Global Data Center UPS Market Size, Share, Industry Analysis Report By Component (Solution, Services), By Data Center Size (Small Data Centers, Medium Data Centers, Large Data Centers), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Manufacturing, Healthcare, Government, Other Industry Verticals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 131025

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Data Center UPS Market In North America

- Component Analysis

- Data Centre Analysis

- Industry Vertical Analysis

- Impact Of Generative AI

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

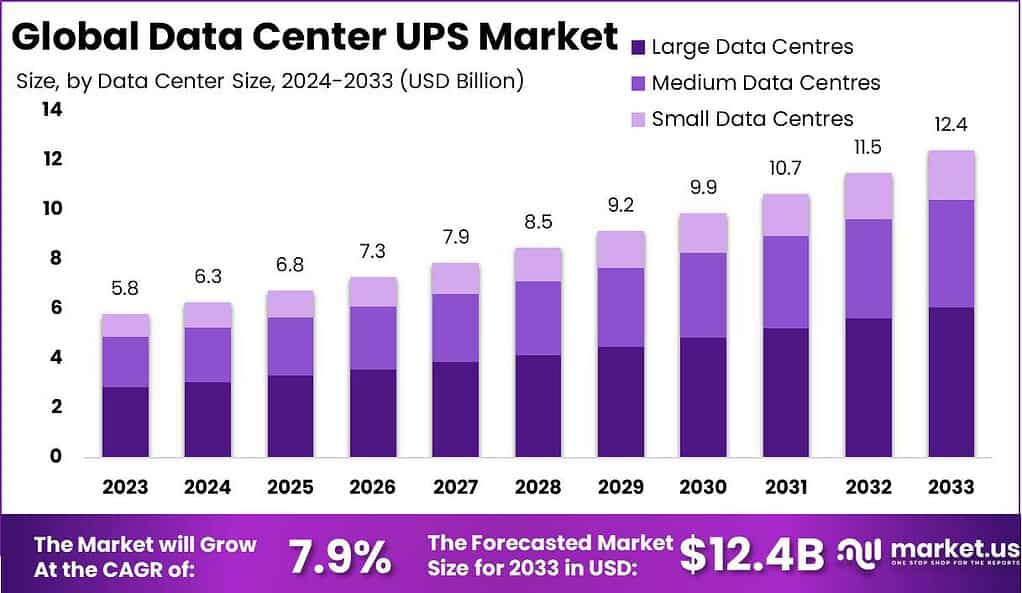

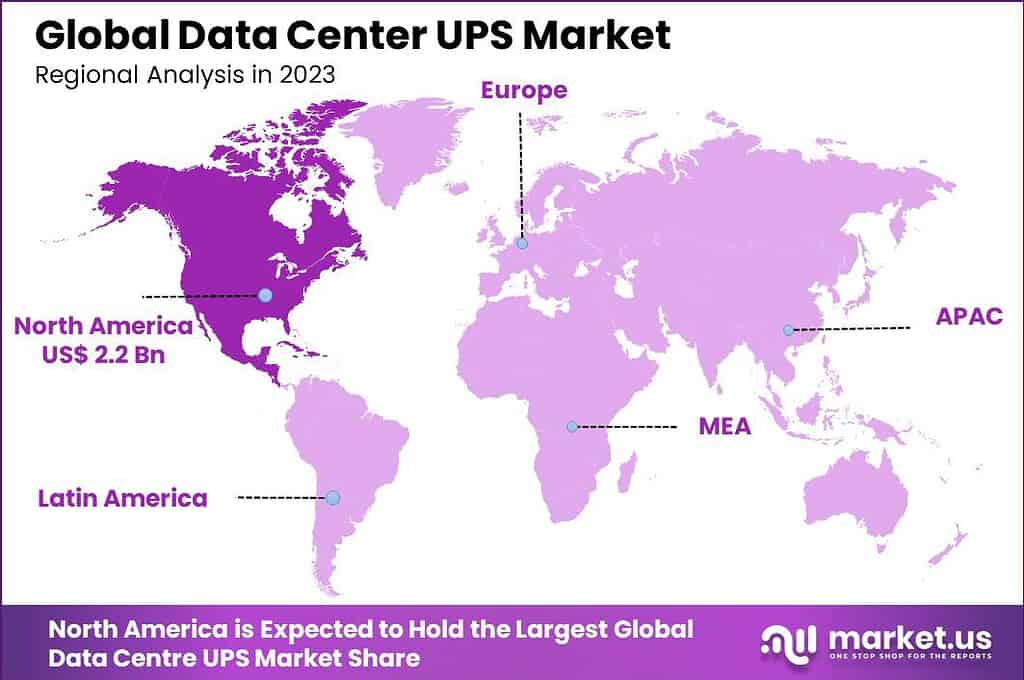

The Global Data Center UPS Market size is expected to be worth around USD 12.4 Billion by 2033, from USD 5.8 Billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 37.1% share, holding USD 2.2 Billion revenue.

