Global Drum Motor Market Size, Share, Growth Analysis By Motor Type (Asynchronous Motors, Synchronous Motors, DC motors), By Power Range (Medium power (0.5 kW to 2.5 kW), Low power (up to 0.5 kW), High power (above 2.5 kW)), By Current Type (AC Current, DC Current), By Application (Conveying Systems, Packaging & Sorting, Bottle Recycling, X-Ray, Security Scanning System, Pharmaceutical Handling System), By End-user (Manufacturing, Food Processing, Logistics and Warehousing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177762

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

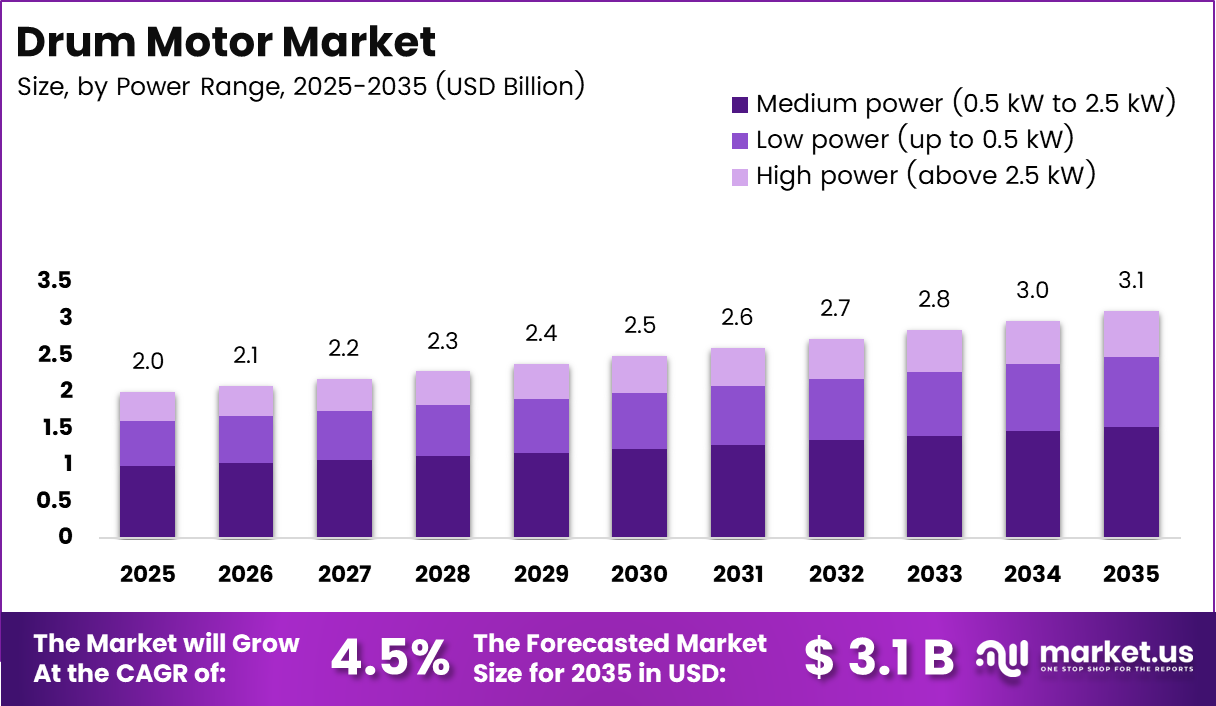

Global Drum Motor Market size is expected to be worth around USD 3.1 Billion by 2035 from USD 2.0 Billion in 2025, growing at a CAGR of 4.5% during the forecast period 2026 to 2035.

The drum motor market encompasses integrated motorized pulley systems that combine electric motors, gearboxes, and bearings within a cylindrical drum assembly. These compact drive solutions are primarily used in conveyor belt systems across manufacturing, food processing, logistics, and packaging industries. Consequently, they eliminate external drive components, reducing installation complexity and spatial requirements.

Drum motors offer significant advantages over traditional external motor configurations. Their sealed construction protects internal components from environmental contaminants including dust, moisture, and chemicals. Moreover, the integrated design minimizes noise levels and vibration while enhancing operational efficiency. Therefore, industries demanding hygienic and space-constrained solutions increasingly prefer these systems.

