Digital PCR Market - By Product (Instruments and Reagents & Consumables), By End-User (Hospitals & Clinics, Academic & Research Organization, Diagnostic Centers, Pharmaceutical & Biotechnology Industries, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2024

- Report ID: 67760

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

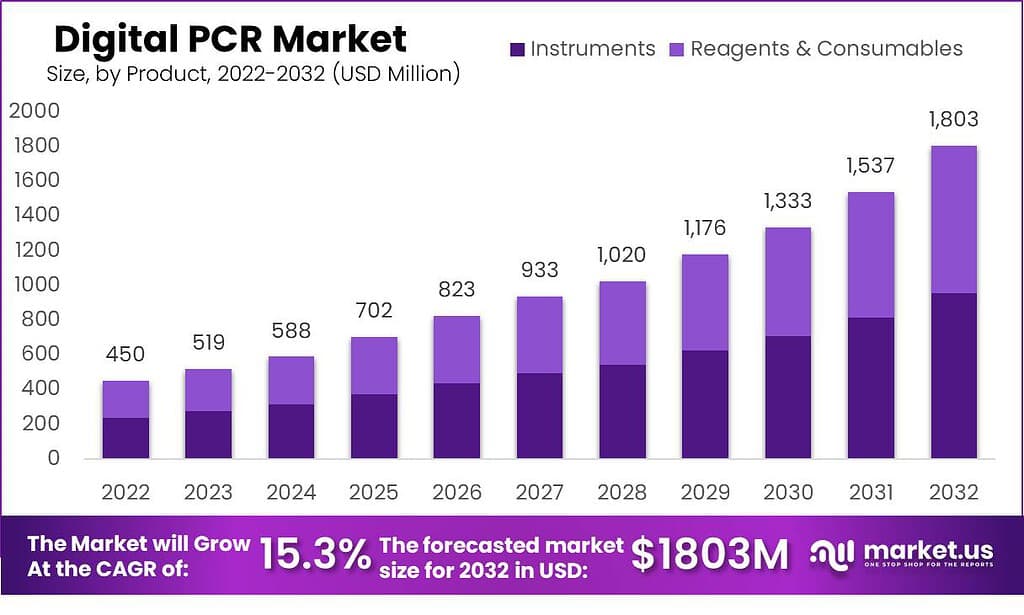

The Global Digital PCR Market Size is expected to be worth around USD 1,803 Million by 2032 from USD 450 Million in 2022, growing at a CAGR of 15.3% during the forecast period from 2023 to 2032.

The biotechnological development of the conventional polymerase chain reaction is the digital polymerase chain reaction or dPCR. It is a sensitive and reproducible way to measure the amount of DNA or RNA in a sample using a high-throughput absolute quantitative method. Some of the most important factors anticipated to drive market growth over the forecast period are an increase in acquisitions, the introduction of new products, and the growing adoption of digital devices by laboratories for cancer, infectious diseases, and genetic disorders.

In addition, digital device technological advancements are anticipated to contribute to market expansion over the forecast period. During the forecast period, there will likely be less demand for COVID-19 infection diagnostic tests due to a significant decline in industry growth. However, some key factors exist, such as the rising demand for advanced diagnostics and the expanding use of PCR in research and forensic laboratories. In addition, it is anticipated that contract research organizations and the introduction of new technologies will propel PCR test demand forward during the forecast period.

Key Takeaways

- In 2022, instruments represented 34% of revenue generated across product categories.

