Global Disposable Plates Market By Product Type (Plastic Plates, Aluminum Plates, Paper Plates, Others), By Design (Compartmental, Plain), By Sales Channel (B2B: Food Service Outlets, Educational Institutes, Corporate Offices, Healthcare Facilities; B2C (Retail) Online, Supermarkets and Hypermarkets, Convenience Stores, Mom and Pop Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132355

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

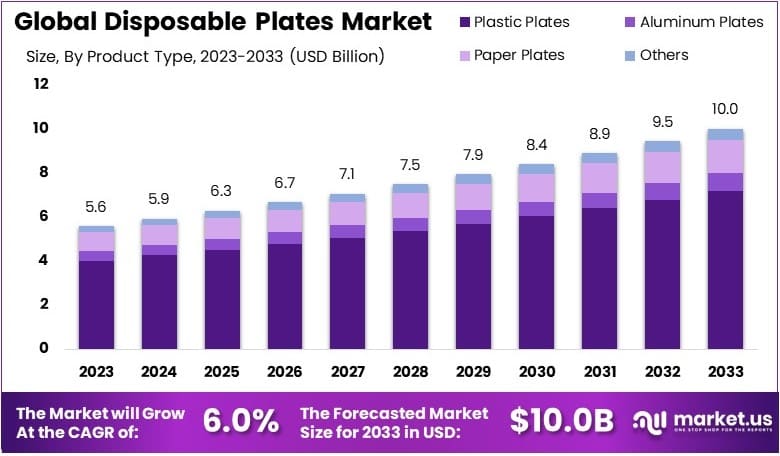

The Global Disposable Plates Market size is expected to be worth around USD 10.0 Billion by 2033, from USD 5.6 Billion in 2023, growing at a CAGR of 6.0% during the forecast period from 2024 to 2033.

Disposable plates are single-use products typically made from materials such as paper, plastic, or biodegradable fibers. They are designed for convenience and are widely used at events, picnics, or gatherings where immediate disposal is preferred. These plates reduce the need for washing, making them practical for on-the-go meals and large gatherings.

The disposable plates market encompasses the manufacturing and sale of these single-use products for consumer and commercial use. This market benefits from demand across sectors like hospitality, catering, and household use.

Growth in the disposable plates market is driven by shifting consumer preferences and global environmental concerns. As of 2021, over 170 nations committed to significantly reducing plastic use by 2030.

For example, the European Union banned various single-use plastics, including plates, with the goal of lowering plastic container and cup consumption by 2026. Meanwhile, Canada implemented bans on plastic items such as bags, straws, and cutlery, aiming for zero plastic waste by 2030.

This increasing demand for eco-friendly alternatives presents significant opportunities in the market. Many manufacturers are now focused on producing biodegradable plastics or compostable plates to cater to environmentally conscious consumers. Although the market is not yet saturated, competition is growing as more brands develop sustainable options to meet evolving preferences.

On a broader scale, the disposable plates market has a notable environmental impact. Currently, less than 10% of global economic activity is circular, with approximately 100 billion tonnes of materials used each year, of which more than 90% are discarded. As a result, the shift toward sustainable disposable plates aligns with the broader circular economy movement, which aims to eliminate waste entirely.

Locally, regulations have begun influencing consumer behavior. For instance, Germany introduced a plastic ban in 2021, achieving a 99% return rate for plastic bottled water due to its deposit return system. Such policies encourage consumers to adopt reusable and compostable options, supporting a gradual reduction in single-use plastic waste and fostering a more sustainable approach to disposables.

Government initiatives and regulations are key drivers in shaping the disposable plates market. Policies targeting plastic reduction and waste management are motivating manufacturers to explore sustainable materials.

Key Takeaways

- The Disposable Plates Market was valued at USD 5.6 billion in 2023 and is projected to reach USD 10.0 billion by 2033, with a CAGR of 6.0%.

- In 2023, Plastic Plates dominate the product type with 71.7%, driven by their affordability and widespread use.

- In 2023, Plain Plates lead in design, reflecting simplicity and cost-effectiveness.

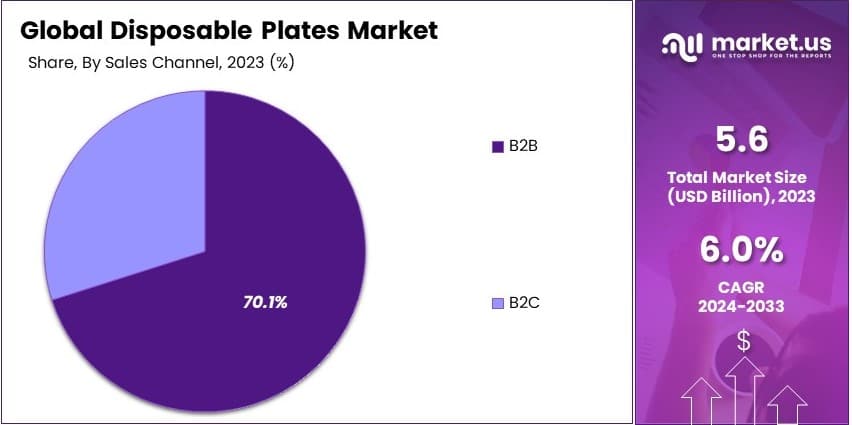

- In 2023, B2B sales channel holds 70.1%, supported by high demand in food services and institutions.

