Global Digital Ticketing Market Share Analysis Report By Platform Type(Web-Based, Mobile-Based, Kiosk-Based (Self-service Terminals), By Offering (Software, Services), By Application (Transportation, Entertainment & Events, Government & Civic Utilities, Others), By Technology(QR Code-Based, NFC-Based, Barcode-Based, Biometric/Face Recognition-Based, Blockchain-Enabled Ticketing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153526

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

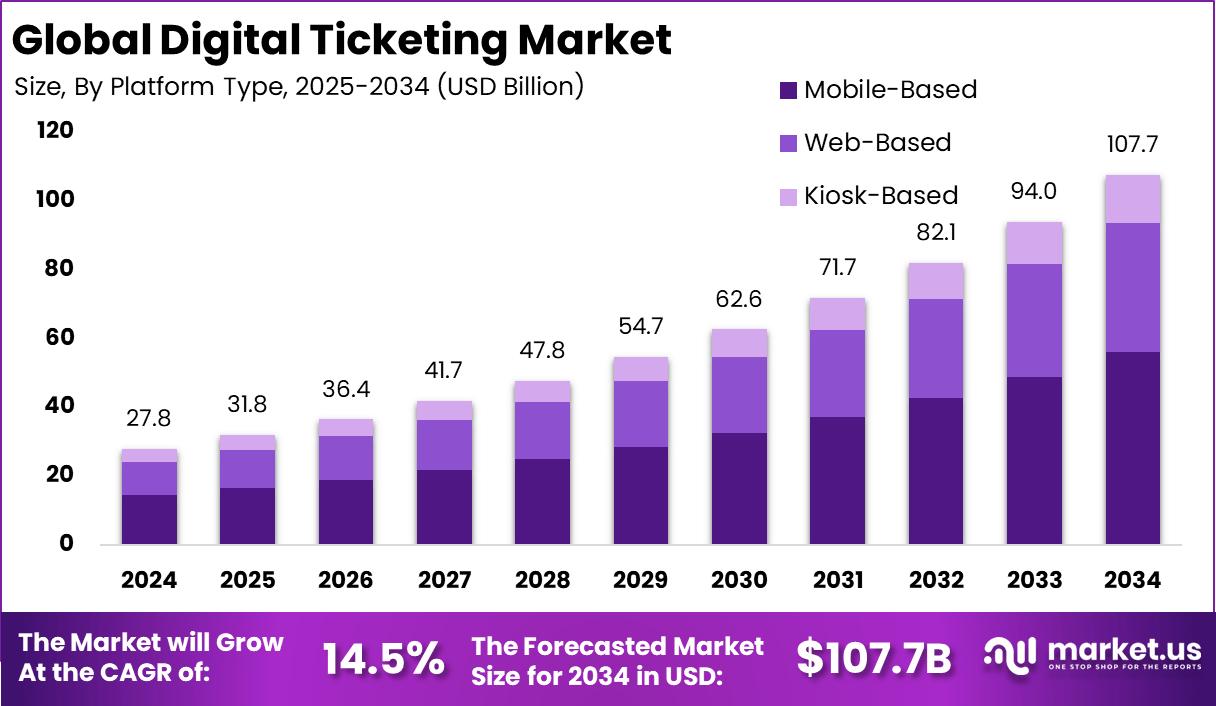

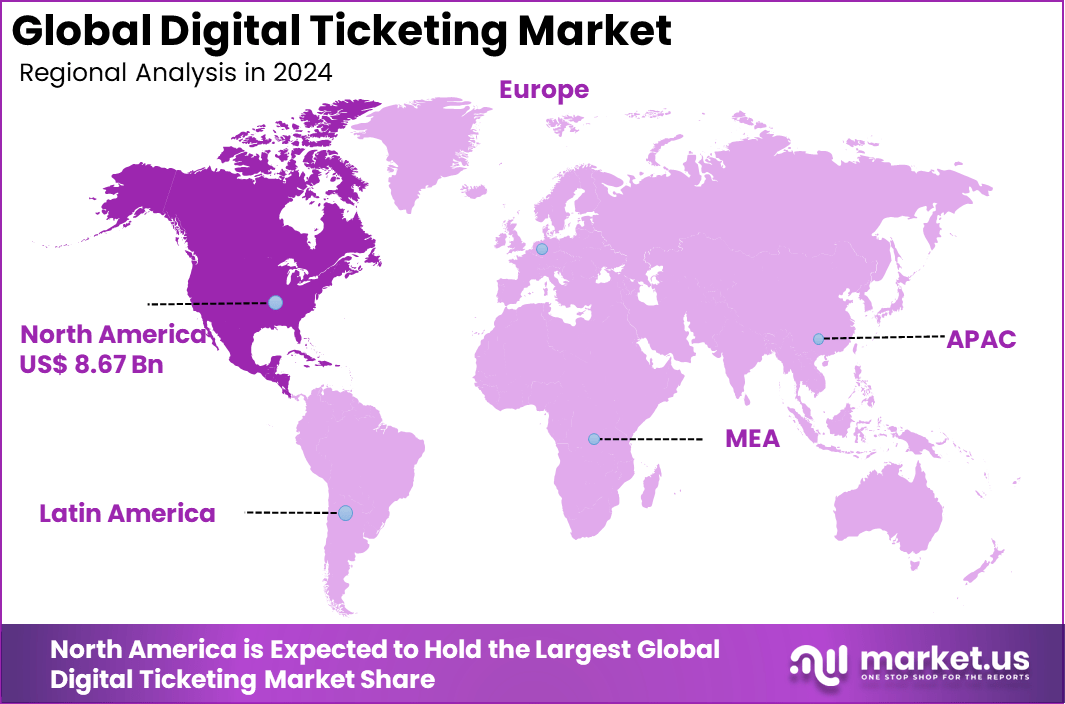

The Global Digital Ticketing Market size is expected to be worth around USD 107.7 billion by 2034, from USD 27.8 billion in 2024, growing at a CAGR of 14.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 31.2% share, holding USD 8.67 billion in revenue.

The digital ticketing market has experienced significant transformation as event organizers, transit systems, and entertainment platforms pivot toward fully digital workflows. This landscape has been reshaped by the integration of mobile wallets, QR codes, contactless systems, and blockchain. The surge in smartphone usage and internet availability has facilitated an entirely digital approach to ticket issuance and validation, replacing legacy paper-based methods.

According to Gitnux, around 70% of consumers prefer buying tickets through their smartphones, indicating a strong shift toward mobile-first experiences. Event ticketing fraud causes an estimated $10 billion in global losses each year, highlighting the need for more secure platforms. About 30% of event organizers are now using AI tools to manage ticketing and improve customer service.

Scope and Forecast

Report Features Description Market Value (2024) USD 27.8 Bn Forecast Revenue (2034) USD 107.7 Bn CAGR (2025-2034) 14.5% Largest Segment Software Segment (71%) Largest Market North America [31.2% market share] Top driving factors underpinning this evolution include widespread smartphone penetration, the demand for touch-free experiences, and heightened concerns around fraud. Smartphones now commonly act as digital ticket wallets, easing purchase, storage, and validation all in a single device and simultaneously reducing costs associated with paper production and logistics.

A rigorous demand analysis reveals strong uptake in sectors such as live entertainment, sports, public transit, and hybrid events. Entertainment venues have embraced digital ticketing to streamline entry flow and cut down on staff overhead. Public transit systems have adopted contactless and mobile validation to improve throughput and reduce queues.

For instance, in 2025, Arriva expanded its digital ticketing platform after securing a new contract, boosting its role in public transport. This move allowed the company to deliver more accessible and user-friendly ticketing across wider regions. The development reflects a growing shift among transport operators toward digital solutions to modernize services and better meet passenger expectations.

