Global Dry-Cleaning and Laundry Services Market Size, Share, Growth Analysis By Service (Laundry, Dry Cleaning, Duvet Cleaning), By Application (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 150200

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Size

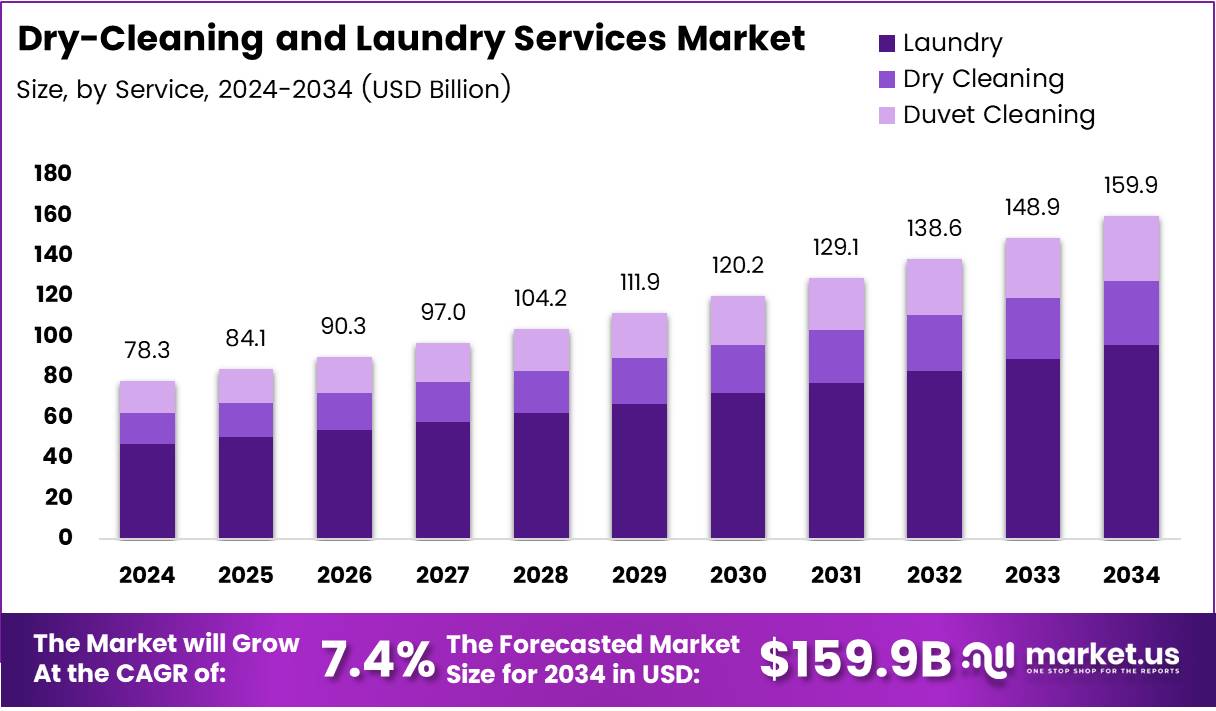

The Global Dry-Cleaning and Laundry Services Market size is expected to be worth around USD 159.9 Billion by 2034, from USD 78.3 Billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034. The growth of this market is driven by increasing consumer demand for convenience, the rise in disposable income, and the expansion of urban populations seeking reliable fabric care solutions.

Key Takeaways

- The Global Dry-Cleaning and Laundry Services Market is expected to reach USD 159.9 Billion by 2034, growing at a CAGR of 7.4% from 2025 to 2034.

- Laundry services dominated the By Service Analysis category in 2024, capturing 53.9% of the market share.

