Global DNA Polymerase Market By Product Type (Taq Polymerase, Proprietary Enzyme Blends, Pfu Polymerase and Others), By Application (Polymerase Chain Reaction, DNA Cloning, DNA Sequencing and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Hospitals & Diagnostic Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174215

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

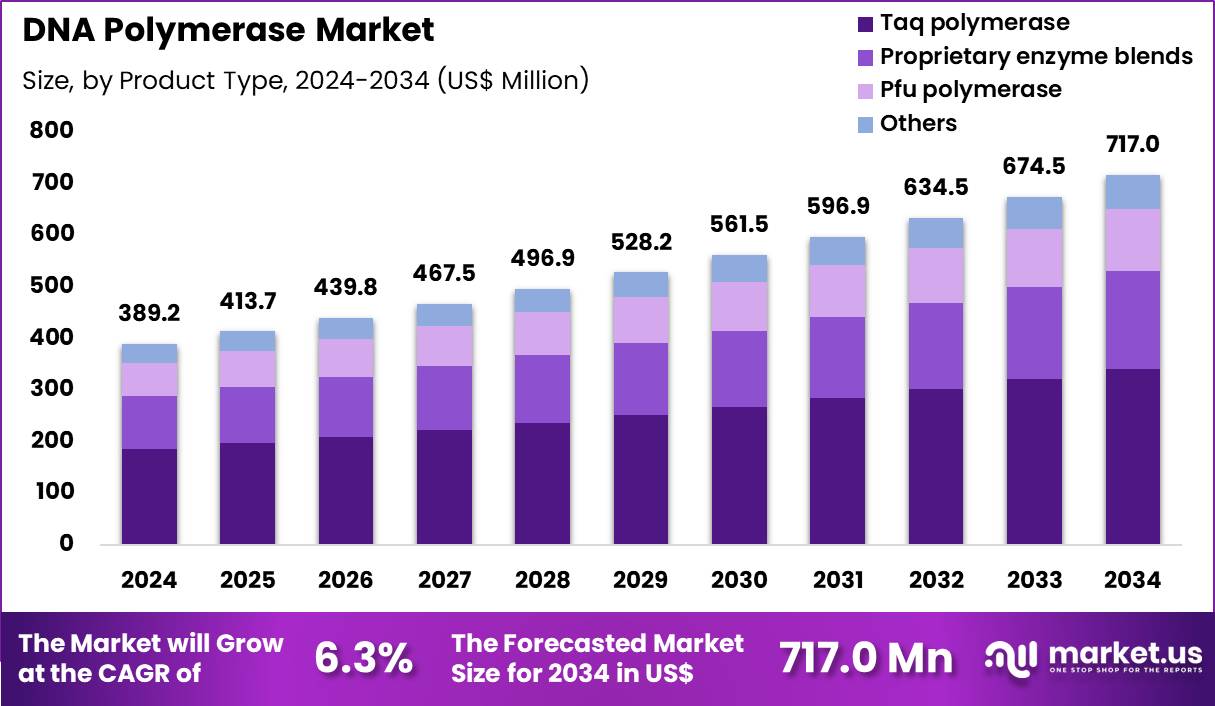

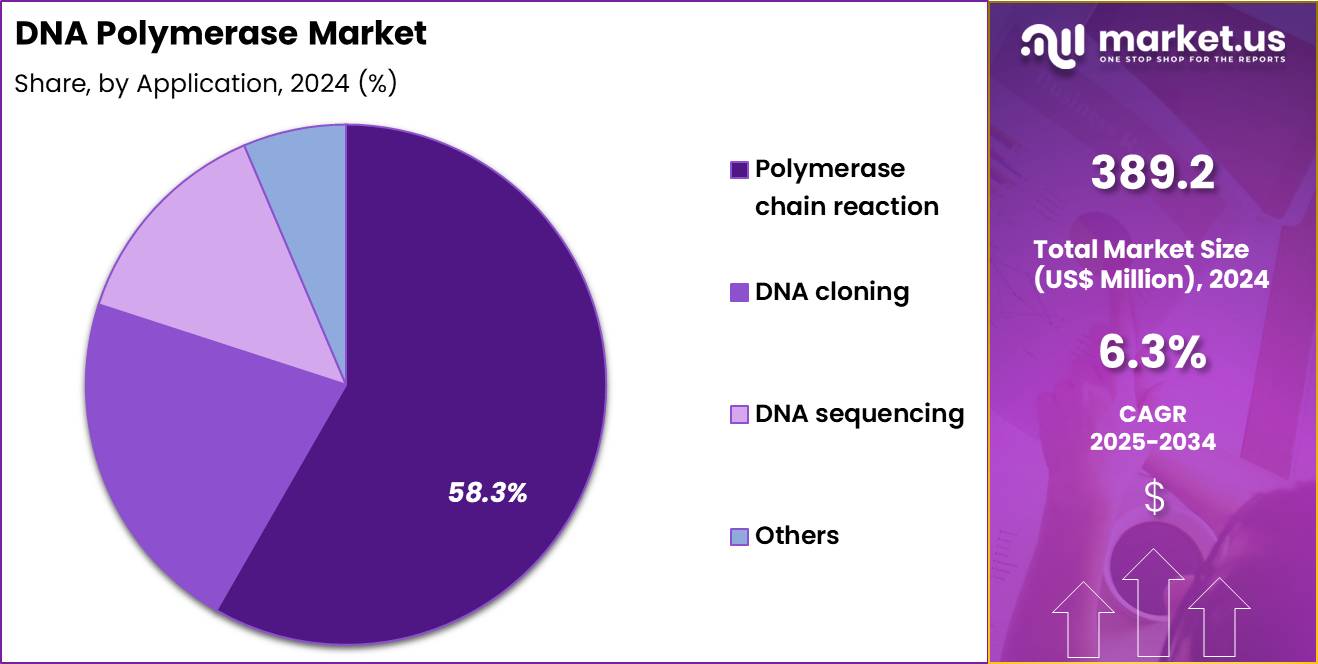

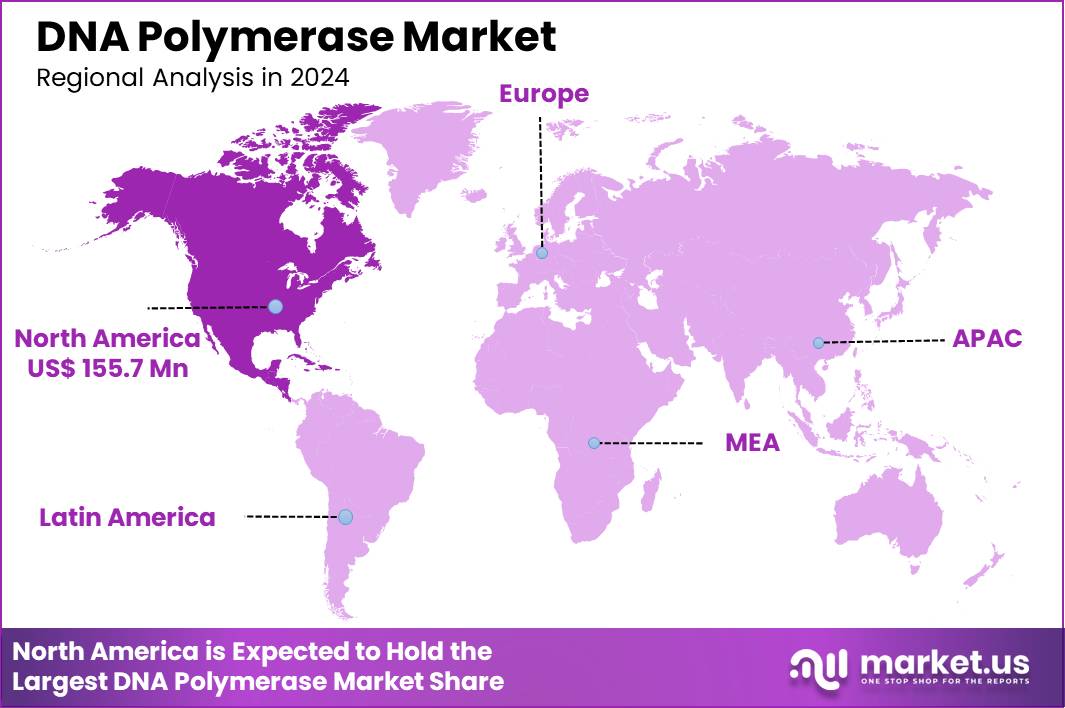

The Global DNA Polymerase Market size is expected to be worth around US$ 717.0 Million by 2034 from US$ 389.2 Million in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.0% share with a revenue of US$ 155.7 Million.