The market experiences robust growth driven by accelerating automation trends across global industrial sectors. Manufacturing facilities and distribution centers are rapidly modernizing their material handling infrastructure to improve productivity and reduce labor costs. Additionally, stringent hygiene regulations in food and pharmaceutical sectors necessitate washdown-capable conveying equipment. This demand pattern supports sustained market expansion throughout the forecast period.

Technological advancements continue reshaping product capabilities and performance standards. Manufacturers are developing variable frequency drive compatible models that enable precise speed control and energy optimization. Furthermore, integration of IoT sensors and predictive maintenance features enhances operational reliability. However, the ongoing shift toward stainless steel construction addresses corrosion resistance requirements in demanding environments.

E-commerce expansion and warehouse automation represent critical growth catalysts for drum motor adoption. The proliferation of fulfillment centers requires efficient, low-maintenance conveying systems capable of handling diverse product types. According to Van der Graaf, drum motors operate at 96% mechanical efficiency, significantly reducing energy consumption. Similarly, these systems are engineered for 80,000 hours of continuous operation before requiring maintenance.

Performance characteristics vary based on motor type and power configuration. According to Interroll, asynchronous drum motors achieve efficiency levels up to 78%, while synchronous variants offer up to 83% efficiency. Additionally, manufacturers provide solutions in multiple material configurations to accommodate specific environmental conditions. According to Rulmeca, products feature 3-phase or 1-phase AC induction motors, ensuring compatibility with diverse power supply infrastructures.

Key Takeaways

- Global Drum Motor Market projected to reach USD 3.1 Billion by 2035, growing at 4.5% CAGR from 2025 to 2035

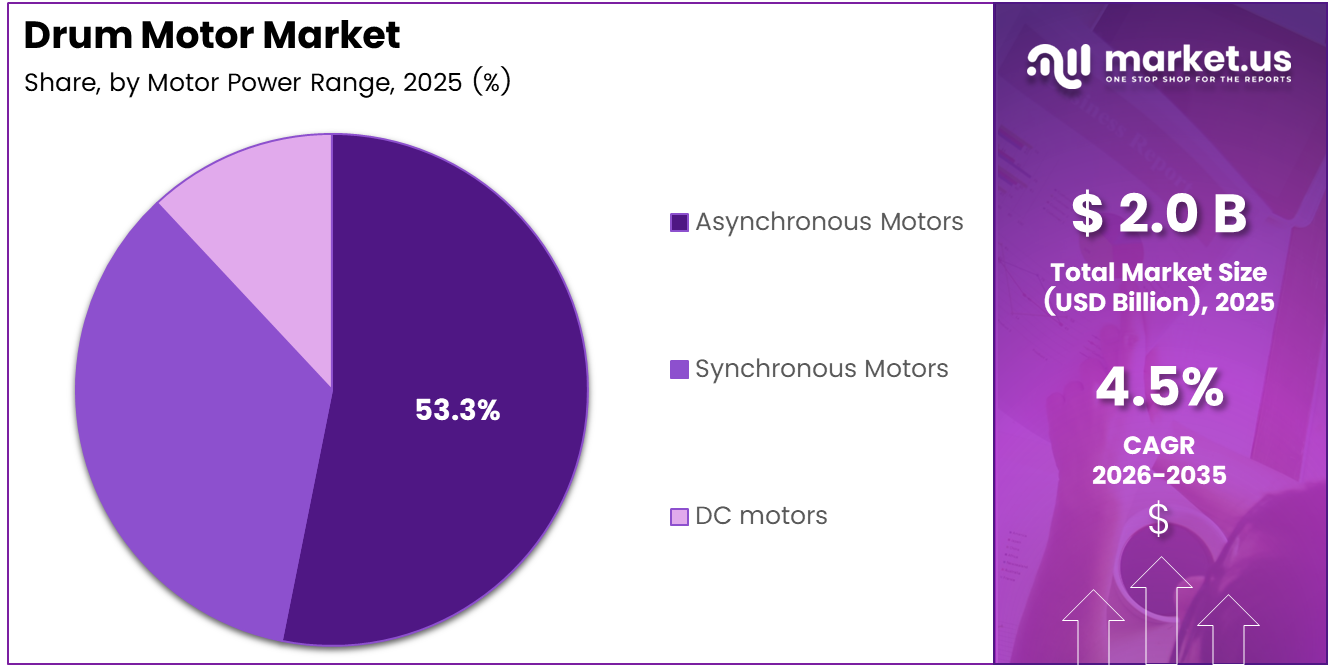

- Asynchronous Motors segment dominates motor type category with 53.3% market share in 2025

