Global Earned Wage Access Market Size, Share Analysis By Component (Solutions and Services), by Deployment Mode (Cloud-Based and On-Premise), By End-User (Large Enterprises and SMEs), By Industry Vertical, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154961

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of AI in EWA Market

- U.S. Market Size

- By Component

- By Deployment Mode

- By End-User

- By Industry Vertical

- Top 5 Growth Factors

- Top 5 Trends and Innovations

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

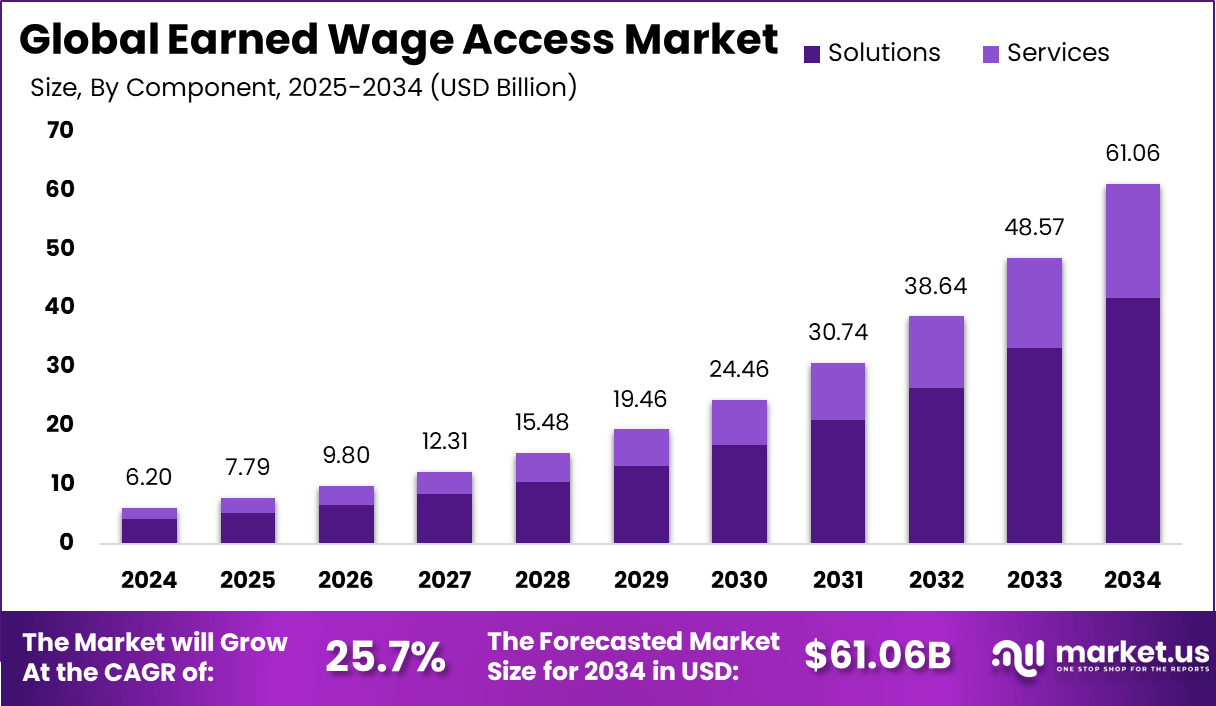

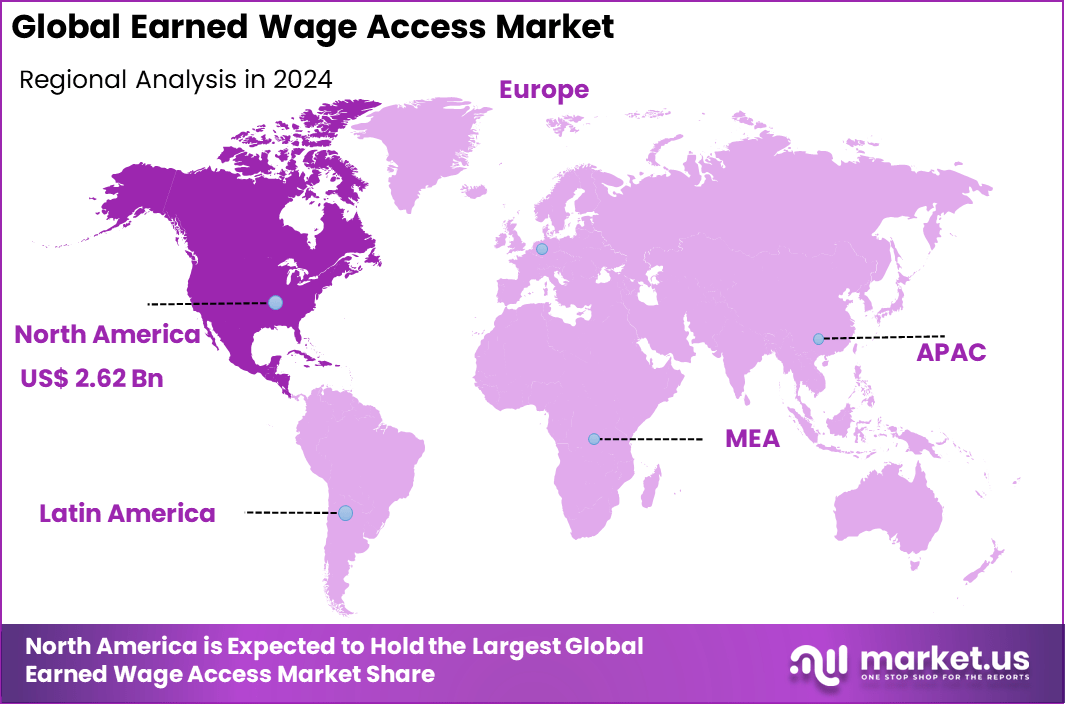

The Global Earned Wage Access Market size is expected to be worth around USD 61.06 billion by 2034, from USD 6.2 billion in 2024, growing at a CAGR of 25.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.4% share, holding USD 2.62 million in revenue.

The earned wage access market, also referred to as on‑demand pay, entails services that grant workers access to wages already earned before the regular payday. It is especially prominent among hourly, gig, and paycheck‑to‑paycheck workers. Access is typically enabled via applications or employer-integrated systems, with funds delivered directly to bank accounts, prepaid cards, or digital wallets.

The market has gained traction owing to widespread financial fragility among workers, rising living costs, and a growing interest in financial well‑being solutions. The prevalence of the gig economy and the growing demand for pay flexibility have functioned as catalysts. Additionally, the adoption of cloud‑based platforms and mobile technologies has enabled rapid and scalable deployment of EWA services.

