Global Digital Health Insurance Market Size, Share, Industry Analysis Report By Technology (Telemedicine & Telehealth, Artificial Intelligence (AI) & Machine Learning (ML), Internet of Things (IoT) & Wearables, Big Data & Analytics, Blockchain, Others), By Service Type (Health & Wellness Apps, Online Sales & Policy Management, Digital Claims Management, Virtual Assistance & Customer Support, Preventive Care & Remote Patient Monitoring (RPM), Others), By Deployment (Cloud-based, On-premise), By Payment Model (Subscription-based, As-You-Go Payment, Microinsurance), By End-User (Individuals, Healthcare Providers, Employers, Families, Government Programs), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163118

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Role of Generative AI

- US Market Size

- Emerging Trends

- Growth Factors

- By Technology

- By Service Type

- By Deployment

- By Payment Model

- By End-User

- Key Market Segment

- Key Regions and Countries

- Drivers

- Restraints

- Opportunities

- Challenge

- SWOT Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

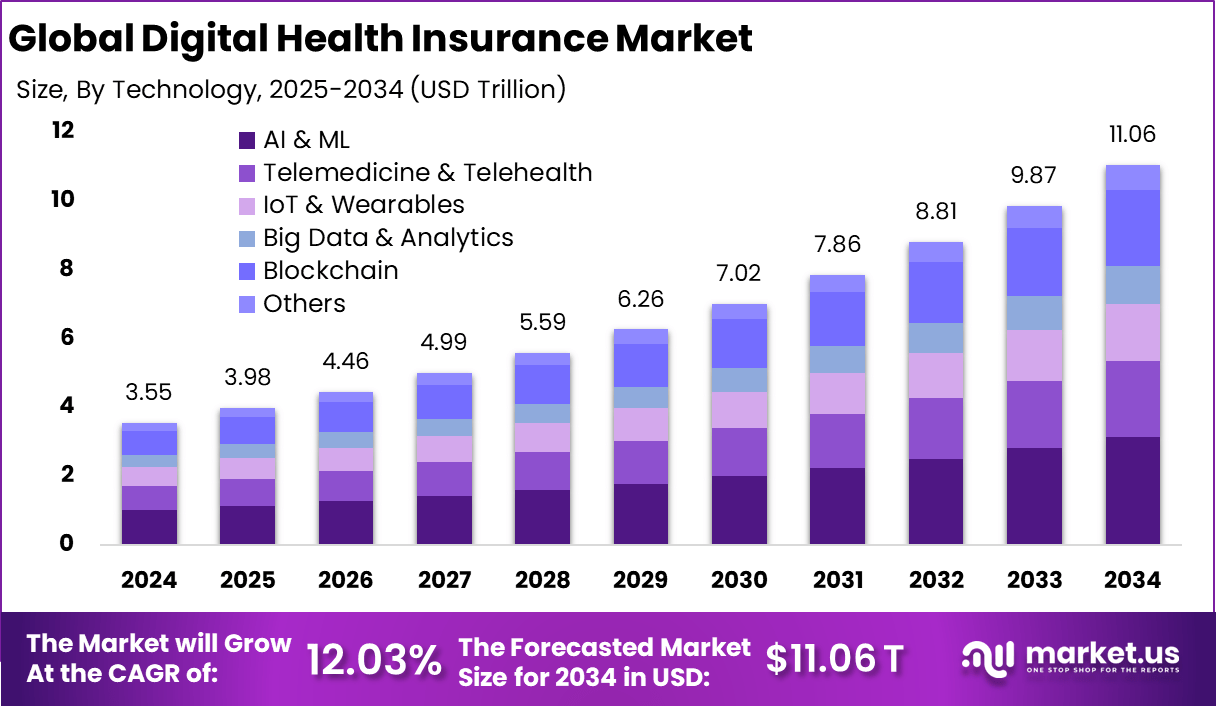

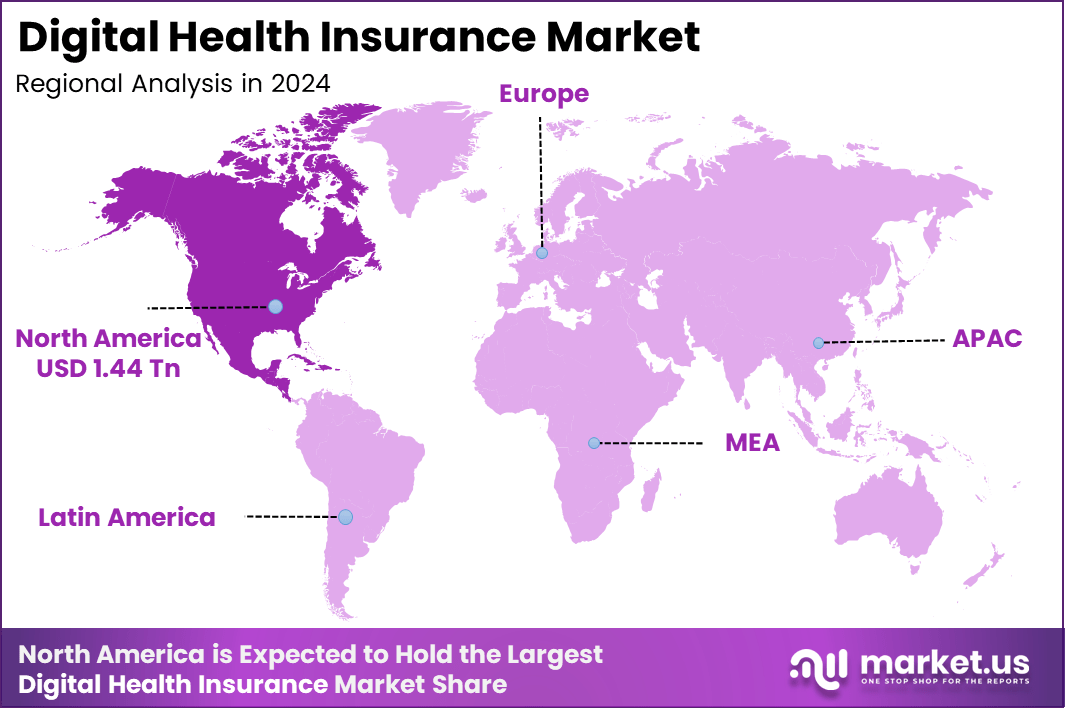

The Global Digital Health Insurance Market generated USD 3.55 Trillion in 2024 and is predicted to register growth from USD 3.98 Trillion in 2025 to about USD 11.06 Trillion by 2034, recording a CAGR of 12.03% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 40.6% share, holding USD 1.44 Trillion revenue.

The digital health insurance market refers to the segment of health insurance that is delivered, managed and enhanced through digital platforms, technologies and data-driven care services. It includes digital policy distribution, telehealth services bundled with insurance, remote monitoring, mobile apps and AI-based underwriting and claims processing.

Approximately 70% of health executives plan significant digital investments in 2025, responding to consumer needs for convenience, transparency, and personalized care. Digital identities and electronic health records are revolutionizing the way health information is managed while improving security and efficiency in claims processing and policy administration.

A major driver of this market is the growing consumer expectation for convenient, digital-first healthcare experiences and seamless access to care services via mobile and online channels. Another driver is the need for cost containment in healthcare and insurance, which is pushing insurers to adopt digital tools such as remote monitoring and preventive care to reduce downstream claims.

According to Forbes, nearly 400 million people in India lack access to any form of health insurance. Approximately 70% of the population is covered under public or private health insurance schemes, while the remaining 30%, representing over 40 crore individuals, remain without health insurance coverage, highlighting a significant gap in healthcare accessibility.

Demand for digital health insurance is especially strong among younger, tech-savvy insured populations and corporate group plans seeking to provide value-added services. Digital distribution and mobile member portals dominate as preferred channels for policy purchase and service management. One report notes that in 2024 the segment for telehealth coverage had the largest uptake within digital health insurance.

