Global Digital Comics Market Size, Share, Industry Analysis Report By Type (Manga, Manhwa, Manhua, Western Comics, Others), By Genre (Action, Comedy, Sci-Fi, Horror, Romance, Others), By Target Audience (Kids, Adults), By Revenue Model (Subscription-based, Ad-based), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 137959

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Generative AI

- APAC Market Size

- Type Analysis

- Genre Analysis

- By Target Audience

- By Revenue Model

- Regional Insight

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Growth Factors

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

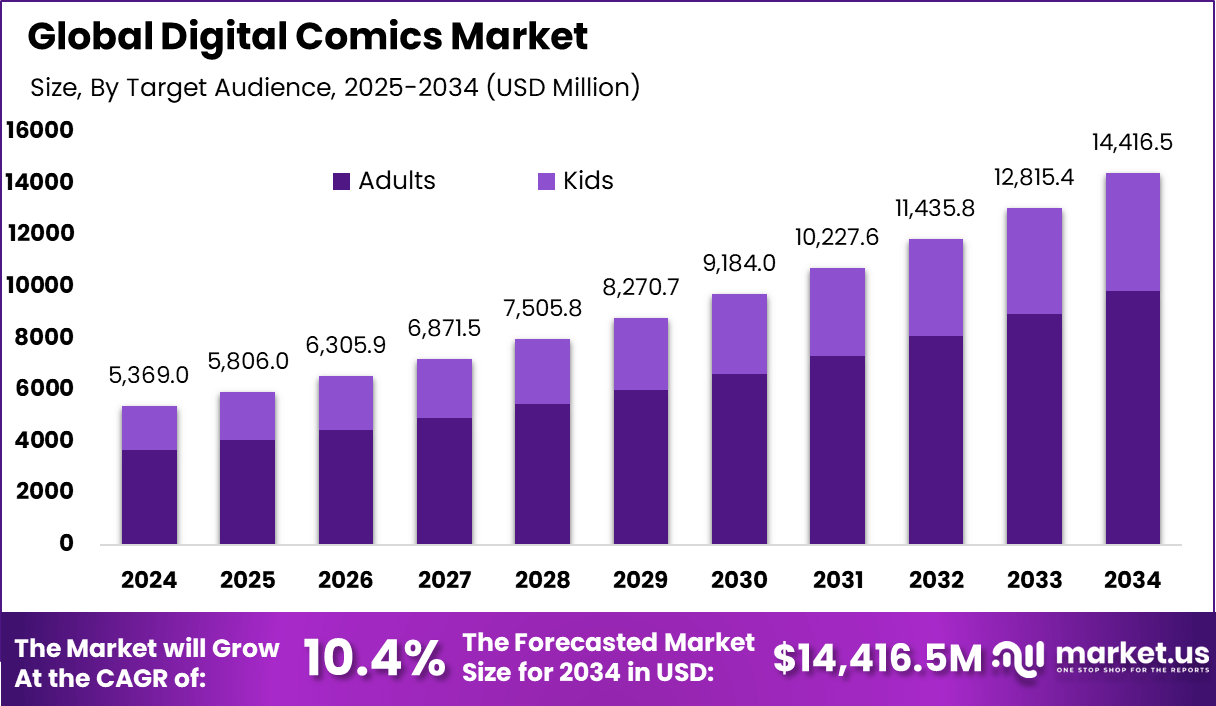

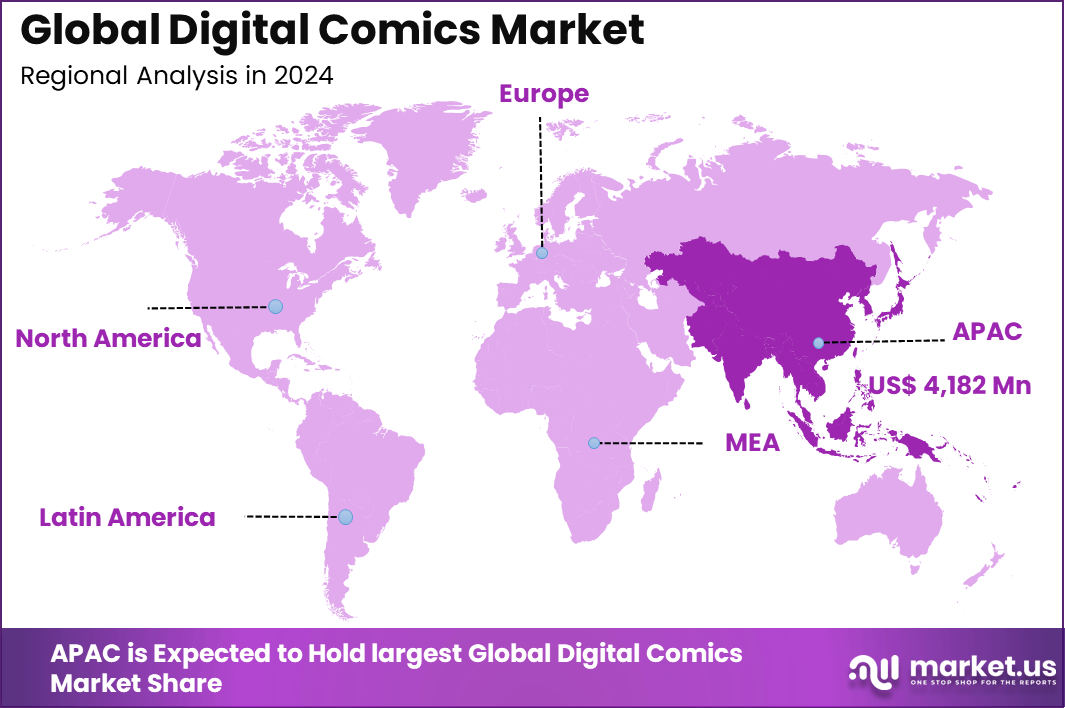

The Global Digital Comics Market generated USD 5,369 Million in 2024 and is predicted to register growth from USD 5,806 Million in 2025 to about USD 14,416.5 Million by 2034, recording a CAGR of 10.4% throughout the forecast span. In 2024, APAC held a dominan market position, capturing more than a 77.9% share, holding USD 4,182 Million revenue.

The digital comic market encompasses comics that are created, distributed or consumed via digital devices (such as smartphones, tablets, e-readers and computers) rather than traditional printed formats. It includes formats such as webcomics, webtoons, subscription-based comic platforms, interactive comics and other screen-native forms.

One primary driving factor is the increasing penetration of mobile devices and high-speed internet, which make digital content consumption more accessible and convenient. Another driver is the shift in consumer behaviour toward digital media and preference for on-demand reading experiences. The growth of services offering digital comics via subscription models and platforms that allow global distribution and localisation has enabled creators and publishers to reach new audiences.

Demand for digital comics is increasing particularly among tech-savvy young people and in regions with growing internet penetration, such as Asia Pacific. The popularity of webcomics and the ability to update stories in real time keep readers engaged. Content variety is expanding beyond entertainment, reaching applications in education and corporate training, further widening the demand base.

Investment opportunities arise from the rapid growth and ongoing innovation in digital formats. Businesses and investors focus on platforms that offer subscription services, exclusive content, and AI-driven features for better user experience. Startups enabling new storytelling methods, secure digital rights, and global distribution attract capital.

According to Coolest Gadgets, The comic book industry continues to experience dynamic growth, driven by a balance between physical and digital formats. Physical comics currently represent 55% of global sales, while digital comics account for 45% as of 2024, showcasing a strong shift toward digital consumption. The Asia-Pacific region is projected to contribute 71% of global market growth, highlighting its pivotal role in the industry’s future.

