Global Digital Asset Custody Market Size, Share, Industry Analysis Report By Type of Custody (Hot Wallet Custody, Cold Wallet Custody), By Asset Type (Cryptocurrencies, Digital Securities, Tokenized Assets, Non-Fungible Tokens (NFTs)), By Service Type (Custody Services, Trading Services, Reporting & Compliance Services, Risk & Security Management), By Deployment (On-Premise, Cloud-based), By End Use (Institutional Investors, Hedge Funds, Asset Managers, Banks, Family Offices, Exchanges & Trading Platforms), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161536

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Cybersecurity Risks

- Role of Generative AI

- Investment Gains

- North America Market Size

- By Type of Custody

- By Asset Type

- By Service Type

- By Deployment

- By End-Use

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

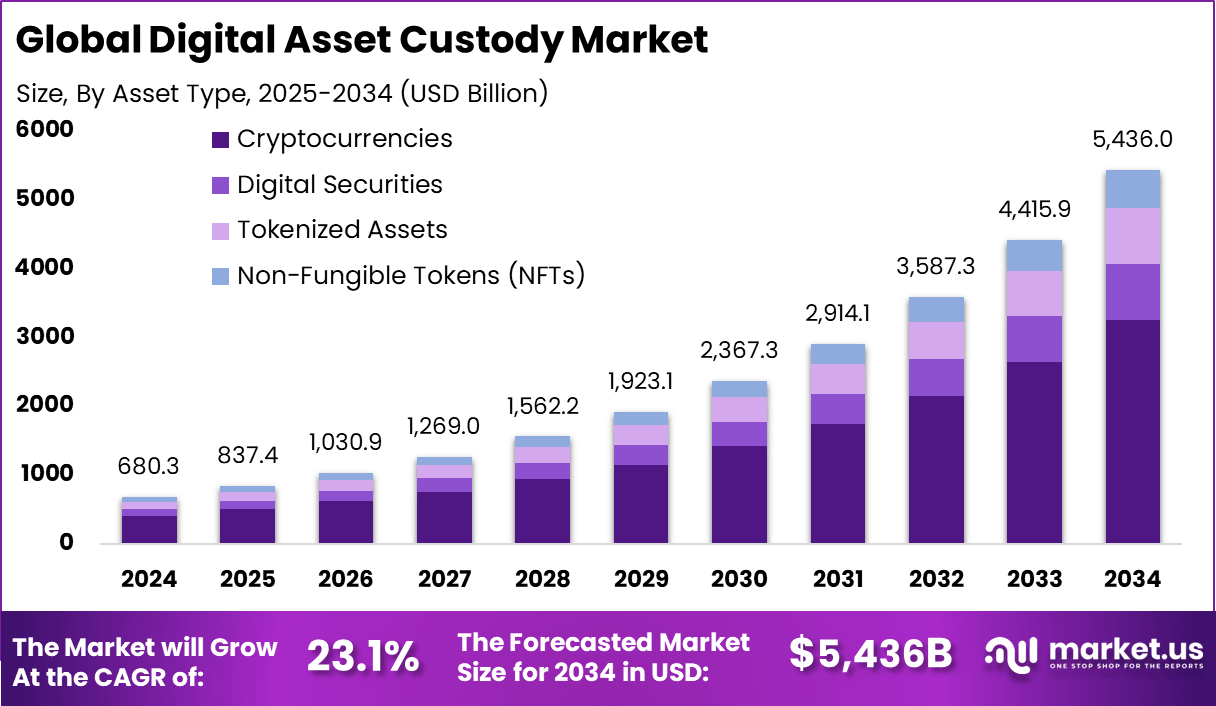

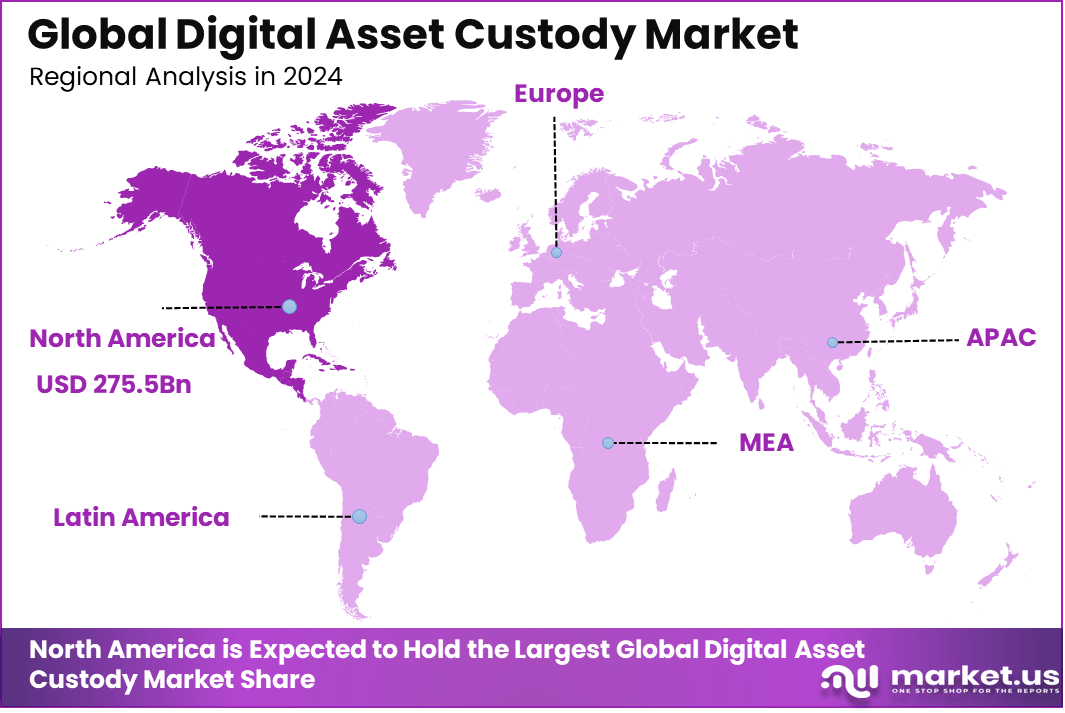

The Global Digital Asset Custody Market generated USD 680.3 billion in 2024 and is predicted to register growth from USD 837.4 billion in 2025 to about USD 5,436 billion by 2034, recording a CAGR of 23.1% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 40.5% share, holding USD 275.5 Billion revenue.

The Digital Asset Custody Market refers to the services and technology infrastructure that secure and manage digital assets such as cryptocurrencies, tokenized securities, and other blockchain-based assets. These custody solutions are designed for individuals and institutions that need safe storage, transaction facilitation, and compliance management for digital assets.

The market has grown rapidly as digital assets move from niche investment instruments to mainstream financial products, requiring advanced security, regulatory adherence, and operational efficiency to protect assets from theft, loss, or unauthorized access. Top driving factors for this market include growing institutional adoption of digital assets and the rise of blockchain technology across finance and retail sectors.

Institutional investors are increasingly incorporating digital assets for portfolio diversification and high returns, pushing demand for secure custody solutions that offer multi-layered security and regulatory compliance. Furthermore, the increasing integration of DeFi (decentralized finance) platforms and tokenization drives the need for sophisticated custody systems that support complex asset classes beyond traditional cryptocurrencies.

Technologies driving increasing adoption include multi-signature wallets, cold storage solutions, and blockchain-based access control systems that enhance security and asset management. Custody solutions are integrating APIs, real-time monitoring, and insurance layers to reduce risk and improve operational efficiency. These technologies address rising cyber threats and asset complexity, allowing individuals and institutions to securely store and transact with digital assets.

Top Market Takeaways

- By Type of Custody, Hot wallet custody held 74.2%, reflecting its strong role in facilitating quick and accessible transactions.

- By Asset Type, Cryptocurrencies accounted for 60%, confirming their dominance as the primary digital asset class under custody.