Key Takeaways

- The Artificial Intelligence (AI) & Machine Learning (ML) segment accounted for 28.4%, reflecting the growing use of advanced analytics for claims automation, fraud detection, and personalized policy recommendations.

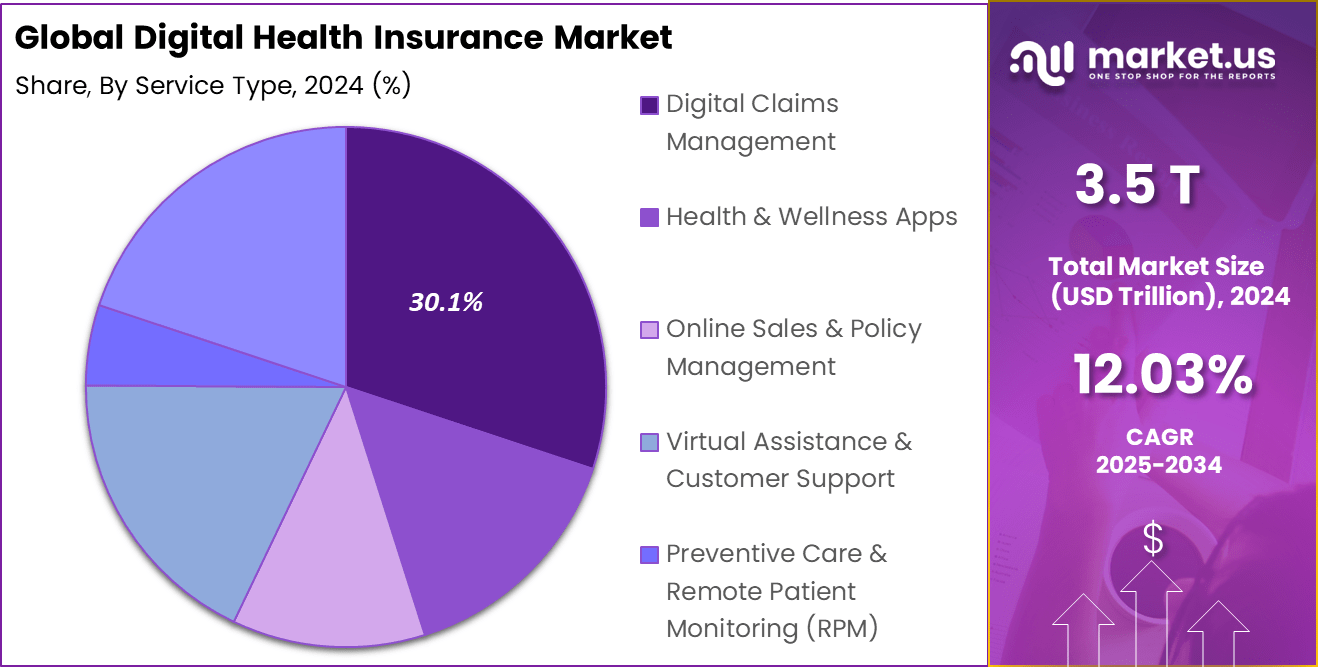

- Digital Claims Management led by service type with 30.1%, driven by insurers’ focus on process automation and real-time settlement systems.

- Cloud-based deployment dominated with 85.3%, supported by scalability, data interoperability, and seamless integration with health platforms.

- The Subscription-based payment model held 80.8%, highlighting its appeal for affordability, flexibility, and predictable premium structures.

- The Individuals segment represented 35.5%, reflecting rising consumer preference for digital-first insurance products and self-service health plan management.

- North America captured 40.6% of the global market, supported by strong digital health ecosystems and early adoption of AI in insurance services.

