Global Dental Fluoride Treatment Market By Product Type (Toothpaste & Gel, Varnish & Mouth Rinse, and Others), By End-user (Children & Adolescents, Adults, and Pregnant Women), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154908

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

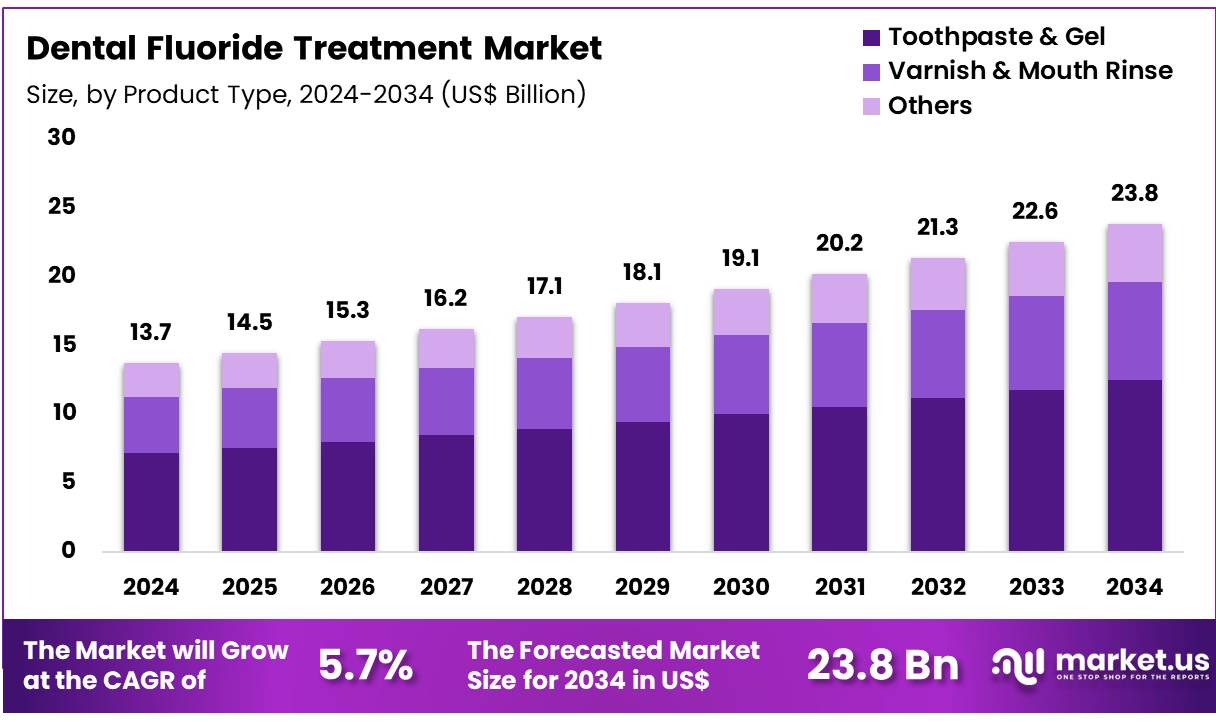

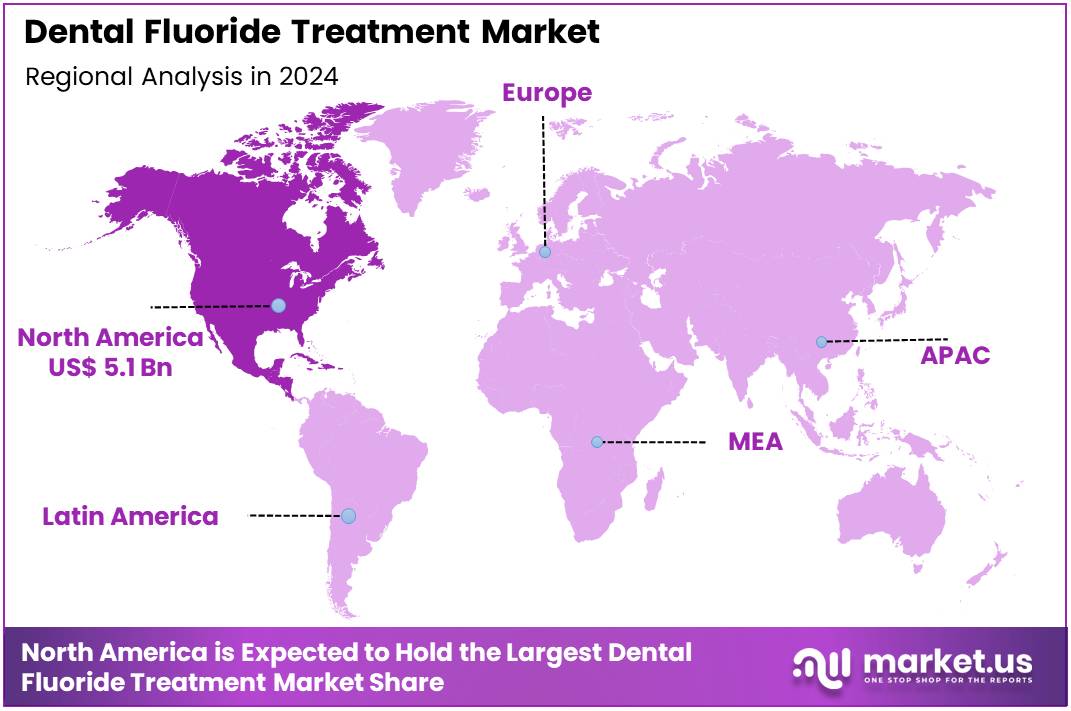

Global Dental Fluoride Treatment Market size is expected to be worth around US$ 23.8 Billion by 2034 from US$ 13.7 Billion in 2024, growing at a CAGR of 5.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.9% share with a revenue of US$ 4.1 Billion.

The dental fluoride treatment market is experiencing significant expansion, primarily driven by the escalating prevalence of dental caries on a global scale. According to the World Health Organization, oral diseases affect nearly 3.5 billion people, and untreated dental caries in permanent teeth is the most common health condition. This widespread issue, coupled with a growing public awareness about the importance of preventive oral care, is fueling the demand for effective treatments. The market’s growth is further propelled by technological advancements, such as the development of new fluoride products and the integration of digital technologies, which enhance treatment efficacy and patient convenience.

Government initiatives and public health campaigns are playing a crucial role in promoting the adoption of fluoride treatments. The Centers for Disease Control and Prevention (CDC) reports that community water fluoridation, a key public health measure, is credited with reducing tooth decay by 25% in both children and adults.

Such initiatives are aimed at improving access to patient-centric treatment and advancing a holistic approach to oral health equity. For instance, in September 2022, the American Medical Association authorized the use of silver diamine fluoride by health workers to prevent tooth decay without dental fillings, thereby broadening treatment accessibility, especially in underserved populations.

The high prevalence of dental conditions, particularly among younger demographics, is a key market driver. Globally, over 530 million children suffer from tooth decay in primary teeth, as reported by the WHO. Unhealthy food habits and inadequate oral hygiene practices contribute to this high susceptibility, increasing the need for effective preventive measures.

The FDI World Dental Federation’s World Oral Health Day initiatives, which aim to increase awareness about the prevention and treatment of oral diseases, are also projected to drive market growth by encouraging early detection and treatment. These efforts, in collaboration with national dental associations, governments, and NGOs, are vital in improving funding and support for oral health.

Key Takeaways

- In 2024, the market for dental fluoride treatment generated a revenue of US$ 13.7 billion, with a CAGR of 5.7%, and is expected to reach US$ 23.8 billion by the year 2034.

- The product type segment is divided into toothpaste & gel, varnish & mouth rinse, and others, with toothpaste & gel taking the lead in 2023 with a market share of 52.3%.

