Global Digital Learning Resources Market Size, Share and Analysis Report By Content Type (eLearning Courses & Modules, Interactive Videos & Simulations, Digital Textbooks & eBooks, Assessments & Quizzes, Others), By End-User (K-12 Education, Higher Education, Corporate Training, Self-paced Learners), By Deployment Mode (Cloud-based / SaaS, On-premises), By Business Model (Subscription, One-time License, Freemium, Advertising-based), By Subject Area (STEM (Science, Technology, Engineering, Math), Humanities & Languages, Professional & Skills-based, Test Preparation), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173292

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Content Type Analysis

- End-User Analysis

- Deployment Mode Analysis

- Business Model Analysis

- Subject Area Analysis

- Key Reasons for Adoption

- Key Benefits

- Key Usage Areas

- Emerging Trends

- Growth Factors

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Competitive Analysis

- Future Outlook

- Recent Development

- Report Scope

Report Overview

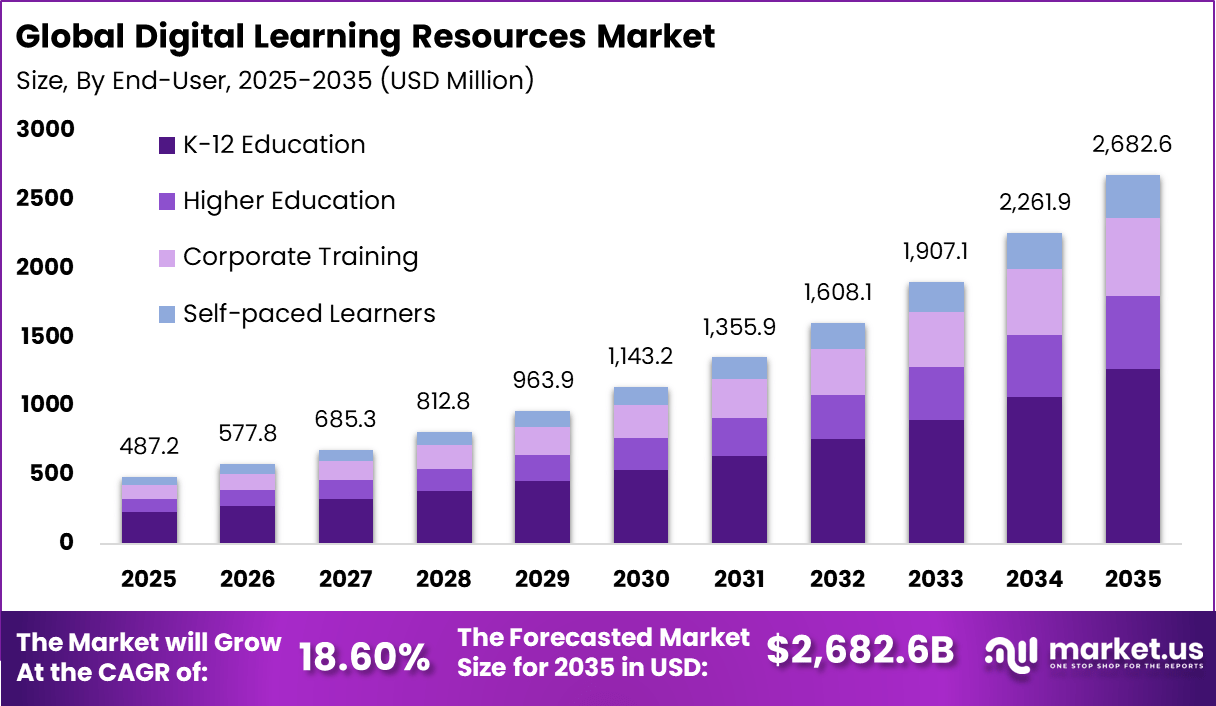

The Global Digital Learning Resources Market generated USD 487.2 Million in 2025 and is predicted to register growth from USD 577.8 million in 2025 to about USD 2,682.6 million by 2034, recording a CAGR of 18.60% throughout the forecast span. In 2024, North mmerica held a dominan market position, capturing more than a 38.5% share, holding USD 187.57 Million revenue.

