Global Digital Signage for Events Market Size, Share, Industry Analysis Report By Screen Size (22 inches - 32 inches, 32 inches - 45 inches, 45 inches - 55 inches, 55 inches - 65 inches, 65 inches - 85 inches, Others), By Display Type (LED, LCD, OLED, Others), By Application (Event Branding, Wayfinding, Live Streaming, Product Displays, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158026

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

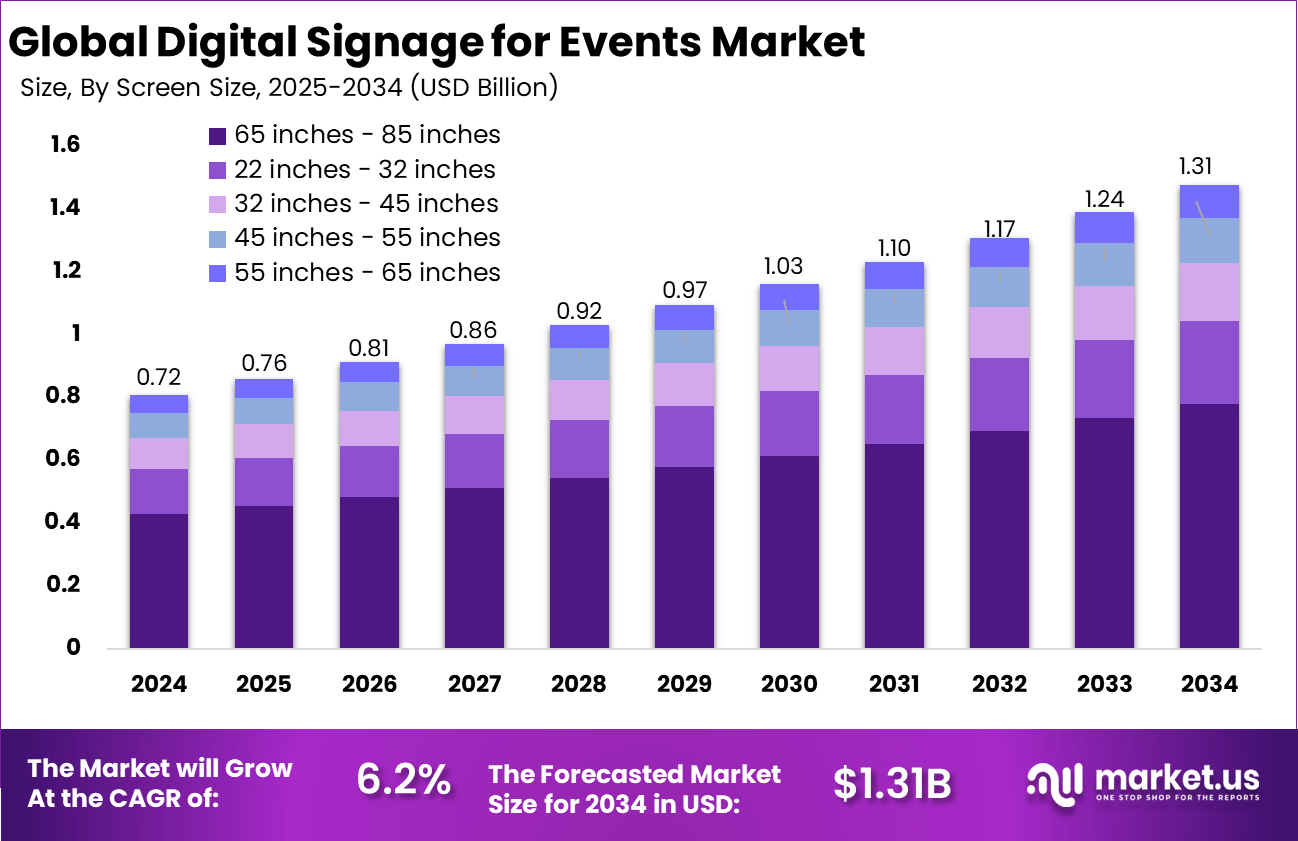

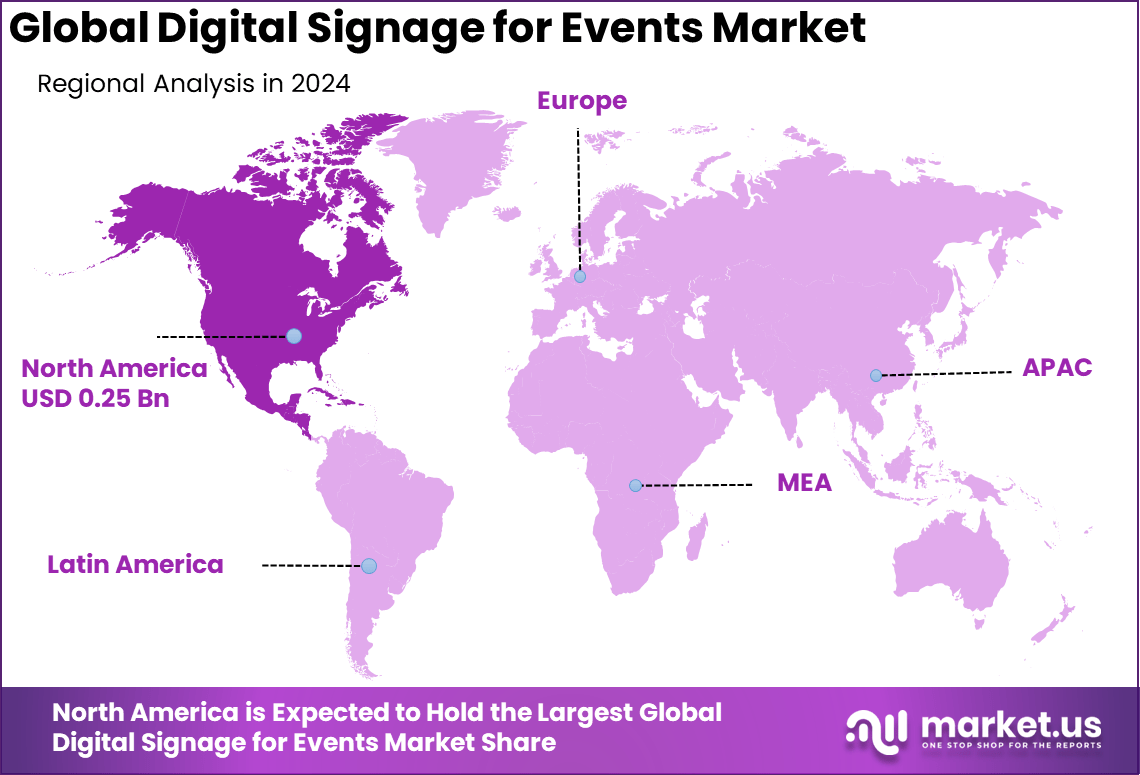

The Global Digital Signage for Events Market size is expected to be worth around USD 1.31 billion by 2034, from USD 0.72 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.8% share, holding USD 0.25 billion in revenue.

The Digital Signage for Events Market refers to the use of digital displays, such as LED screens, interactive kiosks, and video walls, to enhance attendee experiences, deliver real-time information, and promote brand engagement at live events. These events include conferences, trade shows, exhibitions, concerts, sports events, and corporate functions. Digital signage systems are used to display schedules, directions, speaker information, sponsor messages, interactive content, and emergency alerts.

The market includes hardware (displays, media players, mounts), software (content management systems), and services (installation, maintenance, and support). The growth of the digital signage for events market is driven by the increasing demand for engaging and interactive event experiences. As the events industry seeks to provide attendees with dynamic content, real-time updates, and personalized interactions, digital signage becomes an essential tool.

In May 2025, Sharp introduced the PN-LM Series AQUOS BOARD® displays, featuring bright, touch-enabled screens aimed at enhancing creative collaboration and smarter signage across various business environments. These displays are designed to support seamless interactions, making them ideal for modern meeting rooms, classrooms, and digital signage applications.

According to Market.us, In 2024, the global digital signage market was valued at USD 28.9 billion and is projected to reach USD 52.7 billion by 2032, reflecting a steady CAGR of 7.7%. The growth of this market is supported by rising adoption across retail, hospitality, transportation, and corporate sectors, where visual communication has become a vital tool for customer engagement and brand visibility.

