Global Digital Art and Design Tools Market Size, Share and Analysis Report By Component (Software, Services), By Tool Type (Raster Graphics Software, Vector Graphics Software, 3D Modeling & Animation Software, Digital Painting & Illustration Software, UI/UX & Prototyping Tools, Others), By Deployment Mode (Cloud-based, On-premises), By End-User (Professional Artists & Designers, Hobbyists & Enthusiasts, Enterprises, Educational Institutions), By End-User Industry (Media & Entertainment, Advertising & Marketing, Gaming, Architecture & Engineering, Education, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 172933

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

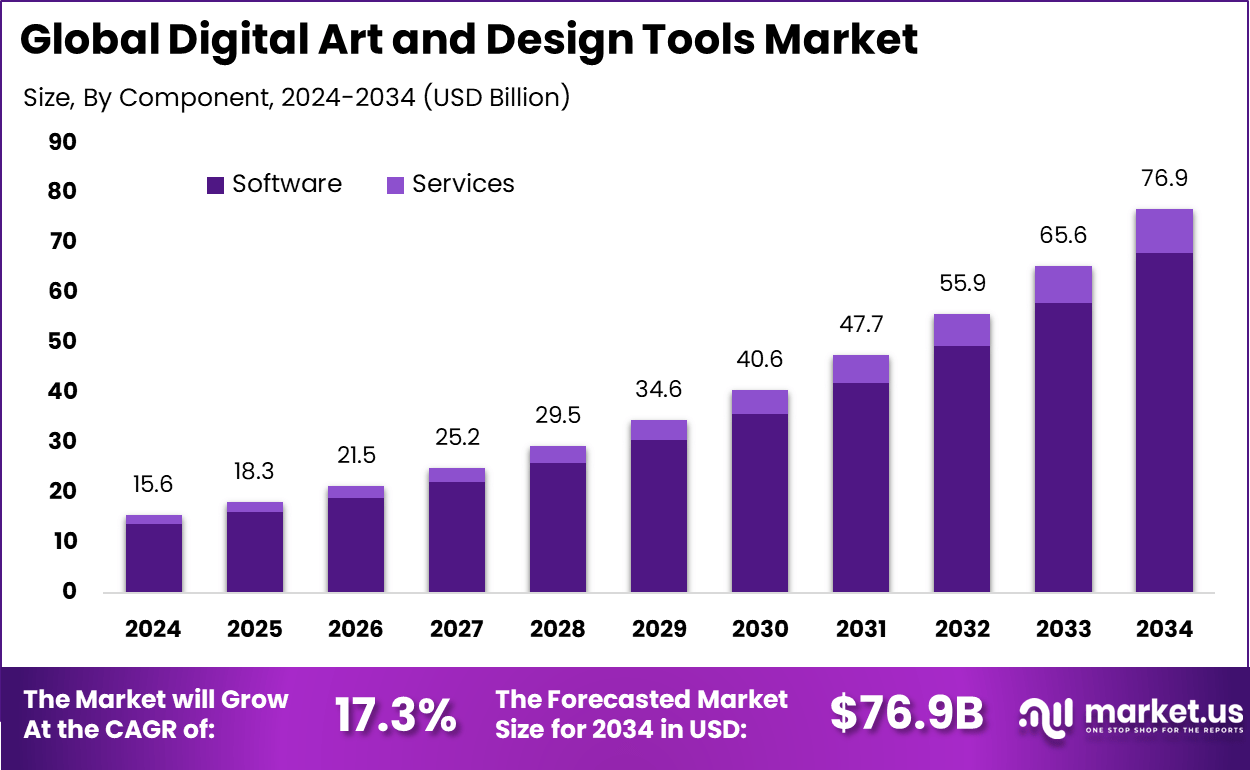

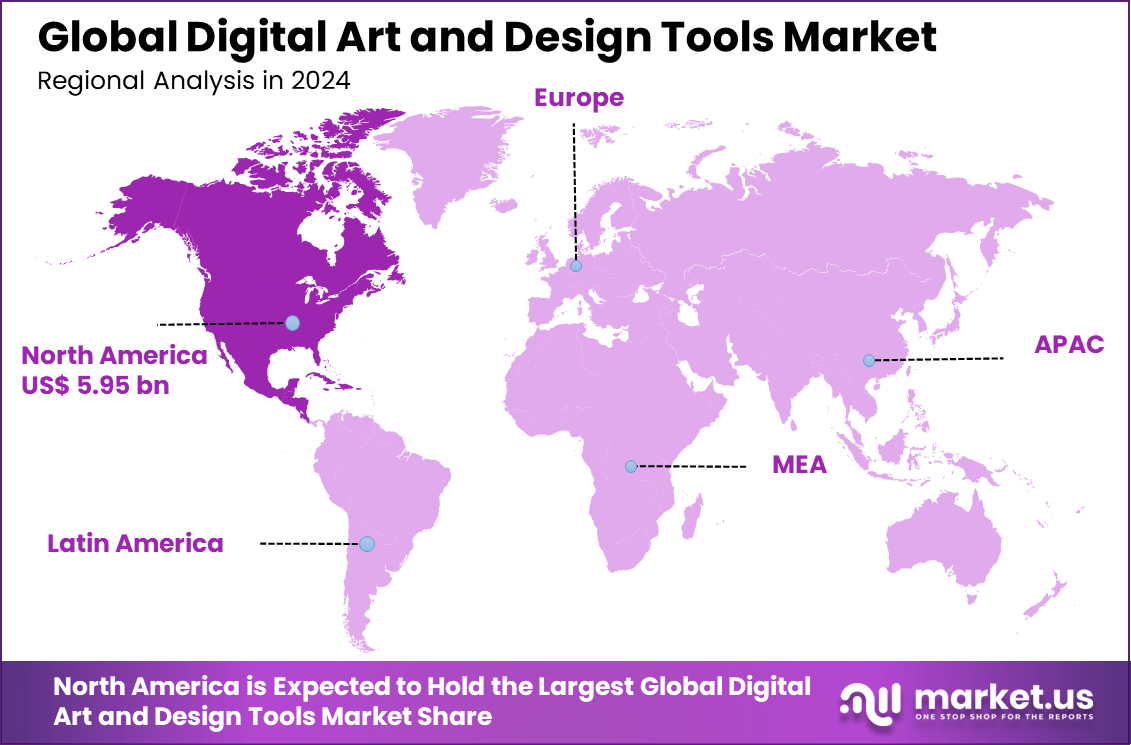

The Global Digital Art and Design Tools Market size is expected to be worth around USD 76.9 billion by 2034, from USD 15.6 billion in 2024, growing at a CAGR of 17.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.15% share, holding USD 5.95 billion in revenue.

Digital art and design tools refer to software and platforms used for creating visual content, illustrations, animations, and user interface designs. These tools enable artists, designers, and creative professionals to produce digital work with precision and flexibility. The market encompasses solutions such as vector editors, raster graphics software, 3D modeling applications, and digital painting platforms. Increasing demand across industries such as advertising, entertainment, gaming, and education has broadened the application of these tools.

The market for digital art and design tools has expanded as remote work and digital content creation have grown. Creative professionals seek tools that enhance productivity, support collaboration, and deliver high quality output. The evolution of user interfaces and integration of cloud capabilities have further strengthened market adoption. As digital media continues to proliferate, the role of these tools in professional and educational settings has become more central.

For instance, in May 2025, Figma’s Config conference launched Figma Sites for responsive web design-to-code, Figma Draw with texture effects and shape builders, plus AI-powered Figma Make for prompt-to-code. These tools turn Figma into a full production platform, bridging design and dev teams seamlessly.

One major driver of the market growth is the rapid expansion of digital content across media channels. Businesses and creators require visually engaging content to attract audiences on social media, websites, and digital advertising. This increased content demand has driven investment in advanced digital art and design solutions. Tools that combine ease of use with powerful features are especially preferred.

Another driving factor is the growth of the gaming and entertainment sectors. These verticals employ sophisticated graphics and immersive visual experiences that depend on robust design tools. Continued growth in video streaming and interactive media has heightened the need for high quality creative software. As a result, demand for tools that support 2D and 3D design, animation, and visual effects has risen.

Key Takeaway

- In 2024, software solutions dominated the digital art and design tools market with an 88.5% share, reflecting strong reliance on feature-rich creative applications for illustration, editing, and design workflows.

- Raster graphics software led by type with 38.7%, driven by its widespread use in digital painting, photo editing, and visual content creation.

- Cloud-based deployment captured 71.6%, highlighting demand for flexible access, collaboration, and real-time updates across devices.

