Global Distributed Solar Power Generation Market Size, Share, and Industry Analysis Report By Product Type (Monocrystalline (Mono-SI), Polycrystalline (p-Si), Amorphous Silicon (A-Si), Concentrated PV Cell (CVP)), By Installation (Roof-Top, Ground Mounted), By Application (On-Grid, Off-Grid), By End-Use (Utility-Scale, Residential, Commercial), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170942

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

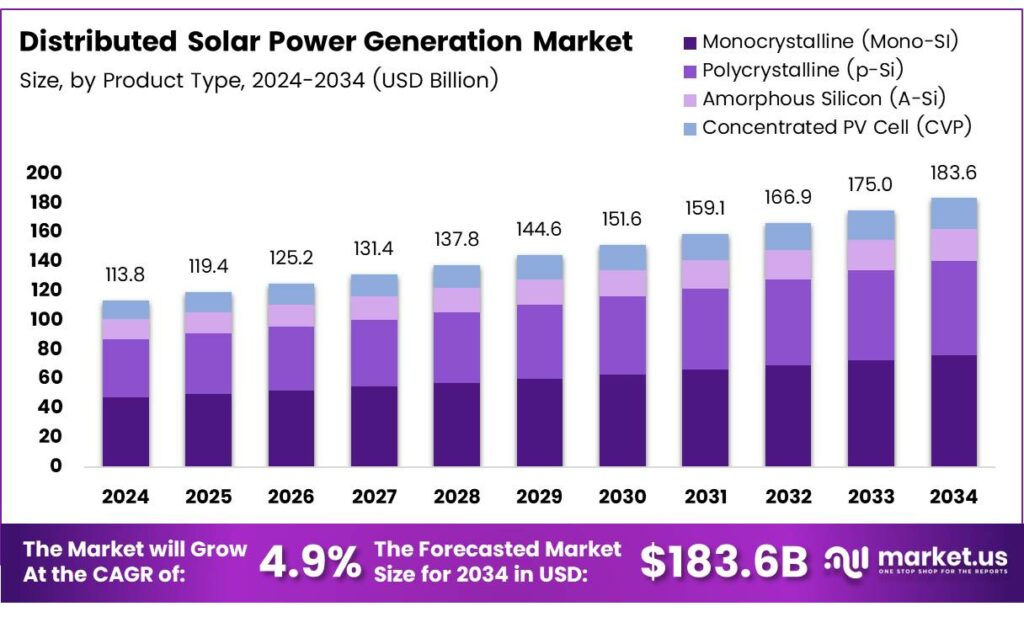

The Global Distributed Solar Power Generation Market size is expected to be worth around USD 183.6 billion by 2034, from USD 113.8 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Distributed Solar Power Generation Market is a localized electricity model where power is produced close to consumption points. It includes rooftop systems, ground-mounted assets, and community installations. Therefore, it reduces transmission losses, improves energy resilience, and supports decentralized energy planning across residential, commercial, and institutional users.

Distributed solar generation is gaining traction because energy consumers now value cost stability and energy independence. Moreover, falling module prices and simpler financing models are accelerating adoption. Project developers, landowners, and EPC firms are increasingly treating distributed solar assets as long-term infrastructure investments. Importantly, distributed solar supports industrial decarbonization, agricultural electrification, and rural development.

- According to the International Renewable Energy Agency, about 60% of global installed solar capacity comes from ground-mounted projects, highlighting large-scale distributed adoption. Meanwhile, India’s National Institute of Solar Energy, India holds potential for nearly 3,343 GWp across 27,571 square kilometers of wasteland, strengthening the long-term capacity outlook.

Ground-mounted systems require roughly 100–120 square feet per 1 kW, depending on design and shading factors. National solar capacity reached 71.61 GWAC, supported by favorable irradiance levels near 1000 W/m², improving system performance and cost efficiency. Module efficiency remains a decisive factor. Efficiency reflects usable power from 1,000 watts per square meter of solar radiation. Monocrystalline silicon modules now exceed 20% efficiency, enabling higher yields per area.