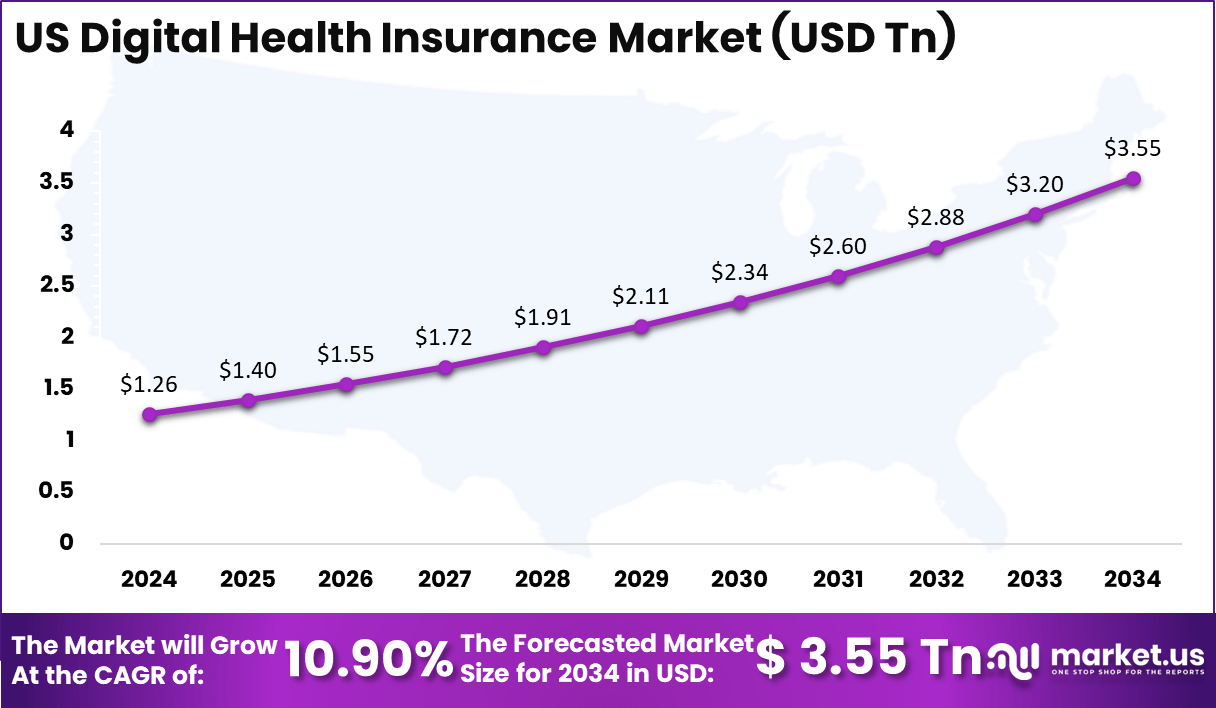

- The US market reached USD 1.26 Trillion in 2024, expanding at a solid 10.9% CAGR, driven by digital transformation in health coverage, telehealth integration, and policy personalization.

Analysts’ Viewpoint

Key technologies enabling digital health insurance adoption include AI-powered underwriting, cloud-based platforms, wearable devices for health data integration, and mobile health applications. Insurers increasingly use AI to predict health risks, adjust premiums dynamically, and prevent fraud. Cloud computing offers scalable infrastructure to manage large datasets and automate processes, while mobile apps empower customers to manage policies and wellness activities conveniently.

Investment opportunities in this market are diverse, ranging from startups focusing on insurtech platforms to technologies that enhance telemedicine and wearables integration. Venture capital and corporate investments frequently target AI analytics, cloud infrastructure, and secure digital identity solutions to unlock value and address customer demands.

From a business perspective, digital health insurance offers significant benefits including reduced operational costs, accelerated claims processing, and enhanced risk management. Real-time data and AI analytics enable insurers to personalize coverage, detect fraud, and optimize pricing more accurately. Customers benefit from improved access to services, increased transparency, and holistic wellness support.

