Global Dog Dental Chews Market Size, Share, And Business Benefits By Product Type (Rawhide Chews, Dental Bones, Dental Sticks, Others), By Age (Puppy, Adult, Senior), By Flavor (Chicken, Beef, Peanut Butter, Others), By Application (Oral Care, Entertainment, Nutritional Supplementation, Others), By Sales Channel (Supermarkets / Hypermarkets, Convenience Stores, Drugstores, Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159186

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

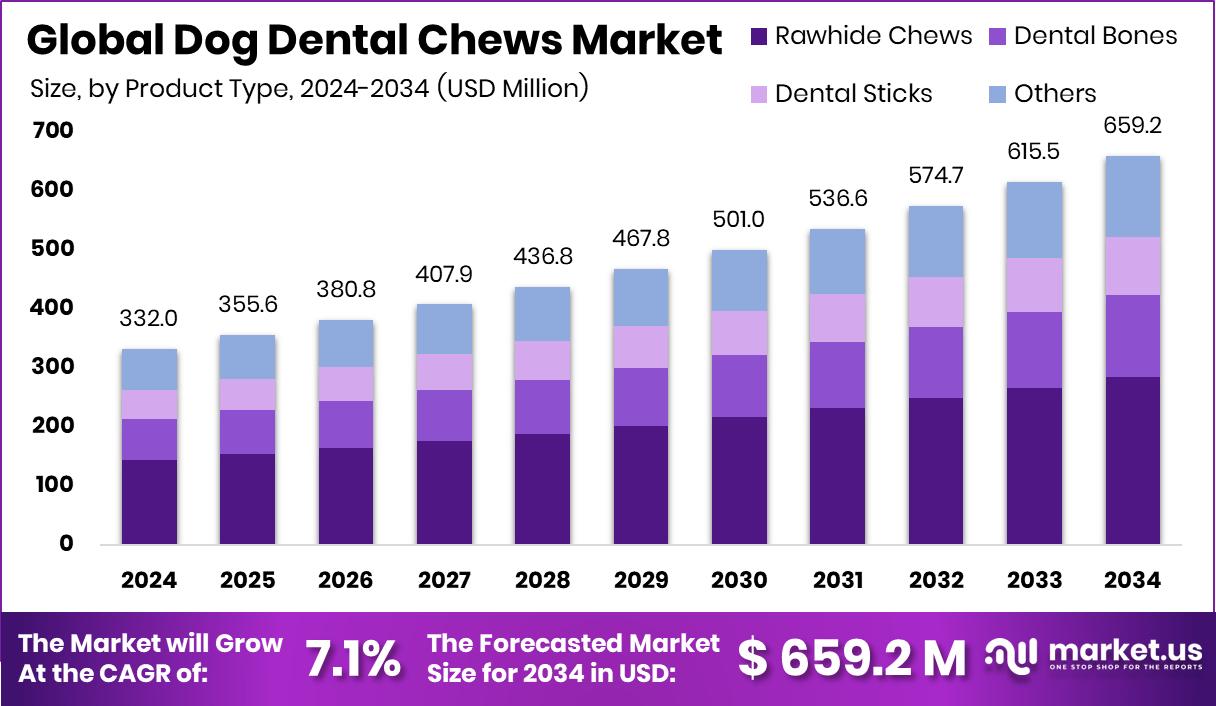

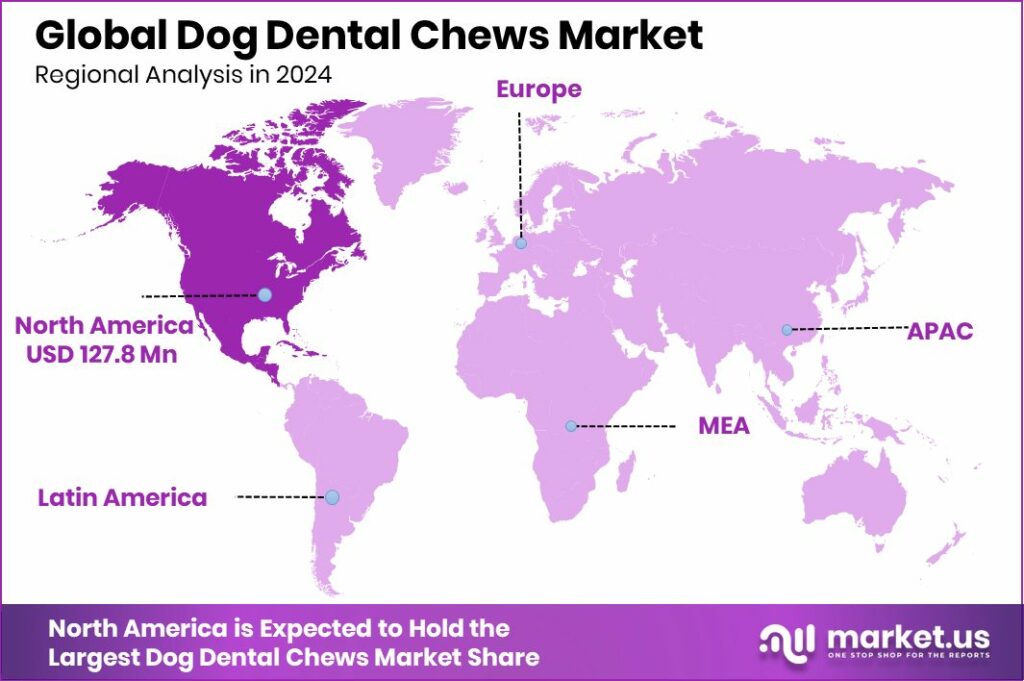

The Global Dog Dental Chews Market is expected to be worth around USD 659.2 million by 2034, up from USD 332.0 million in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034. The North America Dog Dental Chews Market reached USD 127.8 Mn, capturing a 38.50% regional share.

Dog dental chews are specially formulated treats designed to promote oral hygiene in dogs. These chews help reduce plaque and tartar buildup, freshen breath, and support overall dental health. They come in various forms, including bones, sticks, and treats, often made with ingredients that are safe and beneficial for canine teeth and gums.

The growth of the dog dental chews market is primarily driven by the increasing pet ownership worldwide. As more households adopt dogs, the demand for pet care products, including dental chews, rises. Additionally, pet owners are becoming more aware of the importance of maintaining their pets’ oral hygiene, leading to a greater emphasis on products that support dental health.