A Data Center Uninterruptible Power Supply (UPS) is a crucial component that ensures uninterrupted power to data centers during electrical failures. Its main job is to provide a backup power source to keep critical systems running without any glitches when the main power source fails. Data centers rely heavily on UPS systems to prevent data loss and ensure continuous operations, making them indispensable in modern IT environments.

The Data Center UPS market is witnessing significant growth due to the increasing reliance on digital data and the expansion of cloud services. As businesses and services continue to digitalize, the need for robust, reliable data storage facilities has become more critical. This demand drives the growth of data centers, which in turn boosts the demand for UPS systems to protect these facilities from power interruptions.

The growth of the Data Center UPS market is primarily fueled by the rising volume of data generated by industries, the surge in cloud computing, and the growing dependency on online services which require robust IT infrastructure. Additionally, the increase in data center constructions globally due to digital transformation initiatives across various sectors supports the expansion of the UPS market.

One notable trend in the Data Center UPS market is the shift towards more energy-efficient and environmentally friendly UPS systems. Companies are investing in green UPS technologies that offer lower power consumption and reduced carbon footprints. Modular UPS systems are also gaining popularity, as they provide scalability and flexibility, allowing data centers to expand their power protection systems as needed.

The demand for Data Center UPS systems is climbing, driven by the need to ensure high availability and reliability of services that are increasingly online. Financial services, healthcare, and telecommunications sectors, in particular, exhibit high demand due to their critical need for uninterrupted operations and data security.

For instance, In March 2024, Eaton announced a significant addition to their data center solutions with the introduction of the SmartRack modular data center. This new offering is designed to bring together everything a modern data center needs: racks, cooling systems, and service enclosures. It’s tailored to handle heavy equipment loads up to 150kW.

There are significant opportunities in the Data Center UPS market with the ongoing advancements in UPS technology, such as lithium-ion batteries, which offer longer life and faster charging times. Emerging markets also present substantial growth opportunities as they continue to enhance their IT infrastructure.

According to a survey by the Uptime Institute, about one-third of data centers faced an outage last year, revealing a concerning trend over time. Although the percentage of operators reporting outages in the past three years dropped to 60% in 2022 from 69% in 2021, these figures highlight ongoing reliability issues. Notably, 36% of these disruptions were due to power failures, pinpointing a critical vulnerability in data center operations.

Research by mecojax underscores the severe financial consequences of these outages. Astonishingly, 25% of these incidents cost organizations over $1 million, while another 45% saw damages ranging from $100,000 to $1 million. The average cost of a data center outage has soared to an estimated $740,357, marking a 38% increase since 2010.

Key Takeaways

- The Global Data Center UPS Market is projected to reach USD 12.4 billion by 2033, up from USD 5.8 billion in 2023, with a CAGR of 7.9% during the forecast period from 2024 to 2033. This growth is driven by the increasing demand for uninterrupted power supply solutions, as more businesses rely on data centers for critical operations.

- In 2023, the solutions segment dominated the market, capturing more than 64.5% of the market share. This highlights the growing need for advanced UPS systems to ensure minimal downtime in data centers.

- Large data centers also played a significant role, holding over 48.9% of the market, reflecting the demand for scalable UPS systems in massive IT infrastructures.

- The IT and telecommunications sector led the industry in 2023, accounting for 23.4% of the total market share. The reliance on stable power in these sectors is crucial, as any interruption could lead to significant losses in operations and services.

- Regionally, North America held a dominant market position, securing 37.1% of the global market, driven by a high concentration of data centers and technological advancements in the region.

Data Center UPS Market In North America

In 2023, North America held a dominant market position in the Data Center UPS market, capturing more than a 37.1% share with revenues amounting to USD 2.2 billion. This leadership is largely due to the region’s advanced IT infrastructure and the high concentration of tech giants and data-intensive industries that require robust and reliable data center operations.