According to FlexWage, 97% of full-time employees in the U.S. report experiencing financial stress, and 87% say it impacts them in some form. Approximately 72% of U.S. employees express concern over their financial stability, while 62% are specifically stressed about their financial situation. Inflation is a widespread concern, with 80% of employees across all demographics worried about rising costs.

Data from LLCBuddy reveals that 28% of employees earning between $50,000 and $99,999 live paycheck to paycheck, and 70% of them carry debt. Furthermore, 48% of U.S. workers admit that financial concerns distract them at work. Around 80% of the American workforce is living paycheck to paycheck. EWA has become a key tool, with 77% of users reporting reduced stress and 72% noting increased financial confidence and a stronger sense of control over their finances

An increasing acceptance of EWA solutions, propelled by the shift towards digital payroll systems and mobile-first payment technologies. Employees are seeking more control over their finances to handle unexpected expenses, and EWA platforms fulfill this need by providing timely access to wages. Rising gig work and financial wellness awareness make EWA a key benefit to cut absenteeism and boost productivity.

Key Takeaways

- The global EWA market is valued at USD 6.2 billion in 2024 and is projected to expand at a robust CAGR of 25.7%, reflecting the growing shift toward real-time pay access and financial wellness tools.

- The Solutions segment dominates by component with a 68% share, driven by widespread adoption of employer-integrated and direct-to-consumer (D2C) platforms that offer seamless, on-demand wage withdrawals.

- Cloud-based deployment leads with an 81% share, favored for its scalability, easy integration into payroll systems, and lower IT overheads for employers and providers.

- Large enterprises account for 59.7% of the market, as they increasingly implement EWA solutions to support employee retention, boost engagement, and reduce financial stress.

