Drug Device Combination Products Market By Product Type (Infusion Pumps (Volumetric, Disposables, Syringes, and Others), Drug Eluting Stents, Inhalers (Nebulizers, Dry Powder, and Metered Dose), Wound Care Combination Products, and Others), By Application (Diabetes, Respiratory Problems, Cardiovascular Disorders, Cancer Treatment, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 54764

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

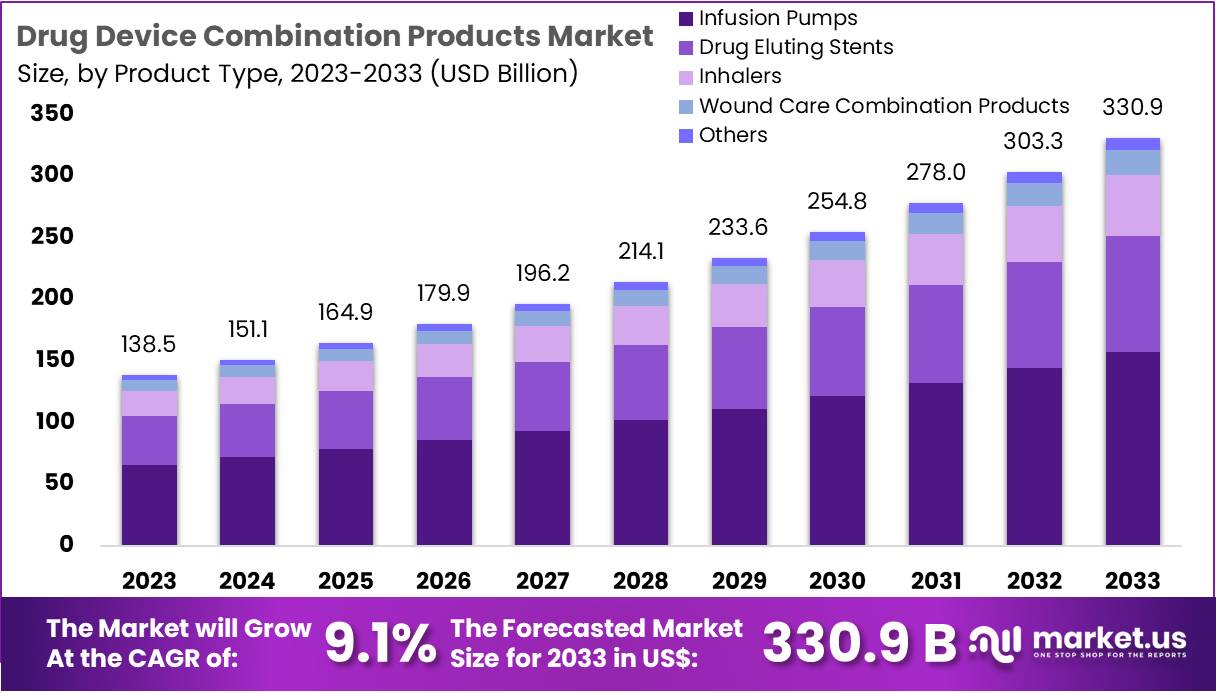

The Drug Device Combination Products Market Size is expected to be worth around US$ 330.9 billion by 2033 from US$ 138.5 billion in 2023, growing at a CAGR of 9.1% during the forecast period 2024 to 2033.

Growing demand for integrated healthcare solutions is driving the expansion of the drug-device combination products market. These products, which combine pharmaceutical drugs with medical devices, offer a streamlined approach to treatment, improving patient outcomes through enhanced efficacy and convenience. As the healthcare industry continues to focus on personalized medicine, the market for combination products is seeing significant growth.

Drug-device combinations are increasingly used in areas such as oncology, diabetes management, respiratory care, and neurology. In April 2023, Teikoku Seiyaku and Kowa introduced the ALLYDONE Patches, designed for the treatment of Alzheimer’s disease-related dementia, demonstrating how drug-device combinations can address complex medical conditions.

These innovative products not only provide better therapeutic effects but also reduce patient burden by simplifying treatment regimens. The market benefits from continuous technological advancements, particularly in device design and drug delivery systems, creating opportunities for new product developments. Additionally, the increasing prevalence of chronic diseases and the need for efficient, cost-effective treatments further fuel market demand.

Regulatory advancements, such as clearer approval pathways for combination products, are also contributing to market growth. The market is witnessing a trend toward greater patient compliance due to the convenience of these combined therapies, which could open new avenues for market players. With ongoing innovation and regulatory support, the drug-device combination products market is poised for significant expansion.

