Global Digiceuticals Market Analysis By Platform (Smartphone, Watches, Medical device system), By Product Type (Software, Devices), By Application (Diabetes management, Substance abuse, Pulmonary diseases, Alcohol and smoking addiction, Neurological disorders, Others), By Sales Channel (Business-to-Business (B2B), Business-to-Consumer (B2C)) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164728

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

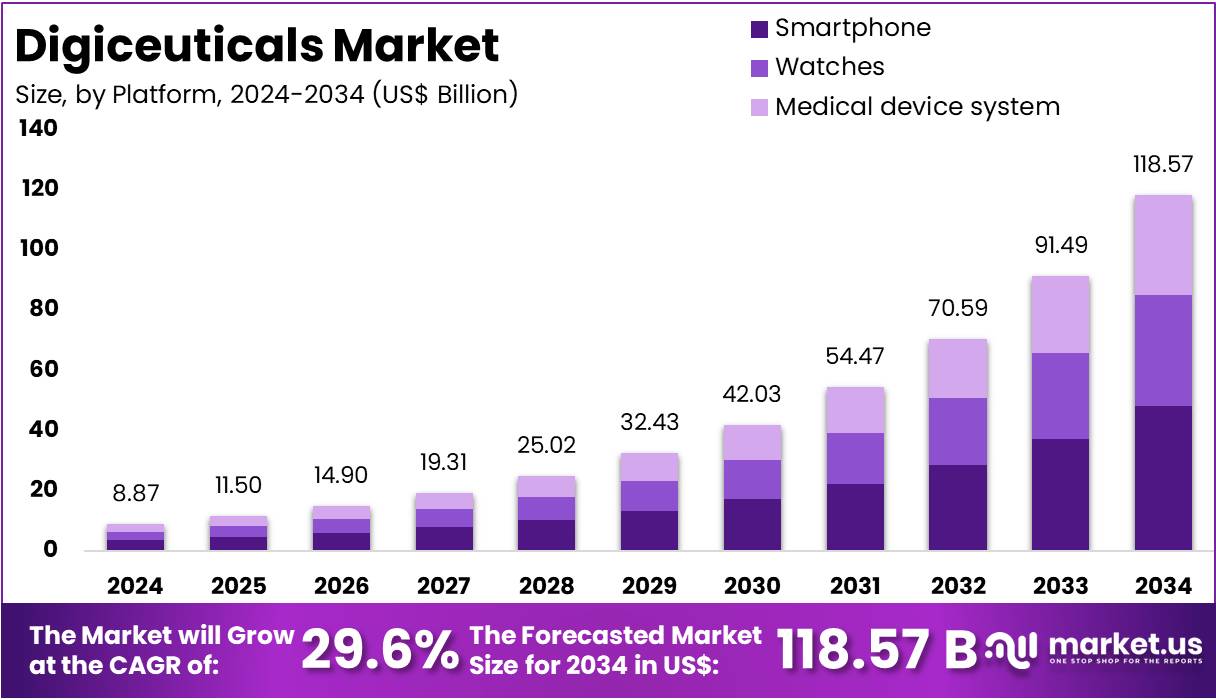

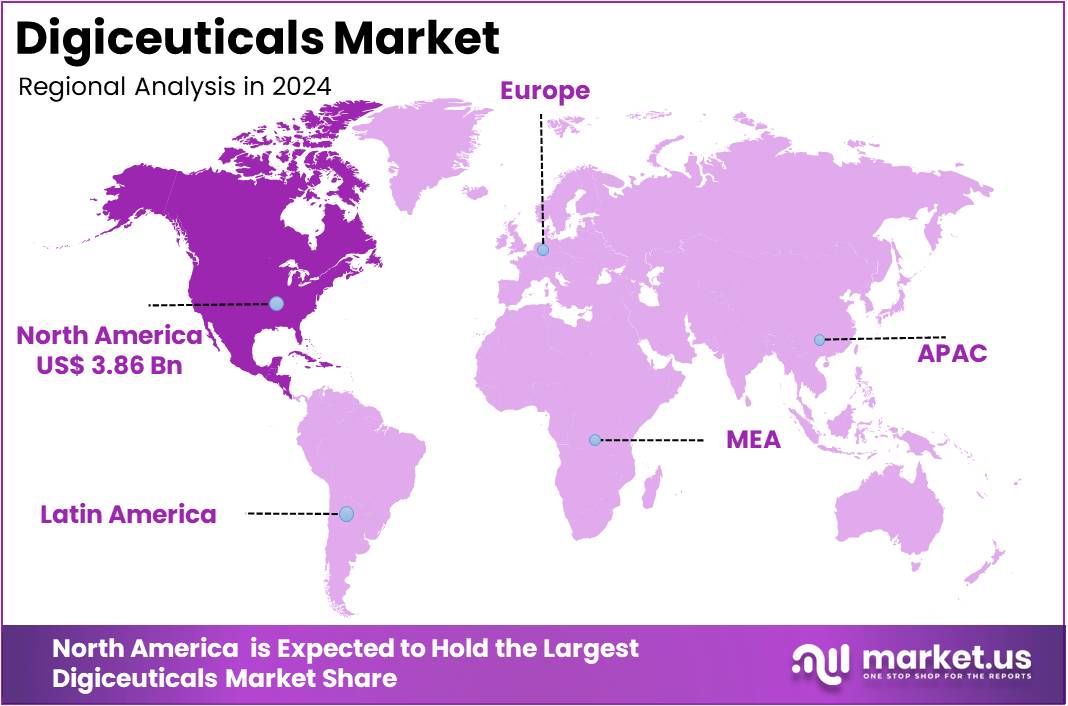

The Global Digiceuticals Market Size is expected to be worth around US$ 118.57 Billion by 2034, from US$ 8.87 Billion in 2024, growing at a CAGR of 29.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 43.5% share and holds US$ 3.86 Billion market value for the year.

Digiceuticals are software-based therapeutic tools that are validated through clinical studies and delivered through mobile apps, web platforms, and connected sensors. According to global health agencies, their growth has been supported by the wider use of structured digital protocols and controlled trials that mirror pharmaceutical standards. These tools are gaining acceptance because they enable prevention, management, and treatment of multiple conditions through scalable and low-cost delivery models.

The demand for digiceuticals has increased due to the rising burden of chronic diseases. Noncommunicable diseases account for nearly three quarters of global deaths, and premature mortality is concentrated in low and middle income countries. Study by the World Health Organization indicates that this trend is creating long-term need for adherence support, self-management tools, and behavior-change interventions. For example, digital platforms now form part of chronic care pathways across several public systems.

Mental health needs are also shaping adoption. More than one billion individuals are reported to live with a mental health condition worldwide, and depression and anxiety result in an economic loss of about 1 trillion US dollars each year. According to WHO assessments, these figures have accelerated the evaluation of digital self-help and remote psychological tools. For instance, health systems have tested remote cognitive and behavioral therapies to meet rising demand and limited specialist supply.

Policy direction has further strengthened market confidence. The World Health Assembly has adopted a strategy focused on national digital health plans and standards that support integration, assessment, and scale. This has reduced regulatory uncertainty and encouraged investment. Digital infrastructure has also expanded. OECD data confirm that remote consultations increased sharply during the pandemic and became routine afterward. According to these trends, patient familiarity with app-guided care has improved, which supports sustained use of validated digiceuticals.

Regulatory and Reimbursement Drivers

Regulatory clarity in advanced markets is accelerating evidence generation for digiceuticals. In the United States, the FDA has established a Digital Health Center of Excellence and a Digital Health Advisory Committee to guide policies for software-as-a-medical-device. For example, the FDA has defined how digital health technologies may collect clinical trial data directly from patients, reducing development risk and improving the speed of clinical validation for new software-based therapies.