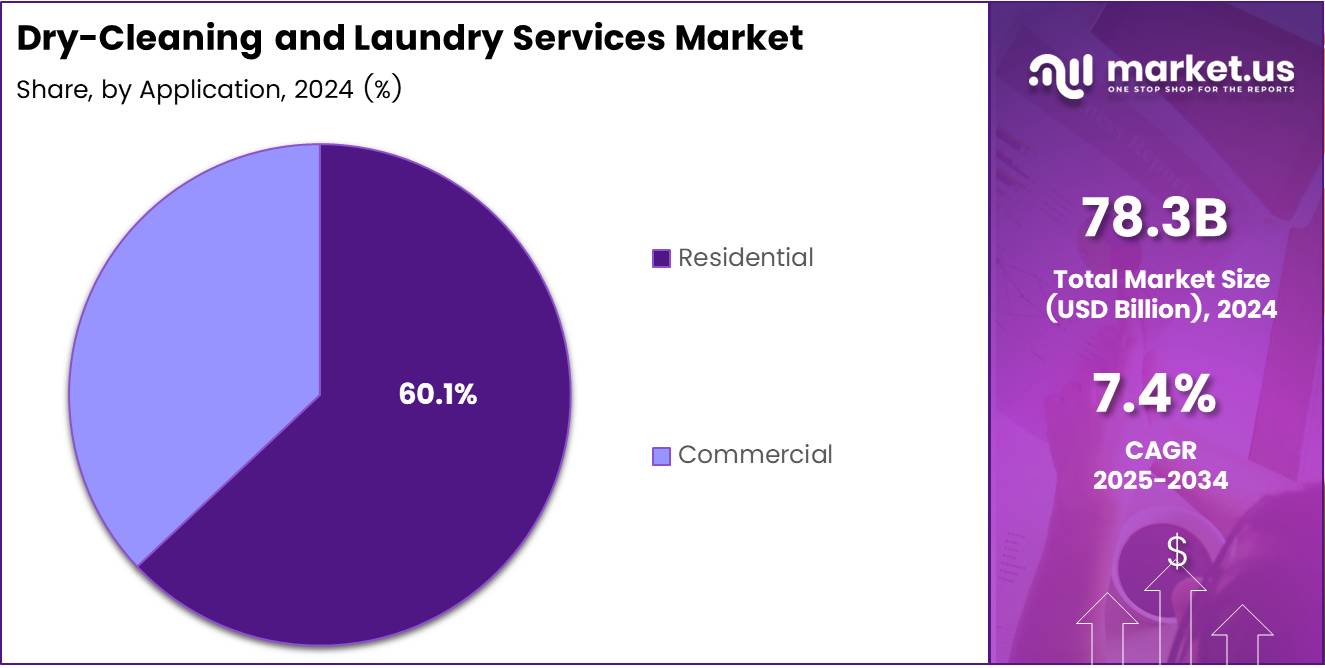

- In 2024, Residential services led the By Application Analysis segment, holding 60.1% of the market share.

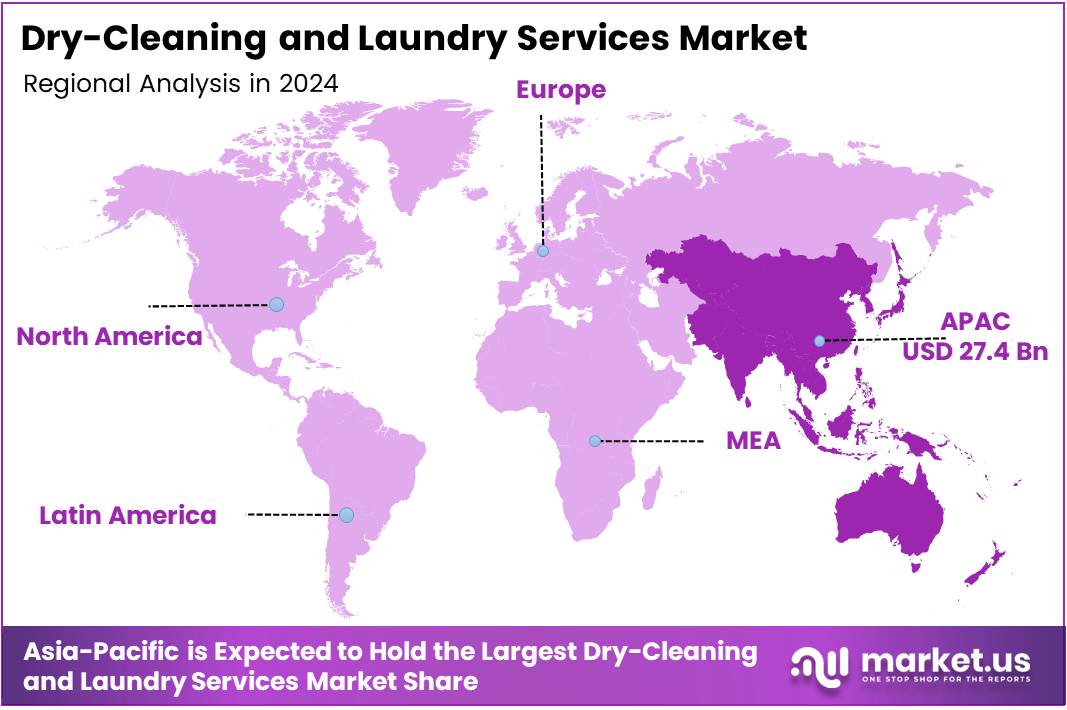

- The Asia Pacific region was the largest market in 2024, accounting for 35.7% of the total market share, valued at USD 27.4 billion.

