Global Digital Money Transfer and Remittances Market By Type(Domestic Transfers, International Remittances, Cross-Border Business Payments), By Mode(Online Transfers, Mobile Wallets, Bank Transfers, Agent Networks), By Application(Personal Remittances, Business Payments, Government Transfers, Retail Purchases), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 128186

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

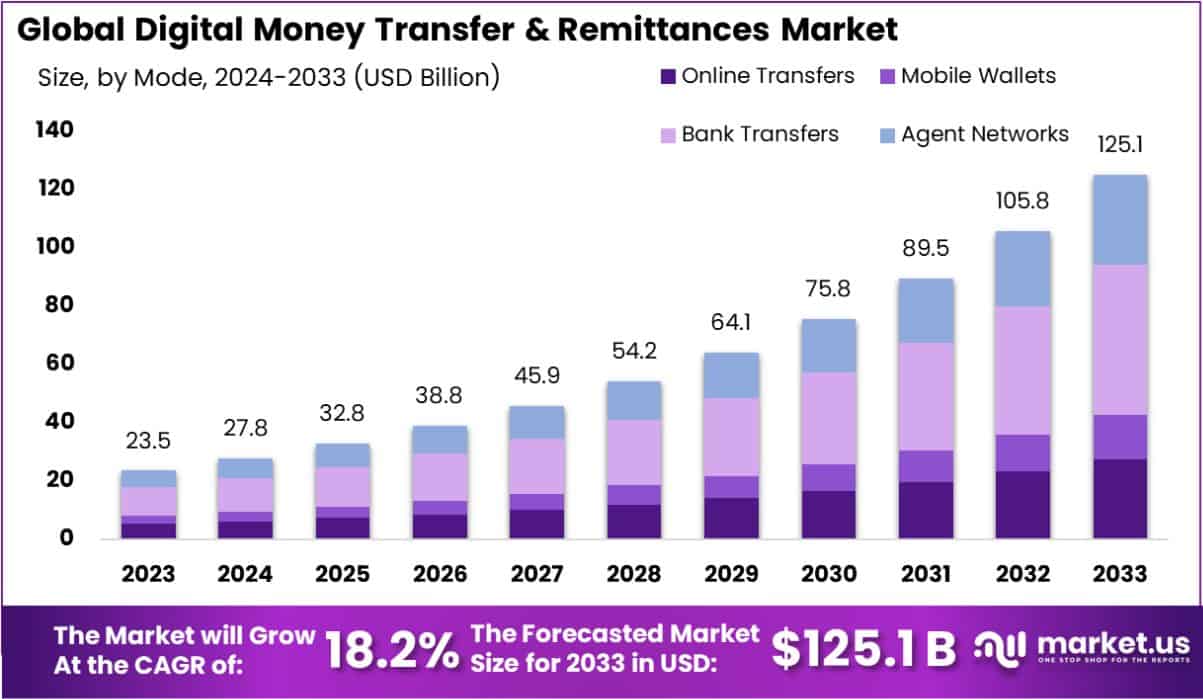

The Global Digital Money Transfer and Remittances Market size is expected to be worth around USD 125.1 Billion By 2033, from USD 23.5 Billion in 2023, growing at a CAGR of 18.2% during the forecast period from 2024 to 2033. North America dominates the Digital Money Transfer & Remittances Market with a 36.5% share, generating revenue of USD 8.57 billion.

Digital money transfers and remittances refer to the electronic transfer of funds between individuals or entities, often across borders, facilitated by digital platforms and services. This method has grown in popularity due to its speed, convenience, and the increasing accessibility of mobile and internet technology.

The market for digital money transfers and remittances is expanding rapidly, driven by globalization and the growing migrant workforce. Key growth factors include technological advancements that make transfers quicker and more secure, regulatory support for digital payments, and the rise of fintech companies that offer competitive fees and user-friendly platforms.

Top opportunities in this market lie in developing innovative, low-cost remittance solutions tailored for emerging markets, integrating blockchain to enhance security and transparency, and expanding mobile wallet services to reach unbanked populations, fostering greater financial inclusion globally.

The Digital Money Transfer and Remittances Market is witnessing a notable transformation, driven by technological advancements and the increasing globalization of the workforce. In 2024, remittances to low- and middle-income countries (LMICs) are projected to grow at a rate of 2.3%, as reported by gpfi.org. This growth, however, is expected to vary across different regions, reflecting the diverse economic landscapes and migration trends globally.