Reimbursement mechanisms have expanded alongside regulatory improvements. Medicare introduced Remote Therapeutic Monitoring codes in 2022, enabling billing for adherence tracking, symptom monitoring, and monthly management linked to digital interventions. Public guidance from HHS has explained operational use cases, which has encouraged broader provider participation. For instance, discussions on payer parity have gained momentum as digital therapeutic tools demonstrate measurable clinical and economic outcomes.

Europe has created structured access routes for software-based therapies. Germany’s DiGA Fast-Track allows prescription and statutory reimbursement for digital applications for around 73 million insured citizens. France’s PECAN procedure offers one year of early reimbursement for innovative digital medical devices as they build evidence for routine coverage. According to national authorities, these mechanisms now serve as reference models for other payers considering digital adoption frameworks.

Evaluation processes in the United Kingdom continue to mature. NICE maintains an Evidence Standards Framework and operates Early Value Assessment to accelerate access for promising technologies. In July 2025, three “digital front door” tools were reviewed and two were recommended for NHS use during evidence generation. In October 2025, five AI imaging tools for vertebral fragility fracture detection entered EVA. NHS data show that Talking Therapies completed 670,000 treatment courses in 2023/24, with funding to add 384,000 more by 2029, which demonstrates growing demand for scalable digital pathways.

Key Takeaways

- The Global Digiceuticals Market is projected to reach US$ 118.57 Billion by 2034, rising sharply from US$ 8.87 Billion in 2024, at a 29.6% CAGR.

- In 2024, the Smartphone segment dominated the Platform category, accounting for over 40.7% of the total market share due to widespread mobile health adoption.

- The Software segment led the Product Type category in 2024, capturing more than 74.8% share, driven by increasing reliance on digital therapeutic applications.

- Within the Application segment, Diabetes management solutions held a strong lead in 2024, contributing over 38.6% share due to rising global diabetes prevalence.

- The Business-to-Business (B2B) channel secured a commanding 69.7% share in 2024, reflecting growing partnerships between healthcare providers and digital therapy developers.

- North America emerged as the market leader in 2024, holding 43.5% share and achieving a market value of US$ 3.86 Billion, supported by advanced digital health infrastructure.

Platform Analysis

In 2024, the Smartphone section held a dominant market position in the Platform Segment of the Digiceuticals Market, capturing over 40.7% share. This growth is linked to the rapid rise in smartphone adoption and the increasing use of health applications. Smartphones allow easy access to digital therapeutics, enabling users to monitor their health in real time. Their ability to deliver personalized guidance and integrate with other digital tools makes them the preferred platform for modern health management.

The Watches segment is also showing strong momentum within the digiceuticals space. Smartwatches now come with advanced biosensors that track vital signs and activity levels continuously. They help users manage lifestyle-related conditions such as obesity, stress, and hypertension. Their role in preventive care is expanding as users rely on reminders and alerts for medication and activity. These features enhance patient engagement, making smartwatches an essential tool in digital healthcare delivery.

The Medical Device Systems segment remains crucial for clinical-grade digital therapeutics. These platforms combine certified hardware with validated digital interventions. Healthcare providers often use them for remote monitoring, rehabilitation, and chronic disease management. Their accuracy and compliance with medical standards make them suitable for hospital and clinical use. The segment supports the growing shift toward connected care, where technology bridges the gap between patients and professionals for better outcomes and continuous monitoring.

Product Type Analysis

In 2024, the Software Section held a dominant market position in the Product Type Segment of the Digiceuticals Market, and captured more than a 74.8% share. This segment’s growth is driven by the rising adoption of mobile applications and cloud-based therapeutic platforms. The increasing use of digital tools for managing chronic diseases and mental health conditions also contributes to this strong demand. These solutions offer personalized interventions, continuous monitoring, and improved patient engagement.