Within this, the digital signage hardware segment is gaining notable traction. Valued at USD 15.7 billion in 2024, it is expected to expand to USD 30 billion by 2034 at a CAGR of 6.8%. North America led the hardware market in 2024, holding over 36% share, which represented around USD 5.6 billion in revenue.

Key Takeaway

- By Screen Size: 65–85 inches held the largest share at 59.4%.

- By Display Type: LED displays dominated with 55.7% share.

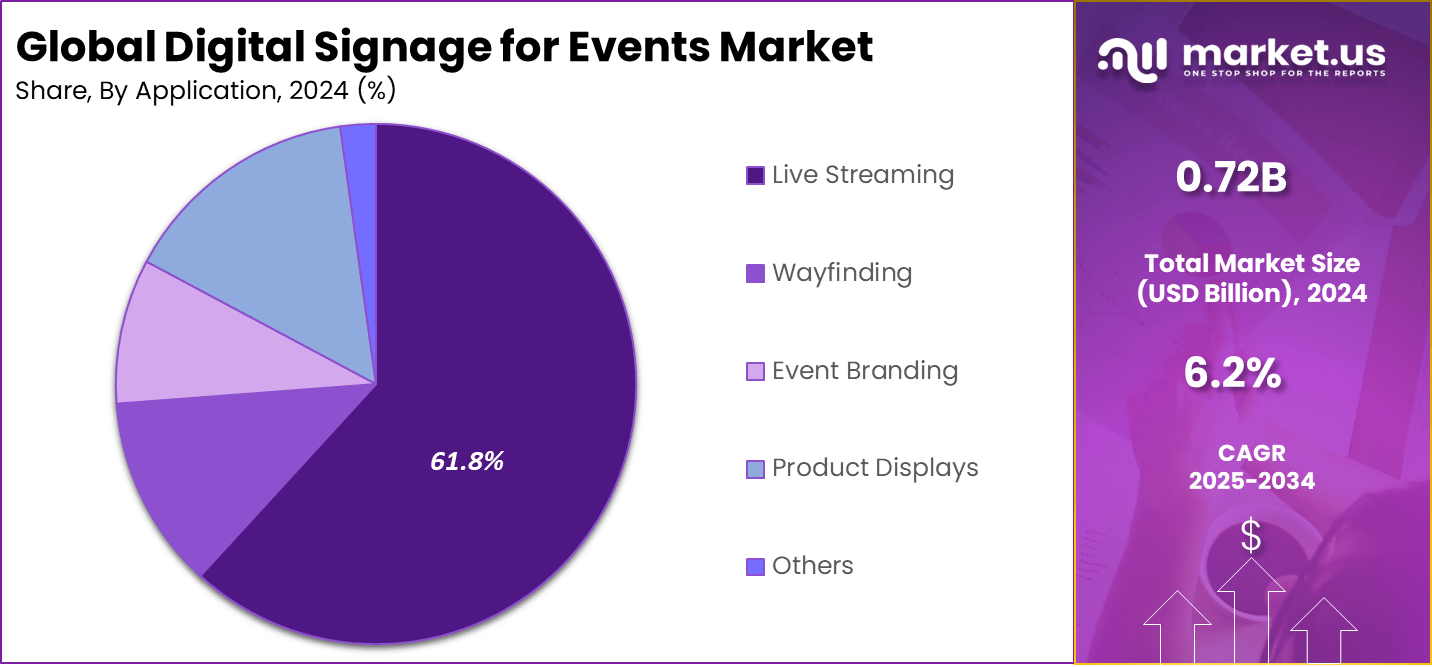

- By Application: Live Streaming led the market with 61.8% share.

- Regional Insights: North America captured 35.8% share of the global market.