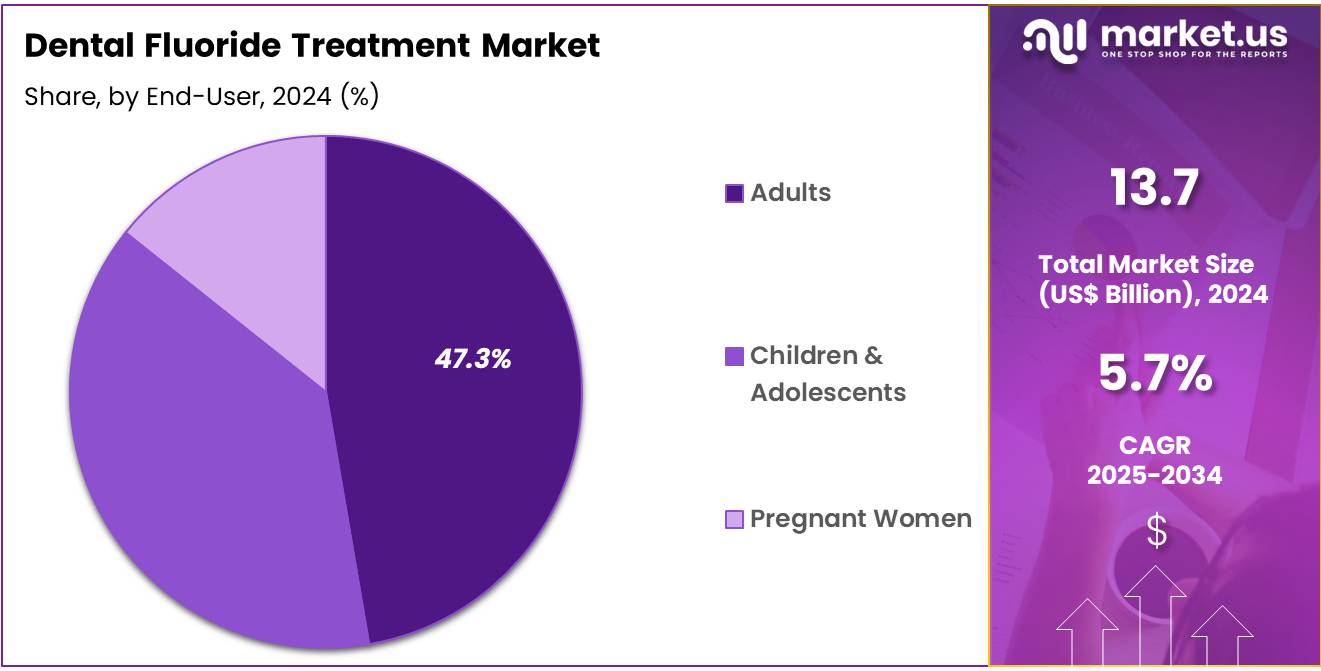

- Considering end-user, the market is divided into children & adolescents, adults, and pregnant women. Among these, adults held a significant share of 47.3%.

- North America led the market by securing a market share of 36.9% in 2024.

Product Type Analysis

The toothpaste and gel segment currently leads the market, holding a dominant 52.3% share. This leadership position is poised for continued growth. The ubiquity and convenience of these products, particularly those fortified with fluoride, are the primary drivers. As global awareness of the crucial role of oral hygiene and cavity prevention grows, especially in both mature and emerging economies, the demand for these accessible solutions escalates. Fluoride’s proven efficacy in strengthening enamel, reducing cavities, and preventing decay positions it as a cornerstone ingredient in over-the-counter oral care.

The trend toward preventive healthcare, coupled with the search for cost-effective solutions for oral health, ensures a stable growth trajectory for fluoride-based toothpastes and gels. Furthermore, ongoing innovations in this sector, such as the development of high-concentration fluoride gels and specialized formulas for sensitive teeth, are expanding their market appeal and broadening the consumer base. This focus on preventive dental care is expected to solidify the segment’s enduring dominance within the fluoride treatment market.

