Global Door Hinges Market Size, Share and Future Trends Analysis Report By Product (Barrel Hinge, Butt Hinges, Pivot Hinge, HL Hinges, Concealed Hinges, Flag Hinges, Others), By Material (Cold-Rolled Steel, Stainless Steel, Solid Brass), By Application (Ball Bearing Door, Spring Door, Specialty Door, Others), By End Use (Residential, Commercial) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148530

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

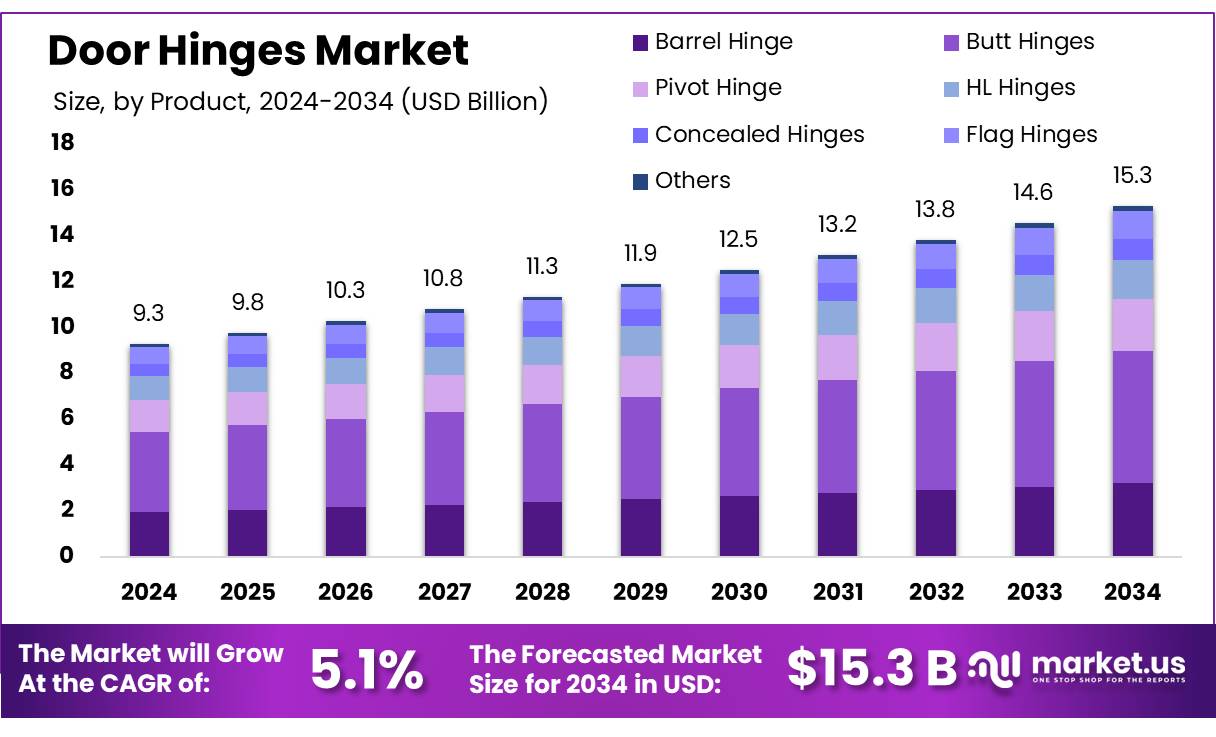

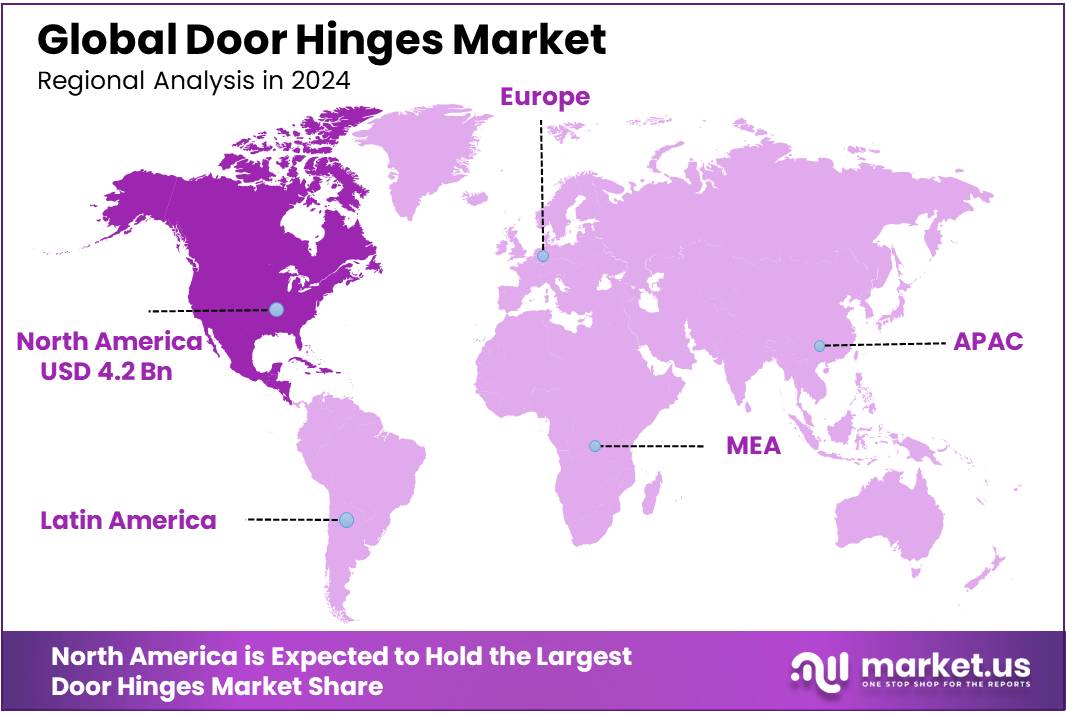

The Global Door Hinges Market size is expected to be worth around USD 15.3 Billion by 2034, from USD 9.3 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024, North America was the leading region, with a 46% market share, generating around USD 4.2 billion in revenue.

The door hinges industry, a critical segment of the hardware and construction sector, plays an essential role in residential, commercial, and industrial applications, ensuring functionality and durability in door systems. Door hinges, though small, are integral to infrastructure development, automotive manufacturing, and furniture production, supporting seamless movement and structural integrity. The global demand for door hinges is driven by rapid urbanization, infrastructure expansion, and advancements in material technologies, with the industry witnessing steady growth due to rising construction activities and evolving consumer preferences for aesthetically pleasing, high-performance hinges.

In 2025, the Indian government introduced the Hinges (Quality Control) Order, mandating that all hinges sold domestically bear the Bureau of Indian Standards (BIS) mark. This regulation aims to curb the import of sub-standard goods and boost domestic manufacturing . The order, effective from July 1, 2025, requires adherence to Indian Standard 18297:2023 for cabinet hinges, ensuring product quality and safety .

Material preferences are shifting towards options that offer strength and corrosion resistance. In 2024, the stainless-steel segment dominated the door hinges market, acquiring a market share of 40% and is expected to grow at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Key Takeaways

- Door Hinges Market size is expected to be worth around USD 15.3 Billion by 2034, from USD 9.3 Billion in 2024, growing at a CAGR of 5.1%.

- Butt Hinges held a dominant market position, capturing more than a 37.6% share in the global door hinges market.

- Stainless Steel Hinges held a dominant market position, capturing more than a 47.3% share in the global door hinges market.

- Ball Bearing Door Hinges held a dominant market position, capturing more than a 41.1% share in the global door hinges market.

