Global Edge AI for Smart Grid Market Size, Share, Statistics Analysis Report By Component (Hardware, (Processors (CPUs, GPUs, ASICs), Sensors, Memory devices, Edge nodes/gateways, Others), Software (Edge AI platforms, Analytics software, Machine learning models, Data management tools, Others), Services (Deployment and integration, Maintenance and support, Training and consulting), By Deployment Model (On-premises, Cloud-based), By Application (Grid Management (Load forecasting, Demand response, Outage management, Voltage/VAR optimization, Others), Asset Management (Predictive maintenance, Asset health monitoring, Fault detection and diagnosis, Others), Advanced Metering Infrastructure (AMI) (Smart meter data analytics, Energy theft detection, Billing and customer insights, Others), Distributed Energy Resource Management (Renewable integration, Microgrid control, Energy storage optimization, Others,(Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139857

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

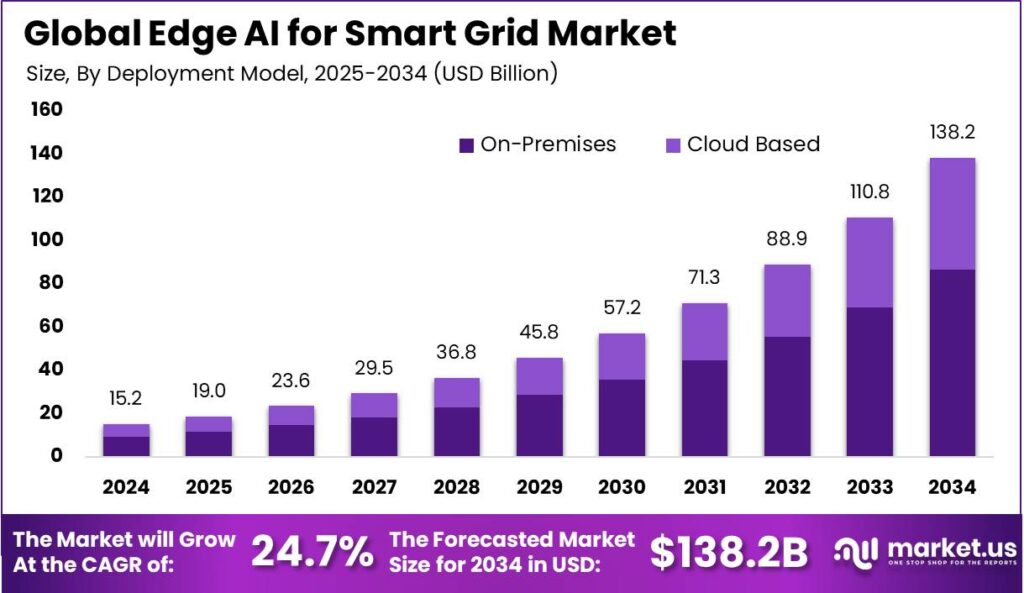

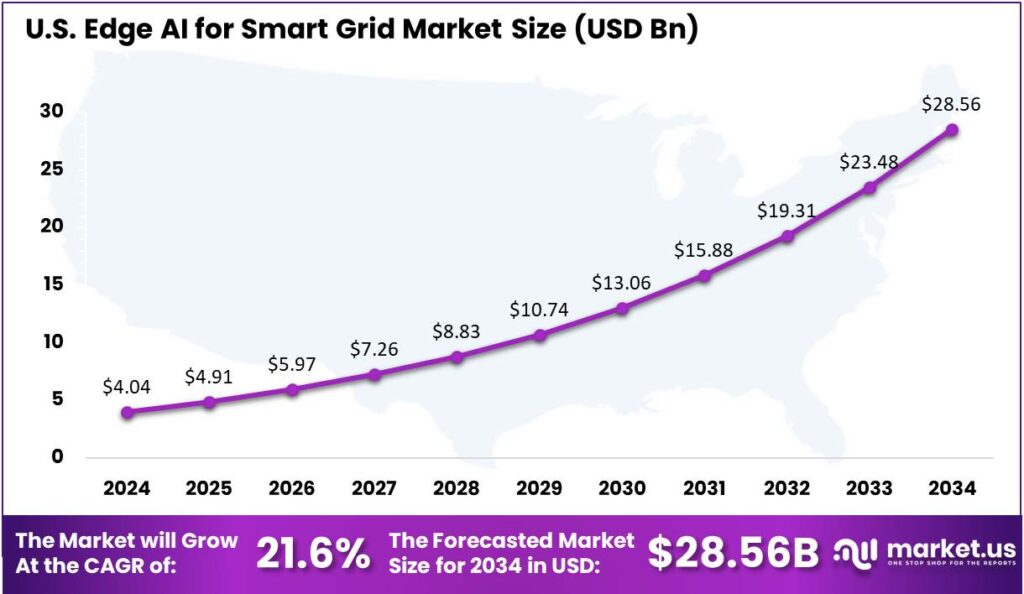

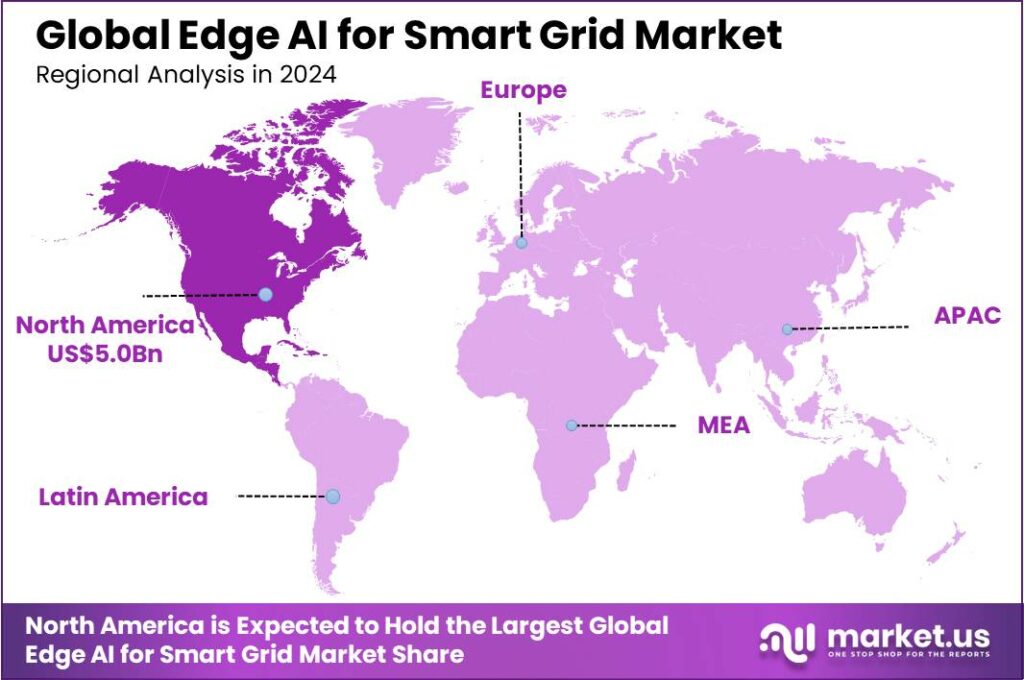

The Global Edge AI for Smart Grid Market size is expected to be worth around USD 138.2 Billion By 2034, from USD 15.2 Billion in 2024, growing at a CAGR of 24.70% during the forecast period from 2025 to 2034. In 2024, North America led the Edge AI for Smart Grid market with a 33.2% share and revenues of USD 5.0 billion. The U.S. market was valued at $4.04 billion, growing at a CAGR of 21.6%.