By the end of 2023, it is estimated that over 200 million migrants will have sent approximately US$ 656 billion to support around 800 million recipients in LMICs. This substantial flow of funds underscores the critical role of digital remittance services in facilitating efficient and secure transactions across borders. The market is increasingly competitive, with numerous players leveraging technology to enhance user experience and expand their service offerings.

Factors such as improved mobile connectivity, the proliferation of financial apps, and regulatory support are further catalyzing the market’s expansion. As digital platforms become more integrated into the financial habits of global consumers, the reliance on digital remittances is expected to increase, presenting significant opportunities for growth and innovation in the sector.

Key Takeaways

- The Global Digital Money Transfer & Remittances Market size is expected to be worth around USD 125.1 Billion By 2033, from USD 23.5 Billion in 2023, growing at a CAGR of 18.2% during the forecast period from 2024 to 2033.

- In 2023, International Remittances held a dominant market position in the by-type segment of the Digital Money Transfer & Remittances Market, capturing more than a 39% share.

- In 2023, Bank Transfers held a dominant market position in the By Mode segment of the Digital Money Transfer & Remittances Market, capturing more than a 41.5% share.

- In 2023, Personal Remittances held a dominant market position in the By Application segment of the Digital Money Transfer & Remittances Market, capturing more than a 47.52%5 share.

- North America dominated a 36.5% market share in 2023 and held USD 8.57 Billion in revenue from the Digital Money Transfer & Remittances Market.

By Type Analysis

In 2023, International Remittances held a dominant market position in the “By Type” segment of the Digital Money Transfer & Remittances Market, capturing more than a 39% share. This segment outperformed others such as Domestic Transfers and Cross-Border Business Payments, illustrating the significant reliance on international transactions by expatriates and businesses globally.

The growth in International Remittances is fueled by the increasing globalization of businesses and the rising number of migrant workers who rely on digital platforms to send money back to their home countries. This trend is supported by improvements in financial technology that offer safer, faster, and more cost-effective transfer options.

Domestic Transfers, though significant, trailed with a lower market share due to the maturity of local banking systems and the prevalent use of mobile banking solutions within countries. Meanwhile, Cross-Border Business Payments are on the rise, driven by expanding international trade and the adoption of e-commerce platforms that require efficient cross-border smart payment solutions. This segment is expected to grow as businesses continue to seek streamlined solutions for international transactions, emphasizing the overall expanding scope of the digital money transfer industry.

By Mode Analysis

In 2023, Bank Transfers held a dominant market position in the “By Mode” segment of the Digital Money Transfer & Remittances Market, capturing more than a 41.5% share. This mode of transfer remains a cornerstone in the industry, favored for its security and the established trust in banking institutions. As consumers and businesses continue to prioritize reliability in their financial transactions, bank transfers outshine newer methods like Online Transfers, Mobile Wallets, and Agent Networks.

Online Transfers and Mobile Wallets are also gaining traction, driven by the increasing penetration of internet and smartphone usage globally. These methods appeal especially to a younger demographic that values speed and convenience. However, they still lag in market share due to varying degrees of regulatory scrutiny and consumer wariness about security.

Agent Networks, traditionally strong in regions with lower bank penetration, continue to play a crucial role, especially in rural or underbanked areas. They offer physical touchpoints for cash transactions, which are indispensable in less digitized economies. Overall, while Bank Transfers lead the market, the growth of digital methods points to a dynamic future for the sector, with diverse options catering to different needs and markets.

By Application Analysis

In 2023, Personal Remittances held a dominant market position in the “By Application” segment of the Digital Money Transfer & Remittances Market, capturing more than a 47.5% share. This substantial market share reflects the critical role of remittances in the global economy, particularly as a financial lifeline for families in lower and middle-income countries. The robustness of this segment is propelled by the growing diaspora populations and their increasing employment in foreign nations, driving the need for efficient and secure channels to support families back home.

Business Payments, while also significant, capture a smaller segment as they often involve more complex regulations and require more robust transactional frameworks. Government Transfers and Retail Purchases, although essential components of digital transfers, typically account for less of the market share. Government Transfers are primarily bolstered by social welfare distributions or inter-governmental funds, whereas Retail Purchases through digital remittances are emerging with the rise of e-commerce but are still in the relatively early stages of adoption.

The dominance of Personal Remittances underscores not only the social and economic dependencies but also the technological advancements that are making cross-border financial support more accessible and affordable.

