Global Edge Application Security Market Size, Share Report By Component (Solutions/Platforms, Services), By Security Type (Edge Application Security, Bot Management, DDoS Mitigation, Web Application Security, Data Security & Privacy, Others), By Deployment (On-Premises, Cloud-based), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-User (IT & Telecommunications, BFSI, Retail & Ecommerce, Healthcare, Manufacturing & Automotive, Government & Defense, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169190

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

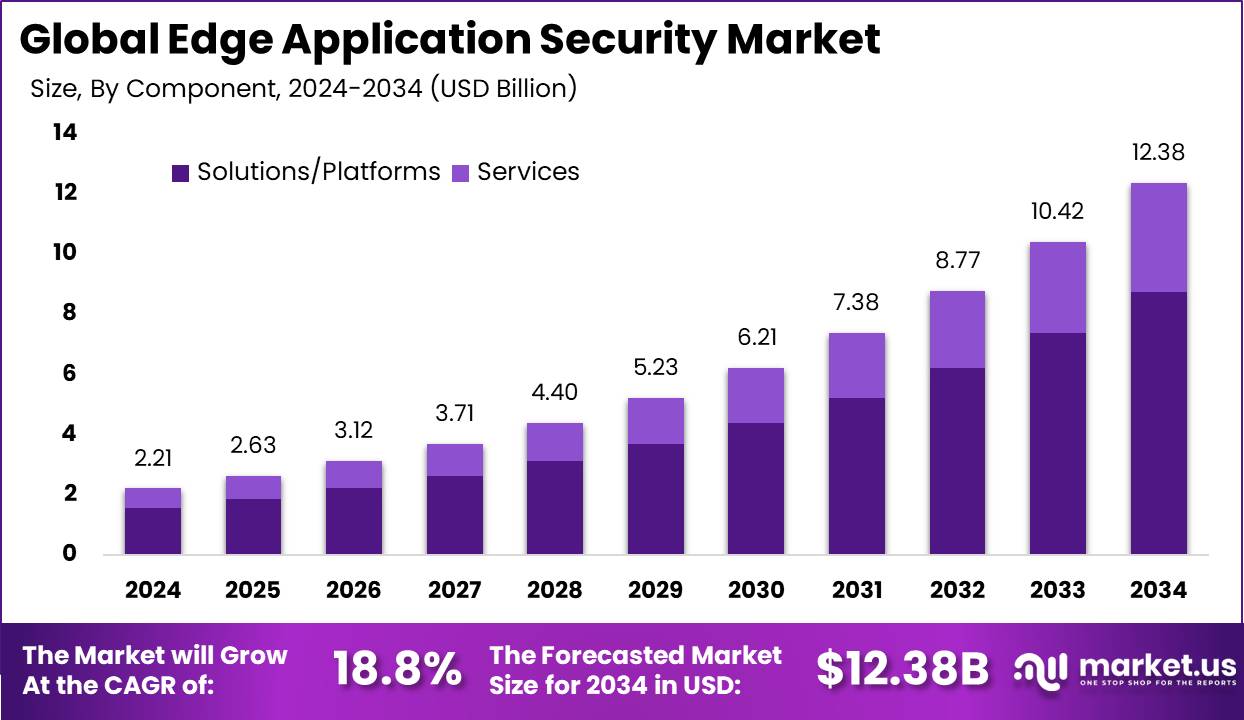

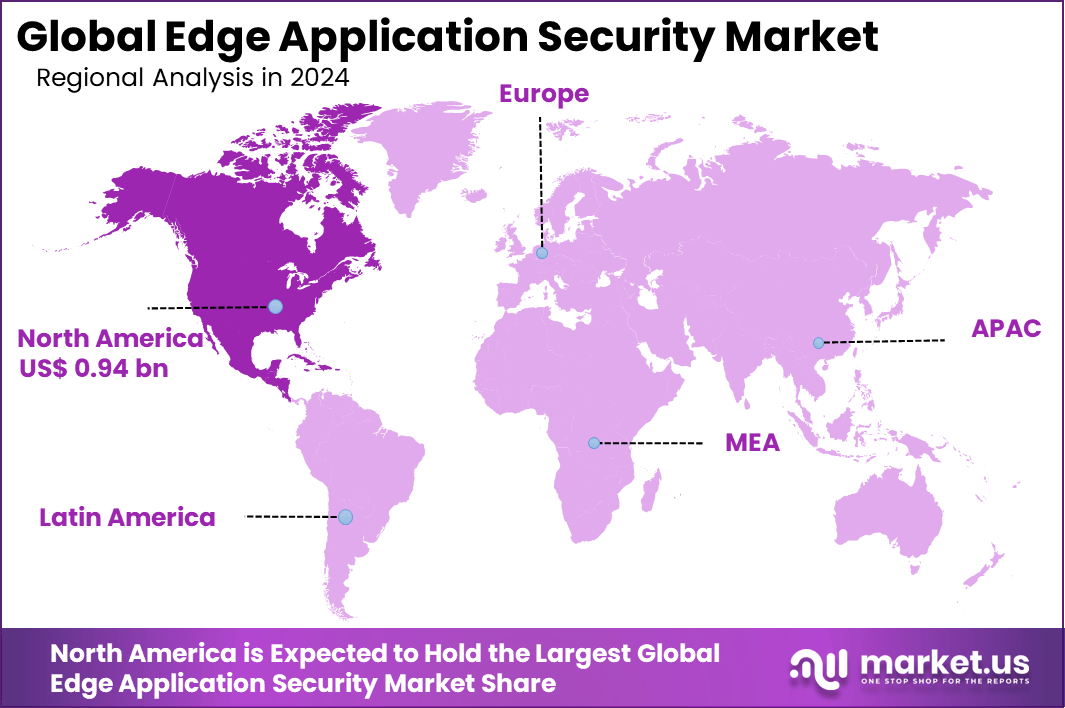

The Global Edge Application Security Market size is expected to be worth around USD 12.38 billion by 2034, from USD 2.21 billion in 2024, growing at a CAGR of 18.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 42.6% share, holding USD 0.94 billion in revenue.

The edge application security market has expanded as organisations move critical workloads closer to users through edge computing environments. Growth reflects rising adoption of distributed applications, real time processing, and low latency services that operate outside traditional data centers. As workloads shift toward IoT devices, branch sites and edge nodes, security controls must follow, creating strong demand for platforms that safeguard applications deployed at the network edge.

Top driving factors for Edge Application Security include the rapid growth of edge computing and IoT deployments that expand the attack surface. More than half of organizations plan to implement edge technologies imminently, which intensifies the demand for security frameworks capable of managing decentralized, often resource-constrained environments. The need for real-time threat detection and access control at the data source drives businesses to adopt edge-specific security solutions.

The market for Edge Application Security is driven by the growing need to secure distributed and remote endpoints as more organizations adopt cloud services and support remote workforces. With data increasingly processed outside traditional data centers, protecting applications and devices at the network edge becomes critical. About 60% of firms now use edge security to handle rising data flows from connected gear.

For instance, in September 2025, Palo Alto Networks launched Prisma Browser within Prisma SASE 4.0, focusing on intercepting and neutralizing encrypted, evasive web threats directly inside browsers. This edge application security advancement targets sophisticated browser-based attacks that bypass traditional secure gateways, enhancing protection for enterprise users.

Key Takeaway

- Solutions and platforms accounted for 70.8% in 2024, showing that organizations rely heavily on integrated edge security stacks to manage rising application threats.

- Web application firewalls held 36.2%, reflecting continued demand for defenses that protect apps against injection attacks, bots, and emerging exploit patterns.

- Cloud-based deployment dominated with 90.4%, supported by the shift toward distributed architectures and the need for scalable edge protection.

- Large enterprises represented 74.5%, indicating that companies with complex digital ecosystems drive most investment in edge security capabilities.