Increasing reliance on precise nucleic acid amplification techniques propels the DNA polymerase market as researchers and clinicians demand enzymes that deliver high fidelity and efficiency across diverse molecular biology workflows. Laboratories extensively utilize thermostable DNA polymerases like Taq in polymerase chain reaction for diagnostic pathogen detection, enabling rapid identification of infectious agents from clinical specimens.

These enzymes support next-generation sequencing library preparation by amplifying fragmented DNA with minimal error rates, facilitating comprehensive genomic profiling in oncology and genetic disorder studies. Biotechnologists employ high-fidelity variants for site-directed mutagenesis and gene synthesis, ensuring accurate incorporation during synthetic biology construct assembly. Forensic scientists apply robust polymerases in short tandem repeat analysis, amplifying degraded DNA samples to generate reliable profiles for identification purposes.

In June 2025, SeqOne partnered with Agilent to enhance multiomic liquid biopsy analytics for the Avida Cancer panel suite. This partnership drives the DNA polymerase market by advancing liquid biopsy workflows that depend on robust DNA amplification from ultra-low input samples.

Optimizing multiomic assays increases usage of high-performance polymerases capable of amplifying fragmented circulating tumor DNA with minimal bias. Expansion of liquid biopsy adoption in oncology directly supports sustained growth in demand for premium DNA polymerase enzymes across clinical and research laboratories.

Manufacturers seize opportunities to engineer hot-start and proofreading polymerases that minimize non-specific amplification, expanding applications in quantitative PCR for gene expression analysis and viral load monitoring. Developers create specialized enzymes tolerant to inhibitors, broadening utility in direct PCR from crude samples like blood or soil in environmental and agricultural testing.

These innovations facilitate long-range PCR for amplifying large genomic fragments in structural variant detection and haplotype phasing. Opportunities arise in multiplex PCR setups that simultaneously detect multiple targets, streamlining companion diagnostic development for personalized therapeutics.

Companies advance reverse transcriptase-polymerase hybrids for RNA amplification, supporting transcriptomics and viral RNA quantification in infectious disease research. Firms invest in lyophilized enzyme formats that enhance stability, enabling field-deployable assays for point-of-care molecular diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 389.2 Million, with a CAGR of 6.3%, and is expected to reach US$ 717.0 Million by the year 2034.

- The product type segment is divided into taq polymerase, proprietary enzyme blends, pfu polymerase and others, with taq polymerase taking the lead in 2024 with a market share of 47.6%.

- Considering application, the market is divided into polymerase chain reaction, DNA cloning, DNA sequencing and others. Among these, polymerase chain reaction held a significant share of 58.3%.

- Furthermore, concerning the end-user segment, the market is segregated into pharmaceutical & biotechnology companies, academic & research institutes, hospitals & diagnostic centers and others. The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 54.9% in the market.

- North America led the market by securing a market share of 40.0% in 2024.

Product Type Analysis

Taq polymerase accounted for 47.6% of growth within the product type category and represents the backbone of the DNA Polymerase market. Laboratories rely on Taq polymerase for routine amplification due to its robustness and cost efficiency. High tolerance to thermal cycling supports consistent PCR performance. Diagnostic laboratories favor Taq polymerase for standardized workflows. Clinical testing volumes increase demand for reliable amplification enzymes. Infectious disease testing strengthens routine usage.

Academic laboratories prefer Taq polymerase for teaching and basic research applications. Bulk availability supports high-throughput operations. Simplified reaction optimization reduces experimental variability. Compatibility with multiple PCR platforms increases adoption. Manufacturers continuously improve formulation stability. Shelf-life advantages support global distribution. Routine genotyping workflows depend heavily on Taq polymerase.

Regulatory familiarity supports continued diagnostic use. Automation in molecular labs reinforces enzyme demand. Price competitiveness supports large-scale procurement. Taq polymerase remains central to conventional PCR assays. Emerging markets rely on cost-effective enzyme solutions. Consistent yield supports reproducibility requirements. The segment is projected to maintain dominance due to widespread routine usage and affordability.

