Global Digital Health in Neurology Market Analysis By Component (Software, Hardware, Services), By Indication (Alzheimer’s Disease, Parkinson’s Disease, Multiple Sclerosis, Epilepsy, Others), By End-User (Patients, Healthcare Providers (Hospitals & Clinics, Specialty Centers, Others), Healthcare Payers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155998

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

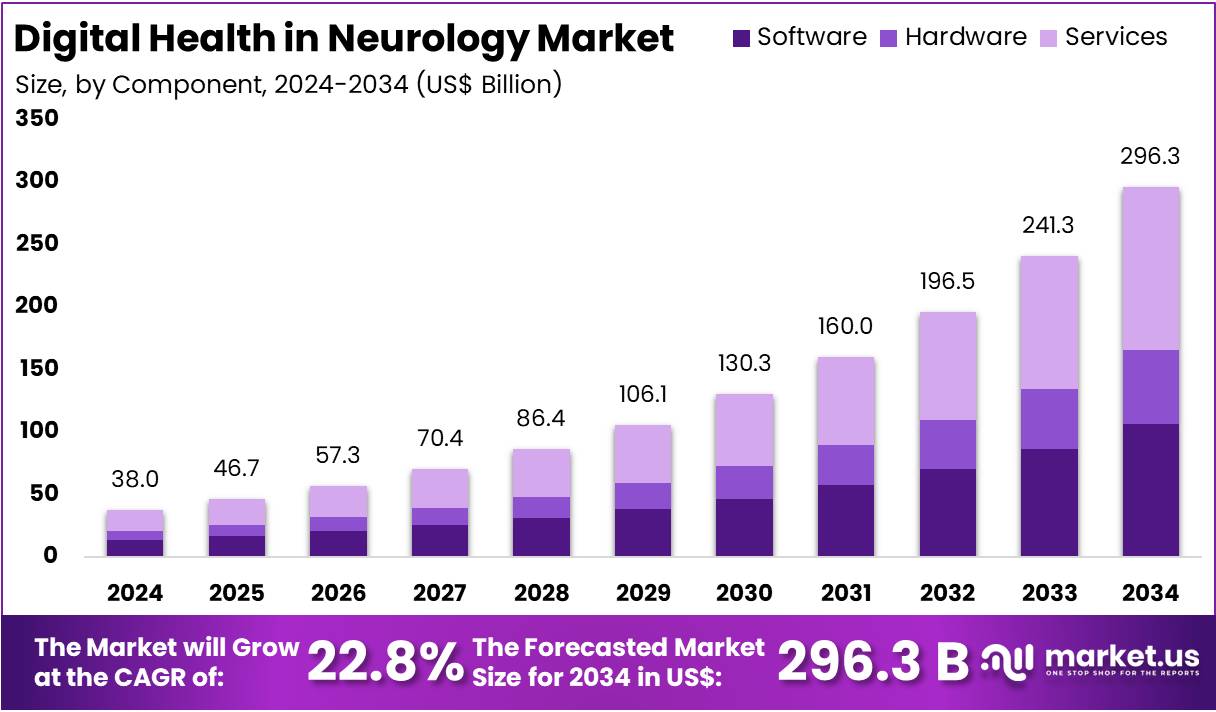

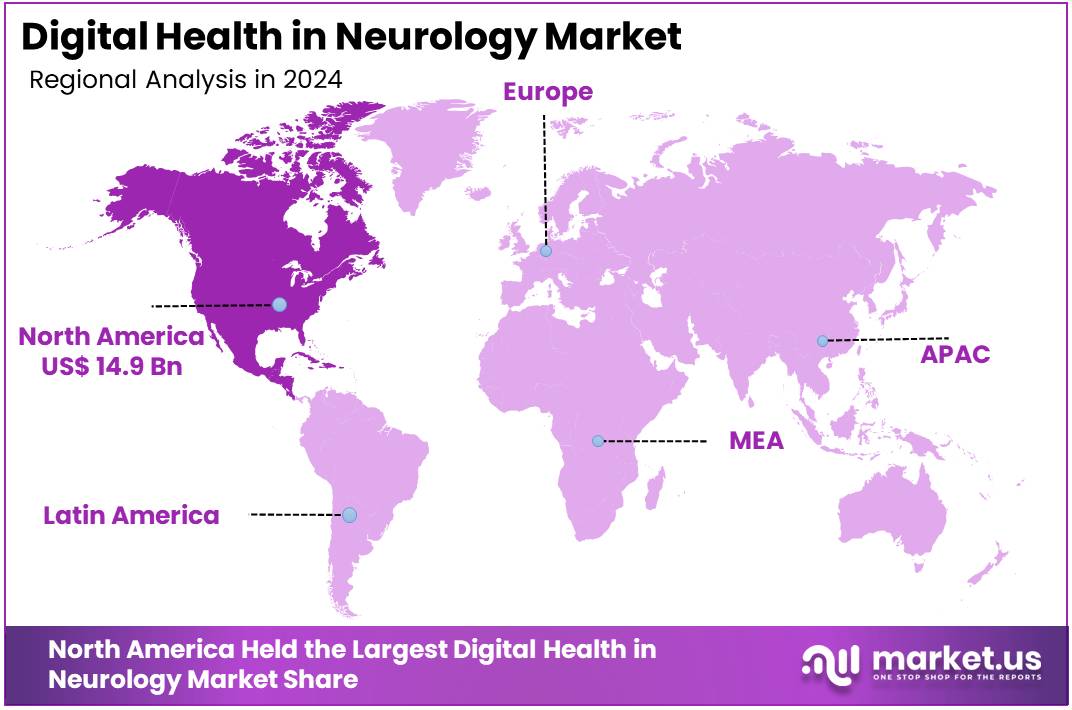

The Global Digital Health in Neurology Market size is expected to be worth around US$ 296.3 Billion by 2034, from US$ 38 Billion in 2024, growing at a CAGR of 22.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.2% share and holds US$ 14.9 Billion market value for the year.

Growing Need and Demand for Digital Health in Neurology

Digital health in neurology refers to the use of telemedicine, mobile apps, wearable devices, and artificial intelligence to support the care of neurological disorders. These technologies enable remote diagnosis, continuous monitoring, and data-driven decision-making. According to market.us study, such tools have enhanced early detection of conditions like epilepsy, Parkinson’s disease, and multiple sclerosis. By linking real-time patient data with electronic health records, digital health enables personalized treatments, improves patient outcomes, and creates more efficient care pathways.

