Global Data Center Cooling Market By Product (Air Conditioners, Precision Air Conditioners, Liquid Cooling, Air Handling Units, Others), By Type (Raised Floors, Non-raised Floors), By Structure (Rack-based Cooling, Row-based Cooling, Room-based Cooling), By Application (IT & Telecom, Retail, Healthcare, BFSI, Energy, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121602

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

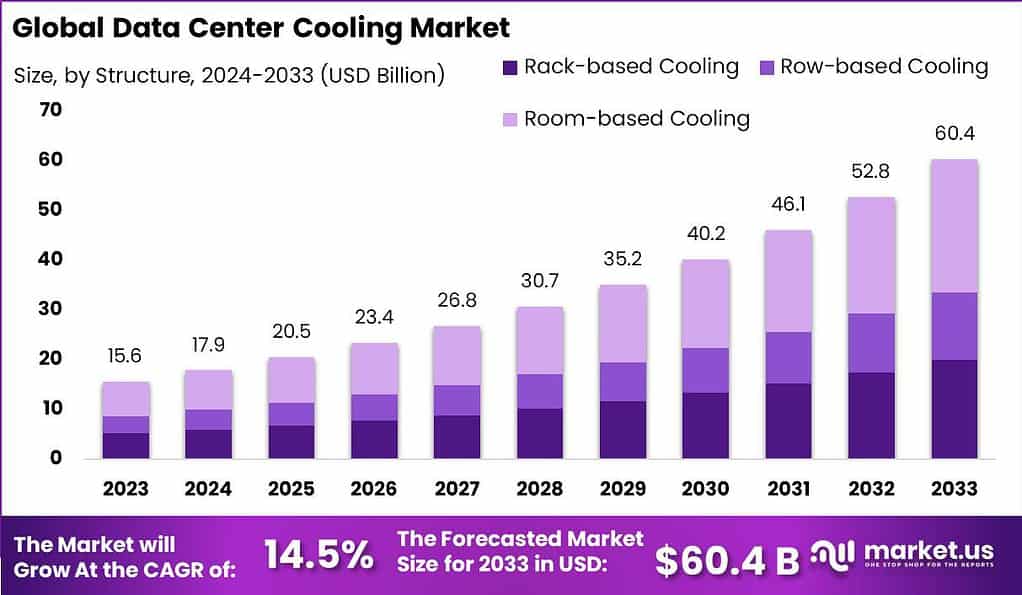

The Global Data Center Cooling Market size is expected to be worth around USD 60.4 Billion By 2033, from USD 15.6 Billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2024 to 2033.

Data centers are a strategic block that has an ability of centralizing the storage, networking and backups of the data for any organizations. An increase in the requirement for upsurge computing capacity of the computer network is being driven by the vast amount of data generated by the companies. This has further contributed to a growth in the energy consumption of the data centers, which has increased the financial and environmental concerns for the firms. These concerns have potentially lead to a need for optimized data center cooling strategies.

The data center cooling market has experienced remarkable growth in recent years, driven by several key factors. The increasing demand for cloud computing, big data analytics, and artificial intelligence has led to the expansion of data centers worldwide. As these data centers grow in size and complexity, the amount of heat generated by the equipment within them also increases, highlighting the crucial need for efficient cooling solutions.

One of the significant growth factors for the data center cooling market is the rising power density of IT equipment. Modern servers and networking devices are becoming more powerful and compact, resulting in higher heat dissipation. To ensure the reliable and optimal performance of these devices, data center operators are investing in advanced cooling technologies to effectively remove heat and maintain a consistent temperature.

Another driver for the market is the growing emphasis on energy efficiency and sustainability. Data centers consume substantial amounts of energy, and cooling is a significant contributor to their power consumption. As organizations strive to reduce their environmental impact and operational costs, they are seeking innovative cooling solutions that offer higher energy efficiency and lower carbon footprints. This demand has created opportunities for companies providing energy-efficient cooling equipment and services.