Application Analysis

Polymerase chain reaction represented 58.3% of growth within the application category and stands as the primary driver of the DNA Polymerase market. PCR remains essential across diagnostics, research, and quality control. Expansion of molecular diagnostics increases testing frequency. Clinical laboratories rely on PCR for pathogen detection and genetic screening. Research institutions use PCR for gene amplification and validation. PCR-based workflows integrate seamlessly with automation platforms.

High sensitivity and specificity support broad application. COVID-era infrastructure expansion continues to support PCR capacity. Oncology and genetic disease testing strengthen demand. Regulatory approvals increasingly reference PCR-based assays. Multiplex PCR adoption increases enzyme consumption. Pharmaceutical R&D depends on PCR for early discovery stages.

Environmental and food testing expand PCR usage beyond healthcare. Training programs emphasize PCR as a core molecular technique. Point-of-care molecular platforms reinforce PCR relevance. Reagent standardization supports repeat purchasing. Global surveillance programs rely on PCR workflows. PCR turnaround time advantages support clinical preference. Continuous assay development sustains long-term demand. The segment is anticipated to remain dominant due to universal application and methodological centrality.

End-User Analysis

Pharmaceutical and biotechnology companies accounted for 54.9% of growth within the end-user category and dominate the DNA Polymerase market. Drug discovery pipelines require extensive molecular biology experimentation. PCR and cloning workflows remain foundational in early-stage research. Biologics development depends on precise genetic manipulation. High R&D investment supports sustained reagent consumption. Pharmaceutical labs operate high-throughput screening platforms.

Enzyme consistency supports regulatory-compliant research. Biotechnology firms rely on polymerases for assay development. Vaccine research increases amplification demand. Gene therapy programs expand molecular testing requirements. Internal quality standards favor validated enzyme suppliers. Contract research expansion supports outsourced molecular workflows. Automation adoption increases reaction volumes. Companion diagnostics development strengthens PCR dependency.

Scale of operations supports bulk purchasing agreements. Innovation cycles increase experimental iterations. Regulatory documentation requires reproducible molecular data. Precision medicine research strengthens demand for high-quality enzymes. Strategic collaborations increase shared research activity. Capital investment in biotech infrastructure sustains growth. The segment is expected to retain dominance due to R&D intensity and continuous innovation demand.

Key Market Segments

By Product Type

- Taq polymerase

- Proprietary enzyme blends

- Pfu polymerase

- Others

By Application

- Polymerase chain reaction

- DNA cloning

- DNA sequencing

- Others

By End-User

- Pharmaceutical & biotechnology companies

- Academic & research institutes

- Hospitals & diagnostic centers

- Others

Drivers

Rising demand for high-fidelity DNA polymerases is driving the market

The DNA polymerase market experiences robust expansion primarily due to the escalating demand for high-fidelity variants, which offer superior accuracy in applications requiring precise DNA replication. Researchers in genomics and molecular diagnostics prefer these enzymes to minimize errors during amplification, ensuring reliable results in critical experiments. Biotechnology firms prioritize high-fidelity polymerases for next-generation sequencing workflows, where sequence integrity is paramount.

Academic laboratories adopt these products to support advanced studies in gene editing and synthetic biology. Clinical settings utilize them for diagnostic assays that demand low mutation rates. Global initiatives in precision medicine amplify the need for enzymes capable of faithful template copying. Pharmaceutical development pipelines incorporate high-fidelity options to accelerate drug target validation.

Patient-focused research benefits from accurate polymerases in biomarker discovery. Economic incentives from reduced rework in failed amplifications further encourage adoption. High-fidelity DNA polymerases are increasingly favored for their error rates significantly lower than standard Taq, supporting complex sequencing and cloning tasks.

Restraints

Limited availability of specialized reagents is restraining the market

The DNA polymerase market faces limitations from the limited availability of specialized reagents, which are essential for optimizing enzyme performance in niche applications. Suppliers encounter supply chain disruptions for rare cofactors and buffers tailored to proprietary polymerases. Researchers in remote or underfunded laboratories struggle with inconsistent reagent access, hindering experimental reproducibility.

Biotechnology startups delay projects due to shortages in high-purity nucleotides required for polymerase reactions. Academic institutions report challenges in procuring reagents for large-scale genomic studies. Clinical diagnostics experience variability when reagent lots differ, affecting assay validation. Global trade restrictions on certain biochemicals exacerbate availability issues.