The demand for digital solutions is being driven by the rising burden of neurological disease. In 2021, more than one in three people worldwide were living with a neurological condition. Neurological disorders were reported as the leading cause of illness and disability. Dementia alone affected around 57 million people, with nearly 10 million new cases recorded each year. For example, Parkinson’s disease affected more than 8.5 million people in 2019, doubling over the past 25 years. These numbers highlight sustained demand for digital neurology services.

Capacity shortages in neurology further reinforce the need for digital health. According to WHO’s Neurology Atlas, the global median density of adult neurologists is only 0.43 per 100,000 people. Large gaps are seen particularly in low- and middle-income countries. Such constraints make digital tools valuable for extending specialist reach, standardizing care, and supporting triage. For instance, AI-enabled tools can analyze imaging and quickly alert specialists, reducing delays in critical conditions like stroke. This makes digital care models highly relevant to address workforce shortages.

Policy, Technology, and Evidence Driving Adoption

Adoption of telehealth has already become mainstream. In the United States, 37% of adults reported using telemedicine in 2021. Across OECD countries, teleconsultations per patient more than doubled between 2019 and 2021. For example, remote stroke management and follow-up visits for chronic conditions have been integrated into care models. Policy support has reinforced this trend. U.S. Medicare has extended telehealth flexibilities into 2025, while CMS continues to reimburse remote patient monitoring and therapeutic management. These policies lower adoption risks for providers.