North America’s emphasis on maintaining data integrity and system reliability supports the extensive deployment of UPS systems across its data centers. The region’s commitment to technological innovation and the rapid adoption of cloud services have spurred significant investments in data center infrastructure, further driving the demand for advanced UPS solutions.

These solutions are crucial in safeguarding against power outages and fluctuations, which are potential risks given the region’s varied climatic conditions that can affect power stability. The presence of a well-established technology sector in North America also accelerates the integration of state-of-the-art UPS technologies, such as lithium-ion battery backups and smart UPS systems, which enhance efficiency and reliability.

Moreover, regulatory policies in North America focusing on data security and energy efficiency mandate the adoption of reliable power management systems in data centers, bolstering the growth of the UPS market. Initiatives aimed at reducing carbon footprints and enhancing energy efficiency also play a significant role in the adoption of new and upgraded UPS systems, which are designed to optimize power usage and reduce operational costs.

Additionally, the push towards digital transformation across various sectors such as finance, healthcare, and government in North America necessitates uninterrupted data center services, thus underpinning the sustained demand for high-quality UPS systems. This trend is expected to continue as the reliance on digital technologies grows, ensuring that North America retains its leading position in the global Data Center UPS market.

Component Analysis

In 2023, the Solution segment held a dominant market position in the Data Center UPS (Uninterruptible Power Supply) market, capturing more than a 64.5% share. This segment’s leadership can be attributed primarily to the critical role that UPS systems play in maintaining continuous power supply and protecting against data loss during power disruptions.

UPS solutions are integral to ensuring operational continuity in data centers, which is increasingly vital as businesses depend more on digital infrastructure and cloud services. The growing emphasis on data security and the high costs associated with downtime are significant drivers for the UPS solutions market.

As companies experience more frequent power disturbances and outages, the demand for robust UPS systems that can provide immediate power backup is escalating. These systems help prevent data corruption, hardware damage, and operational interruptions, which are costly setbacks for any data-reliant business.

For instance, In September 2023, Vertiv introduced a new addition to their UPS portfolio, the Liebert APM2. This model stands out for its scalability and high energy efficiency, designed to meet modern demands with less space usage. It’s also versatile, supporting both VRLA and lithium-ion batteries, making it a flexible option for various data center needs. This launch highlights Vertiv’s commitment to innovating products that are not only powerful but also adaptable to different energy storage technologies.

Moreover, advancements in UPS technology have bolstered the segment’s growth. Modern UPS systems are more energy-efficient and have better power management capabilities, making them ideal for today’s energy-conscious world. Enhanced features like scalable power and runtime options, along with smarter management software, allow data centers to optimize their power usage and reduce operational costs, further solidifying the leading position of the Solutions segment in the market.

The increasing construction of hyper-scale data centers globally also fuels the expansion of the UPS Solutions segment. These large-scale facilities require highly reliable and efficient UPS systems to safeguard critical data against power instability, thus driving the segment’s dominance in the market. This trend is expected to continue as the digital economy expands and the reliance on data centers deepens across industries.

Data Centre Analysis

In 2023, the Large Data Centers segment held a dominant market position in the Data Center UPS market, capturing more than a 48.9% share. This significant market share is driven by the extensive power requirements and higher energy consumption of large data centers, which necessitate robust UPS systems to ensure uninterrupted power and operational reliability.

Large data centers, often operated by major tech companies, financial institutions, and telecommunications providers, support vast amounts of data traffic and critical applications, making reliable power solutions a top priority. The scale of operations in these facilities often involves complex IT infrastructure and sensitive data storage that cannot afford downtime without incurring substantial financial and reputational losses.

As a result, the demand for high-capacity UPS systems that can support extended power outages and maintain critical systems operational is particularly high in this segment. These systems are essential for handling emergencies and power fluctuations, ensuring that even during a power failure, data integrity and services remain unaffected.

Additionally, the push towards digital transformation and increased reliance on cloud-based services have prompted the expansion of large data centers globally. The ongoing construction of new facilities and upgrading of existing ones to accommodate higher data loads also drives the need for advanced UPS solutions that offer scalability, sustainability, and enhanced energy efficiency.

Moreover, regulatory compliance regarding data security and energy usage in different regions further compels large data centers to invest in high-quality UPS systems. These systems not only provide power stability but also contribute to energy management strategies that align with green initiatives and sustainability goals, underpinning the dominant position of large data centers in the UPS market.

