Global Edge Observability For RAN Market Size, Share and Analysis Report By Component (Software, Services), By Deployment Mode (On-premises, Cloud-based), By Network Type (Public 4G/5G RAN, Private/Enterprise 5G RAN), By Application (Performance Monitoring & Assurance (PM/A), Fault Detection & Root Cause Analysis (RCA), Security & Anomaly Detection, Capacity Planning & Optimization, Others), By End-User (Mobile Network Operators (MNOs), Telecom Infrastructure Providers, Enterprises with Private Networks, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 176047

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- U.S. Market Size

- Regional Driver Comparison

- Component Analysis

- Deployment Mode Analysis

- Network Type Analysis

- Application Analysis

- End-User Analysis

- Investment Opportunities

- Business Benefits

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

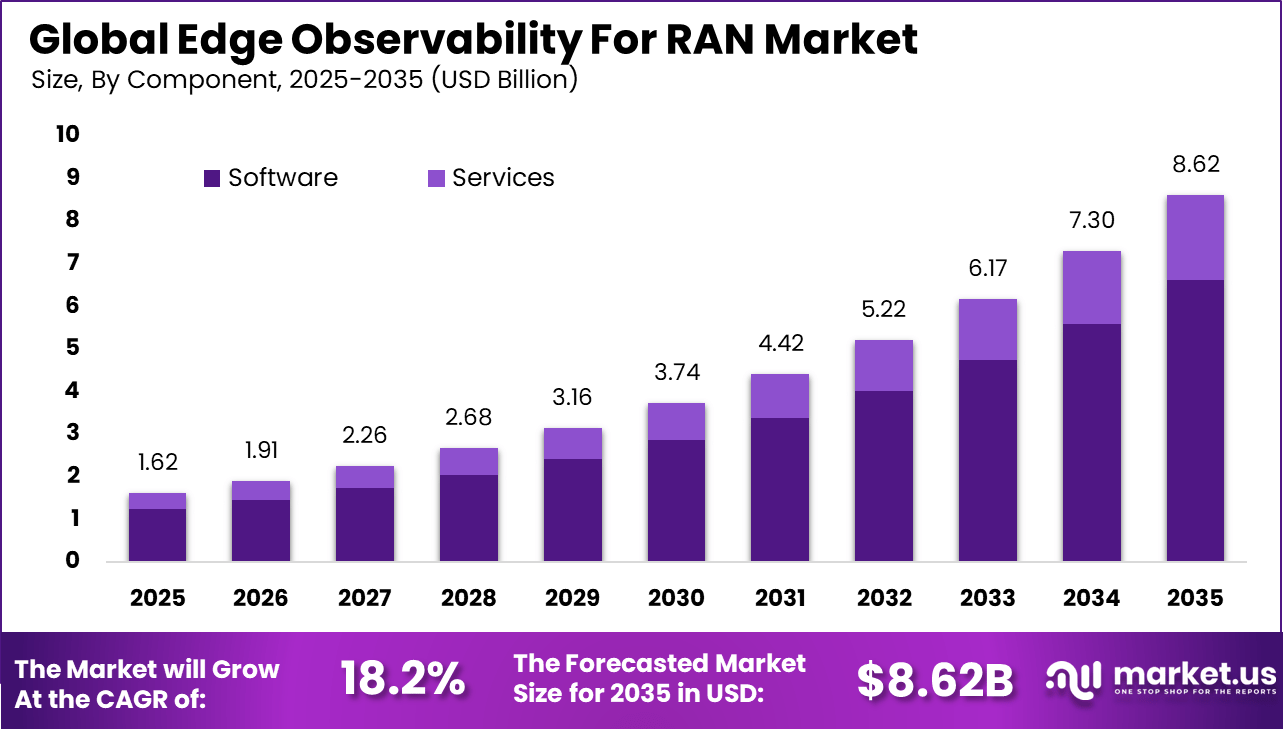

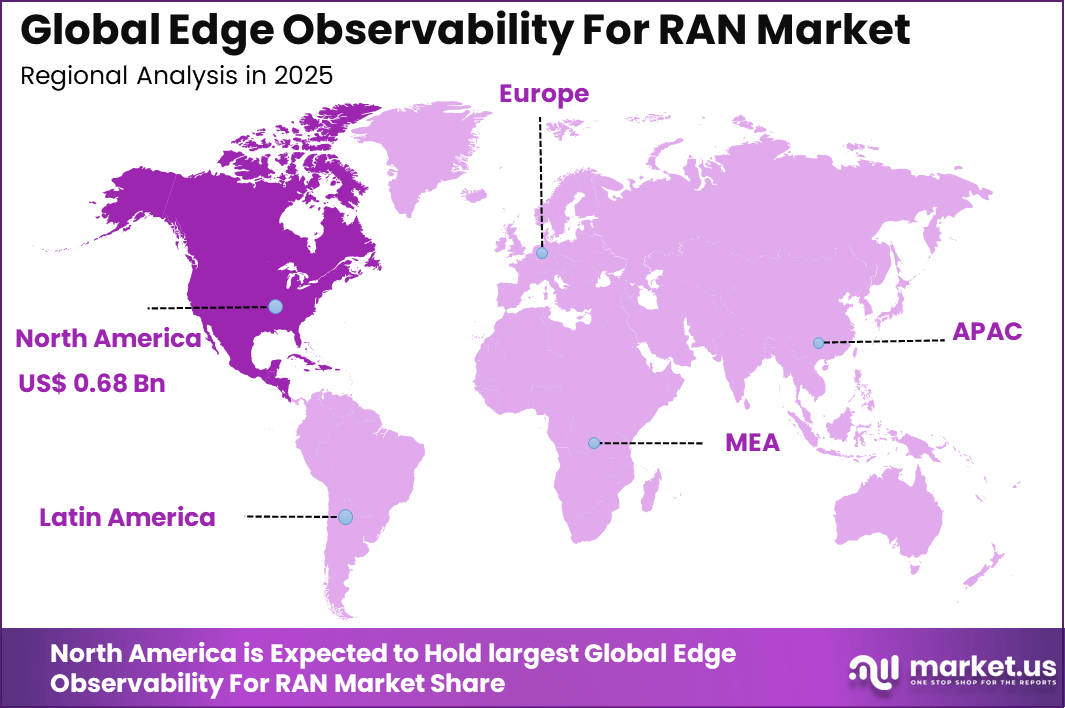

The Global Edge Observability for RAN Market presents a compelling telecom and edge-computing investment opportunity, having generated USD 1.62 billion in 2025 and expected to scale to nearly USD 8.62 billion by 2035, expanding at a CAGR of 18.2%. North America’s dominant position, accounting for more than 42.1% market share and USD 0.68 billion in revenue, reinforces the region’s role as a primary growth engine for long-term capital deployment.

The edge observability for RAN market covers software and platforms that collect, standardize, and analyze telemetry from radio access networks near the network edge, so that faults, performance drops, and user experience issues can be detected faster. In practical terms, this includes monitoring data from disaggregated RAN functions such as CU, DU, and RU, plus edge cloud workloads that host virtualized RAN components.

The focus is on visibility across metrics, logs, traces, alarms, and performance measurements, presented in a way that operations teams can act on quickly. Adoption is being pushed by the shift toward Open RAN and cloud native RAN designs, where traditional appliance based monitoring is often not enough to explain issues across multiple software layers.

O RAN architecture also increases the number of interfaces and managed elements that must be supervised, which raises the importance of consistent, standards aligned data collection. As a result, observability is being treated as an operational requirement rather than an optional add on, especially for large scale multi vendor environments.

A major growth driver is the expanding scope of standardized management and assurance expectations for 5G networks. 3GPP work in the management area continues to emphasize performance measurements, KPIs, and broader assurance data needs, which makes continuous monitoring and structured telemetry more central to daily operations. As RAN features become more advanced, operational visibility is increasingly needed not only to detect outages, but also to maintain service quality and verify that new capabilities behave as intended.