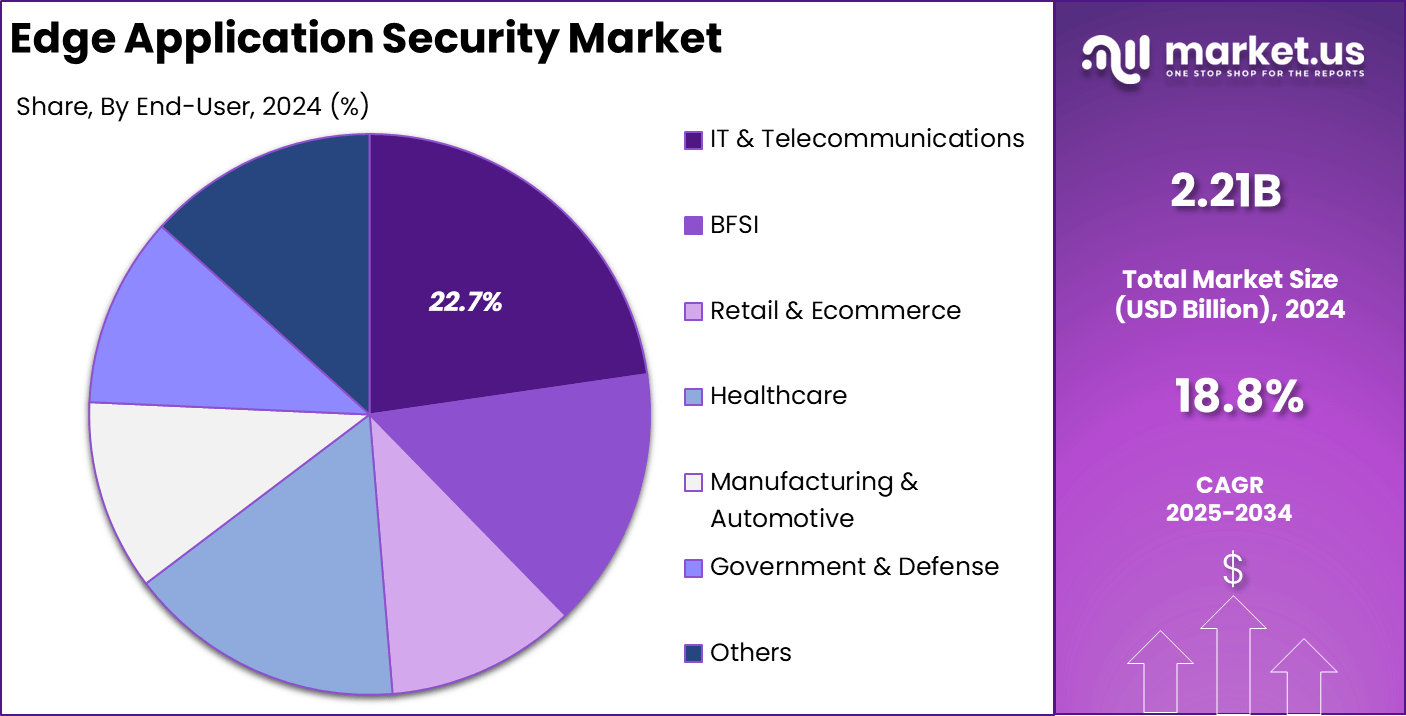

- The IT and telecommunications sector captured 22.7%, highlighting the critical need to secure networks that handle high traffic volumes and real-time services.

