Global Edge AI ICs Market Size, Share, Statistics Analysis Report By Chipset (CPU, GPU, ASIC, Others), By Function (Training, Inference), By Device (Consumer Devices, Enterprise Devices), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143199

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

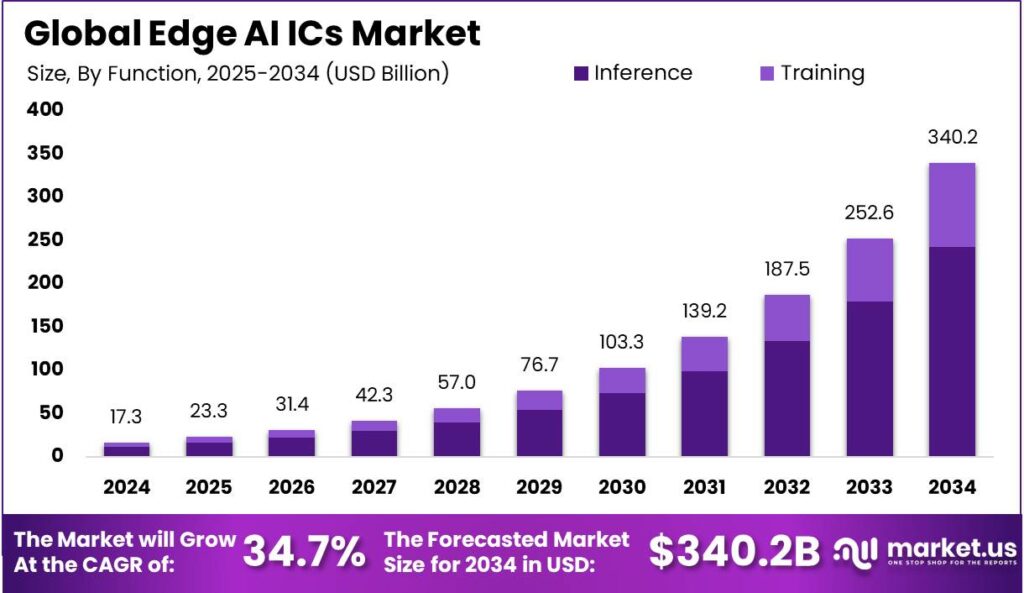

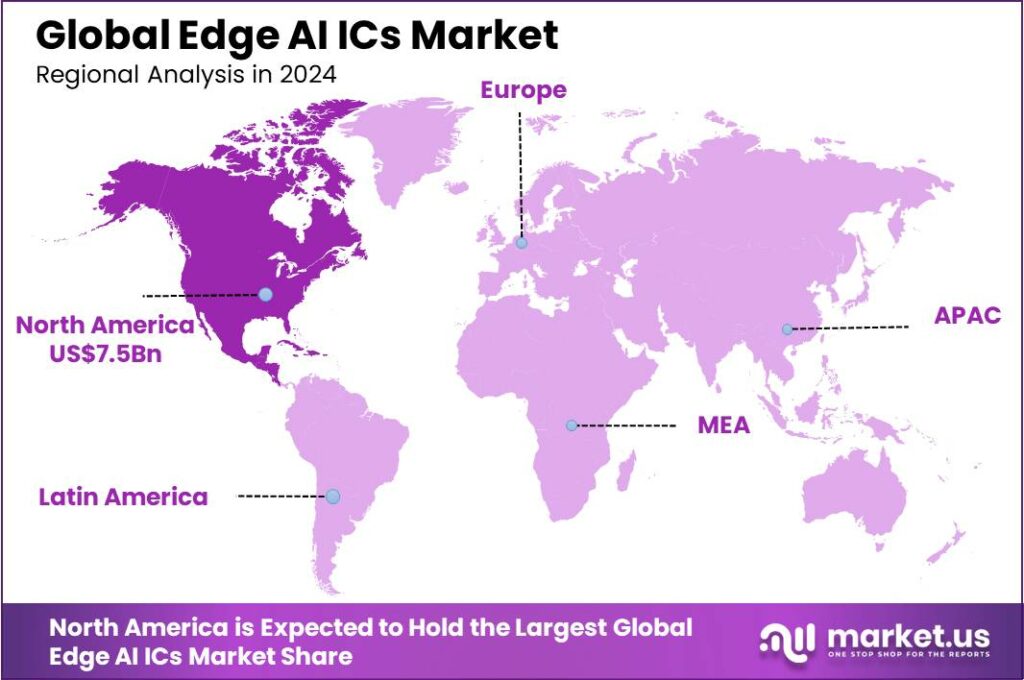

The Global Edge AI ICs Market size is expected to be worth around USD 340.2 Billion By 2034, from USD 17.3 Billion in 2024, growing at a CAGR of 34.70% during the forecast period from 2025 to 2034. In 2024, North America dominated the Edge AI ICs market with 37.4% market share and USD 7.5 billion in revenues. The U.S. market was valued at USD 6.8 billion and is expected to grow at a CAGR of 33.2%.

Edge AI integrated circuits (ICs) are specialized hardware components designed to facilitate artificial intelligence processing at the edge of networks than relying solely on cloud computing. These ICs are integral in processing data locally on devices such as smartphones, cameras, and IoT devices, enabling real-time data processing without the latency associated with data transmission to a distant server.

The market for Edge AI ICs is expanding significantly due to the increasing demand for real-time, efficient, and secure data processing across various industries including automotive, healthcare, manufacturing, and consumer electronics. These industries benefit greatly from edge computing as it enhances operational efficiency, reduces latency, and supports the growing number of connected devices

