Global Dental X-ray Market Analysis By Product (Digital X-ray Systems, Analog X-ray Systems), By Type (Intraoral, Extraoral), By Application (Medical, Forensic, Cosmetic), By End-User (Dental Hospitals & Clinics, Dental Academic & Research Institutes, Dental Diagnostic Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 57903

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

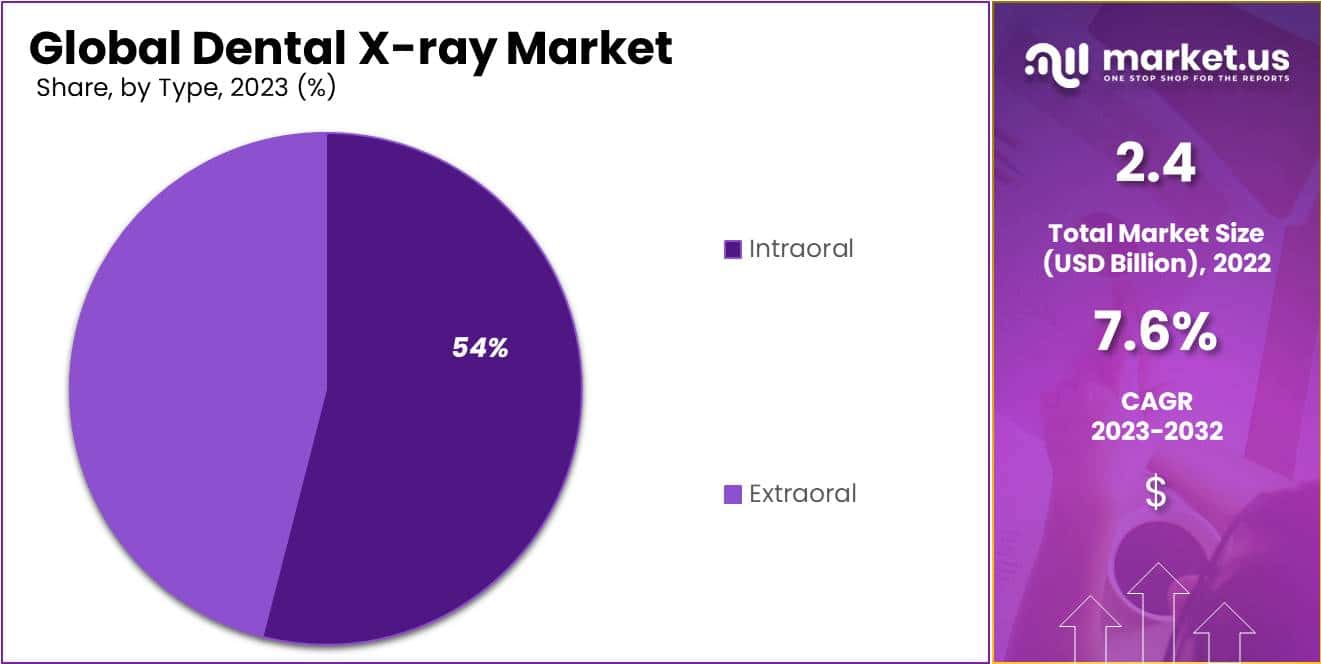

The Dental X-Rays Market Size is projected to grow from USD 2.4 billion in 2023 to approximately USD 4.9 billion by 2033. This growth represents a compound annual growth rate (CAGR) of about 7.6% over the ten-year period from 2024 to 2033.

*Note: Actual Numbers Might Vary In The Final Report

Dental X-rays, essential diagnostic tools in dentistry, produce detailed images of teeth and oral structures for diagnosing dental conditions more efficiently. Intraoral X-rays taken inside of the mouth offer intricate images of teeth and bones, such as Bitewing X-rays to detect interdental cavities or Periapical X-rays that assess entire teeth with their surrounding bone structures; extraoral X-rays taken outside provide more of a sweeping picture.