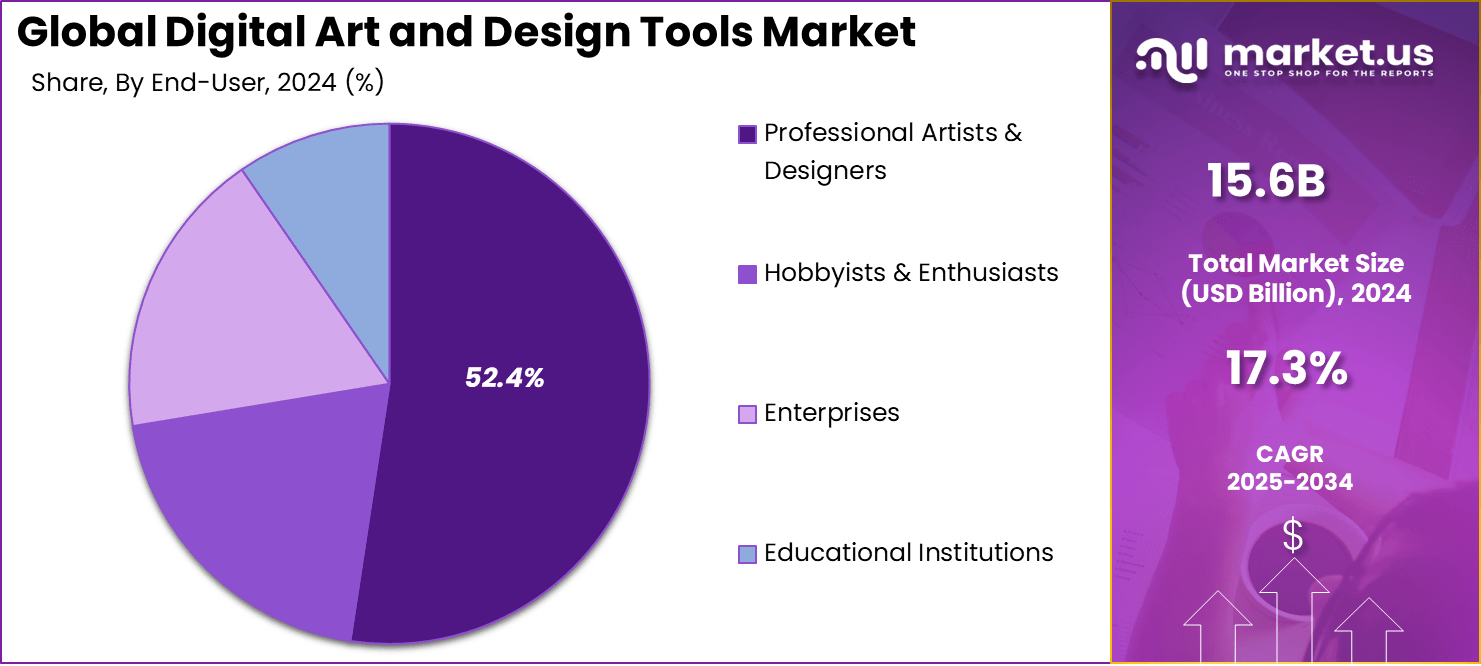

- Professional artists and designers accounted for 52.4% of total usage, supported by high adoption in commercial, freelance, and studio environments.

- Media and entertainment represented 41.3%, reflecting strong demand from gaming, film, animation, and digital content production sectors.