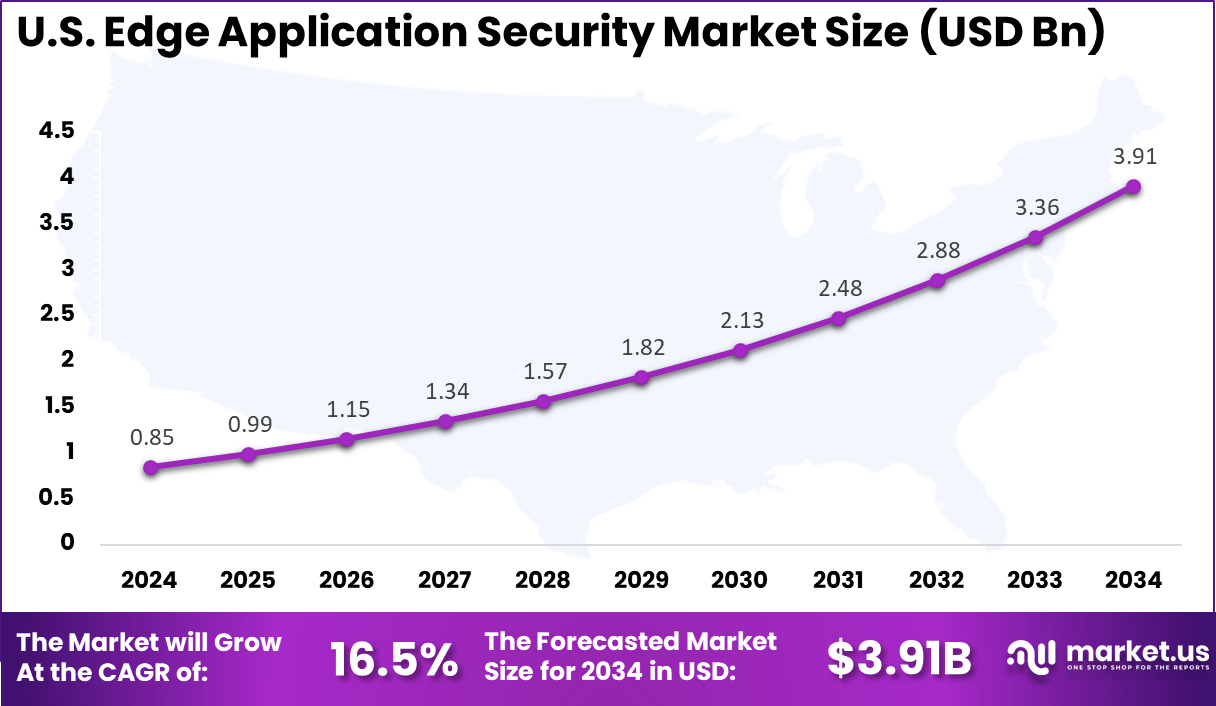

- The U.S. market reached USD 0.85 billion in 2024 with a 16.5% CAGR, showing strong commitment to advanced edge defense as application traffic grows.

- North America held 42.6%, supported by early adoption of edge technologies and strong cybersecurity spending across major industries.

Threat Landscape

- Vulnerability exploitation has increased sharply, showing that attackers now rely more on unpatched weaknesses to gain initial access and trigger security breaches.

- IoT attacks surged by 87%, driven by weak or unprotected edge nodes that expose large numbers of distributed devices to exploitation.

- About 75% of mobile and edge devices operate without proper endpoint protection, leaving a wide attack surface for threat actors.

- Edge environments face a 3x higher risk of physical and network-layer attacks than centralized cloud systems, highlighting the unique exposure of distributed infrastructure.

U.S. Market Size

The market for Edge Application Security within the U.S. is growing tremendously and is currently valued at USD 0.85 billion, the market has a projected CAGR of 16.5%. The market is growing due to rising demand for secure digital transformation. Increasing adoption of cloud computing, IoT, and 5G technologies fuels the need to protect data and applications at the network edge.

Heightened cyber threats and stringent regulatory compliance further push organizations to invest in advanced edge security solutions. Large enterprises and IT sectors drive adoption with cloud-based platforms integrating AI for real-time threat detection and response, ensuring robust protection across distributed environments.

For instance, in November 2025, Microsoft Corporation released a new version of Microsoft Edge with enhanced security updates, including Microsoft Defender Application Guard integration and advanced AI-driven browsing protections tailored for enterprise edge security. These updates support multi-platform policy management to secure browsing across Windows, macOS, iOS, and Android, helping organizations maintain control across diverse environments.

In 2024, North America held a dominant market position in the Global Edge Application Security Market, capturing more than a 42.6% share, holding USD 0.94 billion in revenue. This dominance stems from its advanced digital infrastructure and proactive cybersecurity investments.

