Global Direct-to-Chip Liquid Cooling Market Size, Share Analysis Report By Solution Type (Single-phase liquid cooling, Two-phase liquid cooling), By Component Cooling (CPU cooling, GPU cooling, ASIC cooling, Memory cooling, Other), By Liquid Coolant Type (Water-based coolants, Dielectric fluids, Mineral oils, Engineered fluids), By Application (Datacenter, Workstations, High-performance computing (HPC), Edge computing devices, Supercomputers, Others), By End Use (Telecommunications, Financial services, Healthcare and life sciences, Oil and gas, Aerospace and defense, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151527

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- US Market Expansion

- Solution Type Analysis

- Component Cooling Analysis

- Liquid Coolant Type Analysis

- Application Analysis

- End Use Analysis

- Key Market Segments

- Emerging Trend

- Market Driver

- Market Restraint

- Market Opportunity

- Market Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

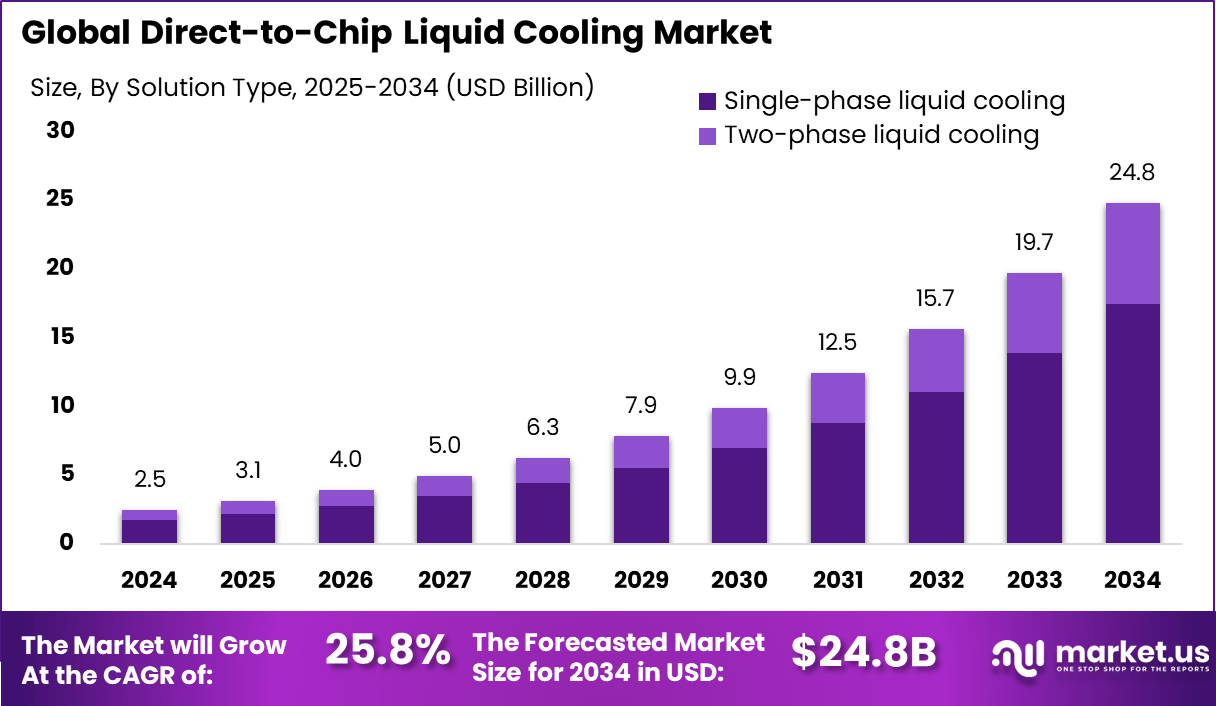

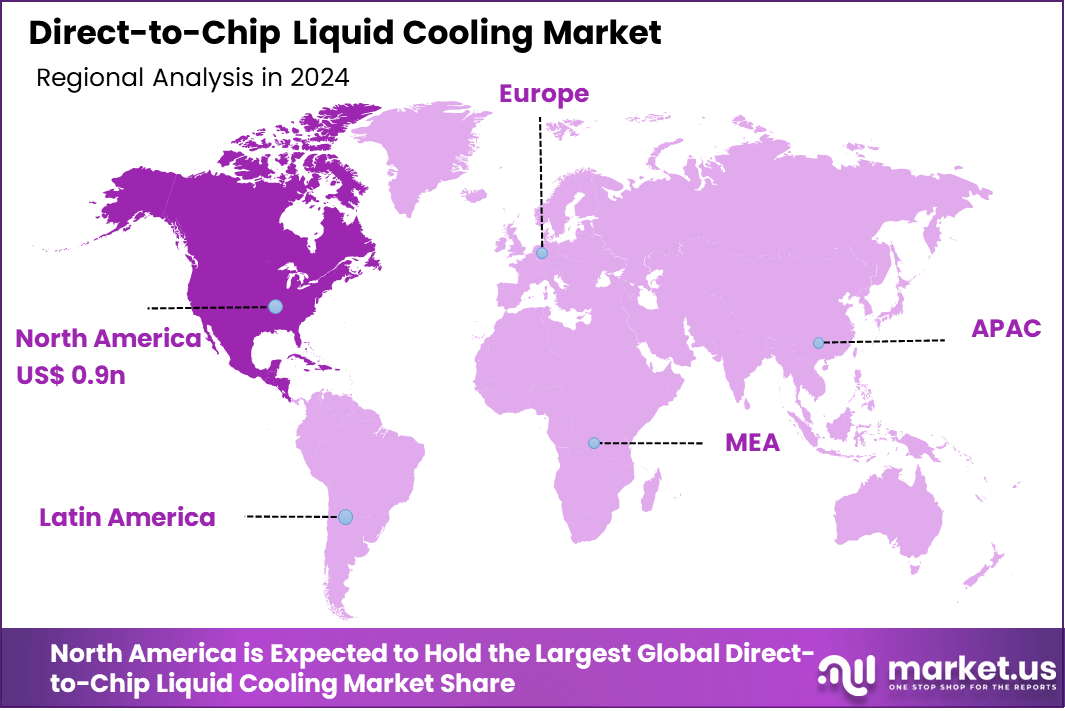

The Global Direct-to-Chip Liquid Cooling Market size is expected to be worth around USD 24.8 Billion By 2034, from USD 2.5 billion in 2024, growing at a CAGR of 25.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.2% share, holding USD 0.9 Billion revenue.

The Direct-to-Chip Liquid Cooling (D2C) market focuses on cooling systems that transfer heat away from high-performance processors by circulating fluid directly through cold plates attached to chips such as CPUs and GPUs. This design enables much faster and more efficient heat removal compared to air-based methods. It supports the growing need for high-density computing and helps maintain optimal performance levels, especially in hyperscale data centers and AI-driven infrastructures.

One of the top drivers is the increase in processor power consumption. With chips now reaching heat densities beyond 1 kW, traditional air cooling fails to maintain safe operating conditions. Liquid cooling systems address this by reducing thermal resistance and improving temperature stability, which leads to longer hardware life and uninterrupted system performance.

For instance, In March 2025, CoolIT launched a new cold plate tailored for direct-to-chip (D2C) liquid cooling in data centers, focusing on efficient thermal management for high-performance components like CPUs and GPUs. Drawing from technologies used in AIO and custom liquid cooling in PCs, this solution delivers improved cooling performance for intensive data center workloads.

Environmental concerns are also accelerating this shift, as liquid cooling reduces both electricity and water usage. Studies show that data centers using advanced D2C systems can cut cooling energy by up to 82% compared to conventional systems. Demand is high in sectors that rely on constant high-performance computing. These include AI model training, high-frequency trading, and large-scale scientific simulations.

Organizations are adopting these systems for various reasons. Beyond better temperature control, D2C lowers noise levels, reduces reliance on fans, and supports compact rack configurations. These benefits translate into operational cost savings and smaller facility footprints. Additionally, some systems allow for heat reuse, enabling further energy efficiency in line with net-zero goals.