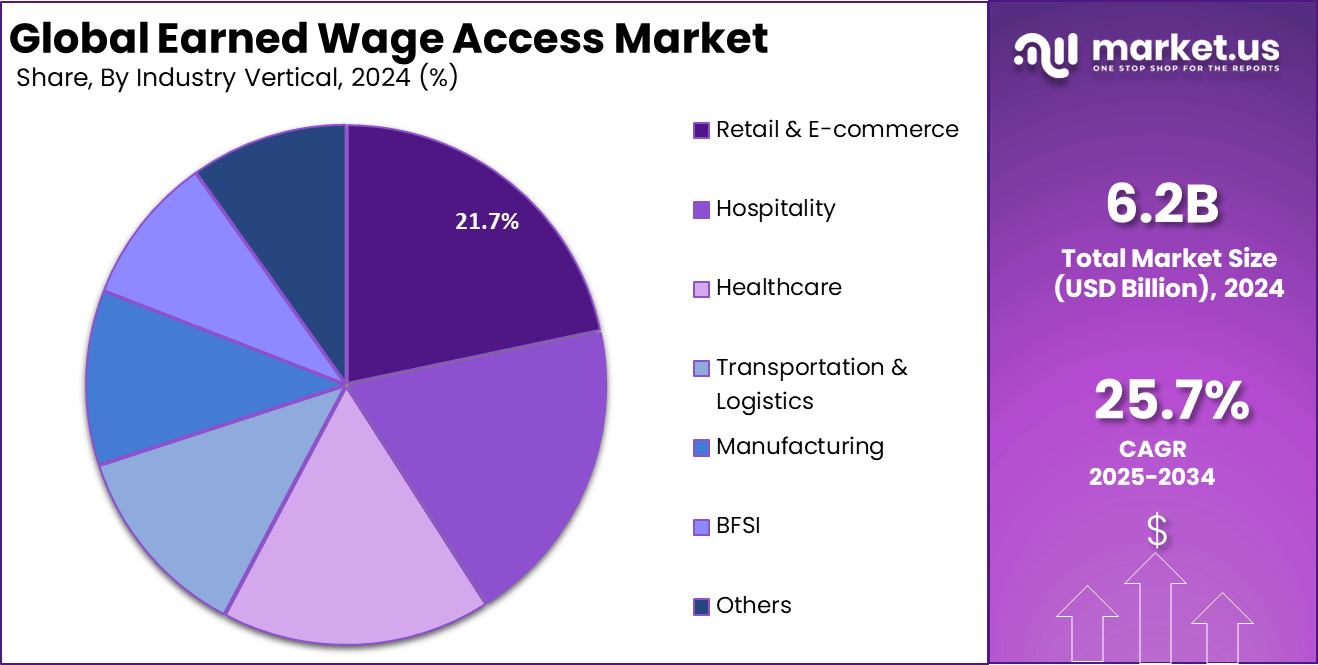

- The Retail & E-commerce sector holds the top industry position with a 21% share, reflecting the demand for flexible pay options in high-turnover, hourly-wage environments.

- North America leads globally with a 42.4% share, supported by high fintech penetration and employer-led financial wellness initiatives.