Global policy frameworks and infrastructure are also enabling growth. The EU launched the European Health Data Space in 2025 to support cross-border health data access and secondary use in research. Interoperability rules in the U.S., such as the ONC Cures Act Final Rule and USCDI standards, allow easier integration of neurology tools with electronic health records. Connectivity has reached scale, with ITU reporting that 5.5 billion people—about 68% of the world—were online in 2024, and 95 mobile-broadband subscriptions per 100 people. This creates a strong base for mobile neurology solutions.

Evidence continues to support digital health in neurology. For instance, the U.S. FDA cleared Viz.ai software for stroke detection, signaling regulatory acceptance of AI-based decision-support tools. Studies by AHRQ confirm that telehealth consultations often match or exceed in-person outcomes. Emerging telestroke networks also show faster treatment times, which directly improve recovery prospects. Meanwhile, large markets like India are embedding digital health in national strategies through programs such as the Ayushman Bharat Digital Mission. Combined with WHO’s global strategies on neurological disorders and digital health, these initiatives ensure sustained momentum in digital neurology.

Key Takeaways

- The global digital health in neurology market will soar to US$ 296.3 Billion by 2034, rising from US$ 38 Billion in 2024.

- From 2025 to 2034, the market is expected to grow rapidly at a compound annual growth rate (CAGR) of 22.8%, showing strong expansion.

- In 2024, services dominated the component segment of digital health in neurology, accounting for over 44.1% of the total market share.

- Alzheimer’s Disease led the indication segment in 2024, capturing more than 26.7% share, reflecting rising demand for digital neurological health solutions.