Key Takeaways

- In 2023, the market for drug device combination products generated a revenue of US$ 5 billion, with a CAGR of 9.1%, and is expected to reach US$ 330.9 billion by the year 2033.

- The product type segment is divided into infusion pumps, drug eluting stents, inhalers, wound care combination products, and others, with infusion pumps taking the lead in 2023 with a market share of 47.6%.

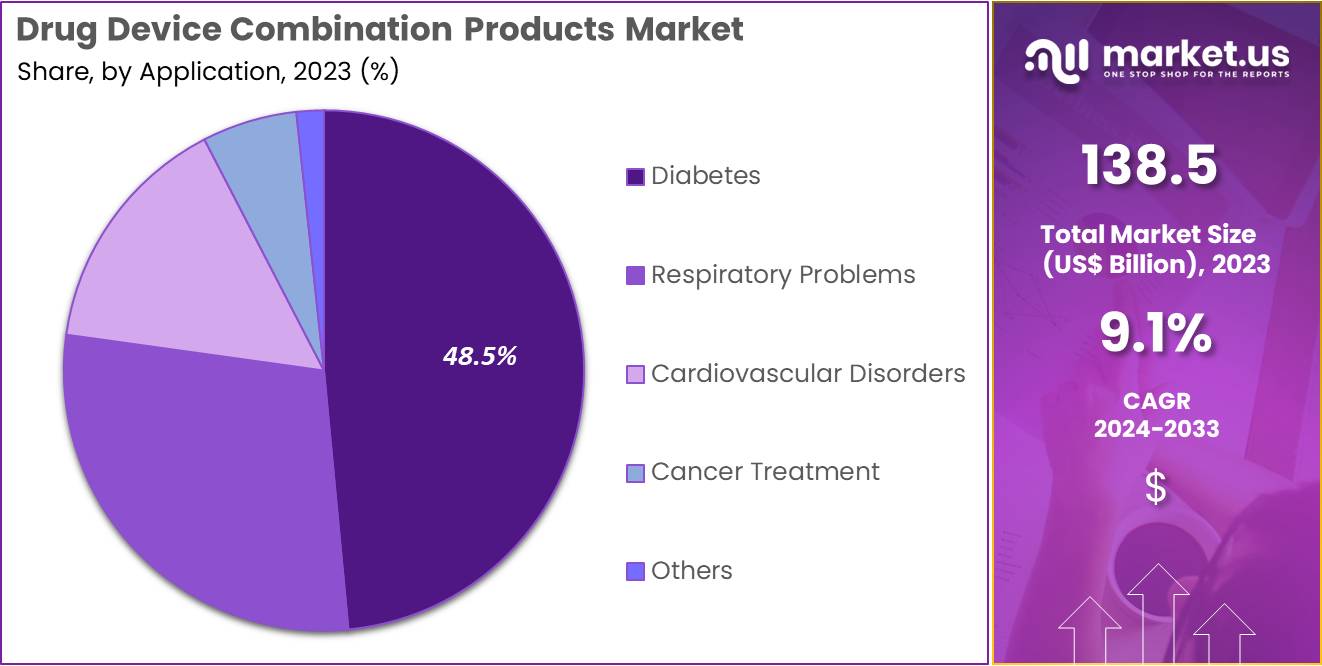

- Considering application, the market is divided into diabetes, respiratory problems, cardiovascular disorders, cancer treatment, and others. Among these, diabetes held a significant share of 48.5%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, ambulatory surgical centers, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 58.1% in the drug device combination products market.