Demand is being driven by the operational need to reduce troubleshooting time in distributed, software driven RAN architectures. When RAN functions run on general purpose edge infrastructure, root cause analysis can require correlation across radio metrics, virtualization metrics, and application level signals. This makes unified telemetry collection and correlation more valuable, because it supports faster isolation of whether an issue is caused by radio conditions, compute saturation, software faults, or configuration drift.

According to Market.us analysis, The global Cloud Radio Access Network (C RAN) market was valued at USD 128.2 billion in 2025 and is expected to expand rapidly over the forecast period. The market is projected to reach approximately USD 159.8 billion by 2033, growing at a strong CAGR of 24.20% from 2024 to 2033. This growth is driven by increasing deployment of 5G networks, rising demand for network virtualization, and the need for cost efficient and scalable mobile infrastructure.

For instance, in November 2025, Ericsson partnered with Orange France on Cloud RAN and Open RAN trials, achieving the first successful Cloud RAN 5G call. These efforts advance flexible, software-centric networks with improved spectral efficiency and automation.

Key Takeaway

- By component, software led the market with 76.8% share, reflecting strong demand for analytics and monitoring platforms that improve RAN visibility and performance.

- By deployment mode, cloud based centralized analytics accounted for 58.3%, supported by scalability and centralized control across distributed radio networks.

- By network type, public 4G and 5G RAN dominated with 71.5%, driven by ongoing network expansion and performance optimization needs.

- By application, performance monitoring and assurance (PM/A) held 42.7% share, as operators focus on maintaining service quality and network reliability.

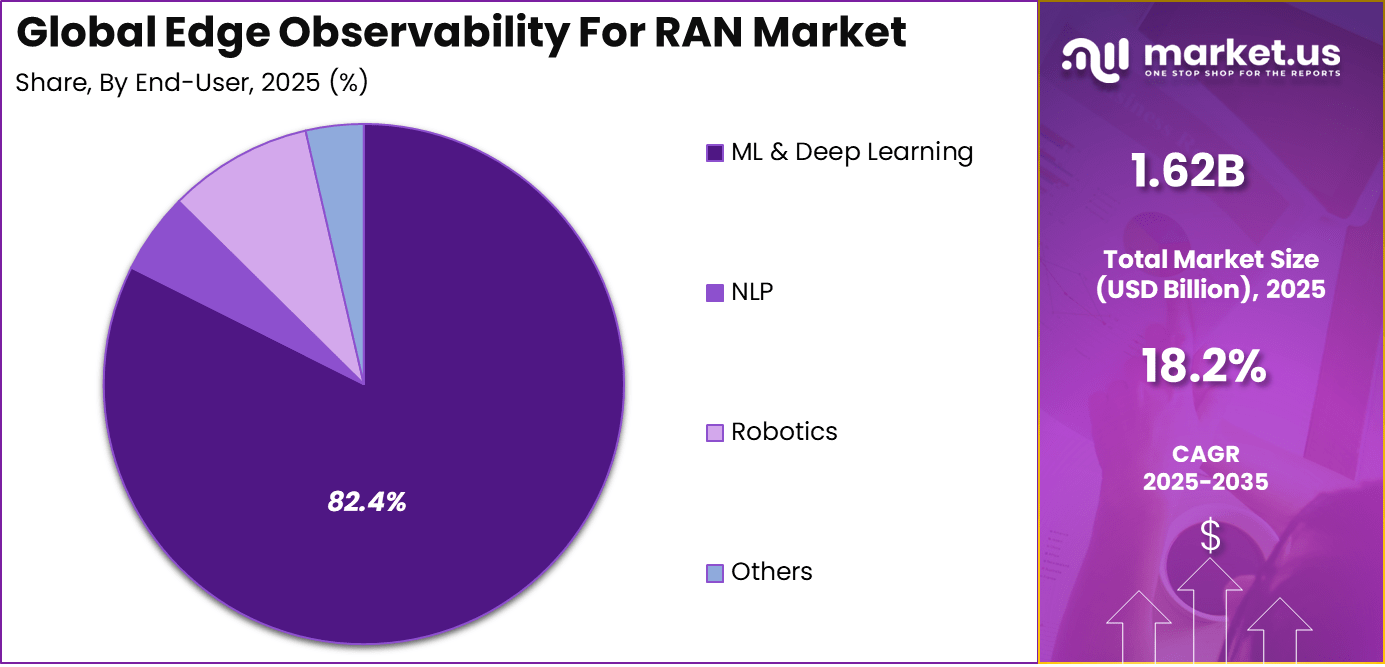

- By end user, mobile network operators accounted for 82.4%, reflecting their central role in deploying and managing RAN infrastructure.