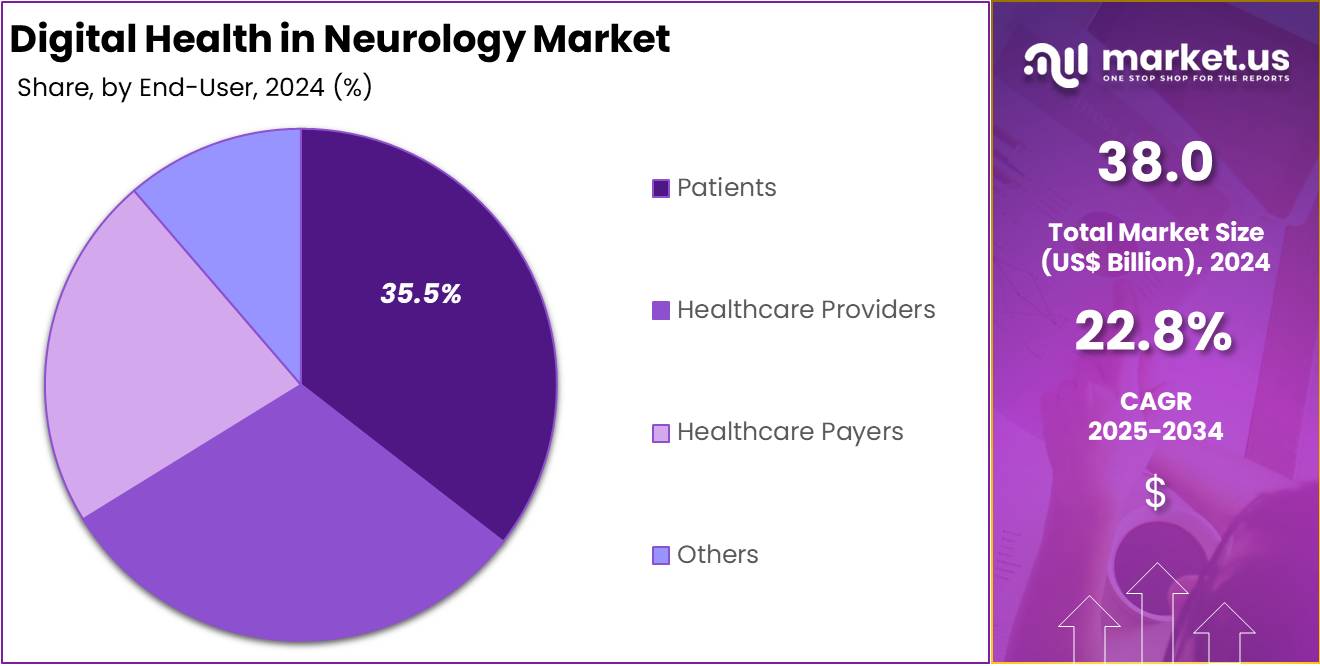

- Patients emerged as the top end-user segment in 2024, representing over 35.5% market share, highlighting growing adoption of patient-centric digital health tools.

- North America led globally in 2024, securing over 39.2% market share with a market value of US$ 14.9 Billion.

Component Analysis

In 2024, the Services Section held a dominant market position in the Component Segment of the Digital Health in Neurology Market, and captured more than a 44.1% share. This dominance was linked to the increasing demand for teleconsultations and remote monitoring. Hospitals and clinics were found to depend heavily on digital services to deliver neurological care. Subscription-based models also supported this trend. Partnerships between digital health companies and healthcare providers further helped in expanding access to these solutions.

The Software Segment was reported to secure a strong position in the market. The growth was largely supported by mobile health applications and diagnostic platforms. Digital tools that helped neurologists in making informed clinical decisions gained higher adoption. AI-based systems for imaging analysis were also used widely. The trend of digitalizing medical records and using cloud platforms contributed further. Software solutions became essential for tracking patient conditions and offering better clinical outcomes in neurological care.

The Hardware Segment demonstrated consistent progress across the market. Neurology-focused wearable devices and connected monitoring systems were identified as key drivers. These devices supported the real-time tracking of brain health and movement disorders. The use of portable diagnostic equipment also expanded in hospitals and home-based care. Hardware solutions improved the accuracy of neurological assessments. Patients and caregivers adopted these devices at a higher rate. Their growing popularity strengthened the role of connected technologies in neurology care delivery.

Component analysis revealed that services continued to dominate, but software and hardware also displayed promising growth. The future demand for these components is expected to rise due to technology integration. Hospitals, clinics, and research institutions were observed to rely more on digital platforms. The move toward personalized care supported this adoption further. Cloud-based solutions and artificial intelligence will remain central to this transformation. Together, these components shaped a market environment defined by innovation, accessibility, and improved patient management in neurology.

Indication Analysis

In 2024, the Alzheimer’s Disease section held a dominant market position in the Indication Segment of the Digital Health in Neurology Market, and captured more than a 26.7% share. This leadership is attributed to the growing prevalence of dementia worldwide. The increasing elderly population has accelerated the demand for early diagnosis and remote monitoring tools. Digital platforms offering cognitive training and patient engagement solutions are also expanding adoption. These factors together have secured Alzheimer’s Disease as the leading segment.

Parkinson’s Disease was observed as the second-largest contributor within the indication category. The segment’s growth is supported by digital tools designed for tremor tracking, gait analysis, and medication adherence. Wearable technologies and mobile-based monitoring applications have played a critical role in improving patient care. Artificial intelligence integration has further enhanced personalized treatment approaches. These advancements are driving greater reliance on digital health solutions. Consequently, Parkinson’s Disease continues to secure a strong position.

Multiple Sclerosis and Epilepsy were reported to hold significant shares as well. Multiple Sclerosis adoption is rising due to the demand for relapse monitoring and therapy management. Teleconsultation platforms and connected health services are assisting in long-term disease control. Epilepsy solutions are advancing with AI-powered seizure detection devices and predictive analytics. These tools support timely intervention for patients and caregivers. Other neurological disorders such as migraine and neuropathic conditions are also expanding their presence, driven by personalized digital therapeutic offerings.