The demand for dog dental chews is also influenced by the growing trend of pet humanization, where pets are considered family members. This shift has led to a higher willingness among pet owners to invest in premium products that ensure their pets’ well-being. Moreover, the availability of a wide range of dental chews catering to different dog sizes, ages, and dietary needs has further fueled this demand.

Opportunities in the dog dental chews market lie in product innovation and expanding distribution channels. Developing chews with natural ingredients, targeting specific dental issues, and offering personalized options can attract health-conscious pet owners. Furthermore, leveraging e-commerce platforms and subscription services can enhance accessibility and convenience for consumers, tapping into the growing online shopping trend.

The dental sector has seen significant investments, indicating a strong belief in the industry’s potential. For instance, Dantech Digital Dental Solutions secured ₹21 crore in funding to expand operations, highlighting investor confidence in dental innovations. Similarly, dental startup Toothsi raised $40 million, led by Eight Roads Ventures and others, to enhance its services. Additionally, dental-care AI startup Pearl raised $58 million, showcasing the growing interest in technology-driven dental solutions. These investments underscore the promising future of dental-related products and services.

Key Takeaways

- The Global Dog Dental Chews Market is expected to be worth around USD 659.2 million by 2034, up from USD 332.0 million in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034.

- Rawhide chews dominate the Dog Dental Chews Market, capturing 43.2% of total product sales.

- Adult dogs represent 67.5% of the Dog Dental Chews Market by age category globally.

- Chicken-flavored chews lead the Dog Dental Chews Market, accounting for 42.8% consumer preference.

