Global Data Contracts for AI Market Size, Share, Industry Analysis Report By Component (Tools & Platforms, Services), By Deployment (Cloud, On-premise), By Application (Data Quality Assurance, Compliance & Governance, Model Reliability, Others), By End-User (Data Teams, AI/ML Engineers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 168444

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Deployment Analysis

- Application Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

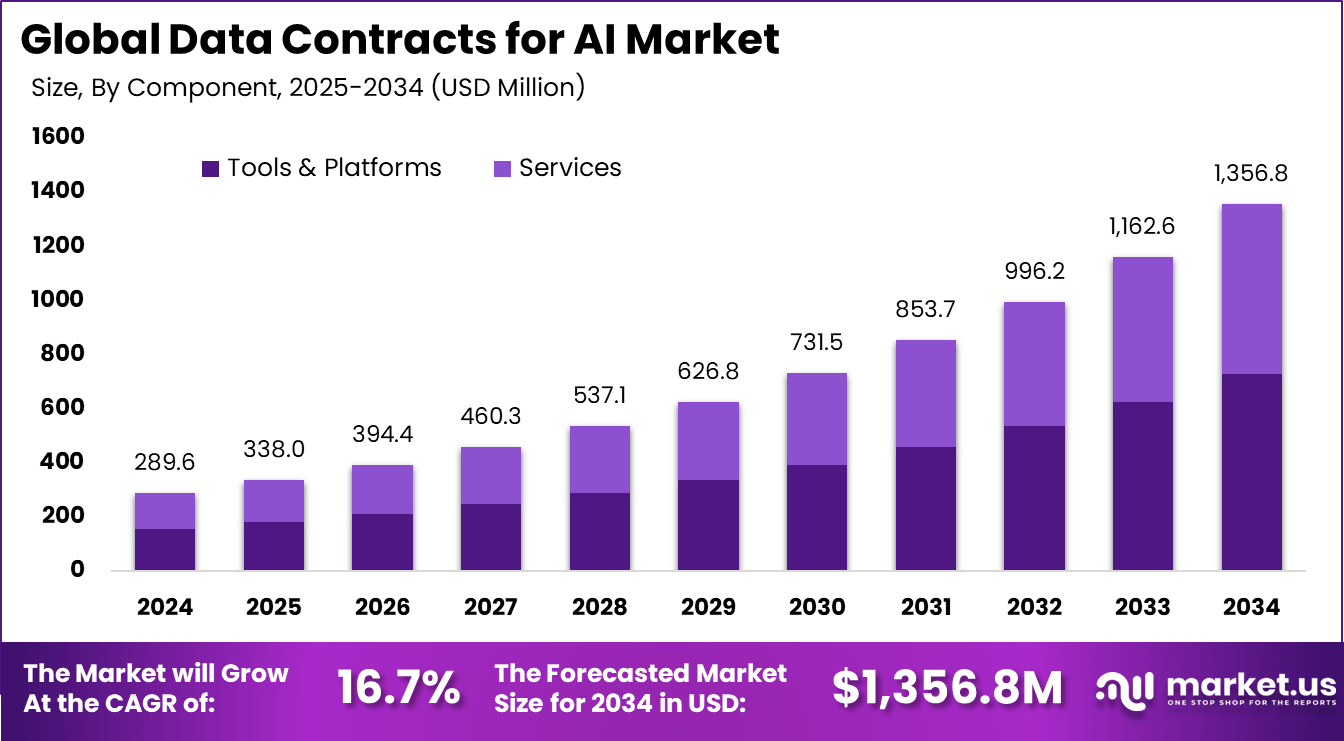

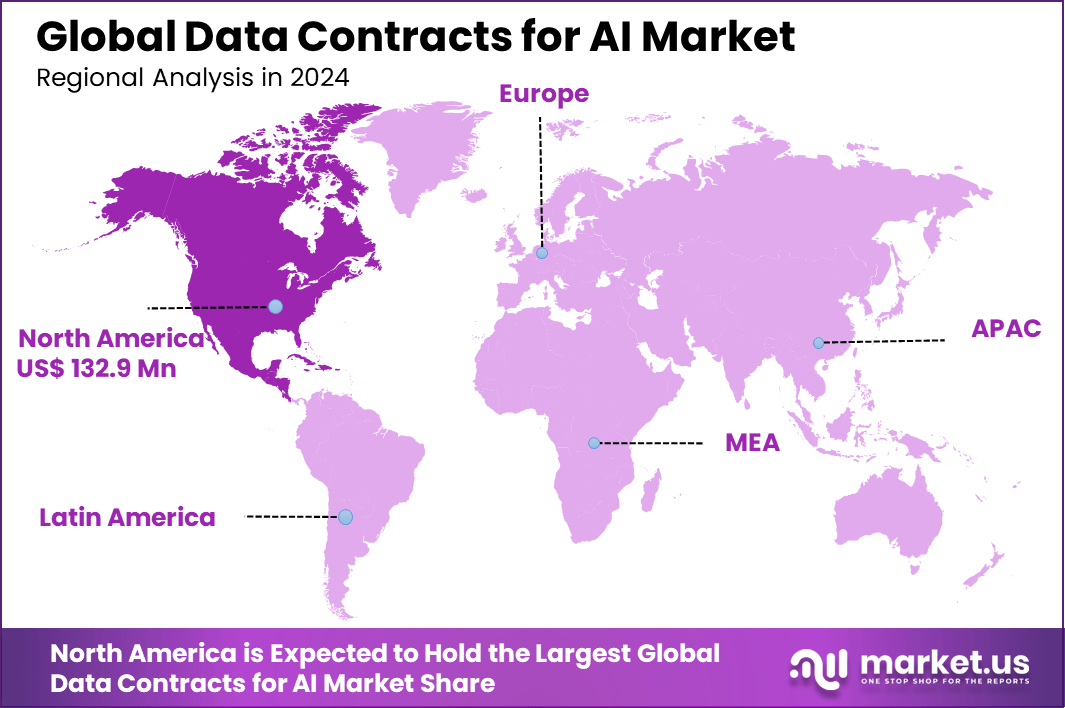

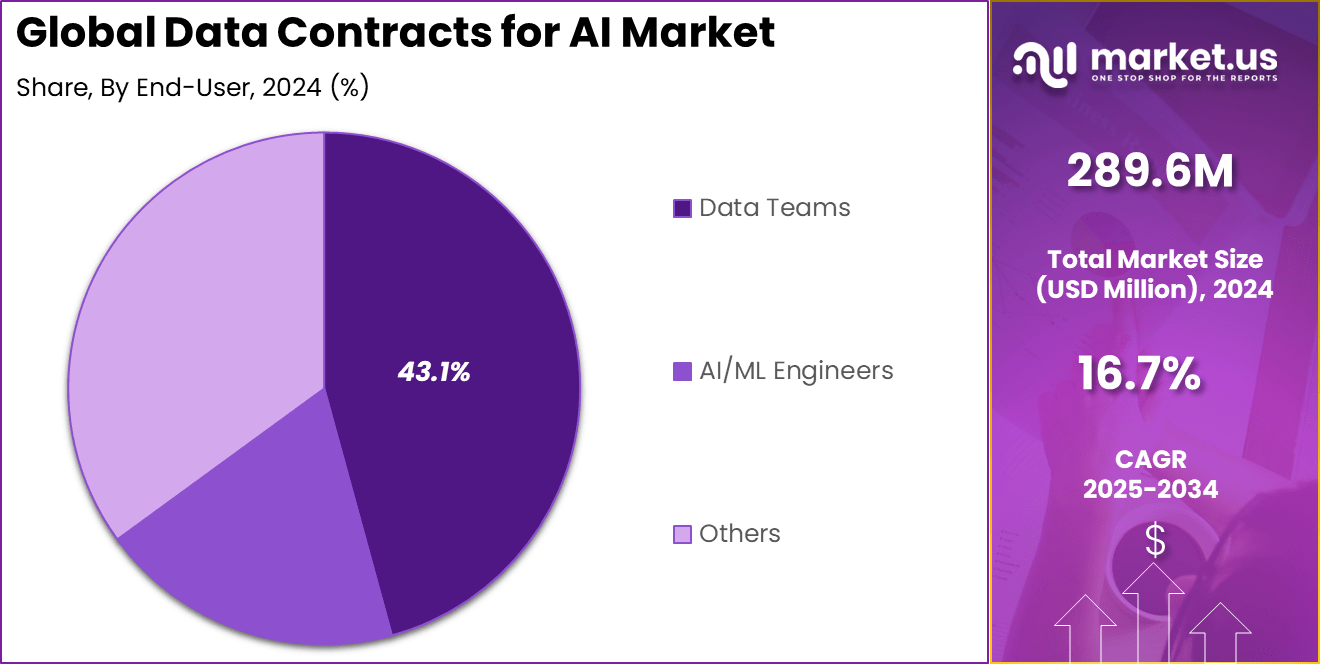

The Global Data Contracts for AI Market size is expected to be worth around USD 1,356.8 million by 2034, from USD 289.6 million in 2024, growing at a CAGR of 16.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.9% share, holding USD 132.9 million in revenue.