End-User Analysis

In 2024, the Patients Section held a dominant market position in the End-User Segment of the Digital Health in Neurology Market, and captured more than a 35.5% share. This leading position was explained by growing use of digital health platforms among patients. Tools for self-monitoring, symptom tracking, and remote consultations became highly preferred. The rising demand for home-based care services and increasing awareness about neurological conditions also contributed. These factors placed patients as the primary users of digital health solutions in neurology.

The Healthcare Providers Segment accounted for the second-largest share of the market. This group included hospitals, clinics, and specialty centers. Hospitals and clinics adopted digital platforms and tele-neurology services at a faster pace. Specialty centers used advanced technologies such as AI-driven diagnostics to support neurological care. Other providers also integrated electronic health records into practice. Together, these improvements strengthened provider reliance on digital platforms. This steady adoption showed healthcare providers as key enablers in market expansion.

The Healthcare Payers Segment showed promising potential for future growth. Insurers and public payers promoted digital tools to reduce treatment costs and ensure improved outcomes. The rise of value-based care and wider reimbursement for telehealth supported this adoption. Beyond payers, other stakeholders also added to the market. Research groups, technology firms, and caregivers invested in partnerships and wearable devices. These developments highlighted broader industry participation. Collectively, these groups played a crucial role in driving innovation and extending digital health in neurology.

Key Market Segments

By Component

- Software

- Hardware

- Services

By Indication

- Alzheimer’s Disease

- Parkinson’s Disease

- Multiple Sclerosis

- Epilepsy

- Others

By End-User

- Patients

- Healthcare Providers

- o Hospitals & Clinics

- o Specialty Centers

- o Others

- Healthcare Payers

- Others

Drivers

Rising Neurological Disease Burden and Remote Patient Monitoring Adoption Driving Market Growth

The digital health in neurology market is driven by the increasing prevalence of neurological disorders worldwide. According to The Lancet Neurology, over 3 billion people were living with neurological conditions in 2021, making them the leading cause of disability and ill health. Disorders such as Alzheimer’s, epilepsy, and stroke have significantly increased the global disease burden, accounting for millions of deaths and disability-adjusted life years (DALYs). This rising patient population creates a strong demand for innovative digital health tools for diagnosis, treatment, and long-term management.

The rising incidence of specific conditions further strengthens the case for digital health adoption. Dementia affected 55 million people in 2021, with 10 million new cases annually. Parkinson’s disease prevalence is accelerating, projected to exceed 12 million cases by 2040. Similarly, epilepsy impacts nearly 50 million individuals worldwide, with substantial new case incidence each year. These conditions require continuous monitoring, early interventions, and personalized care—factors that highlight the growing role of digital health solutions in neurology.

Remote patient monitoring (RPM) and telehealth are emerging as critical enablers in addressing this growing health burden. Neurological conditions often require lifelong care, frequent assessments, and precise medication management. Digital tools enable real-time monitoring of symptoms, support data-driven decision-making, and reduce healthcare system strain. The combination of expanding telehealth adoption and the need for accessible neurological care is expected to accelerate the integration of digital health technologies across clinical practice and patient management.

Restraints

Regulatory Complexity and Approval Challenges

The regulatory landscape for digital health in neurology is complex. The European Union’s Medical Device Regulation (MDR), which took effect in 2021–2022, increased demands for clinical evidence, post-market surveillance, and conformity assessment. This tightening raised uncertainty about classification and approval pathways for software-based tools. In 2022, many neurology apps and digital therapeutics (DTx) faced slower market entry, despite MDR being intended to enhance patient safety. This created delays and additional compliance costs, limiting early adoption.

In the U.S., regulators continued expanding oversight through 2023–2024, with the FDA focusing on AI, machine learning, and software-as-medical-devices. While this increased clarity in some areas, reimbursement and real-world evidence requirements remained less defined. By the end of 2024, cross-country analyses confirmed that multiple regulators, including in the U.S., China, Germany, and Belgium, had approved growing numbers of digital therapeutics. Despite this rise, the regulatory workload and evolving guidance posed persistent barriers to predictable market entry in neurology.