Key Takeaway

- In 2024, North America emerged as the leading region, accounting for 31.2% of the global market and generating USD 8.67 billion in revenue.

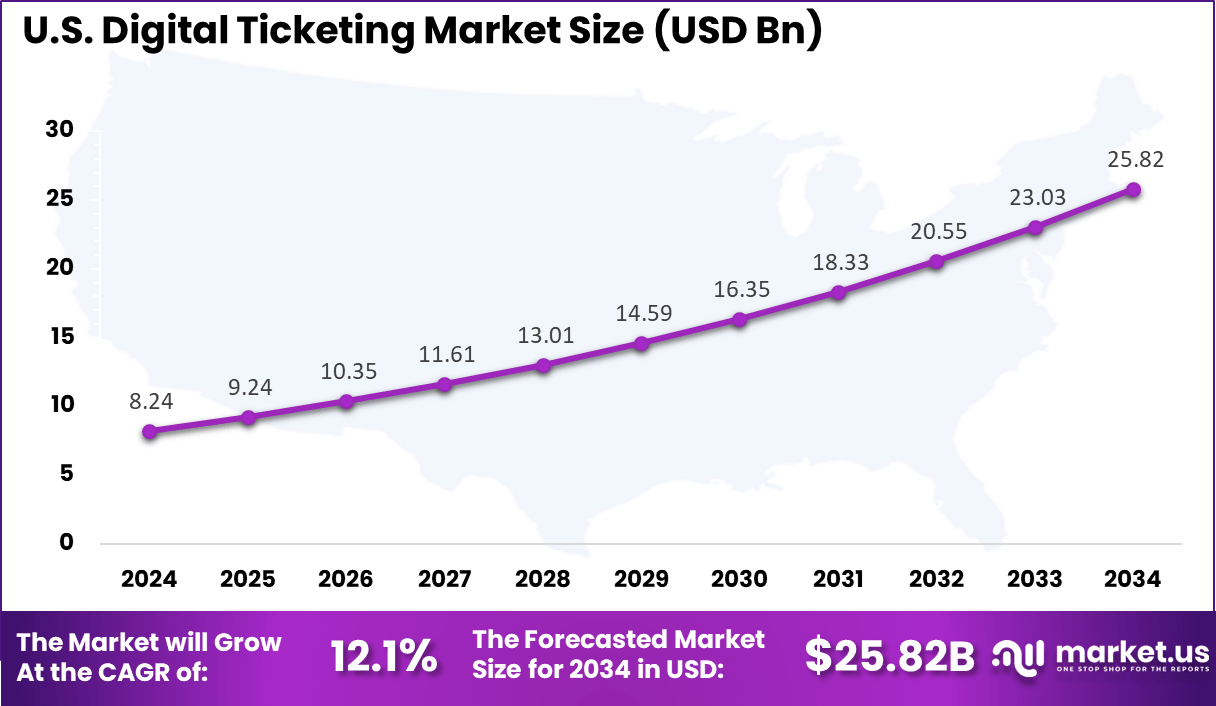

- The United States alone contributed USD 8.24 billion, with a CAGR of 12.1%, reflecting high adoption in urban and entertainment-focused economies.

- By platform type, mobile-based solutions dominated with 52% share. This trend is driven by smartphone ubiquity and the preference for contactless, on-the-go ticket access.

- In terms of offering, software solutions accounted for 71%, highlighting the strong demand for centralized ticket management systems, integrated analytics, and fraud prevention technologies.