Pharmaceutical manufacturing scales slowly without steady reagent supplies for quality control. Patient-related research suffers from paused trials awaiting reagent restocking. Economic volatility in raw material sourcing contributes to persistent shortages.

Opportunities

Advancements in synthetic biology applications is creating growth opportunities

The DNA polymerase market presents promising growth opportunities through advancements in synthetic biology applications, where engineered polymerases enable novel DNA assembly and modification techniques. Innovators can design custom enzymes for non-natural nucleotide incorporation, expanding possibilities in bioengineering. Regulatory support for synthetic biology initiatives encourages investment in polymerase variants for industrial biotechnology.

Healthcare advancements benefit from polymerases optimized for vaccine development and gene therapy vectors. Pharmaceutical entities explore polymerase roles in directed evolution for protein engineering. Clinical research integrates synthetic approaches for rapid pathogen detection systems. Global collaborations focus on polymerases for sustainable biomanufacturing processes.

Academic breakthroughs in polymerase engineering open avenues for commercial translation. Patient therapies advance with synthetic constructs for personalized medicine. These opportunities position the market for diversification beyond traditional PCR and sequencing.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions allocate resources to genomic research initiatives, enhancing the DNA polymerase market through greater utilization in PCR diagnostics and sequencing applications worldwide. Executives capitalize on burgeoning biotech investments in Asia-Pacific regions, where rapid urbanization fuels adoption of high-fidelity enzymes for personalized medicine. Nonetheless, ongoing worldwide inflation heightens expenses for biochemical precursors and lab equipment, obliging producers to recalibrate budgets in high-competition zones.

Mounting geopolitical discord in enzyme-sourcing territories impedes reliable shipments of recombinant proteins, testing distribution networks for cross-continental operators. Strategists mitigate these interruptions by cultivating hybrid supply ecosystems in resilient jurisdictions, which streamlines access and promotes joint development ventures.

Current US tariffs, applying additional duties up to 25% on imported biotech enzymes from primary exporters like China, intensify fiscal challenges for firms dependent on global trade. Indigenous manufacturers leverage this context to augment homegrown synthesis capacities, which stimulates specialized workforce training and elevates quality benchmarks domestically. Transformative strides in thermostable polymerase variants persistently catalyze the industry’s ascent, assuring amplified efficiency and prosperous horizons for stakeholders universally.

Latest Trends

Development of high-fidelity polymerases for NGS is a recent trend

In 2024, the DNA polymerase market has shown a clear trend toward the development of high-fidelity polymerases tailored for next-generation sequencing, which demand ultra-low error rates for accurate genome assembly. Manufacturers are prioritizing enzymes with enhanced proofreading capabilities to support long-read sequencing platforms. Researchers are adopting these polymerases to improve variant calling in clinical genomics.

Regulatory evaluations are increasing for NGS-compatible reagents demonstrating superior fidelity. Clinical laboratories are integrating high-fidelity options to reduce false positives in diagnostic panels. Academic publications are highlighting performance gains in complex sample types.

Global sequencing initiatives are driving demand for robust polymerases in population studies. Patient diagnostics benefit from precise sequencing enabled by these advancements. Ethical guidelines are shaping validation standards for NGS applications. High-fidelity DNA polymerases continue to gain traction in NGS workflows for their reduced error rates compared to standard enzymes.

Regional Analysis

North America is leading the DNA Polymerase Market

In 2024, North America held a 40.0% share of the global DNA polymerase market, bolstered by intensified genomic research and diagnostic applications, where high-fidelity enzymes like Taq and Phusion variants enable precise amplification for next-generation sequencing and PCR-based testing in oncology and infectious disease labs.

Biopharmaceutical companies ramped up procurement of thermostable polymerases to support vaccine development and personalized medicine, driven by federal grants emphasizing rapid assay optimization amid talent constraints in traditional methods. Innovations in error-proofing formulations improved specificity for CRISPR workflows, aligning with regulatory priorities for reproducibility in preclinical trials.

Rising chronic disease screenings amplified usage for biomarker discovery, prompting integrated platforms with automated pipetting. Academic centers refined recombinant expressions for high-yield production, facilitating broader integrations in microbiome analyses.