Panoramic X-rays, covering all areas of the mouth, provide comprehensive dental health assessments and treatment planning, while cephalometric X-rays focusing on one side of the head can be helpful when performing orthodontic evaluations for facial structures. According to estimates from the American Dental Association, approximately 60% of Americans receive at least one annual dental x-ray highlighting its significance as an integral component of oral healthcare.

The dental X-ray market encompasses businesses and industries involved with producing, distributing, and selling dental X-ray equipment and related products. This market comprises manufacturers of X-ray machines, imaging software, and related accessories; dental clinics, hospitals and imaging centers who utilize these technologies for diagnostic purposes also make up part of this marketplace. Over the past years, technological innovations in dental X-ray have seen great advancement.

Digital X-ray systems offer numerous advantages compared to their film-based predecessors, reduced radiation exposure, faster image processing times and enhanced quality compared to their older versions. Additionally, this market encompasses regulatory concerns as well as research & development efforts worldwide and adoption by oral healthcare providers worldwide.

Key Takeaways

- Market Growth: Dental X-ray market Size set to grow from $2.4 billion (2023) to $4.9 billion (2033) with a 7.6% CAGR (2024-2033).

- Product Analysis: In 2023, Analog X-ray Systems dominated with over 58% market share, but the digital market is expected to grow significantly due to technological advances and the adoption of digital sensors.

- Type Analysis: Intraoral X-rays held a dominant market position in 2023, capturing more than 54% share.

- Application Analysis: Medical diagnostics led in 2023 with over 62.1% market share, emphasizing the integral role of dental X-rays in diagnosing oral health conditions.

- End-User Analysis: Dental Hospitals & Clinics dominated with a share of over 39.7% in 2023, showcasing a preference for dental X-ray technologies in clinical settings.

- Driving Factors: Technological advancements, global rise in dental disorders, and dental tourism contribute to market expansion.

- Restraining factors: High initial costs hinder market accessibility, with advanced X-ray systems requiring substantial investments.

- Reimbursement Challenges: Inconsistent or limited reimbursement policies impact market growth, discouraging regular usage and affecting patient care.

- Regional Dominance: North America holds a commanding 37% market share (2023) and a $0.8 billion market value, driven by advanced diagnostic facilities and proactive healthcare models.

- Future Opportunities: Expanding geriatric population creates growth opportunities, and trends like teledentistry and portable X-ray devices offer promising prospects for the market.

Product Analysis

In 2023, Analog X-ray Systems held a dominant market position, capturing more than a 58% share of all revenue. The market share will likely decrease over the next coming years. This slow growth is due to the requirement for numerous x-rays to obtain a decent image. Continuous exposure to radiation can also be blamed. This radiation exposure is higher than that of digital systems. The system poses a higher risk of radiation exposure than the digital systems. It also requires increased time and chemicals.

Also, it is difficult to develop x-rays without the assistance of trained personnel. The digital market will see dramatic growth owing to technological advances, digital innovation, as well as the growth of businesses. The rapid adoption of digital sensors is expected to keep this segment in the market. The factors that have led to digital sensors’ increasing adoption are the lower operating times and high-quality imaging.

Market growth is being driven by the rapid adoption of Cosmetic Dentistry, and an eventual increase in radiography requirements. The market is also growing due to the expanding application of digital dental X-rays in diagnostics and therapeutics as well as forensics and cosmetics. However, poor reimbursement standards are believed to be hindering the adoption of radiography digital techniques and limiting their growth.

Type Analysis

In 2023, intraoral X-rays segment held a dominant market position, capturing more than a 54% share. The intraoral x-rays can provide detailed images that allow dentists to treat decays and monitor the overall health of jawbones and teeth. The most common diagnostic method used in dentistry is intraoral radiology imaging. Intraoral imaging can be used for many processes such as diagnosis of caries and checking the location of endodontic files. The spatial and contrast resolution of intraoral x-rays will result in high growth.

Periapical radiographs have the main purpose of taking a picture of the root tip. This helps to picture the whole tooth as well as the other adjacent bones. Bitewing x-rays focus on the buccal surface and capture images of the mandibular and maxillary crowns. The occlusal scans give a greater view of both the maxilla & mandible and allow you to determine the extent and dislocation of fractures in both upper and lower jaws.