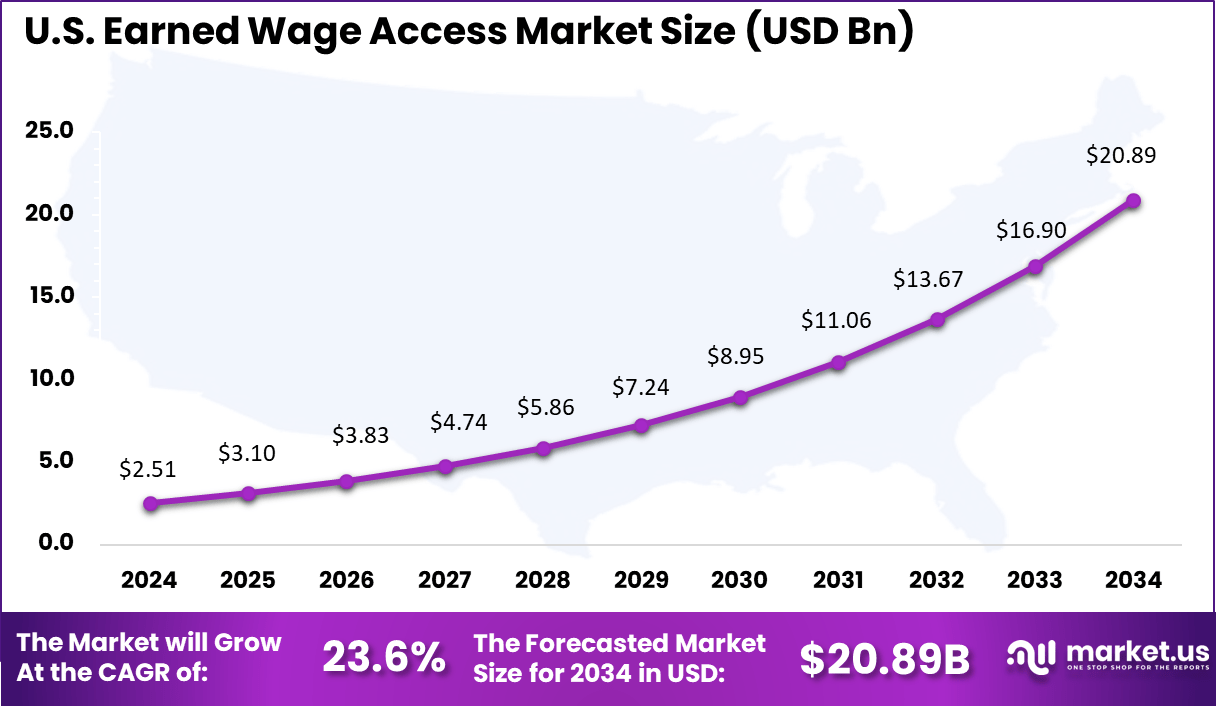

- The U.S. market alone is valued at USD 2.51 billion, underscoring strong workforce demand for pay flexibility and employer investment in digital compensation tools.

Role of AI in EWA Market

Role/Function Description Real-Time Payroll Automation AI computes accurate available wages instantly without disrupting payroll cycles Safe Withdrawal Limit Setting Algorithms dynamically set withdrawal limits based on work hours, salary, history, and cash flow Fraud Detection Machine learning identifies irregular or suspicious transactions and behavioral anomalies Personalized Financial Planning AI-powered tools offer budgeting, saving advice, and financial wellness support Instant Transfers & Integration AI supports U.S. Market Size

The U.S. Earned Wage Access (EWA) market is one of the most mature and rapidly growing globally, driven by rising demand for financial flexibility among workers and increasing employer adoption. Over 55 million U.S. workers had access to EWA solutions by the end of 2024.

Major providers like DailyPay, Payactiv, and EarnIn dominate the market, partnering with large employers such as Walmart, Target, and McDonald’s to offer on-demand access to earned wages. For instance, Walmart’s partnership with Even and Payactiv has enabled over 1.4 million employees to access wages ahead of payday, reducing financial stress and turnover.

The gig economy has also fueled growth, with platforms like Uber offering Instant Pay, allowing drivers to cash out multiple times daily. Regulatory scrutiny is rising, with states like California and Nevada proposing frameworks to ensure consumer protection. Despite challenges, the U.S. market continues to lead innovation in EWA adoption and integration.

North America Dominates the Market with a Major Revenue Share of 42.4%.

North America leads the Global Earned Wage Access (EWA) market, accounting for approximately 42.4% of the global share, driven primarily by the U.S., which alone generated around USD 2.51 billion in 2024 and is expected to grow at a CAGR of 23.6%. The region’s dominance is attributed to high EWA adoption among large employers, increasing demand for financial wellness tools, and a mature fintech infrastructure.

U.S. companies such as DailyPay, Earnin, and Payactiv are at the forefront, offering both employer-integrated and direct-to-consumer (D2C) solutions to millions of workers across industries like retail, logistics, and healthcare. For example, Walmart partnered with Even (acquired by One) to offer early wage access to over 1.4 million employees.

By Component

In 2024, the solutions component drives 68% of the Earned Wage Access market, reflecting strong demand for software platforms that enable employees to access their earned wages before payday. These solutions simplify wage tracking and integrate securely with payroll systems, allowing organizations to deliver timely financial support to workers.

By offering real-time access to earned pay, these platforms help reduce employee financial stress and enhance overall workforce satisfaction. Employers benefit from investing in these solutions because they help improve retention and productivity. When employees can manage their cash flow better, they are less distracted by financial difficulties and more engaged at work, making solutions a critical element in modern workforce management.