Role of Generative AI

Generative AI is playing a big part in shaping the future of digital health insurance. It can analyze enormous amounts of data from electronic health records, wearable devices, and other sources to create personalized insurance plans. The stats show that about 60% of health insurers are now using AI-driven tools to offer tailored plans based on individual health risks, preferences, and lifestyle.

By doing this, insurers can improve health outcomes and reduce costs while giving customers plans that truly fit their needs. It also makes claims processing much faster and more accurate because AI can handle complex tasks that used to take days, sometimes even weeks, to complete. Customers benefit from quicker responses and fewer errors, which makes their experience more positive and less frustrating.

Another important aspect is how AI helps automate routine tasks like answering customer queries and managing claims. Around 70% of insurance companies are expected to adopt AI-powered virtual assistants by 2025 that can provide 24/7 support. These bots understand medical and insurance language well enough to answer detailed questions about benefits, deductibles, and claims.

They also help guide policyholders through complicated procedures, reducing wait times and boosting satisfaction. This human-like interaction makes customers feel more cared for, even when dealing with complex or sensitive issues. Overall, generative AI is making digital health insurance more efficient, personalized, and accessible for everyone.

US Market Size

The United States alone contributes around 1.26 trillion dollars, with a robust 10.9% CAGR. The nation’s early adoption of advanced analytics and regulatory support for interoperable data platforms have accelerated innovation.

Digital payment models and app-based insurance management continue to gain trust among consumers, transforming traditional coverage models into interactive, value-driven services. This regional leadership reflects the U.S. focus on scalable, technology-enabled health protection solutions that emphasize accessibility and efficiency.

North America leads the global market with a 40.6% share, backed by strong digital healthcare infrastructure and widespread insurance technology adoption. The region’s insurers are rapidly deploying cloud-based systems and AI-driven tools to streamline claims, improve fraud detection, and enhance user experience. Government efforts to expand telehealth and digital health records are reinforcing this growth pattern.

Emerging Trends

One key trend is the rise of telemedicine and virtual health services integrated into insurance plans. Since 2024, over 40% of insurers worldwide have added telehealth options, allowing people to connect with doctors and specialists from home. Consumers appreciate the convenience, and insurers see it as a way to lower costs and improve care quality.

As digital health becomes more common, many companies are offering plans that include wellness programs, mental health support, and fitness tracking via wearables. Experts predict that by 2025, there will be more than 1 trillion connected devices used to monitor health, encouraging healthier lifestyles and better preventative care.

Another emerging trend is the shift toward value-based care supported by advanced digital tools. Insurers are moving away from volume-based models and focusing on outcomes that matter most to policyholders. Digital health platforms now provide data-driven insights to adjust premiums, improve treatments, and prevent diseases.

This approach helps involve patients more actively in managing their health and enables insurers to offer personalized, flexible plans. The trend is supported by government initiatives and investments, which are fueling innovation and infrastructure development. For example, investments from governments are helping build digital health ecosystems in many countries, creating a solid foundation for future growth.

Growth Factors

The growth of digital health insurance is fueled by increasing consumer demand for personalized and easy-to-use services. Reports indicate that by 2025, over 75% of health insurance customers prefer digital platforms for their health needs. Insurers are responding by investing heavily in online apps, virtual consultations, and automated claims management to meet this demand.

The need for quicker, efficient, and transparent processes drives the market forward, with some companies reporting a 20% reduction in claims processing time after adopting digital solutions. These improvements boost customer satisfaction and help insurers retain clients in a competitive landscape. Also, rising healthcare costs and shortages of healthcare staff are pushing digital adoption.

With health costs continuing to grow and an aging population, insurers can offer more cost-effective care through digital channels. Digital health solutions allow for preventive care, remote monitoring, and early diagnosis, reducing emergency visits and hospital stays. The digital transformation also helps insurers control expenses while providing enhanced services.

By Technology

In 2024. Artificial Intelligence (AI) and Machine Learning (ML) hold a 28.4% share in the digital health insurance market. These technologies are driving automation in claims processing, risk evaluation, and fraud detection, allowing insurers to make faster and more accurate decisions.