The growth of the Edge AI ICs market is driven by several key factors. The surge in IoT devices generates large volumes of data that need quick and efficient processing, which Edge AI ICs enable through local data processing, improving IoT performance. Concerns over data privacy and security are driving industries to adopt edge computing, enabling local processing of sensitive information and reducing the risk of data breaches.

The primary driving factors for the Edge AI ICs market include the proliferation of IoT devices, the need for real-time computing, advancements in neural network technology, and the increasing automation in industries requiring immediate data analysis. The continuous evolution and enhancement of neural networks and computing infrastructure significantly contribute to the market’s growth.

There is a high demand for Edge AI ICs in applications where latency and privacy are critical. This includes sectors like healthcare for real-time diagnostic systems, automotive for immediate decision-making in autonomous vehicles, and industrial applications for predictive maintenance and operational efficiency

Key Takeaways

- The Global Edge AI ICs Market size is projected to reach USD 340.2 Billion by 2034, up from USD 17.3 Billion in 2024, growing at a CAGR of 34.70% during the forecast period from 2025 to 2034.

- In 2024, the CPU segment held a dominant position within the Edge AI ICs market, capturing more than 64.02% of the market share.

- The Inference segment of the Edge AI ICs market dominated in 2024, capturing more than 71.4% of the total market share.

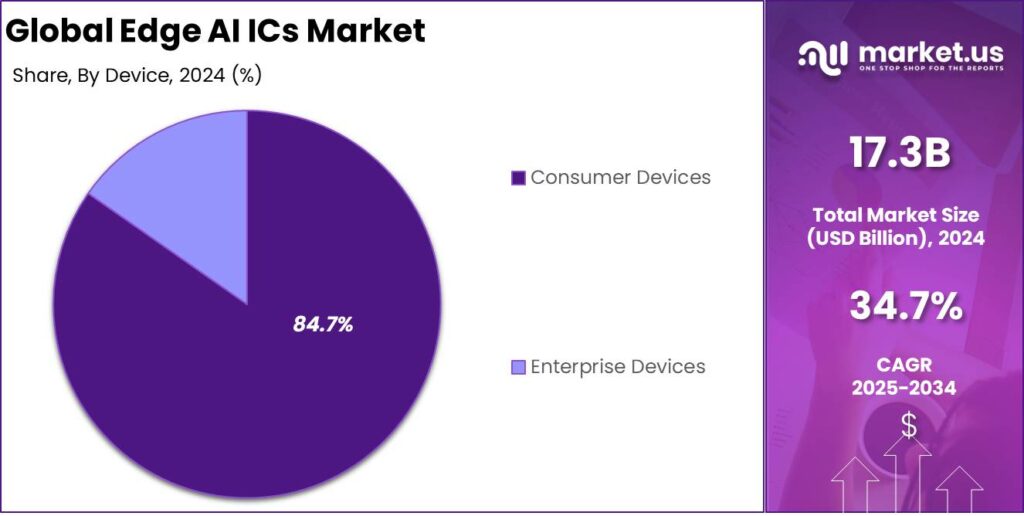

- In 2024, the Consumer Devices segment held a dominant market position in the Edge AI ICs market, capturing more than 84.7% of the share.