As they offer radiation protection, extraoral x-rays are expected to grow in popularity over the next few years. They are commonly used to diagnose larger disorders like temporomandibular disorders and wedged teeth.

*Note: Actual Numbers Might Vary In The Final Report

Application Analysis

In 2023, the Dental X-ray market displayed an outstanding presence, with medical diagnostics taking the lead with over 62.1 per cent market share for Dental X-rays. This substantial share can be attributed to their integral use as part of medical diagnosis in diagnosing oral health conditions and issues.

Healthcare professionals use dental X-rays extensively in diagnosing dental issues like cavities, gum diseases and anomalous tooth structures using detailed images captured with this technology. Accurate diagnosis allows healthcare practitioners to take timely and efficient treatment measures quickly.

Furthermore, Forensic segment became an influential player, contributing significantly to overall dental X-ray market. It serves an invaluable purpose during forensic investigations by aiding experts with identification through dental records. Utilization of dental X-rays helps resolve legal cases more swiftly while increasing human identification accuracy.

Dental X-rays have quickly become an indispensable asset within the cosmetic segment, offering reliable support for aesthetic dentistry procedures such as smile makeovers, orthodontic treatments and dental implants. Cosmetic dentistry has gained tremendous momentum recently as patients look for advanced diagnostic tools such as dental X-rays to achieve maximum results when improving their smiles.

End-User Analysis

In 2023, the Dental Hospitals & Clinics segment asserted its dominance in the Dental X-ray market, securing a robust market position with a commanding share of over 39.7%. This segment takes the lead as the primary end-user, signifying a significant preference for dental X-ray technologies within clinical settings.

Dental hospitals & clinics, being at the forefront, demonstrate an insatiable demand for advanced imaging solutions that support accurate diagnoses and treatment planning. Dental x-rays play an essential part in this regard ensuring optimal patient care.

Simultaneously, Dental Academic & Research Institutes emerge as notable contributors to the market landscape, reflecting a commitment to innovation and education within the dental field. These institutions exhibit a steady adoption of dental X-ray technologies to enhance teaching methodologies and fuel groundbreaking research endeavors.

Dental Diagnostic Centers have made themselves known in the market, serving the needs of those searching for diagnostic services with increasing frequency. Dental X-ray solutions adopted by this segment signal an emerging trend toward decentralized diagnostic facilities that offer convenient access to advanced imaging technology solutions.

The Dental X-ray market is experiencing an exciting interplay among its key segments – each playing an essential part in shaping industry landscape. Furthermore, growth and technological innovations within dental X-ray applications may further secure its place as an established market segment; offering numerous promising opportunities to stakeholders from diverse end user sectors.

Key Market Segments

Product

- Digital X-ray Systems

- Analog X-ray Systems

Type

- Intraoral

- Extraoral

Application

- Medical

- Forensic

- Cosmetic

End-User

- Dental Hospitals & Clinics

- Dental Academic & Research Institutes

- Dental Diagnostic Centers

Drivers

Technological Advancements in Imaging

The dental X-ray market has been greatly affected by technological innovations, specifically with regards to digital imaging systems and 3D capabilities. These advances play an integral part in improving diagnostic precision while decreasing radiation exposure, thus strengthening treatment efficacy. Their incorporation into dental practices across the board has proven its significant advantages.

Digital imaging systems offer clearer images with quicker processing times compared to traditional methods, and 3D imaging has revolutionized dental diagnostics by providing detailed views of dental structures and helping hygienists perform accurate diagnoses while streamlining clinic workflow.

Growth of Dental Disorders

Global dental disorders have seen dramatic increases, creating demand for increased dental X-ray markets worldwide. With such high prevalence levels for oral diseases such as cavities, periodontal diseases and cancer affecting nearly 3.5 billion people according to World Health Organization figures dental X-rays play an essential part in early diagnosis for various conditions including cavities, periodontal diseases and cancer at their beginning. Dental X-rays play a pivotal role as reliable tools in modern oral healthcare practice that make them indispensable tools in contemporary dental practice for oral healthcare providers worldwide.