The region leads in adopting cloud-native edge security solutions driven by large technology enterprises and service providers. Strong regulatory frameworks and increased cyberattack risk spur organizations to prioritize edge security. Additionally, innovations in IoT, 5G, and AI technologies foster the deployment of robust edge protection, maintaining North America’s leadership in securing complex, distributed enterprise environments.

For instance, in July 2025, Akamai Technologies announced a strategic partnership with Aqua Security aimed at securing AI workloads with runtime protection combined with Akamai’s edge-based Firewall for AI. The collaboration enhances full-lifecycle security for AI applications at the edge, addressing threats like prompt injections and data exfiltration without requiring modification to existing applications.

Component Analysis

In 2024, the Solutions or Platforms segment led the Global Edge Application Security Market with a dominant 70.8% share. This position was supported by growing demand for integrated security platforms that streamline management and unify endpoint protection, firewall controls, and threat intelligence. Their ability to secure distributed edge environments through a centralized approach strengthened adoption across organizations.

The growing preference for AI-enhanced, cloud-compatible security frameworks strengthens demand for these solutions. Providers continue to innovate, adding automated threat detection and response capabilities tailored for the edge, enabling businesses to tackle emerging cyber risks effectively and maintain operational continuity.

For Instance, in November 2025, Microsoft rolled out the latest Edge Stable Channel update with enhanced security patches. This release tackles critical vulnerabilities in the Chromium engine, bolstering platform protections. Organizations gain better defense against real-world exploits through these integrated fixes. The update supports seamless edge application security for broader enterprise use.

Security Type Analysis

In 2024, the Web Application Security (WAF) segment held a dominant market position, capturing a 36.2% share of the Global Edge Application Security Market. WAF solutions protect web applications by filtering and monitoring HTTP traffic, preventing attacks such as SQL injection and cross-site scripting. Their robust protection mechanisms are especially critical in environments with increasing online transactions and application exposure.

Large enterprises prioritize WAF integration due to their need to safeguard sensitive business applications and customer data from sophisticated cyber threats. These enterprises often leverage advanced detection features and sandboxing capabilities that WAF provides, making it a cornerstone of their application security strategy.

For instance, in July 2025, F5 earned recognition as a leader in Web Application and API Protection by KuppingerCole. Their WAAP solutions excel in hybrid cloud setups for edge security. Advanced WAF features protect against evolving cyber threats effectively. Enterprises rely on this for comprehensive web app defense.

Deployment Analysis

In 2024, The Cloud-based segment held a dominant market position, capturing a 90.4% share of the Global Edge Application Security Market. The cloud model offers scalability, flexibility, and centralized management, crucial for securing distributed edge infrastructures. Cloud-based security solutions enable rapid deployment and streamline updates while providing consistent policy enforcement across various edge nodes.

Businesses favor cloud deployment because it minimizes the complexity and overhead of managing security locally at each edge location. This approach supports hybrid and multi-cloud environments, making it easier to integrate edge security within broader enterprise IT frameworks.

For Instance, in September 2025, Zscaler advanced its cloud security platform with Prisma SASE 4.0 innovations. Prisma Browser blocks evasive web threats directly in browsers via the cloud. This supports zero-trust access for edge-cloud hybrid models. Organizations achieve consistent protection across deployments.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 74.5% share of the Global Edge Application Security Market. These organizations face complex security challenges due to extensive digital footprints, vast amounts of sensitive data, and numerous edge endpoints. Their need for robust, scalable security drives significant investment in advanced edge security solutions.

The increasing risks of cyberattacks and regulatory compliance requirements compel large enterprises to adopt comprehensive edge security measures. Their adoption is bolstered by features such as centralized threat intelligence, extensive monitoring, and advanced firewall protections tailored to secure critical assets effectively.

End-User Analysis

In 2024, The IT & Telecommunications segment held a dominant market position, capturing a 22.7% share of the Global Edge Application Security Market. This sector’s rapid growth is propelled by the expansion of 5G networks, IoT ecosystems, and cloud services, all requiring robust edge security to protect interconnected systems.

Telecom companies and IT service providers prioritize edge security to safeguard data transmission across base stations, edge data centers, and connected devices. The demand for low latency and high reliability in these networks fuels the adoption of advanced edge security solutions that maintain service integrity and protect against distributed threats.