- North America held a dominant market position in 2024, capturing more than 37.4% of the Edge AI ICs market with revenues totaling USD 7.5 billion.

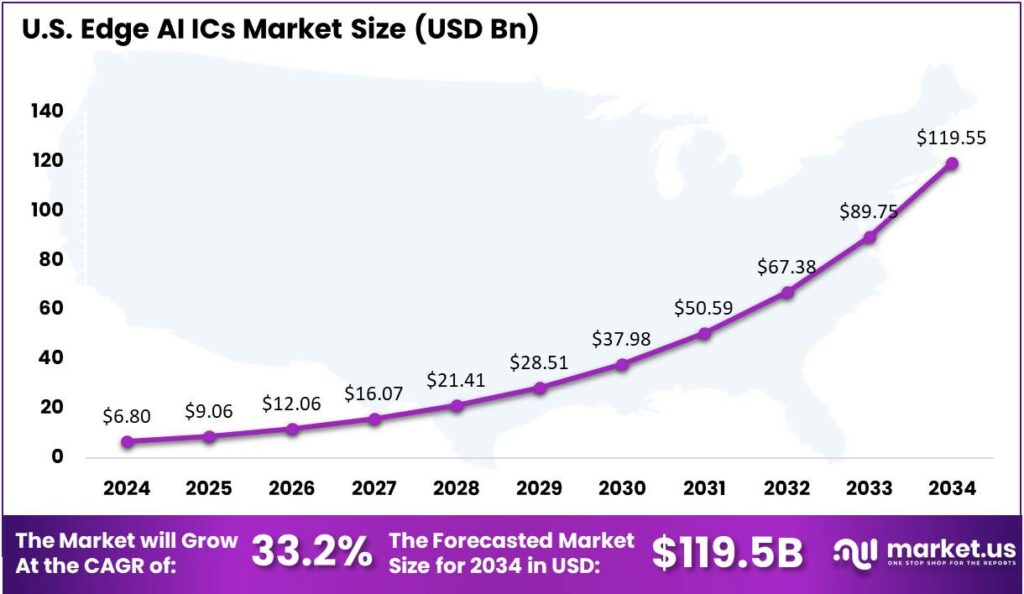

- The U.S. market for Edge AI integrated circuits (ICs) was valued at USD 6.8 billion in 2024. This sector is expected to experience a strong CAGR of 33.2%.

Analysts’ Viewpoint

The Edge AI ICs market offers numerous investment opportunities, particularly in developing more energy-efficient and powerful chips that can handle more complex AI tasks without compromising speed. Investments are also encouraged in sectors that could benefit from edge computing enhancements, such as smart cities, advanced healthcare systems, and more autonomous industrial operations.

Recent technological advancements in Edge AI ICs include improvements in chip efficiency, reductions in power consumption, and the ability to handle more complex algorithms. These advancements enable more robust and reliable AI processing at the edge, leading to quicker and smarter decision-making capabilities across various devices and applications.

The regulatory environment for Edge AI ICs is primarily focused on data protection and privacy laws, which are becoming increasingly stringent. Companies must ensure compliance with these regulations, as Edge AI devices often process sensitive and personal data. This compliance is crucial not only for legal adherence but also for maintaining consumer trust and safeguarding against data breaches.

U.S. Edge AI ICs Market

In 2024, the U.S. market for Edge AI integrated circuits (ICs) was estimated to have a value of USD 6.8 billion. This sector is projected to experience a robust compound annual growth rate (CAGR) of 33.2%.

The substantial growth in the U.S. Edge AI ICs market can be attributed to increasing demands for faster processing and real-time decision-making capabilities at the edge of networks. As industries such as autonomous vehicles, healthcare, and manufacturing continue to incorporate advanced AI functionalities, the need for edge computing devices that can process data locally without latency is escalating.