Dental Tourism

Rising dental tourism where individuals seek affordable dental treatments abroad – has had a substantial impact on the dental X-ray market. Clinics located at popular medical tourism destinations are increasingly adopting advanced X-ray technologies in order to attract international patients, which not only improves care quality but also expands market opportunities. Thailand, Mexico and Hungary have become hot spots for dental tourism offering high-quality services at reduced costs; drawing customers that in turn generate demand for advanced X-ray technologies which further propel market expansion.

Restraints

High Initial Capital Costs Impede Market Accessibilite

Dental X-ray equipment markets face significant hurdles due to high initial costs. Modern, technologically advanced X-ray systems often require substantial investments that may be prohibitive for smaller dental practices and healthcare facilities – this financial restriction limits widespread adoption, thus impacting market expansion; for instance a standard digital radiography system costs from $3,000- $5,000 which limits adoption as it favors larger practices with greater financial resources over small practices with fewer funds.

Reimbursement Policies Restricting Utilization

Growth of the dental X-ray market can also be hindered by inconsistent or limited reimbursement policies. Many insurance providers provide inadequate coverage of dental X-ray procedures, placing undue financial strain on patients while discouraging regular use. Without full support from insurers and patient reimbursement plans for dental X-ray services – such as full mouth series of X-rays that cost around $150 for example – regular usage falls off significantly, inhibiting market expansion as patients must cover remaining out-of-pocket. As a result frequency drops, impacting both patient care as well as market expansion.

Compliance Challenges of Market Expansion

Financial constraints present one of the key obstacles facing players in the dental X-ray market. Navigating diverse and complex regulatory frameworks across regions makes launching new products difficult and penetrating various markets difficult, particularly where newcomers or smaller players may struggle with accessing certain markets like in the U.S. Food and Drug Administration’s (FDA’s) testing requirements for medical devices containing dental X-rays; its regulations necessitate substantial investments into research & development as well as regulatory affairs to comply. Complex processes associated with regulatory affairs processes can delay product launch while restrict market entry opportunities, particularly among smaller or newcomer companies or newcomers seeking market access opportunities within different markets.

Opportunities

An Expanding Geriatric Population and Dental X-Ray Market

An expanding elderly population is driving growth of the dental X-ray market worldwide. Elderly individuals require comprehensive dental care that includes advanced diagnostics for age related oral conditions; demand is therefore rising for precise imaging solutions that offer precision. According to World Health Organization projections, worldwide population aged 60 years or over by 2050 may reach ~2 billion an astounding increase from 2015 levels at just under 900 million! Providing ample opportunity for market expansion.

Teledentistry and Remote Consultations

Tele-dentistry represents emerging growth opportunities for the dental X-ray market. Tele-dental consultations integrate imaging technologies with teledental services to enable remote diagnosis while expanding access to dental care especially for underserved populations. According to a 2020 American Dental Association study, ~11.2% of dentists were using this approach by 2020 compared with just 0.7% prior to COVID-19 pandemic; reflecting its increasing importance within dental industry.

Trends

Transition to Digital Imaging

Healthcare institutions have begun adopting digital X-ray imaging increasingly due to its instant image capture and storage efficiency, along with ease of sharing through electronic sharing systems – reflecting healthcare’s larger digital transformation – while at the same time decreasing radiation exposure while improving diagnostic accuracy; according to Radiological Society of North America estimates digital systems reduce patient radiation exposure up to 90% compared to film X-rays.

Advancements in AI Integration

AI Integrationavancee Artificial Intelligence is revolutionizing dental X-ray interpretation by offering faster and more precise image analyses. AI algorithms improve diagnostic accuracy while streamlining treatment planning – showing off dental industry dedication to adopting cutting edge tech for better patient care. A recent American Dental Association study highlighted AI’s capabilities of detecting pathologies similar to human experts with accuracy comparable to radiograph interpretation – signalling significant advancement in dental diagnostics.