For Instance, in September 2025, Palo Alto Networks introduced Prisma Browser in SASE 4.0 for evasive threat protection. It neutralizes attacks assembling in browsers, vital for telecom data flows. Cloud-edge integration safeguards IT infrastructures effectively. Telecom providers gain from real-time web security enhancements.

Emerging Trends

Emerging trends in edge application security focus on adopting trusted access models where every device and user must be verified continuously. This approach limits vulnerabilities by ensuring that no entity is automatically trusted, which is becoming widely accepted in edge security solutions.

AI-powered automation is another trend, allowing faster threat detection and response without relying solely on human intervention, which enhances overall protection at the network edge. The spread of 5G technology improves security by enabling faster, encrypted communications critical to edge applications.

It allows for real-time analysis and protection in industries that require low latency, like manufacturing and healthcare. Another key trend is the use of secure hardware that keeps sensitive data protected during processing, helping prevent unauthorized access even if the device is compromised.

Growth Factors

The spread of 5G technology improves security by enabling faster, encrypted communications critical to edge applications. It allows for real-time analysis and protection in industries that require low latency, like manufacturing and healthcare.

Another key trend is the use of secure hardware that keeps sensitive data protected during processing, helping prevent unauthorized access even if the device is compromised. Growth in edge application security is largely driven by changes in workforce patterns and technology use.

With more employees working remotely, securing devices and applications outside traditional corporate networks has become essential. This shift pushes organizations to focus on protecting the edge where data is generated and accessed to prevent cyber risks from expanding.

Key Market Segments

By Component

- Solutions/Platforms

- Services

- Professional Services

- Managed Security Services

By Security Type

- Edge Application Security

- Bot Management

- DDoS Mitigation

- Web Application Security

- Data Security & Privacy

- Others

By Deployment

- On-Premises

- Cloud-based

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By End-User

- IT & Telecommunications

- BFSI

- Retail & Ecommerce

- Healthcare

- Manufacturing & Automotive

- Government & Defense

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Need for Secure Access and Endpoint Protection

The market is being driven by the rising need to secure access to cloud services and applications as enterprises expand remote workforces and depend more on distributed environments. Protecting sensitive data at endpoints has become essential, and edge security enables policies to be applied closer to the data source. This decentralised approach reduces exposure to threats, particularly as IoT devices and mobile users operate outside traditional data centres.

Greater cloud adoption has increased the risk of targeted attacks on endpoints, making real time monitoring and prevention at access points necessary. Edge security solutions strengthen protection by reducing the attack surface and supporting compliance with strict data privacy requirements. These capabilities are becoming critical for maintaining operational continuity in widely distributed networks.

In September 2025, Palo Alto Networks introduced Prisma SASE 4.0 with Prisma Browser to block evasive threats within web browsers. The launch, adopted across more than 6 million seats, reflects how advanced edge protection is being used to secure users in diverse and dispersed environments.

Restraint

Lack of Awareness and Skilled Personnel

One significant restraint hindering the edge application security market is the lack of widespread awareness and understanding of edge security architectures, such as Secure Access Service Edge (SASE). Many organizations, especially smaller enterprises, struggle to comprehend the complexities of deploying comprehensive edge security frameworks. This knowledge gap results in slow adoption and underutilization of available advanced technologies, limiting broader market growth.

Moreover, the cybersecurity industry suffers from a shortage of skilled professionals capable of implementing and managing sophisticated edge security solutions. The lack of adequate expertise causes delays in deployment, improper maintenance, and gaps in security coverage. This challenge is particularly relevant for small and medium-sized businesses that may lack the resources to train or hire specialized personnel, further restraining the market expansion.

For instance, in August 2025, F5 Networks faced a sophisticated nation-state breach with long-term access to their systems, as disclosed in security incident reports. The event highlighted gaps in edge device management and the need for specialized skills to detect persistent threats. It underscored challenges in maintaining awareness across complex edge infrastructures.