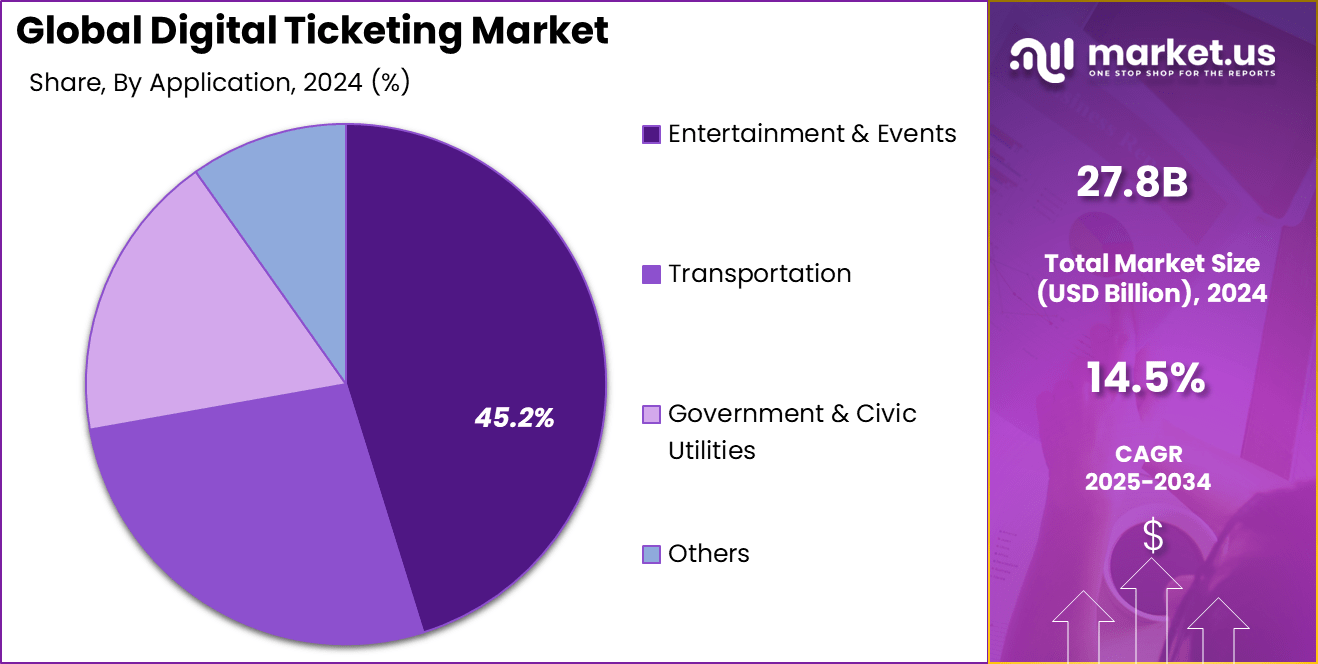

- Under application, entertainment and events remained the top category, securing 45.2% of the share. The growth is supported by widespread digitization in concerts, festivals, and sports.

- By technology, QR code-based ticketing led with a share of 46%, favored for its speed, security, and ease of validation across sectors.

U.S. Digital Ticketing Market Size

The market for digital ticketing within the U.S. is growing tremendously and is currently valued at USD 8.24 billion, the market has a projected CAGR of 12.1%. The rapid growth of the digital ticketing market in the U.S. is attributed to smartphone penetration, consumer preference for contactless and convenient solutions, and significant investments in smart infrastructure.

The rise of mobile wallets and regulatory support for secure and sanitary transactions enhance user experience. Furthermore, strong collaboration among event organizers, such as sports, concerts, and festivals, and transportation agencies and technology providers drives innovation, while advanced data analytics enable personalized services, collectively accelerating the market’s expansion across various sectors in the U.S.

For instance, In May 2025, SeatGeek became the official digital ticketing partner for the USGA Championships. This collaboration allows SeatGeek to offer secure and easy ticketing for golf fans attending these major events. The partnership highlights a rising trend where top sports bodies adopt digital platforms to improve fan experience with smooth and dependable ticket access.