Report Overview

The Dry-Cleaning and Laundry Services market is an essential part of the global consumer services industry. It covers a broad range of services, including dry cleaning, washing, ironing, and garment care, catering to both individual and commercial customers. This market is significantly influenced by consumer demand for convenience, quality service, and time-saving solutions. The market’s growth is also driven by the increasing need for professional garment care, particularly in urban areas where busy lifestyles prevail.

The market’s growth prospects are promising, fueled by both an expanding consumer base and technological advancements. Key players are increasingly adopting automation and eco-friendly technologies to improve operational efficiency and cater to environmentally-conscious customers.

According to Fabrico, the profit margin in a laundry and dry cleaning business typically ranges from 15% to 30%, depending on factors such as location, services offered, and operational efficiency. This variability reflects the adaptability of businesses within the market to adjust their services in response to customer needs and market conditions.

Government investments and regulations also play a critical role in shaping the market. In many regions, regulatory frameworks are being introduced to reduce environmental impacts, with a focus on water usage, chemical disposal, and energy efficiency.

For instance, the implementation of stricter environmental guidelines pushes laundry and dry-cleaning businesses to adopt greener technologies and sustainable practices. These regulations not only help protect the environment but also create new opportunities for growth as companies innovate to comply with them.

Furthermore, rising consumer awareness of health and hygiene is driving demand for professional laundry and cleaning services. In both residential and commercial sectors, the focus on cleanliness and hygiene, particularly post-pandemic, is expected to maintain growth momentum.

Businesses that invest in high-quality service, innovation, and sustainability are likely to emerge as market leaders. The continued urbanization and evolving consumer lifestyles are also contributing to increased demand for quick and reliable laundry services.

Service Analysis

Laundry held a dominant market position in 2024, with a 53.9% share in the Dry-Cleaning and Laundry Services Market.

In 2024, the Laundry segment led the By Service Analysis category, capturing 53.9% of the market share. This strong performance reflects its widespread consumer acceptance and consistent demand in the market. Laundry services have long been integral to the fabric care industry, contributing significantly to overall market growth.

The Dry Cleaning segment, while essential, represented a smaller portion of the market compared to Laundry, making up a significant share but lagging behind. Despite its role in specialized garment care, Dry Cleaning services continue to face stiff competition from Laundry services, which offer broader consumer appeal due to their convenience and affordability.

The Duvet Cleaning segment, though important, holds a more niche position in the market. It caters to specific consumer needs related to household bedding, with a smaller but steady demand. Its market share is lower than the primary Laundry and Dry Cleaning services, but it still plays a vital role in the overall service mix.

Application Analysis

Residential held a dominant market position in 2024, with a 60.1% share in the Dry-Cleaning and Laundry Services Market.

In 2024, Residential services were the dominant force in the By Application Analysis segment, accounting for 60.1% of the market share. The high preference for residential laundry services is attributed to the consistent demand from households for regular cleaning, convenience, and reliability in fabric care.

The Commercial segment, while contributing significantly to the market, trailed behind Residential with a lower share. Commercial laundry services cater to businesses, hotels, and other industries, where bulk laundry needs are more specialized. Though growing, the Commercial segment still faces strong competition from Residential services, which benefit from broader consumer engagement and more frequent use.

Key Market Segments

By Service

- Laundry

- Dry Cleaning

- Duvet Cleaning

By Application

- Residential

- Commercial

Drivers

Drivers of Growth in Dry-Cleaning and Laundry Services Market

The increasing demand for convenience and time-saving services has become a key driver in the growth of the dry-cleaning and laundry services market. Consumers are seeking more efficient ways to manage their daily routines, with professional laundry services offering a quick and hassle-free alternative to traditional home washing.