The digital learning resources market refers to online materials and platforms that support teaching, learning, and skill development through digital formats. These resources include e-books, videos, interactive modules, simulations, assessments, and learning management content. Digital learning resources are used by schools, universities, training institutes, and corporate learning programs. They enable flexible access to educational content across devices and locations.

Adoption supports scalable and personalized learning experiences. One major driving factor of the digital learning resources market is the growing demand for flexible and remote learning options. Learners seek education that fits diverse schedules and locations. Digital resources support self-paced and asynchronous learning. Flexibility improves participation and completion rates. Accessibility needs strongly drive adoption.

Cloud-based content delivery technologies play a key role in adoption. Cloud platforms enable reliable access to learning materials. Scalability supports high user volumes. Cloud deployment reduces infrastructure burden. Technology availability supports market expansion. Interactive and multimedia technologies also support adoption. Videos, simulations, and quizzes improve learner engagement. Interactive content enhances retention.

Rich media improves learning outcomes. Technological innovation increases resource effectiveness. One key reason institutions adopt digital learning resources is improved learning accessibility. Content can be accessed anytime and anywhere. Learners benefit from consistent availability. Reduced geographic barriers improve inclusion. Accessibility supports adoption. Another reason is cost efficiency and scalability.

Top Market Takeaways

- By content type, eLearning courses and modules took 38.6% of the digital learning resources market, delivering interactive lessons and videos.

- By end-user, K-12 education held 47.3% share, supporting classrooms with adaptive content and remote access.

- By deployment mode, cloud-based SaaS captured 91.7%, enabling instant updates and multi-device use.

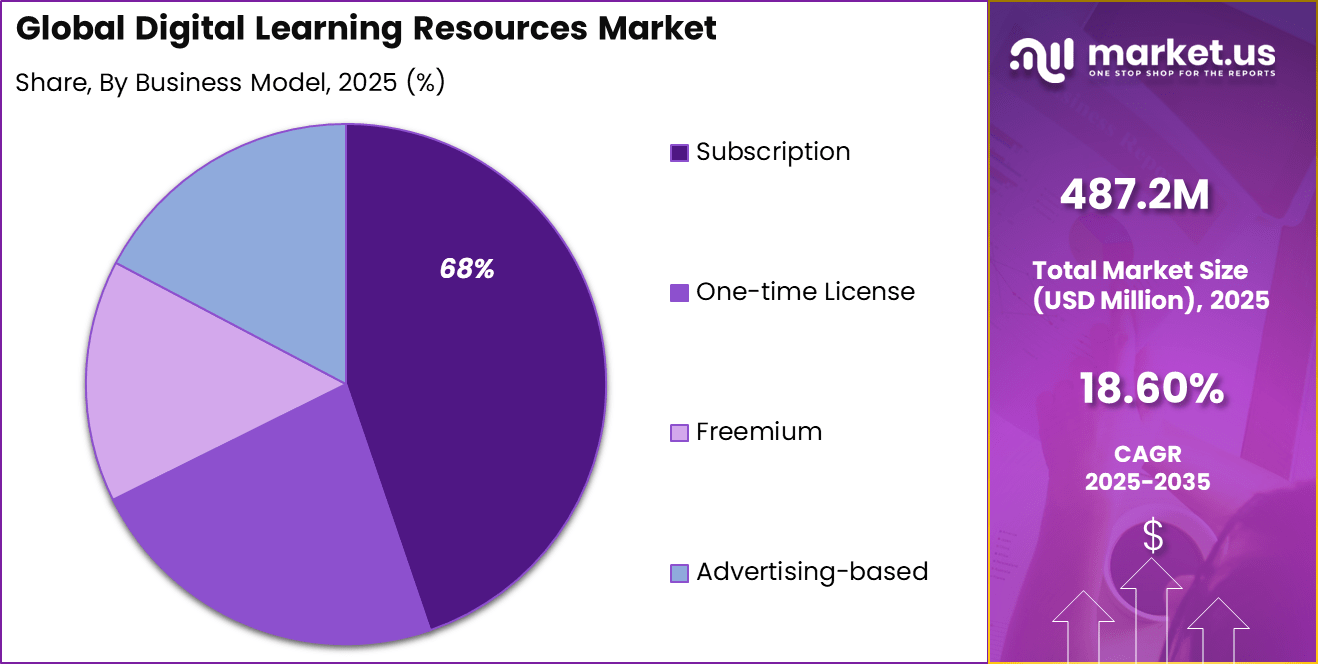

- By business model, subscription led with 68.4%, providing ongoing access to growing libraries.