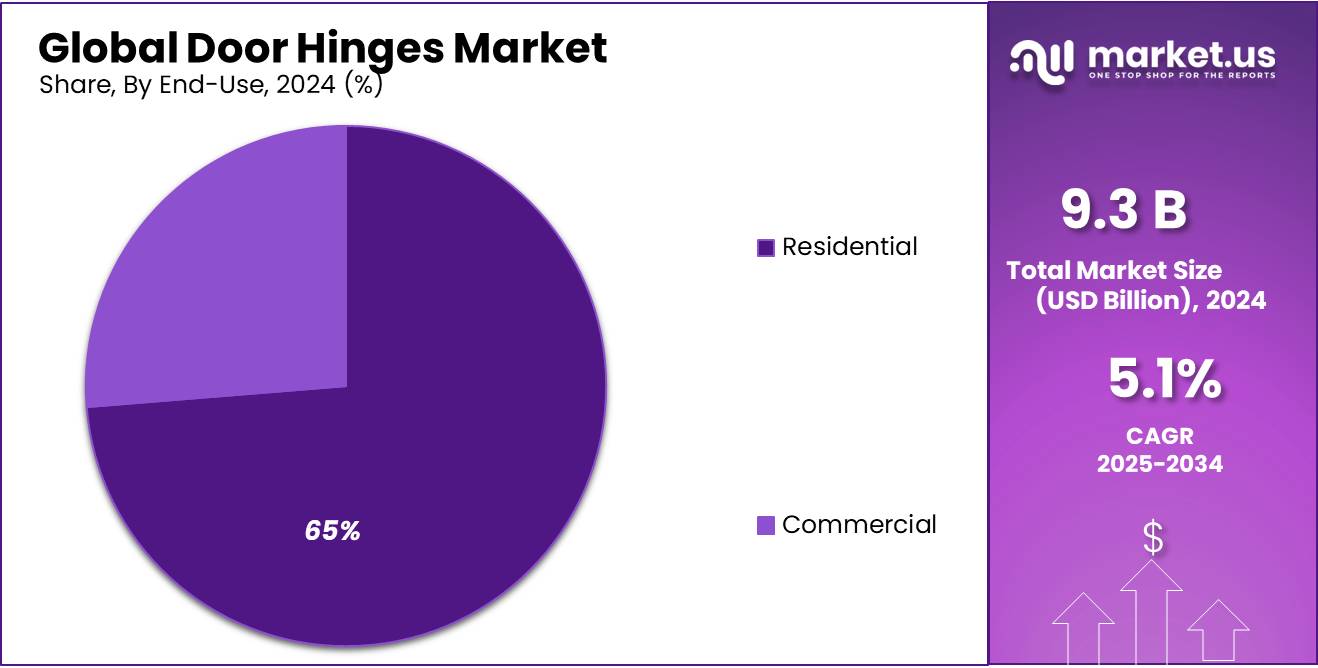

- Residential held a dominant market position, capturing more than a 64.5% share in the global door hinges market.

- North America emerged as the leading region in the global door hinges market, commanding a substantial 46% share, equivalent to approximately USD 4.2 billion.

By Product

Butt Hinges dominate with 37.6% share driven by durability and widespread application.

In 2024, Butt Hinges held a dominant market position, capturing more than a 37.6% share in the global door hinges market. The robust demand for butt hinges is largely attributed to their durability, cost-effectiveness, and extensive use in residential, commercial, and industrial applications. Butt hinges are preferred for heavy-duty doors due to their ability to bear substantial weight while maintaining stability and alignment.

Additionally, the growing focus on infrastructure development in emerging economies, particularly in the Asia-Pacific region, has significantly contributed to the demand for butt hinges in the construction sector. In North America, the increasing renovation and replacement of older doors with modern, heavy-duty doors have also bolstered the sales of butt hinges. With advancements in corrosion-resistant materials and improved design aesthetics, the adoption of stainless steel and brass butt hinges has surged, further strengthening the market share of this segment. As the construction and real estate sectors continue to expand globally, the butt hinges market is anticipated to maintain its leadership position in 2025, with incremental growth driven by rising investments in infrastructure projects.