Collaborative validations tracked enzyme kinetics, fostering confidence in long-amplification protocols. Supply adaptations ensured ultra-pure kits compliant with quality norms in high-throughput facilities. Thermo Fisher Scientific’s Platinum II Taq Hot-Start DNA Polymerase demonstrated exceptional performance, cited in more than 5,000 publications between 2019 and 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry experts anticipate vigorous escalation in DNA polymerase solutions across Asia Pacific throughout the forecast period, as nations fortify biotech infrastructures to combat infectious outbreaks and genetic disorders amid rapid urbanization. Researchers deploy high-fidelity enzymes in sequencing initiatives, optimizing protocols for tropical pathogen detection in densely populated zones.

Governments channel investments into polymerase R&D through subsidies, equipping labs to accelerate biosimilar cloning for affordable diagnostics. Biotech firms customize thermostable variants with enhanced robustness, suiting humid storage needs for rural screening programs. Cross-border consortia assess amplification efficiencies through comparative trials, enhancing accuracy for hereditary disease mapping in diverse cohorts.

Pharmaceutical manufacturers localize recombinant production, ensuring cost-effectiveness for export-oriented economies. Policy drives promote technician education on kinetic optimizations, extending capabilities to peripheral institutes facing equipment shortages. South Korea’s government invested approximately KRW 910 billion in 2024 to raise additional venture funding for biotech startups, underscoring regional commitment to enzyme advancements.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the DNA Polymerase market drive growth by expanding high-fidelity and hot-start enzyme portfolios that support PCR, qPCR, sequencing, and advanced molecular diagnostics with higher accuracy and speed. Companies strengthen differentiation through enzyme engineering, buffer optimization, and performance consistency that reduce amplification errors in demanding research and clinical workflows.

Commercial strategies emphasize bundled reagent systems, application-specific kits, and technical support that simplify adoption and increase repeat laboratory usage. Innovation priorities include polymerases optimized for long-read sequencing, inhibitor tolerance, and rapid cycling to meet evolving genomics needs.

Market expansion targets fast-growing biotech clusters and diagnostic labs scaling infectious disease and oncology testing. Roche operates as a key participant through its strong life science reagent portfolio, deep assay-development expertise, and global distribution network that supports reliable enzyme supply for research and clinical applications worldwide.

Top Key Players

- New England Biolabs

- Thermo Fisher Scientific

- QIAGEN

- Promega Corporation

- Takara Bio Inc.

- Roche Diagnostics

- Sigma-Aldrich (Merck)

- Bio-Rad Laboratories

- Agilent Technologies

- Bioneer Corporation

Recent Developments

- In June 2025, QIAGEN and Incyte agreed to co-develop a diagnostic panel to support investigational therapies for myeloproliferative neoplasms. This collaboration drives the DNA polymerase market by increasing demand for high-fidelity polymerases used in PCR, quantitative PCR, and next-generation sequencing assays that underpin oncology diagnostics. Development of companion and supportive diagnostics requires highly accurate DNA amplification to detect low-frequency mutations, thereby reinforcing demand for advanced polymerase enzymes optimized for sensitivity, specificity, and clinical reproducibility.

- In June 2025, Acurx Pharmaceuticals presented Phase 3-ready data for its DNA polymerase IIIC inhibitor targeting Gram-positive bacterial pathogens. This milestone drives the DNA polymerase market by spotlighting bacterial DNA polymerases as validated and commercially relevant drug targets. Increased focus on polymerase-directed anti-infectives stimulates broader research activity, including enzymatic assays, screening platforms, and mechanistic studies that rely on purified DNA polymerases. As antibiotic resistance intensifies, investment in polymerase-focused research expands demand for specialized polymerase reagents and analytical tools.

Report Scope

Report Features Description Market Value (2024) US$ 389.2 Million Forecast Revenue (2034) US$ 717.0 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Taq Polymerase, Proprietary Enzyme Blends, Pfu Polymerase and Others), By Application (Polymerase Chain Reaction, DNA Cloning, DNA Sequencing and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Hospitals & Diagnostic Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape New England Biolabs, Thermo Fisher Scientific, QIAGEN, Promega Corporation, Takara Bio Inc., Roche Diagnostics, Sigma-Aldrich (Merck), Bio-Rad Laboratories, Agilent Technologies, Bioneer Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- New England Biolabs

- Thermo Fisher Scientific

- QIAGEN

- Promega Corporation

- Takara Bio Inc.

- Roche Diagnostics

- Sigma-Aldrich (Merck)

- Bio-Rad Laboratories

- Agilent Technologies

- Bioneer Corporation