their ability to respond swiftly to legal challenges.

The scale of data management needs within large enterprises also fosters continuous innovation in the eDiscovery market. Providers are compelled to enhance their offerings with cutting-edge technologies such as AI and machine learning to meet the evolving demands of these organizations. This focus on innovation not only supports the legal processes but also contributes to more strategic data management and security, reinforcing the leading position of the Large Enterprise segment in the eDiscovery market.

By End Use Vertical

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the eDiscovery sector, capturing more than a 35% share. This sector’s leading role is primarily driven by the high volume of transactions, coupled with stringent regulatory requirements and the need for stringent compliance measures. Financial institutions frequently face investigations and litigation, necessitating robust eDiscovery solutions to manage, analyze, and archive large volumes of sensitive data efficiently.

The BFSI sector’s complexity is increased by the necessity to adhere to multiple national and international regulations, such as GDPR, KYC, and anti-money laundering laws, which demand meticulous record-keeping and data retrieval capabilities. eDiscovery platforms assist in automating these processes, ensuring that financial organizations can quickly respond to legal inquiries without jeopardizing compliance. This capability is critical not only for managing day-to-day operations but also for maintaining corporate integrity and customer trust.

Moreover, the ongoing digital transformation in the BFSI sector, including the shift towards digital banking, mobile services, and enhanced customer data analytics, further fuels the demand for eDiscovery solutions. These technologies help manage the increased data footprint by providing sophisticated tools for data processing and review, which are essential for both ongoing legal cases and proactive regulatory compliance checks. As the BFSI sector continues to evolve, the integration of advanced eDiscovery technologies remains crucial for managing the complexities of the financial landscape effectively.

Key Market Segments

By Offerings

- Services

- Document Processing and Administrative Support

- Shared Services

- Trustee Services

- Contact Centre Services

- Others

- Solutions

- Forensics and Collections

- Processing and Hosting

- Data Analytics

- Document Review

- Contract Solutions

- Business Advisory Solutions

- Spend Management Solutions

- Others

By Deployment Mode

- On-Premise

- Cloud-Based

By Organization Size

- Large Enterprise

- SMEs

By End Use Vertical

- Government and Public Sector

- Legal

- BFSI

- Media and Entertainment

- Healthcare and Life Sciences

- Retail and Consumer Goods

- IT and Telecommunications

- Others

Driver

Integration of AI and Automation

The eDiscovery market is experiencing significant growth driven by the integration of artificial intelligence (AI) and automation technologies. These innovations enhance the efficiency and accuracy of the eDiscovery process, which involves identifying, collecting, and producing electronically stored information for legal proceedings.

AI and automation streamline complex tasks such as data analysis and document review, reducing the time and labor traditionally required and minimizing human error. This technological advancement meets the increasing demands for speed and efficiency in legal investigations and compliance checks, making it a critical driver in the eDiscovery market’s expansion.

Restraint

High Costs and Complexity

Despite the advantages, the high costs associated with implementing and maintaining eDiscovery solutions pose a significant restraint. The complexity of eDiscovery systems, requiring specialized training and technical support, adds further to the overheads.

This makes it challenging for smaller firms or those with limited IT budgets to adopt these advanced systems. As a result, the market’s growth is somewhat inhibited as potential users may seek less expensive alternatives or delay the adoption of advanced eDiscovery technologies.

Opportunity

Increasing Volume of ESI and Regulatory Demand

The burgeoning volumes of electronically stored information (ESI) and stringent regulatory requirements present substantial opportunities for the eDiscovery market. As businesses and government agencies face more rigorous compliance demands and an increasing need for efficient data management amid growing data breaches and privacy concerns, eDiscovery solutions become invaluable.

These tools not only help in efficiently managing and retrieving information but also ensure compliance with various international regulations like GDPR. This regulatory landscape and the digital data explosion drive the demand for eDiscovery solutions, offering significant market opportunities.

Challenge

Data Security and Privacy Concerns

Data security and privacy remain formidable challenges in the eDiscovery market. With the increasing adoption of cloud-based solutions, concerns about data breaches, unauthorized access, and loss of sensitive information have heightened.