Key Takeaways

- The Distributed Solar Power Generation Market is projected to grow from USD 113.8 billion in 2024 to USD 183.6 billion by 2034, registering a 4.9% CAGR during 2025–2034.

- Monocrystalline (Mono-Si) panels dominate with a market share of 56.8%, supported by higher efficiency and long-term performance.

- Roof-top systems lead the market with a share of 67.3%, driven by residential and commercial adoption.

- On-Grid systems account for the largest share at 72.4%, supported by net-metering and grid connectivity benefits.

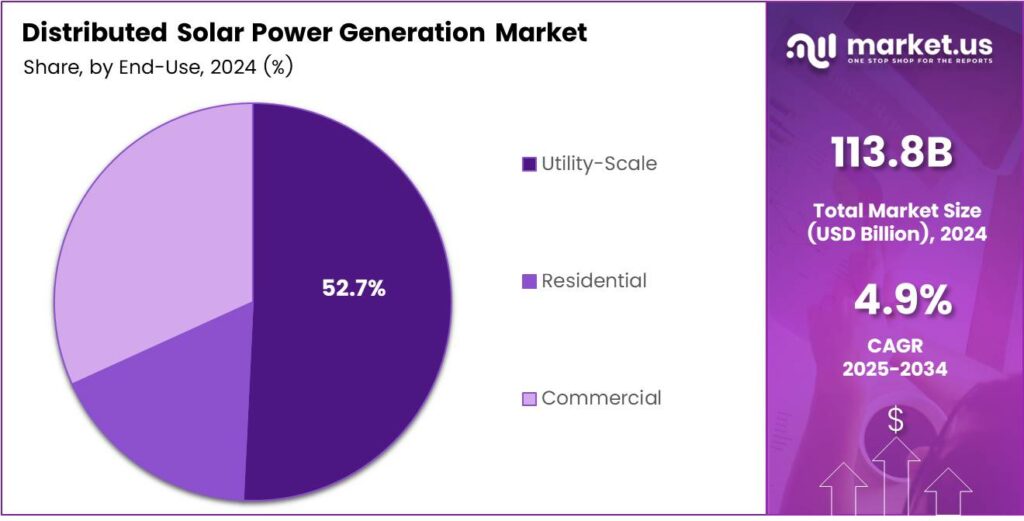

- Utility-scale installations hold a dominant share of 52.7%, reflecting distributed grid reinforcement strategies.