The expansion of the urban population and the rising number of working professionals is another significant factor. With more individuals living in busy metropolitan areas and juggling demanding jobs, the need for professional cleaning services is rising. These services allow working professionals to save valuable time while maintaining a polished appearance.

Growing environmental awareness and the shift toward eco-friendly practices are influencing the market as well. Many laundry services are adopting green technologies, such as water and energy-efficient machines, along with the use of biodegradable detergents. This not only meets consumer expectations but also helps businesses differentiate themselves in an increasingly eco-conscious market.

Additionally, the rise in disposable income and consumer spending plays a pivotal role. As people’s financial capacity increases, they are more willing to spend on premium services like dry-cleaning and laundry, which offer convenience and higher-quality results compared to home washing methods.

Restraints

Restraints on Growth in Dry-Cleaning and Laundry Services Market

High operational costs and intense price competition pose significant challenges to the dry-cleaning and laundry services market. Operational expenses, such as labor costs, utilities, and maintenance of equipment, can limit profit margins. At the same time, price competition among local providers may lead to reduced prices, further impacting profitability.

Stringent government regulations on chemical usage are another constraint for the market. Many laundry services rely on chemicals that are subject to environmental and health regulations. Complying with these regulations often increases operational costs and requires investments in safer, eco-friendly alternatives, which could be more expensive.

The impact of economic downturns on consumer spending is also a limiting factor. During periods of economic uncertainty, consumers are more likely to cut back on non-essential expenses, such as dry cleaning, affecting the demand for these services.

Finally, the availability of alternative cleaning methods, such as home washing machines, serves as a restraint. Many consumers prefer to wash their clothes at home, especially with the increasing affordability and efficiency of modern washing machines. This has led to less reliance on professional laundry services for everyday garment care.

Growth Factors

Growth Opportunities in Dry-Cleaning and Laundry Services Market

The adoption of advanced laundry technologies and automation presents a significant growth opportunity in the dry-cleaning and laundry services market. Technological advancements, such as robotic cleaners, automated sorting systems, and more efficient machines, are improving service quality while reducing labor costs.

Expansion in emerging markets with a growing middle class is another key growth opportunity. As the disposable income of consumers in developing regions increases, demand for convenient laundry services is expected to rise. Companies that enter these markets early can establish a strong foothold in these high-growth areas.

The introduction of specialized laundry services, such as organic and hypoallergenic options, is also a promising growth avenue. With growing concerns over skin sensitivities and allergies, consumers are becoming more interested in specialized services that use gentle and safe cleaning methods.

Collaborations with hotels, hospitals, and other commercial establishments present another growth opportunity. By offering bulk and specialized cleaning services to these industries, laundry businesses can secure long-term, consistent contracts that provide steady revenue streams.

Emerging Trends

Trending Factors in Dry-Cleaning and Laundry Services Market

The integration of sustainable and eco-friendly laundry solutions is one of the top trends in the dry-cleaning and laundry services market. With increasing concerns about environmental impact, businesses are moving toward sustainable practices, including water and energy conservation technologies and the use of eco-friendly cleaning agents.

Increased use of digital platforms for service booking is transforming the way customers interact with laundry services. Online booking systems, mobile apps, and customer portals are improving convenience and customer experience, making it easier for users to schedule pickups, track their orders, and make payments.

The growth of subscription-based laundry services is another key trend. Subscription models offer convenience and regular income streams for service providers while meeting the needs of consumers who want hassle-free laundry management without frequent trips to the laundromat.

Rising demand for garment care services among millennials and Gen Z is also shaping the market. These younger generations are more focused on maintaining the longevity and appearance of their clothing, leading to increased demand for professional garment care services like dry cleaning, repair, and preservation.

Regional Analysis

Asia Pacific Dominates the Dry-Cleaning and Laundry Services Market with a Market Share of 35.7%, Valued at USD 27.4 Billion

In 2024, the Asia Pacific region held the leading position in the Dry-Cleaning and Laundry Services market, contributing 35.7% of the total market share, valued at USD 27.4 billion. This dominance is driven by the expanding urban population, increasing disposable income, and growing demand for convenience-driven services. The rising number of working professionals and evolving consumer behavior in emerging economies, particularly in countries like China and India, continues to fuel market growth.

North America Dry-Cleaning and Laundry Services Market Insights

North America is the second-largest market in the Dry-Cleaning and Laundry Services industry, with a significant share of the market driven by high service quality and established industry standards. The increasing trend of time-saving services, along with growing environmental awareness, supports demand across the region. Additionally, innovations in eco-friendly cleaning technologies further contribute to the growth in the region.

