Global Disposable Cups Market Size, Share, Growth Analysis By Product Type (Hot Beverage Cups, Cold Beverage Cups, Foam Cups, Plastic Cups, Paper Cups, Biodegradable Cups), By End-Use (Food Service, Household, Institutional, Corporate Offices), By Distribution Channel (Online Retail, Supermarkets or Hypermarkets, Specialty Stores, Wholesale or Distributors), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144683

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

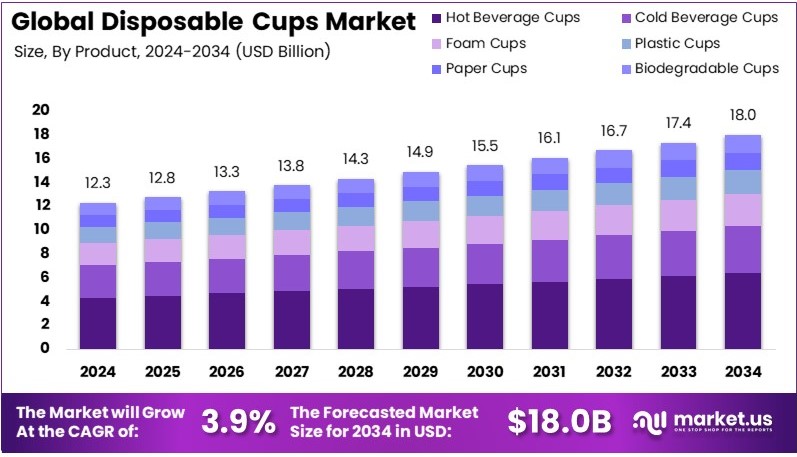

The Global Disposable Cups Market size is expected to be worth around USD 18.0 Billion by 2034, from USD 12.3 Billion in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

Disposable cups are single-use containers made from paper, plastic, or biodegradable materials. They are commonly used for serving beverages like coffee, tea, or soft drinks. These cups are lightweight and convenient for on-the-go consumption. They are widely used in fast food outlets, cafes, events, and households for easy disposal after use.

The disposable cups market is expanding due to increasing demand in food and beverage sectors. Convenience and hygiene are key factors driving growth. The market features various cup types, including paper, plastic, and compostable options. Growing awareness of environmental issues is leading to more eco-friendly disposable cup alternatives.

Disposable cups continue to dominate the market. Their convenience drives widespread use, especially in the food and beverage sector. However, rising environmental concerns are shifting consumer preferences. Consequently, companies are focusing on sustainable alternatives. For instance, in November 2024, Berry Global launched recyclable polypropylene cups, which are 10-15% lighter than traditional polystyrene ones. This innovation supports retailers’ sustainability goals.

The disposable cups market is evolving as consumers demand eco-friendly options. In February 2025, Starbucks introduced fiber-based compostable cups for cold drinks in 14 U.S. states, including California and Washington. This move aligns with their goal to make all packaging recyclable or reusable by 2030. As a result, more brands are investing in biodegradable and compostable cup technologies to meet sustainability targets.

Growth factors in the disposable cups market include increasing fast-food consumption and on-the-go lifestyles. However, environmental regulations are encouraging a shift towards compostable and recyclable options. Consequently, companies are innovating to stay competitive. Additionally, rising consumer awareness about plastic waste is boosting demand for eco-friendly cups. Therefore, brands that adapt are likely to thrive.

The demand for disposable cups is substantial, especially in urban centers where fast food and takeout are popular. However, as awareness grows, the demand for sustainable options also rises. Notably, companies like Biocup are expanding into the U.S. market, focusing on biodegradable containers. This trend reflects a broader shift towards sustainable packaging.

On a broader scale, plastic pollution from disposable cups poses serious environmental threats. Annually, around 350 million tonnes of plastic waste are produced globally. In this context, governments are implementing regulations to reduce single-use plastics. For instance, many regions now ban polystyrene cups, pushing businesses to find alternatives. Consequently, this trend encourages the adoption of compostable and recyclable cups.

Key Takeaways

- The Disposable Cups Market was valued at USD 12.3 billion in 2024 and is expected to reach USD 18.0 billion by 2034, with a CAGR of 3.9%.