The Software segment benefits from its easy scalability and low distribution cost. Healthcare providers and patients are increasingly shifting toward app-based therapies that can be integrated with existing medical systems. The availability of AI-driven algorithms for treatment personalization further strengthens this segment. Moreover, the growing trend of remote healthcare delivery has accelerated the use of digital therapeutics software across diverse medical conditions.

In contrast, the Devices segment, though smaller, is witnessing gradual adoption. It includes wearables and sensor-based tools that track patient activity, behavior, and physiological data. These devices often complement software-based therapies by offering real-time health insights. Their integration with mobile and cloud platforms enhances the accuracy of treatment outcomes and promotes long-term disease management.

Application Analysis

In 2024, the Diabetes Management Section held a dominant market position in the Application Segment of the Digiceuticals Market, and captured more than a 74.8% share. This dominance is driven by the rising global burden of diabetes and the growing adoption of digital therapeutics for continuous glucose monitoring and lifestyle management. The integration of AI-based monitoring tools and personalized treatment apps has further improved patient engagement and treatment outcomes in diabetes care.

The Substance Abuse and Addiction Management Segment also showed notable growth. Increasing awareness about mental health and the rising prevalence of substance dependence have accelerated the adoption of digital therapeutics for behavior modification and relapse prevention. These apps offer cognitive behavioral therapy (CBT) and remote counseling features that enhance user compliance.

Meanwhile, Pulmonary Diseases and Neurological Disorders segments are projected to expand steadily over the forecast period. Digital interventions for chronic obstructive pulmonary disease (COPD), asthma, and conditions like depression, anxiety, and ADHD are gaining traction. Other emerging applications, including alcohol and smoking addiction management, are expected to witness steady demand, supported by preventive healthcare initiatives and the growing focus on personalized digital therapy.

Sales Channel Analysis

In 2024, the Business-to-Business (B2B) Section held a dominant market position in the Sales Channel Segment of the Digiceuticals Market, and captured more than a 69.7% share. The B2B segment’s growth is driven by rising collaborations between digital therapeutic providers and healthcare institutions. Hospitals, clinics, and corporate wellness programs increasingly integrate digiceutical platforms to improve patient engagement and treatment adherence. This trend strengthens the adoption of licensed and evidence-based digital health solutions.

The B2B model also benefits from strategic partnerships with pharmaceutical companies for co-development and distribution of digital therapeutics. Such alliances enhance brand credibility and regulatory compliance. Furthermore, healthcare professionals prefer clinically validated software solutions that can be prescribed alongside traditional treatments, increasing trust and usage rates.

On the other hand, the Business-to-Consumer (B2C) segment is gaining steady traction. Growing smartphone penetration and the rise of self-care awareness are fueling direct consumer purchases of digital therapy apps. Users seek convenient, cost-effective options for managing chronic conditions like diabetes, depression, and anxiety. As a result, B2C channels are expected to register significant growth during the forecast period, supported by subscription-based models and personalized therapy features.

Key Market Segments

By Platform

- Smartphone

- Watches

- Medical device system

By Product Type

- Software

- Devices

By Application

- Diabetes management

- Substance abuse

- Pulmonary diseases

- Alcohol and smoking addiction

- Neurological disorders

- Others

By Sales Channel

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

Drivers

Disease Burden And Clinical Outcomes Are Supporting Adoption

The rising prevalence of untreated mental and physical health conditions has strengthened the need for scalable therapeutic tools. Demand for effective and accessible care has increased because traditional systems remain overstretched. This has supported the rising adoption of digiceuticals. The growth of the market can be attributed to continuous pressure on health systems to improve clinical outcomes. Digital solutions are being positioned as structured, evidence-based interventions that can serve large populations. Their role in early detection and long-term management is becoming more significant.

The scale of unmet need highlights a clear adoption driver. According to the World Health Organization, approximately one in seven people worldwide, or nearly 1.1 billion individuals, were living with a mental disorder in 2021. Conditions such as anxiety and depression accounted for a major share. This level of disease burden has encouraged the shift toward digital therapeutic models. For instance, digiceuticals are being deployed to expand access, improve adherence, and support personalized care pathways where traditional resources are insufficient.