ML models also help predict patient health trends and optimize personalized policy pricing, which supports more transparent and preventive healthcare coverage. AI-based chatbots and virtual assistants are improving user engagement by offering real-time support and efficient query resolutions. The demand for AI integration is growing as insurers adopt predictive analytics for medical cost management and digital underwriting.

Health data collected from wearables and electronic records is being leveraged for precise policy assessments. As regulatory frameworks mature, the expansion of AI tools is expected to reduce manual intervention in claim management and improve overall operational efficiency. The segment’s momentum highlights how technology is transforming digital coverage models toward more data-driven and customer-focused frameworks.

By Service Type

In 2024, Digital claims management leads with 30.1% of the market. The convenience of filing claims online, real-time document tracking, and automated verification processes have made digital claims platforms widely adopted across insurance providers. Streamlined workflows reduce turnaround time for reimbursements and enhance transparency for end users.

This segment continues to expand as insurers digitize legacy systems to meet the growing expectations of tech-driven consumers. Further progress in blockchain and AI-based validation tools is reinforcing data security and accuracy across claims.

Automation reduces paperwork errors and ensures compliance with evolving regulations like HIPAA. As insurers focus on customer-centric operations, digital claims management systems are evolving into multifunctional platforms integrating analytics and personalized health insights. These developments emphasize reliability, speed, and operational consistency in digital health insurance services.

By Deployment

In 2024, Cloud-based deployment dominates the digital health insurance sector with an 85.3% share. Cloud systems provide insurers with scalable infrastructure, enabling faster adoption of new technologies without costly hardware investments. They support easy integration with IoT devices and electronic health records, facilitating seamless access to patient data and predictive analytics.

This flexibility aligns with the rising demand for remote services and real-time monitoring in modern healthcare. Cloud infrastructure also enhances cybersecurity and interoperability, two priorities for healthcare providers and insurers.

With ongoing enhancements in encryption and access management, cloud solutions now comply with strict data protection standards. Their ability to handle large-scale datasets efficiently is making them indispensable to modern insurance operations. The widespread use of cloud-based systems shows that insurers are prioritizing flexibility, lower operational costs, and data-driven service continuity.

By Payment Model

In 2024, Subscription-based models hold a 80.8% share, reflecting the sector’s shift from one-time purchases to ongoing service engagement. Consumers increasingly prefer predictable monthly or annual payment structures that cover a set of digital services such as telemedicine, wellness tracking, and claims assistance. This model creates continuous customer interaction, supporting loyalty and policy retention.

For insurers, subscription models allow stable revenue streams and simpler cost forecasting. They also help in bundling multiple digital health benefits, increasing overall value perception among policyholders. With convenience and transparency driving customer preferences, this segment continues to redefine the economics of health insurance, aligning service accessibility with affordability.

By End-User

In 2024, Individuals account for 35.5% of the total market. Growing awareness of digital health solutions, alongside mobile-based policy management and virtual consultations, has driven direct adoption among consumers. Many users prefer digital interfaces that simplify policy comparison, claim submission, and medical record integration.

Individual-oriented insurance apps are also fostering transparency by allowing instant access to policy details and health analytics. Rising disposable incomes and the spread of digital health ecosystems, especially in urban areas, are strengthening this segment’s reach.

Younger demographics are increasingly opting for digitally managed health plans that blend personal wellness tracking with medical protection. The widening role of self-service tools has made digital platforms an attractive option for independent policyholders seeking control over healthcare decisions.