- In 2024, Paper Cups led the product type segment with 35.4%, driven by increasing adoption of biodegradable options.

- In 2024, Food Service dominated the end-use segment with 61.2%, supported by growing demand from cafes and restaurants.

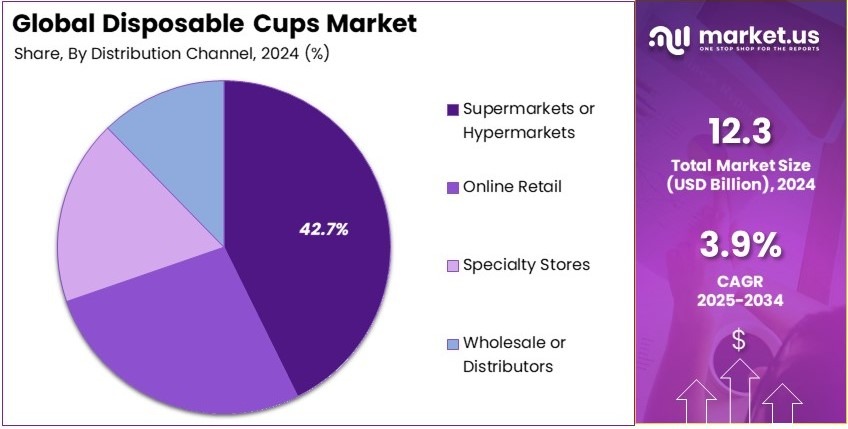

- In 2024, Supermarkets or Hypermarkets led the distribution channel with 42.7%, benefiting from strong retail presence.

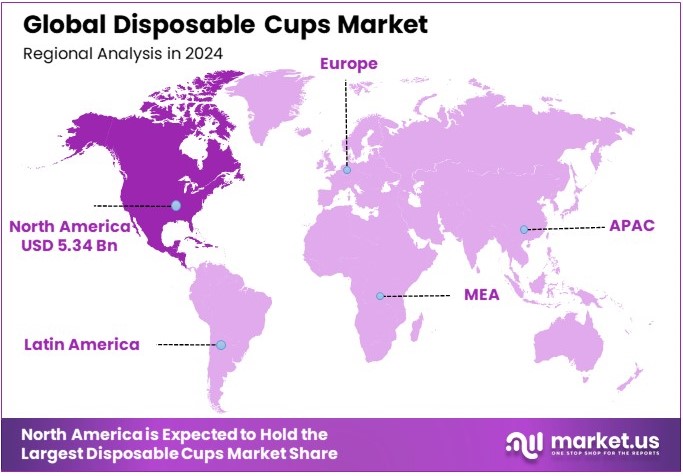

- In 2024, North America held 43.4% of the market, reaching USD 5.34 billion, due to high consumption of on-the-go beverages.

Business Environment Analysis

The Disposable Cups Market is nearing saturation in developed markets such as the United States and Europe. However, the increased focus on sustainability and recyclable materials presents opportunities for innovation and differentiation within this mature market.

The target demographic for disposable cups primarily includes the fast food industry, coffee shops, and event organizers. These sectors consistently demand high volumes, driven by consumer preferences for convenience and fast service. This demand highlights the need for products that balance utility with environmental concerns.

Product differentiation is becoming increasingly crucial as companies seek to stand out by offering cups made from biodegradable materials or featuring innovative designs. These features appeal to environmentally conscious consumers and can significantly influence purchasing decisions in a competitive market.

A value chain analysis reveals that cost efficiency in production and distribution is vital. Manufacturers that can scale their operations to reduce costs while adhering to environmental regulations are more likely to succeed. Additionally, strategic partnerships with raw material suppliers can enhance the supply chain’s sustainability.

Investment opportunities are abundant in developing markets where the expansion of the food service sector drives demand for disposable cups. These markets are projected to experience approx CAGR of 6.1% over the next several years, fueled by urbanization and changing consumer lifestyles.

Adjacent markets, such as disposable cutlery and takeout food containers, are also growing. These markets benefit from similar trends affecting the disposable cups sector, including shifts towards convenience and sustainability, offering opportunities for synergy and market expansion.