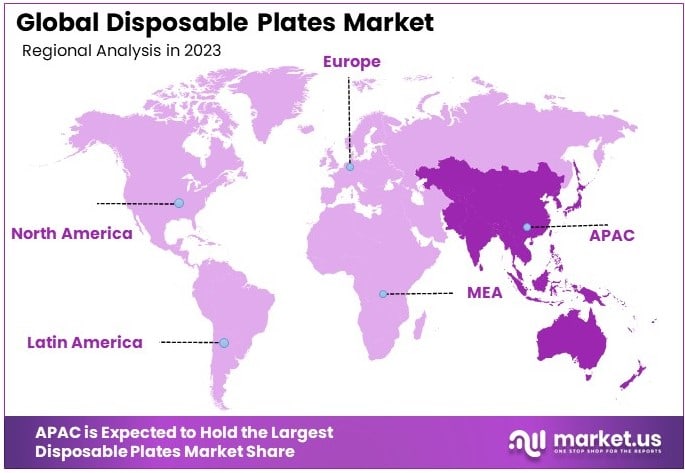

- In 2023, Asia-Pacific holds a significant market share, fueled by high consumption in emerging economies.

Product Type Analysis

Plastic Plates Dominate with 71.7% Due to Versatility and Cost-Efficiency

In the “Product Type” segment of the Disposable Plates Market, Plastic Plates hold the dominant position, capturing 71.7% of the market. This substantial share is primarily due to their versatility and cost-efficiency, which make them suitable for a wide range of applications from casual dining to upscale events.

Plastic plates offer the benefits of durability and lower costs, compared to other materials, which significantly drives their demand across both commercial and residential settings.

Aluminum plates serve as a sturdy alternative, particularly valued for their ability to withstand high temperatures, making them ideal for use in situations where plates need to be exposed to heat.

Paper plates, on the other hand, are favored for their environmental benefits and are commonly used in casual and quick service dining settings where easy disposability is a priority. The “Others” category includes biodegradable and compostable options, which are gaining traction due to growing environmental concerns, illustrating a shift towards more sustainable consumer practices.

Design Analysis

Plain Plates Lead Due to Their Broad Utility in Various Settings

Plain plates dominate the “Design” segment of the market, as they are preferred for their simplicity and versatility. These plates can seamlessly fit into any dining occasion without the constraints of specific aesthetic requirements, making them the go-to choice for both everyday meals and special events. Consequently, their simplicity allows for greater flexibility in table setting designs, enhancing their appeal.

Compartmental plates, while less dominant, play a crucial role in specific dining contexts where separation of food items is necessary, such as in cafeterias and during catering events. These plates help in portion control and maintain the integrity of different cuisines served together, thereby fulfilling unique customer needs and dietary preferences.

Sales Channel Analysis

B2B Leads with 70.1% Driven by Extensive Use Across Various Institutions

The “Sales Channel” segment is predominantly led by B2B (Business-to-Business) channels, accounting for 70.1% of the market. This dominance is due to the extensive use of disposable plates across various institutional settings such as food service outlets, educational institutes, corporate offices, and healthcare facilities.

In these environments, the convenience of disposable plates significantly reduces the time and effort required for cleanup, enhancing operational efficiency.

Within the B2B segment, food service outlets are the largest consumers, utilizing disposable plates to serve a high volume of customers with minimal hassle. Educational institutes and corporate offices value disposables for their convenience during events and daily operations, whereas healthcare facilities prioritize them for hygiene and safety reasons.

The B2C (Retail) channel also plays a significant role, with online platforms expanding rapidly as consumers appreciate the convenience of home delivery. Supermarkets and hypermarkets offer a broad selection of disposable plates, catering to immediate consumer needs, while convenience and mom-and-pop stores provide easy access in local neighborhoods.

Key Market Segments

By Product Type

- Plastic Plates

- Aluminum Plates

- Paper Plates

- Others

By Design

- Compartmental

- Plain

By Sales Channel

- B2B

- Food Service Outlets

- Educational Institutes

- Corporate Offices

- Healthcare Facilities

- B2C (Retail)

- Online

- Supermarkets/Hypermarkets

- Convenience Stores

- Mom & Pop Stores

Drivers

Rising Demand for Convenience Drives Market Growth

Consumers, particularly in urban settings, are increasingly turning to disposable plates for their ease of use and time-saving benefits. With busy schedules and the rising trend of quick dining solutions, disposable plates provide an accessible option for meals without cleanup.

