Global Digital Signage in Restaurants Market Size, Share, Industry Analysis Report By Screen Size (22 inches - 32 inches, 32 inches - 45 inches, 45 inches - 55 inches, 55 inches - 65 inches, 65 inches - 85 inches, Others ), By Display Type (LED, LCD, OLED, Others ), By Application (Menu Boards, Promotions, Order Displays, Others ), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156285

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Investment and Regulatory Outlook

- China Market Size

- Regional Outlook

- Trends & Innovations

- Economic Impact

- By Screen Size

- By Display Type

- By Application

- Key Market Segments

- Driver Factor

- Restraint Factor

- Opportunity Analysis

- Challenge Analysis

- Customer Insights

- Top 5 Use Cases

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

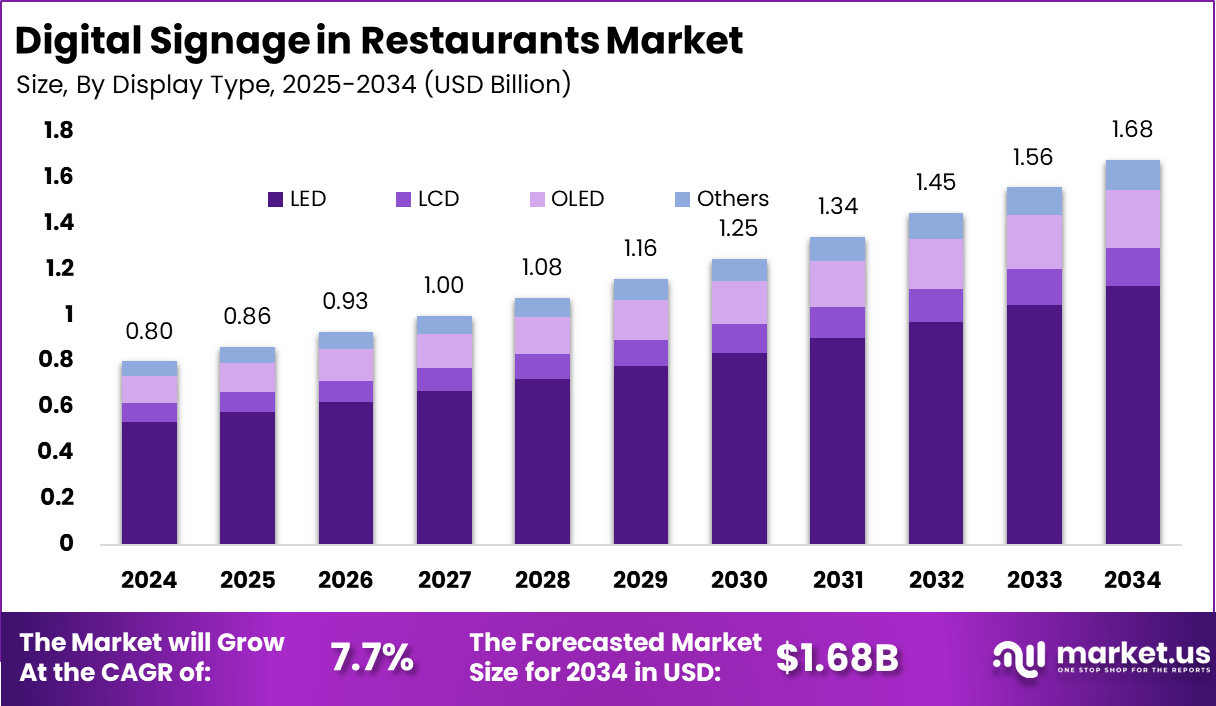

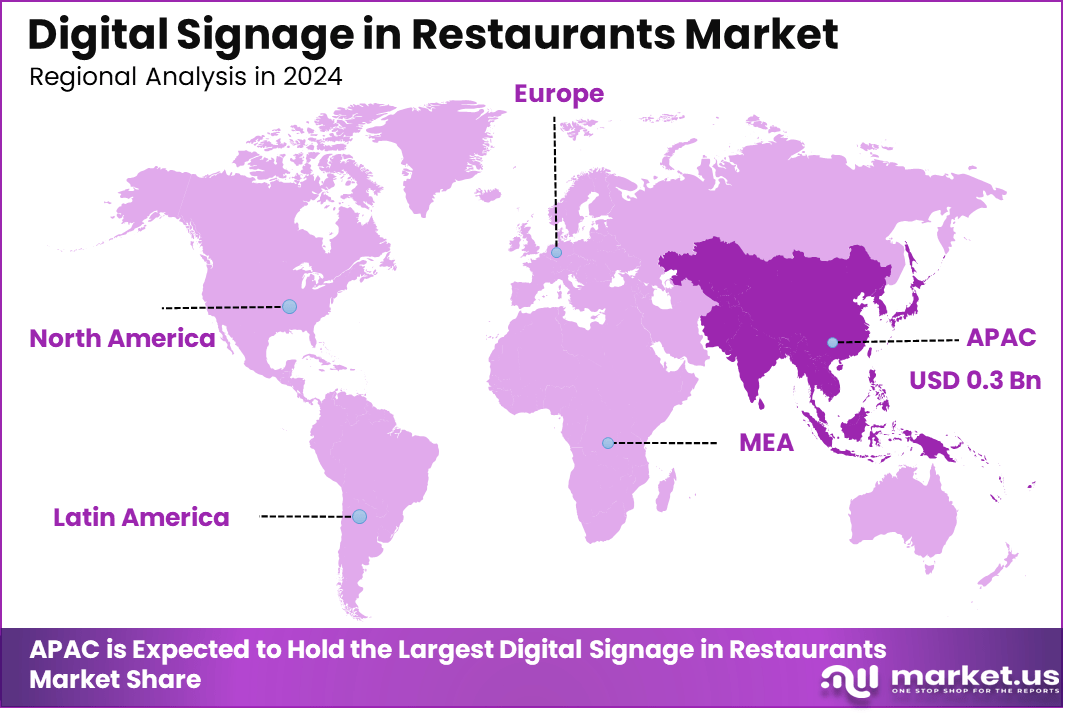

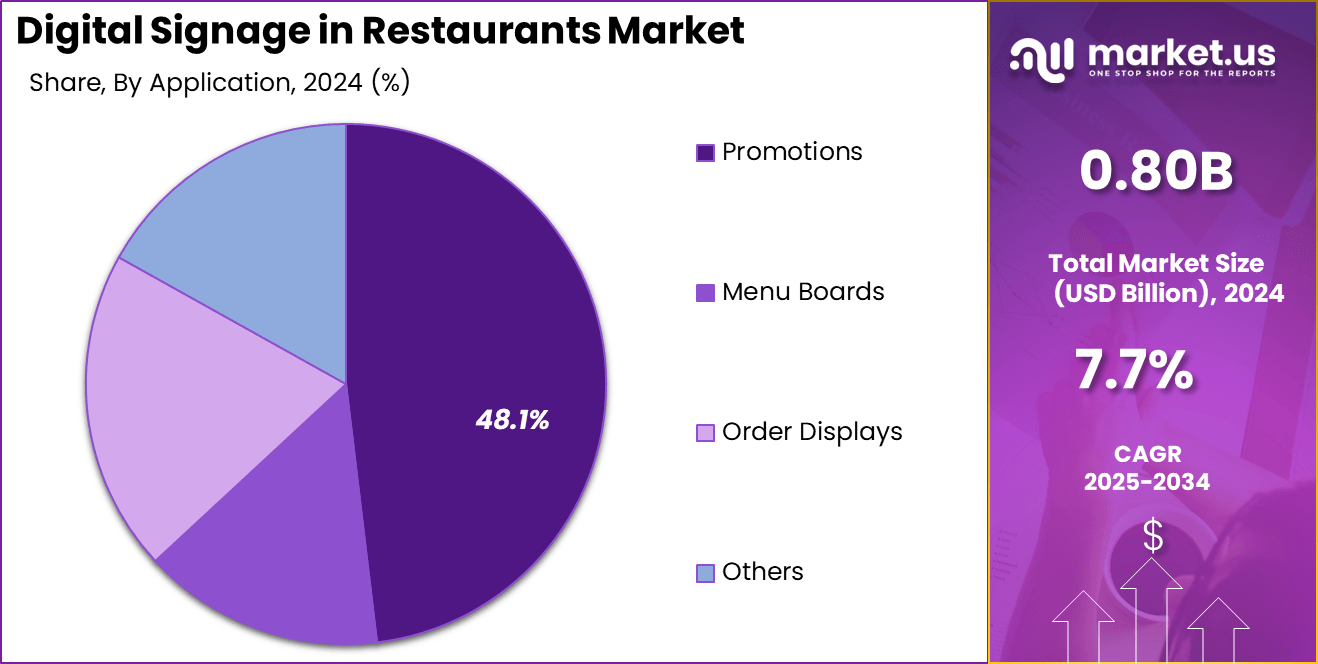

The Global Digital Signage in Restaurants Market size is expected to be worth around USD 1.6 Billion By 2034, from USD 0.80 billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 42.7% share, holding USD 0.3 Billion revenue.