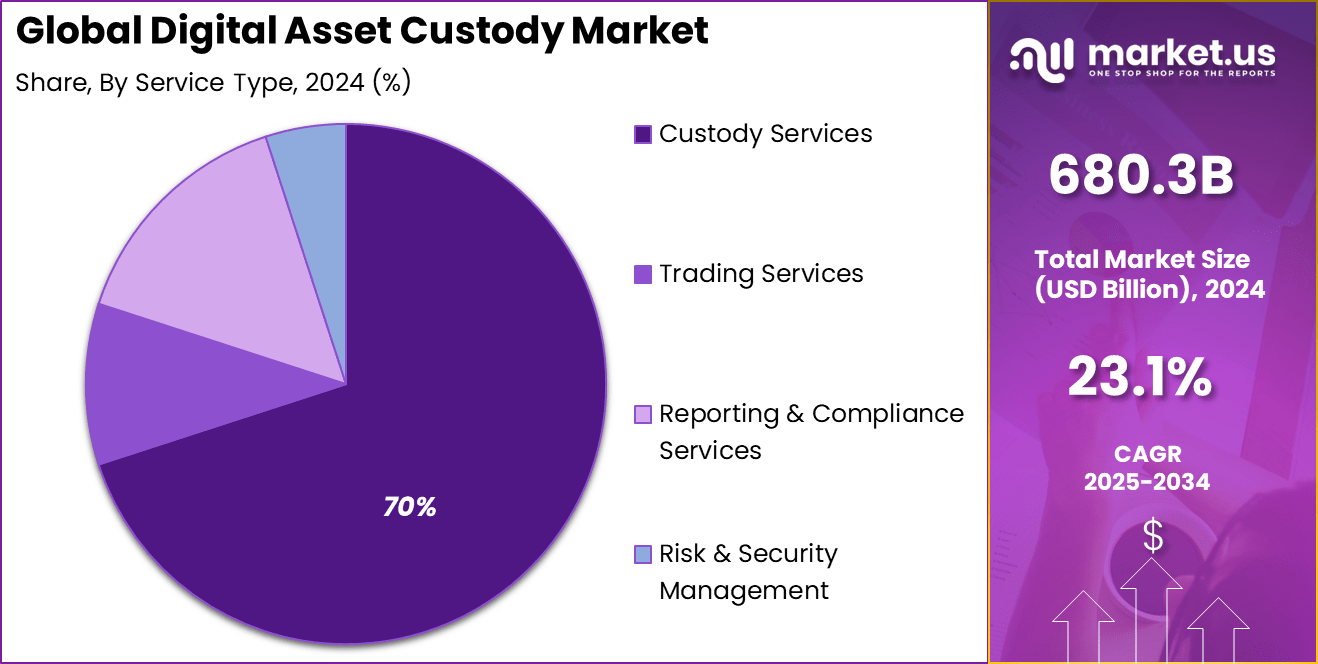

- By Service Type, Custody services captured 70%, highlighting their importance in safeguarding digital assets.

- By Deployment, Cloud-based models held 60.3%, showing preference for scalable and flexible infrastructure.

- By End Use, Institutional investors represented 45.5%, underlining their growing reliance on secure custody solutions.

- By Region, North America led with 40.5%, demonstrating its position as the largest market for digital asset custody.

Cybersecurity Risks

Top statistics on cyberattacks in 2024

- Total Funds Stolen: In 2024, approximately $2.2 billion was stolen from cryptocurrency projects. This sharp rise in value loss underlines the growing sophistication of attackers despite tighter security protocols.

- Year-on-Year Increase: The losses represented a 22% increase compared to $1.8 billion stolen in 2023. The steady growth in theft highlights how cyber defenses are not keeping pace with evolving attack strategies.

- Attack Volume: The number of blockchain hacks reached 303 incidents in 2024, surpassing the 283 incidents recorded in 2023. This growth set a new record for annual attack frequency in the sector.

Major attack vectors

- Compromised Private Keys: Private key theft accounted for over 80% of total losses in 2024. Major breaches included the $305 million DMM Bitcoin hack in May and the $230 million WazirX hack in July, both demonstrating the systemic weakness of key management.

- Social Engineering Threats: Phishing and deceptive tactics dominated, with 93.5% of stolen funds linked to such attacks. State-sponsored groups like Lazarus used fake job interviews and malicious code to gain access to credentials.

- Hot Wallet Vulnerabilities: Centralized exchanges remained attractive targets. BingX lost $43 million, while UAE-based M2 suffered $13.7 million in damages. Hot wallets, while convenient, exposed exchanges to high-value thefts.

- Smart Contract Exploits: DeFi protocols suffered significant breaches through poorly secured contracts. The Munchables attack drained $62.5 million, Penpie lost $27 million, and UwU Lend faced losses of $20 million, revealing gaps in smart contract audits.

- Flash Loan Attacks: Attackers leveraged flash loans to manipulate asset prices. Radiant Capital was among the victims in 2024, showing how these instant borrowing methods remain a serious systemic weakness in DeFi markets.

