Global Deadhand System Market Size, Share Analysis Report By Component (Sensors and Detectors, Command and Control (C2) Systems, Communication Infrastructure, Trigger Mechanisms, Weapon Platforms, Others), By Platform (Land-Based, Naval-Based, Air-Based), By End-User (National Strategic Forces, Defense Ministries & Intelligence Agencies, Defense Contractors & System Integrators), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148599

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Deadhand System Market size is expected to be worth around USD 19.0 Billion By 2034, from USD 4.5 billion in 2024, growing at a CAGR of 15.5% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 28.5% share, holding USD 1.2 Billion revenue. In Russia, the Deadhand System market is valued at USD 0.55 billion in 2024 and is expected to grow at a CAGR of 12.8% over the forecast period.

The Dead Hand system, officially termed “Perimeter,” is an automated nuclear weapons control mechanism developed by the Soviet Union during the Cold War. Its primary function is to ensure a retaliatory nuclear strike in the event that the nation’s leadership is incapacitated by an enemy attack. The system operates through a network of sensors that detect nuclear detonations, seismic disturbances, and communication disruptions.

The market for Deadhand Systems is a specialized segment within the broader defense technology industry, focusing on automated and autonomous nuclear command-and-control systems. While specific market data on Deadhand Systems is limited due to their classified nature, the overall defense automation market provides some insights.

Several factors are driving the interest and potential expansion of Deadhand-like systems. These include the need for assured second-strike capabilities, advancements in artificial intelligence (AI) and machine learning, and the desire to reduce human error in critical decision-making processes. The integration of AI allows for real-time data analysis and autonomous decision-making, enhancing the reliability of such systems.

Additionally, the geopolitical landscape, characterized by renewed great-power competition, underscores the importance of maintaining credible deterrent capabilities. Technological advancements play a crucial role in the evolution of Deadhand Systems. The incorporation of AI and machine learning enables these systems to process vast amounts of data swiftly, improving threat detection and response times.

The regulatory environment surrounding Deadhand Systems is complex, given their strategic significance and potential implications for global security. International treaties, such as the New START agreement, aim to limit the number of deployed strategic nuclear warheads and delivery systems, indirectly influencing the development and deployment of automated nuclear command-and-control mechanisms.

Key Takeaways

- The Global Deadhand System Market is projected to reach USD 19.0 Billion by 2034, up from USD 4.5 Billion in 2024, expanding at a CAGR of 15.5% during 2025 to 2034.

- In 2024, Europe led the global market, holding a dominant 28.5% share, with regional revenue reaching USD 1.2 Billion, driven by increasing investments in strategic deterrent technologies.

- The Russian market was valued at approximately USD 0.55 Billion in 2024 and is forecasted to grow steadily at a CAGR of 12.8%, supported by continued modernization of its nuclear command infrastructure.

- The Command and Control (C2) Systems segment held the leading share in 2024, accounting for over 32.7% of the global market, owing to its central role in decision-making and automated response functions.

- The Land-Based platform segment also dominated in 2024, capturing more than 40.4% of the global share, as ground-based delivery systems remain a strategic priority for many defense programs.