The market for Edge AI in smart grids is expanding rapidly as utilities seek to leverage advanced technologies to optimize energy usage, integrate renewable energy sources, and enhance grid reliability. This market includes a variety of technologies such as IoT sensors, advanced predictive analytics, and real-time data processing solutions. These innovations are crucial for managing the complex dynamics of modern energy grids, especially with the increasing penetration of variable renewable energy sources.

The demand for Edge AI in smart grids is driven by the critical need for robust grid management systems capable of handling and analyzing vast amounts of data generated by grid sensors and devices. Utilities are increasingly investing in Edge AI technologies to improve the reliability and efficiency of power distribution, cater to the growing energy demands, and ensure customer satisfaction in terms of energy savings and cost reductions.

The need for better grid management, cybersecurity, and the integration of real-time data analytics and predictive maintenance are key factors driving Edge AI adoption in grid infrastructure. Edge AI allows for the collection and analysis of data from various grid components, directly at the source, enabling early detection of potential failures, optimizing maintenance schedules, and ensuring smoother operations.

A key emerging trend in integrating Edge AI with smart grids is the shift towards decentralized energy resources (DERs) like solar panels and wind turbines. Edge AI manages variable energy sources by predicting and adjusting to power fluctuations, while also enabling predictive maintenance to detect potential failures, reducing downtime and costs.

Technological innovations in Edge AI are transforming the smart grid landscape. Advances in AI algorithms and machine learning models have boosted predictive analytics for energy consumption and generation. The development of efficient microprocessors enables real-time data processing and automated decision-making at the edge, enhancing grid management.

The market for Edge AI in smart grids is expanding globally, with significant growth opportunities in both developed and developing regions. Developed countries focus on upgrading infrastructure for better energy efficiency and renewable integration, while developing regions rapidly adopt smart grid technologies, using Edge AI to create resilient energy systems and improve access to reliable electricity.

Key Takeaways

- The Global Edge AI for Smart Grid Market size is expected to reach USD 138.2 Billion by 2034, up from USD 15.2 Billion in 2024, growing at a CAGR of 24.70% during the forecast period from 2025 to 2034.

- In 2024, the Hardware segment held a dominant position in the Edge AI for Smart Grid market, capturing more than 43.7% share.

- The On-premises segment also dominated the market in 2024, with a more than 62.6% share.

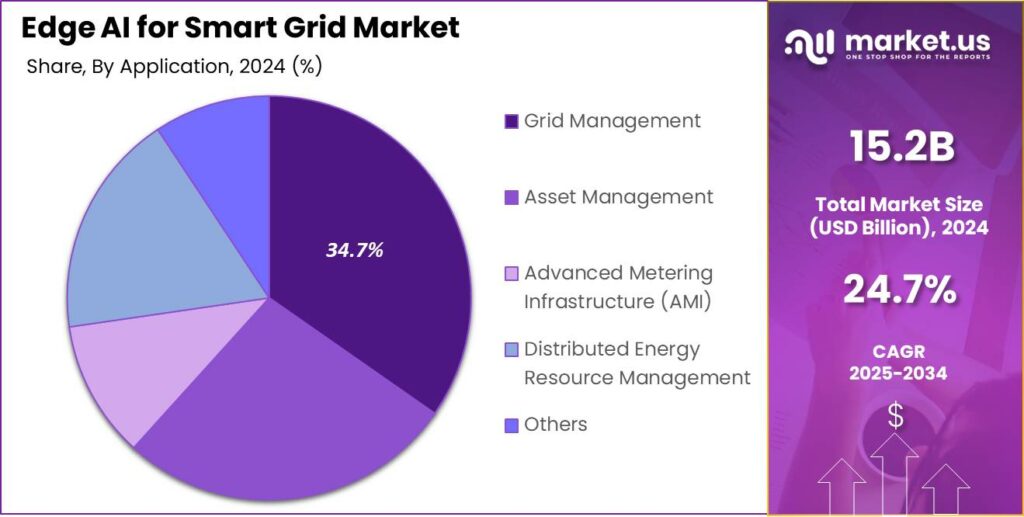

- The Grid Management segment held the largest market share in 2024, capturing more than 34.7% share.