Key Market Segments

By Type

- Domestic Transfers

- International Remittances

- Cross-Border Business Payments

By Mode

- Online Transfers

- Mobile Wallets

- Bank Transfers

- Agent Networks

By Application

- Personal Remittances

- Business Payments

- Government Transfers

- Retail Purchases

Drivers

Key Trends in Digital Remittances

In the rapidly evolving landscape of the Digital Money Transfer and Remittances Market, several key drivers are propelling growth. Firstly, the widespread adoption of smartphones and increasing internet penetration globally are making digital transfers more accessible to a broader audience.

Additionally, the rise in migration rates has boosted the demand for quick and secure cross-border transactions, catering to expatriates and businesses alike. Financial technologies, or fintech innovations, play a pivotal role by introducing user-friendly platforms that reduce transaction times and costs, enhancing customer satisfaction.

Regulatory support in various countries has also been crucial, as governments recognize the economic benefits of digital remittances and aim to ensure secure and streamlined services. Together, these factors are significantly advancing the market, providing convenient solutions for international money transfers.

Restraint

Challenges in Digital Remittances

Despite the growth in the Digital Money Transfer and Remittances Market, several restraints hinder its broader acceptance and expansion. A major challenge is the high level of regulatory scrutiny across different countries, which can lead to complex compliance requirements and restrict market entry for new players.

Security concerns are also paramount, as the rise in cyber threats and fraud associated with digital transactions makes consumers wary of using online remittance services. Furthermore, the digital divide, particularly in underdeveloped regions, limits the accessibility of digital remittance services for a significant portion of potential users who lack reliable internet access or digital literacy.

These factors collectively slow down the adoption rate and could potentially stall the market’s growth unless effectively addressed through enhanced security measures and targeted financial inclusion initiatives.

Opportunities

Growth Trends in Digital Remittances

In the Digital Money Transfer and Remittances Market, several opportunities are shaping the future landscape. Firstly, technological advancements are simplifying cross-border transactions, allowing users to send and receive funds swiftly and securely. The rising adoption of blockchain and cryptocurrencies could significantly reduce costs and enhance transparency in remittances.

Furthermore, the growing global migration and the expansion of the workforce across international borders are increasing the demand for remittance services. Mobile-based remittance apps are becoming increasingly popular due to their convenience, driving the market’s expansion.

Additionally, partnerships between leading remittance providers and local financial institutions in emerging markets are helping to increase the accessibility of services to underserved populations, thereby expanding the market’s reach. This holistic approach to innovation and collaboration presents substantial growth opportunities for stakeholders in the digital remittance space.

Challenges

Barriers in the Digital Remittances Sector

The Digital Money Transfer and Remittances Market faces several challenges that could hinder its growth. Regulatory compliance across different countries presents a significant hurdle, as companies must navigate complex legal frameworks to operate internationally, which can be costly and time-consuming.

Additionally, the threat of cyber-attacks and data breaches requires robust security measures, increasing operational costs for providers. Another major challenge is the competition from traditional banks and emerging fintech startups, creating a highly competitive market environment. Market penetration in rural or underdeveloped regions remains limited due to inadequate digital infrastructure and low financial literacy among potential users.

Furthermore, fluctuating exchange rates can impact the cost-effectiveness of sending remittances, potentially deterring users from utilizing digital platforms. Addressing these challenges is crucial for companies to capitalize on the opportunities in the evolving remittance landscape.

Growth Factors

Drivers of Digital Remittance Growth

Several key factors are propelling the growth of the Digital Money Transfer and Remittances Market. The increasing global migration, where people move to other countries for jobs or education, creates a constant demand for cost-effective remittance solutions.

Technological advancements, particularly in mobile technology, have made it easier and more convenient for users to send money across borders using their smartphones. The integration of blockchain technology is also a significant driver, offering faster transactions and reduced costs compared to traditional methods.

Moreover, regulatory support in many countries is improving, encouraging the formal use of digital remittances and helping to bring more services to previously underserved areas. Additionally, the COVID-19 pandemic has accelerated the shift towards digital solutions, as physical remittance channels were disrupted. These factors collectively contribute to the robust expansion of the digital remittance sector.

Emerging Trends

New Trends in Money Transfers

Emerging trends in the Digital Money Transfer and Remittances Market are reshaping how money is sent across borders. A notable trend is the increased use of cryptocurrency and blockchain technology, which promises to make transactions faster, cheaper, and more transparent.