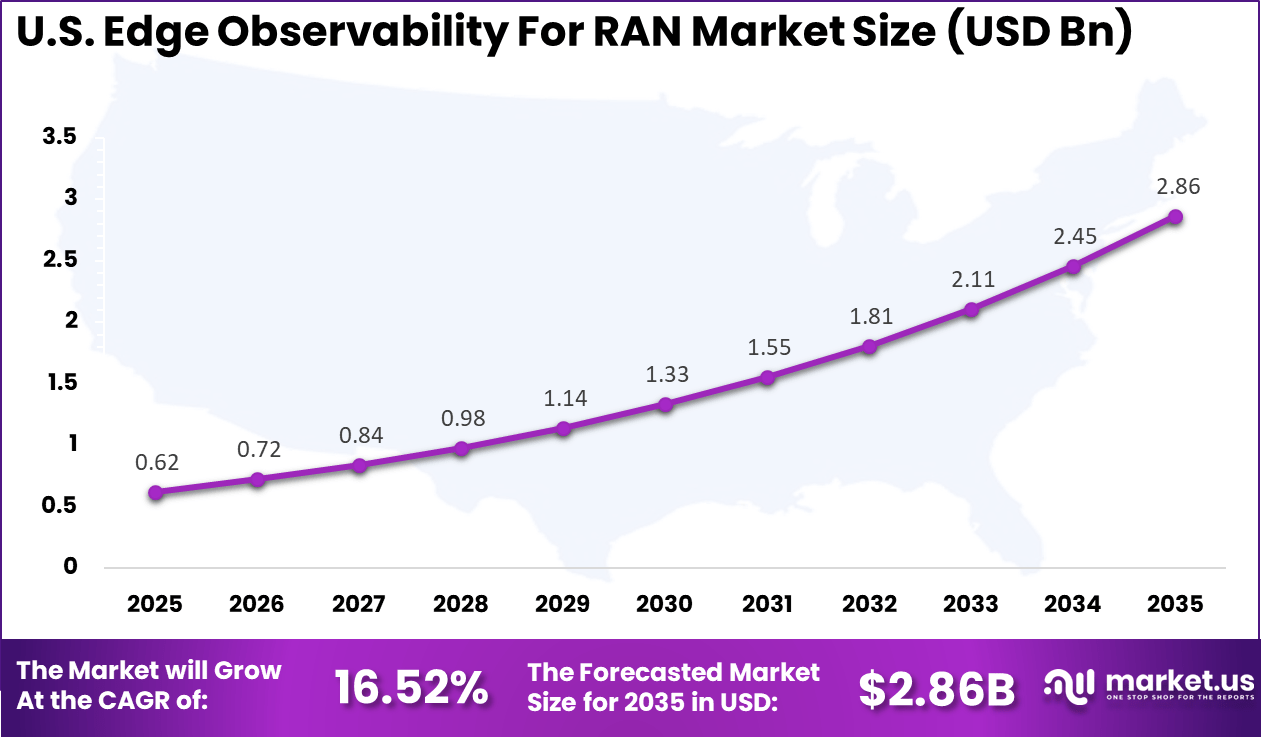

- North America represented 42.1% of the global market, with the US valued at USD 0.62 billion and growing at a 16.52% CAGR, supported by early 5G adoption and advanced network management practices.