- North America was the leading region in the Edge AI for Smart Grid market in 2024, holding a more than 33.2% share, with revenues approximately reaching USD 5.0 billion.

- The U.S. market for Edge AI in smart grids was estimated at $4.04 billion in 2024, showing a robust CAGR of 21.6%.

U.S. Edge AI for Smart Grid Market

The U.S. market for Edge AI in smart grids was estimated at $4.04 billion in 2024, showcasing a robust compound annual growth rate (CAGR) of 21.6%. This growth highlights the rising use of Edge AI to boost the power grid’s efficiency and reliability.

Edge AI adoption in smart grids allows real-time data processing and decision-making at the data source, eliminating the need to transmit data to central servers. This reduces latency, saves bandwidth, and improves system responsiveness. It is essential for managing the complexities of modern energy systems, where renewable energy and fluctuating demand require advanced grid management.

The strong CAGR reflects growing interest and investment in Edge AI technologies within the U.S. smart grid sector. This growth is driven by the demand for advanced grid management and energy sustainability. As the technology matures, Edge AI is set to transform U.S. energy infrastructure, making it more resilient, efficient, and ready for future energy challenges.

In 2024, North America held a dominant market position in the Edge AI for Smart Grid market, capturing more than a 33.2% share with revenues reaching approximately USD 5.0 billion. This leadership stems largely from the region’s advanced technological infrastructure and early adoption of smart grid technologies.

The region’s focus on energy efficiency and carbon reduction has driven the adoption of Edge AI technologies. These technologies enable real-time grid monitoring, optimize energy flows, and predict maintenance issues. Strict government regulations in North America have further incentivized utilities to invest in these advanced solutions, offering operational improvements and cost savings.

North America’s dominance in the Edge AI market is reinforced by major technology firms and startups focused on AI and IoT, constantly innovating to meet the smart grid industry’s needs. Financial support from both public and private sectors for smart grid R&D has also played a key role in accelerating Edge AI deployment in the region.

Component Analysis

In 2024, the Hardware segment held a dominant market position within the Edge AI for Smart Grid market, capturing more than a 43.7% share. This segment’s leadership is attributed to the essential role of physical components such as processors, sensors, and edge nodes in enabling the foundational capabilities of Edge AI.

Processors, including CPUs, GPUs, and ASICs, are pivotal in the hardware lineup, providing the necessary computational power to handle complex algorithms and real-time data processing. The growing need for powerful processing capabilities at the edge to support advanced AI applications drives the demand for these specialized processors.

Sensors and edge nodes/gateways also significantly contribute to the hardware segment’s lead. Sensors collect critical data from various points on the smart grid, enabling real-time monitoring and management of grid conditions. Edge nodes/gateways facilitate the local processing of this data, reducing latency and reliance on central data centers.

Furthermore, the integration of advanced memory devices that provide higher speed and capacity supports the enhanced functionality of edge computing solutions. These components are essential for the storage and retrieval of large volumes of data generated by the grid, ensuring that the system’s performance remains optimal.

Deployment Model Analysis

In 2024, the On-premises segment held a dominant market position in the Edge AI for smart grid market, capturing more than a 62.6% share. This segment’s leadership stems primarily from its ability to offer enhanced security and control, which are crucial for energy management systems.

The preference for on-premises solutions stems from the need for high reliability and uptime, avoiding risks from external internet connectivity issues that can affect cloud-based systems. Utilities and energy companies rely on uninterrupted access to ensure stable grid operation and quick responses to grid integrity problems.

On-premises deployment offers lower long-term costs for data storage and processing. While the upfront hardware and infrastructure costs may be higher than cloud-based solutions, on-premises systems avoid ongoing costs like data transfer fees and monthly subscriptions, making them more cost-efficient over time.