Additionally, the popularity of fast-food chains and food delivery services boosts demand for disposable plates. These businesses rely on disposables for easy food packaging and serving, helping meet high consumer volumes swiftly. The shift toward on-the-go eating and delivery-friendly packaging contributes significantly to the disposable plates market.

Moreover, urbanization accelerates this trend. As cities expand and populations grow, more consumers live in spaces where traditional kitchen setups may be limited. This urban growth drives the need for convenient, disposable dining solutions.

Restraints

Environmental Concerns Restrain Market Growth

Environmental concerns present substantial challenges to the disposable plates market. Rising awareness of plastic waste and its impact on the environment leads consumers to reconsider single-use products. This shift impacts demand as more people seek sustainable alternatives.

Furthermore, government regulations restrict single-use plastics, placing limitations on non-biodegradable disposable plates. These policies, increasingly common worldwide, limit the options available to manufacturers and impose additional compliance costs.

The cost of sustainable materials also acts as a barrier. While eco-friendly options exist, their higher cost restricts their accessibility for some consumers. Limited awareness of these alternatives exacerbates the issue, as many remain unaware of compostable and biodegradable options.

Opportunity

Expansion of Eco-Friendly Products Provides Opportunities

Consumers today seek products that minimize environmental impact, creating a clear opening for biodegradable and compostable plates. Many companies are expanding their product lines to include these options, attracting eco-conscious consumers.

Additionally, the growth of outdoor events and catering fuels demand for disposables. Biodegradable plates, in particular, appeal to event organizers looking for environmentally responsible solutions. The rise of online retail further amplifies these opportunities, allowing consumers easy access to eco-friendly products.

Companies that embrace these trends stand to benefit. Offering sustainable options not only attracts a growing customer base but also helps strengthen brand image. As consumers continue prioritizing environmental impact, these trends are likely to offer ongoing opportunities for market players.

Challenges

Competition from Reusable Products Challenges Market Growth

As awareness of waste reduction grows, more consumers consider long-term reusable plates, impacting demand for disposables. Price sensitivity among consumers further compounds this issue, as disposable plates, particularly eco-friendly ones, can be more expensive than their reusable counterparts.

Another challenge lies in the limited supply of biodegradable materials. Biodegradable plates require specific raw materials, which are not always readily available, driving up costs and limiting production.

Additionally, waste management infrastructure for compostable products is often lacking, creating challenges for consumers looking to dispose of these items properly.

These challenges necessitate innovation and adaptation within the market. Companies that can address these issues through pricing strategies, supply chain improvements, or consumer education may have an edge in this evolving landscape.

Growth Factors

Demand from Food Delivery Services Is a Growth Factor

As online food delivery services expand, disposable plates and containers are in constant demand, providing a practical solution for packaging meals. This need is particularly high among quick-service restaurants and cloud kitchens, which rely heavily on disposable products to serve meals efficiently.

Rising awareness of hygiene and food safety further fuels the demand for disposable plates. Consumers prioritize cleanliness, especially when eating outside their homes, making disposable options attractive due to their single-use nature.

The increasing adoption of disposable plates in corporate events and gatherings also supports market growth. Many companies now opt for disposables to simplify event logistics, reducing the need for cleanup and minimizing contact.

Lastly, educational institutions are turning to disposable solutions for meal services. Schools and colleges, aiming to streamline their food services, rely on disposables to enhance efficiency and ensure hygiene.

Emerging Trends

Shift Towards Sustainable Products Is Latest Trending Factor

A notable trend in the disposable plates market is the shift toward sustainable products. Consumers increasingly prefer items that align with environmental values, creating demand for plates made from renewable materials. Natural fiber-based plates are particularly popular, reflecting a growing preference for products with minimal environmental impact.

Increased consumer awareness about the effects of single-use plastics also drives demand for sustainable plates. As people become more conscious of waste, eco-friendly disposables gain favor over traditional options.

Additionally, there is a rising demand for customizable products, allowing consumers to choose plates that reflect both their environmental priorities and aesthetic preferences.

This trend also aligns with the broader consumer shift toward ethical consumption. As brands focus on sustainability, they are well-positioned to attract environmentally-conscious customers, driving market growth and reinforcing this ongoing trend.

Regional Analysis

Asia-Pacific Dominates with Market Share

Asia-Pacific currently records a major share in the Disposable Plates Market. The demand for disposable plates is growing in response to the region’s large population and rising need for convenient, single-use products, particularly in urban and densely populated areas.