Drivers Impact Analysis

Key Growth Driver Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact Rapid deployment of 5G standalone networks and Open RAN +5.9% North America, Europe Short to medium term Increasing network complexity at the edge layer +5.1% Global, strongest in North America Medium term Rising demand for real time RAN performance visibility +4.6% North America, developed Asia Pacific Short term Expansion of edge computing for ultra low latency services +3.9% North America, Asia Pacific Medium term Growth of private 5G and enterprise edge networks +3.2% North America, Europe Medium to long term Restraint Impact Analysis

Key Restraint Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact High deployment and integration complexity -2.8% Global Short to medium term Shortage of skilled RAN and edge observability professionals -2.4% North America, Europe Medium term Budget constraints among smaller telecom operators -2.0% Asia Pacific, Latin America Medium term Interoperability challenges across multi vendor RAN setups -1.7% Global Medium to long term Data security and compliance concerns at the network edge -1.3% Europe, North America Long term U.S. Market Size

The market for Edge Observability For RAN within the U.S. is growing tremendously and is currently valued at USD 0.62 billion, the market has a projected CAGR of 16.52%. The market is growing due to rapid nationwide 5G rollout and rising network complexity. Mobile operators are increasingly deploying cloud native and virtualized RAN architectures, which require real-time visibility at the network edge to maintain performance and service quality.

Growing demand for low latency applications such as autonomous systems, industrial IoT, and private 5G networks is accelerating adoption. Increased focus on proactive fault detection, SLA compliance, and cost optimization is also driving investment in advanced observability platforms across US telecom infrastructure.

For instance, in July 2025, Keysight Technologies showcased its leadership in Open RAN observability during the O-RAN Alliance Spring 2025 Global PlugFest, powering 11 multi-vendor integration tests across labs in North America, Asia, and Europe. Their KORA solutions validated energy efficiency, transport reliability, and test repeatability for scalable 5G deployments, reinforcing U.S. innovation in edge RAN monitoring.

In 2025, North America held a dominant market position in the Global Edge Observability For RAN Market, capturing more than a 42.1% share, holding USD 0.68 billion in revenue. This dominance is due to early and large scale deployment of 5G networks, strong investments in cloud native and virtualized RAN architectures, and the presence of advanced telecom infrastructure.

For instance, in January 2026, Viavi Solutions expanded its XEdge platform with new sensors for enhanced edge monitoring in private 4G/5G networks, providing continuous visibility into device connectivity and performance. This advancement supports reliable edge environments for enterprises, strengthening North American dominance in RAN observability solutions.

Regional Driver Comparison

Region Core Demand Driver Growth Influence Level Market Maturity North America Advanced 5G rollout and Open RAN adoption Very High Mature Europe Network modernization and regulatory focus on quality High Developing to mature Asia Pacific Rapid mobile data growth and dense urban networks Medium to High Developing Middle East Smart city projects and telecom infrastructure upgrades Medium Developing Latin America Gradual transition toward 5G and edge analytics Low to Medium Early stage Africa Early investments in next generation mobile networks Low Early stage Component Analysis

In 2025, The Software segment held a dominant market position, capturing a 76.8% share of the Global Edge Observability For RAN Market. As operators adopt virtualized and cloud native RAN, they need software platforms that can provide real-time visibility into network behavior. Software based observability helps teams monitor performance, detect faults early, and manage traffic efficiently across distributed edge locations.

Growth is also supported by the flexibility that software offers compared to hardware solutions. Operators can update, scale, and customize observability tools without major infrastructure changes. This reduces operational complexity and supports faster response to network issues. Software platforms also integrate well with automation and analytics workflows, helping operators improve efficiency and reduce manual intervention.

For Instance, in December 2025, Ericsson launched its RAN Observability rApp, a software tool that consolidates KPIs and resource data from cloud RAN layers into one dashboard. This helps operators cut troubleshooting time from hours to minutes by correlating multi-vendor anomalies automatically. It supports daily operations in Open RAN setups, reducing tool overload and boosting security through single data access.

Deployment Mode Analysis

In 2025, the Cloud-based (Centralized Analytics) segment held a dominant market position, capturing a 58.3% share of the Global Edge Observability For RAN Market. Operators choose them to handle traffic surges from events or peak hours, adjusting resources in minutes. Growth stems from lower upfront costs and remote management, perfect for sprawling 5G grids. It lets teams monitor everything from one dashboard, spotting issues network-wide. As edges pop up everywhere, cloud keeps things simple and cost-effective.