Reimbursement Barriers in Neurology Digital Health

Reimbursement remains an uneven barrier in digital neurology health. Germany’s DiGA program emerged as a strong model by 2024. It offered a national fast-track reimbursement route for apps and was described as a scalable framework for digital therapeutics. Where this model was available, adoption and clinical integration accelerated. However, most countries in 2024 still lacked predictable reimbursement pathways, preventing many products from achieving widespread coverage. This absence made it harder for patients and clinicians to adopt solutions at scale.

The lack of reimbursement clarity is particularly restrictive for neurology products that require strong clinical validation. Many apps and wearables developed for Parkinson’s and movement disorders have limited evidence, slowing payer confidence. A 2024 systematic review identified 113 smartphone apps in this space, with 82 dedicated to Parkinson’s disease alone. Despite this crowded ecosystem, only a fraction secured reimbursement because clinical outcomes data were insufficient. Without broader reimbursement pathways like DiGA, most digital neurology tools remained underutilized in practice.

Data Privacy and Cybersecurity Concerns

Data privacy and cybersecurity remain significant restraints for digital neurology health. The U.S. healthcare sector continues to be a prime target for cyberattacks. The Office for Civil Rights (OCR) reported around 720 large breaches of 500+ records in 2022. This number remained high in 2024, with approximately 725 large breaches recorded. Each incident exposed millions of patient records, reinforcing concerns among payers, clinicians, and patients. Weak safeguards directly limit the willingness to adopt connected neurology apps and therapeutics.

These persistent breaches underline systemic risks. Regulators, clinicians, and payers remain reluctant to engage with digital tools unless strong cybersecurity standards are demonstrated. Neurology patients, often older and digitally less literate, are particularly vulnerable to privacy issues. The frequency of breaches in both 2022 and 2024 highlights why privacy is treated as a primary barrier to adoption. Without consistent security guarantees, digital health tools in neurology face delays in trust-building and slower integration into clinical practice.

Opportunities

Convergence of AI, Wearables, and Digital Therapeutics in Neurology

The integration of AI-driven diagnostics, wearable devices, and digital therapeutics represents a transformative opportunity for digital health in neurology. This convergence enables early detection, real-time monitoring, and personalized therapeutic interventions for neurological conditions. The availability of over 100,000 healthcare applications across Apple and Google platforms illustrates a vast ecosystem ready to support neurology-focused digital solutions. As adoption continues, the combination of intelligent diagnostics, remote tracking, and tailored therapies will strengthen precision care and improve neurological patient outcomes on a large scale.

Physicians are increasingly embracing digital health tools, which further enhances this opportunity. By 2022, 93% of physicians reported that digital tools improved patient care, compared with 85% in 2016. Usage per physician also grew, from 2.2 tools in 2016 to 3.8 in 2022. Telehealth adoption rose sharply, with virtual visits increasing from 14% to 80%. Similarly, remote monitoring device usage climbed from 12% to 30%. These statistics highlight strong physician willingness to integrate digital solutions into neurology care.

The social and cognitive benefits of digital engagement reinforce this potential. A meta-analysis of more than 130 studies covering 411,430 adults aged 50+ found technology use reduced cognitive impairment risk by 58% and cognitive decline risk by 26%. Activities such as digital gaming, emails, and social media positively impact cognitive health. When combined with AI-driven therapies and wearable monitoring, these digital engagements create powerful avenues for delaying or mitigating neurological decline. This strengthens the case for expanding digital neurology solutions within the broader healthcare landscape.

Trends

AI-Based Remote Monitoring and Personalized Neurology Care

Digital health in neurology is experiencing a strong shift toward AI-based remote patient monitoring and personalized care. The growing adoption of telehealth, wearables, and VR/AR tools highlights this movement. In 2022, 43% of U.S. adults with healthcare visits used telemedicine, and RPM adoption reached nearly 21.5% among physicians. These benchmarks underline a structural change in care delivery. Integration with electronic health records (EHRs) adds further value by enabling seamless clinical workflows, supporting early detection, and ensuring better patient-centered care in neurology.