Moreover, the expansion of IoT devices and smart applications across residential, commercial, and industrial sectors is fueling the demand for Edge AI ICs. The integration of AI capabilities directly into edge devices enhances responsiveness and operational efficiency, thereby driving the market forward. This trend is supported by ongoing advancements in semiconductor technologies and machine learning algorithms, which are making edge devices increasingly capable and cost-effective.

In 2024, North America held a dominant market position in the Edge AI ICs market, capturing more than a 37.4% share with revenues amounting to USD 7.5 billion. This leadership is primarily driven by the region’s advanced technological infrastructure and the rapid adoption of AI technologies across various industries, including automotive, healthcare, and consumer electronics.

The prominence of North America in this market can be attributed to several key factors. First, the region is home to some of the world’s leading technology companies and startups focused on AI and machine learning innovations. These entities are pivotal in developing and deploying cutting-edge AI solutions integrated into edge devices.

The widespread implementation of IoT systems across North American industries has necessitated the deployment of efficient and powerful edge computing solutions. Edge AI ICs are essential in processing data locally at the edge of the network, thus reducing latency and enhancing the speed of data analysis.

Europe, APAC, Latin America, the Middle East, and Africa each play a key role in the global Edge AI ICs market, with distinct growth drivers. Europe’s strong data protection and AI ethics regulations foster secure AI development. APAC sees rapid growth, driven by technological adoption and industrialization, especially in China and India, where smart technologies are being widely implemented.

Chipset Analysis

In 2024, the CPU segment held a dominant market position within the Edge AI ICs market, capturing more than a 64.02% share. This significant market share can be attributed primarily to the versatility and general-purpose nature of CPUs.

CPUs are capable of handling a variety of tasks ranging from simple to complex computational processes, making them indispensable in diverse applications across numerous industries. Their broad applicability supports widespread adoption in edge computing, where flexibility in processing different AI workloads is crucial.

The widespread infrastructure supporting CPU integration is a key factor in the CPU segment’s prominence in the Edge AI ICs market. Existing systems and software are optimized for CPUs, simplifying the integration of AI functionalities, reducing development time and costs, and driving preference for CPUs over specialized chipsets.

Continuous advancements in CPU technology have boosted their efficiency and capabilities, crucial for AI processes. Modern CPUs now support parallel processing and power management, essential for edge AI applications. These enhancements help balance power and performance, a key factor for edge devices, reinforcing the CPU’s dominant role in the market.

Function Analysis

In 2024, the Inference segment of the Edge AI ICs market held a dominant position, capturing more than a 71.4% share. This segment leads primarily because inference-based applications are integral to executing pre-trained AI models directly on edge devices.

Inference ICs are designed to efficiently process data inputs on the device itself, providing immediate outputs without the need for extensive computation power or connectivity. This capability is particularly crucial in applications where real-time decision-making and responsiveness are essential, such as in autonomous vehicles and smart security systems.

The Inference segment’s dominance is driven by its broad applicability across industries. In consumer electronics, it enables features like voice recognition and gesture control, while in industrial settings, it improves process monitoring, efficiency, and safety. This versatility highlights the crucial role of inference ICs in the adoption of Edge AI technologies.

Advancements in semiconductor technology have made inference ICs more cost-effective and energy-efficient, making edge AI solutions more practical and accessible for smaller companies and startups. This has fueled strong growth in the adoption of inference ICs, reinforcing their leading position in the Edge AI ICs market.

Device Analysis

In 2024, the Consumer Devices segment held a dominant market position in the Edge AI ICs market, capturing more than an 84.7% share. This segment’s leadership is predominantly attributed to the widespread incorporation of AI technologies into consumer electronics such as smartphones, wearables, home automation systems, and security cameras.

The growth of the Consumer Devices segment is driven by ongoing advancements in consumer technology. As consumers demand more intuitive and feature-rich devices, manufacturers are integrating Edge AI ICs to enable devices to learn from user interactions and adapt, improving both user experience and performance.

Moreover, the rise of the Internet of Things (IoT) in the consumer sector significantly contributes to the dominance of this segment. IoT devices, which often require immediate processing of vast amounts of data, leverage Edge AI ICs to manage tasks locally, thus minimizing latency and reducing bandwidth usage. This capability is crucial for applications requiring instant responses, such as in smart home systems and personal assistants.