Industry Vertical Analysis

In 2023, the IT and Telecommunications segment held a dominant market position in the Data Center UPS market, capturing more than a 23.4% share. This leading status is primarily due to the critical need for uninterrupted power supply in maintaining network infrastructure and telecommunications services, which are integral to the operations of IT and telecom companies. These industries depend heavily on data centers to manage vast amounts of data, host services, and ensure continuous connectivity.

The IT and Telecommunications sector is characterized by its reliance on high-speed, always-available network services, which can suffer significant disruptions and financial losses in the event of even minimal downtime. As such, deploying reliable UPS systems is essential to mitigate the risks associated with power fluctuations and outages. These systems ensure that data handling and communications services can continue without interruption, thereby maintaining service reliability and customer trust.

Furthermore, the ongoing expansion of digital communication channels and the increasing shift towards cloud-based platforms have heightened the demand for more extensive and sophisticated data centers within the IT and Telecommunications sector. This expansion is driving the need for UPS solutions that can provide not only backup power but also contribute to energy efficiency and system optimization to handle the growing data throughput.

Moreover, the rapid deployment of 5G technology and the Internet of Things (IoT) across the globe increases reliance on data centers, thereby necessitating robust UPS systems to support these advanced technologies. These developments highlight the crucial role of uninterrupted power supply systems in supporting the growth and operational continuity of the IT and Telecommunications industry, further consolidating its lead in the Data Center UPS market.

Impact Of Generative AI

The impact of generative AI on data centers is profound and multi-faceted, particularly as these technologies become more integrated into various sectors, demanding substantial computational power and thus, influencing data center operations significantly.

Generative AI applications are creating a new demand for data centers that is comparable to the rise of cloud computing. This new demand is driving significant changes in how data centers are designed and operated. For instance, the power requirements for data centers are expected to increase markedly due to the high computational demands of generative AI. These AI workloads are not only energy-intensive but also increase the density of data center infrastructure.

Data centers are now facing the need to modernize to accommodate these new technologies. This includes adopting more advanced cooling solutions to manage the heat generated by intense AI workloads. Techniques such as direct-to-chip liquid cooling or even more innovative cooling architectures are becoming necessary. Moreover, the structural design of data centers is evolving to support the greater power and cooling needs.

The generative AI boom is also shifting how data center space is leased and managed, with a noted increase in the leasing activity due to speculative expansion to meet the anticipated needs of AI applications. However, this rush has also introduced challenges, including supply chain constraints and regulatory pressures, which data center operators must navigate.

These challenges are compounded by the need for rapid deployment of AI-capable infrastructures, pushing operators towards more creative and fast-paced project executions. Strategically, data center operators are encouraged to embrace collaboration with technology providers and innovate in their operational approaches to successfully capitalize on the generative AI wave.

Key Market Segments

By Component

- Solution

- Services

By Data Center Size

- Small Data Centres

- Medium Data Centres

- Large Data Centres

By Industry Vertical

- IT and Telecommunications

- BFSI

- Retail

- Manufacturing

- Healthcare

- Government

- Other Industry Verticals

Driver

Increasing Adoption of Edge Computing and IoT

The Data Center UPS market is experiencing robust growth driven by the increasing adoption of edge computing and the Internet of Things (IoT). As businesses push computing power closer to the edge of the network to ensure faster processing and reduced latency in real-time data handling, the need for reliable power solutions in these edge data centers has escalated.

This trend is heightened by the growing IoT applications that require continuous connectivity and real-time data analysis. The increasing volume of data processed at the edge necessitates uninterrupted power supplies to prevent data loss and service disruptions, thus propelling the demand for UPS systems.

Restraint

High Operational and Maintenance Costs

A significant restraint in the Data Center UPS market is the high operational and maintenance costs associated with UPS systems. These systems not only require initial capital but also ongoing maintenance to ensure efficiency and reliability. The costs are further amplified by the need for regular battery replacements and technical upgrades to keep up with the latest technologies.

Additionally, the complexity of managing these systems, especially in large-scale deployments, adds to the total cost of ownership, potentially limiting the adoption among smaller enterprises or those with limited budgets.

Opportunity

Advancements in UPS Technology

There is a substantial opportunity in the development and adoption of more advanced UPS technologies, particularly those that incorporate lithium-ion batteries. These batteries offer a longer life span, higher power density, and faster recharge rates than traditional lead-acid batteries, making them more suitable for modern data center environments.

The shift towards lithium-ion technology can lead to more compact, efficient, and environmentally friendly UPS systems, catering to the increasing demand for green and sustainable data center solutions. This transition presents a significant growth opportunity for UPS manufacturers and data center operators looking to enhance their infrastructure and operational efficiencies.