The digital signage in restaurants market is rapidly growing as restaurants adopt advanced display technologies to improve customer experience, operational efficiency, and marketing effectiveness. Digital signage in this sector goes beyond traditional static menus, offering dynamic content updates, real-time queue management, and AI-powered personalization that can drive sales and enhance brand engagement.

A key driver of this market is the rising demand for enhanced customer interaction and streamlined ordering processes. Digital signage solutions enable restaurants to reduce wait times through self-service kiosks and interactive menu boards, while AI integration tailors content to customer preferences in real time. This leads to faster decision-making and increases the average order size by suggesting add-ons and promotions based on individual behavior.

According to Market.us, In 2023, the global Digital Signage market was valued at USD 27.1 billion, reflecting strong adoption across retail, transportation, healthcare, and hospitality. The market is projected to nearly double, reaching USD 52.7 billion by 2032, CAGR of 7.7%.

Within this landscape, the Quick-Service Restaurants (QSRs) segment is emerging as one of the fastest-growing applications. The global digital signage market in QSRs is projected to rise from USD 3.3 billion in 2024 to nearly USD 12.78 billion by 2034. This represents an impressive CAGR of 14.50%.

Customer demand continues to rise for personalized and seamless dining experiences, with digital signage playing a pivotal role. Restaurants use these technologies to display nutritional information, allergen alerts, and ingredient sources, helping customers make informed choices while fostering trust. Augmented reality (AR) and interactive touchscreens elevate the dining experience further by providing engaging visualizations and easier navigation of menu options.

Key Insight Summary

- By Region, Asia Pacific led with a 42.7% share, reflecting rapid adoption of digital displays in the foodservice sector.

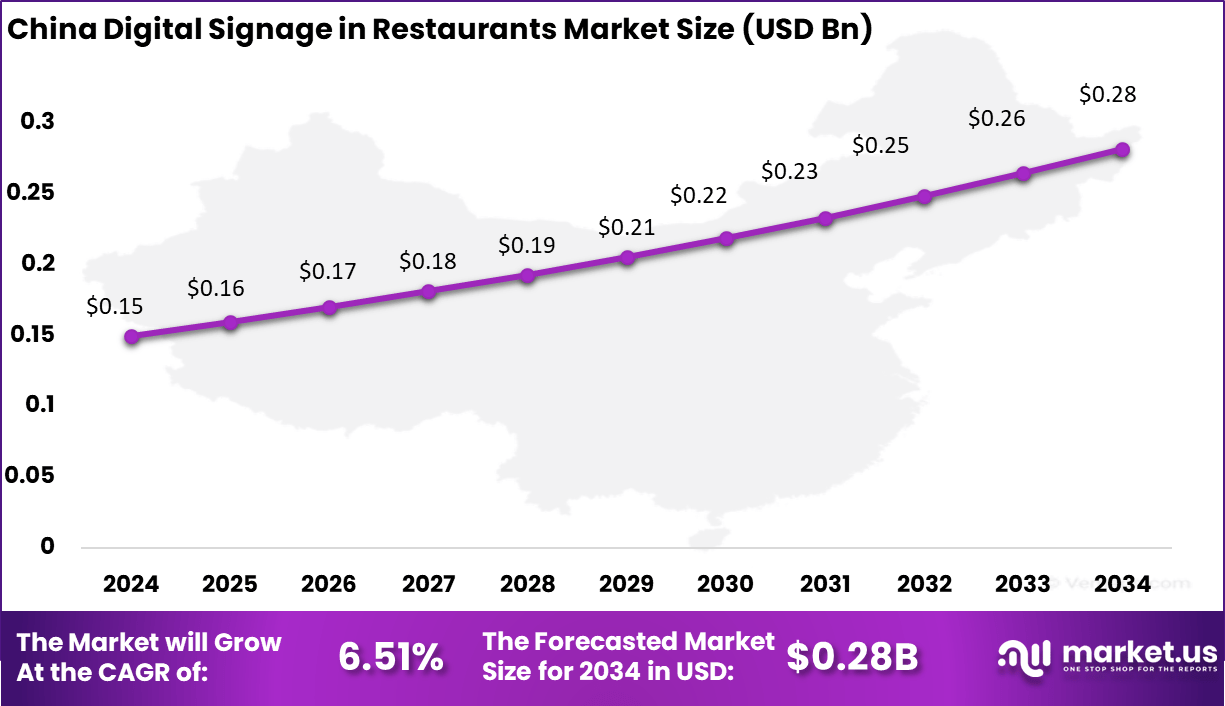

- China accounted for USD 0.15 Billion in 2024, with a projected CAGR of 6.51%, driven by strong urban restaurant digitization.