Role of Generative AI

Generative AI is playing an increasingly important role in digital asset custody by enhancing data analysis, decision-making, and operational efficiency. Around 32-39% of work in capital markets and asset management today involves AI, including generative AI, which supports predictive analytics, portfolio generation, and real-time risk assessment.

This technology also improves investor communication by enabling natural language queries and dynamic reporting, allowing custodians to serve clients more intuitively and efficiently. These advancements enable quicker detection of anomalies and threats, fortifying asset security and compliance in an evolving digital landscape.

The integration of generative AI is shifting operational frameworks by automating routine tasks such as data processing and compliance reporting, leading to significant time and resource savings. Institutions that use generative AI can focus more on strategic decisions while reducing human errors. It streamlines custody services and offers a competitive edge through timely, accurate, and customized asset management, enabling more secure and scalable solutions.

Investment Gains

Investment opportunities in digital asset custody are expanding as regulatory clarity improves and institutional acceptance grows. Financial institutions and fintech firms see custody as a gateway to offering broader digital asset services like tokenized asset issuance, stablecoins, and integrated DeFi products.

Emerging regulatory frameworks reduce entry barriers, making it attractive for new service providers and investors to build innovative custody platforms and infrastructure, fostering a dynamic ecosystem. Business benefits of digital asset custody include enhanced client trust, streamlined operations, and access to new revenue streams.

Custody solutions enable firms to expand their digital asset portfolios securely, meet regulatory demands efficiently, and offer new products that cater to digital-native clients. This enhances market competitiveness, improves asset liquidity management, and fosters stronger client relationships by ensuring asset safety and regulatory compliance

North America Market Size

In 2024, North America holds a dominant 40.5% share in the digital asset custody market, underscoring its role as a global hub for digital finance innovation. The region benefits from a strong financial ecosystem, regulatory clarity, and the presence of leading custody providers supporting institutional adoption.

The U.S. market, in particular, anchors North America’s leadership with significant investments in secure custody infrastructure and progressive regulatory frameworks. American banks and fintech firms are expanding digital custody services, making the region a focal point for secure and compliant digital asset storage.

The U.S. digital asset custody market commands a leading position within North America, supported by a rapidly evolving regulatory landscape and a robust technological base. Major financial institutions are actively providing custody solutions that meet stringent compliance requirements while integrating with global digital asset ecosystems.

Regulatory developments and strong institutional demand in the U.S. are fueling innovation in custody services, focusing on security enhancements, scalability, and interoperability. The country’s leadership in this space attracts global capital and sets benchmarks for custody standards worldwide.

By Type of Custody

In 2024, Hot wallet custody dominates the digital asset custody market, holding a commanding 74.2% share. This type of custody is favored for its accessibility and convenience, allowing quicker access to digital assets for transactions and trading activities.

Hot wallets are especially popular among active traders and institutions that require frequent asset movement, as they offer seamless integration with blockchain networks and trading platforms. While hot wallets provide ease of use, they also present higher risks due to their continual online exposure.

To address security concerns, many custody providers integrate multi-factor authentication and advanced encryption methods. Despite inherent vulnerabilities, the appeal of hot wallet custody remains strong due to its efficiency in supporting real-time digital asset management.

By Asset Type

In 2024, Cryptocurrencies lead the market by asset type, accounting for 60% of digital asset custody demand. Their widespread use as both an investment vehicle and medium of exchange has made cryptocurrencies the primary focus for custodians. Bitcoin, Ethereum, and other major cryptocurrencies constitute the bulk of assets under custody, requiring robust management to mitigate risks like theft and loss.

The growing diversity and acceptance of cryptocurrencies continue to drive the demand for specialized custody solutions. Institutions seek secure infrastructure to safeguard these volatile assets while complying with regulatory frameworks. Increasing institutional interest and mainstream adoption reinforce cryptocurrencies as the cornerstone of digital asset custody portfolios.

By Service Type

In 2024, Custody services represent a substantial 70% share within the market. These services provide secure storage and management of digital assets, encompassing safeguarding private keys, transaction oversight, and insurance protections. Custody services are essential for both individual investors and institutions seeking to protect assets from hacking, fraud, and mismanagement.

As digital financial products become more complex, custodians are expanding their offerings to include integrated solutions such as compliance monitoring, reporting, and liquidity management. The growth in custody services reflects the escalating need for trust and security as digital assets move into mainstream finance.