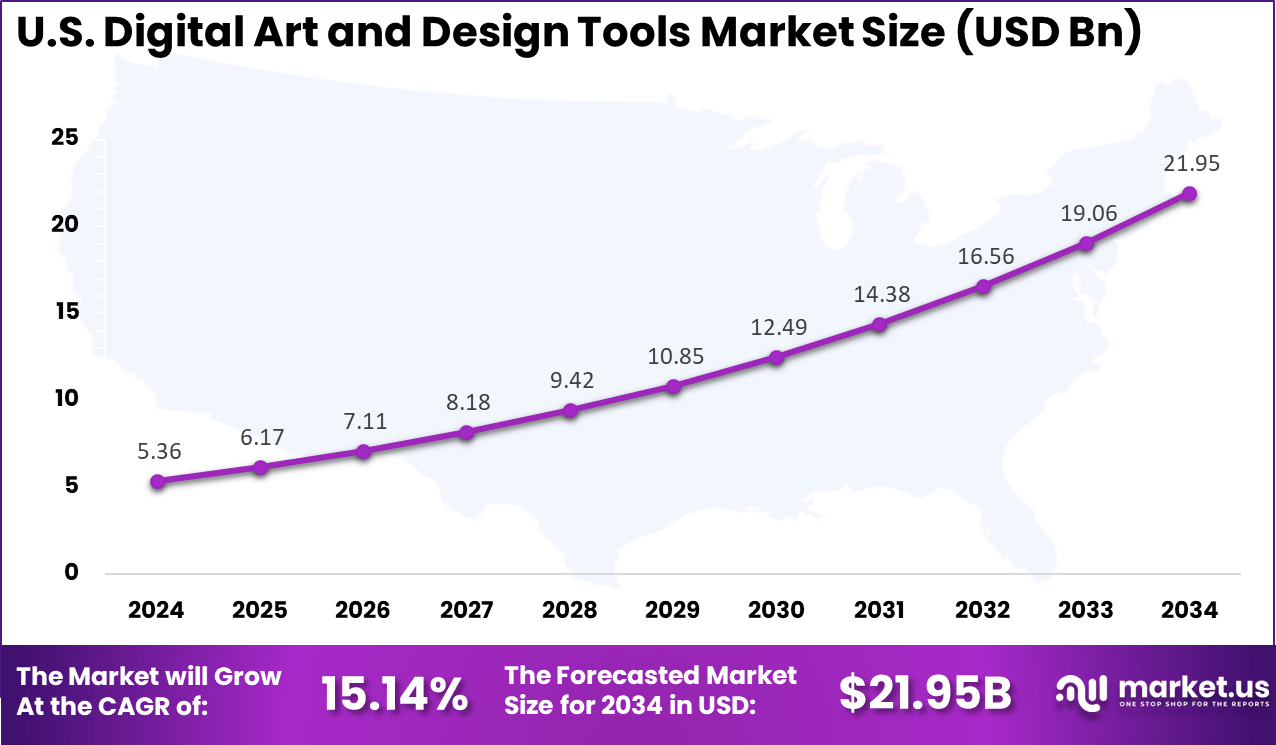

- The U.S. market reached USD 5.36 billion in 2024 and is growing at a 15.14% CAGR, driven by creator economy growth and digital media expansion.

- North America led globally with over 38.15% share, supported by advanced creative industries, high software adoption, and strong digital infrastructure.

U.S. Market Size

The United States reached USD 5.36 Billion with a CAGR of 15.14%, reflecting steady growth. Expansion is driven by digital content creation. Creative professionals invest in advanced tools. Demand spans multiple industries. Market momentum remains positive.

For instance, in October 2025, Adobe unveiled groundbreaking AI innovations at Adobe MAX 2025, introducing AI assistants and advanced models in Photoshop, Lightroom, Premiere, and Illustrator. New features like Firefly Boards for image upscaling and AI-powered creative production enhance workflow efficiency and creative control for professionals.

In 2024, North America held a dominant market position in the Global Digital Art and Design Tools Market, capturing more than a 38.15% share, holding USD 5.95 billion in revenue. This dominance stems from the region’s advanced tech infrastructure and concentration of creative hubs like Los Angeles and New York.

High adoption of cloud-based tools supports seamless remote workflows for studios. A skilled workforce of professional designers drives demand for innovative software. Strong investment in AI-enhanced features accelerates production in media and entertainment. These factors solidify North America’s lead in digital creativity.

For instance, in September 2025, Autodesk, Inc. launched “neural CAD” at Autodesk University 2025 for Forma and Fusion users. This AI-driven technology reimagines CAD geometry creation and system translations, enabling rapid transitions from design concepts to detailed layouts. It reinforces North America’s dominance in advanced digital design software innovation.

Component Analysis

In 2024, Software accounts for 88.5%, showing that digital art and design activities are primarily driven by software-based tools. These tools enable drawing, illustration, photo editing, and layout creation. Software solutions offer flexibility across creative workflows. Regular updates improve functionality and performance. This makes software the foundation of digital design.

The dominance of software is driven by its adaptability and ease of access. Artists prefer tools that work across devices and platforms. Software integrates well with other creative applications. Subscription and cloud access also support continuous usage. This sustains strong reliance on software components.

For Instance, in October 2025, Adobe, Inc. unveiled new AI innovations at Adobe MAX, integrating advanced models into Photoshop and Illustrator for Creative Cloud software. These updates boost precision in masking and compositing, helping artists handle complex edits faster while keeping full control. The focus on software enhancements reinforces its dominant role in daily creative tasks.

Tool Type Analysis

In 2024, Raster graphics software holds 38.7%, making it the leading tool type. These tools work with pixel-based images, which are essential for detailed artwork. Designers use raster software for photo editing and digital painting. High precision supports creative expression. Visual quality remains a key advantage.