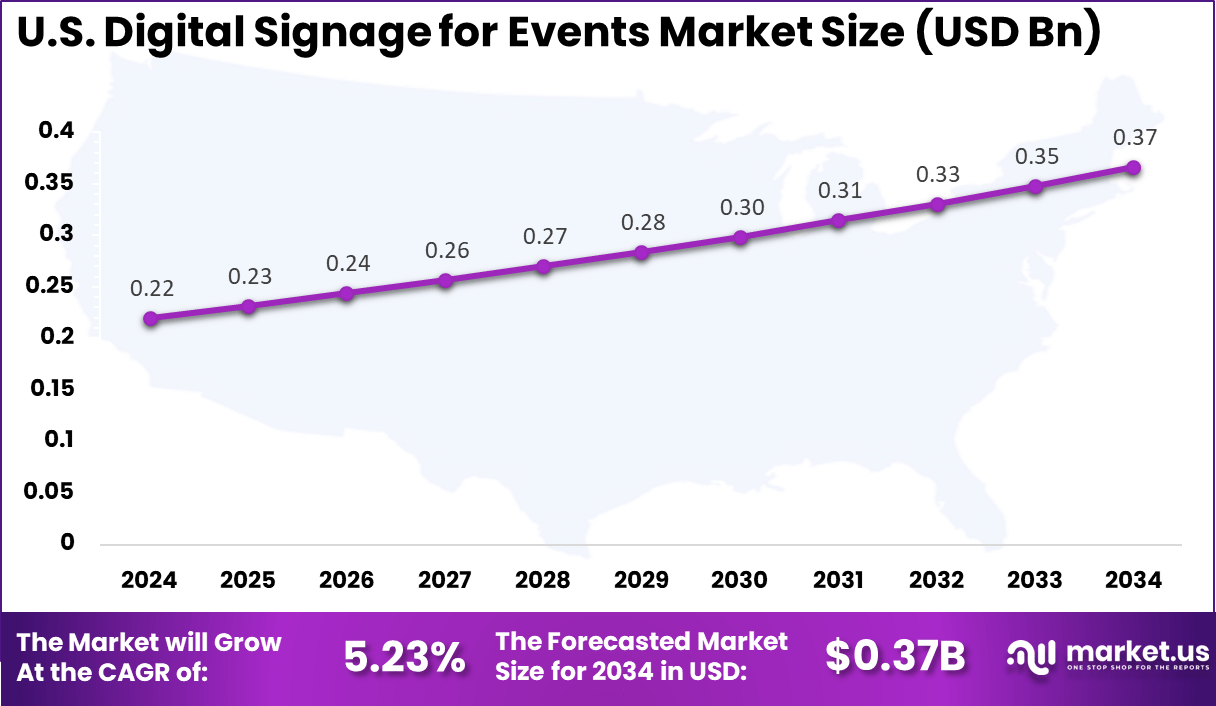

- U.S. Market: Valued at USD 0.22 Billion in 2024, projected to grow at a CAGR of 5.23%.

U.S. Market Size

The market for Digital Signage for Events within the U.S. is growing tremendously and is currently valued at USD 0.22 billion, the market has a projected CAGR of 5.23%. The market is growing tremendously due to the increasing demand for immersive, interactive experiences at events. Technological advancements in high-definition displays, touchscreens, and AI-driven content personalization are making digital signage more accessible and effective.

Additionally, the rise of hybrid and virtual events, especially post-pandemic, is driving the need for dynamic and real-time communication tools. As businesses and event organizers prioritize innovation and audience engagement, digital signage has become a vital component in the U.S. events industry.

For instance, in October 2024, OptiSigns launched its Pro Digital Signage Player in North America and Europe, further solidifying North America’s dominance in the digital signage for events market. The launch of this advanced player, designed to deliver high-performance, scalable digital signage solutions, meets the growing demand for dynamic, interactive content at events.

In 2024, North America held a dominant market position in the Global Digital Signage for Events Market, capturing more than a 35.8% share, holding USD 0.25 billion in revenue. This dominance is due to its advanced technological infrastructure and high adoption of digital solutions across various industries.

The region’s robust event industry, including large-scale conferences, exhibitions, and trade shows, fuels the demand for innovative digital signage solutions. Additionally, the growing trend of hybrid and virtual events, along with the region’s focus on enhancing attendee engagement and experience, further strengthens leadership.

For instance, in September 2025, Questex’s Digital Signage Experience 2025 further reinforced the U.S.’s dominance in the digital signage for events market. With industry giants like Google joining as sponsors and visionary speakers lined up, the event showcased the cutting-edge innovations driving the future of digital signage.

Screen Size Analysis

In 2024, the 65-inch to 85-inch segment held a dominant market position, capturing a 59.4% share of the Global Digital Signage for Events Market. This dominance is due to the optimal size range for large-scale events, offering a balance between visibility and portability.