By Deployment

In 2024, Cloud-based deployment accounts for 60.3% of the market, reflecting the trend toward scalable and flexible custody infrastructure. Cloud deployment offers advantages including reduced upfront costs, easier updates, and accessibility from multiple locations, which are critical for global asset management and real-time monitoring.

Cloud environments also enable custodians to deploy advanced security measures like multi-party computation and hardware security modules without the need for burdensome internal IT infrastructure. These capabilities are increasingly attractive to institutions seeking both convenience and robust protection for their digital assets.

By End-Use

In 2024, Institutional investors drive 45.5% of the digital asset custody market demand. This group includes pension funds, hedge funds, and asset managers who are incorporating digital assets into their portfolios as part of broader diversification strategies. Their focus on compliance, security, and transparency has elevated the demand for regulated custody solutions.

The increasing acceptance of digital assets by institutional investors marks a critical shift from retail-driven markets to professionalized investment activities. This transformation underpins the market’s growth, pushing custodians to refine their service offerings to accommodate large-scale, regulated portfolios.

Emerging Trends

Emerging trends in digital asset custody revolve around institutional adoption and regulatory clarity, which are shaping trust and security expectations. Today, about 70% of digital-native investors express willingness to switch financial institutions for superior digital asset services, highlighting a growing demand for advanced custody capabilities.

Additionally, the use of tokenized assets and stablecoins is on the rise, with stablecoins appealing to 84% of institutions for yield and transactional benefits. This reflects a broader shift towards integrating traditional financial services with innovative digital asset frameworks. The custody market is also advancing towards bank-grade frameworks to address security gaps exposed by earlier models, especially exchange custody services.

Regulatory bodies increasingly provide guidance to ensure robust risk management and operational standards. This openness is encouraging more conventional banks and financial institutions to enter the digital custody space, accelerating the normalization of digital assets as core components of investment and wealth management portfolios.

Growth Factors

Key growth factors driving digital asset custody include demographic shifts, technological advancements, and institutional demand. Younger investors such as Gen Z and Millennials, which make up a substantial portion of digital asset holders, prioritize seamless, mobile-first custody solutions with 24/7 access and transparent processes.

At the same time, older generations focus on custody services integrated with legacy planning and wealth transfer needs, emphasizing trust and regulatory backing. This diverse demand fuels innovation and broader service offerings in the custody sector. Technological breakthroughs such as enhanced cybersecurity protocols, AI-powered risk management, and scalable digital infrastructure also contribute to growth.

These advances help institutions reduce operational risks while meeting fiduciary responsibilities. With regulatory frameworks evolving to provide clarity, there is increased confidence among market participants, encouraging more extensive adoption of digital asset custody services.

Key Market Segments

By Type of Custody

- Hot Wallet Custody

- Cold Wallet Custody

By Asset Type

- Cryptocurrencies

- Digital Securities

- Tokenized Assets

- Non-Fungible Tokens (NFTs)

By Service Type

- Custody Services

- Trading Services

- Reporting & Compliance Services

- Risk & Security Management

By Deployment

- On-Premise

- Cloud-based

By End Use

- Institutional Investors

- Hedge Funds

- Asset Managers

- Banks

- Family Offices

- Exchanges & Trading Platforms

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Institutional Adoption of Digital Assets

The rapid increase in institutional investment in digital assets is a key driver for the digital asset custody market. Many financial institutions, hedge funds, and wealth managers are adding cryptocurrencies and tokenized assets to their portfolios. These investors need highly secure custody solutions that comply with regulations to protect their digital holdings.

The market value for digital asset custody grew strongly in recent years as institutions seek trusted partners to safeguard their assets. North America leads this trend due to advanced regulatory frameworks and robust technology supporting secure custody services.

This demand encourages providers to develop innovative custody products, such as multi-party computation and wallet-as-a-service. The growing interest from high-net-worth investors and institutions ensures sustained momentum for the market’s expansion.

Restraint

Regulatory Uncertainty and Fragmentation

One major restraint slowing the digital asset custody market is uncertainty in regulations. Many regions lack clear legal definitions and rules for digital assets and how to custody them. This creates challenges for custody providers serving clients across different countries, increasing compliance costs and risks.

