Global Drug Eluting Balloon Market By Product Type (Peripheral Drug Eluting Balloon, Coronary Drug Eluting Balloon, and Others), By Technology (Paccocath, EnduraCoat, FreePac, TransPax, and Others), By End-user (Hospitals & Ambulatory Surgery Centers, CATH Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150962

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

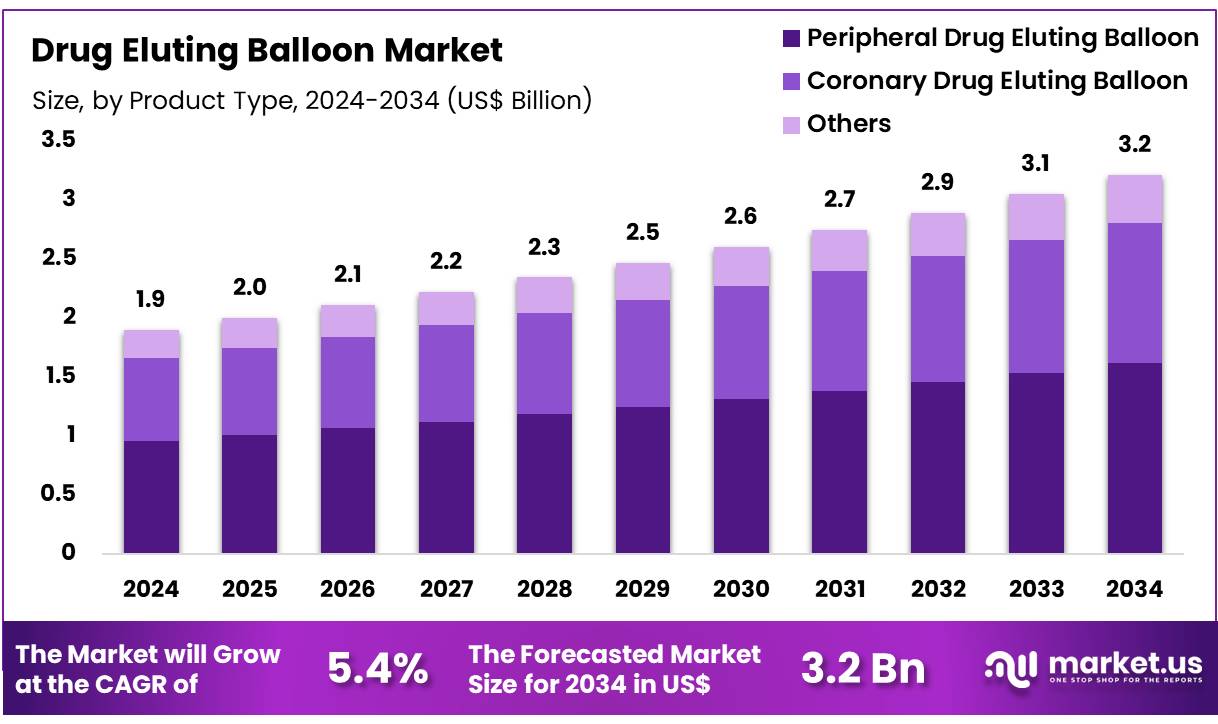

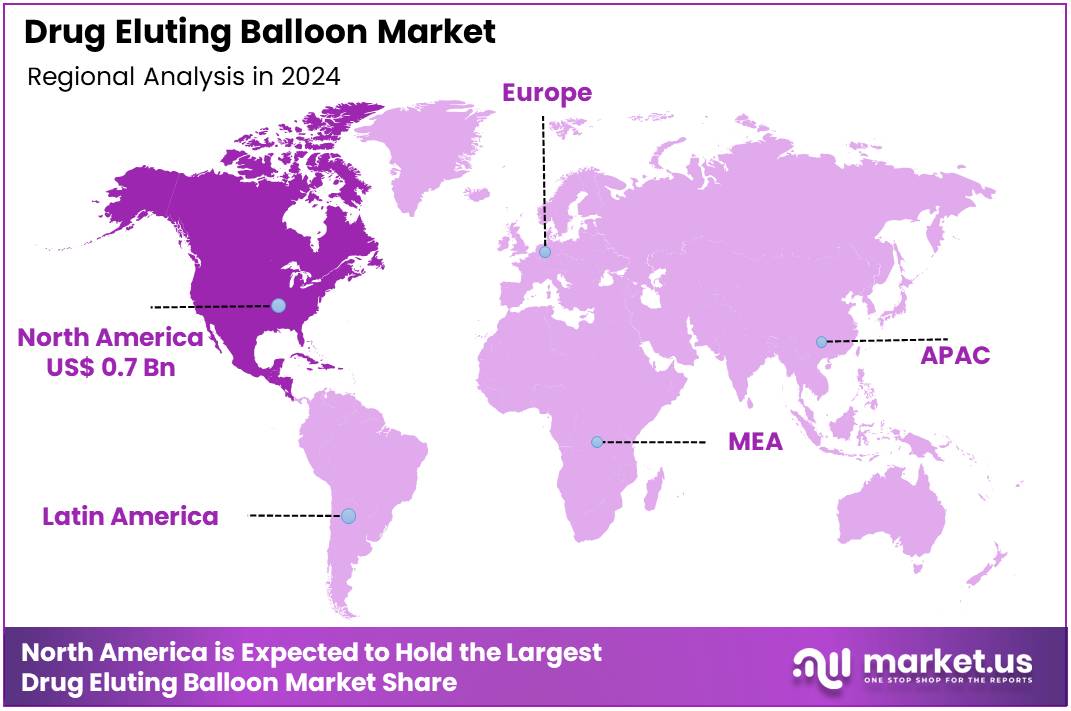

Global Drug Eluting Balloon Market size is expected to be worth around US$ 3.2 Billion by 2034 from US$ 1.9 Billion in 2024, growing at a CAGR of 5.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.7% share with a revenue of US$ 0.7 Billion.

Increasing prevalence of cardiovascular diseases and the growing demand for minimally invasive treatments drive the expansion of the drug eluting balloon market. These balloons are primarily used in coronary artery interventions, particularly in patients with peripheral artery disease and restenosis following angioplasty. The drug eluting balloon delivers targeted medication directly to the affected area, helping prevent restenosis and improving long-term patient outcomes.

As the need for effective treatment options grows, drug eluting balloons are gaining popularity for their ability to reduce complications and enhance recovery time compared to traditional stenting procedures. Recent trends indicate advancements in balloon technology, with new formulations focusing on improving drug delivery and balloon performance. The market also benefits from innovations in bioresorbable materials, which offer additional advantages, such as reducing the risk of adverse reactions.

Moreover, increasing awareness of the benefits of drug-eluting technologies and the rising number of patients with cardiovascular diseases present significant opportunities for market growth. As the medical field continues to prioritize patient-centric treatments, drug-eluting balloons provide a promising solution to enhance the efficacy and safety of cardiovascular interventions. These developments are likely to drive future growth, particularly as the global healthcare industry seeks more effective and minimally invasive treatment alternatives.

Key Takeaways

- In 2024, the market for drug eluting balloon generated a revenue of US$ 1.9 billion, with a CAGR of 5.4%, and is expected to reach US$ 3.2 billion by the year 2034.

- The product type segment is divided into peripheral drug eluting balloon, coronary drug eluting balloon, and others, with peripheral drug eluting balloon taking the lead in 2024 with a market share of 50.4%.

- Considering technology, the market is divided into paccocath, enduracoat, freepac, transpax, and others. Among these, paccocath held a significant share of 56.3%.