- Medium power range (0.5 kW to 2.5 kW) leads power segment with 49.2% share

- AC Current segment holds dominant position with 71.7% market share

- Conveying Systems application accounts for 39.5% of market demand

- Manufacturing end-user segment represents 41.8% of total market share

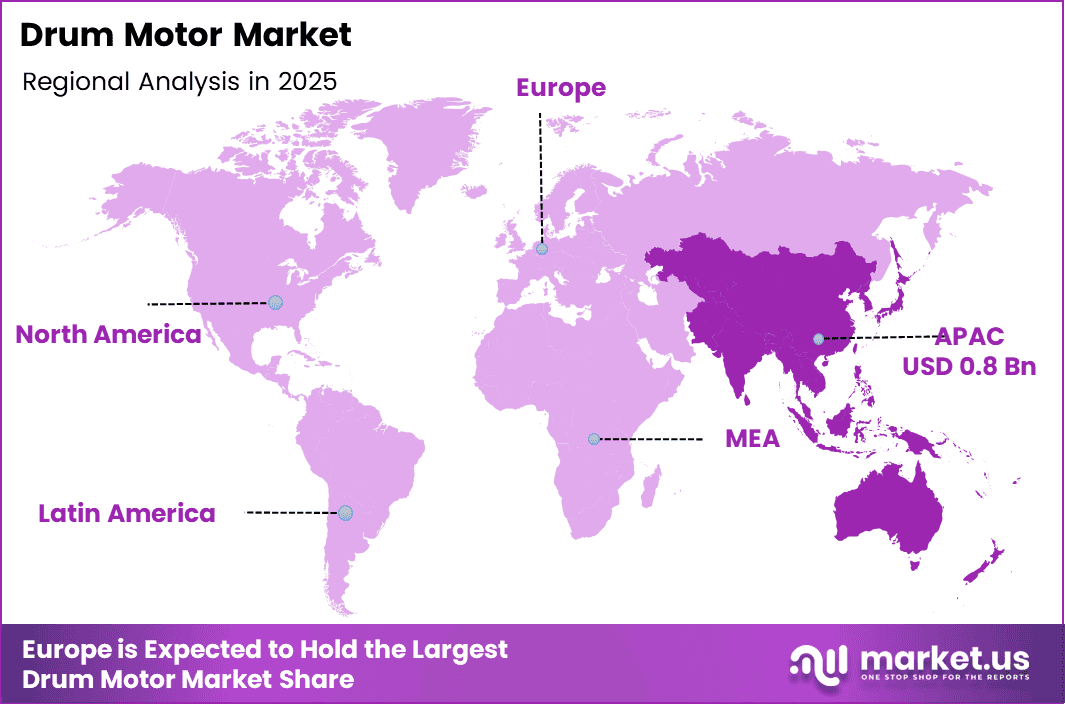

- Asia Pacific region dominates with 43.20% share, valued at USD 0.8 Billion in 2025

Motor Type Analysis

Asynchronous Motors dominate with 53.3% due to cost-effectiveness and reliability in standard conveyor applications.

In 2025, Asynchronous Motors held a dominant market position in the Motor Type segment of Drum Motor Market, with a 53.3% share. These motors provide robust performance across diverse industrial environments while maintaining competitive pricing. Their proven reliability in continuous operation makes them preferred choices for manufacturing and logistics facilities. Moreover, compatibility with standard power infrastructure reduces installation complexity and operational costs.

Synchronous Motors represent a growing segment driven by superior energy efficiency and precise speed control capabilities. These motors deliver enhanced performance in applications requiring consistent rotational speeds regardless of load variations. Additionally, their higher efficiency ratings reduce long-term operational expenses. Consequently, industries prioritizing energy optimization increasingly adopt synchronous motor configurations for conveyor systems.