This mode thrives on its ability to blend edge data with central brains for deeper analysis, unlike stiff local systems. Providers roll out features like auto-scaling that match real demands, reducing waste. Operators save big on travel for fixes since alerts route straight to experts. With public clouds maturing, trust builds fast, pulling more deployments.

For instance, in November 2025, Nokia and Elisa deployed Europe’s first commercial 5G Cloud RAN with Red Hat OpenShift, enabling hybrid setups with purpose-built networks. This cloud-native approach offers flexibility for edge workloads and consistent performance across footprints. It supports agile services closer to users while maintaining features.

Network Type Analysis

In 2025, The Public 4G/5G RAN segment held a dominant market position, capturing a 71.5% share of the Global Edge Observability For RAN Market. Public 4G and 5G networks continue to expand as mobile data usage rises across consumer and enterprise users. Video streaming, cloud access, remote work, and connected devices place a constant load on public networks.

The shift from 4G to 5G also increases the need for observability across public networks. Operators must manage two technologies at the same time, which adds complexity to daily operations. Observability solutions support smooth handovers, efficient spectrum management, and consistent service quality. As public networks remain essential for digital services, investment in observability continues to grow to ensure dependable performance.

For Instance, in November 2025, NetScout enhanced RAN visibility for public 5G networks, providing real-time control plane views across physical and virtual setups. Their ISNG-RAN prioritizes traffic in Open RAN revolutions, aiding optimization for coverage and quality. It tackles diverse architectures in live public grids.

Application Analysis

In 2025, The Performance Monitoring & Assurance (PM/A) segment held a dominant market position, capturing a 42.7% share of the Global Edge Observability For RAN Market. Operators use it to measure key metrics and ensure quality before complaints roll in. Growth comes from tying data to business wins, like fewer churns from slow service. In RAN edges, it flags anomalies fast, letting fixes happen live. Demand surges as 5G promises ultra-reliability that demands proof.

This application grows through its role in proving SLAs to regulators and partners, building trust. It watches throughput, latency, and drops end-to-end, turning numbers into action plans. Teams shift from guesswork to data-driven tweaks that boost capacity. With apps like AR demanding perfection, monitoring becomes essential. Its focus on outcomes over raw logs makes it indispensable, steadily claiming more share.

For Instance, in January 2026, NetScout upgraded 5G observability for network slicing, offering end-to-end RAN-to-core views for PM/A in standalone setups. It enables AIOps-driven SLA checks and root cause in minutes for gaming or remote surgery slices. CSPs verify performance to monetize premium services reliably.

End-User Analysis

In 2025, The Mobile Network Operators (MNOs) segment held a dominant market position, capturing a 82.4% share of the Global Edge Observability For RAN Market. Mobile Network Operators lead adoption because they operate large and complex wireless networks. As traffic volumes and coverage areas expand, traditional monitoring methods become inefficient.

Edge observability enables operators to monitor performance across regions and user groups in a more detailed and timely manner. This helps reduce outages, improve service quality, and maintain a consistent experience for millions of subscribers.

Cost control and operational efficiency also play a major role in driving adoption. Operators face pressure to expand capacity while keeping expenses in check. Observability tools help pinpoint issues faster and optimize resource usage, reducing unnecessary maintenance efforts. By improving visibility and efficiency, these solutions directly support operator performance goals and continue to see strong demand.

For Instance, in December 2025, Ericsson partnered with MasOrange on an Intelligent Automation Platform for MNOs, deploying rApps like Cell Anomaly Detector for RAN optimization. It automates energy savings and fault isolation, improving user experience in live networks. MNOs gain proactive issue spotting without extra tools.

Investment Opportunities

Investment opportunities are emerging in data model aware observability that can interpret RAN specific semantics rather than treating telemetry as generic infrastructure data. The O RAN community continues to expand specification titles and releases, including work linked to O1 and network resource models, which indicates ongoing evolution in how RAN elements are described and managed.