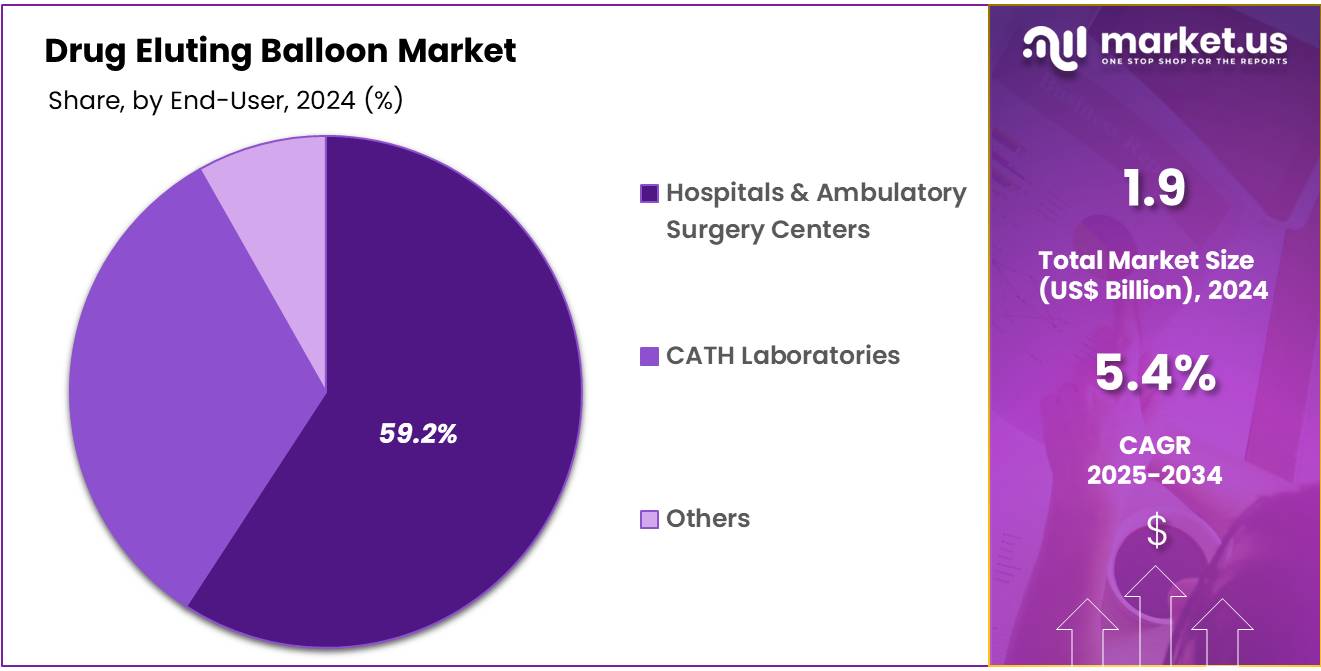

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & ambulatory surgery centers, CATH laboratories, and others. The hospitals & ambulatory surgery centers sector stands out as the dominant player, holding the largest revenue share of 59.2% in the Drug Eluting Balloon market.

- North America led the market by securing a market share of 36.7% in 2024.

Product Type Analysis

The peripheral drug eluting balloon segment claimed a market share of 50.4% owing to the increasing prevalence of PAD, particularly in aging populations. The demand for minimally invasive treatments is rising, as patients and healthcare providers seek alternatives to traditional surgical procedures. Furthermore, advancements in drug-eluting technology, which improve the performance of these balloons, are likely to accelerate their adoption.

Hospitals and ambulatory surgery centers are anticipated to increase their use of these balloons due to their ability to reduce restenosis rates, providing better long-term patient outcomes. The ongoing focus on improving vascular health treatments and the increasing awareness about PAD treatments are expected to further propel the growth of the peripheral drug-eluting balloon market.