In 2024, North America held a dominant market position in the Global Digital Ticketing Market, capturing more than a 31.2% share, holding USD 8.67 billion in revenue. The global digital ticketing market was largely driven by North America’s advanced technology and high smartphone usage. The use of mobile and web-based ticketing is becoming more prevalent among consumers.

Advanced payment systems, loyalty programs, and AI-powered personalized experiences are contributing to the growth. The close partnerships between ticketing providers, entertainment companies, and public transit organizations foster innovation by catering to the growing demand for streamlined, secure, personalized ticket services, which together fuel the market.

For instance, In March 2025, LaLiga North America partnered with TickPick as its official ticketing partner for the region. The partnership aims to improve matchday experiences by offering fans a transparent, secure, and easy way to buy tickets. This move reflects a broader trend of major sports leagues working with digital ticketing platforms to boost fan accessibility and engagement across North America.

Platform Type Analysis

In 2024, Mobile-Based segment held a dominant market position, capturing a 52% share of the Global Digital Ticketing Market. This dominance is primarily due to the rapid rise in smartphone usage, widespread availability of user-friendly ticketing apps, and consumer preference for the convenience and speed of mobile transactions.

Mobile ticketing offers seamless integration with digital wallets and contactless payment systems that enhance user experience. Additionally, real-time updates, ease of access, and strong security features contribute to its popularity, making mobile platforms the preferred choice for both event organizers and consumers worldwide.

For instance, In 2024, Ticketzone introduced a new mobile app to streamline digital ticket buying and management. Built with a user-friendly interface and seamless event organizer integration, the app allows secure payments, quick ticket browsing, and instant access. This development shows how tech-driven solutions are fueling growth in the digital ticketing market by focusing on ease of use and security for both users and providers.

Offering Analysis

In 2024, the Software segment held a dominant market position, capturing a 71% share of the Global Digital Ticketing Market. The demand in this sector has been driven mainly by the increasing need for advanced ticketing platforms that offer seamless booking, real-time data analytics, customization, and integration with payment systems.

The growing popularity of cloud-based solutions, AI analytics, and strong security features is boosting demand. Software is essential for efficient and innovative digital ticketing operations, as event organizers and transportation providers depend on it for its ability to handle dynamic pricing, personalized experiences with users, and seamless multi-channel distribution.

In November 2024, Indian Railways revealed plans to launch a super app combining ticket booking, train tracking, and food ordering in one platform. This initiative is designed to make travel easier and more convenient for billions of passengers by offering multiple services in a single app. The move reflects a broader shift in digital ticketing, where platforms are evolving into comprehensive solutions to boost convenience and passenger engagement.

Application Segment Analysis

In 2024, the Entertainment & Events segment held a dominant market position, capturing a 45.2% share of the Global Digital Ticketing Market. This dominance is driven by the increasing demand for convenient, contactless ticketing solutions at concerts, sports, theaters, and festivals.

The surge in demand for online and mobile ticketing, as well as the growth of live events and virtual experiences, is driving this trend. Furthermore, new features like dynamic pricing, personalized services, and enhanced security enhance the segment’s market position.

For Instance, In April 2025, M Selen partnered with Islands of the Seas Entertainment Reggae Haus to introduce e-tickets for their events. This collaboration brings digital ticketing to the local music scene, giving fans easier and safer access to live shows. It highlights a rising trend where smaller event organizers are adopting digital platforms to improve ticketing efficiency and enhance the attendee experience.

Technology Analysis

In 2024, the QR Code-Based segment held a dominant market position, capturing a 46% share of the Global Digital Ticketing Market. This dominance is due to its simplicity, affordability, and wide compatibility with smartphones. By utilizing QR codes, ticket organizers can verify their tickets in seconds using contactless technology and ensure their safety.

The widespread adoption of QR codes in public transportation and event management, as well as their effortless integration with mobile applications or digital wallets, makes them the go-to option for efficient digital ticketing solutions.