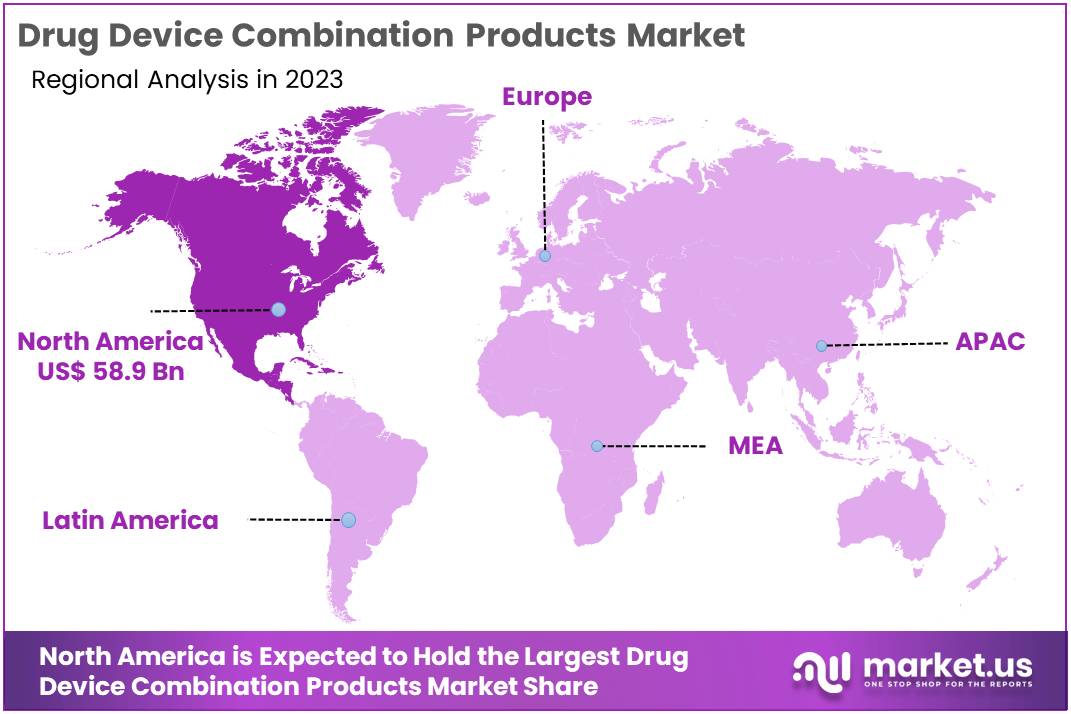

- North America led the market by securing a market share of 42.5% in 2023.

Industrial Advantages

Drug-device combination products offer significant business benefits to market key players. Enhanced product efficacy is a prime advantage, as these products improve therapeutic outcomes by controlled medication delivery, thus ensuring improved patient compliance and treatment efficacy. This differentiation in the market attracts more customers and supports premium pricing strategies. Additionally, combination products can extend the lifecycle of existing pharmaceuticals or devices, creating new intellectual property and delaying generic competition, thereby sustaining market exclusivity.

In the industry, drug-device combinations hold substantial advantages, including streamlined regulatory pathways that expedite market access compared to traditional drug or device approvals. The synergy between pharmaceutical and medical device sectors fuels innovative R&D, leading to groundbreaking solutions. Furthermore, these products typically offer cost-effectiveness and enhanced safety, reducing treatment side effects and improving therapeutic effectiveness, which benefits both patients and healthcare providers.

The market for drug-device combination products is ripe with opportunities. The growing demand from aging populations and the increasing prevalence of chronic diseases necessitate more effective treatment options. Advances in technology, such as in microelectronics and biotechnology, pave the way for sophisticated new delivery systems. Moreover, emerging global markets with improving healthcare infrastructures offer new territories for expansion. Strategic collaborations between pharmaceutical and device companies can also hasten development and market penetration, maximizing the potential for success in this innovative field.

Product Type Analysis

The infusion pumps segment led in 2023, claiming a market share of 47.6%. Increasing demand for precise drug delivery, particularly in critical care settings, is expected to drive this growth. Infusion pumps enable accurate and controlled delivery of medications, which is essential for patients with chronic conditions or those requiring long-term drug therapy.

As healthcare providers prioritize patient safety and treatment efficacy, infusion pumps’ role in minimizing medication errors and optimizing patient care is anticipated to lead to broader adoption. Moreover, technological advancements, such as smart infusion pumps with integrated software, are expected to enhance their appeal, further contributing to market expansion. The ongoing shift toward home healthcare and outpatient treatment options is likely to increase the demand for portable and user-friendly infusion pumps, thus supporting the segment’s growth.

Application Analysis

The diabetes held a significant share of 48.5% due to the increasing prevalence of diabetes globally. The rising incidence of both Type 1 and Type 2 diabetes has led to a growing demand for effective and convenient management solutions, including insulin pumps and continuous glucose monitoring devices. As the need for more personalized and precise diabetes treatment options grows, the market for drug device combinations tailored to diabetes care is projected to expand.

Additionally, advancements in drug delivery technologies that integrate medications with medical devices are likely to improve patient compliance and outcomes. The segment’s growth will also be supported by the increasing focus on reducing healthcare costs, as effective diabetes management can help prevent complications and reduce long-term treatment costs.

End-user Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 58.1% as hospitals continue to implement advanced medical technologies for better patient care. The integration of drug delivery devices with medical products is expected to enhance treatment precision and efficiency, especially in specialized fields like oncology, cardiology, and endocrinology. Hospitals’ adoption of these products is driven by their potential to improve patient outcomes while reducing the likelihood of medication errors.