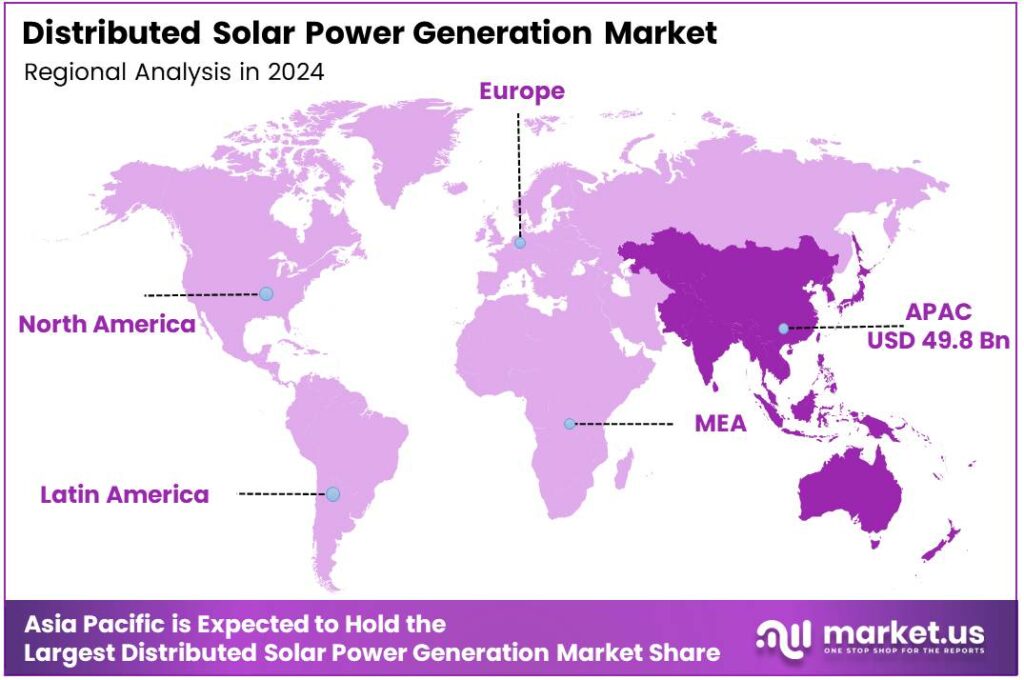

- Asia-Pacific dominates the global market with a 43.8% share, valued at USD 49.8 billion.

By Product Type Analysis

Monocrystalline (Mono-Si) dominates with 56.8% due to higher efficiency and long-term performance benefits.

In 2024, Monocrystalline (Mono-Si) held a dominant market position in the By Product Type Analysis segment of the Distributed Solar Power Generation Market, with a 56.8% share. This leadership is driven by higher power output, better space utilization, and strong performance in low-light conditions, making it suitable for rooftops and commercial installations.

Polycrystalline (p-Si) panels continue to find demand due to their lower manufacturing cost and steady efficiency levels. Although efficiency is slightly lower than mono-Si, these panels remain popular in price-sensitive projects, especially in developing regions where upfront investment decisions strongly influence distributed solar adoption.

Amorphous Silicon (A-Si) panels support niche applications where flexibility and lightweight design are important. These panels perform well in diffused sunlight and high temperatures, which supports their use in small rooftops, portable systems, and building-integrated solar solutions across urban environments.

Concentrated PV Cell (CVP) technology addresses high-irradiance locations by using optical lenses to focus sunlight. While adoption is limited, CVP systems support efficiency-driven projects in specific climates, contributing to technology diversification within distributed solar power generation frameworks.

By Installation Analysis

Roof-top installation leads with 67.3% as it supports decentralized energy access and space optimization.

In 2024, Roof-Top held a dominant market position in the By Installation Analysis segment of the Distributed Solar Power Generation Market, with a 67.3% share. Growth is supported by residential and commercial demand, net-metering policies, and reduced transmission losses, making rooftops an attractive choice for localized energy generation.

Ground-mounted installations serve areas with available land and higher capacity needs. These systems support community solar projects, small utility developments, and industrial campuses, offering easier maintenance access and scalability compared to rooftop systems in semi-urban and rural locations.

By Application Analysis

On-Grid systems dominate with 72.4% due to grid connectivity and financial incentives.

In 2024, On-Grid held a dominant market position in the By Application Analysis segment of the Distributed Solar Power Generation Market, with a 72.4% share. Grid connectivity enables surplus power export, stable revenue through net-metering, and lower system costs, encouraging adoption among residential, commercial, and small utility users.

Off-grid systems support energy access in remote and underserved regions. These systems reduce dependence on diesel generators, improve energy reliability, and support rural electrification, agricultural operations, and telecom infrastructure where grid availability remains inconsistent or economically unviable.

By End-Use Analysis

Utility-Scale end-use leads with 52.7% supported by distributed grid reinforcement strategies.

In 2024, Utility-Scale held a dominant market position in the By End-Use Analysis segment of the Distributed Solar Power Generation Market, with a 52.7% share. Utilities increasingly adopt distributed solar to reduce peak load stress, improve grid resilience, and support renewable energy integration closer to consumption centers.

Residential installations continue to grow as households seek energy cost savings and independence. Rooftop solar systems help reduce electricity bills, enhance energy security, and support sustainability goals, particularly in urban and suburban housing developments.

Commercial end-use adoption is driven by corporate sustainability targets and predictable energy demand. Offices, retail spaces, and industrial facilities use distributed solar to manage operating costs, stabilize power supply, and strengthen long-term energy planning.