End-User Analysis

Adults constitute the largest end-user segment, accounting for 47.3% of the dental fluoride treatment market. This segment’s growth is expected to persist as adults increasingly integrate fluoride-based oral care into their daily routines to proactively manage dental health and stave off common issues like decay, gingivitis, and enamel erosion. As the long-term benefits of fluoride treatments become more widely understood, a greater number of adults are seeking both at-home products and professional treatments to counteract age-related effects on their oral health.

The rise of cosmetic dentistry, including teeth whitening and enamel restoration, is also contributing to this trend. Adults undergoing these procedures often turn to fluoride treatments to strengthen their teeth and protect against cavities. Additionally, the growing prevalence of chronic conditions like diabetes, which can adversely impact oral health, is spurring further demand for fluoride treatments to mitigate complications such as gum disease. As more adults prioritize regular dental care and preventive treatments, this segment is projected to maintain its significant market share and drive continued growth.

Key Market Segments

By Product Type

- Toothpaste & Gel

- Varnish & Mouth Rinse

- Others

By End-user

- Children & Adolescents

- Adults

- Pregnant Women

Drivers

The increasing prevalence of dental diseases is driving the market.

The rising global burden of dental diseases, particularly dental caries, is a primary driver for the demand for fluoride treatments. These treatments are a cornerstone of preventive dentistry, and their efficacy in preventing and arresting tooth decay is well-established. The World Health Organization (WHO) has noted that oral diseases affect billions of people worldwide.

A 2024 report from the Centers for Disease Control and Prevention (CDC) indicated that nearly 21% of adults aged 20–64 years had one or more permanent teeth with untreated decay, highlighting the widespread nature of the problem in a major market.

Furthermore, the WHO’s Global Burden of Disease study for 2021 found that severe periodontitis affected approximately 1.07 billion people globally. This substantial disease burden and high prevalence of caries create a constant need for effective preventive measures, directly stimulating the market for these products and services through public health campaigns and clinical applications.

Restraints

Safety concerns and alternative preventive measures are restraining the market.

The market faces a significant restraint from public and professional concerns regarding the safety of fluoride, particularly in high concentrations, and the availability of alternative preventive measures. Despite decades of research supporting its benefits, public hesitancy and misinformation about fluoride’s potential health effects can deter individuals from seeking treatment. This is particularly prevalent in communities without fluoridated water systems.

Additionally, the widespread availability of over-the-counter fluoride products, such as toothpaste and mouth rinses, can lead some consumers to believe these are sufficient for their oral health needs, thereby reducing the perceived necessity for professional, in-office applications. A 2024 survey from Healthwatch England revealed that one in five people avoided going to the dentist due to the cost of treatment. For these individuals, the financial barrier combined with the perception that consumer products are sufficient further reduces their willingness to seek out professional fluoride applications, impacting market growth.

Opportunities

The expansion of dental insurance coverage and public health programs is creating growth opportunities.

The expansion of dental insurance coverage and the implementation of public health programs focused on oral hygiene present significant growth opportunities. Increased insurance coverage directly reduces the financial barrier for patients, making preventive care, including fluoride treatments, more accessible and affordable. This leads to higher patient uptake and a more consistent demand for professional applications.

A 2024 survey in the UK by the NHS Business Services Authority (NHSBSA) showed that 56% of courses of treatment for children included fluoride varnish, demonstrating a strong integration into routine pediatric care. In the US, the American Dental Association (ADA) continues to advocate for policies that improve access to care, with the ADA stating in a 2024 press release that “optimally fluoridated water is accessible to communities regardless of socioeconomic status,” highlighting the role of public health initiatives in increasing preventive care access. These initiatives, when coupled with broader insurance access, drive increased utilization of preventive treatments across all demographics.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the operational landscape for manufacturers and suppliers. Global inflation has led to a rise in the cost of raw materials, energy, and transportation, which places upward pressure on the price of dental products. This inflationary environment can shrink profit margins for manufacturers and result in higher prices for dental practices, potentially impacting patient affordability and the overall volume of preventive treatments.