- By subject area, STEM accounted for 41.5%, focusing on math, science, and tech skills for future jobs.

- North America had 38.5% of the global market, with the U.S. at USD 168.1 million in 2025 and growing at a CAGR of 16.28%.

Key Insights Summary

General Adoption Rates (2026 Forecasts)

- Online learning platform users are expected to exceed 1 billion globally by 2029.

- Around 69% of students worldwide prefer online, blended, or hybrid learning formats.

- Digital materials are projected to account for over 50% of educational content consumption in the U.S. by 2026.

- In India, schools with internet access reached 53.9% by late 2024, up from 22.3% in 2020.

Usage and Engagement Statistics

- Mobile learning improves productivity by 43%.

- Employees complete training 45% faster on mobile compared with desktop platforms.

- Online learning improves knowledge retention by 25% to 60%.

- About 86% of students already use AI tools in their studies.

- Around 60% of teachers have integrated AI into daily teaching.

- Gamified learning increases engagement by up to 48%.

- Course completion rates reach nearly 90% with gamification.

Corporate Adoption and ROI

- Around 93% of businesses worldwide are expected to adopt e-learning by 2026.

- About 38% of companies increased training budgets in 2025–2026.

- Dow Chemical reduced training costs from USD 95 to USD 11 per learner through online learning.

- 90% of companies use Learning Management Systems for training administration.

- 83% of employees prefer instructional videos over other learning formats.

Content Type Analysis

eLearning courses and modules account for 38.6% of the digital learning resources market, reflecting their central role in structured digital education. These resources provide organized learning paths, assessments, and progress tracking. Educational institutions and learners rely on them for consistent and scalable instruction delivery. The demand for courses and modules is driven by curriculum alignment and standardized learning outcomes.

Digital formats allow frequent content updates and interactive learning experiences. This supports improved learner engagement and knowledge retention. As digital education expands, structured eLearning content remains essential. Institutions prefer modular formats that can be customized. This sustains strong adoption across education systems.

End-User Analysis

K-12 education represents 47.3% of market demand, making it the largest end-user segment. Schools increasingly adopt digital resources to support classroom teaching and remote learning. Digital tools enhance lesson delivery and student engagement. Educators use digital resources to address diverse learning needs and improve accessibility.

Interactive content supports differentiated instruction. This improves learning outcomes across grade levels. As digital literacy becomes a priority, K-12 adoption continues to grow. Government initiatives and school modernization programs support integration. This segment remains a key market driver.

Deployment Mode Analysis

Cloud-based and SaaS deployment dominates the market with a 91.7% share. This reflects the need for scalable and easily accessible learning platforms. Cloud solutions allow learners and educators to access content from any location. SaaS models reduce infrastructure management for schools and institutions.

Automatic updates and centralized management improve operational efficiency. These features support rapid deployment and usage. As digital learning ecosystems mature, cloud-based delivery remains preferred. Flexibility and cost efficiency reinforce adoption. This deployment model continues to lead the market.

Business Model Analysis

The subscription model holds 68.4% of the Digital Learning Resources market, driven by its predictable cost structure and continuous content access. Subscriptions provide learners and institutions with ongoing access to updated materials, tools, and assessments. This model supports long-term learning engagement rather than one-time content usage.

From a provider perspective, subscriptions support stable revenue and regular content improvement. Users benefit from regular updates and added features. The strong share of this model reflects preference for affordable and continuous access to digital learning resources.

Subject Area Analysis

STEM subjects represent 41.5% of content demand within the market. Digital resources are well suited for teaching science, technology, engineering, and mathematics concepts. Interactive simulations and virtual labs enhance understanding.

Educators use digital STEM resources to support practical learning and problem-solving skills. These tools help bridge gaps between theory and application. This improves student readiness for future careers. As demand for STEM skills grows, digital learning adoption increases. Curriculum focus supports sustained investment. STEM remains a leading subject area in the market.