Key Takeaways

- The global direct-to-chip liquid cooling market is expected to reach USD 24.8 billion by 2034, expanding at a rapid CAGR of 25.8% from 2025 to 2034.

- In 2024, North America led the market with over 37.2% share, generating approximately USD 0.9 billion, driven by robust datacenter infrastructure growth.

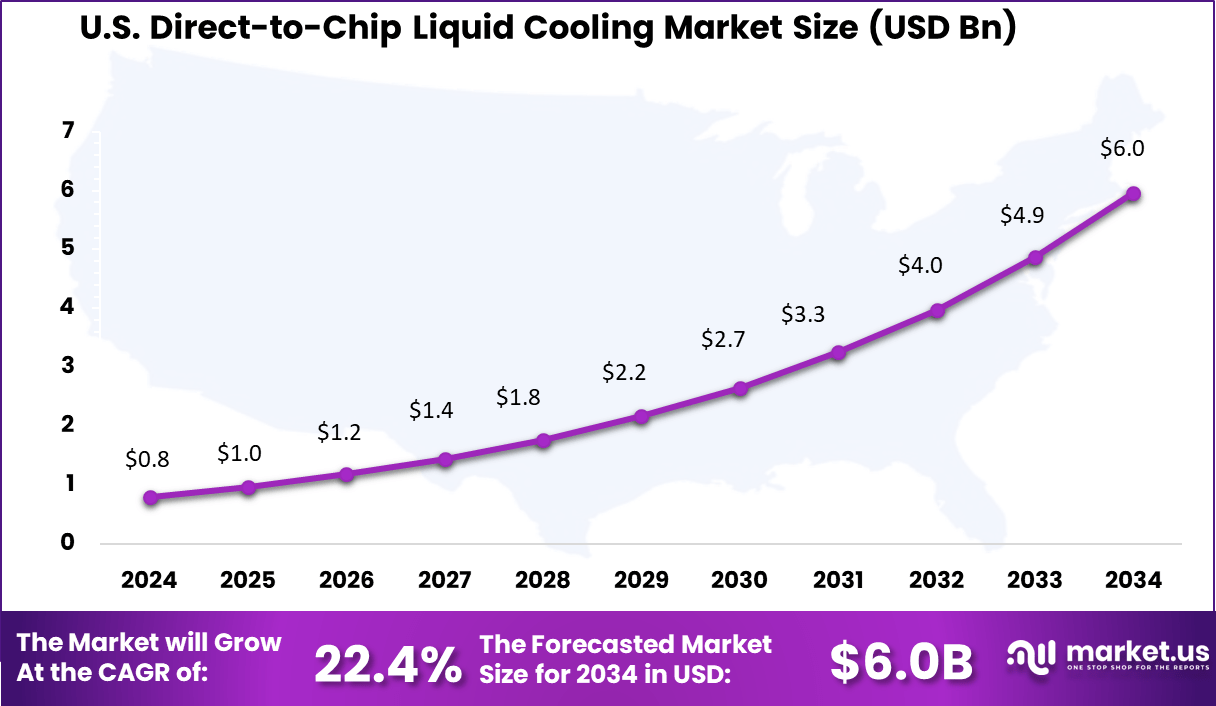

- The U.S. market alone reached USD 0.79 billion in 2024 and is advancing at a strong CAGR of 22.4%, fueled by energy-efficient cooling demand in hyperscale facilities.

- Single-phase liquid cooling dominated the solution type segment, capturing 70.4% share, due to its lower complexity and ease of integration.

- In component-level use, CPU cooling accounted for 34.7%, supported by rising thermal output in high-performance computing.