Challenge

Environmental Concerns and Regulatory Compliance

One of the main challenges facing the Data Center UPS market is addressing environmental concerns and regulatory compliance. Data centers consume a substantial amount of energy, leading to high carbon emissions. As environmental regulations tighten globally, data centers are pressured to reduce their carbon footprint. This requires UPS systems to not only be reliable and efficient but also environmentally friendly.

Meeting these regulatory demands while maintaining service reliability and minimizing costs is a complex challenge for UPS providers and data center operators, as they navigate the balance between technological advancements and environmental responsibilities.

Growth Factors

The Data Center UPS (Uninterruptible Power Supply) market is experiencing robust growth, primarily driven by the increasing reliance on digital services that demand continuous and reliable power supply to prevent data losses and operational disruptions. As businesses and services continue to digitalize, there is a heightened focus on maintaining operational uptime and safeguarding data integrity, which significantly fuels the demand for UPS systems.

Additionally, the expansion of cloud services and the proliferation of data centers, including hyperscale facilities, require advanced power management solutions to handle large volumes of data and ensure seamless operations. The technological advancements in UPS systems, such as the development of modular and scalable UPS solutions, further contribute to the market growth.

These innovations offer greater flexibility and adaptability, accommodating the evolving needs of modern data centers by allowing incremental power capacity adjustments and improved energy efficiency. This adaptability is crucial as it helps data centers scale their operations without extensive overhauls, thus minimizing operational disruptions and downtime risks.

Moreover, the shift towards sustainable and energy-efficient practices in the data center industry is prompting the adoption of UPS systems that align with these goals. Modern UPS systems are designed to optimize power usage, reduce carbon emissions, and lower operational costs, making them an integral component of sustainable data center operations.

Emerging Trends

Emerging trends in the Data Center UPS market are predominantly shaped by the ongoing advancements in technology and the shifting dynamics of data center requirements. One significant trend is the increasing adoption of lithium-ion batteries in UPS systems, which offer longer life spans, faster recharge times, and better performance compared to traditional lead-acid batteries.

This shift enhances the reliability and efficiency of power backup solutions, which is critical for maintaining uninterrupted operations in data centers. Another prominent trend is the integration of IoT and AI technologies into UPS systems. These technologies enable smarter energy management and predictive maintenance capabilities, allowing data center operators to monitor and optimize their power usage proactively.

This integration not only improves the operational efficiency of UPS systems but also enhances their reliability by predicting potential failures and mitigating risks before they lead to downtime. The focus on modular UPS designs is also gaining traction. These systems provide the flexibility to expand power capacity and adapt to changing power needs without significant infrastructure changes, supporting the rapid scaling of data center operations.

Modular UPS systems are particularly appealing because they offer cost-effective scalability and are easier to install and maintain than traditional setups. Additionally, the geographical expansion of data centers into emerging markets presents new opportunities for the UPS market. As these regions experience growth in digital services and infrastructure development, the demand for reliable power backup solutions increases, driving further growth in the global Data Center UPS market.

Business Benefits

Data center UPS (Uninterruptible Power Supply) systems are crucial for maintaining continuous operations and reliability in data centers. They offer immediate power backup during outages, ensuring that critical operations and data integrity are not compromised. This reliability is essential as power interruptions can lead to significant downtime, resulting in substantial financial losses and damage to an organization’s reputation.

The adoption of modular UPS systems has significantly benefited businesses by enhancing flexibility and scalability. These systems allow data centers to add or remove power modules as needed, adapting to changing power requirements without major system overhauls. This adaptability reduces initial capital expenditure and operational costs because facilities can invest in additional capacity only when necessary.

Moreover, modern UPS systems are designed with energy efficiency in mind, incorporating advanced technologies that minimize power wastage and contribute to lower electricity costs. For instance, the use of lithium-ion batteries in UPS systems has grown due to their longer life spans and better performance compared to traditional lead-acid batteries.

These batteries also support quicker recharge times and offer a smaller footprint, which is advantageous in data center environments where space is at a premium. The strategic incorporation of UPS systems aligns with broader corporate sustainability goals.

By reducing the energy consumption and improving the power usage effectiveness (PUE) of data centers, companies can enhance their environmental profiles and comply with increasing regulatory demands for greener operations.

Regional Analysis

The presence of major technology giants and a significant number of data centers in the U.S. and Canada drives demand for reliable UPS systems to ensure uninterrupted service and data protection. Furthermore, North America’s stringent regulatory standards for data security and energy efficiency compel data center operators to invest in high-quality UPS systems, bolstering the market growth.