The audience remains diverse, with 32% of comic readers aged 18 to 34, reflecting significant engagement from young adults. Gender demographics show that 58% of readers are men, while 42% are women, demonstrating a growing interest across both genders. Globally, 50 million people read comics every month, emphasizing the medium’s enduring popularity and cultural relevance

Key Takeaways

- The Manga type segment accounted for 59.8%, indicating dominant consumer preference for Japanese-style digital comics.

- The Action genre held a 34.4% share, showing action-oriented storylines lead audience engagement in digital comic platforms.

- The Adults target audience represented 68.3%, reflecting that the majority of digital comic consumers are mature readers seeking complex themes.

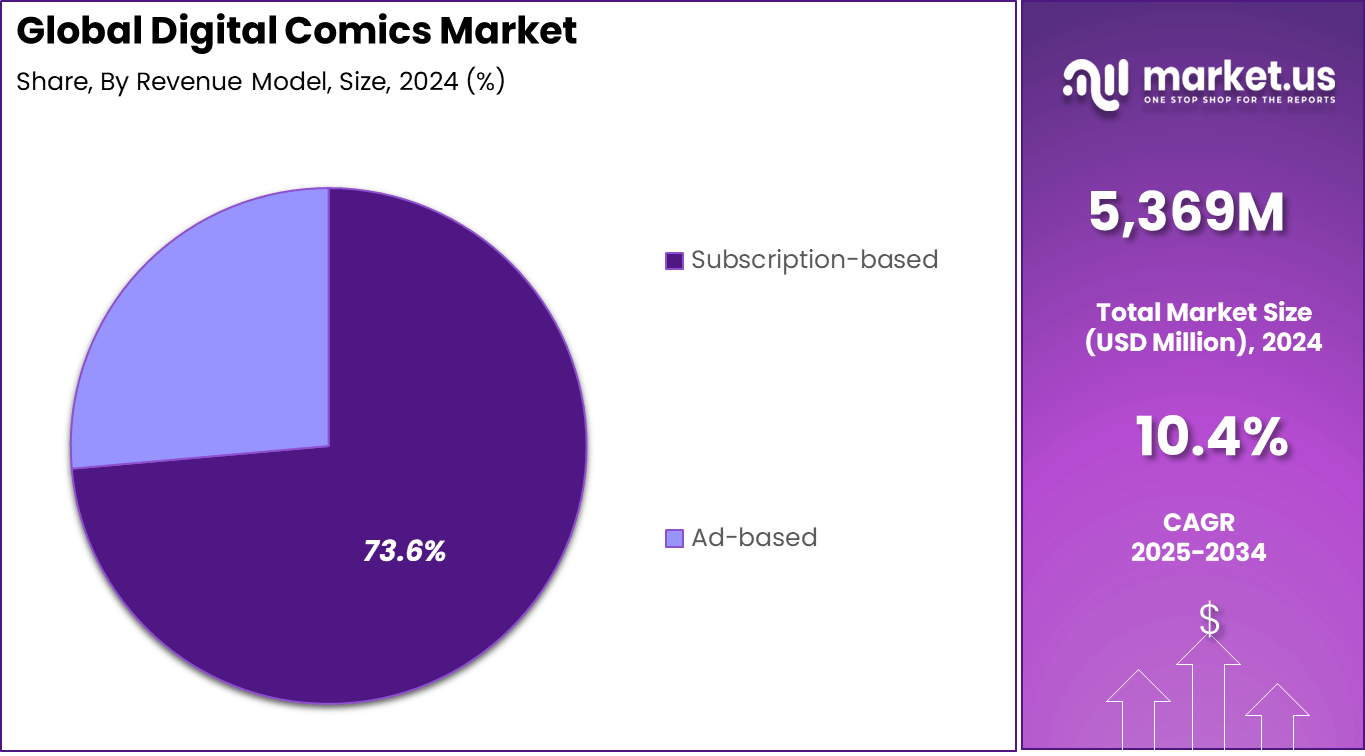

- The Subscription-based revenue model dominated with 73.6%, driven by recurring access models and steady user monetisation.