Technology Analysis

The paccocath held a significant share of 56.3% due to its enhanced ability to deliver drug therapy and mechanical dilation simultaneously. This dual action improves the effectiveness of coronary and peripheral interventions, making Paccocath balloons a preferred choice for treating restenosis in coronary artery disease. The segment is estimated to benefit from growing clinical evidence supporting the technology’s superior outcomes in terms of restenosis prevention and improved long-term vessel patency.

As more research proves the advantages of Paccocath over traditional angioplasty, its adoption is likely to increase among healthcare providers. Paccocath’s ability to provide better patient outcomes with fewer complications will drive its increased usage in hospitals and ambulatory surgery centers. Furthermore, technological innovations and the continuous development of next-generation drug-eluting devices are expected to boost the market for Paccocath balloons in the coming years.

End-User Analysis

The hospitals & ambulatory surgery centers segment had a tremendous growth rate, with a revenue share of 59.2% owing to their established infrastructure and increasing demand for minimally invasive procedures. These settings are anticipated to see growth due to a shift toward outpatient care, driven by advancements in healthcare technology and the desire to reduce healthcare costs.

The adoption of drug-eluting balloons in these centers is likely to rise as they offer effective treatments for conditions such as peripheral artery disease and coronary artery disease. Additionally, the ability of these facilities to handle high volumes of procedures, along with the growing preference for outpatient vascular interventions, is expected to drive the use of drug-eluting balloons.

The anticipated expansion of healthcare facilities and investments in advanced medical technologies will further boost the market share of hospitals and ambulatory surgery centers in the drug-eluting balloon market.

Key Market Segments

By Product Type

- Peripheral Drug Eluting Balloon

- Coronary Drug Eluting Balloon

- Others

By Technology

- Paccocath

- EnduraCoat

- FreePac

- TransPax

- Others

By End-user

- Hospitals & Ambulatory Surgery Centers

- CATH Laboratories

- Others

Drivers

Rising Prevalence of Peripheral Artery Disease is Driving the Market

The increasing global prevalence of peripheral artery disease (PAD) is a significant driver for the drug eluting balloon market. PAD, a condition where narrowed arteries reduce blood flow to the limbs, particularly the legs, necessitates interventional procedures to restore circulation. Drug eluting balloons offer a promising treatment option by delivering an anti-proliferative drug directly to the vessel wall during angioplasty, preventing restenosis without leaving a permanent implant.

The American College of Cardiology (ACC) highlighted in October 2024 that PAD affects over 200 million people globally, with a higher prevalence in individuals over 50 years of age, often linked to risk factors such as hypertension, diabetes mellitus, and smoking. This substantial and growing patient population, coupled with the advantages of these balloons in maintaining vessel patency, fuels their demand in revascularization procedures.

Restraints

Stringent Regulatory Approval Processes are Restraining the Market

The drug eluting balloon market faces significant restraint due to the stringent and often lengthy regulatory approval processes required for these devices. Manufacturers must undergo rigorous clinical trials and provide extensive safety and efficacy data to gain regulatory clearance, which can be a time-consuming and costly endeavor. This stringent oversight, while ensuring patient safety, can delay market entry for innovative products and increase the financial burden on developers.

For instance, the US Food and Drug Administration (FDA) requires comprehensive clinical evidence before granting approvals for new medical devices like these balloons. A December 2023 report from the FDA indicates that medical device approvals involve multiple stages, from pre-market submission to post-market surveillance, each with specific data requirements. This regulatory complexity acts as a barrier, particularly for smaller companies attempting to introduce new technologies.

Opportunities

Technological Advancements and Next-Generation Designs Create Growth Opportunities

The continuous technological advancements and the development of next-generation drug eluting balloon designs present significant growth opportunities in the market. Researchers and manufacturers are focused on improving drug delivery efficiency, developing novel drug coatings with enhanced anti-proliferative properties, and creating balloons tailored for specific vascular anatomies or lesion types.