Key factors driving potential market growth include the increasing popularity of on-the-go food services and events that require disposable options. Countries like China and India, with their significant population bases and expanding foodservice sectors, show strong demand for cost-effective, convenient tableware solutions, fueling potential market expansion.

Asia-Pacific’s market dynamics reflect a growing trend toward disposable and single-use items in busy urban centers. However, environmental concerns and government regulations, particularly regarding single-use plastics, are also shaping consumer preferences. As a result, many brands are investing in biodegradable and eco-friendly options to meet sustainability goals.

Regional Mentions:

- North America: North America shows steady demand for disposable plates, driven by a strong foodservice industry and consumer interest in convenient, single-use products. Increasing regulations on single-use plastics are shifting the market toward biodegradable options.

- Europe: Europe has a notable presence in the disposable plates market, with a strong focus on sustainable and eco-friendly options. Environmental regulations and consumer awareness drive demand for compostable and recyclable materials, especially in countries like Germany and France.

- Middle East & Africa: The Middle East and Africa are emerging markets for disposable plates, driven by growing events and hospitality sectors. While demand is rising, environmental concerns and regulations may influence a gradual shift toward sustainable alternatives.

- Latin America: Latin America sees growing interest in disposable plates, particularly for events and informal dining. Economic considerations and consumer convenience fuel demand, though environmental awareness is beginning to shape market preferences toward eco-friendly options.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Disposable Plates Market is led by top players focused on sustainability, innovation, and adaptability to changing consumer preferences for eco-friendly options. Key companies like Dixie (Georgia-Pacific), Huhtamaki, Dart Container Corporation, and Eco-Products (Novolex) dominate this sector by offering a mix of traditional and environmentally conscious disposable plate products.

Dixie, a brand of Georgia-Pacific, is a well-established player with a wide array of disposable tableware. Known for convenience and durability, Dixie’s disposable plates are widely available and trusted for both personal and commercial use. The brand’s reach and strong reputation make it a preferred choice, especially in North America, where demand for reliable disposable options remains high.

Huhtamaki has carved a significant position with its focus on sustainable packaging solutions. The company offers a range of eco-friendly disposable plates made from renewable resources like molded fiber. Huhtamaki’s commitment to reducing plastic use resonates with environmentally conscious consumers, giving it a strong market presence, especially in Europe, where sustainability is highly prioritized.

These leading players shape the Disposable Plates Market by addressing both traditional and eco-conscious consumer demands. Their efforts to provide a balance of convenience, affordability, and sustainability drive the market forward, reflecting shifting preferences towards more environmentally friendly disposable options.

Top Key Players in the Market

- Dixie (Georgia-Pacific)

- Huhtamaki

- Dart Container Corporation

- Eco-Products (Novolex)

- Pactiv LLC

- Greenwave International Inc.

- Genpak

- BioPak

- Lollicup USA Inc.

- Solia

- Natural Tableware

- Vegware

- World Centric

- EcoPack

- Bambu

Recent Developments

- Green Elephant Biotech: On February 2024, German start-up Green Elephant Biotech introduced the world’s first plant-based 96-well microtitre plate, made from polylactic acid (PLA) derived from corn starch. This product aims to address the 5.5 million tonnes of non-recyclable plastic waste generated annually in life science laboratories.

- Loliware: On May 2023, Loliware, a San Francisco-based company specializing in seaweed materials, launched a new seaweed-derived resin suitable for injection molding at the Rethinking Materials Innovation and Investment Summit. This resin enables the production of compostable utensils using existing plastic manufacturing equipment, providing an eco-friendly alternative to single-use plastics.

Report Scope

Report Features Description Market Value (2023) USD 5.6 Billion Forecast Revenue (2033) USD 10.0 Billion CAGR (2024-2033) 6.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Plastic Plates, Aluminum Plates, Paper Plates, Others), By Design (Compartmental, Plain), By Sales Channel (B2B: Food Service Outlets, Educational Institutes, Corporate Offices, Healthcare Facilities; B2C (Retail): Online, Supermarkets and Hypermarkets, Convenience Stores, Mom and Pop Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dixie (Georgia-Pacific), Huhtamaki, Dart Container Corporation, Eco-Products (Novolex), Pactiv LLC, Greenwave International Inc., Genpak, BioPak, Lollicup USA Inc., Solia, Natural Tableware, Vegware, World Centric, EcoPack, Bambu Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dixie (Georgia-Pacific)

- Huhtamaki

- Dart Container Corporation

- Eco-Products (Novolex)

- Pactiv LLC

- Greenwave International Inc.

- Genpak

- BioPak

- Lollicup USA Inc.

- Solia

- Natural Tableware

- Vegware

- World Centric

- EcoPack

- Bambu