DC Motors serve specialized applications requiring variable speed control and compact design parameters. These motors offer excellent torque characteristics at lower speeds, making them suitable for specific material handling requirements. Furthermore, their simple control mechanisms enable cost-effective integration in legacy systems. However, their market share remains limited compared to AC motor variants due to maintenance considerations and efficiency constraints.

Power Range Analysis

Medium power (0.5 kW to 2.5 kW) dominates with 49.2% due to widespread applicability in standard conveyor systems.

In 2025, Medium power (0.5 kW to 2.5 kW) held a dominant market position in the Power Range segment of Drum Motor Market, with a 49.2% share. This power range addresses the majority of industrial conveying requirements across manufacturing, packaging, and warehousing sectors. The balanced performance-to-cost ratio makes these motors ideal for moderate load applications. Therefore, their versatility supports extensive adoption across diverse operational environments.

Low power (up to 0.5 kW) motors cater to light-duty conveying applications in food processing, pharmaceutical handling, and small-scale packaging operations. These compact units excel in space-constrained installations where minimal footprint is essential. Additionally, their lower energy consumption aligns with sustainability objectives. However, load capacity limitations restrict their deployment in heavier industrial applications.

High power (above 2.5 kW) motors serve heavy-duty material handling operations requiring substantial torque and load-bearing capabilities. These robust systems support mining, automotive manufacturing, and bulk material processing industries. Furthermore, their durability ensures reliable performance under demanding operational conditions. Consequently, they command premium pricing while addressing specialized industrial requirements.

Current Type Analysis

AC Current dominates with 71.7% due to superior efficiency and widespread power infrastructure compatibility.

In 2025, AC Current held a dominant market position in the Current Type segment of Drum Motor Market, with a 71.7% share. Alternating current motors integrate seamlessly with existing industrial electrical systems without requiring additional power conversion equipment. Their higher efficiency ratings reduce operational costs while delivering consistent performance across variable load conditions. Moreover, extensive availability of three-phase and single-phase AC power infrastructure supports their widespread deployment.

DC Current motors maintain relevance in specialized applications requiring precise speed control and battery-powered operations. These motors offer excellent starting torque characteristics and simplified control mechanisms for mobile conveying systems. Additionally, their compatibility with renewable energy sources supports sustainability initiatives. However, higher maintenance requirements and lower efficiency compared to AC alternatives limit their overall market penetration.

Application Analysis

Conveying Systems dominate with 39.5% due to fundamental role in material handling across industrial sectors.

In 2025, Conveying Systems held a dominant market position in the Application segment of Drum Motor Market, with a 39.5% share. These systems represent the primary deployment area for drum motors across manufacturing, distribution, and processing facilities. Their reliability in continuous material transport operations drives sustained demand. Furthermore, the sealed drum motor design eliminates contamination risks, ensuring consistent performance in diverse environmental conditions.

Packaging & Sorting applications leverage drum motors for precise product handling and automated distribution center operations. These systems require quiet operation and minimal maintenance to maximize productivity. Additionally, compact drum motor designs optimize valuable floor space in high-density packaging facilities. Consequently, e-commerce growth accelerates adoption in fulfillment center conveying infrastructure.

Bottle Recycling operations utilize drum motors in washdown environments where corrosion resistance and hygiene compliance are critical. Stainless steel drum motor construction withstands aggressive cleaning procedures and chemical exposure. Moreover, sealed designs prevent contamination from processed materials. Therefore, recycling facilities increasingly specify drum motors for sustainable material recovery operations.

X-Ray, Security Scanning System applications demand smooth, vibration-free conveying to ensure accurate detection and imaging results. Drum motors deliver consistent belt speeds without fluctuations that could compromise scanning quality. Additionally, their low electromagnetic interference characteristics prevent signal disruption. However, market penetration remains limited to specialized security and inspection installations.

Pharmaceutical Handling System environments require stringent hygiene standards and validated equipment performance. Drum motors meet cleanroom requirements through sealed construction and washdown-compatible materials. Furthermore, their reliability minimizes contamination risks during sterile product transport. Consequently, pharmaceutical manufacturers specify drum motors for GMP-compliant material handling applications.