The acceleration of AI research has strengthened this trend between 2022 and 2024. A 2024 scoping review cataloged 66 original AI neurology studies, covering areas such as imaging, diagnostics, and remote monitoring. Another review traced 25 years of AI progress and noted that neurological disorders impact up to 15% of the global population. This rising disease burden, combined with AI advancements, is driving more interest in scalable digital solutions. The evidence suggests digital neurology tools are entering a rapid expansion phase.

Despite strong adoption, operational barriers remain important. In 2023, around 51% of neurologists reported technological difficulties during telemedicine visits, with many requiring IT support. These challenges slow down seamless implementation, particularly in resource-limited settings. However, wearables and digital measures show promising real-world benefits. In 2024, smartphone and smartwatch data distinguished early Parkinson’s patients from controls, while 76% of Parkinson’s disease users reported positive impact. This suggests future adoption will be driven by patient engagement, technical refinements, and integration of AI-enabled personalized care pathways.

Regional Analysis

North America’s Market Leadership

In 2024, North America held a dominant market position, capturing more than a 39.2% share and holds US$ 14.9 Billion market value for the year. This leadership was supported by strong healthcare IT ecosystems, which allowed wide adoption of telemedicine, digital therapeutics, and remote monitoring. Sustained investment across providers, payers, and technology companies further encouraged innovation. Clear regulatory frameworks, such as FDA digital health initiatives, also helped speed product approvals and foster the early introduction of advanced neurology solutions.

Dense digital infrastructure has played a central role. Nearly 96% of non-federal acute care hospitals in the United States used certified EHR systems, enabling effective neurology data flow and device integration. With almost 9 out of 10 adults owning smartphones, remote monitoring, seizure-logging apps, and virtual neurology consultations became practical. Stable reimbursement models from Medicare, including telehealth payments and RPM coding, ensured provider incentives. This stability reinforced chronic disease management and consistent virtual neurology follow-ups.

Regulatory clarity provided another advantage. The FDA’s Digital Health Center of Excellence and Software as a Medical Device (SaMD) framework simplified submissions for AI-driven neurology tools. New draft guidance highlighted lifecycle and marketing pathways for AI-enabled devices. Collaborative principles set by the FDA, Health Canada, and the UK MHRA also guided machine learning applications. These frameworks not only accelerated approvals but also established industry-wide trust, leading to greater adoption of neurology-focused software and remote patient management technologies across the region.

Clinical and Regional Insights

Clinical adoption has been a major driver in North America. Neurology specialists were among the earliest to use telemedicine, especially through telestroke programs. Current studies confirm high levels of outpatient tele-neurology utilization, making virtual care an integral part of neurology. The disease burden added urgency. In the United States, stroke affects about 795,000 people annually, while Alzheimer’s disease impacts nearly 6.9 million adults aged 65 years and above. Epilepsy prevalence also increased demand for digital screening and long-term monitoring solutions.

Research funding further strengthened this dominance. The NIH BRAIN Initiative allocated US$ 402 million in FY2024 to advance neuroscience tools relevant to digital care. In Canada, the Canadian Institutes of Health Research invested over US$ 256 million in dementia research between 2019 and 2024, supporting brain-health platforms and digital care pathways. Regional comparisons show Europe’s regulatory tightening under the European Health Data Space, Asia–Pacific’s rapid infrastructure upgrades, Latin America’s PAHO-led initiatives, and Africa CDC’s digital strategies, though gaps remain in connectivity and resources.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Neofect stands out in the digital health neurology space with its AI-powered neurorehabilitation tools. The company focuses mainly on stroke recovery through smart devices and connected software. Its home-based therapy solutions support patients who cannot attend clinics regularly. Partnerships with national health organizations in South Korea have strengthened its innovation. Neofect’s hardware and software model makes rehabilitation more engaging and accessible. This unique approach positions the company as a strong player in improving neurological care through technology-driven rehabilitation programs.