For example, in March 2024, the US Food and Drug Administration (FDA) approved the AGENT Paclitaxel-Coated Balloon Catheter for the treatment of coronary in-stent restenosis, marking a significant milestone as the first such coronary device approved in the US. Ongoing research also explores alternative anti-proliferative agents beyond paclitaxel, with new limus-based formulations showing promise in early clinical trials. These innovations aim to improve clinical outcomes, reduce reintervention rates, and expand the applicability of these balloons to a wider range of patients and vascular conditions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the drug eluting balloon market, primarily through their impact on healthcare expenditure, capital investments in medical infrastructure, and patient access to advanced procedures. Periods of economic stability and growth often correlate with increased healthcare budgets, enabling hospitals and clinics to invest in advanced medical devices like drug eluting balloons and expanding insurance coverage for complex interventional procedures.

Conversely, economic downturns, high inflation, or austerity measures can lead to tighter healthcare spending, potentially delaying equipment upgrades or limiting reimbursement for new technologies, which can impact market growth. The US Bureau of Economic Analysis reported that healthcare spending in the US increased by 7.5% in 2023 to US$4.9 trillion, accelerating from a 4.6% rise in 2022.

Geopolitical factors, such as international trade relations, intellectual property protections, and stability of global supply chains for specialized materials and components used in manufacturing these devices, are also crucial. Political instability or trade disputes can disrupt the flow of raw materials, impacting production costs and the availability of these essential medical devices.

Despite these broader influences, the critical need for effective revascularization in cardiovascular and peripheral artery diseases ensures a persistent demand for these devices, often leading to market resilience even in challenging economic and geopolitical landscapes.

Current US tariff policies can directly impact the drug eluting balloon market. Tariffs imposed on imported components, raw materials, or finished medical devices, particularly from key manufacturing regions, could significantly increase production costs for medical device companies. The US increased its reliance on China for medication imports, doubling them between 2020 and 2022, as reported by the US Census Bureau.

The American Hospital Association (AHA) stated in May 2025 that new tariffs could have “significant implications for healthcare,” noting that the United States imported over US$75 billion in medical devices and supplies in 2024. This could translate to higher prices for drug eluting balloons, potentially impacting patient access and affordability, particularly for procedures where cost is a significant factor.

However, these tariffs could also incentivize domestic manufacturing of components and finished devices within the US. This might lead to a more secure and localized supply chain in the long term, potentially reducing dependency on foreign suppliers and enhancing national medical device resilience despite the initial cost pressures.

Latest Trends

Expansion of Clinical Indications is a Recent Trend

A prominent recent trend in the drug eluting balloon market is the expansion of their clinical indications beyond their initial uses, particularly for in-stent restenosis and peripheral artery disease. While these remain key areas, there is a growing body of clinical evidence supporting the use of these balloons in de novo lesions, small vessel disease, bifurcation lesions, and even in patients with high bleeding risk who may benefit from shorter dual antiplatelet therapy durations.

A 2024 scientific update on the clinical performance of drug-coated balloons, published in AsiaIntervention and cited by the American Heart Association Journals, discusses the growing evidence from long-term follow-up of large randomized clinical trials regarding the use of these devices in scenarios such as de novo small and large vessel disease and complex bifurcations. This broadening of application areas, supported by positive clinical trial outcomes, is driving increased adoption and market penetration.

Regional Analysis

North America is leading the Drug Eluting Balloon Market

North America dominated the market with the highest revenue share of 36.7% owing to increasing regulatory approvals and a rising need for effective revascularization strategies in peripheral and coronary artery diseases. A significant development was the US Food and Drug Administration (FDA) approval of Boston Scientific’s AGENT Drug-Coated Balloon in March 2024 for the treatment of coronary in-stent restenosis, marking the first such approval for a coronary DEB in the US This approval provides a crucial alternative to repeat stenting for patients experiencing narrowing within previously placed coronary stents.