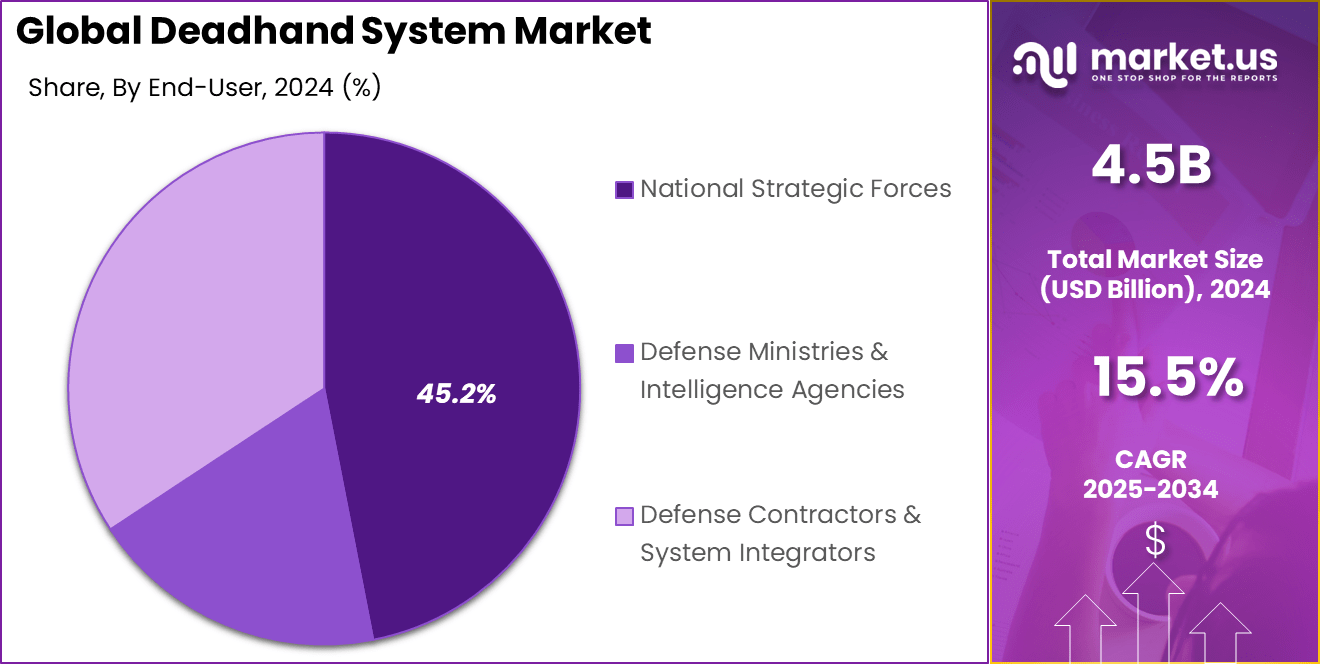

- The National Strategic Forces segment led by mission-critical deployment, accounted for over 45.2% of the global Deadhand System market in 2024, emphasizing the system’s role in sovereign security operations.

Europe Market Growth

In 2024, Europe held a dominant market position, capturing more than 28.5% share of the global Deadhand System market, with an estimated revenue of around USD 1.2 billion. This leadership can be attributed to the region’s early adoption of automated retaliatory military systems, advanced defense infrastructure, and strong investments in strategic deterrent technologies.

Meanwhile, Russia emerged as a significant contributor, with the Deadhand System market valued at approximately USD 0.55 bn in 2024. It is projected to expand at a CAGR of 12.8%, supported by continuous modernization of its legacy Perimeter system. Given its historical role in pioneering Deadhand concepts, Russia has been actively upgrading its command automation with artificial intelligence, strategic sensors, and early-warning capabilities to maintain its deterrence posture amid growing global tensions.

Countries like the United Kingdom and France have continued to prioritize modernization of nuclear command and control frameworks. The regional focus on maintaining geopolitical balance – especially in the wake of rising Eastern European tensions – has led to increased allocation in defense automation programs and secure launch-authority systems.

Europe’s lead in this space is further strengthened by the region’s strong regulatory coordination and collaboration in defense R&D through NATO-aligned initiatives. Member states within the EU have emphasized the importance of autonomous fail-safe systems to maintain credible deterrence without risking accidental escalation.

By Component Analysis

In 2024, the Command and Control (C2) Systems segment held a dominant position in the Deadhand System market, capturing over 32.7% of the global share. This leadership is primarily attributed to the critical role C2 systems play in ensuring the integrity and responsiveness of automated strategic deterrent frameworks.

These systems serve as the central nervous system of the Deadhand architecture, orchestrating real-time decision-making, secure communications, and multi-domain coordination essential for credible second-strike capabilities. The prominence of C2 systems is further reinforced by advancements in artificial intelligence and machine learning, which have enhanced their ability to process vast data streams from various sensors and platforms.

This integration enables rapid threat assessment and autonomous decision-making, reducing the risk of human error in high-stakes scenarios. The modernization of military infrastructures across major powers, including the development of joint all-domain command and control (JADC2) initiatives, underscores the strategic importance of robust C2 systems in contemporary defense doctrines .

Moreover, the increasing complexity of modern warfare, characterized by the convergence of cyber, space, and conventional domains, necessitates sophisticated C2 systems capable of seamless interoperability. These systems must facilitate secure and resilient communication channels to maintain command continuity, even in contested environments.

By Platform Analysis

In 2024, the Land-Based segment held a dominant market position in the Deadhand System market, capturing over 40.4% of the global share. This leadership is primarily due to the strategic advantages offered by land-based platforms, which include enhanced survivability, ease of maintenance, and the capacity for larger payloads.

These platforms are integral to national defense strategies, providing a reliable and secure means for deploying automated retaliatory systems. The prominence of land-based systems is further reinforced by their integration into existing military infrastructures.