End-user Analysis

Manufacturing dominates with 41.8% due to extensive conveyor system deployment across production facilities.

In 2025, Manufacturing held a dominant market position in the End-user segment of Drum Motor Market, with a 41.8% share. Industrial production facilities across automotive, electronics, and consumer goods sectors rely heavily on conveying systems for assembly line operations. Drum motors enhance productivity through reliable material transport and reduced maintenance downtime. Moreover, their compact design optimizes factory floor layouts while supporting lean manufacturing initiatives.

Food Processing facilities require hygienic conveying solutions capable of withstanding frequent washdown procedures and food-grade material compliance. Drum motors constructed from stainless steel resist corrosion while maintaining sanitary conditions throughout production cycles. Additionally, sealed designs prevent lubricant contamination of food products. Therefore, regulatory compliance and operational efficiency drive adoption in food manufacturing environments.

Logistics and Warehousing operations leverage drum motors in distribution centers, fulfillment facilities, and airport baggage handling systems. E-commerce expansion fuels demand for automated material handling infrastructure capable of processing high volumes efficiently. Furthermore, low-noise operation characteristics support warehouse environments requiring minimal sound pollution. Consequently, logistics sector modernization sustains market growth trajectories.

Others category encompasses diverse applications including mining, recycling, pharmaceutical production, and specialized material handling operations. These sectors demand customized drum motor specifications addressing unique environmental and performance requirements. Additionally, emerging applications in renewable energy and advanced manufacturing expand addressable market opportunities. However, fragmented demand patterns result in smaller individual market shares compared to primary end-user segments.

Key Market Segments

By Motor Type

- Asynchronous Motors

- Synchronous Motors

- DC motors

By Power Range

- Medium power (0.5 kW to 2.5 kW)

- Low power (up to 0.5 kW)

- High power (above 2.5 kW)

By Current Type

- AC Current

- DC Current

By Application

- Conveying Systems

- Packaging & Sorting

- Bottle Recycling

- X-Ray, Security Scanning System

- Pharmaceutical Handling System

By End-user

- Manufacturing

- Food Processing

- Logistics and Warehousing

- Others

Drivers

Rapid Adoption of Compact and Space-Saving Conveyor Drive Systems in Automated Facilities

Industrial automation expansion drives accelerating demand for integrated motorized pulley systems that eliminate external drive components. Manufacturing and warehousing facilities face increasing pressure to maximize operational floor space while enhancing material handling efficiency. Consequently, drum motors deliver compact footprint advantages compared to traditional external motor configurations. Moreover, their sealed construction reduces installation complexity and spatial requirements throughout automated production environments.

E-commerce growth and distribution center modernization amplify the need for space-efficient conveying solutions. Fulfillment facilities require dense storage layouts with optimized material flow pathways to support high-volume order processing. Additionally, drum motor integration enables tighter conveyor radius configurations without sacrificing performance reliability. Therefore, logistics operators increasingly specify these systems to enhance warehouse capacity utilization and operational throughput.

Energy efficiency mandates and sustainability initiatives further accelerate drum motor adoption across industrial sectors. These integrated drive systems minimize power transmission losses through direct coupling of motor and conveyor components. Furthermore, reduced mechanical complexity lowers maintenance requirements and extends operational lifespan. Consequently, facility managers recognize total cost of ownership advantages that justify initial investment premiums over conventional motor systems.

Restraints

Higher Initial Procurement Cost Compared to Conventional External Motor Systems

Drum motor systems command significant price premiums relative to traditional external motor and gearbox configurations. This cost differential creates barriers for price-sensitive industrial buyers operating under constrained capital expenditure budgets. Moreover, smaller enterprises often prioritize immediate acquisition costs over long-term operational savings. Consequently, market penetration faces challenges in developing regions where upfront investment capacity remains limited despite favorable total cost ownership economics.

Limited load capacity flexibility restricts drum motor deployment in heavy-duty industrial applications requiring extreme torque capabilities. Mining operations, bulk material handling, and large-scale manufacturing facilities frequently exceed standard drum motor specifications. Additionally, customized high-capacity solutions involve extended lead times and substantial cost escalations. Therefore, industries with demanding load requirements continue relying on conventional external drive systems.