The growing focus on personal privacy and data security is boosting the Consumer Devices segment in the Edge AI ICs market. Edge computing allows local data processing, reducing risks tied to cloud storage and transmission, which appeals to privacy-conscious consumers. As edge AI capabilities continue to improve, they will sustain the growth and appeal of consumer electronics.

Key Market Segments

By Chipset

- CPU

- GPU

- ASIC

- Others

By Function

- Training

- Inference

By Device

- Consumer Devices

- Enterprise Devices

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Proliferation of IoT Devices

One key driver of the Edge AI integrated circuit (IC) market is the ongoing expansion and proliferation of Internet of Things (IoT) devices. These devices, ranging from consumer electronics to industrial IoT applications, increasingly require processing power at the edge of the network to reduce latency, enhance data privacy, and decrease bandwidth costs associated with cloud computing.

The deployment of Edge AI enhances the efficiency of these devices by enabling real-time data processing and decision-making without the need to transmit large amounts of data to centralized servers. This shift not only boosts the performance of IoT applications but also expands the potential for more complex and responsive AI functionalities at the edge

Restraint

Thermal Management Challenges

A significant restraint in the development and deployment of Edge AI ICs is the challenge of managing heat dissipation within compact and densely packed electronic devices. Advanced Edge AI ICs, especially those performing high-computation tasks, generate considerable amounts of heat. Managing this heat is crucial to maintain system reliability and efficiency.

Techniques like using ultra-thin vapor chambers help spread the heat and minimize hot spots, yet they face limitations in mobile environments where movement can reduce their effectiveness. This issue emphasizes the need for innovative solutions in thermal management to ensure Edge AI ICs can operate effectively within the strict thermal limits of modern electronic devices

Opportunity

Advanced Power Management Technologies

The integration of advanced power management technologies presents a substantial opportunity for the Edge AI IC market. Technologies such as autonomous intelligent power management enable selective powering of SoC sections based on processing demand and use case.

This approach not only optimizes power consumption during periods of low demand but also enhances the battery life of edge devices, making them more efficient and environmentally friendly. By incorporating such technologies, Edge AI systems can perform intense computations more sustainably, appealing to an increasingly eco-conscious market

Challenge

Integration and Interoperability

A prevalent challenge in the Edge AI sector is ensuring seamless integration and interoperability of diverse hardware and software components. Edge AI systems must effectively communicate and collaborate with various devices and platforms, which often operate on different standards.

Achieving this requires meticulous planning and compatibility testing, alongside the adoption of flexible software architectures and communication protocols like MQTT, CoAP, and HTTP. This integration is critical for the efficient operation of Edge AI systems, as it affects everything from data flow to user interface design, posing a persistent challenge for developers aiming to create cohesive and versatile AI solutions

Emerging Trends

One notable trend is the development of Micro AI—lightweight, highly efficient AI models designed for edge devices such as smartwatches, IoT sensors, drones, and home appliances. These compact AI models enable real-time data processing and decision-making directly on devices, minimizing reliance on cloud infrastructure.

Another significant trend is the integration of Neural Processing Units (NPUs) into edge devices. Integrating dedicated NPUs boosts AI inference, saving power, improving thermal management, and enabling efficient multitasking. This enhances edge AI for power-sensitive, latency-critical applications like wearables and sensor nodes.

The shift of AI model training to the ‘thick edge’ is also noteworthy. This approach trains AI models on edge servers or micro data centers, reducing reliance on centralized cloud systems. It boosts data privacy, cuts costs, and enhances AI application responsiveness on edge devices, advancing edge computing strategies.

Business Benefits

Key benefits include improved data privacy and security, as local processing minimizes exposure to cyber threats, ensuring user privacy and regulatory compliance. Additionally, reduced latency enables real-time decision-making, crucial for applications like autonomous vehicles and industrial automation.

Bandwidth efficiency is also improved through edge AI ICs. Processing data at the source minimizes the need for extensive data transmission to centralized servers, leading to lower bandwidth usage and associated costs.