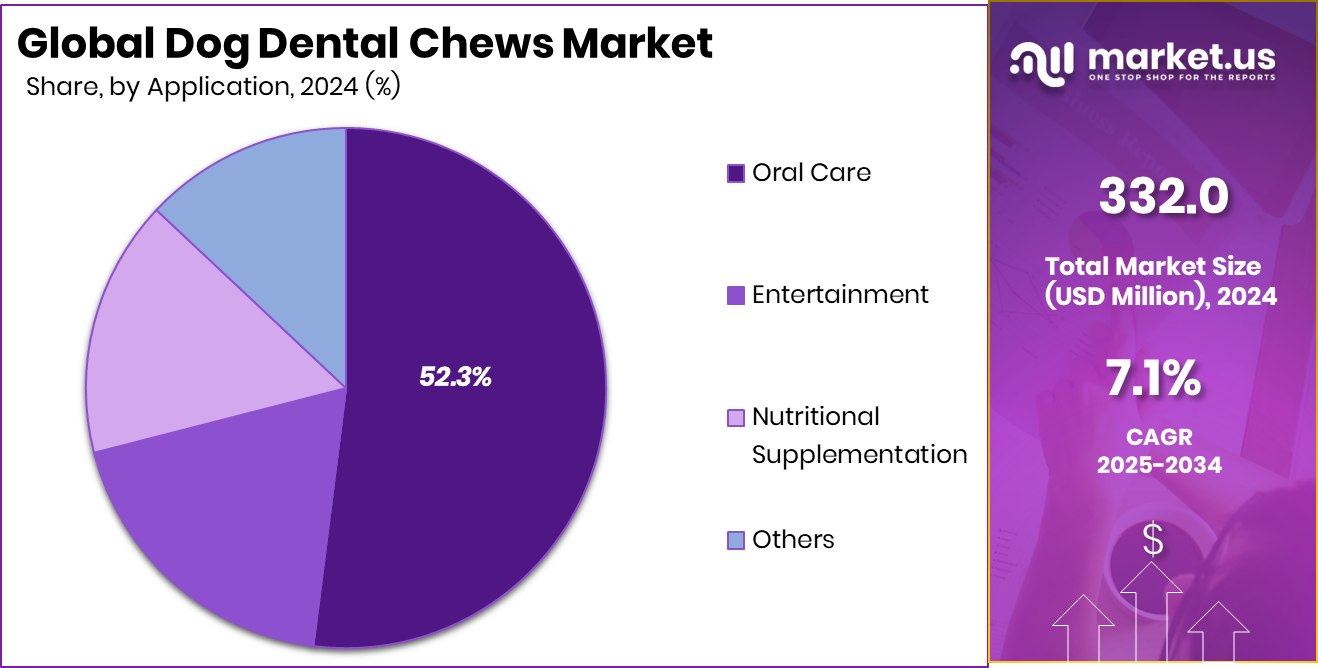

- Oral care applications hold 52.3% of the Dog Dental Chews Market, highlighting a hygiene focus.

- Supermarkets and hypermarkets drive 35.6% of Dog Dental Chews Market sales through physical channels.

- In North America, rising pet ownership and health awareness drove the Dog Dental Chews market value to USD 127.8 Mn.

By Product Type Analysis

Rawhide chews dominate the Dog Dental Chews Market with 43.2% share.

In 2024, Rawhide Chews held a dominant market position in the By Product Type segment of the Dog Dental Chews Market, with a 43.2% share. Rawhide Chews have gained popularity among pet owners due to their effectiveness in reducing plaque and tartar buildup while providing a satisfying chewing experience for dogs. The product’s durability and texture make it ideal for maintaining oral health, which has contributed to its strong adoption across various dog breeds and sizes.

Growing awareness of canine dental care and the increasing trend of pet humanization have further reinforced the preference for Rawhide Chews. As a result, this product type continues to lead the segment, reflecting both consumer trust and consistent demand.

By Age Analysis

Adult dogs lead the Dog Dental Chews Market at 67.5% usage.

In 2024, Adult held a dominant market position in the By Age segment of the Dog Dental Chews Market, with a 67.5% share. This strong position is attributed to the higher prevalence of dental issues among adult dogs, making dental chews an essential part of their daily care routine.

Adult dogs require products that effectively manage tartar and plaque buildup, and dental chews are preferred for their ease of use and preventive benefits. Increasing awareness among pet owners about oral health maintenance and the role of dental chews in preventing serious dental problems has driven adoption in this age group. Consequently, adult dogs represent the largest consumer base, reinforcing the segment’s leading market share.

By Flavor Analysis

Chicken flavor drives the Dog Dental Chews Market with 42.8% preference.

In 2024, Chicken held a dominant market position in the By Flavor segment of the Dog Dental Chews Market, with a 42.8% share. The popularity of chicken-flavored chews is driven by its widespread acceptance among dogs, as the flavor appeals to a majority of pets, encouraging regular consumption.

Pet owners prefer chicken-flavored chews because they combine taste with dental health benefits, making it easier to maintain their dogs’ oral hygiene. The high adoption of this flavor also reflects the growing trend of providing palatable and functional treats that support both health and enjoyment. As a result, chicken-flavored dental chews continue to lead the market segment, highlighting strong consumer preference and consistent demand.

By Application Analysis

Oral care applications represent 52.3% of the Dog Dental Chews Market.