The data contracts for AI market has expanded as organisations adopt structured agreements that define how data is collected, validated, shared and consumed across AI pipelines. Growth reflects rising complexity in enterprise data flows and the need for consistent, machine readable standards that prevent data drift. Data contracts are becoming a core layer for connecting engineering teams, data owners and AI developers in a unified operating model.

A key driving factor is the rising focus on data accountability and trust in AI systems. Organizations are formalizing data-sharing arrangements to align with privacy regulations, manage risk, and ensure traceability of inputs across the AI lifecycle. This shift is supported by the need to validate algorithms with high-quality, auditable data pipelines. Businesses view well-structured contracts as a way to reduce bias and protect against misuse, especially as AI systems become embedded in decision-making processes.

Demand is increasing as enterprises move toward collaborative data ecosystems. AI applications depend on large, diverse datasets, and contracts enable secure cooperation between organizations without exposing sensitive information. This trend supports sectors that rely on shared insights, including logistics optimization, fraud detection, and predictive maintenance.

For instance, in July 2023, IBM introduced the AI DataOps solution aimed at automating data pipelines to improve data reliability and governance for AI workloads. This positions IBM to serve enterprises seeking to scale AI while maintaining robust data governance and operational excellence.

Key Takeaway

- In 2024, the Tools and Platforms segment accounted for 53.8% of the Global Data Contracts for AI Market, reflecting its leading role in managing structured data agreements for AI systems.

- In 2024, the Cloud segment captured 62.8%, showing that most data contract frameworks were implemented through cloud-based infrastructures.

- In 2024, the Compliance and Governance segment reached 35.6%, indicating rising demand for structured controls to support responsible AI development.