- By Screen Size, the 32-45 inches segment dominated with a 55.7% share, preferred for visibility and space efficiency in restaurants.

- By Display Type, LED displays led with 67.2% share, due to their durability, brightness.

Investment and Regulatory Outlook

Investment opportunities in this market focus on AI-driven content personalization, cloud management platforms, and integration of digital signage with mobile apps and loyalty programs. The ability to gather data insights and run targeted marketing campaigns is attractive to restaurant chains aiming for competitive differentiation and improved customer retention.

The popularity of digital advertising through signage also accelerates revenue opportunities for restaurants and marketers alike. From a business perspective, digital signage boosts sales by up to 30% in some cases by influencing customer decisions and increasing average ticket sizes. It also enhances operational efficiency by cutting down order errors and reducing load on staff.

The regulatory environment around digital signage in restaurants revolves mainly around content compliance, accessibility standards, and data privacy, especially when linked with AI-driven personalization. Restaurants must ensure their advertising and nutritional information meets legal standards while protecting customer data gathered via interactive platforms.

China Market Size

The China Digital Signage in Restaurants Market was valued at USD 0.15 Billion in 2024 and is anticipated to reach approximately USD 0.28 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.51% during the forecast period from 2025 to 2034.

China leads the Digital Signage in Restaurants Market due to a combination of advanced digital infrastructure, rapid urbanization, and a strong cultural emphasis on tech-driven dining experiences. The widespread deployment of smart displays and AI-powered ordering systems in quick-service and full-service restaurants reflects a growing demand for real-time communication with customers.

Digital signage is increasingly used for dynamic menu boards, promotional content, and personalized customer engagement in high-traffic food chains and urban dining hubs. The leadership can also be attributed to the country’s aggressive adoption of smart retail technologies and integration with mobile ecosystems such as WeChat Pay and Alipay.

In 2024, APAC held a dominant market position, capturing more than 42.7% share and generating USD 0.3 Billion in revenue in the digital signage in restaurants market. The leadership of APAC can be attributed to rapid urbanization, higher consumer spending on dining experiences, and the widespread adoption of digital technologies in the food service sector.

Countries such as China, Japan, South Korea, and India have been driving this growth, with quick-service restaurants and large dining chains heavily investing in digital menu boards, interactive displays, and smart promotional signage to attract customers. The rising influence of younger, tech-savvy consumers has further accelerated the integration of digital displays as they prefer visually engaging and personalized dining experiences.

The strong position of APAC is also supported by favorable government initiatives promoting digital transformation in retail and hospitality. The region has seen significant cost reductions in display technologies, making adoption more affordable for small and medium-sized restaurants. The strong presence of global and regional quick-service brands has made digital signage a key tool to improve engagement, streamline operations, and boost visibility.

Regional Outlook

Europe

In Europe, the growth of digital signage in the restaurant sector is largely driven by the demand for a more personalized customer experience alongside strong sustainability initiatives. Businesses are increasingly adopting eco-friendly and energy-efficient solutions.

Asia Pacific

The Asia Pacific region is experiencing rapid market expansion, fueled by the rising number of restaurant chains and the widespread adoption of modern technologies. This growth reflects the region’s dynamic consumer market and strong appetite for digital transformation.

Latin America

In Latin America, the digital signage market is emerging with a strong focus on improving operational efficiency and enhancing customer engagement. Restaurants are beginning to embrace technology to remain competitive and meet evolving consumer expectations.

Middle East & Africa

The Middle East and Africa are witnessing increasing investment in modern digital signage solutions, supported by the significant growth of the hospitality and dining sectors. The region’s modernization efforts are driving greater technology adoption across restaurants.