Furthermore, as hospitals focus on improving operational efficiency and reducing treatment times, the demand for combination products that streamline drug delivery and minimize the need for manual intervention is projected to rise. The increasing focus on personalized medicine and treatment plans is expected to further support this segment’s growth, as hospitals seek solutions that can be tailored to individual patient needs.

Key Market Segments

By Product Type

- Infusion Pumps

- Volumetric

- Disposables

- Syringes

- Others

- Drug Eluting Stents

- Inhalers

- Nebulizers

- Dry Powder

- Metered Dose

- Wound Care Combination Products

- Others

By Application

- Diabetes

- Respiratory Problems

- Cardiovascular Disorders

- Cancer Treatment

- Others

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Growing Prevalence of Diabetes Driving Market Growth

The growing prevalence of diabetes significantly drives the drug-device combination products market. In 2021, the International Diabetes Federation (IDF) reported that 537 million adults aged 20-79 were living with diabetes, a figure expected to rise to 783 million by 2045. With about 90% of individuals diagnosed with diabetes at risk of progressing to type 2 diabetes, the demand for innovative therapeutic solutions continues to grow.

As diabetes cases rise globally, there is an increased need for integrated treatments, including combination products that merge drugs and devices for enhanced management of the condition. These solutions are anticipated to improve patient compliance, offer convenience, and support more effective treatment regimens. Therefore, the growing diabetes burden is expected to drive the demand for combination products in the market, particularly those offering easier administration, such as insulin delivery systems and continuous glucose monitoring devices.

Restraints

Reimbursement and Pricing Issues Restraining Market Growth

High reimbursement and pricing issues restrain the growth of the drug-device combination products market. Despite the growing demand for advanced therapeutic solutions, the high cost of development, manufacturing, and regulatory approval can lead to significant pricing challenges. Many insurance companies limit coverage for these products, often leading to reimbursement delays or denials.

Additionally, the cost disparity between drug-device combinations and traditional treatments could hinder adoption among healthcare providers and patients, particularly in cost-sensitive markets. These pricing and reimbursement concerns are likely to impede market growth as both manufacturers and patients face barriers to affordability and access. As a result, the market may experience slower uptake and expansion until cost-effectiveness and reimbursement strategies improve.

Opportunities

Increase in R&D Activities as an Opportunity

Increasing investment in research and development (R&D) activities presents a significant opportunity for the drug-device combination products market. In December 2022, Terumo Corporation launched the G-Lasta Subcutaneous Injection 3.6 mg BodyPod, a drug-device combination developed in collaboration with Kyowa Kirin Co., Ltd., highlighting the growing focus on innovative solutions.

R&D activities in this area are expected to lead to the development of more efficient, patient-friendly drug-device combinations, addressing unmet medical needs, particularly in chronic disease management. These advancements could enhance drug delivery, reduce side effects, and improve patient compliance. The rise in R&D investment across the pharmaceutical and medical device sectors is anticipated to accelerate the introduction of novel combination products, expanding market opportunities and driving growth in the coming years.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the drug device combination products market. Economic instability, such as recessions, can limit healthcare spending, leading to slower adoption of innovative combination therapies. On the other hand, geopolitical tensions, particularly trade barriers and regulatory challenges, can disrupt the supply chain, affecting the availability of raw materials and delaying product development.

However, in response to the increasing prevalence of chronic diseases and the demand for personalized medicine, governments in many regions continue to invest in healthcare infrastructure, which bolsters demand for these products. Additionally, the global focus on improving healthcare access and delivery, particularly in emerging markets, drives the market forward. Despite challenges posed by economic fluctuations and trade uncertainties, the market outlook remains optimistic, driven by growing healthcare demands and technological advancements in combination products.

Trends

Rising Demand for Hi-Tech Drug Delivery Systems Driving the Market

The drug device combination products market is experiencing significant growth, driven by increasing demand for high-tech drug delivery systems. Innovations in this sector aim to enhance efficiency, precision, and patient comfort during drug administration. As a result, new technologies are continually emerging to meet these demands.

In October 2023, Medtronic received FDA approval for its SynchroMed III intrathecal drug delivery system. This system is engineered to manage chronic pain, cancer pain, and severe spasticity. Its introduction represents a major advancement in combining drug delivery technologies with medical devices, offering hope for patients with debilitating conditions.

As healthcare continues to evolve, there is a growing shift towards more personalized and efficient therapies. This trend is expected to boost the demand for advanced drug delivery systems further. Consequently, the development and adoption of drug device combination products are projected to expand, supporting the need for innovative solutions in medical treatment.