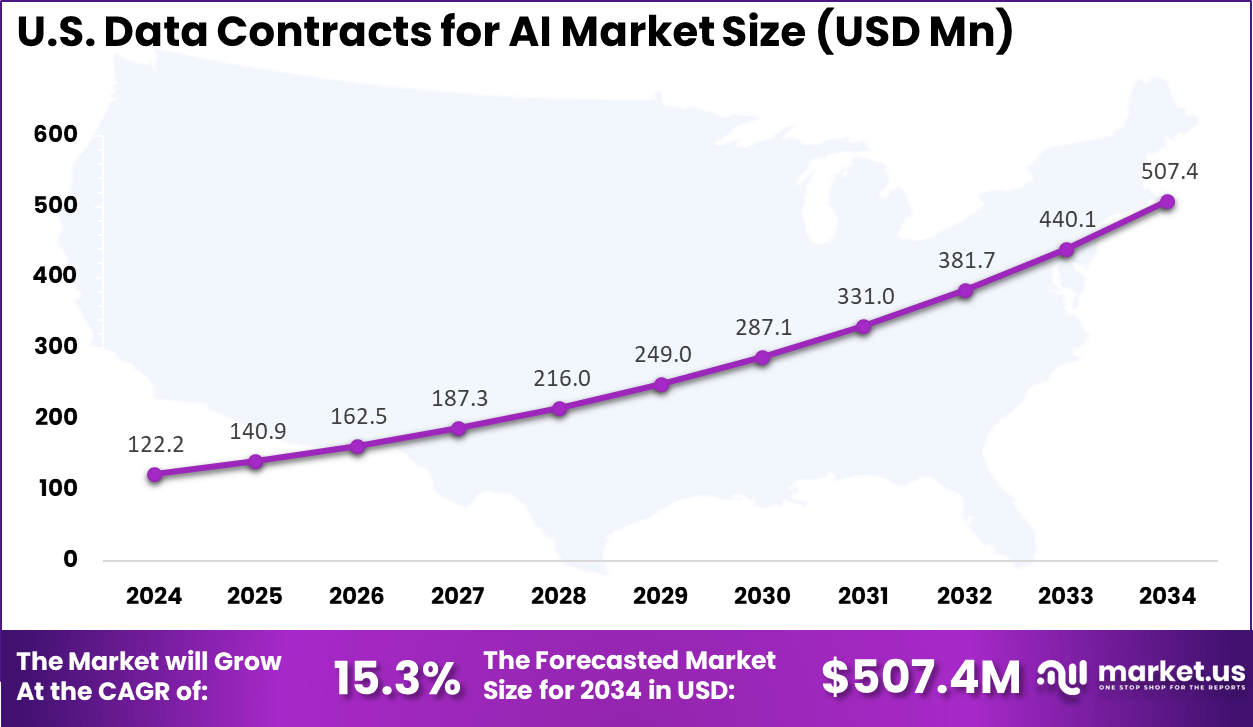

- The US market recorded USD 122.2 Million in 2024 with a CAGR of 15.3%, highlighting steady adoption of standardized data agreements across AI workflows.

- In 2024, North America held 45.9%, confirming the region’s strong focus on secure, well-governed data practices for AI applications.

Role of Generative AI

Generative AI greatly improves the process of creating and managing data contracts by automating repetitive tasks such as drafting clauses and reviewing terms. This not only speeds up contract turnaround times by about 50% but also reduces errors and inconsistencies that human drafters may introduce.

By analyzing existing contracts and relevant data, the AI assists in suggesting suitable terms and highlighting potential risks, making contract creation more reliable and efficient. The impact of generative AI in contract management is also seen in increasing compliance accuracy by over 50% and cutting down administrative work by almost one-third.

It helps organizations save time and reduce costly mistakes by catching issues earlier during negotiations. On average, businesses experience up to a 90% reduction in incorrect payments due to improved contract clarity and monitoring powered by generative AI tools. This enhances overall efficiency and reliability in managing data contracts.

Investment and Business Benefits

Investment opportunities are growing as enterprises and technology developers seek scalable governance solutions for data infrastructure. Venture and institutional investors are looking toward platforms that simplify cross-domain data access while maintaining transparency and security.

There is significant potential for startups offering contract automation, monitoring tools, and integration middleware tailored for AI data ecosystems, particularly in cloud-based and edge AI environments. The business benefits of data contracts extend across operational, legal, and strategic domains.

Standardized data governance allows organizations to comply with global privacy laws, reduce costs from data mismanagement, and improve return on data assets. Clear contractual terms also minimize disputes, accelerate AI deployment cycles, and strengthen trust among partners. Ultimately, data contracts form the foundation for reliable and ethically aligned AI development across industries.

U.S. Market Size

The market for Data Contracts for AI within the U.S. is growing tremendously and is currently valued at USD 122.2 million, the market has a projected CAGR of 15.3%. The market is growing due to several key factors. The increasing adoption of AI across various industries, such as healthcare, finance, and technology, is driving demand for reliable and governed data.

Organizations require data contracts to ensure data quality, compliance, and traceability, which are essential for trustworthy AI deployments. Additionally, the growth of cloud infrastructure and AI-ready data centers in the U.S. supports scalable and secure data contract deployment, facilitating seamless data sharing and governance. Strong investments in AI infrastructure and regulatory focus on data compliance further accelerate market growth.

For instance, in November 2025, Databricks advanced data contracts for AI through its Unity Catalog governance platform, enabling production-grade contract analysis with GenAI on Azure Databricks. A healthcare manufacturer achieved a 95% reduction in processing time for complex multilingual contracts, using ensemble-validated LLMs and RAG pipelines for accurate data extraction while maintaining full traceability and compliance.

In 2024, North America held a dominant market position in the Global Data Contracts for AI Market, capturing more than a 45.9% share, holding USD 132.9 million in revenue. This dominance is driven by the region’s advanced digital infrastructure and strong presence of AI technology leaders like Microsoft, IBM, and NVIDIA. These companies are driving innovation in AI data governance and contract management.