Key Reasons for Adoption

- Learning institutions are adopting digital resources to support flexible and remote education models

- Growing demand for continuous skill development is driving the use of online learning materials

- Easy access to updated content helps learners stay aligned with current academic and industry needs

- Widespread use of smartphones and internet services supports large-scale adoption

- Digital formats allow personalized learning paths based on learner pace and preferences

Key Benefits

- Learners gain access to a wide range of content anytime and from any location

- Digital resources reduce dependency on physical books and printed materials

- Interactive content improves understanding and learner engagement

- Institutions can update and distribute content quickly without high operational effort

- Progress tracking tools support better learning outcomes and assessment

Key Usage Areas

- Schools use digital resources to support classroom and home-based learning

- Universities rely on them for lectures, research materials, and student collaboration

- Corporate organizations use digital learning for employee training and upskilling

- Competitive exam preparation increasingly depends on online study resources

- Self-learners use digital platforms to build new skills and explore career interests

Emerging Trends

Key Trend Description AI-driven personalized learning AI algorithms adapt content and pacing to individual learner needs, improving engagement and outcomes. Immersive VR/AR experiences Virtual and augmented reality create interactive simulations for experiential learning. Microlearning modules Short, focused content bursts enhance retention and fit busy schedules. Gamification for engagement Game elements such as badges and leaderboards increase motivation and participation. Learning analytics integration Data tools provide insights into learner progress, enabling real-time adjustments. Growth Factors

Key Factors Description Rising demand for remote learning Post-pandemic shift favors flexible online access over traditional learning setups. Smartphone and internet penetration Wider device access enables mobile learning adoption across regions. Corporate upskilling needs Businesses invest in employee training to address evolving skill requirements. Government digital initiatives Policies promote education technology adoption and digital infrastructure. Cost-effectiveness and scalability Digital learning resources reduce costs while reaching a larger user base. Driver Analysis

The digital learning resources market is being driven by the expanding adoption of online and blended learning across education and corporate training environments. Learners increasingly prefer flexible, accessible educational content that can be accessed anytime and anywhere, supporting self-paced study and continuous professional development.

Digital learning resources encompass adaptive courseware, interactive modules, multimedia content, assessment tools, and collaborative platforms that enhance engagement and learning outcomes. Technology advances such as cloud delivery, mobile access, and artificial intelligence-enabled personalisation further stimulate uptake by improving relevance, responsiveness, and user experience for diverse learner needs.

Restraint Analysis

A significant restraint in the digital learning resources market relates to disparities in digital infrastructure and digital literacy among users and institutions. Effective use of digital resources depends on reliable internet connectivity, up-to-date devices, and sufficient technical skills among educators and learners.

In regions or organisations with limited connectivity or older technology, adoption may be constrained. Additionally, educators may encounter challenges in curating and integrating digital materials into curricula without adequate training and support, which can slow broader implementation of digital learning initiatives.

Opportunity Analysis

Emerging opportunities in the digital learning resources market are linked to increasing demand for personalised, competency-based learning that adapts to individual learner progress and preferences. Artificial intelligence and analytics can guide learners to tailored content, recommend practice exercises, and provide adaptive feedback that accelerates mastery.

The corporate sector also represents opportunity as employers invest in upskilling and reskilling programmes to maintain workforce agility in evolving technology landscapes. Partnerships between content developers, educational institutions, and technology platforms can expand the range of high-quality, contextualised resources that support diverse learning objectives and outcomes.

Challenge Analysis

A central challenge confronting this market involves ensuring the quality, relevance, and alignment of digital learning resources with educational standards and learner needs. With the proliferation of content providers and open-source materials, ensuring consistency in instructional quality and pedagogical soundness can be difficult without robust evaluation frameworks.

Educators and learners require clear indicators of content effectiveness and alignment with learning goals. Additionally, maintaining engagement and motivation in digital environments requires thoughtful instructional design that balances interactivity with cognitive load and accessibility considerations.