Teladoc Health is a global leader in telemedicine and offers virtual neurology consultations. With operations in over 130 countries, it provides services to millions of patients annually. Teladoc’s strength lies in its integrated platform, which combines neurology care with chronic disease management, mental health support, and digital monitoring. This broad coverage creates a seamless healthcare experience. Its scale, brand trust, and technology-driven approach give Teladoc a competitive advantage. This makes it one of the most influential companies in remote neurology healthcare.

Proteus Digital Health, Aural Analytics, and Omada Health contribute to digital neurology innovation. Proteus introduced ingestible sensors for medication tracking, which remain relevant in managing epilepsy and Parkinson’s disease. Aural Analytics, now part of Linus Health, developed speech-based biomarkers for detecting ALS and dementia. Omada Health focuses on lifestyle interventions to prevent neurological risks such as stroke. Each company adds value with different strengths, from medication adherence and early detection to behavioral modification. Together, they diversify and strengthen the digital neurology market landscape.

Leading Digital Health in Neurology Market Key Players:

- Neofect

- Teladoc

- Proteus Digital Health

- Aural Analytics

- Omada Health

- AppliedVR

- BehaVR

- BetterHelp

- Big Health

- Akili Labs

- Blackrock Neurotech

- AdvancedMD

- Cognivive Inc.

Recent Developments

- In May 2024: AppliedVR formally introduced its RelieVRx® program to the workers’ compensation sector. This extension represents the first FDA-authorized immersive virtual reality prescription therapeutic for chronic lower back pain tailored for injured workers, payers, and physicians in that domain. The solution delivers a home-based, immersive treatment grounded in evidence-based principles such as cognitive behavioral therapy, biofeedback, and emotional regulation. It aims to reduce pain intensity and interference, and has demonstrated sustained efficacy, including prolonged benefits measured up to 24 months post-treatment.

- In August 2023: Neofect was awarded a government subsidy of approximately ₩1.65 billion (around USD 1.23 million) by the Korea Medical Device Development Foundation (KMDF) to advance research and development of an AI-based digital rehabilitation solution. The funding specifically supports the creation of a “digital smart board” designed for patient rehabilitation using artificial intelligence. This endorsement highlights strong governmental support, positioning Neofect to accelerate the development of next-generation neurorehabilitation technologies with significant potential for clinical application and innovation in digital healthcare.

- In July 2023: Teladoc Health announced an enhanced collaboration with Microsoft, incorporating Microsoft Azure OpenAI Service, Azure Cognitive Services, and Nuance Dragon Ambient eXperience (DAX™) into its Solo™ platform. These integrations automate the creation of clinical documentation during virtual visits—significantly reducing clinician administrative burden and improving the quality of shared medical data. This development enhances the telehealth platform’s capacity to support neurological and other specialty care through more efficient, AI-powered documentation workflows.

Report Scope

Report Features Description Market Value (2024) US$ 38 Billion Forecast Revenue (2034) US$ 296.6 Billion CAGR (2025-2034) 22.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Hardware, Services), By Indication (Alzheimer’s Disease, Parkinson’s Disease, Multiple Sclerosis, Epilepsy, Others), By End-User (Patients, Healthcare Providers (Hospitals & Clinics, Specialty Centers, Others), Healthcare Payers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Neofect, Teladoc, Proteus Digital Health, Aural Analytics, Omada Health, AppliedVR, BehaVR, BetterHelp, Big Health, Akili Labs, Blackrock Neurotech, AdvancedMD, Cognivive Inc., And Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Health in Neurology MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Health in Neurology MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Neofect

- Teladoc

- Proteus Digital Health

- Aural Analytics

- Omada Health

- AppliedVR

- BehaVR

- BetterHelp

- Big Health

- Akili Labs

- Blackrock Neurotech

- AdvancedMD

- Cognivive Inc.