Global Diabetes Treatment Devices Market By Device Type BGM Devices, Continuous Glucose Monitoring Devices, Insulin Delivery Devices, By End User (Hospitals, Homecare, Diagnostic Centers, Ambulatory Surgery Centers, and Others), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2032

- Published date: Oct 2023

- Report ID: 95307

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

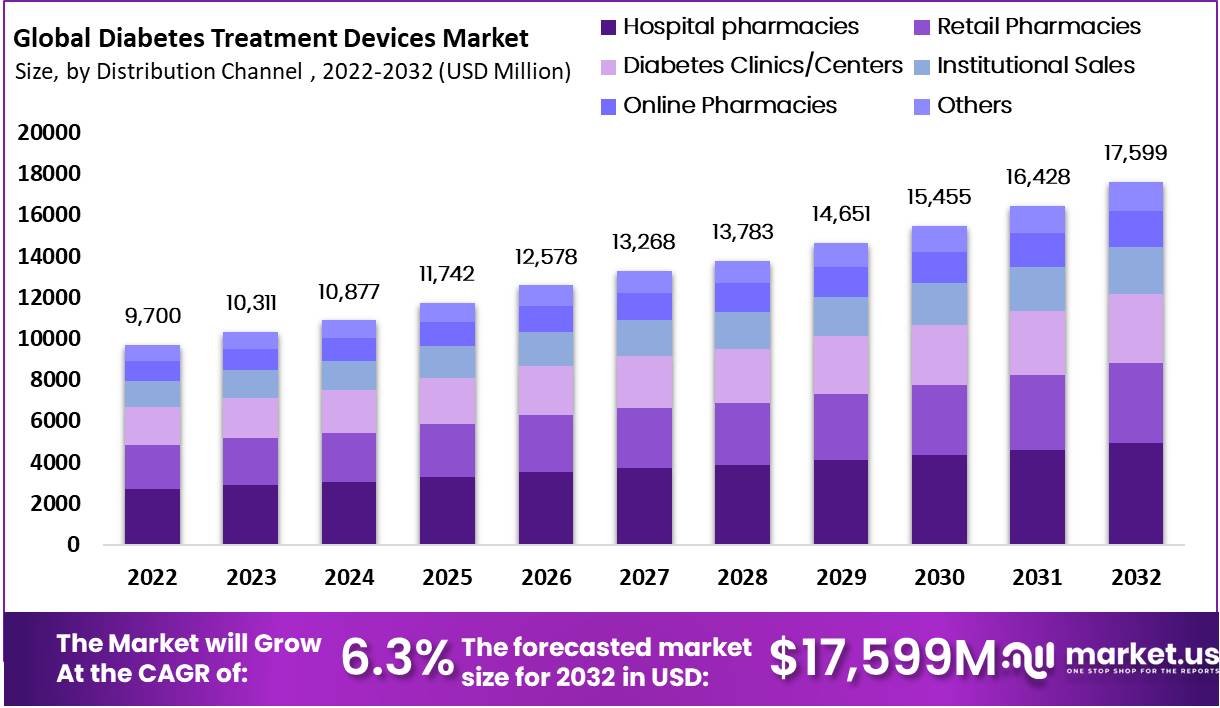

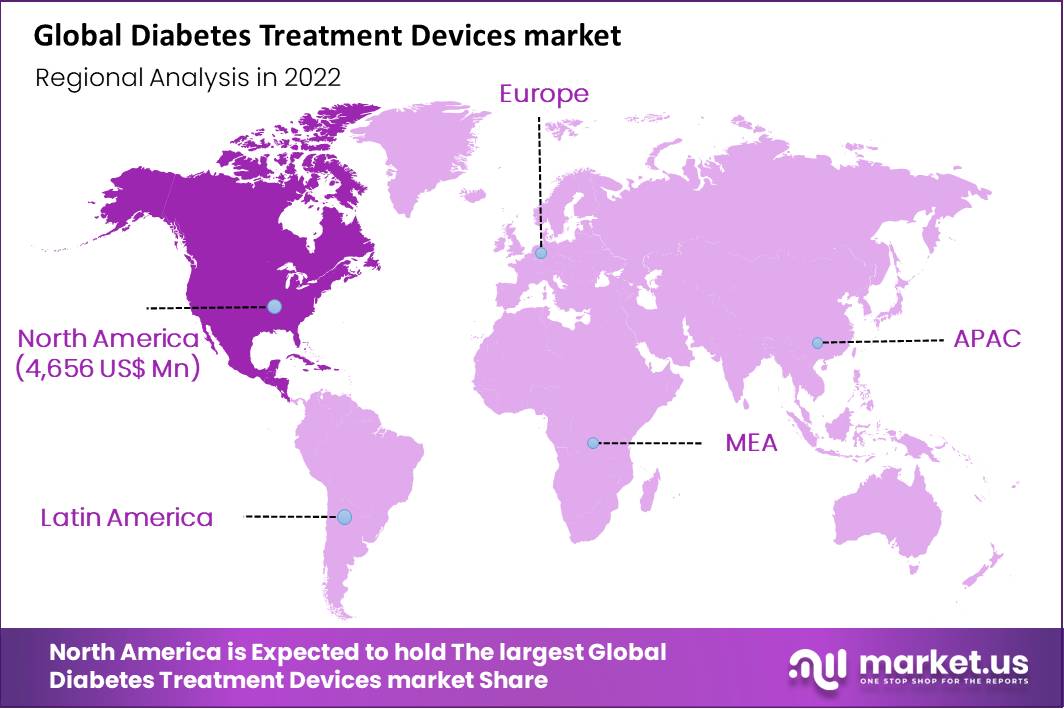

Global Diabetes Treatment Devices Market size is expected to be worth around USD 17,599 Million by 2032 from USD 10,311 Million in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2032. North America held a dominant market position, capturing more than a 48% share and holds US$ 4656 Million market value for the year.

Diabetes refers to a condition in which blood glucose levels rise beyond normal. This is due to a defect of insulin production. Blood glucose is the main source of energy. It can be obtained from the foods that we eat. The blood glucose levels are controlled by insulin, a pancreatic hormone. A defect in insulin synthesis can lead to diabetes. Normal blood glucose levels are between 70 and 100 mg/dL. Diabetes patients may experience an increase of 80-130 mg/dL. Diabetes care devices can be used to monitor the glucose levels of diabetic patients.

A Continuous Glucose Monitor (CGM) is a medical device that continuously monitors the glucose levels of diabetic patients. This wearable technology is especially helpful for people with diabetes as it allows them to control their glucose levels. Many devices can monitor diabetes conditions. These include blood glucose monitor, ketone monitors, and continuous glucose monitors. These devices include smart insulin pens and continuous glucose monitors. To monitor and control glucose levels, glucose monitoring devices can be used. This helps to improve the patient’s overall health.

Key Takeaways

- Market Growth: Diabetes Treatment Devices Market size is expected to be worth around USD 17,599 Million by 2032 from USD 10,311 Million in 2023.

- Market Share: The market growing at a CAGR of 6.3% during the forecast period from 2024 to 2032.

- Device Types: Segmented into BGM, Continuous Glucose Monitoring, and Insulin Delivery Devices, offering diverse options.

- Distribution Channels: Include hospital pharmacies, retail pharmacies, online pharmacies, and more, adapting to consumer preferences.