Key Market Segments

By Content Type

- eLearning Courses & Modules

- Interactive Videos & Simulations

- Digital Textbooks & eBooks

- Assessments & Quizzes

- Others

By End-User

- K-12 Education

- Higher Education

- Corporate Training

- Self-paced Learners

By Deployment Mode

- Cloud-based / SaaS

- On-premises

By Business Model

- Subscription

- One-time License

- Freemium

- Advertising-based

By Subject Area

- STEM (Science, Technology, Engineering, Math)

- Humanities & Languages

- Professional & Skills-based

- Test Preparation

- Regional Analysis

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Established education publishers such as Pearson, plc, McGraw Hill, LLC, and Cengage Learning, Inc. lead the market with structured digital curricula. John Wiley & Sons, Inc. and Houghton Mifflin Harcourt Company support higher education and K-12 segments. Their platforms combine digital textbooks, assessments, and analytics.

Online learning and skill development platforms such as Coursera, Inc., Udemy, Inc., and Pluralsight, LLC focus on professional and vocational learning. LinkedIn Learning strengthens enterprise training adoption. These providers use data and AI to personalize learning paths. Demand is supported by workforce upskilling needs and flexible learning formats for working professionals.

Edtech focused players such as BYJU’S, Khan Academy, Inc., and Chegg, Inc. address student centric learning needs. Age of Learning, Inc. and IXL Learning, Inc. focus on personalized and adaptive education. Other regional providers expand access and content diversity. This competitive landscape supports continuous innovation in digital learning resources.

Top Key Players in the Market

- Pearson, plc

- McGraw Hill, LLC

- Cengage Learning, Inc.

- Wiley (John Wiley & Sons, Inc.)

- Houghton Mifflin Harcourt Company

- Discovery Education, Inc.

- BYJU’S

- Coursera, Inc.

- Udemy, Inc.

- Pluralsight, LLC

- LinkedIn Learning (Microsoft)

- Khan Academy, Inc.

- Chegg, Inc.

- Age of Learning, Inc.

- IXL Learning, Inc.

- Others

Future Outlook

Growth in the Digital Learning Resources market is expected to continue as education and training shift toward online and blended formats. Schools, universities, and organizations are using digital content to improve access, update materials quickly, and support different learning styles.

Wider availability of devices and internet connectivity is supporting adoption across regions. Over time, more interactive content, adaptive learning features, and integration with learning platforms are likely to improve engagement and learning outcomes.

Recent Development

- August, 2025: Cengage Group ramped up AI tools across higher ed, K-12, and workforce lines, including an AI content leveler for educators to tweak materials on the fly.

- September, 2025: Discovery Education’s Experience platform snagged multiple 2025 Tech & Learning Awards for back-to-school tools like ready lessons, virtual field trips with NBA/WNBA, and career explorations.

Report Scope

Report Features Description Market Value (2025) USD 487.2 Mn Forecast Revenue (2035) USD 2,682.6 Mn CAGR(2025-2035) 18.60% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Content Type (eLearning Courses & Modules, Interactive Videos & Simulations, Digital Textbooks & eBooks, Assessments & Quizzes, Others), By End-User (K-12 Education, Higher Education, Corporate Training, Self-paced Learners), By Deployment Mode (Cloud-based / SaaS, On-premises), By Business Model (Subscription, One-time License, Freemium, Advertising-based), By Subject Area (STEM (Science, Technology, Engineering, Math), Humanities & Languages, Professional & Skills-based, Test Preparation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pearson, plc, McGraw Hill, LLC, Cengage Learning, Inc., Wiley (John Wiley & Sons, Inc.), Houghton Mifflin Harcourt Company, Discovery Education, Inc., BYJU’S, Coursera, Inc., Udemy, Inc., Pluralsight, LLC, LinkedIn Learning (Microsoft), Khan Academy, Inc., Chegg, Inc., Age of Learning, Inc., IXL Learning, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Learning Resources MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Digital Learning Resources MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Pearson, plc

- McGraw Hill, LLC

- Cengage Learning, Inc.

- Wiley (John Wiley & Sons, Inc.)

- Houghton Mifflin Harcourt Company

- Discovery Education, Inc.

- BYJU'S

- Coursera, Inc.

- Udemy, Inc.

- Pluralsight, LLC

- LinkedIn Learning (Microsoft)

- Khan Academy, Inc.

- Chegg, Inc.

- Age of Learning, Inc.

- IXL Learning, Inc.

- Others