North America’s growth is further supported by the widespread adoption of AI across key sectors such as finance, healthcare, and telecommunications, where data contracts are essential for ensuring compliance and data quality. The region also benefits from extensive venture capital funding and government initiatives promoting AI innovation and data privacy.

For instance, in October 2025, Microsoft, headquartered in Redmond, Washington, evolved its OpenAI partnership with a $250 billion Azure services commitment, maintaining exclusive IP rights for frontier models and enabling secure, high-volume data contracts for AI development.

Component Analysis

In 2024, The Tools & Platforms segment held a dominant market position, capturing a 53.8% share of the Global Data Contracts for AI Market. This dominance shows the crucial role these platforms play in managing and automating data contracts. Such tools are designed to ensure data integrity by enforcing rules that govern data usage between producers and consumers.

They also provide essential features like schema validation and real-time error detection, which help maintain consistent and trustworthy data necessary for AI applications. These platforms also significantly improve operational efficiency by automating contract lifecycle management tasks, reducing manual intervention, and minimizing risks associated with data mishandling.

Their increasing adoption highlights a shift toward integrated solutions that provide end-to-end contract enforcement, fostering greater collaboration and trust in data ecosystems. Innovation in this segment is marked by the inclusion of AI-powered analytics, predictive risk assessments, and enhanced security features to cater to complex enterprise needs.

For Instance, in November 2025, Google Cloud secured a multi-million-dollar contract with NATO to provide its Google Distributed Cloud air-gapped solution, a cutting-edge platform designed for secure data handling and AI workloads in isolated environments. This highlights Google’s commitment to robust, sovereign cloud solutions that underpin the critical role of tools and platforms in managing secure, rule-based data contracts for AI.

Deployment Analysis

In 2024, the Cloud segment held a dominant market position, capturing a 62.8% share of the Global Data Contracts for AI Market. The cloud enables centralized management of data contracts, allowing organizations to enforce data policies easily across distributed teams and systems. Real-time monitoring and seamless integration with other cloud-native services further enhance the value proposition of cloud deployments.

The cloud approach also supports rapid scaling and reduces infrastructure overhead, making it appealing to both large enterprises and small to medium-sized businesses. It facilitates collaborative environments where AI data workflows are secured and governed efficiently, which is essential given the growing volume and complexity of data in AI initiatives.

For instance, in October 2025, Microsoft announced plans to double its data center capacity to enhance AI capabilities and cloud services, reinforcing the importance of cloud as the leading deployment model for data contracts in AI. This expansion supports scalable, real-time data governance and contract enforcement across distributed environments.

Application Analysis

In 2024, The Compliance & Governance segment held a dominant market position, capturing a 35.6% share of the Global Data Contracts for AI Market. This dominance is due to the increasing need for organizations to meet regulatory requirements and maintain ethical AI usage. Data contracts in this application area help embed compliance rules directly into data management processes, ensuring transparency, traceability, and accountability.

These applications automate the enforcement of governance policies, mitigating risks related to data breaches or misuse. By providing clear audit trails and standardized contract terms, compliance-focused contracts become critical tools for organizations aiming to build trustworthy AI systems. This focus on governance supports wider adoption of data contracts as safeguards against evolving legal and ethical challenges in AI data handling.

For Instance, in May 2025, SAP deepened its partnership with Icertis to embed AI-driven contract intelligence within SAP solutions, improving real-time insights, compliance, and governance. This integration demonstrates how data contracts support governance by automating policy enforcement and enhancing transparency.

End-User Analysis

In 2024, The Data Teams segment held a dominant market position, capturing a 43.1% share of the Global Data Contracts for AI Market. This dominance is due to their vital role in preparing and managing data for AI projects. These teams rely on data contracts to formalize agreements around data quality, usage rights, and delivery timelines, which helps reduce misunderstandings and errors.

Embedding data contracts into operational workflows allows data teams to automate validation checks and monitor data pipelines continuously. This reduces manual workloads, enhances collaboration between data producers and consumers, and accelerates AI model development cycles. The prominence of data teams in this space highlights how technical teams are central to operationalizing data contracts for better AI outcomes.