Despite the growth prospects, the data center cooling market also faces a set of challenges. One of the main challenges is the complexity of cooling large-scale data centers. As data centers continue to scale up in size, it becomes increasingly challenging to distribute cooling effectively and maintain uniform temperature and humidity levels across the facility. This requires sophisticated cooling designs and strategies to overcome hotspots and ensure efficient heat removal.

Moreover, the rapid advancements in IT infrastructure and the increasing adoption of new technologies pose a challenge for data center cooling. Emerging technologies such as high-performance computing, artificial intelligence, and edge computing are pushing the boundaries of traditional cooling methods. Data center cooling systems need to adapt to the evolving IT landscape and provide effective cooling solutions for the next generation of hardware and workloads.

These challenges present opportunities for new entrants in the data center cooling market. Companies that can develop innovative cooling technologies, such as liquid-based cooling systems or intelligent cooling management software, have the potential to capture market share. Additionally, there is room for consulting and professional services providers who can offer expertise in designing and optimizing cooling solutions for data centers.

According to survey, the data center cooling market is anticipated to achieve a substantial growth, reaching USD 26.8 billion by 2027, with a Compound Annual Growth Rate (CAGR) of 14.5% during the forecast period. This growth underscores the increasing demand for efficient cooling solutions as data centers become pivotal in managing the burgeoning data requirements globally.

In terms of environmental impact, data centers are set to become more significant contributors to carbon emissions. By 2025, it is projected that they will be responsible for 3.2% of global carbon emissions, emphasizing the need for sustainable practices within this sector.

Analyzing the product segments within the market, chillers emerged as a dominant technology, representing about 60% of the total market in 2019. This highlights their crucial role in traditional data center cooling strategies. Furthermore, it is reported that over 80% of data centers employ room-based cooling methods, indicating a widespread adoption of conventional cooling techniques.

However, the energy efficiency of these cooling systems remains a pressing issue, as approximately 40% of the total energy consumed by data centers is attributed to cooling operations. This significant figure underscores the urgency and opportunity for innovations in energy-efficient cooling technologies to mitigate environmental impacts and reduce operational costs.

Key Takeaways

- The Data Center Cooling Market size is estimated to reach USD 60.4 billion in the year 2033 with a CAGR of 14.5% during the forecast period and was valued at USD 15.6 billion in the year 2023.

- Based on the product type, the Air Conditioners segment has dominated the market with a share of 32.5% in the year 2023.

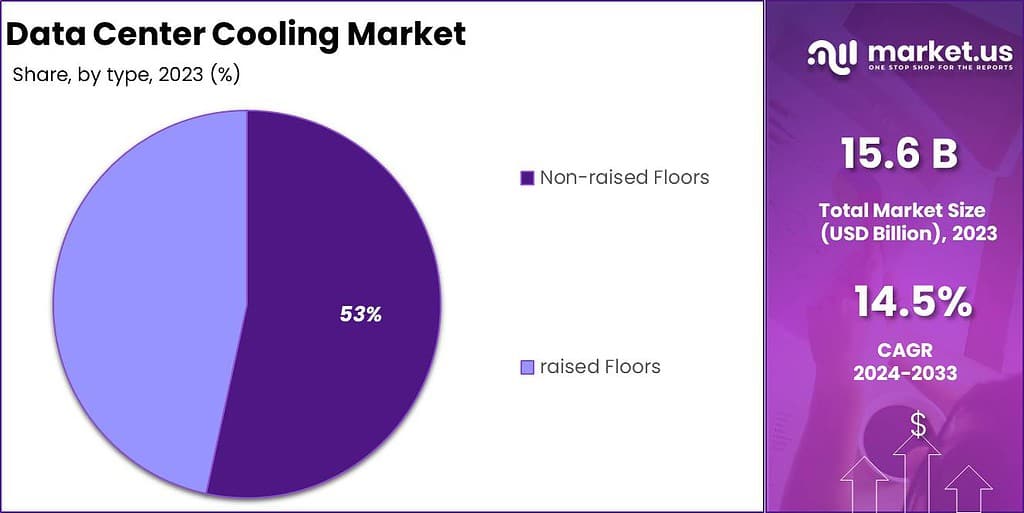

- Based on the Type, the Non-Raised Floors segment has dominated the market with a share of 53.4% in the year 2023.