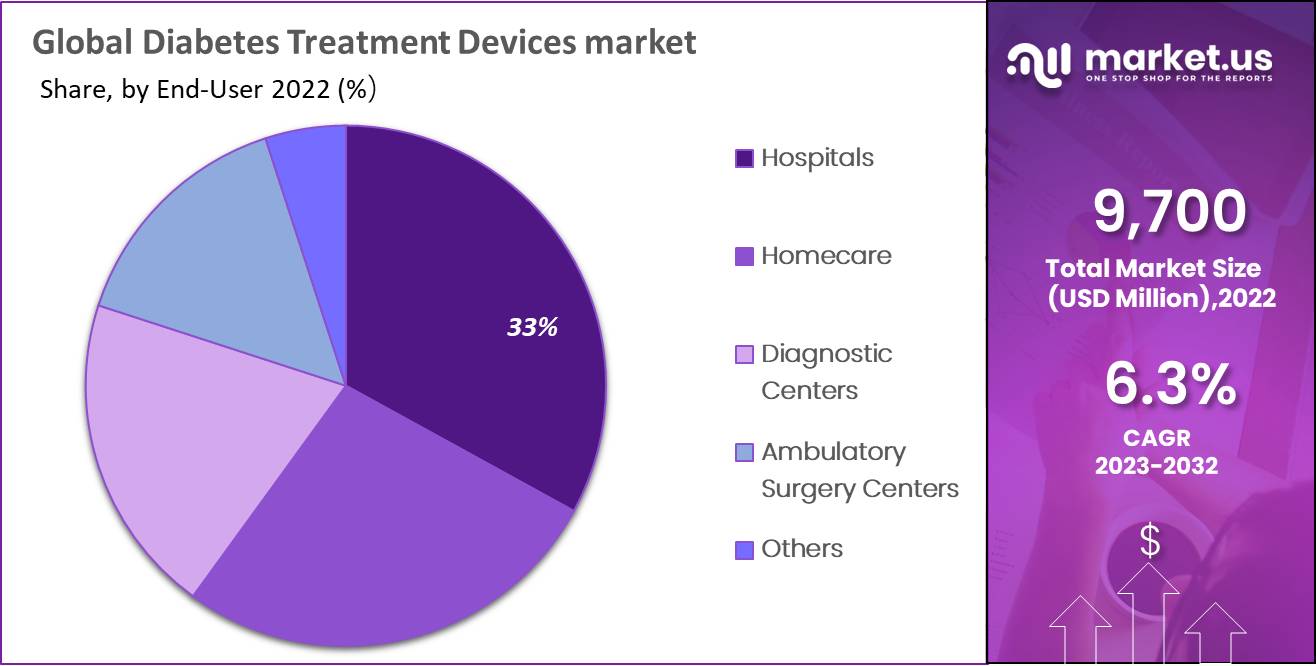

- End-User Dominance: Hospitals held 40.9% of the market in 2021, while homecare is set to grow at a 7.4% CAGR.

- Drivers: Obesity rates contribute to market growth, along with government initiatives, technological innovations, and awareness campaigns.

- Regional Insights: North America dominates, benefiting from established healthcare infrastructure. The Asia-Pacific region is the fastest-growing due to increasing cancer cases.

- Challenges: Painful sensor insertions and device usability challenges impact market expansion.

- Opportunities: Increased funding, government initiatives, and supportive campaigns are anticipated to boost demand in the market.

- Competitive Advantage: Novo Nordisk’s potential dominance in the diabetic treatment devices market.

- Future Trends: The market’s trajectory is shaped by technology advancements, government awareness efforts, and diabetes prevention initiatives.

Device Type Analysis

Based on Device Type, the market for diabetes treatment devices is segmented into BGM Devices (Self-Monitoring Devices, Blood Glucose Meters, Testing Strips, Lancets), Continuous Glucose Monitoring Devices (Sensors, Transmitters, Receiver), Insulin Delivery Devices (Pumps, Disposable pens, Cartridges in Reusable Pens, Syringes, Needles, Diagnostic, Others). The increase in diabetes awareness programs by governments and other organizations is expected to lead to more people using insulin devices.

Distribution Channel Analysis

Online pharmacies can purchase diabetes devices directly from manufacturers. This allows them to offer customers lucrative deals. This segment is driven by a growing awareness of online pharmacies among patients and an increase in public-private funding.