Opportunities

Accelerated Adoption of 5G and IoT

The expansion of 5G and the growing IoT ecosystem create a strong opportunity for the edge application security market. Faster connectivity and a higher volume of devices increase exposure to threats, raising the need for security applied directly at the edge. As organizations rely on 5G enabled infrastructure and deploy more IoT systems, demand for edge native protection rises.

This shift encourages the development of scalable and low latency security technologies capable of safeguarding distributed networks in real time. Industries with heavy edge activity, including manufacturing and healthcare, stand to benefit from automated and AI supported security tools, strengthening the market’s growth potential.

For instance, in December 2025, Amazon Web Services (AWS) announced general availability of Edge Device support in Strands Agents at again invent, targeting IoT security. GuardDuty Extended Threat Detection now covers EC2 and ECS for 5G environments, using AI to spot multi-stage attacks. This boosts protection for high-speed IoT traffic at the network edge.

Challenges

Managing Highly Distributed Environments

A major challenge in this market is managing the complexity of securing highly distributed and diverse IT environments. Edge systems must function across numerous devices, network points, and cloud platforms, making it difficult to enforce uniform policies and maintain coordinated protection. The sheer scale and variety of endpoints add pressure to threat detection and response, reducing operational clarity for security teams.

Maintaining low latency, ensuring scalability, and achieving compatibility with legacy systems further increases the technical difficulty of edge deployments. Integrating new tools into segmented and uneven networks often requires advanced architectures and experienced personnel, slowing adoption and reducing overall efficiency.

In November 2025, Cloudflare experienced a global service disruption caused by a Bot Management bug that affected edge traffic. The incident highlighted how challenging it is to maintain stability and security across millions of distributed endpoints, reinforcing the complexity of safeguarding heterogeneous edge environments.

Key Players Analysis

One of the leading players in December 2025, Akamai Technologies acquired Fermyon, a leader in serverless WebAssembly functions, to bolster its edge compute platform with faster, more secure application deployment at the network edge. This move lets developers run lightweight AI and performance-critical apps closer to users while tying into Akamai’s strong security layer. It’s a smart play in edge application security, where low-latency protection matters most for real-time threats.

Top Key Players in the Market

- Microsoft Corporation

- Amazon Web Services (AWS)

- Akamai Technologies

- Cloudflare

- Fortinet

- Palo Alto Networks

- Cisco Systems

- F5 Networks

- Zscaler

- Check Point Software Technologies

- Trend Micro

- Juniper Networks

- Others

Recent Developments

- In July 2025, Palo Alto Networks wrapped up its acquisition of Protect AI, bringing full-lifecycle security for AI models right to the edge through integration with the Prisma AIRS platform. Now they scan vulnerabilities, run red team tests, and guard runtime behavior in distributed environments. Customers in finance and government get end-to-end coverage as AI apps push to the edge.

- In July 2025, F5 Networks enhanced its application delivery platform with AI-driven tools for API protection and vulnerability management across on-premises, cloud, and edge setups. The updates pull threat intel from F5 Threat Campaigns for proactive fixes, giving teams clearer visibility into runtime risks. Solid step for keeping apps safe in distributed deployments.

Report Scope

Report Features Description Market Value (2024) USD 2.21 Bn Forecast Revenue (2034) USD 12.38 Bn CAGR(2025-2034) 18.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions/Platforms, Services), By Security Type (Edge Application Security, Bot Management, DDoS Mitigation, Web Application Security, Data Security & Privacy, Others), By Deployment (On-Premises, Cloud-based), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-User (IT & Telecommunications, BFSI, Retail & Ecommerce, Healthcare, Manufacturing & Automotive, Government & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Amazon Web Services (AWS), Akamai Technologies, Cloudflare, Fortinet, Palo Alto Networks, Cisco Systems, F5 Networks, Zscaler, Check Point Software Technologies, Trend Micro, Juniper Networks, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Edge Application Security MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Edge Application Security MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Amazon Web Services (AWS)

- Akamai Technologies

- Cloudflare

- Fortinet

- Palo Alto Networks

- Cisco Systems

- F5 Networks

- Zscaler

- Check Point Software Technologies

- Trend Micro

- Juniper Networks

- Others