By Deployment Mode

In 2024, Cloud-based deployment holds an 81% share of the Earned Wage Access market, favored for its flexibility and scalability. Cloud platforms enable rapid implementation across geographically dispersed teams and provide secure, real-time wage access without the need for costly on-site infrastructure. The cloud’s ability to integrate smoothly with existing HR and payroll systems makes it the preferred choice for enterprises seeking efficient, cost-effective deployment options.

In addition, cloud-based EWA solutions offer automatic updates and continuous feature enhancements, helping organizations keep up with changing regulatory and operational requirements. The remote accessibility factor allows employees to access their wages anytime, which aligns well with the demands of a modern, mobile workforce.

By End-User

In 2024, Large enterprises represent 59.7% of the market as they frequently have sizable hourly or shift-based workforces requiring flexible payroll options. These organizations, often in industries like retail, healthcare, and logistics, implement earned wage access programs to boost employee financial wellness and reduce turnover.

Their large scale enables them to tailor EWA for multi-jurisdiction compliance and align it with broader benefit programs. By analyzing workforce data, they enhance satisfaction, engagement, and productivity while showing clear business impact.

By Industry Vertical

The retail and e-commerce sector accounts for 21% of the Earned Wage Access market, driven largely by its extensive hourly workforce and notable staff turnover challenges. Earned wage access solutions help these businesses attract and retain workers by providing immediate financial relief, which is highly valued among frontline employees.

This sector’s fast-paced nature demands quick and reliable payroll access, making EWA platforms indispensable. By addressing worker financial needs promptly, retail and e-commerce companies enhance job satisfaction and reduce absenteeism. The ability of these industries to offer real-time earnings access strengthens employee engagement and supports a more stable, motivated workforce.

Top 5 Growth Factors

Key Factors Description Rising Employee Financial Stress Increasing cost of living and financial insecurity drive demand for immediate wage access Growth of Gig & Hourly Economy Freelancers and part-time workers prefer flexible, on-demand payments Digital Payroll & Payment Adoption Cloud payroll systems and mobile apps facilitate seamless EWA integration Employer Focus on Workforce Wellness EWA improves employee satisfaction, reduces turnover, and enhances retention High Smartphone Penetration Mobile access enables convenient use especially for remote and hourly workers Top 5 Trends and Innovations

Trend/Innovation Description AI-Driven Financial Planning Personalized budgeting, saving tips, and financial insights integrated into EWA platforms Expansion Across Industries Growing adoption beyond retail/hospitality to healthcare, construction, caregiving, and more Regulatory Clarity & Compliance Fair usage policies and regulatory frameworks boost market trust and sustainable growth Cloud-Based Scalable Platforms Cloud infrastructure enables faster deployment and scalability of EWA software Mobile Wallet & App Integration Inclusion of EWA in digital wallets and employer apps for real-time, easy wage access Key Market Segments

Component

- Solutions

- Employer-Integrated EWA

- Direct-to-Consumer (D2C) EWA

- Services

Deployment Mode

- Cloud-Based

- On-Premise

End-User

- Large Enterprises

- SMEs

Industry Vertical

- Retail & E-commerce

- Hospitality

- Healthcare

- Transportation & Logistics

- Manufacturing

- BFSI

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

One of the primary drivers behind the adoption of EWA is the rising concern for employee financial well-being amid economic uncertainty. As living costs rise and more workers live paycheck to paycheck, the demand for access to earned wages ahead of payday has surged. Employers recognize that offering EWA not only supports employees’ immediate cash flow needs but also serves as a competitive advantage in attracting and retaining talent.

Especially in industries with high turnover rates, providing early wage access is viewed as an employee-centric benefit that boosts satisfaction and loyalty. This growing awareness of financial stress’s impact on productivity and well-being is pushing businesses to incorporate EWA solutions as part of their broader financial wellness programs.

Restraint Analysis

Despite its benefits, the Earned Wage Access market faces several restraints, notably regulatory and operational challenges. The regulatory environment remains unsettled as different states and countries develop varying laws and standards for EWA providers. Discrepancies in fee structures, disclosure requirements, and consumer protections create complexity for businesses wanting to adopt these solutions.

Furthermore, technical issues such as delays in wage disbursement or access limits can undermine user trust and satisfaction. Users sometimes report operational hiccups like app loading problems or discrepancies in accessed wages, which can lead to frustration and diminish the perceived value of the service.