Hospital pharmacies were responsible for high market penetration in recent years. This is due to their high footfall and the availability of products. Inpatient pharmacies and outpatient pharmacies are the two types of pharmacies that can be found within a hospital campus. The hospital’s inpatient pharmacy can only be accessed by authorized personnel.

It is located within the hospital and serves operation rooms, ICUs, special service areas, and other areas. Outpatient pharmacies, on the other hand, are usually located in the hospital’s lobbies or entrances. The outpatient pharmacy has insulin delivery devices and handheld glucose meters. The COVID-19 pandemic had a positive impact on the e-pharmacies industry. Diabetes device sales volumes have increased via this platform.

End-User Analysis

This market was dominated by the hospital segment, which held 40.9% of the total market in 2021.

The demand for this segment is increasing due to the rising number of diabetes patients admitted to hospitals. Three times as likely to be admitted for diabetes than those without it are patients with diabetes. In the last few years, diabetes technology has advanced rapidly. These technologies are designed to improve diabetes care in clinics and hospitals. These technological advances have led to an increase in insulin pump usage in clinics and hospitals. The homecare sector is expected to grow at a 7.4% Compound Annual Growth Rate (CAGR) over the forecast period. This is due to growing awareness of diabetes preventive care.

The demand for insulin pumps in homecare settings is increasing due to increased awareness of diabetes by the government and an easy-to-use interface for insulin pumps. The demand for home care is also increasing due to the aging population. According to the World Health Organization, 80% of all the world’s elderly live in low- or middle-income countries. The total population of 60-year-olds and over is expected to grow to 2 billion by 2050. The demand for insulin pumps in home care settings is increasing because of the above-mentioned factors. This will lead to an exponential growth rate

Key Market Segments

Based on the Device Type

- BGM Devices

- Self-Monitoring Devices

- Blood Glucose Meters

- Testing Strips

- Lancets

- Continuous Glucose Monitoring Devices

- Sensors

- Transmitters

- Receiver

- Insulin Delivery Devices

- Pumps

- Disposable pens

- Cartridges in Reusable Pens

- Syringes

- Needles

- Diagnostic

- Others

Based on Distribution Channel

- Hospital pharmacies

- Retail Pharmacies

- Diabetes Clinics/Centers

- Institutional Sales

- Online Pharmacies

- Others

Based on End-User

- Hospitals

- Homecare

- Diagnostic Centers

- Ambulatory Surgery Centers

- Others

Driver

Increasing Prevalence of Diabetes Worldwide

The primary driver of the diabetes treatment devices market is the global rise in diabetes prevalence, fueled by aging populations, sedentary lifestyles, and increasing obesity rates. The International Diabetes Federation estimates that over 537 million adults live with diabetes, projected to rise to 643 million by 2030.

This escalating incidence necessitates advanced treatment devices such as insulin pumps, glucose monitors, and continuous glucose monitoring systems, driving significant market growth and innovation in treatment technologies to manage and monitor diabetes effectively.

Trend

Technological Advancements in Diabetes Devices

A major trend shaping the diabetes treatment devices market is the rapid technological evolution in device functionalities and integration capabilities. Devices are becoming more user-friendly and precise, with features like real-time data tracking, long-term glucose monitoring, and seamless integration with smartphones and digital health platforms.

This shift towards connected and smart devices enhances patient engagement and compliance, promoting better diabetes management. Innovations like artificial pancreas systems and minimally invasive sensor technologies further exemplify how technology is transforming diabetes care, making it more proactive and personalized.

Restraint

High Cost of Advanced Diabetes Treatment Devices

One significant restraint in the diabetes treatment devices market is the high cost associated with advanced technologies. Devices such as insulin pumps and continuous glucose monitors (CGMs) are often expensive, making them less accessible to low-income patients and those without adequate insurance coverage.

The cost barrier limits the adoption rate of these advanced devices, especially in developing regions where healthcare spending is constrained. Additionally, the need for regular maintenance and the recurrent cost of consumables, like sensors and test strips, add to the overall financial burden on patients.