In July 2024, Amazon Pay partnered with Delhi Metro to allow commuters to book QR code-based tickets directly through the Amazon app. This integration provides a convenient and contactless ticketing option, making travel simpler for billions of daily users. The partnership shows how digital payment platforms are increasingly working with public transport systems to promote efficient, technology-driven ticketing solutions.

Key Market Segments

By Platform Type

- Web-Based

- Mobile-Based

- Kiosk-Based (Self-service Terminals)

By Offering

- Software

- Booking Engines

- Ticket Validation & Scanning Systems

- Mobile Apps

- APIs for Integration

- Services

- Implementation Services

- Managed Services

- Consulting & Customization

By Application

- Transportation

- Railways

- Airlines

- Buses & Metro

- Ferries

- Entertainment & Events

- Music Concerts

- Sports Events

- Theaters & Cinemas

- Museums & Amusement Parks

- Government & Civic Utilities

- Public Parking

- Toll Booths

- Cultural Festivals

- Others

By Technology

- QR Code-Based

- NFC-Based

- Barcode-Based

- Biometric/Face Recognition-Based

- Blockchain-Enabled Ticketing

Emerging Trends

Rise of Contactless Mobile-First Ticketing

A clear trend shaping digital ticketing is the fast-growing adoption of contactless and mobile-first solutions. Increasingly, event-goers and travelers are using smartphones, empowered by QR codes or Near Field Communication (NFC), to store, display, and validate their tickets for entry.

This move toward digital-only access has simplified entry experiences, offering users convenience and eliminating the hassle and waste of physical tickets. The momentum for contactless ticketing is underscored by health and safety priorities in a post-pandemic environment and an overall preference for seamless, tech-driven journeys.

Event organizers and transportation providers are leveraging these technologies for faster check-ins and improved crowd management. Personalization has also become a front-line feature, as digital platforms now use collected data to tailor experiences and special offers for attendees. The advance of contactless tools continues to drive both customer satisfaction and operational efficiency.

Driver

Demand for Convenience and Real-Time Access

One of the strongest forces pushing digital ticketing forward is the demand for convenient and immediate access to events and transportation. People now expect to buy, store, and use their tickets instantly, directly from their smartphones or computers, anywhere and anytime.

The convenience of skipping the ticket window, avoiding long lines, and having all tickets in one digital wallet has completely reshaped consumer expectations. This expectation blends with a broader shift toward digital lifestyles, where real-time updates and reminders about events or travel times are seen as essential to a good experience.

Digital ticketing platforms respond to these needs by providing not only quick and hassle-free purchasing, but also immediate, up-to-date information. This has raised the bar for both service providers and technology developers, who must ensure that platforms are responsive and easy to use, making digital channels the preferred method for access.

Key Restraint

Security Concerns and Fraud Risks

A central concern holding back some users and organizations from fully embracing digital ticketing involves security and fraud risks. Digital ticketing platforms, like all online systems, are targets for hackers and scammers who seek to create fake tickets or steal user information.

The risk of someone inadvertently buying a counterfeit or already-used ticket has ramifications for customer trust and event reputation. Additionally, payment and data security remain high-priority issues, especially when sensitive financial and personal data is being processed.

The industry must remain vigilant, routinely updating security protocols such as encryption and multi-factor authentication to prevent fraud and protect buyers. Ensuring users recognize official platforms and offering education on safe purchasing practices further helps reduce vulnerabilities.

For instance, In 2025, Cathay Pacific was urged to boost loyalty program security after a fraud incident caused a major passenger loss. The case stresses the need for stronger protection in digital ticketing to safeguard user trust.

Opportunity

Integration with Mobility and Smart City Platforms

Digital ticketing presents a significant opportunity for integration with urban mobility solutions and emerging smart city infrastructure. By embedding ticketing into apps that also handle payment, navigation, and access to various transportation modes or event systems, cities and businesses stand to make journeys much more seamless and attractive for residents and visitors.