Displays in this size range are ideal for conferences, trade shows, and exhibitions, delivering impactful content without overwhelming the space. Their ability to offer high-definition visuals and interactive features makes them highly preferred for engaging and dynamic event experiences.

For Instance,In September 2025, Planar launched its UltraRes P Series, offering 65- to 85-inch displays designed for digital signage in events. These models deliver sharper visuals, higher energy efficiency, and advanced connectivity, creating an immersive experience for conferences, exhibitions, and large gatherings.

Display Type Analysis

In 2024, the LED segment held a dominant market position, capturing a 55.7% share of the Global Digital Signage for Events Market. The demand in this sector has been driven mainly by LEDs’ ability to deliver bright, high-resolution visuals that perform well in both indoor and outdoor environments.

Their energy efficiency, durability, and ability to create large, seamless displays make them ideal for large-scale events. Additionally, their flexibility in design and cost-effectiveness for long-term use further boost their popularity in the event industry.

For instance, in July 2025, Orion LED will showcase its extensive range of digital signage solutions at the OAC Expo 2025. The company’s focus on LED displays for event environments highlights the growing demand for high-quality, energy-efficient signage that delivers vibrant, clear visuals.

Application Analysis

In 2024, The Live Streaming segment held a dominant market position, capturing a 61.8% share of the Global Digital Signage for Events Market. This dominance is due to the increasing demand for hybrid and virtual events, allowing organizers to engage both in-person and remote audiences seamlessly.

Live streaming enables real-time content delivery, broadening event reach and enhancing audience interaction. The ability to broadcast keynotes, panels, and other event activities in high quality has made live streaming an essential tool for modern events.

For Instance, in January 2020, Tripleplay launched its new multiview multicast streaming feature for its digital signage product, enhancing live streaming capabilities for events. This feature allows event organizers to stream multiple video sources simultaneously on digital signage displays, enabling a more dynamic and engaging experience for attendees.

Key Market Segments

By Screen Size

- 22 inches – 32 inches

- 32 inches – 45 inches

- 45 inches – 55 inches

- 55 inches – 65 inches

- 65 inches – 85 inches

- Others

By Display Type

- LED

- LCD

- OLED

- Others

By Application

- Event Branding

- Wayfinding

- Live Streaming

- Product Displays

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Adoption of Digital Technology

As industries across the globe increasingly embrace digitalization, the demand for digital signage solutions at events is growing. Advanced technologies like high-definition displays, interactive touchscreens, and cloud-based content management systems are becoming more accessible and cost-effective.

These innovations enable event organizers to create dynamic, engaging experiences that capture audience attention, deliver real-time information, and enhance overall event communication. The rise of digital technology is thus a key factor driving the growth of the digital signage market in events.

For instance, In September 2025, The Westin Desaru Coast adopted Cayin Technology’s digital signage solutions to improve guest engagement and event management. The system delivers real-time schedules, directions, and promotions, offering a more interactive and seamless experience for guests and attendees.

Restraint

High Initial Investment

Despite the long-term savings offered by digital signage, the initial investment required for hardware, software, installation, and ongoing maintenance can be a significant barrier, particularly for small-scale events or businesses with limited budgets.

The costs associated with high-quality screens, content management systems, and technical support can be daunting. This financial hurdle often prevents smaller organizations from fully embracing digital signage, limiting its potential adoption in events where budgets are constrained, despite the clear advantages of digital solutions.

For instance, in July 2023, Dallas-based digital signage company Korbyt received significant growth investment from a Boston VC firm. While this investment underscores the potential of digital signage solutions, it also highlights one of the key restraints in the industry: high initial investment. For many businesses, the cost of hardware, software, and installation can be a significant barrier to adopting digital signage.

Opportunities

Increased Demand for Virtual and Hybrid Events

The rise of virtual and hybrid events, especially after the pandemic, presents new opportunities for digital signage to enhance attendee engagement. Digital signage can bridge the gap between in-person and remote audiences by delivering synchronized content to both groups.

This technology allows event organizers to provide real-time updates, virtual exhibitor booths, and interactive sessions, making it an essential tool for hybrid event formats. As the demand for these events continues to grow, digital signage becomes an integral part of creating seamless, immersive experiences.

For instance, in January 2025, Events.com acquired key assets of Remo, marking a significant step into the rapidly growing $98 billion virtual events and meetings market. This acquisition highlights the increasing demand for virtual and hybrid events as organizations seek to enhance their reach and engagement beyond physical venues.