By Material

Stainless Steel Hinges lead with 47.3% share due to superior corrosion resistance.

In 2024, Stainless Steel Hinges held a dominant market position, capturing more than a 47.3% share in the global door hinges market. The growing preference for stainless steel hinges is driven by their exceptional resistance to corrosion, making them ideal for outdoor and high-moisture applications. Residential and commercial construction projects increasingly adopt stainless steel hinges due to their durability and sleek aesthetic appeal.

Additionally, in regions such as North America and Europe, stringent building codes emphasizing rust-resistant materials have further propelled the demand for stainless steel hinges. The rising trend of modular kitchens and modernized bathroom fittings also contributes to the extensive use of stainless steel hinges, particularly in cabinetry and storage units. In 2025, the segment is expected to witness sustained growth as infrastructure projects and renovation activities continue to rise globally, reinforcing the stronghold of stainless steel in the door hinges market.

By Application

Ball Bearing Door Hinges lead with 41.1% share driven by smooth operation and durability.

In 2024, Ball Bearing Door Hinges held a dominant market position, capturing more than a 41.1% share in the global door hinges market. The demand for ball bearing hinges is primarily fueled by their ability to provide smooth and noise-free operation, making them a preferred choice in commercial and industrial applications. These hinges are specifically designed to handle heavy doors, reducing friction and preventing wear over prolonged use.

In North America, the adoption of ball bearing door hinges has surged in office complexes and public buildings, where robust and long-lasting door systems are a necessity. Furthermore, in the Asia-Pacific region, increased investment in high-rise residential projects and commercial infrastructure has significantly driven the use of ball bearing door hinges. As more construction projects incorporate modern architectural designs and heavier door structures, the segment is expected to maintain its leading position through 2025, driven by the growing emphasis on operational efficiency and door hardware durability.

By End Use

Residential Hinges lead with 64.5% share driven by housing expansions and renovations.

In 2024, Residential held a dominant market position, capturing more than a 64.5% share in the global door hinges market. The substantial demand in the residential sector is driven by ongoing housing expansions, renovation projects, and the increasing emphasis on home aesthetics. In North America, the surge in new housing developments and urban apartment projects has significantly propelled the sales of residential door hinges.

Additionally, the adoption of modern, stylish hinges with enhanced corrosion resistance and smoother operation has further fueled market growth. In Asia-Pacific, the rapid urbanization and rising middle-class income levels have led to increased spending on residential construction, boosting the demand for durable and visually appealing door hinges. As the trend towards modernizing living spaces continues, the residential segment is poised to maintain its dominant position in 2025, driven by both new constructions and home improvement activities.

Key Market Segments

By Product

- Barrel Hinge

- Butt Hinges

- Pivot Hinge

- HL Hinges

- Concealed Hinges

- Flag Hinges

- Others

By Material

- Cold-Rolled Steel

- Stainless Steel

- Solid Brass

By Application

- Ball Bearing Door

- Spring Door

- Specialty Door

- Others

By End Use

- Residential

- Commercial

Drivers

Rising Vehicle Production and Electrification Fueling Door Hinges Market Growth

One of the primary drivers propelling the door hinges market is the steady increase in vehicle production worldwide. As emerging economies witness rapid urbanization and rising disposable incomes, there is a growing demand for automobiles, thereby fueling the need for door hinges.

In 2021, global car production reached approximately 80.1 million units, marking a 3.8% increase compared to the previous year. This surge in vehicle manufacturing directly impacts the demand for automotive components, including door hinges.