Medtronic, a leading medical technology company, reported an increase in its Cardiovascular Portfolio revenue, which grew by 6.6% as reported and 7.8% organically in the fourth quarter of its fiscal year 2025 (which ended April 26, 2024), underscoring the demand for interventional cardiovascular devices. Boston Scientific also reported its Peripheral Interventions net sales at US$2.410 billion for the full year 2024, reflecting a 14.2% reported growth and 15.5% operational growth compared to 2023, driven by a robust portfolio that includes DEBs.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to to the increasing prevalence of cardiovascular diseases, improving diagnostic and interventional cardiology infrastructure, and growing healthcare expenditure across the region. While specific 2022-2024 data on peripheral artery disease prevalence by country is actively being compiled, a study on global trends in peripheral arterial disease among older adults, published in May 2025, highlights the continued burden of the disease.

China’s National Medical Products Administration (NMPA) continues to approve a growing number of innovative medical devices, with 6,247 imported medical device items approved in 2024, many of which are cardiovascular interventional products from countries like the United States, indicating an expanding market for advanced therapies. Furthermore, India’s Ministry of Health and Family Welfare’s budget allocation increased to Rs 89,155 crore (approximately US$10.6 billion) for 2023-2024, signaling enhanced investment in healthcare infrastructure and patient access to advanced medical technologies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the drug eluting balloon market employ strategies such as expanding their product portfolios, enhancing formulation technologies, and pursuing strategic partnerships to drive growth. Companies focus on developing long-acting injectable formulations to improve patient compliance and reduce treatment frequency.

They also invest in research and development to explore new therapeutic applications and improve existing formulations. Collaborations with healthcare providers and other pharmaceutical companies help in expanding market reach and improving patient access to treatments. Additionally, key players are increasing their presence in emerging markets to capitalize on the growing demand for these treatments.

Medtronic is a leading global medical technology company headquartered in Dublin, Ireland. The company operates in more than 150 countries and offers a wide range of innovative products and therapies, including drug-eluting balloons for treating coronary artery diseases. Medtronic focuses on advancing patient care through continuous innovation, research, and development, aiming to improve outcomes and quality of life for patients worldwide. The company’s commitment to innovation and patient-centered solutions positions it as a key player in the drug-eluting balloon market.

Top Key Players

- Medtronic plc

- Boston Scientific Corporation

- Becton, Dickinson and Company (BD)

- Terumo Corporation

- Koninklijke Philips

- Biotronik SE & Co. KG

- MedAlliance

- Advanced NanoTherapies

Recent Developments

- In September 2022, Advanced NanoTherapies secured approval from the US FDA for its SirPlux Duo Drug Coated Balloon, intended for use in coronary artery disease cases involving vessels smaller than 3.0 mm. This approval is expected to enhance the treatment options for coronary artery disease, particularly for patients with smaller vessels, by offering a more effective and targeted therapy to improve outcomes in this challenging patient group.

- In May 2022, MedAlliance’s SELUTION SLR drug-eluting balloon received FDA investigational device exemption approval. This device provides a controlled, sustained drug release specifically for below-the-knee indications in peripheral artery disease. Its approval opens new avenues for treating patients with peripheral artery disease, providing an advanced therapeutic option for those needing more precise and long-lasting treatment to manage their condition.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 Billion Forecast Revenue (2034) US$ 3.2 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Peripheral Drug Eluting Balloon, Coronary Drug Eluting Balloon, and Others), By Technology (Paccocath, EnduraCoat, FreePac, TransPax, and Others), By End-user (Hospitals & Ambulatory Surgery Centers, CATH Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic plc, Boston Scientific Corporation, Becton, Dickinson and Company (BD), Terumo Corporation, Koninklijke Philips, Biotronik SE & Co. KG, MedAlliance, Advanced NanoTherapies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Drug Eluting Balloon MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Drug Eluting Balloon MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic plc

- Boston Scientific Corporation

- Becton, Dickinson and Company (BD)

- Terumo Corporation

- Koninklijke Philips

- Biotronik SE & Co. KG

- MedAlliance

- Advanced NanoTherapies