Ensuring the security of data while it is being processed and stored by eDiscovery tools is crucial, particularly as the legal and reputational risks associated with data breaches grow. These security challenges require continuous advancements in encryption and access control technologies to build trust and ensure the adoption of eDiscovery solutions across more sensitive sectors.

Growth Factors

- Increasing Volume of Data: The eDiscovery market is growing substantially due to the exponential increase in electronically stored information (ESI) across multiple sectors. This growth is driven by the widespread use of digital communication tools and expansive data generation by organizations.

- Technological Advancements: Advancements in AI and machine learning are revolutionizing eDiscovery processes by enhancing the efficiency and accuracy of data processing and analysis. These technologies enable sophisticated data handling capabilities that are critical for managing complex legal and regulatory requirements.

- Regulatory and Compliance Needs: The stringent regulatory landscape, including privacy laws and compliance requirements across different regions, necessitates robust eDiscovery solutions to ensure organizations meet their legal obligations.

- Globalization of Business Operations: As businesses expand globally, there is a growing need for eDiscovery solutions that can handle cross-border legal challenges and manage data across diverse legal environments.

- Increased Litigation and Investigation: The rise in litigation cases and regulatory investigations worldwide is compelling enterprises and government bodies to adopt advanced eDiscovery solutions to manage and analyze large volumes of data effectively.

Emerging Trends

- Cloud Adoption: There is a significant shift towards cloud-based eDiscovery solutions, which offer scalability, cost-efficiency, and enhanced collaboration features for users distributed across various locations.

- AI and Automation: AI technologies and automation are increasingly being integrated into eDiscovery platforms to streamline workflows and reduce the manual effort involved in data sorting and analysis. These technologies help in predictive coding, sentiment analysis, and data clustering.

- Data Privacy and Security Focus: With the increase in data breaches and cyber threats, there is a heightened focus on ensuring data privacy and security within eDiscovery practices. Solutions are being developed to comply with rigorous data protection standards like GDPR and CCPA.

- Diversification of Data Types: eDiscovery solutions are evolving to handle a wider array of data types, including new digital communication channels such as social media, instant messaging, and collaborative platforms. This requires ongoing advancements in how data is processed and reviewed.

- Increased Use of Predictive Analytics: Predictive analytics is becoming a critical component of eDiscovery tools, enabling legal teams to forecast outcomes and identify relevant data more quickly. This trend is enhancing decision-making processes and operational efficiencies in legal reviews.

Regional Analysis

In 2023, North America held a dominant market position in the eDiscovery market, capturing more than a 38.9% share, which equated to approximately USD 5.4 billion in revenue. This prominent position can largely be attributed to the extensive adoption of digitalization across various sectors, including legal, corporate, and government institutions, where the need to manage large volumes of data efficiently is paramount.

Furthermore, the region’s robust legal framework, which mandates the use of eDiscovery solutions during litigation and investigations, has significantly propelled market growth. North America’s lead in this market is further bolstered by the presence of major technology firms and eDiscovery service providers that innovate continuously, ensuring the availability of advanced solutions tailored to complex legal requirements.

The adoption of cloud-based eDiscovery solutions has seen a significant uptick due to their cost-effectiveness and scalability, catering well to the vast and growing data requirements of large enterprises and legal firms in the region. Moreover, the increasing awareness about the benefits of these solutions, such as reduced time and costs associated with data handling during legal proceedings, continues to drive their demand.

Additionally, initiatives and investments in artificial intelligence and machine learning within the eDiscovery sphere are enhancing the capabilities of data processing and analytics, making the process more efficient and precise. These technological advancements not only improve the handling of data but also help in maintaining compliance with evolving regulations, which is a critical concern in North American markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The eDiscovery market features a diverse landscape of key players offering a wide range of software, services, and solutions to meet the evolving needs of organizations and legal professionals. Understanding the key players in the eDiscovery market provides insights into the competitive dynamics and market trends shaping the industry.

Top Market Leaders

- Accessdata Group Inc.

- Commvault Systems Inc.

- Conduent Inc.