Product Type Analysis

Paper Cups dominate with 35.4% due to their eco-friendly attributes and wide usability.

The segment analysis for Disposable Cups highlights Paper Cups as the dominant sub-segment, capturing a substantial market share due to their environmental benefits and versatility in use.

The surge in popularity of paper cups is linked to increasing consumer awareness about sustainability and the push for products that reduce plastic waste. Paper cups are favored in both coffee shops and fast-food chains for serving hot and cold beverages, driven by their biodegradable nature and advancements in leak-proof technologies.

Hot Beverage Cups are essential in the daily operations of cafes and food service businesses, providing convenience for on-the-go consumers. Cold Beverage Cups, typically made from plastic, remain popular for iced drinks, though they face increasing scrutiny over environmental concerns.

Foam Cups, while cost-effective and great insulators, are declining in use due to environmental regulations. Plastic Cups are versatile but are being phased out in favor of more sustainable options like Biodegradable Cups, which are gaining ground due to their minimal environmental impact.

End-Use Analysis

Food Service leads with 61.2% owing to high demand in restaurants, cafes, and fast-food outlets.

In the Disposable Cups market, the Food Service sector emerges as the primary end-user, significantly outpacing other segments. This dominance is primarily due to the high volume of cups used in restaurants, cafes, and fast-food outlets where quick service and convenience are priorities. The vast usage of disposable cups in this sector is driven by the fast-paced lifestyle of consumers who prefer quick and easy access to beverages on-the-go.

Household usage, although smaller, is crucial during events or gatherings where convenience outweighs the need for durable utensils. Institutional settings such as schools and hospitals rely on disposable cups for hygiene and convenience. Corporate Offices, too, contribute to steady demand, often utilizing disposable cups for both employees and visitors to maintain a clean and efficient working environment.

Distribution Channel Analysis

Supermarkets or Hypermarkets dominate with 42.7% due to their widespread availability and consumer accessibility.

Supermarkets or Hypermarkets are currently leading the distribution channels for Disposable Cups, primarily because they offer consumers convenience and immediate accessibility to a wide range of cup options under one roof. The dominance of this channel is supported by the extensive reach and operational scale of these outlets, which cater to a large base of customers seeking variety and affordability.

Online Retail is rapidly growing as consumers shift towards e-commerce platforms for the ease of comparing products and direct-to-doorstep delivery. Specialty Stores play a niche role, often offering specialized or customized disposable cup solutions, which are particularly appealing for specific events or needs. Wholesale or Distributors are key to the B2B segment, supplying large quantities directly to end-use sectors like food service and institutional users, crucial for meeting bulk demand efficiently.

Key Market Segments

By Product Type

- Hot Beverage Cups

- Cold Beverage Cups

- Foam Cups

- Plastic Cups

- Paper Cups

- Biodegradable Cups

By End-Use

- Food Service

- Household

- Institutional

- Corporate Offices

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Wholesale/Distributors

Driving Factors

Growing Demand for Convenient Packaging Drives Market Growth

The disposable cups market is experiencing significant growth, primarily driven by the rising demand from the foodservice and beverage industry. Restaurants, cafes, and quick-service outlets increasingly rely on disposable cups for serving beverages due to their convenience and practicality. This trend is fueled by the fast-paced lifestyle of modern consumers who prefer ready-to-go options.

Additionally, the popularity of on-the-go coffee and cold beverages continues to boost the market. Busy professionals and urban dwellers often pick up their morning coffee or a chilled drink while commuting, making disposable cups an essential part of their routine. To cater to this demand, cafes and beverage chains are consistently adopting disposable cup solutions.

Moreover, the expansion of biodegradable and compostable disposable cups is addressing environmental concerns, attracting consumers and businesses looking for sustainable packaging. Companies are increasingly adopting cups made from PLA, sugarcane bagasse, or other eco-friendly materials to align with sustainability goals.

In addition, the adoption of custom-printed and branded disposable cups is rising. Businesses see value in using cups as a marketing tool, incorporating logos and promotional designs to enhance brand visibility. This trend is especially noticeable in coffee chains and food trucks. Consequently, the combination of convenience, sustainability, and branding is driving the disposable cups market forward.