Furthermore, the shift towards electric vehicles (EVs) is reshaping the automotive landscape. EVs often require specialized components to accommodate their unique designs and weight considerations. For instance, in China, EV sales are anticipated to reach 3.7 million units by 2021, highlighting the rapid adoption of electric mobility.

Government initiatives play a crucial role in this transition. Policies promoting EV adoption, such as subsidies and tax incentives, are encouraging manufacturers to innovate and produce components tailored for electric vehicles. These initiatives not only support environmental goals but also stimulate the demand for advanced door hinge systems compatible with EV architectures.

Restraints

Fluctuating Raw Material Prices Pose Challenges for Door Hinges Market

The door hinges market is currently grappling with the challenge of fluctuating raw material prices, which significantly impact production costs and profit margins. Materials such as steel, brass, and aluminum, essential for manufacturing door hinges, have experienced price volatility due to global supply and demand dynamics, trade policies, and economic conditions. This unpredictability in material costs can lead to increased expenses for manufacturers, potentially resulting in higher prices for consumers and reduced competitiveness in the market.

For instance, the cost of steel, a primary material for door hinges, has seen considerable fluctuations in recent years. Such volatility not only affects the pricing strategies of manufacturers but also complicates budgeting and forecasting processes. Additionally, the presence of counterfeit and low-quality products in the market exacerbates the situation, undermining consumer trust and affecting the reputation of established brands.

To mitigate these challenges, manufacturers are exploring alternative materials and cost-effective production techniques. However, these alternatives may not always match the quality and durability of traditional materials, potentially leading to customer dissatisfaction. Moreover, the need for effective supply chain management and quality control becomes paramount to ensure product reliability and maintain brand reputation.

Opportunity

Government-Backed Infrastructure Projects Driving Door Hinges Market Growth

One significant growth opportunity for the door hinges market lies in the surge of government-supported infrastructure and housing projects, particularly in rapidly urbanizing regions. These initiatives are fueling demand for construction materials, including door hardware like hinges.

In India, the Pradhan Mantri Awas Yojana (PMAY) aims to provide affordable housing to all urban poor by 2022, with a target of constructing over 20 million houses. Such large-scale housing schemes necessitate substantial quantities of building components, including door hinges, to meet construction needs.

Similarly, in the United States, the Infrastructure Investment and Jobs Act allocates $550 billion for new federal investments in infrastructure over five years. This includes funding for the construction and renovation of buildings, which in turn increases the demand for construction materials like door hinges.

These government initiatives not only address housing shortages but also stimulate economic growth by creating jobs and boosting the construction industry. As a result, the door hinges market stands to benefit significantly from these developments, presenting ample growth opportunities for manufacturers and suppliers in the sector.

Trends

Smart Hinges and Automation: Transforming the Door Hinges Market

In 2024, a significant trend reshaping the door hinges market is the integration of smart technologies and automation. Manufacturers are increasingly developing hinges equipped with sensors and automated features to enhance functionality and user convenience. These smart hinges are designed to offer benefits such as remote access, self-closing mechanisms, and integration with home automation systems.

Government initiatives promoting smart home technologies and energy efficiency are also contributing to this trend. For instance, various programs encourage the adoption of smart building solutions, which include automated door systems. These initiatives aim to enhance building performance, reduce energy consumption, and improve occupant comfort.

Furthermore, the rise in urbanization and the increasing demand for modern infrastructure are propelling the adoption of smart hinges in both residential and commercial sectors. Consumers are seeking advanced solutions that offer convenience, security, and energy efficiency, leading to a surge in demand for automated door hardware.

In summary, the integration of smart technologies and automation in door hinges represents a significant trend in 2024, driven by technological advancements, government initiatives, and evolving consumer preferences. As the demand for intelligent building solutions continues to grow, the door hinges market is poised for substantial transformation and growth.

Regional Analysis

In 2024, North America emerged as the leading region in the global door hinges market, commanding a substantial 46% share, equivalent to approximately USD 4.2 billion. This dominance is primarily attributed to the robust construction and renovation activities across the United States and Canada.