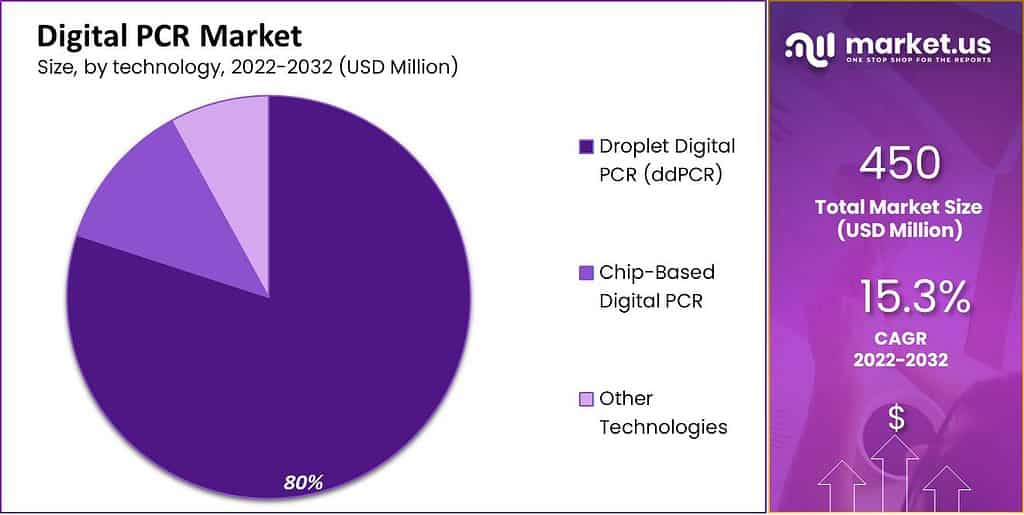

- Technology-wise, digital droplet PCR holds the largest market share.

- By indication, genetic disorders have emerged as the leader of this market and experienced the highest compound annual compound annual compound growth from 2023 to 2032.

- By end-user segment, academic & research organizations held the greatest share of the market.

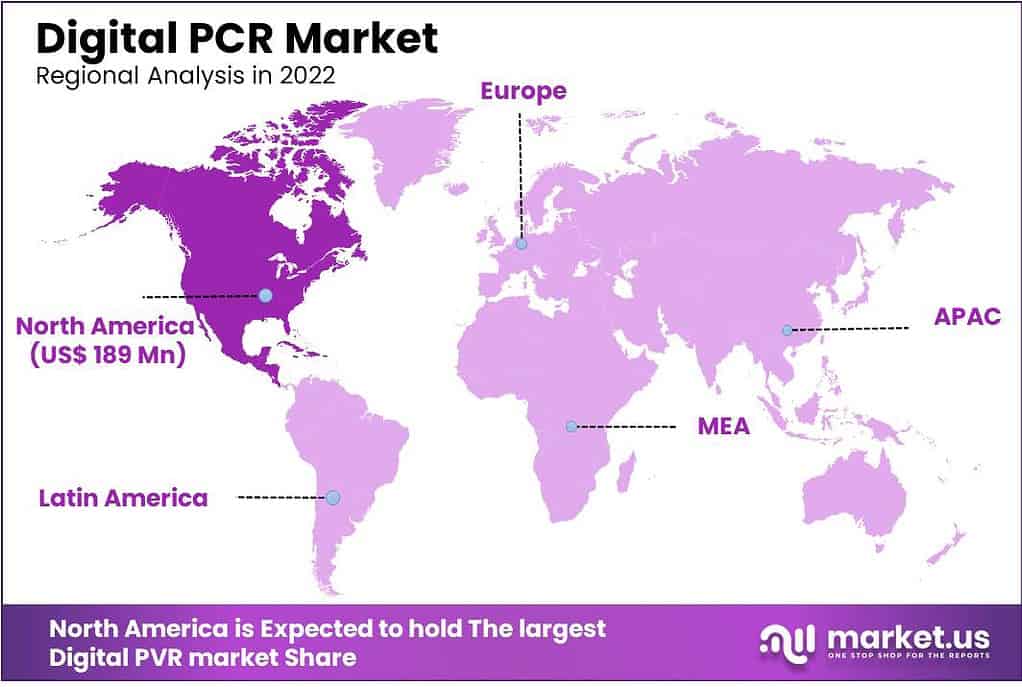

- North America held the highest revenue share with 42%.

- Europe will experience sustained compound annualized growth between 2023-2032.

Product Analysis

The Instruments Segment Accounted for the Largest Market Share

The market has been segmented into instruments, and reagents & consumables are the market segments. In 2022, the instruments segment was accounted to have the largest market share. The significant market share is due to the increasing initiatives of prominent market players to launch new products and increase applications of these digital PCR equipment. During the forecast period, the reagents & consumables segment is expected to grow at the highest CAGR.

The increasing commercialization of these digital device kits for diagnostic purposes is responsible for the segment’s expansion. Additionally, governments granted emergency use authorization for specific digital COVID-19 diagnosis kits due to the COVID-19 pandemic, which is anticipated to boost market expansion in the long run.

Technology Analysis

The Droplet Digital PCR Segment held the Highest Market Share

Among the technology segment, the droplet digital PCR accounted for the largest market share. During the forecast period of 2023 to 2032, it is anticipated to expand at a substantial CAGR. Market participants are increasingly emphasizing the development and commercialization of dPCR for infectious disease diagnostics, which accounts for the expansion.