The on-premises segment’s dominance is strengthened by advancements in technology, such as improved processing power, energy efficiency, and AI algorithms. These developments enable on-premises Edge AI systems to perform more complex tasks with greater autonomy.

Application Analysis

In 2024, the Grid Management segment held a dominant market position in the Edge AI for Smart Grid market, capturing more than a 34.7% share. This segment’s leadership can be attributed to the increasing demand for real-time grid stability and operational efficiency.

As utilities contend with aging infrastructure and increasing renewable energy sources, dynamic grid management has become essential. Edge AI boosts grid management systems by improving load forecasting, demand response, outage management, and voltage/VAR optimization, enhancing grid responsiveness and reliability.

The integration of renewable energy, with its variability in power generation, drives the need for effective grid management. Edge AI aids in predicting and managing these fluctuations, using technologies like load forecasting and demand response to balance supply and demand, reduce outages, and improve grid efficiency.

The increasing focus on sustainability and regulatory pressures is driving utilities to adopt advanced solutions like Edge AI. These technologies aid in voltage/VAR optimization and managing peak load conditions, preventing costly grid failures and ensuring compliance with national and international grid standards.

Key Market Segments

By Component

- Hardware

- Processors (CPUs, GPUs, ASICs)

- Sensors

- Memory devices

- Edge nodes/gateways

- Others

- Software

- Edge AI platforms

- Analytics software

- Machine learning models

- Data management tools

- Others

- Services

- Deployment and integration

- Maintenance and support

- Training and consulting

By Deployment Model

- On-premises

- Cloud-based

By Application

- Grid Management

Load forecasting

Demand response

Outage management

Voltage/VAR optimization

Others - Asset Management

Predictive maintenance

Asset health monitoring

Fault detection and diagnosis

Others - Advanced Metering Infrastructure (AMI)

Smart meter data analytics

Energy theft detection

Billing and customer insights

Others - Distributed Energy Resource Management

Renewable integration

Microgrid control

Energy storage optimization

Others - Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Real-Time Decision-Making

Integrating Edge AI into smart grids significantly improves real-time decision-making capabilities. By processing data locally, edge devices can analyze and respond to fluctuations in energy demand and supply almost instantaneously. This immediacy allows for dynamic load balancing, efficient demand response, and rapid fault detection, leading to a more stable and efficient energy distribution system.

For instance, AI algorithms can predict energy consumption patterns and adjust distribution proactively, reducing energy waste and preventing overloads. This localized processing minimizes latency issues inherent in cloud-based systems, ensuring timely responses crucial for maintaining grid stability. Moreover, by reducing the need to transmit vast amounts of data to central servers, edge computing alleviates network congestion and lowers operational costs.

Restraint

High Implementation Costs

Despite its advantages, the adoption of Edge AI in smart grids is hindered by substantial implementation costs. Deploying edge devices equipped with advanced AI capabilities requires significant capital investment. The expenses encompass not only the hardware and software components but also the integration of these systems into existing grid infrastructures.

Additionally, ongoing maintenance and updates to both hardware and AI models contribute to the financial burden. For many utility companies, especially those operating under tight budget constraints, these high upfront and operational costs can be prohibitive. The financial challenge is further compounded by the rapid pace of technological advancements, which can render investments obsolete within a short period.

Opportunity

Integration of Renewable Energy Sources

Edge AI presents a significant opportunity to enhance the integration of renewable energy sources into smart grids. Renewable energy generation, such as solar and wind, is inherently variable and unpredictable. Edge AI can mitigate these challenges by providing real-time analytics and predictive insights at the point of energy generation and consumption.

By processing data locally, edge devices can forecast energy production from renewable sources based on weather patterns and historical data, allowing for more accurate matching of supply and demand. This capability facilitates the seamless incorporation of renewables into the grid, optimizing their utilization and reducing reliance on fossil fuels. Moreover, Edge AI enables decentralized energy management, allowing microgrids to operate autonomously and efficiently.