Fragmented regulatory requirements can delay the introduction of new products and restrict market growth. Investors may also hesitate to commit funds without strong regulatory protection, which slows the pace of adoption. This unsettled regulatory environment remains a significant hurdle for the industry’s wider acceptance.

Opportunity

Integration with Traditional Financial Services

There is a strong opportunity for digital asset custody to integrate more closely with traditional financial services. As more assets become tokenized, custody solutions that work well with existing services like wealth management and estate planning are in high demand.

This integration allows asset managers to offer portfolios that mix traditional and digital assets seamlessly. Custody providers can develop regulated, bank-grade solutions catering to diverse asset types while meeting compliance needs. This creates a powerful path for growth by bridging legacy finance and digital asset markets.

Challenge

Security Risks and Technological Complexity

Security issues are a critical challenge in digital asset custody. Protecting private keys and preventing cyberattacks requires constant vigilance and advanced technology. Custodians face risks from hacking, insider threats, and system vulnerabilities that may lead to losses.

While innovations like multiparty computation and threshold signatures enhance safety, they add technical complexity and operational costs. Providers must maintain strong security without sacrificing usability or compliance. Balancing these factors is necessary to build investor trust and support ongoing market growth.

Competitive Analysis

The Digital Asset Custody Market is led by major institutional-grade custodians such as Coinbase, BitGo Technologies, LLC, and Anchorage Digital. These companies provide secure storage infrastructure, insurance-backed custody, and compliance-ready solutions for cryptocurrencies and tokenized assets. Their platforms serve banks, hedge funds, crypto exchanges, and asset managers seeking regulated digital asset safekeeping.

Specialized enterprise and institutional providers including Fireblocks, Ledger Enterprise, and Aegis Custody focus on MPC (multi-party computation), hardware security modules, and automated transaction governance. Their infrastructure supports secure transfers, treasury management, and tokenization strategies while reducing counterparty risk for institutional clients.

European and Swiss-regulated custodians such as Bitcoin Suisse, Tangany GmbH, and Sygnum Bank, along with other players, contribute through licensed custody services tailored to digital securities, stablecoins, and DeFi assets. Their growing role in regulatory compliance, staking solutions, and digital wealth management is strengthening institutional adoption across global financial markets.

Top Key Players in the Market

- Coinbase

- BitGo Technologies, LLC

- FMR LLC

- Anchorage Digital

- Ledger Enterprise

- Fireblocks

- Aegis Custody

- Bitcoin Suisse

- Tangany GmbH

- Sygnum Bank

- Other Players

Recent Developments

- October 2025, Coinbase announced a strategic investment in Indian crypto exchange CoinDCX, valuing it at about $2.45 billion post-money. This move signals Coinbase’s expanding footprint in emerging markets and enhances its custody ecosystem by integrating more regional partners with growing assets under custody, which stood near $1.2 billion for CoinDCX as of July 2025.

- September 2025, Bitcoin Suisse expanded its custody services by adding support for PAX Gold (PAXG), a digital asset fully backed 1:1 by physical gold held in LBMA vaults in London. This addition enables clients to trade and securely store tokenized gold through its institutional-grade Bitcoin Suisse Vault. This strategic extension bridges traditional asset stability with blockchain efficiency.

Report Scope

Report Features Description Market Value (2024) USD 680.3 Bn Forecast Revenue (2034) USD 5,436.0 Bn CAGR(2025-2034) 23.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Custody (Hot Wallet Custody, Cold Wallet Custody), By Asset Type (Cryptocurrencies, Digital Securities, Tokenized Assets, Non-Fungible Tokens (NFTs)), By Service Type (Custody Services, Trading Services, Reporting & Compliance Services, Risk & Security Management), By Deployment (On-Premise, Cloud-based), By End Use (Institutional Investors, Hedge Funds, Asset Managers, Banks, Family Offices, Exchanges & Trading Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Coinbase, BitGo Technologies, LLC, FMR LLC, Anchorage Digital, Ledger Enterprise, Fireblocks, Aegis Custody, Bitcoin Suisse, Tangany GmbH, Sygnum Bank Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Asset Custody MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Asset Custody MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Coinbase

- BitGo Technologies, LLC

- FMR LLC

- Anchorage Digital

- Ledger Enterprise

- Fireblocks

- Aegis Custody

- Bitcoin Suisse

- Tangany GmbH

- Sygnum Bank

- Other Players