- The Asia Pacific region captured 77.9% of the market, supported by established digital comic culture and mobile adoption.

- In Japan, the market size stood at USD 3,712.7 Million in 2024, driven by strong domestic demand and digital transition of traditional manga.

- The market is growing at a CAGR of 9.1%, indicating consistent expansion of digital comic consumption and monetisation.

Role of Generative AI

Generative AI has become a game-changer in the digital comics world. It helps creators produce artwork and stories faster and at a lower cost, making comics more accessible to a wider audience. For example, AI tools are capable of generating detailed images and dialogues based on simple prompts, which significantly cuts down the time from conception to publishing.

Studies show that AI can reduce production costs by more than 30%, helping independent artists and small studios compete with larger publishers. Moreover, AI offers personalized storytelling experiences for readers. About 44% of webcomics creators now use AI to tailor narratives to individual reader preferences.

This technology also allows comic styles and themes to be adapted for different cultural markets, broadening reach globally. AI-driven insights into reader data are helping publishers craft content that resonates more deeply with diverse audiences. These advancements are steering the industry toward a more interactive, inclusive, and dynamic future.

APAC Market Size

In 2024, Asia Pacific leads the global digital comics market with 77.9% share. The region’s strong mobile internet penetration and cultural affinity for visual storytelling have driven rapid digital adoption. Local publishers have successfully digitalized traditional comic ecosystems, expanding reach through multilingual formats and mobile-first platforms. Countries such as South Korea, China, and Japan remain growth engines, combining strong content creation with innovative publishing technologies.

Japan stands out as the largest market within the region, valued at around USD 3,712.7 million with a CAGR of 9.1%. Its dominance is rooted in an established manga industry that has seamlessly transitioned into digital platforms. The country’s major publishers continue to set trends in digital serialization, reader engagement, and global distribution. As Japanese manga continues to influence artistic and commercial standards worldwide, the regional market outlook remains highly optimistic.

Type Analysis

In 2024, Manga dominates the digital comics market with around 59.8% share. Its popularity stems from a deep cultural and narrative tradition that appeals to both regional and global readers. The format’s serialized model keeps audiences engaged through continuous story arcs, and digital accessibility has further expanded readership.

Many manga platforms now offer simultaneous global releases, enabling creators to reach international fans faster than print publishing ever allowed. Digital platforms are also supporting original manga creations, giving independent artists wider exposure and monetization opportunities.

The demand for manga is particularly strong among younger readers who prefer mobile reading formats. Strong cross-media integration with anime, gaming, and film industries continues to enhance its visibility, making manga the most influential force in global digital comic consumption.

Market Share (%) By Type Analysis, 2020-2024

Type 2020 2021 2022 2023 2024 Manga 59.6% 59.6% 59.7% 59.7% 59.8% Manhwa 12.8% 12.9% 13.0% 13.0% 13.1% Manhua 7.3% 7.4% 7.5% 7.7% 7.8% Western 15.8% 15.6% 15.5% 15.3% 15.1% Others 4.6% 4.5% 4.4% 4.3% 4.2% Genre Analysis

In 2024, The action genre represents 34.4% of the total digital comics market. Dynamic storytelling, vivid visuals, and character-driven plots attract steady reader interest across regions. The success of this category lies in its adaptability to digital platforms, where fast-paced narratives and motion-enhanced panels can be experienced more vividly.

The action segment often tops download charts due to its appeal among both younger and long-term fans of digital storytelling. Creative studios are increasingly merging traditional comic elements with high-resolution animation techniques to boost reader immersion.

Interactive storytelling tools also complement the action genre, making reading experiences more cinematic. As a result, the category’s strength lies not only in its wide appeal but also in its innovative approach to retaining reader engagement through technology-enhanced experiences.