Clinical validation is reinforcing this trend. Study by JAMA Network reported that digital health interventions delivered greater reductions in systolic blood pressure at six and twelve months when compared with usual care among underserved groups. For example, these improvements demonstrate that structured digital programs can produce measurable health gains. The adoption of digiceuticals is therefore supported by growing evidence that digital tools can enhance outcomes. This is strengthening confidence among providers, payers, and policymakers toward broader integration.

Restraints

Utilization Remains Modest Relative To Eligibility And Supply

The utilization of digiceuticals has remained limited despite broad eligibility. The market has been constrained by a modest rate of patient adoption and a narrow set of approved solutions. This restraint has been reinforced by the gap between the large insured population and the relatively small number of reimbursable digital therapeutics. The growth of the segment has therefore been influenced by restricted product availability, which has reduced opportunities for widespread clinical integration across the healthcare system.

Access to reimbursable digiceuticals has been shaped by strict inclusion criteria and regulatory demands. According to recent assessments, the number of solutions meeting reimbursement standards has remained small compared with overall demand potential. For example, eligibility has extended to millions of insured individuals, while the catalog of approved apps has grown slowly. This imbalance has created a bottleneck in market expansion, as providers and patients have had limited options for clinically validated digital treatments.

The impact of this constraint has been reflected in national adoption trends. Study by statutory health insurers indicated that 73 million insured people qualified for prescribed DiGA applications, yet only 68 solutions were listed for reimbursement by the end of 2024. For instance, the limited catalog has signaled that supply continues to lag behind eligibility, which has restricted real-world utilization. The market has therefore advanced at a measured pace, supported by regulatory caution and controlled product approval pathways.

Opportunities

Clearer Reimbursement Pathways Are Expanding Billable Use

The emergence of structured reimbursement routes is creating a strong commercial opening for digiceuticals. The expansion of clear billing mechanisms is enabling more predictable revenue generation. It is improving provider willingness to adopt digital therapeutic tools because financial risk is reduced. The opportunity is strengthened by rising demand for technology-supported care management across chronic and behavioral conditions. This shift indicates that coverage decisions for digital interventions are becoming more formalized. As a result, market entry barriers for novel digiceuticals are being lowered.

The opportunity is further supported by the establishment of dedicated procedural codes for software-enabled therapeutic monitoring. According to recent regulatory updates, Remote Therapeutic Monitoring codes such as 98975, 98980, and 98981 have been recognized in the United States within the Physician Fee Schedule. These codes are linked to software-supported patient engagement and clinical oversight. For example, reimbursement for treatment adherence and symptom tracking is becoming standardized. This trend signals that digital therapeutic models are being integrated into routine payment systems.

International frameworks are also reinforcing early market access for innovative digital medical tools. Study by European regulatory bodies shows that structured temporary reimbursement programs are enabling companies to generate evidence while scaling adoption. For instance, France introduced the PECAN pathway to allow provisional coverage for digital medical devices while full evaluation is completed. The program provides a defined timeframe for demonstrating clinical and economic value. These mechanisms are improving the financial feasibility of digiceuticals and supporting faster diffusion into clinical practice.

Trends

Integration Into Hybrid Care Endorsed By HTA Bodies

The integration of digital therapeutics into hybrid care pathways has been recognized as a structural shift in mental health delivery. This trend has been driven by the need to enhance service efficiency and broaden access to evidence-based interventions. It has been observed that digitally supported care models create measurable operational gains. The growth of this approach can be attributed to rising demand for scalable solutions, improved clinical acceptance, and the proven ability of digital tools to streamline therapist workloads while maintaining treatment continuity.