- Based on the Structure, the Room-based Cooling segment has dominated the market with a share of 44.5% in the year 2023.

- Based on the Application, the IT & Telecom segment has dominated the market with a share of 24.3% in the year 2023.

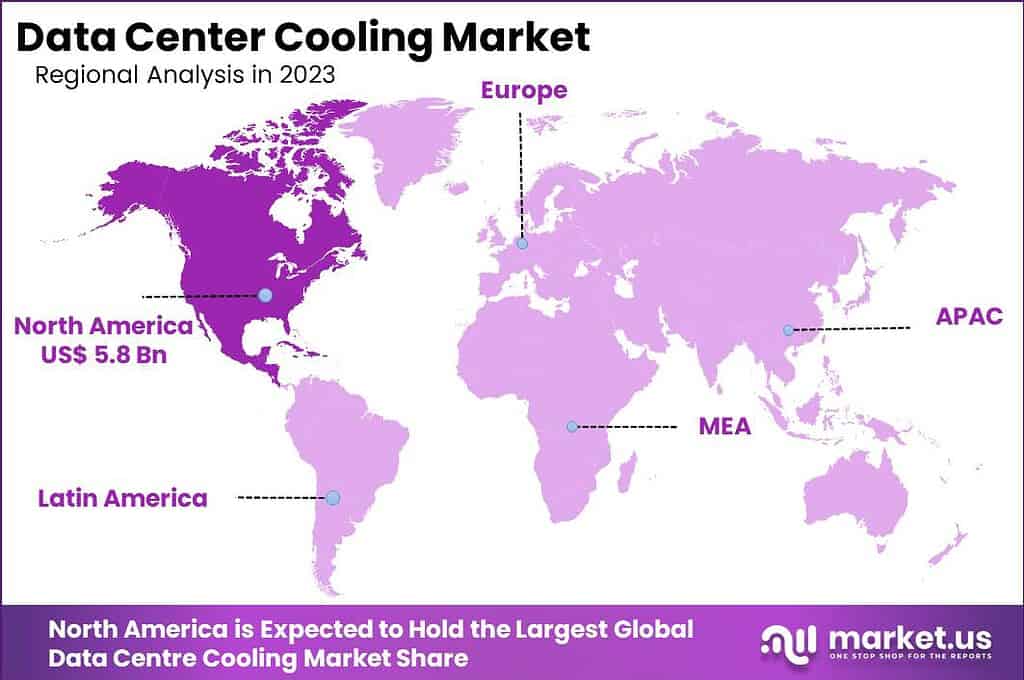

- In 2023, North America held a dominant market position in the data center cooling industry, capturing more than a 37.8% share with revenues reaching approximately USD 5.8 billion.

Product Type Analysis

In 2023, the Air Conditioners segment held a dominant market position in the Data Center Cooling market, capturing more than a 32.5% share. This leadership can be attributed to the essential role air conditioners play in maintaining optimal operational temperatures and humidity levels within data centers. As data centers continue to expand and deal with increasing heat loads due to high-performance computing and 24/7 operational demands, the need for efficient and reliable cooling solutions like air conditioners has intensified.

Air conditioners are preferred for their straightforward installation and maintenance, compatibility with various data center sizes, and ability to offer precise temperature control. This segment’s growth is bolstered by the rising adoption of modular data centers, which often require flexible and scalable cooling solutions that traditional air conditioning systems can provide.