Adoption of raster graphics tools is driven by their suitability for complex visuals. Artists rely on them for shading, texture, and color control. These tools are widely used in digital illustration. Compatibility with design workflows supports adoption. This keeps raster graphics software relevant.

For instance, in July 2025, Procreate launched version 5.4 beta with 144 new brushes optimized for Apple Pencil Pro, enhancing raster painting features. Artists can organize libraries and use barrel rotation for natural strokes, ideal for detailed illustrations. The update solidifies raster tools for mobile-first creators.

Deployment Mode Analysis

In 2024, The Cloud-based deployment accounts for 71.6%, reflecting strong preference for online access. Cloud platforms allow users to work from multiple locations. They support file storage and real-time collaboration. Reduced hardware dependency improves accessibility. This enhances creative productivity.

Growth in cloud deployment is driven by flexible work environments. Designers benefit from automatic updates and backups. Cloud tools simplify collaboration with teams and clients. Subscription-based access supports scalability. This deployment mode continues to expand.

For Instance, in October 2025, Figma advanced its cloud platform with real-time collaboration upgrades and unlimited storage in free tiers. Teams prototype UI designs seamlessly from any browser, streamlining remote work. The browser focus exemplifies the cloud’s accessibility for design pros.

End-User Analysis

In 2024, Professional artists and designers represent 52.4%, making them the largest user group. These users rely on advanced tools for creative output. Digital tools support efficiency and precision. Professionals require stable and feature-rich platforms. Quality remains a top priority.

Adoption among professionals is driven by commercial demand. Creative projects require consistent results and timelines. Digital tools support workflow optimization. Professionals invest in tools that enhance output quality. This sustains strong demand.

End-User Industry

In 2024, Media and entertainment account for 41.3%, highlighting strong usage in this industry. Digital art tools support content creation for film, animation, and media. Visual storytelling depends on high-quality design. Tools enable rapid content production. Creative flexibility is essential.

Growth in this industry is driven by digital content demand. Media companies require scalable design solutions. Digital tools support creative experimentation. Integration with production pipelines improves efficiency. This keeps demand steady.

For instance, in October 2025, Autodesk, Inc. improved Maya and 3D tools at Adobe MAX collaborations for film effects. Artists create complex scenes with better tracking and rendering, fitting VFX pipelines. It serves entertainment’s high-stakes visual needs.

Key Market Segments

By Component

- Software

- Services

By Tool Type

- Raster Graphics Software

- Vector Graphics Software

- 3D Modeling & Animation Software

- Digital Painting & Illustration Software

- UI/UX & Prototyping Tools

- Others

By Deployment Mode

- Cloud-based

- On-premises

By End-User

- Professional Artists & Designers

- Hobbyists & Enthusiasts

- Enterprises

- Educational Institutions

By End-User Industry

- Media & Entertainment

- Advertising & Marketing

- Gaming

- Architecture & Engineering

- Education

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A major driver of market growth is the rising demand for digital content across media, entertainment, advertising, and education. Businesses and individual creators alike seek tools that can produce high-quality visuals quickly and effectively. Digital art and design tools provide capabilities for illustration, animation, layout, and branding that support diverse creative needs. As content consumption increases, investment in advanced design solutions continues to expand.

Another driver is the widespread adoption of mobile devices and cloud-based software that allow creators to work from anywhere. Artists can now sketch, edit, and finalize designs on tablets or laptops without heavy desktop systems. Cloud connectivity also synchronizes work across devices and enables access to assets and tools remotely. Greater accessibility supports broader use among professionals, students, and hobbyists.

Restraint Analysis

One restraint on market expansion is the complexity of many advanced digital art tools, which can pose a learning curve for new or less technical users. High-end design software often requires training and experience to utilize its full capabilities. Users without formal training may find interfaces overwhelming or difficult to navigate. This learning barrier can slow adoption among casual creators and small teams.

Another restraint is concern over intellectual property and licensing when using shared assets and templates. Some platforms provide libraries of elements that may have restrictions based on subscription levels or usage rights. Designers and businesses must ensure compliance with licensing terms to avoid unauthorized use. These legal considerations add complexity to tool selection and usage.

Opportunity Analysis

There is strong opportunity in developing tools with enhanced automation that can simplify routine design tasks such as background removal, color matching, and layout generation. By reducing time spent on technical steps, creators can focus more on originality and artistic expression. This type of automation also supports smaller teams that need high output with limited resources. Automated capabilities are expected to broaden appeal and increase tool adoption.