Trends & Innovations

Trend Description AI-Driven Personalization Tailored menu recommendations based on customer preferences Interactive Displays Touchscreen kiosks for order customization and payments Mobile Integration QR codes and NFC for seamless ordering and feedback Real-Time Content Updates Automated promotions based on time, weather, and demographics Sustainability Focus Energy-efficient and eco-friendly signage solutions Economic Impact

Impact Details Sales Uplift Digital menus boost average sales by 3% to 30% Operational Efficiency Up to 20% improvement in employee productivity Cost Reduction Reduced print costs and manual menu updates Customer Satisfaction 73% of diners value tech-enhanced experiences By Screen Size

In 2024, Displays ranging between 32 to 45 inches hold a dominant share of 55.7% in the restaurant digital signage market. This size range is widely favored by restaurants due to its balance between visibility and space efficiency. Screens within this range are large enough to provide clear and engaging content to diners without overwhelming the available wall or counter space.

This preference is driven by the need to ensure readability from typical viewing distances within dining areas. Restaurants benefit from being able to showcase dynamic menu options, daily specials, and promotional material effectively with this screen size. The manageable investment cost combined with strong visual impact has made these screen sizes the go-to for many business operators seeking to upgrade or install digital signage systems.

By Display Type

LED displays account for 67.2% of the digital signage deployments in restaurants. This technology is preferred for its superior brightness, energy efficiency, and longer lifespan compared with other display types. LED screens produce vivid images and sharp contrast, which are critical for catching the attention of restaurant patrons, especially in environments with varying lighting conditions such as open kitchens or outdoor seating areas.

The rising adoption of LED displays also reflects improvements in affordability and scalability. These features allow restaurants to deploy signage solutions across multiple locations with consistent image quality and reduced maintenance overhead. LED technology supports flexible content presentation, vital for restaurants looking to frequently update menu offerings, showcase promotions, or adapt to different customer segments during the day.

By Application

In 2024, Promotional content makes up nearly half (48.1%) of the applications of digital signage in the restaurant sector. Restaurants use digital signage primarily to advertise special deals, new menu items, and limited-time offers, aiming to influence customer spending behavior directly at the point of purchase. Dynamic promotions delivered through digital boards boost impulse buying and help increase average order values.

The effectiveness of digital signage in promotions is boosted by its ability to engage customers visually and deliver timely, context-sensitive messages. Many restaurants report significant sales uplifts when digital promotion displays are used, as these screens help communicate offers more clearly and persuasively than static signage.

Key Market Segments

By Screen Size

- 22 inches – 32 inches

- 32 inches – 45 inches

- 45 inches – 55 inches

- 55 inches – 65 inches

- 65 inches – 85 inches

- Others

By Display Type

- LED

- LCD

- OLED

- Others

By Application

- Promotions

- Menu Boards

- Order Displays

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Factor

One key driver for the digital signage market in restaurants is the growing demand for enhanced customer experience. Restaurants are adopting digital signage as a dynamic and interactive tool to engage customers more effectively. Digital menu boards that display high-resolution images, videos, and real-time pricing create visually appealing menus, which attract customer attention and enable faster decision-making.

Additionally, interactive ordering kiosks allow customers to customize orders, reducing errors and improving service speed, which directly contributes to increased customer satisfaction. The ability to update promotions and menu items instantly is another advantage driving the adoption of digital signage.

Restaurants benefit from real-time content management that helps keep customers informed about new offerings and deals while enabling personalization. This flexibility aligns with evolving customer expectations for a seamless and personalized dining experience, helping restaurants stay competitive in a crowded market.

Restraint Factor

A significant restraint in the adoption of digital signage in restaurants is the high initial installation and ongoing maintenance costs. Setting up digital signage requires investment in hardware like high-quality display screens and media players, which can be expensive, particularly for small and medium-sized restaurants. Larger, energy-efficient LED displays with premium features incur even higher upfront expenses.

Once installed, digital signage systems need regular maintenance, including software updates and hardware servicing, to ensure they function optimally. In high-traffic restaurant environments, wear and tear can increase maintenance frequency and costs. For businesses operating on tight margins, managing these ongoing expenses can be a considerable financial challenge, limiting wider adoption.

Opportunity Analysis

The expansion of digital signage in emerging markets presents a notable growth opportunity for the restaurant industry. Rapid urbanization, rising disposable incomes, and shifting consumer preferences in regions like Asia-Pacific, Latin America, and the Middle East are fueling demand for modern dining experiences.

Digital signage offers restaurants in these markets an effective way to differentiate themselves and meet rising customer expectations. In countries such as China and India, QSRs (quick-service restaurants) are increasingly investing in digital menu boards and ordering kiosks to enhance convenience and personalization.