Fixed installations, such as missile silos and command centers, offer robust protection against potential threats and ensure the continuity of operations even under adverse conditions. The ability to house sophisticated command and control systems within these installations enhances the responsiveness and effectiveness of the Deadhand System.

Moreover, technological advancements have significantly improved the capabilities of land-based platforms. The incorporation of artificial intelligence and advanced sensor networks allows for real-time threat assessment and autonomous decision-making. These innovations have increased the reliability and precision of land-based systems, making them a preferred choice for nations seeking to bolster their strategic deterrence capabilities.

By End-User Analysis

In 2024, the National Strategic Forces segment held a dominant position in the Deadhand System market, capturing over 45.2% of the global share. This leadership is primarily attributed to the critical role these forces play in maintaining a credible and effective nuclear deterrent.

National Strategic Forces are entrusted with the operation and management of strategic weapon systems, including automated retaliatory mechanisms like the Deadhand System, ensuring a swift and assured response capability in the event of a nuclear attack.

The prominence of National Strategic Forces is further reinforced by their integration into national defense strategies and doctrines. These forces are equipped with the necessary infrastructure, such as hardened command centers and secure communication networks, to operate under extreme conditions.

Moreover, the continuous modernization efforts undertaken by National Strategic Forces contribute to their leading position in the market. Investments in advanced technologies, including artificial intelligence and cyber-resilient systems, enhance the reliability and effectiveness of automated deterrent mechanisms.

Key Market Segments

By Component

- Sensors and Detectors

- Command and Control (C2) Systems

- Communication Infrastructure

- Trigger Mechanisms

- Weapon Platforms

- Others

By Platform

- Land-Based

- Naval-Based

- Air-Based

By End-User

- National Strategic Forces

- Defense Ministries & Intelligence Agencies

- Defense Contractors & System Integrators

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Heightened Geopolitical Tensions and the Pursuit of Strategic Deterrence

The resurgence of great power competition, particularly among nuclear-armed states, has intensified the focus on maintaining credible deterrence capabilities. In this context, systems like the Deadhand System are gaining renewed attention as nations seek to ensure second-strike capabilities in the face of potential decapitation strikes.

The concept of an automated retaliatory mechanism serves as a powerful deterrent, signaling to adversaries that any first strike would be met with assured retaliation, even if command structures are compromised. This strategic posture is particularly relevant for countries like Russia, which has maintained and modernized its Perimeter system to safeguard against surprise attacks.

Moreover, the integration of advanced technologies into these systems enhances their reliability and responsiveness. The incorporation of artificial intelligence and machine learning algorithms allows for real-time threat assessment and decision-making, reducing the reliance on human intervention and minimizing the risk of delayed responses.

Restraint

Ethical and Strategic Concerns Over Autonomous Retaliation

Despite the strategic advantages, the deployment of automated nuclear response systems raises significant ethical and strategic concerns. The prospect of machines making life-and-death decisions without human oversight challenges fundamental principles of accountability and moral responsibility.

Critics argue that removing human judgment from the decision-making loop increases the risk of unintended escalations due to system errors or misinterpretations of data. Furthermore, the reliance on automated systems could undermine crisis stability. In high-tension scenarios, the fear of accidental launches might prompt adversaries to adopt more aggressive postures, increasing the likelihood of conflict.

These concerns have led to calls for international regulations and confidence-building measures to ensure that human control remains integral in nuclear command and control systems. Balancing technological advancements with ethical considerations remains a critical challenge for policymakers and defense planners.

Opportunity

Integration of Artificial Intelligence for Enhanced Decision-Making

The integration of artificial intelligence (AI) into strategic defense systems presents a significant opportunity to enhance the capabilities of the Deadhand System. AI can process vast amounts of data from various sensors and sources, enabling quicker and more accurate threat assessments.

This technological advancement allows for more nuanced decision-making, potentially reducing the risk of false alarms and ensuring that retaliatory actions are based on verified threats. Additionally, AI can improve the resilience of command and control systems by identifying and mitigating cyber threats in real-time.

By continuously learning and adapting to new attack vectors, AI-enhanced systems can maintain operational integrity even under sophisticated cyber assaults. The adoption of AI in the Deadhand System not only modernizes the deterrent infrastructure but also aligns with broader military trends towards automation and intelligent systems, offering a competitive edge in strategic defense.

Challenge

Cybersecurity Risks and System Vulnerabilities

The increasing complexity and connectivity of automated defense systems expose them to cybersecurity risks. Sophisticated adversaries may exploit vulnerabilities in software, communication networks, or sensor inputs to disrupt or manipulate the system’s operations.