Hybrid models are being reinforced as credible care pathways through formal health technology evaluations. According to recent assessments, digital tools have demonstrated the capacity to reduce bottlenecks in psychological therapy services. For example, quantifiable workload reductions have been reported when digital components are embedded within structured treatment flows. This momentum reflects increased confidence in digiceuticals as validated complements to clinician-led interventions rather than standalone replacements.

Independent evaluations have provided concrete evidence supporting these operational efficiencies. Study by national health assessment bodies indicated that digitally enabled therapies may generate approximately 6,800 therapist hours saved per 1,000 depression patients. For instance, anxiety pathways were associated with nearly 6,000 hours saved per 1,000 patients. These findings reinforce the position of digiceuticals as effective enablers of hybrid care, as they contribute to resource optimization, reduce wait times, and enhance the overall capacity of mental health systems.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 43.5% share and holding a market value of US$ 3.86 billion for the year. According to regional assessments, this leadership was supported by strong regulatory clarity and early policy actions. The United States Food and Drug Administration established a dedicated Digital Health Center of Excellence and released multiple guidance documents for software-as-a-medical-device and digital therapeutics. These steps created a predictable approval pathway, reduced regulatory risk, and enabled faster market entry for developers across the region.

The region’s position was further strengthened by federal reimbursement progress. A study by the Centers for Medicare & Medicaid Services confirmed that new HCPCS G-codes were finalized in the Calendar Year 2025 Physician Fee Schedule. These codes cover supply, onboarding, and monthly management of FDA-cleared digital mental health treatment devices. For example, this decision established a national payment precedent that commercial insurers often follow. As a result, revenue visibility improved for suppliers, while financial incentives increased for providers offering digital therapeutic solutions.

Market demand remained high due to the heavy burden of chronic and mental health conditions. According to U.S. health statistics, 38.4 million people had diabetes in 2022, representing 11.6 percent of the population. Additionally, more than one in five adults lived with a mental illness. For instance, these conditions account for nearly 90% of overall national health expenditures. This trend encouraged greater use of scalable and cost-effective digital interventions and expanded the patient base for digiceuticals in North America.

Adoption has also been facilitated by advanced digital health infrastructure. The 21st Century Cures Act and subsequent ONC rules pushed certified electronic health record systems to use FHIR-based APIs. Most hospitals and physicians in the United States now rely on certified EHRs. For example, this interoperability supports seamless integration of digiceuticals into care workflows and enables efficient data exchange between patients and care teams. These developments have supported real-world deployment at scale.

The wider North American landscape benefits from Canada’s regulatory consistency for SaMD. Health Canada issued clear guidance that outlines classification and compliance for software-based medical devices. According to regional policy reviews, this alignment supports cross-border launches and strengthens North America’s overall market position. Collectively, these factors have reduced commercialization barriers and accelerated provider adoption, reinforcing the region’s leadership in the global digiceuticals market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape is shaped by companies that provide evidence-based digital interventions. Omada Health is recognized for chronic disease programs that combine coaching and connected devices. Hinge Health focuses on musculoskeletal care with strong clinical validation. Teladoc Health expands digital therapeutics through large virtual-care networks. These organizations drive adoption through payer partnerships and measurable clinical outcomes. Their platforms have supported strong integration across employer and insurer ecosystems. Market growth has been influenced by rising demand for remote and cost-efficient care models.

Further momentum is created by innovators developing regulated digital therapies. Pear Therapeutics contributed to early regulatory advancement in prescription digital therapeutics for behavioral conditions. Noom strengthened consumer engagement through behavior-change tools and weight-management pathways. Companies in this segment rely on clinical studies to demonstrate efficacy and cost savings. Their market strategies emphasize patient adherence and scalable digital delivery. Demand has been supported by higher awareness of chronic disease management needs. Expanding digital health adoption continues to reinforce their competitive relevance.