Technical awareness gaps among facility maintenance teams create adoption hesitancy despite drum motor performance advantages. Many industrial operators possess extensive experience servicing traditional motor configurations but lack familiarity with integrated drum motor maintenance procedures. Furthermore, perceived complexity of sealed motor repairs discourages transition from established equipment platforms. Consequently, comprehensive training programs become necessary to overcome operational resistance and facilitate technology adoption.

Growth Factors

Expansion of E-Commerce Warehousing Driving Demand for Advanced Conveyor Technologies

E-commerce sector expansion generates unprecedented demand for automated material handling infrastructure across global distribution networks. Fulfillment centers require reliable, low-maintenance conveying systems capable of supporting continuous operations without performance degradation. Moreover, drum motors deliver exceptional uptime through sealed construction that protects internal components from environmental contaminants. Therefore, logistics operators increasingly specify these systems to ensure consistent service levels.

Smart sensor integration and IoT connectivity transform drum motors into intelligent conveying components capable of predictive maintenance and performance optimization. Real-time monitoring capabilities enable proactive intervention before component failures disrupt operations. Additionally, data analytics support energy consumption optimization and operational efficiency improvements. Consequently, industrial automation strategies increasingly incorporate connected drum motor systems to enhance overall equipment effectiveness.

Emerging economy industrialization drives substantial investments in manufacturing automation and material handling infrastructure modernization. Countries across Asia Pacific, Latin America, and Middle East regions expand production capacities to serve growing consumer markets. Furthermore, favorable government policies support industrial development through tax incentives and infrastructure investments. Therefore, drum motor demand accelerates as developing nations upgrade legacy conveying systems with contemporary automation technologies.

Emerging Trends

Shift Toward Stainless Steel Drum Motors for Washdown and Hygienic Environments

Food processing and pharmaceutical manufacturing sectors increasingly mandate stainless steel drum motor construction to comply with stringent hygiene regulations. These corrosion-resistant systems withstand aggressive cleaning procedures involving high-pressure water jets and chemical sanitizers. Moreover, sealed designs prevent bacterial contamination while maintaining food-grade material compatibility standards. Consequently, manufacturers develop specialized product lines addressing cleanroom and washdown application requirements.

Modular and plug-and-play drum motor solutions gain popularity as facility operators demand simplified installation and maintenance procedures. Pre-configured systems reduce commissioning time while minimizing technical expertise requirements for deployment. Additionally, standardized mounting interfaces enable rapid equipment replacement without extensive conveyor modifications. Therefore, industrial buyers prioritize vendors offering comprehensive modular product ecosystems.

Variable frequency drive compatibility becomes standard specification as industries seek precise speed control and energy optimization capabilities. VFD-compatible drum motors enable dynamic conveyor speed adjustment based on real-time production demands and material flow requirements. Furthermore, soft-start functionality reduces mechanical stress and extends component lifespan. Consequently, advanced motor control integration represents critical differentiation factor among competing product offerings.

Regional Analysis

Asia Pacific Dominates the Drum Motor Market with a Market Share of 43.20%, Valued at USD 0.8 Billion

Asia Pacific commands dominant market position driven by extensive manufacturing infrastructure and rapid industrial automation adoption. The region benefits from substantial foreign investment in production facilities across China, India, and Southeast Asian nations. Moreover, government initiatives supporting Industry 4.0 transformation accelerate drum motor deployment throughout automated factories. The region held 43.20% market share in 2025, valued at USD 0.8 Billion, reflecting its manufacturing leadership.

North America Drum Motor Market Trends

North America demonstrates steady growth supported by warehouse automation expansion and food processing industry modernization. E-commerce fulfillment center proliferation drives conveying system upgrades across United States and Canada. Additionally, stringent food safety regulations necessitate hygienic drum motor solutions in processing facilities. Therefore, the region maintains technological leadership through advanced product development and IoT integration initiatives.

Europe Drum Motor Market Trends

Europe exhibits strong market development driven by sustainability mandates and energy efficiency regulations across industrial sectors. German automotive manufacturing and food processing industries represent primary demand sources for drum motor systems. Furthermore, established logistics infrastructure modernization supports market expansion throughout Western European economies. Consequently, the region emphasizes premium product segments featuring advanced control capabilities.