Technological advancements and the integration of smart home systems have also played a pivotal role in shaping the market dynamics. The adoption of concealed hinges, soft-close mechanisms, and rust-resistant materials aligns with the region’s preference for innovative and efficient building solutions. Moreover, the rise of e-commerce platforms has facilitated easier access to a wide range of door hinge products, further driving market growth.

Government initiatives supporting infrastructure development and housing projects have provided additional impetus to the market. For instance, various programs aimed at promoting affordable housing and sustainable construction practices have increased the demand for reliable door hardware. These factors collectively position North America as a dominant force in the global door hinges market, with sustained growth anticipated in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ASSA ABLOY stands as a global leader in access solutions, offering a comprehensive range of door hardware, including high-quality hinges. The company has demonstrated robust growth, with sales increasing by 7% in 2024, driven by strategic acquisitions and product innovations.

ASSA ABLOY’s acquisition of smart lock startup Level Lock underscores its commitment to integrating advanced technologies into traditional hardware products. This strategic move aligns with the company’s vision to enhance security and convenience in both residential and commercial settings.

Dormakaba Group is renowned for its innovative door hardware solutions, including a diverse portfolio of hinges designed for various applications. In the first half of the 2024/25 fiscal year, Dormakaba reported a 5.6% organic sales growth in North America, attributed to strong demand in the hospitality sector and workforce management solutions. The company’s focus on quality and functionality has solidified its position as a trusted provider of door hardware globally.

Top Key Players in the Market

- ASSA ABLOY

- Dormakaba Group

- Emtek Products, Inc.

- Guangdong Archie Hardware Co., Ltd.

- Häfele

- Hager Group,

- Hettich Holding GmbH & Co. oHG

- ITW Proline

- Jako Hardware Aventura Inc.

- Richelieu Hardware (Onward Hardware)

- Stanley Black & Decker, Inc.

- Taymor Industries Ltd.

- The Baldwin Company

- Wixroyd International Ltd

- Zoo Hardware Ltd.

Recent Developments

In 2024, ASSA ABLOY solidified its leadership in the global door hinges market, achieving total sales of SEK 150 billion (approximately USD 13.8 billion), marking a 7% increase from the previous year.

In 2024, Häfele, a German-based global leader in architectural and furniture fittings, continued to strengthen its position in the door hinges market through innovation and quality. The company reported a 4.9% increase in revenue, reflecting its commitment to delivering high-quality hardware solutions.

Report Scope

Report Features Description Market Value (2024) USD 9.3 Bn Forecast Revenue (2034) USD 15.3 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Barrel Hinge, Butt Hinges, Pivot Hinge, HL Hinges, Concealed Hinges, Flag Hinges, Others), By Material (Cold-Rolled Steel, Stainless Steel, Solid Brass), By Application (Ball Bearing Door, Spring Door, Specialty Door, Others), By End Use (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ASSA ABLOY, Dormakaba Group, Emtek Products, Inc., Guangdong Archie Hardware Co., Ltd., Häfele, Hager Group,, Hettich Holding GmbH & Co. oHG, ITW Proline, Jako Hardware Aventura Inc., Richelieu Hardware (Onward Hardware), Stanley Black & Decker, Inc., Taymor Industries Ltd., The Baldwin Company, Wixroyd International Ltd, Zoo Hardware Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ASSA ABLOY

- Dormakaba Group

- Emtek Products, Inc.

- Guangdong Archie Hardware Co., Ltd.

- Häfele

- Hager Group,

- Hettich Holding GmbH & Co. oHG

- ITW Proline

- Jako Hardware Aventura Inc.

- Richelieu Hardware (Onward Hardware)

- Stanley Black & Decker, Inc.

- Taymor Industries Ltd.

- The Baldwin Company

- Wixroyd International Ltd

- Zoo Hardware Ltd.