In addition, the advantages of these devices over other PCR in disease diagnosis and the rising incidence of infectious diseases are anticipated to boost segment growth over the forecast period. During the forecast period, the chip-based digital PCR market is anticipated to expand at a moderate CAGR. Chip-based digital PCR’s ability to detect strain specificity with less variation than the current standard of plate count enumeration and quantitative polymerase chain reaction (qPCR) is the reason for the segmental growth.

Indication Analysis

The Genetic Disorders Segment Dominated the Market

Genetic disorders, oncology, infectious diseases, and others are market segments. The market for genetic disorders is dominant and is anticipated to expand at a moderate CAGR between 2023 and 2032. Due to their specificity and high sensitivity in detection, these devices are increasingly being used to identify gene alterations, which accounts for the segment’s expansion. During the forecast period, the oncology segment is anticipated to expand at a substantial CAGR.

The growing use of digital devices such as these in cancer research and the rising prevalence of cancer diseases are two factors that have contributed to the segment’s expansion. During the forecast period, the infectious diseases sector is expected to expand at the highest CAGR. It is anticipated that the use of these digital droplet devices in diagnosing infectious diseases, including infections caused by bacteria, viruses, and parasites, will rise due to their clinically demonstrated potential advantages.

End-User Analysis

The Academic & Research Organizations Segment held the Largest Market Share

Hospitals & clinics, academic & research organizations, diagnostic centers, pharmaceutical & biotechnology industries, and others comprise the market. During the forecast period, the academic & research organizations segment is anticipated to expand at a moderate CAGR and hold the dominant share. The increasing use of these devices in research studies in various fields, including genetic diseases, oncology, and others, is responsible for expanding this market segment.

During the forecast period, the diagnostics centers segment is anticipated to expand at the highest CAGR. The growth of this market segment can be attributed to the increasing use of digital diagnostic tools for infectious diseases and their rising prevalence. Additionally, due to the COVID-19 outbreak, numerous market participants increased their focus on creating and selling COVID-19 diagnostic kits.

Key Market Segments

Based on Product

- Instruments

- Reagents & Consumables

Based on Technology

- Droplet Digital PCR (ddPCR)

- Chip-Based Digital PCR

- Other Technologies

Based on Indication

- Genetic Disorders

- Oncology

- Infectious Diseases

- Other Applications

Based on End-User

- Hospitals & Clinics

- Academic & Research Organization

- Diagnostic Centers

- Pharmaceutical & Biotechnology Industries

- Other End-Users

Drivers

Increasing Frequency of Infectious Diseases

As demonstrated, various infectious agents have been detected in trace amounts using PCR. The organisms of interest vary in terms of the optimal amplification conditions. Three assay systems were developed for Mycobacterium tuberculosis, for amplifying human T cell leukemia virus type I, and for Mycoplasma pneumonia.

PCR was used as a rapid and sensitive method for detecting infectious agents. All of these factors will drive the market. In addition, the increasing incidence of infectious diseases and the advancing age of the population significantly impact the expansion of the market for real-time PCR technology.

Increasing R&D Activities

Market expansion is anticipated to be fuelled by the rising use of PCR for cancer diagnosis. In addition, because of the high demand for personalized medicines and genetic engineering, the market is expected to expand strongly over the forecast period. All of these factors are to blame for the rise in demand for this method and research and development activities to provide cutting-edge forensic science and molecular biology.

Restraints

Costly Technology Hindered the Market’s Growth

Technical limitations and the high cost of technology will impede the market’s growth rate. During the forecast period, the digital PCR market may be hindered by high d-PCR device costs and technical limitations of q-PCR and d-PCR techniques. In contrast, the most significant obstacle to expanding the digital polymerase chain reaction (PCR) market is the widespread application and adoption of MIQE guidelines.

Opportunities

Increasing Demand for PCR

The rising demand for personalized medicines accounts for most of the market opportunities. It will be highly beneficial to have technology that can gather information at the molecular level for disease detection. All screening techniques make extensive use of polymerized chain reaction techniques. The biotechnology sector benefited from the introduction of the polymerase chain reaction.

The major pharmaceutical industry and the life sciences rely heavily on the polymerase chain reaction. The demand for PCR technology is estimated to rise significantly in the coming years as the devices are used extensively for drug discovery.