Key Market Segment

By Technology

- Telemedicine & Telehealth

- Artificial Intelligence (AI) & Machine Learning (ML)

- Internet of Things (IoT) & Wearables

- Big Data & Analytics

- Blockchain

- Others

By Service Type

- Health & Wellness Apps

- Online Sales & Policy Management

- Digital Claims Management

- Virtual Assistance & Customer Support

- Preventive Care & Remote Patient Monitoring (RPM)

- Others

By Deployment

- Cloud-based

- On-premise

By Payment Model

- Subscription-based

- As-You-Go Payment

- Microinsurance

By End-User

- Individuals

- Healthcare Providers

- Employers

- Families

- Government Programs

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Convenient and Personalized Insurance Solutions

Digital health insurance market is driven by the increasing need for convenient and user-friendly insurance services. Digital platforms enable quick access to insurance plans, online doctor consultations, and streamlined claims processing. This convenience satisfies consumers who prefer personalized coverage options and faster services compared to traditional health insurance methods.

The rising adoption of smartphones and internet connectivity further boosts consumer engagement with digital health insurance products, accelerating market growth. Consumers appreciate the ability to manage their policies, file claims, and access healthcare information from mobile apps or websites without paperwork. This simplification reduces friction in the insurance experience and makes health coverage more accessible to a larger population.

Restraints

Concerns Around Data Privacy and Cybersecurity

A major restraint for the digital health insurance market is the growing concern over data privacy and cybersecurity risks. As sensitive patient data and health records are stored and processed digitally, these systems attract cyberattacks and data breaches. Healthcare information is highly confidential, and any security lapse can lead to serious privacy violations and loss of consumer trust.

Regulatory frameworks often lag behind evolving threats, increasing the challenge for insurers to safeguard data. This restraint forces digital health insurance providers to invest heavily in robust security infrastructure, which raises operational costs. Moreover, skepticism persists among some healthcare professionals about the safety and reliability of digital platforms, slowing adoption rates in certain markets.

Opportunities

Expansion in Emerging Markets and Telehealth Integration

The digital health insurance market has strong growth opportunities in emerging markets, where increasing smartphone adoption and government digitization initiatives are helping expand healthcare access. Countries like India, Brazil, and others in Southeast Asia are rapidly implementing digital health IDs and remote telehealth services that integrate with insurance offerings.

These advancements enable cost-effective and accessible insurance solutions to previously underserved populations. Integration of telehealth with digital health insurance is another valuable opportunity. Telemedicine services allow for remote consultations and continuous health monitoring, reducing hospitalization rates and claims costs.

This not only improves patient outcomes but also creates new insurance products that bundle healthcare and insurance digitally. As more consumers gain trust in telehealth, insurers can unlock new revenue streams and enhance customer loyalty.

Challenge

Interoperability and Integration with Healthcare Systems

A major challenge for digital health insurance growth is achieving seamless interoperability with diverse healthcare systems and electronic health records (EHRs). Insurers must integrate their platforms with hospitals, clinics, and government databases to automate claims and verify patient data swiftly. However, varying standards and fragmented systems often result in complex and costly integration processes.

Without smooth integration, processing claims can become slower and less accurate, reducing the efficiency gains of digital solutions. Furthermore, technology disparities across regions and healthcare providers limit access for some populations, especially in rural or underdeveloped areas.

SWOT Analysis

Strengths

- Strong adoption of AI, telemedicine, and cloud technologies is improving operational efficiency.

- Growing demand for personalized and data-driven health insurance solutions.

- High consumer engagement through mobile apps, wellness tracking, and self-service platforms.

- Reduction in claim processing time and fraud through automation and blockchain integration.

- Supportive government policies promote digital healthcare accessibility.

Weaknesses

- High implementation cost of advanced digital infrastructure.

- Data privacy concerns and vulnerability to cyber threats.

- Limited digital literacy among older or rural populations.

- Integration challenges with legacy insurance systems and outdated databases.

- Dependence on third-party technology vendors for platform maintenance.

Opportunities

- Expansion of cloud-based models, 85.3% is driving cost efficiency and scalability.

- The increasing popularity of subscription-based plans 80.8% enhancing recurring revenue.

- Growing potential for microinsurance and telehealth coverage in emerging markets.

- Rising collaboration between insurers, InsurTech firms, and healthcare providers.

- Integration of IoT and wearables enables real-time health data insights for policy optimization.