Regional Analysis

North America is leading the Drug Device Combination Products Market

North America dominated the market with the highest revenue share of 42.5% owing to advancements in medical technology and increasing demand for integrated healthcare solutions. The region’s aging population, rising prevalence of chronic diseases, and an increasing focus on minimally invasive treatments have significantly contributed to the market’s expansion.

In February 2023, Teleflex Incorporated marked significant milestones with the first clinical application of the GuideLiner Coast Catheter and the FDA 510(k) clearance of the Triumph Catheter, highlighting the increasing focus on innovative drug-device combinations that improve treatment outcomes. The market’s growth is also supported by the adoption of more efficient and patient-friendly therapies, such as injectable devices and drug-eluting stents, which combine pharmaceutical drugs with medical devices to enhance drug delivery and improve patient compliance.

The favorable regulatory environment and continuous advancements in combination therapies for conditions such as cardiovascular diseases and cancer further fuel the demand for these products. As the healthcare landscape in North America increasingly shifts toward personalized and integrated treatment options, the drug device combination products market is expected to continue growing in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s expanding healthcare infrastructure, rising healthcare expenditure, and increasing patient awareness. In May 2024, Abbott launched the XIENCE Sierra, a next-generation drug-eluting coronary stent system, in India, reflecting the growing adoption of advanced combination products in the region.

The rising prevalence of chronic conditions such as cardiovascular diseases, diabetes, and respiratory disorders is likely to increase the demand for innovative combination therapies. Additionally, improvements in healthcare access, especially in emerging markets like India, China, and Southeast Asia, are expected to drive the market’s growth.

Governments in the region are increasingly focusing on enhancing healthcare systems and improving the availability of advanced medical technologies, which will further bolster the demand for drug device combination products. As healthcare providers in Asia Pacific adopt more sophisticated solutions for the treatment and management of various diseases, the market for combination products is projected to expand in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the drug device combination products market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the drug-device combination products market focus on innovation, regulatory compliance, and strategic partnerships to drive growth.

Companies prioritize integrating advanced drug delivery technologies, such as pre-filled syringes and auto-injectors, with robust medical devices to improve patient outcomes and convenience. They also invest in expanding product portfolios to address unmet medical needs across various therapeutic areas.

Collaborative efforts with pharmaceutical companies, healthcare providers, and contract manufacturers help enhance distribution and market reach. Additionally, firms emphasize regulatory approvals and maintaining compliance with industry standards to ensure product safety and effectiveness.

Medtronic is a key player in the drug-device combination products market. The company’s growth strategy revolves around providing cutting-edge solutions in the areas of diabetes management, respiratory care, and surgical devices. Medtronic focuses on leveraging its strong R&D capabilities to innovate combination products that offer enhanced performance and patient convenience.

By forming strategic partnerships and expanding its global presence, Medtronic continues to strengthen its leadership in the market. The company’s portfolio includes devices like the MiniMed 670G insulin pump, which integrates advanced drug delivery and monitoring technologies to improve patient care.

Top Key Players in the Drug Device Combination Products Market

- Viatris Inc

- Terumo Medical Corporation

- Teleflex Incorporated

- Stryker

- Novartis AG

- Medtronic

- Boston Scientific Corporation

- Becton, Dickinson and Company

- Abbott

Recent Developments

- In November 2023: Hovione, a leading integrated CDMO, expanded its nasal drug delivery portfolio by introducing a new series of innovative nasal powder delivery devices, co-developed with IDC.

- In July 2023: Becton, Dickinson, and Company received FDA 510(k) approval for an advanced iteration of the Alaris Infusion System. This approval covers a range of updates, including enhanced features for the PCU, auto-identification modules, syringe pumps, large volume pumps, Patient-controlled Analgesia (PCA) pumps, and respiratory monitoring systems.

Report Scope

Report Features Description Market Value (2023) US$ 138.5 billion Forecast Revenue (2033) US$ 330.9 billion CAGR (2024-2033) 9.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Infusion Pumps (Volumetric, Disposables, Syringes, and Others), Drug Eluting Stents, Inhalers (Nebulizers, Dry Powder, and Metered Dose), Wound Care Combination Products, and Others), By Application (Diabetes, Respiratory Problems, Cardiovascular Disorders, Cancer Treatment, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Viatris Inc, Terumo Medical Corporation, Teleflex Incorporated, Stryker, Novartis AG, Medtronic, Boston Scientific Corporation, Becton, Dickinson and Company, and Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Drug Device Combination Products MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Drug Device Combination Products MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Viatris Inc

- Terumo Medical Corporation

- Teleflex Incorporated

- Stryker

- Novartis AG

- Medtronic

- Boston Scientific Corporation

- Becton, Dickinson and Company

- Abbott