Key Market Segments

By Product Type

- Monocrystalline (Mono-SI)

- Polycrystalline (p-Si)

- Amorphous Silicon (A-Si)

- Concentrated PV Cell (CVP)

By Installation

- Roof-Top

- Ground Mounted

By Application

- On-Grid

- Off Grid

By End-Use

- Utility-Scale

- Residential

- Commercial

Emerging Trends

Digital Monitoring and Smart Solar Systems Shape Market Trends

One of the major trending factors in the Distributed Solar Power Generation Market is the use of digital monitoring and smart energy management systems. Real-time performance tracking helps users optimize energy usage and quickly identify faults, improving overall system efficiency.

- The IEA notes that the world is on track to add nearly 940 GW of new renewable capacity every year by 2030, with solar doing the heavy lifting. In 2024 alone, an estimated 593 GW of solar panels were installed globally, which is 29% more than the year before. This trend is driven by people wanting to be “prosumers”—both producers and consumers.

The growing adoption of solar-plus-storage solutions is another key trend. Batteries allow users to store excess power and use it during peak demand or grid outages. This trend increases energy reliability and improves return on investment for solar owners.

Drivers

Rising Electricity Costs and Energy Independence Drive Market Growth

The Distributed Solar Power Generation Market is strongly driven by rising electricity prices across residential, commercial, and industrial users. As grid tariffs increase year after year, consumers actively look for cost-stable power sources. Distributed solar allows users to generate electricity at the point of use, reducing monthly bills and long-term dependence on utilities.

- Homes, factories, and institutions prefer reliable power systems that reduce exposure to grid outages. Rooftop and ground-mounted distributed solar systems offer localized generation, especially in regions with unstable grids. The U.S. Department of Energy (DOE) notes that peak electricity demand is expected to rise from 800 GW in 2024 to 900 GW by 2030. That is a 12.5% jump in just a few years.

Government policies also play a key role in accelerating adoption. Subsidies, net-metering programs, tax credits, and feed-in tariffs encourage investments in small-scale solar installations. These policies reduce upfront costs and shorten payback periods, making solar more affordable.

Restraints

High Initial Investment and Grid Integration Challenges Limit Adoption

One major restraint in the Distributed Solar Power Generation Market is the high upfront cost of installation. Although operating costs are low, the initial investment for panels, inverters, mounting systems, and installation remains a concern for small businesses and households with limited budgets.

- Grid integration issues also restrict market growth in many regions. Aging power infrastructure struggles to manage two-way electricity flow from distributed systems. Homeowners have witnessed dramatic growth in rooftop solar installations — in fact, the residential segment added about 1,106 MWdc of capacity.

Limited rooftop space is another practical challenge, especially in densely populated urban areas. Multi-story buildings and rented properties often lack clear ownership rights, making installation decisions complex. This slows adoption in cities where power demand is high.

Growth Factors

Expanding Commercial Rooftops Create Strong Growth Opportunities

The Distributed Solar Power Generation Market holds strong growth opportunities in the commercial and industrial sectors. Warehouses, shopping malls, factories, and office buildings have large rooftop areas suitable for solar installations. These users also benefit significantly from reduced peak-hour electricity costs.

- Power purchase agreements, leasing options, and pay-as-you-save models reduce upfront costs. This allows more users to adopt solar without heavy capital investment, expanding the addressable market. Distributed solar PV applications — meaning systems installed at homes, businesses, industries, and remote/off-grid sites — now account for about 42% of the overall photovoltaic (PV) expansion worldwide.

Distributed solar systems can provide reliable power to remote areas where grid expansion is costly or slow. Off-grid and hybrid systems support agriculture, small industries, and community services. Integration with battery storage also improves market potential. Storage enables users to consume more self-generated power and manage demand during outages

Regional Analysis

Asia-Pacific Dominates the Distributed Solar Power Generation Market with a Market Share of 43.8%, Valued at USD 49.8 Billion

Asia-Pacific leads the distributed solar power generation market due to strong policy support, fast urbanization, and rising electricity demand. In this region, the market accounts for a dominant 43.8% share, reaching a value of USD 49.8 billion, driven by large-scale rooftop solar adoption and rural electrification programs. Countries across the Asia-Pacific are actively promoting decentralized solar systems to reduce grid pressure and improve energy access.