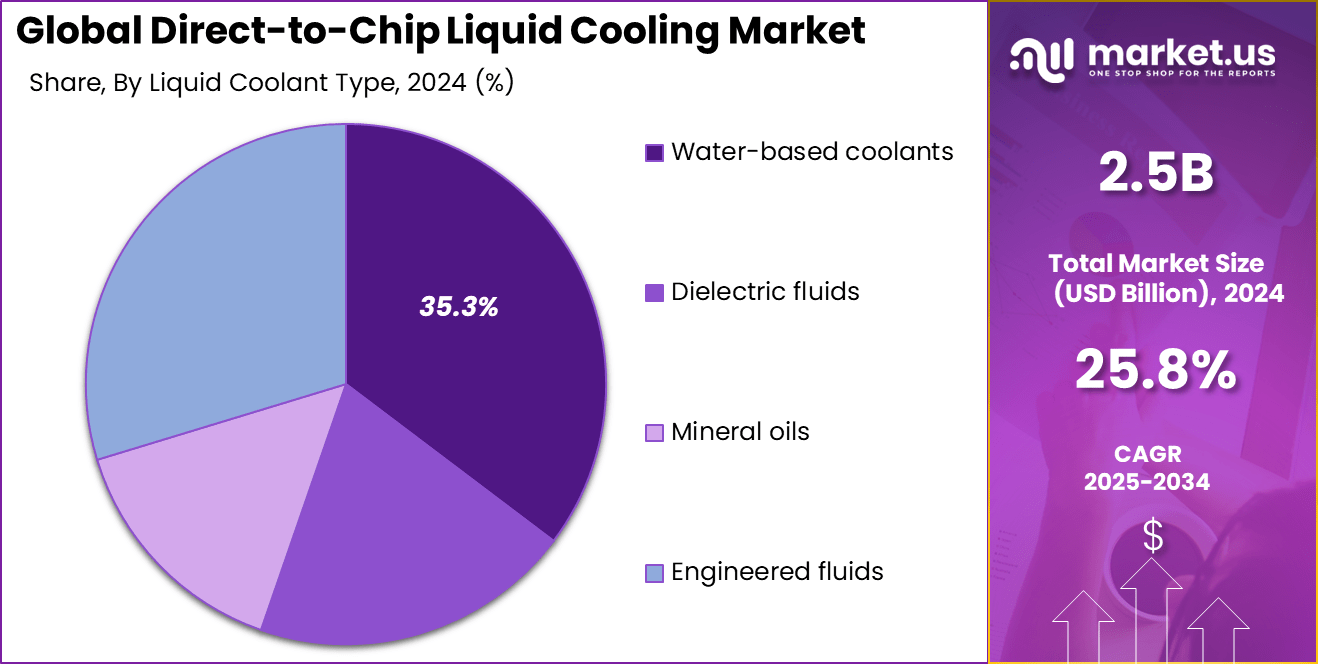

- Water-based coolants led the liquid coolant type segment with a 35.3% share, offering a balance of safety, cost-efficiency, and heat transfer capability.

- The datacenter segment held 30.9% share, underscoring growing reliance on liquid cooling for server rack optimization and sustainability targets.

- Among end users, telecommunications dominated with 32.2%, driven by increasing network densification and 5G infrastructure deployment.

US Market Expansion

The U.S. direct-to-chip liquid cooling market was valued at USD 0.8 Billion in 2024 and is anticipated to reach approximately USD 6.0 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 22.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 37.2% share, accounting for approximately USD 0.9 billion in revenue. This leadership can be attributed to the rising demand for energy-efficient and high-performance cooling solutions across hyperscale data centers and advanced computing facilities.

The region has witnessed significant adoption of direct-to-chip liquid cooling systems, particularly within the United States, where AI workloads, cloud infrastructure, and high-density server deployments have accelerated rapidly. Moreover, increasing concerns over carbon emissions and electricity usage have pushed North American operators to shift from traditional air cooling to liquid-based alternatives.

Governmental emphasis on sustainable IT infrastructure and rising investments from tech giants have further strengthened the demand. The availability of robust R&D ecosystems, early adoption of liquid cooling technologies, and growing awareness about thermal management in AI and HPC systems have provided the region with a strong competitive edge.

Solution Type Analysis

In 2024, the Single‑phase liquid cooling segment held a dominant market position, capturing more than 70.4% share of the direct-to-chip liquid cooling market. This segment’s leading status can be attributed to its simpler architecture, lower implementation cost, and scalable integration into existing data center environments.

Single-phase systems circulate a dielectric or water-based liquid directly over the heat source without involving a phase change. This allows for steady and reliable thermal performance while minimizing risks related to fluid handling and system complexity. For data centers transitioning from air-based to liquid-based cooling, single-phase systems provide a more manageable starting point, especially in large-scale deployments.