Concurrently, geopolitical tensions can disrupt established global supply chains. A manufacturer’s reliance on specific regions for key ingredients or components can be jeopardized by trade disputes or logistical challenges, necessitating a strategic shift towards more diversified sourcing and localized production. The industry can successfully navigate this complex environment by prioritizing operational efficiency and strategic procurement. Companies with resilient supply chains and the capacity to manage or offset these cost pressures are better positioned to maintain stability and profitability, demonstrating that an agile approach can ensure a positive trajectory.

The current US tariffs are creating a challenging dynamic for the supply chain. The imposition of new duties on various imported dental products and raw materials from key trading partners has increased the landed cost of these goods. This rise in cost is then passed down the supply chain, affecting distributors’ margins and ultimately leading to higher prices for dental practices. This can reduce the profitability of providing treatments and increase the cost to the patient, negatively impacting access to preventive care.

However, these tariffs are also providing a competitive advantage to US-based manufacturers who are not subject to these import duties. As a result, some dental clinics are beginning to shift their purchasing toward domestically produced goods to ensure a more stable supply and predictable pricing. This dynamic is fostering domestic manufacturing and encouraging companies to invest in local production capabilities to bypass the tariff burden and strengthen their market position. The industry is responding with adaptive measures, seeking out new suppliers and optimizing logistics, which demonstrates a resilient path forward.

Latest Trends

The increasing use of silver diamine fluoride (SDF) is a recent trend.

A notable trend observed in 2024 and 2025 is the growing adoption of silver diamine fluoride (SDF) as a primary treatment for arresting dental caries, particularly in pediatric and special needs populations. Unlike traditional fluoride varnishes, SDF offers a non-invasive, painless solution for treating active decay, making it a highly attractive alternative for patients who may not tolerate traditional drilling and filling procedures. This is leading to a paradigm shift in pediatric and geriatric dentistry.

A January 2025 review in the journal Cureus highlights that minimally invasive dentistry (MID) techniques like SDF application are transforming pediatric dental care by emphasizing the preservation of healthy tooth structure. This growing trend is supported by an increase in product development, with key industry players introducing new SDF solutions. For example, a 2024 study on SDF for managing childhood caries, published in the Journal of the American Dental Association (JADA), provided clinical evidence supporting its efficacy, further bolstering its acceptance and use in clinical settings.

Regional Analysis

North America is leading the Dental Fluoride Treatment Market

The dental fluoride treatment market in North America commanded a leading position in the global market, holding a 36.9% revenue share in 2024. This robust performance is primarily attributed to a heightened focus on preventive dental care and significant government backing through various initiatives aimed at improving oral health.

For instance, the Centers for Medicare & Medicaid Services (CMS) has been providing technical assistance to states to improve oral health care for children enrolled in Medicaid and the Children’s Health Insurance Program (CHIP), which includes promoting preventive services like fluoride applications. The American Dental Hygienists’ Association (ADHA) reported that in 2023, there were over 214,000 dental hygienists in the US These professionals are instrumental in patient education and the recommendation of preventive treatments, driving awareness and adoption of dental fluoride products.

The growing demand for these products is also linked to the region’s aging population, which necessitates more extensive dental care to combat issues like root caries and tooth loss. This trend is further supported by the high prevalence of dental caries among the general population. According to the CDC’s 2024 Oral Health Surveillance Report, nearly 21% of adults aged 20–64 had at least one untreated cavity. Additionally, the report indicated that about 18% of children aged 6–8 years had untreated decay in their primary teeth, highlighting a persistent need for preventive dental care across all age groups.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The dental fluoride treatment market in Asia Pacific is anticipated to experience the most rapid growth during the forecast period. This is largely due to the region’s substantial aging population and a rising prevalence of dental issues, which are driving up demand for dental care. As a significant example, Japan’s population aged 65 or older constituted 29.1% of the total in 2022, a proportion expected to increase to 34.8% by 2040, creating a vast patient base susceptible to dental problems like tooth decay and periodontitis. This underscores the critical need for preventive measures like fluoride applications.