Moreover, technological advancements have led to the development of energy-efficient air conditioning units that significantly reduce operational costs and are more environmentally friendly, further driving their adoption. Furthermore, the regulatory push towards energy efficiency and sustainability in data center operations has encouraged companies to invest in advanced air conditioning solutions.

Market trends indicate a growing inclination towards air conditioners that incorporate smart technologies such as Internet of Things (IoT) connectivity and automated control systems, which enhance cooling efficiency and data center management. This tech-driven approach not only optimizes cooling processes but also aligns with global standards for energy consumption and carbon footprint reduction, ensuring the continued dominance of the Air Conditioners segment in the Data Center Cooling market.

Type Analysis

In 2023, the Non-raised Floors segment held a dominant market position in the Data Center Cooling market, capturing more than a 53.4% share. This segment’s leadership is largely due to its flexibility and cost-effectiveness, which make it suitable for various data center designs and sizes. Unlike raised floors, non-raised floor solutions do not require a structural platform above the original floor, which reduces initial construction costs and simplifies maintenance.

Non-raised floor systems often utilize overhead cooling distribution, which can be more efficient in managing the heat load in modern high-density data centers. These systems allow for targeted cooling, where cool air is directed precisely where it is needed most, thus reducing energy consumption and enhancing overall cooling efficiency. This method also provides easier access for maintenance and upgrades, as there is no need to dismantle floor panels, a common requirement in raised floor environments.

The increasing trend towards modular and scalable data centers has further fueled the growth of the Non-raised Floors segment. These data centers favor the adaptability of non-raised floor cooling systems, which can be seamlessly integrated with other cooling solutions such as in-row or in-rack cooling to handle higher heat densities effectively.

Additionally, as data centers evolve towards more sustainable operations, the energy efficiency and lower environmental impact of non-raised floor systems align well with global regulatory standards, ensuring their continued market prominence.

Structure Analysis

In 2023, the Room-based Cooling segment held a dominant market position in the Data Center Cooling market, capturing more than a 44.5% share. This segment’s prominence stems from its ability to provide comprehensive cooling solutions that are effective across the entire data center. Room-based cooling systems are designed to manage the ambient environment of the data center rather than focusing on specific hotspots, ensuring a uniformly controlled climate that is critical for the stable operation of all installed IT equipment.

Room-based cooling is favored in scenarios where reliability and redundancy are critical. These systems can be configured in N+1 setups (where one additional backup unit is available) ensuring that cooling is maintained even if one unit fails. Additionally, the centralized nature of room-based cooling simplifies management and maintenance, as it reduces the complexity of having multiple localized systems. This can lead to lower operational costs and increased ease of scalability as data center needs grow.

Moreover, the continued expansion of larger data centers that require consistent environmental conditions across extensive square footage has bolstered the demand for room-based cooling. Technological advancements have also enhanced the efficiency of these systems, incorporating features like variable speed fans and energy recovery ventilators, which significantly reduce energy consumption. This efficiency is crucial as data centers are increasingly driven to lower their carbon footprint and operational costs in response to global energy efficiency standards, ensuring the ongoing dominance of the Room-based Cooling segment in the market.

Application Analysis

In 2023, the IT & Telecom segment held a dominant market position in the Data Center Cooling market, capturing more than a 24.3% share. This segment’s leadership is driven by the rapid growth and expansion of data centers necessary to support the escalating data traffic and complex network operations associated with global IT and telecommunications services. As these industries continue to require high uptime and robust infrastructure to manage vast amounts of data, effective cooling systems become essential to prevent overheating and ensure continuous, reliable service.

The demand within the IT & Telecom segment for data center cooling solutions is fueled by the continuous deployment of cloud-based solutions, increasing reliance on internet-based services, and the rollout of 5G networks, which necessitate advanced data processing capabilities and, consequently, more intensive cooling. These technologies generate significant heat, which requires efficient and effective cooling systems to maintain optimal server performance and prevent hardware damage.