The segment’s popularity is also supported by its ease of maintenance and longer operational lifespan. With fewer variables such as pressure control or vapor management involved, single-phase setups require less technical supervision. These systems have proven effective in cooling CPUs and GPUs across enterprise-grade computing environments, where heat loads are rising due to AI and machine learning workloads.

Component Cooling Analysis

In 2024, CPU cooling segment held a dominant market position, capturing more than a 34.7% share of the direct‑to‑chip liquid cooling market. This leadership is driven by the escalating demand for efficient thermal management across data centers, high‑performance computing (HPC), and enterprise IT environments.

Modern CPUs are generating increasingly high power densities due to advanced process technologies and elevated clock speeds. Direct‑to‑chip solutions provide more effective heat dissipation than air-based methods, enabling processors to maintain sustained performance under heavy workloads. The dominance of CPU cooling is reinforced by its broad applicability and relative implementation simplicity when compared to GPU or ASIC cooling.

CPU cooling systems were the earliest liquid-cooled components to be widely adopted, benefiting from matured cold‑plate designs and streamlined integration procedures. These systems support both legacy and next‑generation servers, making retrofits and new deployments more straightforward. As a result, operators prioritize CPU cooling within their liquid cooling strategies – favoring predictable reliability, ease of maintenance, and proven return on investment – especially under regulatory and sustainability mandates.

Liquid Coolant Type Analysis

In 2024, Water-based coolants segment held a dominant market position, capturing more than a 35.3% share in the direct-to-chip liquid cooling market. This leadership is largely due to the high thermal conductivity of water-based fluids, enabling rapid and efficient heat dissipation at the chip level. Their relative affordability and ease of sourcing further strengthen their appeal for data center and high-performance computing applications.

Operationally, water-based fluids – typically water-glycol mixtures – offer a practical balance between performance and maintainability. Their familiarity to engineering teams, established handling procedures, and compatibility with many existing system infrastructures simplify design, installation, and servicing. As cooling demands rise with increased computing density, these coolants continue to deliver consistent results without significant system redesign.

For instance, In February 2025, ZutaCore® strengthened its leadership team by appointing two experienced executives to support rising global demand for its waterless, two-phase direct liquid cooling technology, aimed at advancing efficiency in AI data centers.

However, while their dominance is clear, water-based coolants do present certain considerations such as corrosion control and potential biological growth, which necessitate preventative measures like corrosion inhibitors and routine water quality monitoring. Despite these challenges, the combination of high thermal efficiency, cost-effectiveness, and operational maturity ensures that water-based solutions remain the leading choice in current direct-to-chip cooling strategies.

Application Analysis

In 2024, Datacenter segment held a dominant market position, capturing more than a 30.9 % share of the direct‑to‑chip liquid cooling market. This leadership reflects the rapid replacement of traditional air‑cooling with more efficient liquid systems in hyperscale and enterprise data centre environments.

Direct‑to‑chip cooling allows for higher rack densities and delivers superior thermal performance, responding to the surge of AI, cloud computing, and big data workloads. The method’s precise chip‑level cooling enhances energy efficiency and reduces operational costs and power usage effectiveness (PUE), making it a preferred choice among data centre operators seeking sustainability and performance.

The segment’s dominance is further reinforced by the maturity of supporting technologies, such as coolant distribution units and cold plates, which offer reliable control over temperature and flow. Integration with existing rack architectures and minimal infrastructural disruption facilitate widespread deployment across new and upgraded facilities.

End Use Analysis

In 2024, Telecommunications segment held a dominant market position, capturing more than a 32.2 % share of the direct‑to‑chip liquid cooling end‑use market. This dominance is driven by telecom operators’ increasing deployment of edge data centers, 5G infrastructure, and network function virtualization systems, all generating high chip‑level heat loads.

Liquid cooling directly addresses thermal and energy efficiency requirements, reducing power usage effectiveness (PUE) and enabling compact modules within telecom facilities – critical as telecom networks decentralize to support ultra-low-latency services. Additionally, the telecom sector’s demand for real-time processing in AI-enhanced networks has accelerated adoption.