Customized and Portable X-Rays

Demand for portable and customizable X-ray devices is on the rise among dental clinics seeking flexible solutions, mobile dental providers and those providing mobile dental services as they increasingly depend on flexible solutions that adapt well across clinic environments. Market research indicates this preference among healthcare providers with global portable X-ray market expected to experience exponential growth as healthcare delivery shifts towards patient centric models of care.

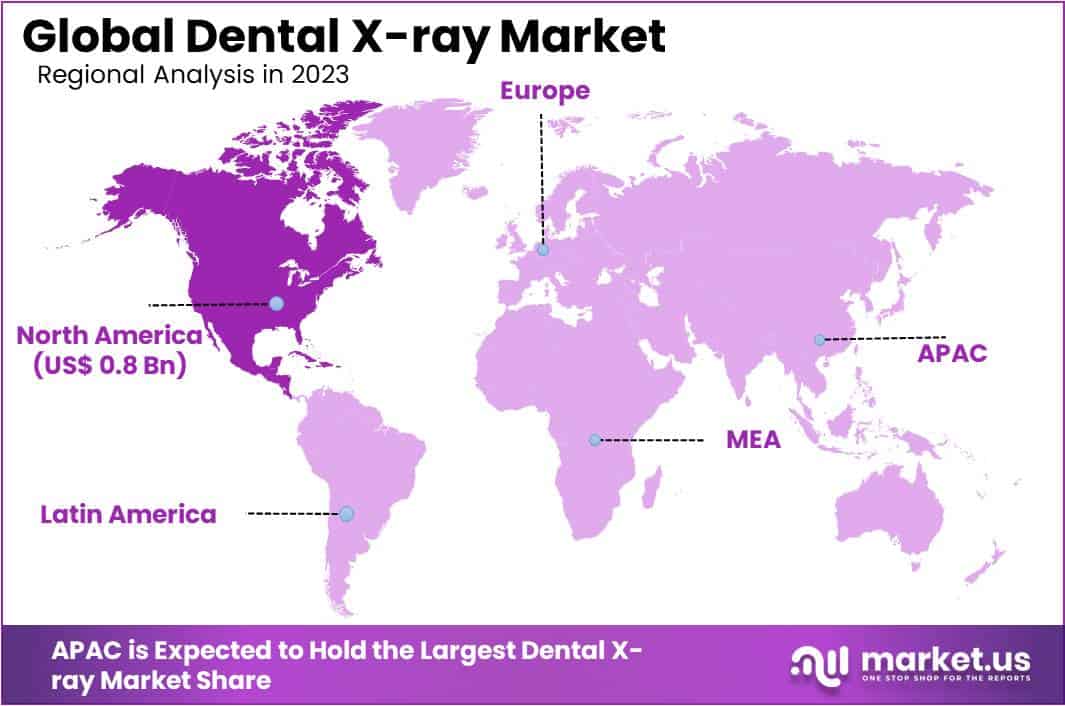

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 37% share and holds USD 0.8 billion market value for the year in the Dental X-ray Market. This dominance can be attributed to numerous key elements which contribute to robust dental imaging sector expansion across its continent.

Particularly, in the US and Canada, dental facilities equipped with cutting edge diagnostic and imaging technologies contribute greatly to accurate diagnoses while driving up demand for advanced dental X-ray equipment. Increased dental disorders and increasing awareness about oral health has spurred adoption of dental diagnostic procedures across North America, while its proactive healthcare model and higher disposable income per capita further facilitate take up. Dental X-ray services have become an indispensable service provider.

North America has significant market dominance to the presence of key market players and an efficient distribution network. Major dental X-ray equipment manufacturers and service providers have strategically located themselves here, forging relationships with clinics, hospitals, and laboratories while simultaneously offering cutting edge imaging solutions and efficient after-sales support that bolster its market strength further.

Regulation support and compliance standards also play a vital role in shaping North America’s Dental X-ray Market landscape. Adherence to quality and safety regulations boost confidence among healthcare practitioners as well as patients alike and promote greater adoption of dental X-ray technologies.