Challenge

Data Security and Privacy Concerns

The deployment of Edge AI in smart grids introduces significant data security and privacy challenges. Edge devices collect and process vast amounts of sensitive information, including consumer energy usage patterns and grid operational data. Protecting this data from unauthorized access and cyberattacks is paramount.

Unlike centralized systems, edge computing involves numerous distributed devices, each potentially serving as a point of vulnerability. Ensuring the security of these devices requires robust encryption protocols, regular software updates, and continuous monitoring to detect and respond to threats promptly. Additionally, maintaining data privacy is crucial to uphold consumer trust and comply with regulatory requirements. Implementing comprehensive security measures across a decentralized network is complex and resource-intensive.

Emerging Trends

By processing data locally, edge AI enables real-time decision-making, enhancing grid efficiency and reliability. This approach reduces the need to send vast amounts of data to centralized cloud servers, thereby decreasing latency and bandwidth usage.

Another significant trend is the use of edge AI to bolster cybersecurity within the grid. By processing sensitive information locally, the risk of data breaches during transmission is minimized, ensuring that critical infrastructure remains secure.

Additionally, edge AI facilitates the seamless integration of renewable energy sources. By analyzing data on-site, it can predict fluctuations in energy generation from sources like wind and solar, enabling the grid to adjust in real-time and maintain stability.

Furthermore, edge AI supports predictive maintenance by continuously monitoring equipment health and performance. It can detect anomalies and signs of wear in machinery, allowing for timely interventions before failures occur.

Business Benefits

One of the primary benefits is enhanced operational efficiency. By processing data at the edge, companies can make swift decisions, optimizing energy distribution and reducing waste. This efficiency translates to cost savings, as the need for extensive data transmission to central servers is minimized, leading to lower bandwidth and cloud storage expenses.

Edge AI also provides businesses with greater agility. The ability to analyze and respond to data in real-time means that companies can quickly adapt to changing energy demands and market conditions. This responsiveness is crucial in today’s dynamic energy landscape, where fluctuations in supply and demand are common.

Moreover, the local processing of data enhances security and compliance. By keeping sensitive information on-site, businesses reduce the risk of data breaches and can more easily adhere to data sovereignty regulations. This aspect is particularly important in regions with strict data protection laws.

Key Player Analysis

NVIDIA Corporation is a leader in Edge AI technologies, especially in the Smart Grid sector. Known for its powerful GPUs, NVIDIA’s hardware and software platforms enable faster data processing at the edge of the network. The company’s deep learning and AI-driven solutions are helping utilities optimize grid performance, manage demand, and prevent outages.

Intel Corporation is another key player driving Edge AI innovation in Smart Grids. Their expertise in processors and AI accelerators makes them a significant force in enabling edge computing for utilities. Intel’s edge computing platforms are designed to process large amounts of data in real-time, allowing Smart Grids to predict power needs, detect anomalies, and manage resources more efficiently.

IBM Corporation brings its decades of expertise in AI and cloud computing to the Edge AI Smart Grid space. IBM’s solutions are designed to enhance decision-making by analyzing data at the grid’s edge, enabling real-time responses to energy demands. Their AI-powered tools for predictive maintenance, load forecasting, and energy optimization contribute to a more stable and reliable grid.

Top Key Players in the Market

- NVIDIA Corporation

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- Siemens AG

- General Electric (GE Grid Solutions)

- Cisco Systems, Inc.

- Schneider Electric SE

- ABB Ltd.

- Huawei Technologies Co., Ltd.

- Itron, Inc.

- Oracle Corporation

- Others

Top Opportunities Awaiting for Players

The integration of Edge AI into smart grid systems presents several promising opportunities for companies in the energy sector.