Market Share (%) By Genre Analysis, 2020-2024

By Genre 2020 2021 2022 2023 2024 Action 33.0% 33.3% 33.7% 34.0% 34.4% Comedy 21.8% 21.7% 21.6% 21.6% 21.5% Sci-Fi 12.9% 12.7% 12.5% 12.3% 12.1% Horror 6.3% 6.2% 6.1% 6.0% 5.9% Romance 15.9% 16.0% 16.1% 16.2% 16.4% Others 10.1% 10.0% 9.9% 9.8% 9.7% By Target Audience

In 2024, Adults make up 68.3% of the user base in digital comics, reflecting the growing demand for mature and diverse storytelling. Digital distribution allows greater freedom for creators to explore complex themes in a format that combines visual artistry with narrative depth. This demographic shift away from youth-only content highlights how the medium has matured into a full-fledged entertainment category for older readers.

Readers in the adult group also show willingness to pay for premium subscriptions and exclusive content. Genres like drama, mystery, and romance are expanding within this audience, blending literary influences with modern visual storytelling. The result is a growing ecosystem that supports longer, more sophisticated narratives tailored to adult readers seeking both entertainment and artistry.

Market Share (%) By Target Audience Analysis, 2020-2024

Target Audience 2020 2021 2022 2023 2024 Kids 32.2% 32.1% 32.0% 31.8% 31.7% Adults 67.8% 67.9% 68.0% 68.2% 68.3% By Revenue Model

In 2024, Subscription-based models account for about 73.6% of the revenues in the digital comics market. This structure provides predictable income for publishers while offering readers unlimited access to vast catalogs. Platforms emphasize affordable monthly pricing paired with frequent content updates, cultivating steady engagement and low churn rates.

Subscriptions also encourage experimentation by allowing users to discover new titles without additional cost barriers. The shift from one-time purchases to recurring subscriptions reflects broader changes in digital media consumption.

Market Share (%) By Revenue Model Analysis, 2020-2024

By Revenue Model 2020 2021 2022 2023 2024 Subscription-based 73.0% 73.1% 73.3% 73.5% 73.6% Ad-based 27.0% 26.9% 26.7% 26.5% 26.4% Personalized recommendations and tiered subscription plans have improved retention rates. For creators, these models support continuous revenue through readership loyalty, helping the industry evolve toward sustainable and content-rich ecosystems.

Regional Insight

North America

The share of North America remained relatively stable over the years, starting at 4.2% in 2020 and holding the same value until 2022. A slight dip occurred in 2023, where it fell to 4.1%, and this level was maintained into 2024. This reflects a marginal but steady decline, suggesting a slower pace of growth compared to other regions.

Europe

Europe showed a gradual decline over the period. It accounted for 11.0% in 2020, which decreased each year to reach 10.5% in 2024. The consistent downward trend indicates a relative weakening of its position in the global share, possibly due to stronger growth in Asia Pacific.

Latin America

Latin America maintained a very small share, standing at 0.8% from 2020 to 2024 without any fluctuation. This indicates a stagnant position in the global distribution, reflecting limited growth and contribution compared to other regions.

Middle East & Africa

The Middle East & Africa consistently held 1.3% in 2020 and 2021, but a slight drop occurred in 2023 and 2024, where the share decreased to 1.2%. The decline is modest but reflects limited competitiveness against Asia Pacific’s rising share.

Key Market Segments

By Type

- Manga

- Manhwa

- Manhua

- Western Comics

- Others

By Genre

- Action

- Comedy

- Sci-Fi

- Horror

- Romance

- Others

By Target Audience

- Kids

- Adults

By Revenue Model

- Subscription-based

- Ad-based

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Digital Consumption

The main driver for the digital comics market is the increasing popularity of digital entertainment. People are shifting towards smartphones and tablets for reading, making digital comics more accessible and convenient. This trend is supported by the availability of high-quality content on various platforms like Webtoon and Tapas, which offer a diverse range of genres that attract a global audience.

Furthermore, technological advancements such as AR and VR are enhancing the storytelling experience, enticing even more users to adopt digital comics. Subscription models are proving attractive because they offer a vast library of content at a low cost, encouraging regular consumption. Overall, the convenience, affordability, and innovation in storytelling are driving the digital comics industry forward.