Products that keep pace with these changes and translate them into practical dashboards, alarms, and automated runbooks can improve adoption in multi vendor deployments. Another opportunity is edge first analytics that reduces backhaul load and supports near real time actions.

When monitoring is paired with edge analytics, high frequency signals can be processed locally and only summarized insights are sent to central systems, improving scalability. This approach also supports automation programs where RAN analytics and control frameworks are used to adjust parameters faster, especially when service quality must be maintained in dense or highly variable radio environments.

Business Benefits

A clear business benefit is improved service stability and fewer prolonged incidents, because telemetry correlation speeds up diagnosis across radio, compute, and software layers. When metrics, logs, and traces are captured in a consistent format, operations teams can reduce repetitive manual checks and shorten escalation loops between radio and IT teams.

Over time, this can lower operational cost per site by reducing truck rolls and limiting the duration of widespread customer impact events. Another benefit is better readiness for multi vendor operations and faster rollout cycles, which becomes more important as networks shift toward disaggregated RAN and cloud native updates.

O RAN management concepts such as O1 and SMO style orchestration increase the importance of clear monitoring, alarms, and configuration tracking across managed elements. In commercial terms, observability supports quicker acceptance testing, clearer accountability, and more reliable scale out of new sites and features, which can improve time to operational maturity after deployment.

Investor Type Impact Matrix

Investor Type Strategic Objective Risk Tolerance Market Influence Telecom equipment vendors Differentiation through network intelligence Medium High Network analytics platform providers Expansion of edge observability capabilities Medium High Venture capital firms High growth telecom software platforms High Medium Private equity investors Long term returns from telecom digitalization Medium Medium Strategic telecom operators Network reliability and service quality leadership Low to Medium Medium Technology Enablement Analysis

Technology Enabler Functional Role Impact on Adoption Adoption Timeline Edge native observability platforms Real time visibility into RAN performance Very High Short term AI driven anomaly detection and root cause analysis Faster fault identification and resolution High Short to medium term Cloud native data collection and processing Scalable monitoring across distributed sites Very High Short term Integration with Open RAN architectures Multi vendor performance assurance High Medium term Advanced telemetry and streaming analytics Continuous monitoring of network KPIs Medium Medium to long term Emerging Trends Analysis

Edge observability for Radio Access Networks (RAN) is being shaped by the increasing complexity of distributed network environments and the need for real-time insight into system performance. Traditional monitoring methods are evolving into comprehensive observability frameworks that collect, correlate, and analyse telemetry from edge nodes to provide visibility into latency, throughput, and packet behaviour at the network edge.

Another emerging trend is the integration of cybersecurity monitoring into edge observability systems for RAN. Edge observability solutions are being used to detect anomalies, identify potential threats, and support rapid security response across distributed radio access points. As cyber threats become more sophisticated, the value of real-time threat detection and proactive security controls at the edge is increasingly recognised by network operators.

Opportunity Analysis

A significant opportunity lies in deploying edge observability solutions to support multi-access edge computing (MEC) and virtualised network functions, where performance must be continuously monitored across distributed computing resources. Observability can help operators understand interactions between network slices, edge applications, and user traffic, improving service reliability in real-time. This creates potential value for service providers prioritising quality of experience and network automation.

Another opportunity is in enhancing security visibility at the network edge, where observability tools can provide actionable insights into unusual activity and potential vulnerabilities. As networks evolve to support more critical services, such as industrial IoT and autonomous applications, robust edge observability that includes security analytics can be a differentiator. This expands use cases beyond performance monitoring to broader network assurance.

Challenge Analysis

A primary challenge is managing the scale of telemetry data generated at the edge, where large volumes of performance metrics, logs, and event data must be collected, processed, and analysed without overwhelming network or compute resources.

Efficiently handling this data requires careful design of observability pipelines and resource allocation strategies. If not managed effectively, high data volumes can negate the responsiveness that edge observability seeks to provide. Another challenge is securing the observability infrastructure itself, as distributing telemetry sources across many edge nodes increases the potential attack surface.