Challenges

Security Concerns

Integrating digital signage into event networks and the internet introduces significant security risks, including data breaches, hacking, and unauthorized access to sensitive content. Cybersecurity threats can compromise the integrity of the event, disrupt the attendee experience, or even lead to the leakage of confidential information.

Ensuring the safety of digital signage platforms requires robust security protocols, which can be complex and costly to implement. As digital signage becomes more prevalent, addressing these security concerns is crucial to protect both organizers and attendees.

For instance, in May 2025, a significant security vulnerability (CVE-2024-7399) was exploited in the software managing Samsung digital displays, raising concerns about the security of digital signage systems. This vulnerability allowed attackers to gain unauthorized access to devices, potentially compromising sensitive event data and content.

Latest Trends

Artificial intelligence (AI) is rapidly transforming digital signage by enhancing productivity and personalization. AI algorithms analyze audience data to deliver tailored content, ensuring that messages resonate with specific demographics or interests. Additionally, AI automates content creation, allowing for dynamic, real-time updates based on audience interactions or environmental factors.

AI also streamlines device management by predicting maintenance needs and optimizing content scheduling, reducing the need for manual intervention. This integration of AI makes digital signage more efficient, engaging, and adaptable for event organizers.

For instance, in November 2024, SmartSource partnered with 22Miles to enhance engagement through AI-assisted digital signage and wayfinding solutions for events. This collaboration allows event organizers to deliver dynamic, personalized content while improving navigation for attendees. AI-driven features enable real-time updates and interactive experiences, making it easier for participants to find their way around large venues.

Key Players Analysis

In the digital signage for events market, Samsung Electronics and LG Electronics lead with advanced display technologies and large-scale production capacity. Their solutions are widely adopted for concerts, exhibitions, and conferences due to high resolution, durability, and seamless integration with event management systems. Their global networks and continuous product innovation position them as preferred suppliers for large venues and international events.

Barco, Christie Digital Systems, Daktronics, and Planar Systems strengthen the market with specialized event-driven solutions. Their products include LED walls, projection systems, and customizable displays that cater to live shows, sports events, and exhibitions. These companies are known for high-performance displays and reliable customer support, making them trusted partners for event organizers seeking advanced visual experiences.

Sharp Corporation, NEC Corporation, Leyard, Panasonic Corporation, and E Ink Corporation add further diversity to the market. Their focus spans from large-format displays to innovative e-paper signage for flexible event communication. These companies provide solutions tailored to both indoor and outdoor environments, supporting efficient crowd management and audience engagement.

Top Key Players in the Market

- Samsung Electronics

- LG Electronics

- Barco

- Christie Digital Systems

- Daktronics

- Planar Systems

- Sharp Corporation

- NEC Corporation

- Leyard

- Panasonic Corporation

- E Ink Corporation

- Others

Recent Developments

- In July 2025, Daktronics launched the DXB-1000, a next-generation digital billboard offering superior image clarity and improved energy efficiency, designed for urban environments and aligning with the growing demand for sustainable digital out-of-home advertising.

- In January 2024, at Integrated Systems Europe (ISE) 2024, LG showcased its advanced digital signage solutions, including Micro LED, All-in-One LED, Transparent OLED, and cloud management platforms, tailored for retail, corporate, education, and hospitality sectors.

Report Scope

Report Features Description Market Value (2024) USD 0.72 Bn Forecast Revenue (2034) USD 1.31 Bn CAGR(2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Screen Size (22 inches – 32 inches, 32 inches – 45 inches, 45 inches – 55 inches, 55 inches – 65 inches, 65 inches – 85 inches, Others), By Display Type (LED, LCD, OLED, Others), By Application (Event Branding, Wayfinding, Live Streaming, Product Displays, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics, LG Electronics, Barco, Christie Digital Systems, Daktronics, Planar Systems, Sharp Corporation, NEC Corporation, Leyard, Panasonic Corporation, E Ink Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Signage for Events MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Signage for Events MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics

- LG Electronics

- Barco

- Christie Digital Systems

- Daktronics

- Planar Systems

- Sharp Corporation

- NEC Corporation

- Leyard

- Panasonic Corporation

- E Ink Corporation

- Others