In retail, edge AI improves inventory management and customer experience by enabling real-time data analysis for accurate stock monitoring and personalized shopping. It enhances operational efficiency and customer satisfaction. Edge AI ICs ensure operational reliability by allowing devices to function independently of network connectivity, maintaining performance during disruptions.

Key Player Analysis

AMD is a key player in the Edge AI ICs market, offering powerful processors and graphics cards that support AI workloads at the edge. Their EPYC processors and Radeon GPUs are increasingly being integrated into edge devices, enabling high-performance computing with low power consumption.

Alphabet Inc., the parent company of Google, is also a major contributor to the Edge AI IC market, primarily through its development of custom AI chips such as the Tensor Processing Unit (TPU). These chips are designed to accelerate machine learning tasks and are used in Google’s cloud services as well as edge devices.

Intel Corporation is one of the leading companies in the development of Edge AI ICs. Through its various lines of processors, including the Intel Core and Xeon series, along with its specialized chips like the Intel Movidius VPU (Vision Processing Unit), Intel plays a significant role in enabling AI at the edge.

Top Key Players in the Market

- Advanced Micro Devices, Inc.

- Alphabet Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Apple Inc.

- Mythic

- Arm Limited

- Samsung

- NVIDIA Corporation

- Huawei Technologies Co., Ltd.

- Other Major Players

Top Opportunities Awaiting for Players

In the dynamic and rapidly evolving Edge AI Integrated Circuits (ICs) market, several key opportunities stand out for industry players.

- Expansion into Emerging Markets: The Asia-Pacific region is expected to dominate the Edge AI ICs market due to its robust semiconductor manufacturing base and increasing adoption of AI technologies. Companies can leverage this regional growth by developing partnerships and expanding their operations into these markets.

- Innovations in AI Chip Technology: Leading companies like NVIDIA, Intel, and Qualcomm continue to push the boundaries of AI chip technology. Innovations such as low-power AI chips and integration with 5G networks offer significant opportunities for market players to differentiate their products and cater to emerging needs, particularly in applications requiring high-performance computing at low energy costs.

- Applications in Diverse Verticals: Edge AI ICs are finding new applications across various sectors, including automotive, healthcare, industrial automation, and consumer electronics. The ability to process data locally on devices, reducing latency and enhancing privacy, is particularly valuable. Companies that develop specialized solutions for these verticals can capture significant market share.

- Partnerships and Collaborations: As the complexity of Edge AI solutions increases, partnerships are becoming crucial. Companies can accelerate their market entry and innovation by collaborating with system integrators, platform providers, and other stakeholders who bring complementary skills and technologies.

- Focus on Sustainability and Security: The Edge AI market is increasingly focusing on sustainable digital infrastructure and enhanced security protocols. Companies that can innovate in these areas not only comply with emerging regulations but also offer added value to customers concerned with environmental impact and data security.

Recent Developments

- In February 2025, NXP Semiconductors agreed to acquire Kinara, an Edge AI pioneer, in an all-cash deal valued at $307 million. This acquisition is expected to enhance NXP’s offerings in the intelligent edge domain.

- In December 2024, STMicroelectronics introduced the STM32N6 series microcontrollers, designed for edge AI and machine learning applications. These microcontrollers enable local image and audio processing, reducing the need for larger data centers.

- Synopsys and SiMa.ai announced a strategic collaboration in December 2024 to accelerate the development of automotive edge AI solutions. This partnership aims to deliver new solutions for automotive companies, enhancing the integration of AI in automotive applications.

Report Scope

Report Features Description Market Value (2024) USD 17.3 Bn Forecast Revenue (2034) USD 340.2 Bn CAGR (2025-2034) 34.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Chipset (CPU, GPU, ASIC, Others), By Function (Training, Inference), By Device (Consumer Devices, Enterprise Devices) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advanced Micro Devices, Inc., Alphabet Inc., Intel Corporation, Qualcomm Technologies, Inc., Apple Inc., Mythic, Arm Limited, Samsung, NVIDIA Corporation, Huawei Technologies Co., Ltd., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Advanced Micro Devices, Inc.

- Alphabet Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Apple Inc.

- Mythic

- Arm Limited

- Samsung

- NVIDIA Corporation

- Huawei Technologies Co., Ltd.

- Other Major Players