Additional growth is enabled by specialized players advancing targeted therapeutic applications. Akili Interactive offers cognitive-based digital treatments supported by clinical evidence. CureApp expands prescription digital therapeutics in markets with established reimbursement systems. Cognoa focuses on developmental diagnostics through validated digital tools. These companies enhance accessibility for underserved clinical areas. Their platforms integrate structured care protocols with technology-enabled monitoring. Rising interest in early intervention and regulated digital solutions has strengthened their market contribution. Their emphasis on clinical validation supports payer acceptance.

Broader competition also includes firms delivering condition-specific digital care models. ResMed’s Propeller Health platform addresses respiratory care through connected sensors and analytics. Sword Health provides digital physical therapy supported by outcomes data. Meru Health focuses on mental-health programs with supervised digital treatment pathways. FriendsLearn adds gamified interventions for behavioral change. These players diversify treatment options across therapeutic segments. Their strategies rely on validated clinical outcomes and strong engagement metrics. Market expansion is supported by demand for scalable, low-cost digital solutions.

Market Key Players

- Omada Health

- Hinge Health

- Teladoc Health

- Pear Therapeutics

- Noom

- Akili Interactive

- CureApp

- Cognoa

- ResMed (Propeller Health)

- Sword Health

- Meru Health

- FriendsLearn

- Other key players

Recent Developments

- In December 2024: Hinge Health announced a partnership with Amazon Health Services to feature its MSK care platform on Amazon.com, making Hinge Health the first digital MSK platform in Amazon’s health-program offering.

- In November 2024: Teladoc Health announced the commercial availability of enhanced AI capabilities for its “Virtual Sitter” offering, designed for hospitals and health-systems. The technology uses motion-detection and pose-estimation algorithms to help a remote staff member monitor up to 25 % more patients, thereby addressing patient fall risk (nearly 1 million falls annually in hospitals, per CDC) and tackling workforce constraints.

- In September 2024: Noom introduced its “industry-first” compounded GLP-1 offering (branded as Noom GLP-1 Rx) starting at US$149, paired with a “Taper-Off Guarantee” and a companion programme aimed at preventing lean muscle loss while using GLP-1 medications.

- In August 2024: Omada Health announced a partnership with the State of Alaska to deploy its virtual behaviour-change programs (covering prevention, hypertension, diabetes) through the state’s “Fresh Start” campaign aimed at rural populations. Under the arrangement, eligible Alaskan residents receive access to Omada’s digital programmes, including connected devices (e.g., cellular-enabled weight scale, BP cuff) for remote monitoring in regions with limited traditional healthcare access. This expansion demonstrates Omada’s scaling of its digital therapeutic platform in underserved geographies—important for broadening reach in chronic care management and digital health interventions.

- In May 2024: Hinge Health launched “Hinge Health Global”, a dedicated global solution allowing multinational employers to deliver personalized digital musculoskeletal (MSK) care via a single platform.

- In May 2023: Noom launched Noom Med, a new individualized obesity-care program combining telehealth services with its behaviour-change platform. The programme pairs board-certified clinicians and health coaches with Noom’s psychological tools for sustained weight-loss and is positioned for users with higher BMI/weight-related conditions.

Report Scope

Report Features Description Market Value (2024) US$ 8.87 Billion Forecast Revenue (2034) US$ 118.57 Billion CAGR (2025-2034) 29.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Platform (Smartphone, Watches, Medical device system), By Product Type (Software, Devices), By Application (Diabetes management, Substance abuse, Pulmonary diseases, Alcohol and smoking addiction, Neurological disorders, Others), By Sales Channel (Business-to-Business (B2B), Business-to-Consumer (B2C)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Omada Health, Hinge Health, Teladoc Health, Pear Therapeutics, Noom, Akili Interactive, CureApp, Cognoa, ResMed (Propeller Health), Sword Health, Meru Health, FriendsLearn, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Omada Health

- Hinge Health

- Teladoc Health

- Pear Therapeutics

- Noom

- Akili Interactive

- CureApp

- Cognoa

- ResMed (Propeller Health)

- Sword Health

- Meru Health

- FriendsLearn

- Other key players