For instance, In July 2023, ABB India’s Electrification division introduced an innovative UPS solution called MegaFlex DPA specifically designed for data centers in India. This new solution stands out for its commitment to sustainability, significantly reducing energy losses. The MegaFlex DPA employs a decentralized parallel architecture that not only enhances the efficiency of power usage but also supports data centers in achieving their sustainability goals by minimizing environmental impact.

Europe also presents a significant share in the global Data Center UPS market, driven by the increasing number of data centers in response to heightened demand for cloud services and digital transformation initiatives across the continent. Countries like Germany, the UK, and France are leading this expansion.

The APAC region is experiencing rapid growth in the Data Center UPS market, thanks to the burgeoning IT and telecommunications sectors in countries like China, India, and Japan. The region’s growth is fueled by increasing digitalization, rising internet penetration, and substantial investments in infrastructure development.

Latin America’s Data Center UPS market is growing steadily, driven by the digital transformation in sectors such as banking, government services, and telecommunications. Countries like Brazil and Mexico are seeing a rise in data center construction, which in turn is increasing the demand for UPS systems. However, the market’s growth is somewhat hampered by economic volatility and regulatory challenges in the region.

The Middle East and Africa (MEA) are emerging as significant players in the Data Center UPS market. This growth is primarily due to the increasing adoption of cloud computing, big data analytics, and IoT, which necessitate robust data center infrastructures. The Gulf Cooperation Council (GCC) countries, in particular, are investing heavily in building state-of-the-art data centers to support their smart city initiatives and digital transformation strategies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Data Center Uninterruptible Power Supply (UPS) market is supported by a diverse array of prominent companies, each contributing uniquely to the sector. Schneider Electric SE is renowned for its robust and efficient UPS systems, often favored for their innovative, energy-efficient solutions that enhance data center reliability.

Eaton Corporation plc stands out with its comprehensive range of UPS products, designed to ensure uptime and data integrity in facilities of all sizes. Vertiv Group Corp. offers tailored UPS solutions that integrate seamlessly with existing data center infrastructures, emphasizing customization and scalability.

ABB Group is another key player, with a strong focus on modular UPS technology that allows for flexibility and expansion as data center needs grow. Huawei Technologies Co., Ltd. is noted for incorporating advanced technologies in its UPS systems, which are highly regarded for their smart energy management capabilities. Mitsubishi Electric Corporation brings precision engineering to the table, offering UPS systems known for their reliability and longevity.

Legrand Group has made a name for itself with its innovative and eco-friendly UPS solutions that help reduce the overall carbon footprint of data centers. Fuji Electric Co., Ltd. specializes in high-capacity UPS systems, ideal for larger data centers requiring robust power backup solutions. Delta Electronics, Inc. is recognized for its highly efficient UPS systems, which optimize power usage and reduce operational costs.

Top Key Players in the Market

- Schneider Electric SE

- Eaton Corporation plc

- Vertiv Group Corp.

- ABB Group

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Legrand Group

- Fuji Electric Co., Ltd.

- Delta Electronics, Inc.

- Other Key Players

Recent Developments

- In October 2024, Schneider Electric enhanced its position in data centers by acquiring Motivair Corporation, which specializes in advanced liquid cooling solutions. This acquisition is aimed at strengthening their data center operations and expanding their technological capabilities.

- In June 2024, Eaton introduced two advanced products aimed at improving the management and security of power and IT infrastructures within data centers. These products include the Tripp Lite series cloud-connected uninterruptible power supply (UPS) and the NetDirector KVM over IP switches.

Report Scope

Report Features Description Market Value (2023) USD 5.8 Bn Forecast Revenue (2033) USD 12.4 Bn CAGR (2024-2033) 7.9% Largest Market North America Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Data Center Size (Small Data Centers, Medium Data Centers, Large Data Centers), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Manufacturing, Healthcare, Government, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schneider Electric SE, Eaton Corporation plc, Vertiv Group Corp., ABB Group, Huawei Technologies Co., Ltd., Mitsubishi Electric Corporation, Legrand Group, Fuji Electric Co., Ltd., Delta Electronics, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schneider Electric SE

- Eaton Corporation plc

- Vertiv Group Corp.

- ABB Group

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Legrand Group

- Fuji Electric Co., Ltd.

- Delta Electronics, Inc.

- Other Key Players