Protecting observability data and ensuring secure communications between edge and central management systems is essential, yet adds complexity to system design and operations. This requires robust security frameworks that balance performance visibility with data protection.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-premises

- Cloud-based

By Network Type

- Public 4G/5G RAN

- Private/Enterprise 5G RAN

By Application

- Performance Monitoring & Assurance (PM/A)

- Fault Detection & Root Cause Analysis (RCA)

- Security & Anomaly Detection

- Capacity Planning & Optimization

- Others

By End-User

- Mobile Network Operators (MNOs)

- Telecom Infrastructure Providers

- Enterprises with Private Networks

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Key Players Analysis

Leading telecom infrastructure vendors such as Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., and Samsung Electronics Co., Ltd. dominate the edge observability for RAN market. Their solutions are closely integrated with 4G and 5G radio access networks. AI-driven analytics support real-time performance monitoring, fault detection, and latency optimization at the network edge. These players benefit from direct relationships with mobile network operators. Demand is driven by the rollout of 5G standalone networks and edge computing use cases.

Test, measurement, and assurance specialists such as Keysight Technologies, Inc., Viavi Solutions, Inc., and Spirent Communications plc play a critical role in validating RAN performance. EXFO, Inc. and Anritsu Corporation support edge observability through advanced probing and analytics tools. Their platforms help operators ensure service quality and compliance. Adoption is strong during network rollout, optimization, and troubleshooting phases.

Software and network visibility providers such as RADCOM, Ltd., Netscout Systems, Inc., and Accedian Networks, Inc. focus on real-time traffic analysis and service assurance. Kentik, Inc., Empirix, Inc., and Cubro Network Visibility strengthen edge-level visibility. Other vendors expand regional reach and innovation. This competitive landscape supports reliable and scalable edge observability for next-generation RAN deployments.

Top Key Players in the Market

- Ericsson

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Keysight Technologies, Inc.

- Viavi Solutions, Inc.

- Spirent Communications plc

- Accedian Networks, Inc.

- EXFO, Inc.

- RADCOM, Ltd.

- Netscout Systems, Inc.

- Anritsu Corporation

- Empirix, Inc.

- Cubro Network Visibility

- Kentik, Inc.

- Others

Recent Developments

- In November 2025, Ericsson Partnered with Orange France on live network trials of next-gen RAN, focusing on AI-driven automation and spectral efficiency. Ericsson’s Intelligent Automation Platform rApps shone, proving edge-ready observability for sustainable 5G evolution.

- In March 2025, Nokia launched its AI-RAN Centre in Dallas, US, to collaborate with partners like T-Mobile and Softbank on developing and testing AI-RAN solutions in real networks. This initiative accelerates AI integration for network optimization and new revenue opportunities, showcasing Nokia’s innovation leadership in edge observability for 5G.

Report Scope

Report Features Description Market Value (2025) USD 1.6 Bn Forecast Revenue (2035) USD 8.6 Bn CAGR(2026-2035) 18.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-premises, Cloud-based), By Network Type (Public 4G/5G RAN, Private/Enterprise 5G RAN), By Application (Performance Monitoring & Assurance (PM/A), Fault Detection & Root Cause Analysis (RCA), Security & Anomaly Detection, Capacity Planning & Optimization, Others), By End-User (Mobile Network Operators (MNOs), Telecom Infrastructure Providers, Enterprises with Private Networks, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Keysight Technologies, Inc., Viavi Solutions, Inc., Spirent Communications plc, Accedian Networks, Inc., EXFO, Inc., RADCOM, Ltd., Netscout Systems, Inc., Anritsu Corporation, Empirix, Inc., Cubro Network Visibility, Kentik, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Edge Observability For RAN MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Edge Observability For RAN MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Ericsson

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Keysight Technologies, Inc.

- Viavi Solutions, Inc.

- Spirent Communications plc

- Accedian Networks, Inc.

- EXFO, Inc.

- RADCOM, Ltd.

- Netscout Systems, Inc.

- Anritsu Corporation

- Empirix, Inc.

- Cubro Network Visibility

- Kentik, Inc.

- Others