Europe Dry-Cleaning and Laundry Services Market Insights

Europe holds a substantial share in the Dry-Cleaning and Laundry Services market, driven by a high concentration of both residential and commercial customers. The demand for sustainable cleaning solutions, coupled with the region’s growing adoption of green technologies, positions Europe as a key player. Additionally, the expanding number of high-end residential and commercial establishments across the region fuels the demand for premium laundry services.

Latin America Dry-Cleaning and Laundry Services Market Insights

Latin America is experiencing steady growth in the Dry-Cleaning and Laundry Services market, driven by the increasing number of urban centers and working professionals. Rising disposable income in key countries such as Brazil and Mexico further supports the adoption of these services. As consumer spending increases, the demand for both traditional and eco-friendly laundry services continues to rise.

Middle East and Africa Dry-Cleaning and Laundry Services Market Insights

The Middle East and Africa region is gradually expanding in the Dry-Cleaning and Laundry Services market. The growing demand for laundry services in urban areas, driven by tourism, business hubs, and large expatriate communities, supports the market’s growth. Furthermore, an increase in disposable income and awareness of convenient service options are contributing to market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Dry-Cleaning and Laundry Services Company Insights

In 2024, Cleanly has positioned itself as a leading player in the dry-cleaning and laundry services market by providing on-demand, eco-friendly cleaning services through its convenient app-based platform. This strategic focus on customer convenience and sustainability has made it popular among urban professionals.

Tide Dry Cleaners (Procter & Gamble) continues to leverage its strong brand recognition and widespread presence. The company’s use of advanced cleaning technology and environmentally friendly practices has bolstered its competitive edge, offering consumers reliable and high-quality laundry services.

ZIPS Dry Cleaners has garnered attention with its consistent pricing model and nationwide presence. The company’s focus on offering superior customer service and fast turnaround times has solidified its position in the market, making it a preferred choice in many regions.

City Dry Cleaning Company is known for its robust service offering, including both residential and commercial cleaning. The company’s strategic investment in high-end equipment and eco-conscious practices has enabled it to cater to a wide range of customer needs, from individual clients to large businesses.

These players demonstrate diverse strategies in the growing dry-cleaning and laundry services market, emphasizing technology, customer service, and eco-friendly practices to enhance their market position.

Top Key Players in the Market

- Cleanly

- Tide Dry Cleaners (Procter & Gamble)

- ZIPS Dry Cleaners

- City Dry Cleaning Company

- Marberry Cleaners & Launderers, Inc.

- East Rand Cleaners

- Rinse, Inc.

- Alsco Pty Limited

- The Huntington Company

- Alliance Laundry Systems LLC

Recent Developments

- In September 2024, Jyothy Labs’ shares experienced a 2% increase following the company’s acquisition of Quiclo, signaling investor confidence in the strategic move. The acquisition is expected to enhance Jyothy Labs’ product portfolio and market presence.

- In February 2025, PureStar expanded its service offerings by acquiring the assets of Radiant Services, further strengthening its position in the laundry and cleaning services industry. This acquisition is aimed at enhancing operational capacity and geographic reach.

- In February 2025, PureStar acquired the assets of California-based Radiant Services Corporation, marking a significant step in its expansion strategy. This move is expected to enhance PureStar’s service capabilities and customer base in the U.S. market.

Report Scope

Report Features Description Market Value (2024) USD 78.3 Billion Forecast Revenue (2034) USD 159.9 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Laundry, Dry Cleaning, Duvet Cleaning), By Application (Residential, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cleanly, Tide Dry Cleaners (Procter & Gamble), ZIPS Dry Cleaners, City Dry Cleaning Company, Marberry Cleaners & Launderers, Inc., East Rand Cleaners, Rinse, Inc., Alsco Pty Limited, The Huntington Company, Alliance Laundry Systems LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dry-Cleaning and Laundry Services MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Dry-Cleaning and Laundry Services MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cleanly

- Tide Dry Cleaners (Procter & Gamble)

- ZIPS Dry Cleaners

- City Dry Cleaning Company

- Marberry Cleaners & Launderers, Inc.

- East Rand Cleaners

- Rinse, Inc.

- Alsco Pty Limited

- The Huntington Company

- Alliance Laundry Systems LLC