Restraining Factors

Environmental Regulations and Raw Material Costs Restrain Market Growth

Stringent environmental regulations on single-use plastics and paper waste present significant challenges for the disposable cups market. Governments worldwide are implementing bans or restrictions on single-use plastic products, including cups, to reduce environmental pollution. These regulations compel manufacturers to shift towards eco-friendly materials, which can increase production costs.

Moreover, the market faces high competition from reusable and recyclable cup alternatives. As consumers become more environmentally conscious, reusable cup initiatives are gaining traction in cafes and restaurants. This shift reduces demand for single-use disposable cups.

Another restraint is the fluctuation in raw material prices. The cost of paper, plastic, and compostable materials can vary due to supply chain issues or changes in global demand. These fluctuations impact profit margins, making it challenging for manufacturers to maintain competitive pricing.

Additionally, health concerns related to plastic-based cups are affecting market perception. Some disposable cups contain harmful chemicals, such as BPA, which can leach into hot beverages. This has led to increased scrutiny and consumer reluctance, particularly regarding plastic cups. Addressing these issues through innovation and sustainable practices is essential to maintaining market stability.

Growth Opportunities

Edible and Smart Cups Provide Opportunities

The disposable cups market is witnessing new opportunities with the development of innovative and eco-friendly products. One of the most exciting areas is the creation of edible and water-soluble cups. These cups offer a zero-waste solution, appealing to environmentally conscious consumers. Brands introducing flavored or biodegradable edible cups are capturing attention, particularly in niche markets like festivals or eco-friendly cafes.

Furthermore, the emergence of smart cups with temperature-sensitive and spill-resistant designs presents another opportunity. These cups enhance customer experience by indicating beverage temperature or preventing spills, making them highly suitable for coffee shops and mobile drink vendors.

Specialty cups designed specifically for bubble tea, cold brews, and smoothies are also in demand. These drinks require durable, leak-proof, and aesthetically pleasing cups, creating a niche market segment. Brands that cater to this demand with unique designs and features are seeing positive responses.

Moreover, the growth of e-commerce and subscription-based supply chains supports bulk disposable cup orders. Foodservice operators and event planners benefit from regular deliveries, ensuring they always have sufficient stock. This business model offers consistent revenue for manufacturers while meeting the ongoing needs of large-scale consumers.

Emerging Trends

Stylish and Functional Cups Are Latest Trending Factor

Disposable cups are becoming more than just beverage containers; they are now fashion statements and functional innovations. The rising popularity of minimalist and aesthetic designs caters to consumers who value style, especially those active on social media. Cafes that use visually appealing cups often see an increase in customer engagement, as patrons share their experiences online.

Furthermore, there is growing use of sustainable materials like sugarcane bagasse and PLA in the production of disposable cups. These materials not only reduce environmental impact but also appeal to eco-conscious customers. The shift towards plant-based alternatives aligns with consumer expectations for sustainable product choices.

Additionally, smart QR code-embedded cups are gaining traction. These codes link to interactive content, such as loyalty programs or product information, offering businesses a unique way to connect with customers. This integration of technology into everyday items enhances brand interaction and customer experience.

Lastly, the demand for double-walled and insulated cups is increasing, particularly in the coffee and tea sector. These cups maintain beverage temperature while preventing heat transfer to the hands, making them practical for hot drinks. Brands that offer stylish and functional disposable cups are well-positioned to attract modern, style-conscious consumers.

Regional Analysis

North America Dominates with 43.4% Market Share in the Disposable Cups Market

North America leads the Disposable Cups Market with a commanding 43.4% share, totaling USD 5.34 billion. This dominance is largely due to high consumer demand driven by convenience culture, widespread quick-service restaurants, and coffee shops where disposable cups are essential.

The region’s market strength is further supported by advanced manufacturing capabilities and robust supply chains that ensure efficient production and distribution of disposable cups. Additionally, increasing awareness of eco-friendly options has led to innovations in biodegradable and recyclable cup designs, catering to the growing demand for sustainable solutions.

The future influence of North America in the Disposable Cups Market looks strong. With ongoing trends towards sustainability and innovations in cup materials, the region is expected to maintain or even increase its market share. The adoption of eco-friendly practices by major corporations and consumers alike will likely keep North America at the forefront of the market.