For Instance, in June 2025, Databricks announced a strategic AI partnership with Google Cloud, combining their unified data platform with Google’s Gemini AI models to deliver scalable, governed AI solutions. This empowers data teams by enabling efficient contract enforcement and metadata management to ensure data quality for AI workloads.

Emerging trends

One key trend is the rise of smaller, specialized AI models that prioritize efficiency, cost-effectiveness, and environmental sustainability. These models consume less energy and resources, helping organizations balance performance and safety in contract analysis.

The adoption of such models is growing steadily, enabling companies to reduce operational costs while maintaining high accuracy in contract review and compliance checks. Multilingual contract automation is also on the rise, allowing businesses to swiftly create and adapt contracts across different languages and legal frameworks.

Another emerging trend involves intelligent AI agents that automate complex contract tasks like continuous monitoring of compliance and automatic adaptation to new legal requirements. These agents use machine learning to recognize patterns and identify potential risks in contracts, optimizing contract terms over time.

Companies are increasingly integrating AI-driven contract analytics with enterprise systems such as CRM and ERP for seamless contract approvals and performance tracking. This enhances regulatory compliance and risk management with real-time insights and alerts.

Growth Factors

The automation of contract creation is a primary growth driver. AI generates contract templates and pre-fills standard clauses, reducing manual effort and speeding up contract processing. This makes contract management more efficient and less prone to human error.

Improved risk management is another key factor; AI systems analyze contract terms to detect risky clauses and non-compliance issues early. This proactive approach enables organizations to avoid costly legal problems and operational disruptions while ensuring adherence to regulatory mandates.

Data-driven insights from AI further fuel growth by helping companies uncover patterns, negotiate better terms, and optimize supplier relationships. By analyzing large contract datasets, AI provides actionable intelligence that supports strategic decision-making.

Enhanced compliance management enables businesses to maintain up-to-date adherence to laws across jurisdictions, reducing penalties and building trust with partners. These factors together promote wider adoption of AI-powered data contracts in industries seeking better control and value from their contractual data.

Key Market Segments

By Component

- Tools & Platforms

- Services

By Deployment

- Cloud

- On-premise

By Application

- Data Quality Assurance

- Compliance & Governance

- Model Reliability

- Others

By End-User

- Data Teams

- AI/ML Engineers

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Data Quality and Trust Assurance

Data contracts strengthen AI development by enforcing clear data standards and preventing schema drift. Their validation mechanisms ensure that data delivered to AI pipelines remains accurate and consistent, which supports dependable training and inference. This stability allows teams to trust the data they use without extensive manual checks.

These contracts also reduce governance gaps by automating quality control and maintaining version clarity between data producers and consumers. The result is a continuous and predictable flow of high-quality data that improves overall AI model performance. Strong ownership structures further enhance reliability across complex data ecosystems.

In October 2025, Google invested USD 15 billion in an AI-focused data hub in Andhra Pradesh, demonstrating the strategic importance of trusted data infrastructure. This investment reflects how robust governance frameworks and well-structured data pipelines accelerate AI adoption at scale.

Restraint

Concerns Over Data Privacy and Security

Data contracts for AI face notable restraints due to rising privacy and security risks. Centralized data systems that rely on these contracts remain susceptible to ransomware, data poisoning, and unauthorized access, creating concerns about the safety of sensitive training data. The need to comply with regulations such as GDPR and CCPA adds further complexity, increasing operational burden and slowing organizational readiness.

Enterprises also experience delays as they attempt to balance strict governance requirements with the need for efficient AI workflows. Concerns about legal exposure and reputational damage make many organizations cautious, even when the technical advantages of data contracts are clear. As a result, adoption progresses more slowly in regulated or high-risk sectors.

In November 2025, AWS entered a USD 38 billion partnership with OpenAI to expand large-scale AI compute capacity. While this collaboration improves low-latency infrastructure for advanced AI workloads, it also magnifies concerns around securing vast volumes of sensitive data. Ensuring protection against cyber threats and meeting regulatory obligations remains a major restraint on wider deployment of AI-driven data contracts.

Opportunities

Automating Compliance and Risk Reduction

The integration of AI-powered automation in data contracts offers promising opportunities to streamline compliance and reduce risks. Automated contracts accelerate the identification of non-compliant clauses and ensure adherence to evolving regulations in real time. This helps organizations stay ahead in governance, reduce legal exposure, and enhance operational efficiency.