Opportunity Analysis

Earned Wage Access programs hold significant opportunities to reshape the landscape of employee benefits and financial inclusion. By integrating with real-time payment platforms, EWA can provide instant liquidity support, helping workers manage unexpected expenses without resorting to high-cost loans or debt. This functional improvement can contribute to financial stability, reducing employee stress and improving productivity.

Additionally, tailoring EWA offerings to underserved groups such as part-time workers and gig economy employees presents a meaningful chance to fill financial gaps and broaden access to earned income. The continued evolution of embedded fintech in payroll systems opens pathways for more personalized and scalable EWA solutions that enhance worker empowerment.

Challenge Analysis

A key challenge for EWA involves balancing accessibility with responsible use to avoid unintended financial strain. While EWA alleviates short-term cash flow issues, it does not address underlying income insufficiency, and some users may rely on it repeatedly, risking paycheck shortfalls later.

Providers and regulators grapple with ensuring transparent pricing and fair terms, preventing the potential for EWA to become a cycle of dependency similar to payday lending. This calls for clear consumer safeguards, education, and ongoing monitoring of EWA’s impact on users’ financial health. Employers must also navigate complex compliance landscapes and align EWA implementation with their broader workforce management goals.

Key Player Analysis

In the Earned Wage Access (EWA) market, DailyPay, Earnin, and PayActiv have established strong brand recognition in the United States. These companies focus on B2B2C models, offering integrations with payroll systems and enterprise platforms. Their services are widely used by retail, hospitality, and healthcare employers. DailyPay, for example, is known for supporting on-demand pay through direct partnerships with large employers.

The growth of this space is further shaped by players such as Even, now integrated with Walmart, and Rain, both emphasizing real-time access to earned income for hourly workers. FlexWage and Wagestream are expanding their footprints by focusing on data-driven financial education tools.

New entrants and regional leaders such as Refyne, CloudPay NOW, Instant Financial, Hastee, and Branch are fueling global competition. These players focus on localized compliance, multilingual platforms, and mobile-first interfaces. Refyne has grown rapidly in India, while CloudPay NOW supports cross-border payroll needs. Instant Financial and Hastee offer prepaid card-based disbursement models.

Top Key Players in the Earned Wage Access Market

- DailyPay

- Earnin

- PayActiv

- Even (U.S., acquired by Walmart)

- Rain

- FlexWage

- Wagestream

- Refyne

- CloudPay NOW

- Instant Financial

- Hastee

- Branch

- Other Key Players

Recent Developments

- July 2025: ABHI partners with Younus Textile Mills to offer Earned Wage Access, enabling employees to access their salaries in real time and improve their financial well-being.

- July 2025: Ice Age Management, Inc., a McDonald’s franchisee, and TTEC Holdings, Inc. have partnered with DailyPay, a worktech platform specializing in on-demand pay solutions. These collaborations underscore a growing trend among employers to prioritize employee financial wellness by offering tools that empower workers to access their earned wages in real time.

- July 2025: Rain announced the launch of the first fully embedded on-demand pay integration within Workday. This integration allows Workday customers to enable Rain directly within the Workday platform, eliminating the need for third-party implementations, system changes, or data handoffs.

- January 2024: Al Ansari Financial Services has entered a strategic partnership with Abhi, an embedded finance platform in the Middle East, to expand the financial solutions available to consumers, ensuring a seamless service experience across the board.

Report Scope

Report Features Description Market Value (2024) USD 6.20 Bn Forecast Revenue (2034) USD 61.06 Bn CAGR (2025-2034) 25.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions and Services), by Deployment Mode (Cloud-Based and On-Premise), By End-User (Large Enterprises and SMEs), By Industry Vertical (Retail & E-commerce, Hospitality, Healthcare, Transportation & Logistics, Manufacturing, BFSI, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DailyPay, Earnin, PayActiv, Even (U.S., acquired by Walmart), Rain, FlexWage, Wagestream, Refyne, CloudPay NOW, Instant Financial, Hastee, Branch, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Earned Wage Access MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Earned Wage Access MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DailyPay

- Earnin

- PayActiv

- Even (U.S., acquired by Walmart)

- Rain

- FlexWage

- Wagestream

- Refyne

- CloudPay NOW

- Instant Financial

- Hastee

- Branch

- Other Key Players