- Real-Time Data Processing and Decision-Making: Edge AI enables the processing of data directly at the source, reducing latency and enhancing the responsiveness of smart grids. This capability is crucial for real-time monitoring and control, allowing utilities to promptly address issues such as power outages or equipment malfunctions. By analyzing data locally, companies can make swift decisions, improving grid reliability and efficiency.

- Enhanced Grid Security: With the increasing volume of data generated by smart grids, ensuring data privacy and security is paramount. Edge computing addresses these concerns by processing sensitive information locally, minimizing the need to transmit data to centralized servers. This approach reduces the risk of data breaches and enhances the overall security posture of the grid.

- Integration of Renewable Energy Sources: The growing adoption of renewable energy sources like solar and wind requires advanced grid management to handle their variability. Edge AI can facilitate the seamless integration of these sources by providing real-time data analysis and predictive insights, enabling better forecasting and balancing of supply and demand. This capability supports the transition to a more sustainable energy mix.

- Predictive Maintenance and Fault Detection: Implementing Edge AI allows for continuous monitoring of grid infrastructure, enabling the early detection of potential faults or equipment degradation. By identifying issues before they lead to failures, companies can perform predictive maintenance, reducing downtime and maintenance costs, and extending the lifespan of critical assets.

- Energy Efficiency and Demand Response: Edge AI can analyze consumption patterns and optimize energy distribution, leading to improved energy efficiency. By understanding demand fluctuations, utilities can implement demand response strategies, encouraging consumers to adjust their usage during peak times, thereby balancing load and reducing the need for additional power generation.

Recent Developments

- In October 2024, at Enlit 2024, Schneider Electric unveiled smart grid solutions focused on wildfire and storm mitigation, including a virtualized substation system and updates to their Digital Grid portfolio. These innovations aim to enhance grid reliability, efficiency, and support renewable energy integration while promoting sustainability and monitoring decarbonization.

- Utilidata is developing a custom AI module for the edge of the grid, powered by NVIDIA’s Jetson platform. This innovation will boost grid resiliency and reduce operational costs by integrating distributed energy resources (DERs) like solar and electric vehicles. To launch in 2024, this module marks a major leap toward a smarter, more efficient electric grid.

- In January 2025, Cisco partnered with Gridspertise to develop digital solutions for electricity grids, focusing on improving resiliency and efficiency using cybersecurity, AI, and IoT technologies. The collaboration aims to support the integration of renewable energy into existing power systems.

Report Scope

Report Features Description Market Value (2024) USD 15.2 Bn Forecast Revenue (2034) USD 138.2 Bn CAGR (2025-2034) 24.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, (Processors (CPUs, GPUs, ASICs), Sensors, Memory devices, Edge nodes/gateways, Others), Software (Edge AI platforms, Analytics software, Machine learning models, Data management tools, Others), Services (Deployment and integration, Maintenance and support, Training and consulting), By Deployment Model (On-premises, Cloud-based), By Application (Grid Management (Load forecasting, Demand response, Outage management, Voltage/VAR optimization, Others), Asset Management (Predictive maintenance, Asset health monitoring, Fault detection and diagnosis, Others), Advanced Metering Infrastructure (AMI) (Smart meter data analytics, Energy theft detection, Billing and customer insights, Others), Distributed Energy Resource Management (Renewable integration, Microgrid control, Energy storage optimization, Others,(Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NVIDIA Corporation, Intel Corporation, IBM Corporation, Microsoft Corporation, Siemens AG, General Electric (GE Grid Solutions), Cisco Systems, Inc., Schneider Electric SE, ABB Ltd., Huawei Technologies Co., Ltd., Itron, Inc., Oracle Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Edge AI for Smart Grid MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Edge AI for Smart Grid MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NVIDIA Corporation

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- Siemens AG

- General Electric (GE Grid Solutions)

- Cisco Systems, Inc.

- Schneider Electric SE

- ABB Ltd.

- Huawei Technologies Co., Ltd.

- Itron, Inc.

- Oracle Corporation

- Others