Restraint

Piracy and Content Security

One of the key restraints is piracy, which hampers revenue for publishers and creators. Unauthorized distribution of digital comics reduces profits and discourages investment in high-quality content development. Despite efforts like digital rights management (DRM), piracy persists, especially on less secure platforms, which affects overall profitability and growth prospects.

Additionally, piracy creates challenges for content monetization and can lead to a decline in consumer trust. Publishers are constantly battling to secure their content against misuse, which increases operational costs. This ongoing threat significantly impairs the industry’s ability to fully capitalize on its potential.

Opportunity

Untapped Markets and Regional Growth

Emerging markets hold substantial growth potential due to rising internet access and smartphone adoption. Countries in Africa, Latin America, and Southeast Asia are witnessing increasing digital engagement, yet they remain relatively underserved by the current digital comics infrastructure. Targeted digital strategies could unlock these markets, expanding the global reach of comics.

Moreover, integrating comics with other forms of entertainment like gaming and streaming creates cross-platform opportunities. Collaborations with education sectors to use comics as learning tools can also open new avenues for growth. These developments could significantly increase consumption levels worldwide and diversify revenue streams.

Challenge

Content Differentiation and Consumer Preferences

The high number of competitors and numerous content options make differentiation a major challenge. Publishers and creators must constantly innovate to catch and retain user attention, which often requires substantial investment in quality and marketing. Standing out in a crowded market demands unique storytelling, exclusive features, and engaging user experiences.

Additionally, consumer preferences are constantly evolving, making it difficult to predict popular genres or formats. Keeping up with these changes while maintaining high content standards is a continuous struggle. The risk of consumer fatigue and changing tastes presents ongoing challenges for the industry.

Emerging Trends

One key trend is the rise of interactive and multimedia comics, which increase engagement among readers. Around 68% of platforms now incorporate features such as sound effects, animations, and even augmented reality elements in their digital comics. This trend is attracting younger audiences, especially those who prefer immersive experiences over traditional reading.

Many publishers are experimenting with combining comics with video, games, and animation, creating a new form of storytelling that appeals to tech-savvy users. Another notable trend is the expansion of webcomics into new markets through regional-focused content. Nearly 70% of digital platforms now prioritize localization, translating comics into multiple languages and curating culturally relevant stories.

This approach helps publishers reach underserved communities and build loyal followings. Its success is evident as the number of monthly active users on major webcomic platforms has increased by more than 20 percent over the past year, demonstrating the growing global appetite for diverse digital comics.

Growth Factors

The growth of digital comics is fueled mainly by the widespread adoption of smartphones and fast internet, which makes access easier for a global audience. Nearly 77% of readers prefer consuming comics on mobile devices, and this preference continues to rise steadily year after year.

Subscription models are also boosting growth, as about 62% of platforms now offer unlimited access to large libraries for a fixed fee. This accessibility and affordability are making comics more appealing to casual readers and dedicated fans alike. Furthermore, the increasing investment in original content and innovative formats like augmented reality and NFTs is broadening the market.

Key Player Analysis

The Digital Comic Market is led by major global publishers and content platforms such as Kadokawa Corporation, Kodansha Ltd., Shueisha Inc., and Shogakukan Inc. These Japanese publishers dominate the digital manga segment, offering extensive online catalogs through mobile apps and web platforms. Their transition to digital distribution and multilingual publishing has significantly expanded readership across Asia, North America, and Europe, reinforcing Japan’s global influence in the comic industry.

Prominent digital-first companies such as WEBTOON Entertainment Inc., Kakao Corporation, Lezhin Entertainment, and NTT Solmare Corporation are reshaping the market with mobile-optimized, vertical-scroll comic formats. These platforms combine AI-based content recommendations, community engagement, and monetization models through ad-supported and subscription services.