Greater integration not only improves the user experience, but also helps operators reduce costs, manage networks more efficiently, and generate valuable data for future service enhancements. As cities and service providers increasingly look to improve convenience and sustainability, digital ticketing stands out as a practical pillar of smarter, more connected communities.

Challenge

Modernizing Legacy Systems and Ensuring Inclusivity

A major hurdle in digital ticketing remains the modernization of legacy systems while also ensuring platforms are accessible to everyone. Many organizations still rely on old, on-premise technologies, which can be rigid, slow to update, and incompatible with the latest digital innovations.

Migrating to cloud-based, integrated systems is essential, but requires significant investment, robust change management, and time. Another challenge is making digital ticketing inclusive, ensuring that less tech-savvy users and those without easy access to digital devices are not excluded.

Key Players Analysis

Several companies are driving innovation in the digital ticketing market by offering seamless and secure booking experiences. Ticketmaster, Eventbrite, and StubHub remain at the forefront, supported by their strong technology infrastructure and wide event portfolios. These companies continue to expand into new sectors such as sports, concerts, and cultural events.

Emerging players such as Seatgeek, TickPick, and Aventus have introduced advanced features like blockchain-based validation, dynamic pricing, and AI-driven event recommendations. These platforms are reshaping how consumers interact with ticketing services by focusing on transparency, fraud prevention, and optimized resale management.

Meanwhile, companies like Live Nation Entertainment, CTS Eventim, Ticketfly, Ticketek, See Tickets, Etix, and Ticket Tailor continue to capture significant market attention through strategic partnerships and regional expansions. These firms often collaborate with venues, event organizers, and entertainment firms to offer end-to-end ticketing ecosystems.

Top Key Players in the Market

- Ticketmaster

- Eventbrite

- StubHub

- Seatgeek

- TickPick

- Aventus

- Live Nation Entertainment

- CTS Eventim

- Ticketfly

- Ticketek

- See Tickets

- Etix

- Ticket Tailor

- Others

Recent Developments

- In May 2025, Viagogo became the official ticketing partner of Sevilla FC, offering secure and seamless digital ticketing for the club’s matches. This move improves the fan experience and shows how ticketing companies are expanding through sports partnerships.

- In April 2025, Chelsea FC deepened its partnership with Ticketmaster to enhance digital ticketing services. The focus is on providing fans with a smoother, more secure, and personalized purchase journey. These collaborations reflect a growing shift among football clubs toward digital platforms to boost access and fan engagement.

- In September 2024, FPT IS and Mastercard partnered to bring advanced payment tech to Metro Line 1 in Ho Chi Minh City. Through an MoU, they aimed to launch an open-loop EMV system, allowing fare payments via bank cards, QR codes, or citizen ID cards.

- In October 2024, the Tasmanian Government chose Cubic Corporation to deliver a smart ticketing system for buses and ferries. This system supports contactless payments and real-time tracking, improving convenience and removing the need for travel cards or cash.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform Type, (Web-Based, Mobile-Based, Kiosk-Based (Self-service Terminals), By Offering, (Software, Services), By Application, (Transportation, Entertainment & Events, Government & Civic Utilities, Others), By Technology, (QR Code-Based, NFC-Based, Barcode-Based, Biometric/Face Recognition-Based, Blockchain-Enabled Ticketing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ticketmaster, Eventbrite, StubHub, Seatgeek, TickPick, Aventus, Live, Nation Entertainment, CTS Eventim, Ticketfly, Ticketek, See Tickets, Etix, Ticket Tailor, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ticketmaster

- Eventbrite

- StubHub

- Seatgeek

- TickPick

- Aventus

- Live Nation Entertainment

- CTS Eventim

- Ticketfly

- Ticketek

- See Tickets

- Etix

- Ticket Tailor

- Others