A successful cyberattack could lead to unauthorized launches or prevent legitimate retaliatory actions, undermining the credibility of the deterrent and potentially triggering unintended escalations. Ensuring the cybersecurity of the Deadhand System requires continuous investment in advanced protective measures, regular system audits, and the development of fail-safes to prevent unauthorized access or actions.

Emerging Trends

In recent years, there has been a renewed interest in modernizing nuclear command and control systems, including concepts akin to the Dead Hand. Advancements in artificial intelligence (AI) and machine learning are being explored to enhance decision-making processes, reduce reaction times, and improve the reliability of threat detection mechanisms.

These technologies aim to address the challenges posed by emerging threats, such as cyberattacks and hypersonic weapons, which could compromise traditional command structures. Moreover, discussions around integrating AI into nuclear deterrence strategies have raised ethical and strategic considerations.

While automation could potentially reduce human error, concerns persist regarding the risks of unintended escalation due to system malfunctions or misinterpretations. As such, there is an ongoing debate about the extent to which automation should be incorporated into nuclear command and control, balancing the benefits of rapid response with the imperative of maintaining human oversight.

Business Benefits

The implementation of systems like the Dead Hand has implications beyond military strategy, influencing defense-related industries and technological innovation. The development and maintenance of such sophisticated systems drive advancements in fields such as sensor technology, secure communications, and AI, fostering growth in sectors that contribute to national security.

These technological developments often have dual-use applications, benefiting civilian industries and promoting economic growth. Additionally, the existence of a credible and automated second-strike capability can serve as a stabilizing factor in international relations, reducing the likelihood of nuclear conflict.

This stability can create a more predictable geopolitical environment, which is conducive to international trade and investment. By deterring aggression and maintaining strategic balance, such systems indirectly support global economic stability.

Key Player Analysis

The Deadhand System market is led by key players like Lockheed Martin, RTX Corporation, and Northrop Grumman. Lockheed focuses on nuclear command technologies, RTX develops advanced communication systems, and Northrop supports strategic deterrence with missile defense and space systems. These companies are central to automating retaliation capabilities and ensuring system reliability under threat.

BAE Systems, General Dynamics, and Thales S.A. play strong supporting roles. BAE contributes in space defense and hardened systems, while General Dynamics enhances secure communications. Thales advances encrypted avionics and command control, improving overall system integrity during conflict.

Russian firms such as Almaz-Antey and Rostec with United Instrument Manufacturing Corporation also shape the market. Almaz-Antey delivers integrated air defense via the S-500, and Rostec focuses on autonomous command units and robotics. These efforts boost Russia’s strategic response capabilities. Other players contribute niche technologies vital for system interoperability and resilience.

Top Key Players in the Market

- The Lockheed Martin Corporation

- RTX Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- General Dynamics Corporation

- Thales S.A.

- Almaz-Antey Corporation

- Rostec & United Instrument Manufacturing Corporation

- Others

Recent Developments

- In January 2025, Northrop Grumman announced the sale of its mission training and satellite ground network communications software business to Serco for $327 million. This divestiture reflects Northrop Grumman’s strategic realignment to focus on core areas such as missile defense and autonomous systems.

- In September 2024, General Dynamics Information Technology (GDIT) acquired Iron EagleX, a company specializing in artificial intelligence, cybersecurity, and software development for special operations and intelligence communities. This acquisition enhances GDIT’s offerings in advanced defense technologies.

- In August 2024, Lockheed Martin agreed to acquire Terran Orbital, a satellite manufacturer, for $450 million. This acquisition aims to enhance Lockheed Martin’s capabilities in satellite technology, particularly for missile tracking and communication systems.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Bn Forecast Revenue (2034) USD 19 Bn CAGR (2025-2034) 15.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Sensors and Detectors, Command and Control (C2) Systems, Communication Infrastructure, Trigger Mechanisms, Weapon Platforms, Others), By Platform (Land-Based, Naval-Based, Air-Based), By End-User (National Strategic Forces, Defense Ministries & Intelligence Agencies, Defense Contractors & System Integrators) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Lockheed Martin Corporation, RTX Corporation, Northrop Grumman Corporation, BAE Systems plc, General Dynamics Corporation, Thales S.A., Almaz-Antey Corporation, Rostec & United Instrument Manufacturing Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Lockheed Martin Corporation

- RTX Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- General Dynamics Corporation

- Thales S.A.

- Almaz-Antey Corporation

- Rostec & United Instrument Manufacturing Corporation

- Others