Moreover, AI can analyze contract data to uncover insights that optimize contract performance and negotiation strategies. The ability to automate contract lifecycle management from data ingestion to enforcement creates a competitive advantage by minimizing manual effort and improving accuracy in complex data environments.

For instance, in November 2025, Salesforce unveiled advanced AI contract management tools integrated with its CRM ecosystem that automate metadata extraction and risk assessment for contracts. This automation streamlines compliance checking and risk reduction, allowing enterprises to manage contract lifecycles with enhanced speed and accuracy.

Challenges

Over-Reliance on Automation and Trust Issues

A key challenge is the growing risk of depending too heavily on automated AI-generated data contracts without adequate validation. Automated systems can create incorrect schemas or misinterpret edge cases, which introduces hidden errors into downstream AI workflows. This creates a false sense of confidence, making it harder for teams to detect issues until they affect model accuracy or operational performance.

Trust gaps also emerge when contracts are produced by opaque AI systems. Teams may hesitate to rely on outputs that appear to come from a black-box process, leading to governance gaps and uncertainty over ownership. Establishing clear validation procedures and accountability remains difficult, requiring cultural and procedural changes within organizations before automated contracts can be used effectively.

In October 2025, IBM introduced AI agents inside Oracle Fusion Applications to automate processes such as purchase requisitions and order entries. While this advancement improves efficiency, the company emphasized the continued need for human oversight to review AI-generated contracts and schemas. Successful deployment depends on balancing automation with strong governance and organizational trust.

Key Players Analysis

Google, Microsoft, IBM, AWS, Salesforce, Oracle, and SAP lead the data contracts for AI market with strong enterprise platforms that establish standardized, governed data pipelines for AI development. Their solutions support data quality enforcement, schema validation, lineage tracking, and policy compliance. These companies help organizations reduce model risk and ensure consistent data flows across complex AI systems.

Databricks, Snowflake, Alation, Collibra, DataRobot, H2O.ai, and Dataiku strengthen the competitive landscape with advanced data governance, MLOps integration, and automated validation frameworks. Their tools align data producers and consumers through shared contracts that ensure accuracy and reliability. These providers support model monitoring, reproducibility, and scalable AI workflows.

Soda Data and other emerging participants broaden the market by offering lightweight, developer-friendly tools for data quality checks and contract automation. Their platforms focus on real-time validation, versioning, and continuous testing across data pipelines. These companies help organizations enforce trustworthy data standards without adding unnecessary operational complexity.

Top Key Players in the Market

- Microsoft

- IBM

- AWS

- Salesforce

- Oracle

- SAP

- Databricks

- Snowflake

- Alation

- Collibra

- DataRobot

- H2O.ai

- Dataiku

- Soda Data

- Others

Recent Developments

- In November 2025, Microsoft continued advancing Azure AI Foundry Agent Services to general availability, integrating AI agents into enterprise applications with enhanced governance, real-time decision-making, and improved model tracking. Microsoft maintains leadership with a strong developer ecosystem and robust cloud AI offerings tied to its productivity suite.

- In April 2025, Google launched AI-enhanced data cataloging and discovery services as part of Google Cloud, improving data transparency and management for AI projects. Google’s focus is on scalable model development and MLOps capabilities to support large language models and AI agents in enterprise workflows.

Report Scope

Report Features Description Market Value (2024) USD 289.6 Mn Forecast Revenue (2034) USD 1,356.8 Mn CAGR(2025-2034) 16.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Tools & Platforms, Services), By Deployment (Cloud, On-premise), By Application (Data Quality Assurance, Compliance & Governance, Model Reliability, Others), By End-User (Data Teams, AI/ML Engineers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google, Microsoft, IBM, AWS, Salesforce, Oracle, SAP, Databricks, Snowflake, Alation, Collibra, DataRobot, H2O.ai, Dataiku, Soda Data, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Contracts for AI MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Data Contracts for AI MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- IBM

- AWS

- Salesforce

- Oracle

- SAP

- Databricks

- Snowflake

- Alation

- Collibra

- DataRobot

- H2O.ai

- Dataiku

- Soda Data

- Others