The relatively lower cost of digital signage solutions in these markets makes adoption more feasible. Additionally, high smartphone penetration and mobile ordering trends create chances to integrate digital signage with mobile apps for a cohesive and interactive customer journey.

Challenge Analysis

One of the biggest challenges for restaurants implementing digital signage is the technological integration with existing systems. Many restaurant chains still rely on legacy point-of-sale (POS) systems and inventory management software.

Ensuring that digital signage synchronizes seamlessly with these systems for real-time updates on menu items, pricing, and promotions can be complex and costly. Moreover, maintaining consistent communication between multiple restaurant locations requires robust cloud-based infrastructure, sometimes outside the reach of smaller operators.

Compatibility issues between signage hardware, software, and back-end systems can result in fragmented solutions that fail to deliver the intended operational efficiencies. Overcoming these technological hurdles is essential to realize the full benefits of digital signage.

Customer Insights

Insights Observations Improved Experience Clear, engaging displays influence dining choice (74% agree) Impulse Purchases 80% of customers make unplanned purchases based on displays Personalized Offers Data-driven menus increase transaction size Digital Queuing Reduces wait-time stress and improves satisfaction Top 5 Use Cases

- Digital Menu Boards: Flexible, visually appealing menu displays with real-time updates and multimedia content.

- Promotional Displays: Highlight limited-time offers, new items, and combo deals to drive impulse purchases.

- Interactive Ordering Kiosks: Self-service ordering that reduces errors and speeds up service.

- Order Tracking Displays: Shows order status/queue to reduce perceived wait time and improve customer experience.

- Customer Engagement Content: Displays cooking demos, nutrition facts, social media feeds, and entertainment to engage customers.

Competitive Analysis

Samsung Electronics, LG Electronics, NEC Corporation, and Panasonic Corporation remain the most influential players in the digital signage in restaurants market. Their leadership is supported by a wide product range, advanced display technologies, and strong brand presence. These companies continue to invest in high-resolution displays, energy-efficient panels, and interactive features.

Elo Touch Solutions, BrightSign, Peerless-AV, and ViewSonic are strengthening their positions by offering specialized solutions. BrightSign leads in media players, while Elo Touch Solutions drives growth with interactive displays. Peerless-AV and ViewSonic expand their portfolios with cost-effective and durable systems tailored for restaurants.

Sharp Corporation, AOPEN, Zeno Technologies, and YCD Multimedia operate in targeted niches within the market. They focus on software integration, cloud-based content management, and scalable platforms that allow restaurants to manage digital menus efficiently. These players are gaining relevance in providing data-driven signage solutions that align with restaurant marketing strategies.

Top Key Players in the Market

- Samsung Electronics

- LG Electronics

- NEC Corporation

- Elo Touch Solutions

- BrightSign

- Peerless-AV

- Panasonic Corporation

- Zeno Technologies

- Sharp Corporation

- ViewSonic

- AOPEN

- YCD Multimedia

- Others

Recent Developments

- LG Electronics has expanded its digital signage portfolio by integrating 5G connectivity into its QSR solutions in 2024, enabling seamless remote content management and real-time updates. Their advanced OLED displays offer superior contrast and color accuracy, critical for attracting customers in high-traffic restaurant settings.

- Zebra Technologies announced its acquisition of Elo Touch Solutions in August 2025 for $1.3 billion. Elo’s interactive touchscreen solutions are critical in self-service kiosks and restaurant digital signage. The acquisition strengthens Zebra’s retail and hospitality portfolio by adding consumer-facing digital engagement platforms, expanding its addressable market by $8 billion and providing immediate financial gains.

Report Scope

Report Features Description Market Value (2024) USD 0.80 Bn Forecast Revenue (2034) USD 1.68 Bn CAGR(2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Screen Size (22 inches – 32 inches, 32 inches – 45 inches, 45 inches – 55 inches, 55 inches – 65 inches, 65 inches – 85 inches, Others), By Display Type (LED, LCD, OLED, Others ), By Application (Menu Boards, Promotions, Order Displays, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics, LG Electronics, NEC Corporation, Elo Touch Solutions, BrightSign, Peerless-AV, Panasonic Corporation, Zeno Technologies, Sharp Corporation, ViewSonic, AOPEN, YCD Multimedia, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Signage in Restaurants MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Signage in Restaurants MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics

- LG Electronics

- NEC Corporation

- Elo Touch Solutions

- BrightSign

- Peerless-AV

- Panasonic Corporation

- Zeno Technologies

- Sharp Corporation

- ViewSonic

- AOPEN

- YCD Multimedia

- Others