Opportunity

Emerging Markets and Diabetes Management Programs

Emerging markets present a considerable opportunity for expansion in the diabetes treatment devices sector due to increasing healthcare investments and a growing middle class. Countries like China, India, and Brazil are experiencing a surge in diabetes prevalence coupled with improved healthcare infrastructure and increased healthcare spending.

Moreover, government initiatives and diabetes management programs aiming to enhance disease awareness and promote advanced treatment modalities open new avenues for market penetration. These factors collectively offer device manufacturers a lucrative potential to expand their global footprint and innovate solutions tailored to regional needs.

Regional Analysis

North America is the dominant market for diabetes treatment devices due to its well-developed healthcare infrastructure, favorable reimbursement policies, and strong regional leadership. North America held a dominant market position, capturing more than a 48% share and holds US$ 4656 Million market value for the year.

The Asia-Pacific region is projected to experience the fastest growth in the period 2024-2032. This is due to increasing cancer incidences in the patients such as bladder, liver, bladder, and esophageal, as well as the increased presence of major U.S. manufacturers, technological advances, and increasing foreign investment. This will affect the market’s recent and future trends.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Diabetes treatment devices market is expected to grow during the forecast period due to an increasing prevalence of diabetes. According to the International Diabetes Federation Report 2017, 66.0 million people worldwide have diabetes. This number is expected to rise to 81.0 million by 2045, according to the report. The United Kingdom, France, and Germany are the top five countries with diabetes in Global. It has been shown that North America has more than 29 million diabetes patients. This number is expected to rise to 34 million in 2027. In 2021, the United States alone had more than 26,000,000 diabetes patients. This increases market growth.

Market Key Players

- Medtronic plc

- Abbott Laboratories

- Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Other key players.

Recent Development

- Simplera CGM (August 2024): Medtronic received FDA approval for Simplera CGM, a new continuous glucose monitor that is half the size of previous models. This device simplifies the diabetes management process and is part of Medtronic’s strategy to integrate with their InPen smart insulin pen app to create a comprehensive diabetes management system.

- Abbott (August 2024): Medtronic also announced a global partnership with Abbott to integrate Abbott’s advanced CGM platform with Medtronic’s smart dosing devices and software. This collaboration is set to enhance Medtronic’s diabetes care solutions, providing more options and advanced care to people with diabetes.

- EOFlow Co. Ltd. (July 2023): Medtronic plc expanded its diabetes offerings by acquiring EOFlow Co. Ltd., a South Korean company specializing in the EOPatch, a tubeless, wearable, and fully disposable insulin delivery device.

Report Scope

Report Features Description Market Value (2023) USD 10,311 Mn Forecast Revenue (2032) USD 17,599 Mn CAGR (2024-2032) 6.3% Base Year for Estimation 2023 Historic Period 2016-2022 Forecast Period 2024-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on the Device Type- BGM Devices (Self-Monitoring Devices, Blood Glucose Meters, Testing Strips, and Lancets), Continuous Glucose Monitoring Devices,( Sensors, Transmitters, and Receiver), Insulin Delivery Devices, (Pumps, Disposable pens, Cartridges in Reusable Pens, Syringes, Needles, Diagnostic, and Others); Based on Distribution Channel- Hospital pharmacies, Retail Pharmacies, Diabetes Clinics/Centers, Institutional Sales, Online Pharmacies, and Others, and Based on End-User- Hospitals, Homecare, Diagnostic Centers, Ambulatory Surgery Centers, and sOthers. Regional Analysis North America – The US, Canada, Mexico; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Eastern Europe – Russia, Poland, The Czech Republic, Greece Rest of Eastern Europe; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA. Competitive Landscape Medtronic plc, Abbott Laboratories, F.Hoffmann-La-Ltd., Bayer AG, Lifescan, Inc., B Braun Melsungen AG, Lifescan, Inc., Dexcom Inc., Insulet Corporation, Ypsomed Holdings, Other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diabetes Treatment Devices MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Diabetes Treatment Devices MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic plc

- Abbott Laboratories

- Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Other key players.