Regional Analysis

North America Dominates the Global Digital PCR Market During the Forecast Period

With a revenue share of 42%, the North America market is anticipated to expand at a substantial CAGR over the forecast period. The population’s high alertness and economic stability are the reasons for the expansion. In addition, the regional market is anticipated to expand during the forecast period due to the growing use of high-tech, expensive diagnostics in the region.

During the forecast period, Europe is anticipated to expand at a moderate CAGR. Substantial volumes of infectious diagnostics in key European nations and rising European expenditures on R&D account for the expansion. During the forecast period, the market in the Asia-Pacific region is anticipated to expand at the highest CAGR. Improving healthcare infrastructure in Asian nations, rising public awareness of improved treatment outcomes, and the region’s high prevalence of chronic and infectious diseases are all contributing factors to the region’s expanding market.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Strong Focus on Acquisitions and Partnerships to Strengthen Leading Players’ Market Position and a Diverse Portfolio

Due to significant market shares held by key market players, the market is consolidated. Bio-Rad Laboratories, Inc. ruled the market with the largest share of the digital PCR market. The company’s robust product portfolio, which includes a wide range of instruments and consumables, positively impacts the market.

Additionally, the company’s substantial market share is the result of previous acquisitions of other manufacturers of digital devices. A few major players in the market are Fluidigm Corporation, Promega Corporation, Danaher Corporation, Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd., ELITech Group, Analytik Jena AG, Roche Sequencing, BioMérieux SA, and other key companies.

Listed below are some of the most prominent global digital PCR market players.

Market Key Players

- QIAGEN

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- JN Medsys

- Stilla

- Sysmex Corporation

- Standard BioTools

- Precigenome LLC.

- Other Key Players

Recent Developments

- In September 2024: In a strategic development, QIAGEN introduced the PAXgene Urine Liquid Biopsy Set. This product aims to complement existing liquid biopsy solutions by allowing the reliable analysis of cell-free DNA from urine samples. This novel solution fills a significant gap in urine sample processing and is integrated with technologies like NGS, qPCR, and digital PCR, broadening the applications in disease monitoring and treatment response.

- In June 2024: New Product Launch, Stilla Technologies expanded their Nio™ product line with the introduction of two new digital PCR system configurations. These additions aim to provide more accessible and adaptable digital PCR solutions tailored to different laboratory needs. The new models introduced are Nio™ E and Nio™, designed to handle 48 and 192 samples per run, respectively. This expansion is part of Stilla’s ongoing effort to cater to a broader range of genomic testing requirements. The Nio™ family also received the Red Dot Design Award, highlighting its exceptional design and innovation.

- In February 2023: Thermo Fisher announced the launch of the QuantStudio Absolute Q AutoRun dPCR Suite. This new solution integrates advanced digital PCR technology with intelligent lab automation to support biopharma and molecular research. The system is designed for high-throughput, multiplex analysis and offers up to 72 hours of hands-free operation, enhancing lab productivity and accelerating the time to market for novel therapeutics.

- 2023: Launch of Clarity Plus™ Digital PCR System, JN Medsys introduced the Clarity Plus™ Digital PCR system, enhancing capabilities over its predecessor. This system features a high-density chip with 45,000 partitions per reaction, allowing for superior quantification of DNA and RNA. It supports multiplexing with a 6-colour detection system, enabling the analysis of multiple targets within a single chip. This system combines high-throughput capabilities with an easy workflow, catering to more complex digital PCR needs.

Report Scope

Report Features Description Market Value (2022) USD 450 Million Forecast Revenue (2032) USD 1,803 Million CAGR (2023-2032) 15.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product- Instruments and Reagents & Consumables; By Technology– Droplet Digital PCR (ddPCR), Chip-Based Digital PCR, and Other Technologies; By Indication- Genetic Disorders, Oncology, Infectious Diseases, and Other Applications; and By End-User- Hospitals & Clinics, Academic & Research Organization, Diagnostic Centers, Pharmaceutical & Biotechnology Industries, and Other End-Users. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape QIAGEN, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., JN Medsys, Stilla, Sysmex Corporation, Standard BioTools, Precigenome LLC., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- QIAGEN

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- JN Medsys

- Stilla

- Sysmex Corporation

- Standard BioTools

- Precigenome LLC.

- Other Key Players