Many companies are adopting these technologies to gain a competitive edge. Additionally, the rise of mobile wallet apps is transforming remittances, allowing users to send money directly from their smartphones, enhancing convenience and accessibility. Artificial intelligence and machine learning are also being integrated to automate and secure transaction processes, reducing errors and fraud.

Another growing trend is the collaboration between fintech firms and traditional banks, aiming to combine fintech innovations with the trust and regulatory framework of banks. These trends highlight a move towards more integrated, tech-driven, and user-friendly remittance services.

Regional Analysis

The Digital Money Transfer & Remittances Market exhibits substantial regional diversity in its growth and adoption patterns. In North America, the market is notably dominant, accounting for 36.5% of the global share, valued at approximately USD 8.57 billion. This prominence is driven by advanced technological infrastructure and the widespread acceptance of digital payment platforms among consumers and businesses.

Europe, while trailing slightly, shows robust growth facilitated by stringent regulatory frameworks enhancing transaction security and fostering trust among users. The Asia Pacific region is witnessing the fastest growth, spurred by increasing smartphone penetration and the emergence of fintech startups focusing on financial inclusivity. In contrast, the Middle East & Africa, and Latin America are experiencing gradual growth.

The expansion in these regions is primarily fueled by the rising need for cost-effective and rapid cross-border transactions among a growing expatriate workforce. Each region’s unique economic and technological landscape plays a critical role in shaping the dynamics of the digital money transfer and remittances sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Digital Money Transfer & Remittances Market, Western Union Holdings Inc., Euronet Worldwide Inc., and Ria Financial Services are pivotal players that continue to shape the industry’s trajectory in 2023.

Western Union remains a stalwart, leveraging its expansive physical network and deep market penetration to maintain a strong customer base, despite the rising competition from digital-first entities. The company’s strategic focus on enhancing digital channels and forming alliances with local entities in emerging markets underscores its adaptive strategies in the face of shifting consumer preferences.

Euronet Worldwide Inc. distinguishes itself with robust technological infrastructure, facilitating efficient and secure transactions across a diverse customer base. The company’s investment in mobile and online transaction solutions has positioned it well to capitalize on the growing demand for digital remittance services, particularly in densely populated regions like Asia and Africa where mobile penetration is skyrocketing.

Ria Financial Services, known for its customer-centric approach, continues to expand its footprint by focusing on underserved regions. Its commitment to providing low-cost remittance solutions aligns with the global push towards financial inclusivity, attracting a significant segment of users who are new to digital banking services. By prioritizing accessibility and affordability, Ria effectively competes in a market driven by cost and convenience.

Top Key Players in the Market

- Western Union Holdings Inc.

- Euronet Worldwide Inc.

- Ria Financial Services

- PayPal

- TransferWise

- OrbitRemit Limited

- MoneyGram

- Remitly

- VayuPay

- TransferGo

- Instarem and Tng Wallet

Recent Developments

- In July 2023, OrbitRemit Limited secured $15 million in Series B funding to scale its operations and enhance its digital platform. This funding is aimed at improving the user experience for its remittance services, focusing on more efficient and cost-effective transfer methods.

- In May 2023, PayPal announced the acquisition of a smaller fintech company to expand its capabilities in seamless, cross-border transactions. This strategic move aims to enhance PayPal’s remittance services by integrating advanced technology that reduces transaction times and fees.

- In February 2023, Wise launched a new multi-currency investment product in February 2023, allowing users to invest in international stocks through their existing currency accounts. This innovation not only diversifies Wise’s offerings but also increases its attractiveness to users seeking more financial services beyond remittances.

Report Scope

Report Features Description Market Value (2023) USD 23.5 Billion Forecast Revenue (2033) USD 125.1 Billion CAGR (2024-2033) 18.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Domestic Transfers, International Remittances, Cross-Border Business Payments), By Mode(Online Transfers, Mobile Wallets, Bank Transfers, Agent Networks), By Application(Personal Remittances, Business Payments, Government Transfers, Retail Purchases) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Western Union Holdings Inc., Euronet Worldwide Inc., Ria Financial Services, PayPal, TransferWise, OrbitRemit Limited, MoneyGram, Remitly, VayuPay, TransferGo, Instarem and Tng Wallet. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Money Transfer and Remittances MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Money Transfer and Remittances MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Western Union Holdings Inc.

- Euronet Worldwide Inc.

- Ria Financial Services

- PayPal

- TransferWise

- OrbitRemit Limited

- MoneyGram

- Remitly

- VayuPay

- TransferGo

- Instarem and Tng Wallet