Another opportunity lies in expanding educational resources, templates, and guided workflows that support learners and new users. Tools that include integrated tutorials, project guides, and contextual help can shorten the learning curve and drive adoption. Educational features also build confidence and improve long-term engagement for individuals seeking to improve their skills. Supportive learning environments encourage broader use across skill levels.

Challenge Analysis

A key challenge for the market is ensuring interoperability and file compatibility across different design tools and platforms. Creators often need to transfer work between programs for specialized tasks, and inconsistencies in formats can disrupt workflows. Standardizing export and import functions remains difficult due to proprietary formats and feature differences. File compatibility issues can create friction in collaborative environments.

Another challenge is balancing sophisticated feature sets with user-friendly interfaces. Advanced capabilities are valuable for professional designers, but overly complex systems can deter casual users. Providers must design intuitive experiences while maintaining powerful functionality behind the scenes. Achieving this balance is critical to satisfy diverse user groups and support market growth.

Key Players Analysis

Adobe, Inc., Canva, Autodesk, Inc., and Figma, Inc. lead the digital art and design tools market by offering comprehensive platforms for graphic design, UI UX creation, and professional content production. Their solutions support cloud collaboration, advanced editing, and cross device workflows. These companies focus on usability, subscription based access, and strong creative ecosystems. Rising demand for digital content across marketing, media, and product design continues to reinforce their leadership.

Corel Corporation, Sketch B.V., Affinity, Clip Studio Paint, and Procreate strengthen the market with specialized tools for illustration, vector design, and digital painting. Their products are widely adopted by artists, designers, and small studios. These providers emphasize performance, one time licensing options, and creative flexibility. Growing use of tablets and stylus based workflows supports wider adoption.

Blender Foundation, Unity Technologies, SideFX, Pixologic, Inc., and Maxon Computer GmbH expand the landscape with advanced 3D modeling, animation, and visual effects tools. Their solutions support gaming, film, and immersive media production. These companies focus on realism, simulation accuracy, and developer communities. Increasing convergence of design, animation, and interactive media continues to drive steady growth in the digital art and design tools market.

Top Key Players in the Market

- Adobe, Inc.

- Canva

- Corel Corporation

- Autodesk, Inc.

- Figma, Inc.

- Sketch B.V.

- Affinity

- Clip Studio Paint

- Procreate

- Blender Foundation

- Unity Technologies

- SideFX

- Pixologic, Inc.

- Maxon Computer GmbH

- GIMP Development Team

- Others

Recent Developments

- In September 2025, Autodesk unveiled AI-powered updates to Fusion and Forma, featuring generative CAD from prompts, Autodesk Assistant for constraint automation, and integrated construction cloud data. This unifies design-to-manufacturing workflows, letting teams onboard faster and engineer smarter for architecture, manufacturing, and media.

- In October 2025, Canva debuted its Creative Operating System with Visual Suite enhancements, AI photo editors, and Canva Grow for marketing campaigns. Enterprise users get Team Context from brand files, making scaled content creation faster and more consistent across global teams.

Report Scope

Report Features Description Market Value (2024) USD 15.6 bn Forecast Revenue (2034) USD 76.9 Bn CAGR(2025-2034) 17.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Tool Type (Raster Graphics Software, Vector Graphics Software, 3D Modeling & Animation Software, Digital Painting & Illustration Software, UI/UX & Prototyping Tools, Others), By Deployment Mode (Cloud-based, On-premises), By End-User (Professional Artists & Designers, Hobbyists & Enthusiasts, Enterprises, Educational Institutions), By End-User Industry (Media & Entertainment, Advertising & Marketing, Gaming, Architecture & Engineering, Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe, Inc., Canva, Corel Corporation, Autodesk, Inc., Figma, Inc., Sketch B.V., Affinity, Clip Studio Paint, Procreate, Blender Foundation, Unity Technologies, SideFX, Pixologic, Inc., Maxon Computer GmbH, GIMP Development Team, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Art and Design Tools MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Digital Art and Design Tools MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe, Inc.

- Canva

- Corel Corporation

- Autodesk, Inc.

- Figma, Inc.

- Sketch B.V.

- Affinity

- Clip Studio Paint

- Procreate

- Blender Foundation

- Unity Technologies

- SideFX

- Pixologic, Inc.

- Maxon Computer GmbH

- GIMP Development Team

- Others