Additional contributors such as Marvel Entertainment, LLC, DC Entertainment, Image Comics, IDW Media Holdings, Inc., Archie Comic Publications, Inc., and Penguin Random House LLC, along with other key players, are accelerating digital comic adoption in Western markets. Their focus on digital distribution, cross-media integration, and licensing collaborations with streaming and gaming industries continues to expand the digital comic ecosystem globally.

Top Key Players in the Market

- Kadokawa Corporation

- Kodansha Ltd.

- WEBTOON Entertainment Inc.

- Kakao Corporation

- Shogakukan Inc.

- Marvel Entertainment, LLC

- Image Comics

- DC Entertainment

- IDW Media Holdings, Inc.

- Shueisha Inc.

- Lezhin Entertainment

- Archie Comic Publications, Inc.

- NTT Solmare Corporation

- Penguin Random House LLC

- Others

Top Opportunities Awaiting for Players

The digital comic market is witnessing a surge in growth opportunities, driven by several key factors and innovations.

- Expansion into Emerging Markets: The digital comic market is experiencing rapid growth in regions like Asia-Pacific, which includes burgeoning markets such as South Korea and Southeast Asia. This growth is driven by mobile platform adoption and greater digital content accessibility, reaching previously underserved demographics.

- Diverse Genre Offerings: Digital formats are diversifying genres beyond traditional superheroes, with rising interest in science fiction, manga, and non-fiction. This expansion helps publishers reach broader audiences and explore new market niches for growth.

- Technological Innovations and Digital Transformation: The digital comic industry is benefiting greatly from technological advancements. The use of AI and digital platforms not only enhances the creation and distribution of comics but also improves the interactive experience for users. Publishers are encouraged to embrace these technologies to stay competitive and relevant in a rapidly evolving market.

- Monetization through Various Formats: Digital comics offer flexibility in monetization strategies. Players in the market can benefit from both free and paid models, with paid subscriptions providing a steady revenue stream while free versions can attract a wider audience base. This dual approach allows businesses to maximize their reach and revenue.

- Strategic Partnerships and Licensing: Partnerships and licensing deals with entertainment and media companies are on the rise, leading to adaptations of popular digital comics into films and series. These collaborations boost visibility and create new revenue opportunities.

Recent Developments

- In June 2024, Marvel Entertainment and Dark Horse Comics have teamed up for a multi-year partnership to launch Bullpen Books, a new imprint dedicated to celebrating Marvel’s artistic legacy. The first release, “The Art of the Amazing Spider-Man” by John Romita, is set for Fall 2024.

- In December 2024, DC has announced that its DC UNIVERSE INFINITE digital comic subscription service (DCUI) is going global. With this expansion, fans worldwide can now dive into an expansive library of comics, bringing their favorite stories closer than ever before. Access to an endless world of heroes, villains, and adventures is now just a tap away, anytime and anywhere.

Report Scope

Report Features Description Market Value (2024) USD 5,369 Mn Forecast Revenue (2034) USD 14,416.5 Mn CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Manga, Manhwa, Manhua, Western Comics, Others), By Genre (Action, Comedy, Sci-Fi, Horror, Romance, Others), By Target Audience (Kids, Adults), By Revenue Model (Subscription-based, Ad-based) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kadokawa Corporation, Kodansha Ltd., WEBTOON Entertainment Inc., Kakao Corporation, Shogakukan Inc., Marvel Entertainment, LLC, Image Comics, DC Entertainment, IDW Media Holdings, Inc., Shueisha Inc., Lezhin Entertainment, Archie Comic Publications, Inc., NTT Solmare Corporation, Penguin Random House LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kadokawa Corporation

- Kodansha Ltd.

- WEBTOON Entertainment Inc.

- Kakao Corporation

- Shogakukan Inc.

- Marvel Entertainment, LLC

- Image Comics

- DC Entertainment

- IDW Media Holdings, Inc.

- Shueisha Inc.

- Lezhin Entertainment

- Archie Comic Publications, Inc.

- NTT Solmare Corporation

- Penguin Random House LLC

- Others