The market is also being fueled by increasing awareness of oral hygiene and government efforts to improve public health. China, for instance, has demonstrated a strong commitment to its healthcare industry, and initiatives promoting dental hygiene awareness, such as the “Elderly Oral Health Promotion Campaign,” are expected to boost the demand for both in-office and consumer-grade fluoride treatments.

A study from July 2022 highlighted that periodontal disease is a leading cause of tooth loss in Japan, affecting 40.4% of men and 34.9% of women. The rising middle-income demographic in countries like China is also attracting key industry players by creating a demand for innovative and cost-effective dental fluoride treatments. These combined factors set the stage for a dynamic and expanding market for dental fluoride treatments across the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leaders in the dental fluoride market are strategically driving growth through product innovation and market expansion. They are investing heavily in research and development to produce advanced formulations, such as high-adhesion varnishes and silver diamine fluoride, which offer enhanced efficacy and minimally invasive application.

Concurrently, these companies are broadening their geographic footprint, particularly in high-growth regions like Asia-Pacific, by establishing partnerships and acquiring local distributors. They also leverage public health initiatives and educational campaigns, aligning their brand with preventive dentistry to increase consumer awareness and adoption of their products.

Colgate-Palmolive Company stands as a dominant force in this sector. The company operates globally, providing an extensive portfolio of oral care products, including various fluoride-based toothpaste, mouthwashes, and professional dental products under well-known brands like Colgate Total. Colgate-Palmolive’s integrated product offerings, combined with strong brand recognition, have secured its leading position in the industry.

Top Key Players

- Young Innovations, Inc

- VOCO GmbH

- Ultradent Products Inc

- The Procter & Gamble Company

- Kulzer GmbH

- Koninklijke Philips

- KaVo Dental

- Ivoclar Vivadent

- GC International AG

- DÜRR DENTAL SE

- DMG Dental-Material GmbH

- Dentsply Sirona Inc

- Colgate-Palmolive Company

- 3M

Recent Developments

- In August 2023, Ames National Laboratory collaborated with Colgate-Palmolive Company to enhance the stability of stannous fluoride in toothpaste formulas. Through the use of advanced NMR technology, Colgate-Palmolive fine-tuned its product formulations, resulting in more consistent and efficient oral care solutions for the consumer market.

- In March 2023, Colgate-Palmolive launched Colgate Total Plaque Pro-Release, a toothpaste designed to reduce plaque buildup and offer continuous antibacterial protection throughout the day. This new product addition strengthened the company’s portfolio, meeting consumers’ growing demand for superior plaque control and long-lasting protection, thus reinforcing its competitive edge in the marketplace.

Report Scope

Report Features Description Market Value (2024) US$ 13.7 Billion Forecast Revenue (2034) US$ 23.8 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Toothpaste & Gel, Varnish & Mouth Rinse, and Others), By End-user (Children & Adolescents, Adults, and Pregnant Women) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Young Innovations, Inc, VOCO GmbH, Ultradent Products Inc, The Procter & Gamble Company, Kulzer GmbH, Koninklijke Philips, KaVo Dental, Ivoclar Vivadent, GC International AG, DÜRR DENTAL SE, DMG Dental-Material GmbH, Dentsply Sirona Inc, Colgate-Palmolive Company, 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dental Fluoride Treatment MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Dental Fluoride Treatment MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Young Innovations, Inc

- VOCO GmbH

- Ultradent Products Inc

- The Procter & Gamble Company

- Kulzer GmbH

- Koninklijke Philips

- KaVo Dental

- Ivoclar Vivadent

- GC International AG

- DÜRR DENTAL SE

- DMG Dental-Material GmbH

- Dentsply Sirona Inc

- Colgate-Palmolive Company

- 3M