In 2024, Oral Care held a dominant market position in the By Application segment of the Dog Dental Chews Market, with a 52.3% share. This leadership is attributed to the growing awareness among pet owners about the importance of maintaining their dogs’ dental health.

Oral care-focused chews are specifically designed to reduce plaque and tartar buildup, freshen breath, and prevent periodontal diseases, making them highly sought after. The increasing preference for preventive healthcare products for pets has further driven the adoption of oral care chews. Their effectiveness in supporting long-term dental hygiene, combined with ease of use, has solidified oral care as the leading application segment in the dog dental chews market.

By Sales Channel Analysis

Supermarkets capture 35.6% of the Dog Dental Chews Market sales.

In 2024, Supermarkets / Hypermarkets held a dominant market position in the By Sales Channel segment of the Dog Dental Chews Market, with a 35.6% share. Their leading position is driven by the convenience and wide availability of pet care products under one roof, attracting a large number of pet owners. Supermarkets and hypermarkets offer easy access to a variety of dental chews, often accompanied by promotional deals and competitive pricing, which encourages bulk purchases and repeat sales.

Additionally, the ability to physically examine products before purchase enhances consumer confidence. The extensive reach and established presence of these retail formats continue to make them the preferred choice for purchasing dog dental chews, reinforcing their market dominance.

Key Market Segments

By Product Type

- Rawhide Chews

- Dental Bones

- Dental Sticks

- Others

By Age

- Puppy

- Adult

- Senior

By Flavor

- Chicken

- Beef

- Peanut Butter

- Others

By Application

- Oral Care

- Entertainment

- Nutritional Supplementation

- Others

By Sales Channel

- Supermarkets / Hypermarkets

- Convenience Stores

- Drugstores

- Online Retailers

- Others

Driving Factors

Rising Awareness of Pet Oral Health Importance

One of the main driving factors for the Dog Dental Chews Market is the rising awareness among pet owners about the importance of oral health for dogs. Pet owners are increasingly realizing that maintaining dental hygiene prevents bad breath, plaque buildup, and serious gum diseases. This awareness has encouraged them to adopt dental chews as a daily or regular part of their dog’s care routine.

Additionally, the trend of treating pets like family members has pushed owners to invest more in preventive health products. The sector has also attracted funding and innovation, such as London’s FoodTech startup Better Nature receiving €1.2 million to expand in the UK’s €3.7 billion chicken market, and Rebellyous Foods securing $2.4 million to introduce plant-based chicken patties, reflecting growing interest in pet-friendly and innovative consumables. This combination of awareness and investment continues to fuel market growth.

Restraining Factors

High Cost of Premium Dog Dental Chews

A significant restraining factor for the Dog Dental Chews Market is the high cost of premium dental chews. Many products that offer superior ingredients, specialized formulations, or enhanced health benefits come at a price that can be challenging for some pet owners to afford. This cost factor limits adoption, especially in regions where pet care spending is more conservative.

Additionally, frequent use of dental chews may increase ongoing expenses, making some owners hesitant to purchase them regularly. While awareness of oral health is growing, price sensitivity remains a barrier. As a result, the market faces challenges in reaching all consumer segments, particularly middle-income pet owners, despite the proven benefits of dental chews for maintaining dog health.

Growth Opportunity

Expansion in Functional and Flavored Dog Chews

A major growth opportunity in the Dog Dental Chews Market lies in expanding functional and flavored chew options. Pet owners are increasingly looking for products that not only maintain dental health but also offer added benefits such as fresh breath, joint support, or digestive aid. Flavored chews, particularly chicken-based varieties, are highly appealing to dogs, encouraging regular use and improving oral hygiene outcomes.

The market is also seeing significant investments that highlight potential growth, such as the $5 million funding for a $3 billion chicken farm guru in Arkansas and $2 million raised by the Chicken QSR Chain BIGGUYS from NRIs. These investments indicate strong confidence in expanding innovative and appealing chew products, making this segment a promising area for market growth.

Latest Trends

Shift Towards Natural and Plant-Based Ingredients

A key latest trend in the Dog Dental Chews Market is the shift toward natural and plant-based ingredients. Pet owners are becoming more conscious about the quality and safety of the products they give their dogs, preferring chews made from organic, non-GMO, and preservative-free ingredients.

Plant-based chews, including flavors like chicken alternatives made from pea protein or other natural sources, are gaining popularity for being both healthy and environmentally friendly. This trend reflects a broader movement in pet care, where wellness and sustainability are prioritized. As dogs increasingly benefit from these safer and nutritious options, manufacturers are innovating to create chews that combine effective dental care with natural ingredients, driving adoption and shaping the future of the market.