Threats

- Regulatory complexity around AI governance and cross-border health data exchange.

- Competition from agile InsurTech startups is disrupting traditional insurers.

- Risk of technology failures or data breaches impacting customer trust.

- Market saturation in developed regions is reducing premium growth margins.

- Rapidly evolving compliance requirements are increasing operational costs.

Key Players Analysis

The Digital Health Insurance Market is driven by leading providers such as UnitedHealth Group, Cigna, Aetna (CVS Health), Anthem Inc., and Humana, which are integrating digital platforms to enhance accessibility, claims management, and patient engagement. Their investments in AI-driven risk assessment, telehealth, and EHR interoperability are modernizing operations and supporting more personalized coverage.

Digital-first insurers like Oscar Health, Clover Health, Lemonade Health, Bright Health, and Alan are reshaping the sector with data analytics, predictive algorithms, and mobile-based models. These platforms simplify policy enrollment, enable dynamic pricing, and encourage preventive healthcare while improving transparency and lowering administrative costs.

Additional players such as Bupa Global, Benevolent Health, Forward, Metromile, Lively, MediSprout, Gusto Health, Kaiser Permanente, Truvian Health, and One Medical are advancing telemedicine, remote diagnostics, and digital wellness tools. Their focus on personalized health insights and hybrid care delivery continues to accelerate the global adoption of digital health insurance solutions.

Top Key Players

- Oscar Health

- Cigna

- Aetna (CVS Health)

- UnitedHealth Group

- Anthem Inc.

- Humana

- Bupa Global

- Benevolent Health

- Lemonade Health

- Clover Health

- Zocdoc

- Forward

- Alan

- Metromile

- Bright Health

- Lively

- MediSprout

- Gusto Health

- Kaiser Permanente

- Truvian Health

- HealthSherpa

- One Medical

- Others

Recent Developments

- October 2025 – Oscar Health launched a new suite of AI-driven health plans tailored for women undergoing menopause and people with chronic diseases like diabetes and asthma. Their AI assistant Oswell helps manage symptoms, medication refills, and provides patients with personalized data to improve care. Oscar also expanded into the ACA marketplace in New Jersey focusing on personalized, culturally relevant plans.

- June 2025 – Cigna introduced AI-powered digital tools through its myCigna portal to simplify health insurance benefits understanding and enhance customer experience with conversational AI features. This move aims to boost health insurance literacy, which affects health outcomes.

Report Scope

Report Features Description Market Value (2024) USD 3.55 Tn Forecast Revenue (2034) USD 11.06 Tn CAGR(2025-2034) 12.03% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Technology (Telemedicine & Telehealth, Artificial Intelligence (AI) & Machine Learning (ML), Internet of Things (IoT) & Wearables, Big Data & Analytics, Blockchain, Others), By Service Type (Health & Wellness Apps, Online Sales & Policy Management, Digital Claims Management, Virtual Assistance & Customer Support, Preventive Care & Remote Patient Monitoring (RPM), Others), By Deployment (Cloud-based, On-premise), By Payment Model (Subscription-based, As-You-Go Payment, Microinsurance), By End-User (Individuals, Healthcare Providers, Employers, Families, Government Programs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oscar Health, Cigna, Aetna (CVS Health), UnitedHealth Group, Anthem Inc., Humana, Bupa Global, Benevolent Health, Lemonade Health, Clover Health, Zocdoc, Forward, Alan, Metromile, Bright Health, Lively, MediSprout, Gusto Health, Kaiser Permanente, Truvian Health, HealthSherpa, One Medical, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Digital Health Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Health Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Oscar Health

- Cigna

- Aetna (CVS Health)

- UnitedHealth Group

- Anthem Inc.

- Humana

- Bupa Global

- Benevolent Health

- Lemonade Health

- Clover Health

- Zocdoc

- Forward

- Alan

- Metromile

- Bright Health

- Lively

- MediSprout

- Gusto Health

- Kaiser Permanente

- Truvian Health

- HealthSherpa

- One Medical

- Others