North America shows steady growth in distributed solar power generation, supported by rising residential rooftop installations and strong commercial adoption. Businesses and households increasingly invest in on-site solar systems to manage high electricity tariffs and improve energy reliability. Grid resilience initiatives and incentives for clean energy systems continue to support long-term market expansion across the region.

Europe’s distributed solar market benefits from strict climate targets and a strong emphasis on energy independence. Many countries encourage rooftop and community solar projects to reduce reliance on centralized power generation. Growth is further supported by advanced grid infrastructure, energy storage integration, and favorable feed-in tariffs promoting small-scale solar installations.

The U.S. remains a key contributor within the distributed solar landscape, supported by strong residential rooftop demand and commercial solar installations. Consumers increasingly adopt distributed solar to achieve energy cost savings and grid independence. Ongoing investments in smart grids and energy storage integration further enhance the market’s long-term outlook.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Suntech Power Holding Co. Ltd. in 2024 remained a practical choice for distributed solar buyers who prioritize bankable modules, predictable lead times, and stable field performance across rooftops and small ground-mount sites. Its viewpoint strength is execution: meeting spec, minimizing warranty risk, and supporting installers with consistent product lines. The key watch-out is margin pressure in a price-competitive module environment, making disciplined channel management essential.

Trina Solar Ltd. stood out in 2024 for pairing high-volume manufacturing with a clearer systems mindset that fits distributed projects needing reliable engineering, documentation, and repeatable procurement. From an analyst lens, Trina’s advantage is scale plus product iteration, helping EPCs standardize designs and shorten project cycles. The challenge is maintaining differentiation when technology improvements diffuse quickly across the market.

Canadian Solar Inc. continued to play well in distributed solar, where customers value a blend of module supply reliability and project-ready support for commercial and industrial deployments. The company’s positioning benefits from a global footprint and experience across multiple demand cycles, which helps it navigate shifting incentives and grid rules. Risk centers on working capital discipline when shipment timing and pricing swing.

Yingli Green Energy Holding Co. Ltd. in 2024 reflected a more value-focused stance, appealing to distributed segments where upfront capex sensitivity is high, and procurement teams seek acceptable performance at competitive pricing. Its opportunity lies in targeted channel partnerships and selective markets where brand familiarity still influences buying decisions. The execution priority is ensuring quality consistency and after-sales responsiveness to protect long-term installer confidence.

Top Key Players in the Market

- Suntech Power Holding Co. Ltd.

- Trina Solar Ltd.

- Canadian Solar Inc.

- Yingli Green Energy Holding Co. Ltd.

- Leonics Company Limited

- Hanwha Group

- Sharp Corporation

- GreenBrilliance

- Jinko Solar Holding Company Ltd.

Recent Developments

- In 2025, Suntech continues to operate in the solar module manufacturing sector, focusing on crystalline silicon solar cells and PV modules for residential, commercial, and utility-scale applications. Earlier positive developments included product upgrades, such as higher-power H48 and H66 module series, and the Ultra V Pro series showcased at Intersolar.

- In 2025, Trina Solar showed strong performance and innovation, with a focus on high-efficiency modules suitable for various applications, including scenario-based solutions that support distributed solar in challenging environments. Highlighting circular innovation, low-carbon manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 113.8 billion Forecast Revenue (2034) USD 183.6 billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monocrystalline (Mono-SI), Polycrystalline (p-Si), Amorphous Silicon (A-Si), Concentrated PV Cell (CVP)), By Installation (Roof-Top, Ground Mounted), By Application (On-Grid, Off-Grid), By End-Use (Utility-Scale, Residential, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Suntech Power Holding Co. Ltd., Trina Solar Ltd., Canadian Solar Inc., Yingli Green Energy Holding Co. Ltd., Leonics Company Limited, Hanwha Group, Sharp Corporation, GreenBrilliance, Jinko Solar Holding Company Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Distributed Solar Power Generation MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Distributed Solar Power Generation MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Suntech Power Holding Co. Ltd.

- Trina Solar Ltd.

- Canadian Solar Inc.

- Yingli Green Energy Holding Co. Ltd.

- Leonics Company Limited

- Hanwha Group

- Sharp Corporation

- GreenBrilliance

- Jinko Solar Holding Company Ltd.