Looking ahead, the North American Dental X-ray Market appears destined to experience robust expansion due to technological innovations and investments made into healthcare infrastructure; early diagnosis becoming ever more crucial as healthcare becomes a cost center. Market participants must remain abreast of changing trends while adapting strategies accordingly in order to stay successful within this increasingly volatile sector of dental imaging in North America.

*Note: Actual Numbers Might Vary In The Final Report

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

This market is extremely competitive and includes big as well as small manufacturers. These companies have developed key business strategies, such as product innovation, strategic partnerships, joint ventures, etc. This has allowed them to raise their market standards while also gaining large market shares. The rapid advancement of technology in restorative dentistry is one of the main factors that drive market competitiveness.

Market Key Players

- 3M Company

- Align Technology Inc.

- Danaher Corporation

- Zimmer Biomet Holdings

- Dentsply Sirona

- Institute Straumann

- Planmeca OY

- Biolase Inc.

- A-Dec

- Align Technology Inc.

- Other Key Players

Recent Developments

- In November 2023, Align Technology Inc. extended their global reach and market share by acquiring Vivera Science, one of Europe’s premier providers of invisible aligners. This move solidified Align’s position within their industry. Furthermore, Align secured FDA clearance for their iTero Element 5D scanner which offers improved speed, accuracy and three-dimensional treatment planning capabilities.

- In September 2023, Danaher Corporation expanded their dental imaging and treatment portfolio with the completion of Ormco Corporation, an esteemed orthodontic appliance manufacturer, as part of a strategic acquisition. Furthermore, Danaher announced their CS 9600 CBCT system, featuring advanced imaging technology as well as an easy workflow designed for oral surgeons and implantologists.

- In July 2023, Zimmer Biomet Holdings unveiled the ZBI Cone Beam 3D System, an affordable and user-friendly CBCT solution suited for dentists and specialists. Furthermore, they entered a partnership agreement with Straumann Group for collaboration on implant and restorative workflow development – marking significant advancements within the dental industry.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Bn Forecast Revenue (2033) USD 4.9 Bn CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Digital X-ray Systems, Analog X-ray Systems), By Type (Intraoral, Extraoral), By Application (Medical, Forensic, Cosmetic), By End-User (Dental Hospitals & Clinics, Dental Academic & Research Institutes, Dental Diagnostic Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M Company, Align Technology Inc., Danaher Corporation, Zimmer Biomet Holdings, Dentsply Sirona, Institute Straumann, Planmeca OY, Biolase Inc., A-Dec, Align Technology Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Dental X-ray market in 2023?The Dental X-ray market size is USD 2.4 billion in 2023.

What is the projected CAGR at which the Dental X-ray market is expected to grow at?The Dental X-ray market is expected to grow at a CAGR of 7.6% (2024-2033).

List the segments encompassed in this report on the Dental X-ray market?Market.US has segmented the Dental X-ray market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Digital X-ray Systems, Analog X-ray Systems. By Type the market has been segmented into Intraoral, Extraoral. By Application the market has been segmented into Medical, Forensic, Cosmetic. By End-User the market has been segmented into Dental Hospitals & Clinics, Dental Academic & Research Institutes, Dental Diagnostic Centers.

List the key industry players of the Dental X-ray market?3M Company, Align Technology Inc., Danaher Corporation, Zimmer Biomet Holdings, Dentsply Sirona, Institute Straumann, Planmeca OY, Biolase Inc., A-Dec, Align Technology Inc., Other Key Players

Which region is more appealing for vendors employed in the Dental X-ray market?North America is expected to account for the highest revenue share of 37% and boasting an impressive market value of USD 0.8 billion. Therefore, the Dental X-ray industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Dental X-ray?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Dental X-ray Market.

Which segment accounts for the greatest market share in the Dental X-ray industry?With respect to the Dental X-ray industry, vendors can expect to leverage greater prospective business opportunities through the pharmaceutical segment, as this area of interest accounts for the largest market share.

-

-

- 3M Company

- Align Technology Inc.

- Danaher Corporation

- Zimmer Biomet Holdings

- Dentsply Sirona

- Institute Straumann

- Planmeca OY

- Biolase Inc.

- A-Dec

- Align Technology Inc.

- Other Key Players