Moreover, the IT & Telecom industry’s push towards sustainability has led to an increased focus on energy-efficient cooling solutions. Innovations such as liquid cooling and smart cooling systems that dynamically adjust to the heat load are particularly appealing in this segment. These solutions not only provide the necessary cooling capacity but also significantly reduce the energy consumption of data centers, aligning with global trends towards environmental responsibility and lower operational costs, thereby supporting the ongoing prominence of the IT & Telecom segment in the Data Center Cooling market.

Key Market Segments

By Product type

- Air Conditioners

- Precision Air Conditioners

- Liquid Cooling

- Air Handling Units

- Others

By Type

- Raised Floors

- Non-raised Floors

By Structure

- Rack-based Cooling

- Row-based Cooling

- Room-based Cooling

By Application

- IT & Telecom

- Retail

- Healthcare

- BFSI

- Energy

- Others

Drivers

Growing Demand for Cloud Services

The data center cooling market is experiencing robust growth, primarily driven by the escalating demand for cloud computing services. As businesses increasingly adopt cloud technologies for better scalability, efficiency, and cost-effectiveness, the need for advanced data center infrastructure intensifies. Efficient cooling systems are essential to manage the heat generated by high-density computing in these data centers, ensuring reliable and continuous operation.

Innovations such as AI-driven optimization and advanced cooling techniques like liquid cooling further support this trend by enhancing the effectiveness and sustainability of data center operations. This driver is reinforced by the ongoing technological advancements and the shift towards more sophisticated cooling solutions that align with the evolving requirements of modern data centers

Restraints

Higher cost of investment

The increased cost of investment brings a substantial restraint for the global data center cooling market. Executing advanced cooling solutions, including liquid cooling systems and energy-efficient technologies, necessitates considerable capital expenditure. For example, the implementation of innovative cooling technologies comprises the acquisition of sophisticated equipment thus the costs related with the installation, incorporation, and potential retrofitting of present data center infrastructures is higher.

Furthermore, the preservation and operational costs of advanced cooling systems can be high. Consistent servicing, the requirement for specialized workers, and the continuing energy costs contribute to the complete financial burden on data center operators. This is predominantly stimulating for small and medium-sized enterprises (SMEs) as they may not have the financial flexibility to capitalize in high-cost cooling solutions, thus restraining their capability to scale and compete effectually.

Opportunities

High-Performance Computing (HPC)

The rise of high-performance computing (HPC) applications, such as artificial intelligence and machine learning, presents a significant opportunity in the data center cooling market. These applications require substantial computational power and generate immense heat, necessitating efficient cooling solutions to maintain optimal performance.

The integration of liquid cooling technologies, capable of managing the intense heat generated by HPC workloads, is gaining traction. This convergence of HPC growth and innovative cooling technologies like liquid cooling is expected to drive considerable market expansion, catering to the need for more powerful and efficient data centers.

For instance, In December 2023, Sunon unveiled a new line of liquid cooling solutions designed for high-capacity computing in data centers, including GPU and CPU systems used in edge computing, AI, and cloud servers. These innovative cooling technologies are tailored to boost performance and efficiency, addressing the intensive heat management needs of high-performance computing environments.

Challenges

Environmental Concerns and Operational Efficiency

Environmental sustainability poses a major challenge to the data center cooling market. The energy-intensive nature of traditional cooling methods and their impact on the environment push for the development of greener cooling technologies. Data center operators face the dual challenge of reducing energy consumption and minimizing environmental impact, all while ensuring high operational efficiency.

Addressing these challenges involves innovating and adopting energy-efficient and environmentally friendly cooling solutions, such as using natural coolants or improving the efficiency of existing cooling systems. This shift not only aligns with global sustainability goals but also helps in reducing operational costs in the long term

Growth Factors

- Increasing Demand for Data Storage and Handling: The exponential growing of data produced by businesses, social media, IoT devices, and digital services requires the growth of data centers, which in turn drives the demand for well-organized cooling solutions.