For instance, In January 2025, ZutaCore presented its HyperCool technology at the Pacific Telecommunications Council (PTC) event in Honolulu, highlighting its focus on enhancing energy efficiency, cost-effectiveness, and sustainability in AI factories and data centers.

Operators have integrated direct-to-chip cooling to manage high-density server racks while maintaining uptime for mission-critical applications. Their infrastructure strategies now foreground energy resilience and environmental responsibility, and liquid cooling aligns with these priorities by lowering energy consumption and carbon footprint.

Key Market Segments

By Solution Type

- Single-phase liquid cooling

- Two-phase liquid cooling

By Component Cooling

- CPU cooling

- GPU cooling

- ASIC cooling

- Memory cooling

- Other

By Liquid Coolant Type

- Water-based coolants

- Dielectric fluids

- Mineral oils

- Engineered fluids

By Application

- Datacenter

- Workstations

- High-performance computing (HPC)

- Edge computing devices

- Supercomputers

- Others

By End Use

- Telecommunications

- Financial services

- Healthcare and life sciences

- Oil and gas

- Aerospace and defense

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Modular Edge Cooling Systems

A key trend emerging in 2024 is the rise of compact, modular direct-to-chip cooling units tailored for edge computing sites. These systems are designed to support distributed architectures like 5G and edge AI, where traditional air cooling proves inefficient.

By deploying liquid-cooled modules near data generation points, operators can significantly reduce thermal losses and latency. This approach allows for quicker deployment and greater energy efficiency in space-constrained environments.

The trend aligns with growing demand for localized compute infrastructure to power applications such as autonomous vehicles, smart factories, and immersive content delivery. Modular liquid cooling also simplifies maintenance and reduces water and energy consumption, making it a preferred option for future-ready edge facilities.

Market Driver

AI and High-Density Compute Growth

The rapid rise in AI-driven workloads is placing unprecedented stress on data center infrastructure, particularly in cooling systems. As chips become denser and more power-hungry, traditional air-cooling methods are proving insufficient. Direct-to-chip liquid cooling enables precise, chip-level heat extraction, allowing processors to perform at peak efficiency without thermal throttling.

Data centers investing in AI, machine learning, and GPU-intensive workloads are increasingly adopting direct-to-chip cooling to manage these thermal loads. Its ability to maintain consistent operating temperatures under sustained processing demand positions it as a vital technology supporting the next wave of computational growth.

Market Restraint

High Initial Implementation Costs

Despite the technical advantages of direct-to-chip liquid cooling, its adoption is hindered by high upfront capital requirements. Setting up the system involves customized cold plates, fluid circulation networks, monitoring sensors, and integration with existing server infrastructure. For smaller enterprises or legacy facilities, these investments often present financial constraints.

Furthermore, operational staff may require retraining to handle liquid systems safely, adding to the transitional cost. These factors combine to slow down deployment among operators without immediate high-density cooling needs, despite long-term cost savings on energy and maintenance.

Market Opportunity

Retrofit Solutions for Sustainable Infrastructure

As data center operators face mounting pressure to reduce carbon emissions and meet energy-efficiency regulations, retrofitting existing facilities with direct-to-chip liquid cooling presents a major growth opportunity. This pathway allows companies to enhance cooling efficiency without completely overhauling their infrastructure. Retrofitting also supports compliance with global energy standards and green data initiatives.

Vendors providing adaptable cooling solutions, custom cold plate kits, and hybrid deployment options are well positioned to capture this segment. The market stands to benefit from rising awareness of sustainable IT operations and the long-term economic value of retrofitting over rebuilding.

Market Challenge

Coolant Management and Compatibility Risks

Managing liquid coolants brings unique operational challenges. Proper selection, containment, and monitoring of the fluid are critical to avoid system damage. Water-based coolants, for instance, may introduce risks of corrosion or microbial growth if not properly treated, while dielectric fluids involve higher handling costs and specific safety requirements.