- Driven Inc. (Xplenty)

- Fronteo Inc. (Formerly UBIC)

- IBM

- FTI Technology LLC

- Kcura LLC

- Zylab Technologies

- Xerox Corp.

- Hewlett Packard Enterprise

- Logik

- Lexbe

- Ernst & Young Global Ltd.

- Navigant Consulting

- Other Key Players

Recent Development

- On January 19, 2023, Exterro, a provider of eDiscovery and legal software solutions, acquired Zapproved, a legal hold and eDiscovery software company. This acquisition is part of Exterro’s strategy to expand its capabilities and market reach.

- On January 20, 2023, Thoma Bravo, a private equity firm, acquired Magnet Forensics for approximately $1.3 billion. Magnet Forensics is known for its digital investigation software that supports eDiscovery processes.

- On January 31, 2023, Open Text completed its acquisition of Micro Focus for approximately $5.8 billion. This acquisition, which includes Micro Focus’ cash and debt, is aimed at enhancing Open Text’s digital transformation capabilities, including its eDiscovery services.

- On February 2, 2023, HBR Consulting acquired Younts Consulting, a move to strengthen its position in the legal technology and eDiscovery market by expanding its consulting capabilities.

Report Scope

Report Features Description Market Value (2023) USD 13.6 Bn Forecast Revenue (2033) USD 32.5 Bn CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offerings {By Services (Document Processing and Administrative Support, Shared Services, and Others), Solutions (Forensics and Collections, Processing and Hosting, Data Analytics and others)}, By Organization Size (Large Enterprise and SMEs), By Deployment Mode (On-Premise, Cloud-Based), By End Use Vertical Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Accessdata Group Inc., Commvault Systems Inc., Conduent Inc., Driven Inc. (Xplenty), Fronteo Inc. (Formerly UBIC), IBM, FTI Technology LLC, Kcura LLC, Zylab Technologies, Xerox Corp., Hewlett Packard Enterprise, Logik, Lexbe, Ernst & Young Global Ltd., Navigant Consulting, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is eDiscovery?Electronic discovery (eDiscovery), or electronic data retrieval and search, is the process by which electronic information is identified, located, secured and examined with an aim of using it as evidence in legal cases. eDiscovery may involve retrieving emails, documents, presentations, databases voicemail audio/video files social media and websites among others for legal use.

How big is eDiscovery Market?The Global eDiscovery Market is anticipated to be USD 32.5 billion by 2032. It is estimated to record a steady CAGR of 9.1% in the review period 2023 to 2033. It is likely to total USD 13.6 billion in 2023.

Who uses eDiscovery services?eDiscovery services are mainly used by legal teams, law firms, corporations, and government agencies. These services are essential for anyone involved in the process of legal discovery where electronic information is a component of the evidence.

What are some common features of eDiscovery software?Common features of eDiscovery software include:

- Data processing and indexing

- Advanced search capabilities

- Data storage and security features

- Analytics and reporting tools

- Review and tagging mechanisms for relevant documents

- Production tools for preparing documents for legal proceedings.

What factors are driving the growth of the eDiscovery market?The eDiscovery market is flourishing due to multiple factors. Rapid data growth, increasing litigation and regulatory compliance requirements, the need for efficient data management and governance procedures and technological innovations for data analysis and review all contribute to its expansion.

Who are the top key players in eDiscovery Market?Some of key players are include: Accessdata Group Inc., Commvault Systems Inc., Conduent Inc., Driven Inc. (Xplenty), Fronteo Inc. (Formerly UBIC), IBM, FTI Technology LLC, Kcura LLC, Zylab Technologies, Xerox Corp., Hewlett Packard Enterprise, Logik, Lexbe, Ernst & Young Global Ltd., Navigant Consulting, Other Key Players

-

-

- Accessdata Group Inc.

- Commvault Systems Inc.

- Conduent Inc.

- Driven Inc. (Xplenty)

- Fronteo Inc. (Formerly UBIC)

- IBM

- FTI Technology LLC

- Kcura LLC

- Zylab Technologies

- Xerox Corp.

- Hewlett Packard Enterprise

- Logik

- Lexbe

- Ernst & Young Global Ltd.

- Navigant Consulting

- Other Key Players