Regional Analysis

North America dominated the Dog Dental Chews Market with a 38.50% share, valued at USD 127.8 Mn.

North America leads the global Dog Dental Chews Market, capturing a 38.50% share valued at USD 127.8 million. This dominance is driven by high pet ownership rates and a strong emphasis on pet health, particularly dental hygiene. Consumers in this region are increasingly seeking preventive care solutions, contributing to the market’s growth.

Europe’s Dog Dental Chews Market is expanding, supported by rising awareness of pet oral health. Pet owners are increasingly investing in dental care products to prevent periodontal diseases, leading to a steady market growth. The trend towards premium and natural ingredients is also gaining traction among European consumers.

The Asia Pacific region is experiencing rapid growth in the Dog Dental Chews Market, driven by urbanization and increasing disposable incomes. As pet humanization trends rise, more pet owners are prioritizing their dogs’ dental health, leading to a surge in demand for dental chews.

In the Middle East and Africa, the Dog Dental Chews Market is emerging, with growing interest in pet care products. Urbanization and changing lifestyles are influencing pet ownership patterns, leading to an increased focus on pet health and wellness, including dental care.

Latin America’s Dog Dental Chews Market is on an upward trajectory, fueled by rising pet ownership and awareness of pet health. As consumers become more informed about the importance of dental hygiene for pets, the demand for dental chews is steadily increasing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Mars Petcare, Nestlé Purina PetCare, and Colgate-Palmolive Company are pivotal players in the global Dog Dental Chews Market, each leveraging their extensive brand portfolios and commitment to pet health.

Mars Petcare continues to lead with its GREENIES™ brand, offering a range of dental chews designed to reduce plaque and tartar buildup. The brand’s commitment to quality and innovation has solidified its position in the market.

Nestlé Purina PetCare enhances its presence through the DentaLife™ line, which features a unique porous texture to clean hard-to-reach teeth and reduce tartar buildup. Their focus on scientifically-backed products caters to health-conscious pet owners.

Colgate-Palmolive Company expands its footprint in pet health with the Hill’s® Prescription Diet™ line, offering therapeutic foods that support dental health. Their investment in pet nutrition underscores a strategic move to diversify beyond traditional oral care products.

Top Key Players in the Market

- Mars, Inc.

- Nestlé Purina PetCare

- Colgate-Palmolive Company

- Merrick Pet Care, Inc.

- The J.M. Smucker Company

- Blue Buffalo Co., Ltd.

- WellPet LLC

- Spectrum Brands Holdings, Inc.

- Nutri-Vet Wellness LLC

- Arm & Hammer

Recent Developments

- In May 2025, Mars introduced the GREENIES™ Canine Dental Check, an AI-powered tool designed to help pet owners monitor their dog’s dental health using smartphone photos. This initiative is part of Mars’ $1 billion investment in digital innovation within its Pet Nutrition segment.

- In February 2024, Nestlé Purina PetCare acquired Red Collar Pet Foods, a move that increased its manufacturing capacity for dog and cat treats. This acquisition is expected to enhance Purina’s ability to develop and produce innovative pet care products, including dental chews, by leveraging the additional production capabilities.

Report Scope

Report Features Description Market Value (2024) USD 332.0 Million Forecast Revenue (2034) USD 659.2 Million CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Rawhide Chews, Dental Bones, Dental Sticks, Others), By Age (Puppy, Adult, Senior), By Flavor (Chicken, Beef, Peanut Butter, Others), By Application (Oral Care, Entertainment, Nutritional Supplementation, Others), By Sales Channel (Supermarkets / Hypermarkets, Convenience Stores, Drugstores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mars, Inc., Nestlé Purina PetCare, Colgate-Palmolive Company, Merrick Pet Care, Inc., The J.M. Smucker Company, Blue Buffalo Co., Ltd., WellPet LLC, Spectrum Brands Holdings, Inc., Nutri-Vet Wellness LLC, Arm & Hammer Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dog Dental Chews MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Dog Dental Chews MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mars, Inc.

- Nestlé Purina PetCare

- Colgate-Palmolive Company

- Merrick Pet Care, Inc.

- The J.M. Smucker Company

- Blue Buffalo Co., Ltd.

- WellPet LLC

- Spectrum Brands Holdings, Inc.

- Nutri-Vet Wellness LLC

- Arm & Hammer