Additionally, compatibility issues may arise with certain chip architectures or server designs, making custom engineering necessary. Ensuring seamless integration across multi-vendor hardware ecosystems remains a persistent challenge for IT teams deploying direct-to-chip solutions at scale. This complexity calls for more robust industry standards and certification processes.

Key Player Analysis

Asetek has remained a pioneering force in the direct-to-chip liquid cooling space, leveraging its deep experience in thermal management solutions originally developed for gaming and enthusiast markets. In recent years, the company has strategically repositioned itself toward enterprise and data center applications by developing advanced cold plate designs compatible with high-density server environments.

CoolIT Systems continues to strengthen its leadership through focused innovation and a strong portfolio of liquid cooling technologies tailored for hyperscale, cloud, and enterprise data centers. The company has actively expanded its presence by entering long-term supply agreements with key OEM partners and infrastructure providers.

ZutaCore is disrupting the market with its two-phase liquid cooling architecture, which offers high thermal transfer capabilities using non-conductive dielectric fluids. The company has signed multiple strategic partnerships with global data center integrators and hardware manufacturers to promote its HyperCool technology.

Vertiv Holdings Co has expanded its thermal management portfolio to include direct-to-chip liquid cooling systems through both organic development and acquisitions. The company focuses on integrated infrastructure, offering end-to-end systems that align with evolving data center cooling requirements.

Iceotope Technologies is gaining visibility with its innovative approach to chassis-level liquid cooling, offering precision cooling through sealed enclosures. While slightly different from traditional cold plate systems, Iceotope’s solution still qualifies as a direct-to-chip approach due to its close-contact thermal transfer.

Top Key Players Covered

- Asetek

- Advanced Micro Devices, Inc.

- Chilldyne, Inc.

- CoolIT Systems

- Fujitsu Ltd.

- Iceotope Technologies

- JETCOOL Technologies Inc.

- LiquidStack

- Schneider Electric

- Submer

- Vertiv Holdings Co

- ZutaCore

- Others

Recent Developments

- In April 2025, JetCool Technologies Inc. introduced the SmartSense Coolant Distribution Unit (CDU), a modular in-rack liquid-to-liquid cooling solution capable of handling up to 300kW per rack and over 2MW per row. Designed for data centers and colocation providers, the CDU enables free cooling with inlet temperatures above 60°C, eliminating the need for chillers while reducing energy and water consumption.

- In March 2025, Accelsius unveiled its NeuCool™ two-phase direct-to-chip liquid cooling solution at Data Centre World London. Through a live tabletop demo and multi-GPU server setups, the company demonstrated how NeuCool™ improves thermal efficiency for next-generation data center workloads.

- In June 2024, Asetek formed a strategic alliance with U.S.-based FABRIC8 LABS to advance desktop liquid cooling solutions. This partnership led to the development of an AI-optimized cold plate using ECAM (Electrochemical Additive Manufacturing) technology, aiming to enhance thermal performance across commercial and consumer-grade systems.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 24.8 Bn CAGR (2025-2034) 25.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution Type (Single-phase liquid cooling, Two-phase liquid cooling), By Component Cooling (CPU cooling, GPU cooling, ASIC cooling, Memory cooling, Other), By Liquid Coolant Type (Water-based coolants, Dielectric fluids, Mineral oils, Engineered fluids), By Application (Datacenter, Workstations, High-performance computing (HPC), Edge computing devices, Supercomputers, Others), By End Use (Telecommunications, Financial services, Healthcare and life sciences, Oil and gas, Aerospace and defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Asetek, Advanced Micro Devices, Inc., Chilldyne, Inc., CoolIT Systems, Fujitsu Ltd., Iceotope Technologies, JETCOOL Technologies Inc., LiquidStack, Schneider Electric, Submer, Vertiv Holdings Co, ZutaCore, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Direct-to-Chip Liquid Cooling MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Direct-to-Chip Liquid Cooling MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Asetek

- Advanced Micro Devices, Inc.

- Chilldyne, Inc.

- CoolIT Systems

- Fujitsu Ltd.

- Iceotope Technologies

- JETCOOL Technologies Inc.

- LiquidStack

- Schneider Electric

- Submer

- Vertiv Holdings Co

- ZutaCore

- Others