Middle East & Africa Drum Motor Market Trends

Middle East and Africa experience gradual market growth supported by diversification initiatives beyond oil-dependent economies. Infrastructure development projects and food processing capacity expansion drive drum motor adoption across GCC nations. Additionally, mining sector modernization in South Africa creates opportunities for heavy-duty conveying applications. However, price sensitivity and limited industrial automation penetration constrain overall market development.

Latin America Drum Motor Market Trends

Latin America shows moderate growth potential driven by manufacturing sector development and agricultural processing modernization. Brazil and Mexico lead regional demand through automotive production and food processing industries. Moreover, logistics infrastructure improvements support warehouse automation initiatives. Therefore, the region represents emerging opportunity for cost-effective drum motor solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Interroll Group maintains prominent market position through comprehensive drum motor portfolio addressing diverse industrial applications. The company delivers solutions featuring efficiency levels up to 83% in synchronous configurations while ensuring reliable operation under aggressive environmental conditions. Moreover, their products withstand water, dust, chemicals, and high-pressure washdown procedures. Consequently, Interroll serves food processing, pharmaceutical, and logistics sectors requiring hygienic conveying systems with minimal maintenance requirements.

Rulmeca establishes strong competitive presence through versatile drum motor offerings compatible with multiple power supply configurations. Their product line features 3-phase and 1-phase AC induction motors alongside diverse material construction options. Additionally, the company emphasizes customization capabilities addressing specific customer requirements across packaging, manufacturing, and distribution applications. Therefore, Rulmeca supports clients seeking tailored solutions for specialized material handling challenges.

Van der Graaf differentiates through engineered drum motors delivering exceptional operational efficiency and extended service intervals. Their systems achieve 96% mechanical efficiency while supporting 80,000 hours of continuous operation before maintenance intervention. Furthermore, the company focuses on reducing total cost of ownership through energy optimization and minimized downtime. Consequently, Van der Graaf attracts industrial customers prioritizing long-term operational economics over initial acquisition costs.

BEGE Power Transmission serves European markets through specialized drum motor solutions emphasizing reliability and application-specific engineering. The company provides comprehensive technical support throughout product selection, installation, and maintenance phases. Moreover, their experience across diverse industrial sectors enables effective problem-solving for complex conveying challenges. Therefore, BEGE maintains customer loyalty through responsive service and proven technical expertise.

Key players

- BEGE Power Transmission

- Boneng Transmission

- Chiorino Group

- CURRAX

- Damon Industry

- Deutronic Elektronik GmbH

- ID MOTEUR

- Interroll Group

- JJ Loughran

- Melco Conveyor Equipment

Recent Developments

- July 2024 – WEG acquired Regal Rexnord Industrial Motors, expanding its product portfolio and enhancing customer service capabilities across global markets. This strategic acquisition aligns with WEG’s innovation-focused growth strategy and strengthens its competitive positioning in industrial motor manufacturing.

- In June 2025, Conveyor Technology, a U.S.-based electric drum motor dealer and repair specialist, announced a $33 million expansion initiative aimed at scaling its manufacturing, repair, and service capabilities in Arkansas.

Report Scope

Report Features Description Market Value (2025) USD 2.0 Billion Forecast Revenue (2035) USD 3.1 Billion CAGR (2026-2035) 4.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Motor Type (Asynchronous Motors, Synchronous Motors, DC motors), By Power Range (Medium power (0.5 kW to 2.5 kW), Low power (up to 0.5 kW), High power (above 2.5 kW)), By Current Type (AC Current, DC Current), By Application (Conveying Systems, Packaging & Sorting, Bottle Recycling, X-Ray, Security Scanning System, Pharmaceutical Handling System), By End-user (Manufacturing, Food Processing, Logistics and Warehousing, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BEGE Power Transmission, Boneng Transmission, Chiorino Group, CURRAX, Damon Industry, Deutronic Elektronik GmbH, ID MOTEUR, Interroll Group, JJ Loughran, Melco Conveyor Equipment Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BEGE Power Transmission

- Boneng Transmission

- Chiorino Group

- CURRAX

- Damon Industry

- Deutronic Elektronik GmbH

- ID MOTEUR

- Interroll Group

- JJ Loughran

- Melco Conveyor Equipment