- Technological Developments: The implementation of advanced cooling technologies, such as liquid cooling and AI-driven climate control systems, improves cooling efficacy and decreases operational costs, nurturing market growth.

- Energy Effectiveness and Sustainability Advantages: Growing focus on energy-efficient and sustainable cooling solutions, driven by environmental guidelines and corporate sustainability goals, is boosting the adoption of advanced cooling technologies in data centers.

- Development of Cloud Services: The rising adoption of cloud computing services and the necessity for large-scale data centers to provision of cloud infrastructure knowingly increase the demand for advanced cooling systems.

- Advance in IT & Telecom Sector: The IT and telecom industries, which are main consumers of data center services, are increasing rapidly, thus driving the necessity for actual cooling solutions to achieve high-density computing environments.

Latest Trends

- Implementation of Liquid Cooling Systems: Liquid cooling systems are becoming more predominant due to their larger competence in handling the heat generated by high-density servers. These systems use water or particular coolants to disperse heat more efficiently than traditional air cooling approaches.

- Augmented Focus on Energy Efficiency: With increasing concerns over energy consumption and environmental influence, data centers are progressively accepting energy-efficient cooling solutions. This comprises the use of free cooling methods, which apply ambient external air to decrease confidence on energy-intensive mechanical cooling.

- Integration of AI and IoT Technologies: Progressive cooling systems are leveraging AI and IoT for real-time monitoring and predictive maintenance. These technologies help enhance cooling performance, decrease energy usage, and preventively address potential issues.

- Development of Modular and Prefabricated Solutions: Modular and assembled data center cooling solutions are ahead traction due to their scalability, rapid deployment, and cost-effectiveness. These systems permit for calmer development and addition with current infrastructure.

- Sustainability and Green Advantages: There is a rising importance on sustainability, with data centers accepting eco-friendly cooling technologies that diminish carbon footprint and water usage. Inventions such as geothermal cooling and advanced control policies are part of this trend.

Regional Analysis

In 2023, North America held a dominant market position in the data center cooling industry, capturing more than a 37.8% share with revenues reaching approximately USD 5.8 billion. This leadership can be attributed to the region’s rapid adoption of advanced technologies and a robust digital infrastructure.

North American data centers, notably in the U.S. and Canada, are at the forefront of implementing innovative cooling solutions that are not only efficient but also environmentally sustainable. This is in response to the increasing computational demands from industries such as IT & telecom, healthcare, and financial services, which require reliable and effective cooling to ensure optimal operation of data centers.

Moreover, the presence of major technology giants and a well-established data center ecosystem further contribute to the growth of the data center cooling market in North America. Companies in this region are pioneering in the adoption of green technologies, including liquid cooling and advanced air management solutions, which significantly enhance the energy efficiency of data centers.

This trend is supported by stringent regulatory standards and a growing emphasis on reducing carbon footprints, driving innovation and investments in the data center cooling sector. As a result, North America is expected to maintain its leadership by setting benchmarks in both technological advancement and sustainability practices in data center operations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The data center cooling market is characterized by the presence of several influential players, each contributing to the technological advancements and market dynamics with their unique solutions and services. Vertiv Holdings Co. is renowned for its comprehensive range of cooling systems, which are pivotal in enhancing the operational efficiency of data centers globally. Asetek has gained prominence with its liquid cooling solutions that cater specifically to high-density computing environments, offering significant energy and cost efficiencies.

Rittal GmbH and STULZ GMBH are another pair of heavyweights in the market, both offering a variety of cooling technologies that include precision air conditioning systems and customized cooling units designed to meet the rigorous demands of modern data centers. Schneider Electric brings to the table integrated cooling infrastructure, known for its reliability and energy efficiency, which aligns well with today’s green initiatives.

Fujitsu stands out with its array of IT infrastructure solutions that optimize air flow and improve cooling efficiencies, catering to both small and large-scale data centers. Coolcentric and Daikin Industries Ltd. contribute with their innovations in air management solutions and HVAC systems, respectively, which are critical in maintaining the delicate temperature balance required for data center operations.