Regional Mentions:

- Europe: Europe holds significant market share, driven by environmental concerns and strict regulations on single-use plastics. The shift towards sustainable materials in disposable cups is prominent, with many countries implementing bans on traditional plastic cups.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the Disposable Cups Market due to urbanization and the expansion of the food service industry. The region’s large population and increasing middle class contribute to higher consumption rates.

- Middle East & Africa: The Middle East and Africa are gradually increasing their presence in the market, with investments in the food service sector and a growing preference for convenience among consumers. The region is also starting to adopt more sustainable practices.

- Latin America: Latin America is embracing disposable cups as part of its burgeoning food service industry. The region is witnessing a shift towards quick-service formats and on-the-go consumption, which supports the growth of the disposable cups market.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Disposable Cups Market, Churchill Container, Pactiv Evergreen, Sirius Plastics, and Berry Global Group Inc. are among the top companies influencing the market landscape. These players are pivotal in setting industry standards, driving innovation, and responding to shifting consumer preferences.

Churchill Container offers a range of customizable disposable cup solutions, making them a favorite among businesses looking to brand their drinkware. Their focus on both aesthetics and functionality appeals to a diverse clientele.

Pactiv Evergreen is renowned for its large scale and extensive product lineup, catering to a wide array of industries from food service to healthcare. Their commitment to sustainability is evident in their increasing shift towards eco-friendly materials.

Sirius Plastics stands out for its specialized offerings in plastic cup solutions. Their products are geared towards durability and cost-efficiency, catering to both high-volume commercial clients and end consumers.

Berry Global Group Inc. leads with innovation in barrier technologies and recycling initiatives. Their products are designed to meet stringent food safety standards while pushing the envelope on reducing environmental impact.

These leading companies in the Disposable Cups Market are essential drivers of growth, continually adapting to environmental policies and consumer demands for sustainable, convenient, and safe products. Their ongoing innovation and strategic market expansions are set to keep them at the forefront of the industry.

Major Companies in the Market

- Churchill Container

- Pactiv Evergreen

- Sirius Plastics

- Berry Global Group Inc.

- Dart Container Corp.

- Georgia-Pacific LLC

- Fuling Global, Inc.

- Lika Cup Company

- Morrison Cup Solutions

- Karat Packaging Inc.

- Eco-Products

- Huhtamaki

- Solo Cup Company

Recent Developments

- Amcor and Berry Global Group: In November 2024, Amcor announced its acquisition of Berry Global Group through a scrip merger valued at approximately $8.4 billion. This strategic acquisition positions Amcor as the world’s largest plastic packaging company, significantly expanding its presence across North America, Western Europe, and emerging markets. The merged entity is expected to generate annual sales of around $23.9 billion.

- Smart Cups: In July 2024, Smart Cups set a new funding goal of $2.3 million on StartEngine to support the scaling of operations, diversification of product lines, and entry into new markets. Additionally, Smart Cups entered into a Cooperative Research and Development Agreement with the U.S. Army Combat Capabilities Development Command Soldier Center to explore innovative applications of its beverage delivery technology.

Report Scope

Report Features Description Market Value (2024) USD 12.3 Billion Forecast Revenue (2034) USD 18.0 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hot Beverage Cups, Cold Beverage Cups, Foam Cups, Plastic Cups, Paper Cups, Biodegradable Cups), By End-Use (Food Service, Household, Institutional, Corporate Offices), By Distribution Channel (Online Retail, Supermarkets or Hypermarkets, Specialty Stores, Wholesale or Distributors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Churchill Container, Pactiv Evergreen, Sirius Plastics, Berry Global Group Inc., Dart Container Corp., Georgia-Pacific LLC, Fuling Global, Inc., Lika Cup Company, Morrison Cup Solutions, Karat Packaging Inc., Eco-Products, Huhtamaki, Solo Cup Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Churchill Container

- Pactiv Evergreen

- Sirius Plastics

- Berry Global Group Inc.

- Dart Container Corp.

- Georgia-Pacific LLC

- Fuling Global, Inc.

- Lika Cup Company

- Morrison Cup Solutions

- Karat Packaging Inc.

- Eco-Products

- Huhtamaki

- Solo Cup Company