Top Key Players in the Market

- Vertiv Holdings Co.

- Asetek

- Rittal GmbH

- STULZ GMBH

- Schneider Electric

- Fujitsu

- Coolcentric

- Daikin Industries Ltd.

- LiquidStack Holdings B.V

- Nortek Air Solutions

- Other Key Players

Recent Developments

- In March 2023, Asetek made an announcement about their new collaboration with TEAMGROUP, an original equipment manufacturer (OEM) partner. Together, they introduced the T-FORCE SIREN GA360 CPU Cooler, which utilizes Asetek’s advanced liquid cooling technology. This cooler is designed to help computer enthusiasts enhance their CPU’s performance by overclocking it, while gamers can enjoy stable and reliable operation for an immersive gaming experience.

- Moving on to October 2023, Schneider Electric revealed their investment of USD 1.2 million in a partnership with the Sustainable Tropical Data Centre Testbed (STDCT). This testbed is located at the National University of Singapore (NUS) and is supported by the National Research Foundation of Singapore. The collaboration involves a group of business partners who aim to explore sustainable solutions for tropical data centers.

- Lastly, in May 2023, Vertiv Group Corp. introduced the Liebert PKDX, a new thermal management unit specifically designed for data centers. This unit includes various components such as rack sensors, intelligent controls, and a central optimizing system control. The Liebert PKDX aims to streamline the management of heat within data centers, helping optimize their performance and efficiency.

- In December 2023, Vertiv has acquired CoolTera Ltd., to strengthen Vertiv’s capabilities and support the deployment of AI.

- In November 2023, Schneider Electirc and Compass Datacenters have expanded its collaboration to deliver and manufacture the prefabricated modular data centre solutions.

Report Scope

Report Features Description Market Value (2023) USD 15.6 Bn Forecast Revenue (2033) USD 60.4 Bn CAGR (2024-2033) 14.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Air Conditioners, Precision Air Conditioners, Liquid Cooling, Air Handling Units, Others), By Type (Raised Floors, Non-raised Floors), By Structure (Rack-based Cooling, Row-based Cooling, Room-based Cooling), By Application (IT & Telecom, Retail, Healthcare, BFSI, Energy, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Vertiv Holdings Co., Asetek, Rittal GmbH, STULZ GMBH, Schneider Electric, Fujitsu, Coolcentric, Daikin Industries Ltd., LiquidStack Holdings B.V, Nortek Air Solutions, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the data center cooling market?The data center cooling market encompasses the technologies and systems used to manage and regulate the temperature within data centers. This is critical to ensure that the electronic equipment within the data centers operates efficiently and does not overheat.

What is the current size of the data center cooling market?The Global Data Center Cooling Market size is expected to be worth around USD 60.4 Billion By 2033, from USD 15.6 Billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Data Center Cooling Market?Increasing data center construction, rising demand for energy-efficient cooling solutions, and the proliferation of cloud computing and big data.

What are the current trends and advancements in Data Center Cooling Market?Adoption of liquid cooling systems, use of AI for cooling optimization, and development of green data centers.

What are the major challenges and opportunities in the Data Center Cooling Market?High initial costs of advanced cooling technologies, energy consumption concerns, and opportunities in renewable energy integration and cooling innovations.

Who are the leading players in the Data Center Cooling Market?Vertiv Holdings Co., Asetek, Rittal GmbH, STULZ GMBH, Schneider Electric, Fujitsu, Coolcentric, Daikin Industries Ltd., LiquidStack Holdings B.V, Nortek Air Solutions, Other Key Players

Data Center Cooling MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Data Center Cooling MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Vertiv Holdings Co.

- Asetek

- Rittal GmbH

- STULZ GMBH

- Schneider Electric

- Fujitsu

- Coolcentric

- Daikin Industries Ltd.

- LiquidStack Holdings B.V

- Nortek Air Solutions

- Other Key Players