Global Cyber Security Market Size, Share, Industry Analysis Report By Component (Hardware, Software (Unified Threat Management (UTM), Intrusion Detection System/Intrusion Prevention System (IDS/IPS), Data Loss Prevention (DLP), Identity and Access Management (IAM), Security Information and Event Management (SIEM), Risk and Compliance Management, and Others), Services (Professional Services, and Managed Services)), By Security Type (Endpoint Security, Cloud Security, Network Security, Application Security, Data Security), By Deployment (Cloud, and On-premises), By Organization Size (Large Enterprises, and SMEs), By Industry Vertical (IT & Telecom, Automotive, BFSI, Retail, Healthcare, Government, Manufacturing, and Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 21477

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Cyber Security Statistics

- Role of Generative

- U.S. Cyber Security Market Size

- Component Segment Analysis

- Security Type Segment Analysis

- Deployment Segment Analysis

- Organization Size Segment Analysis

- Industry Vertical Analysis

- Key Market Segments

- By Geography

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Top Use Cases

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

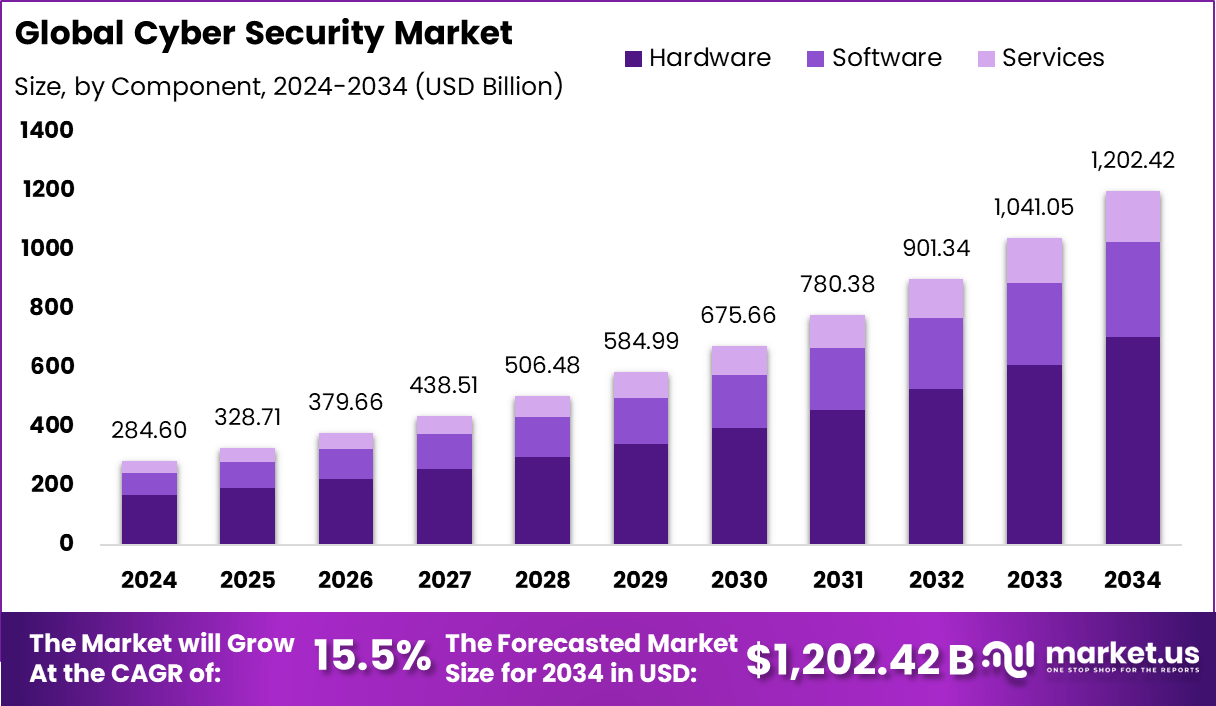

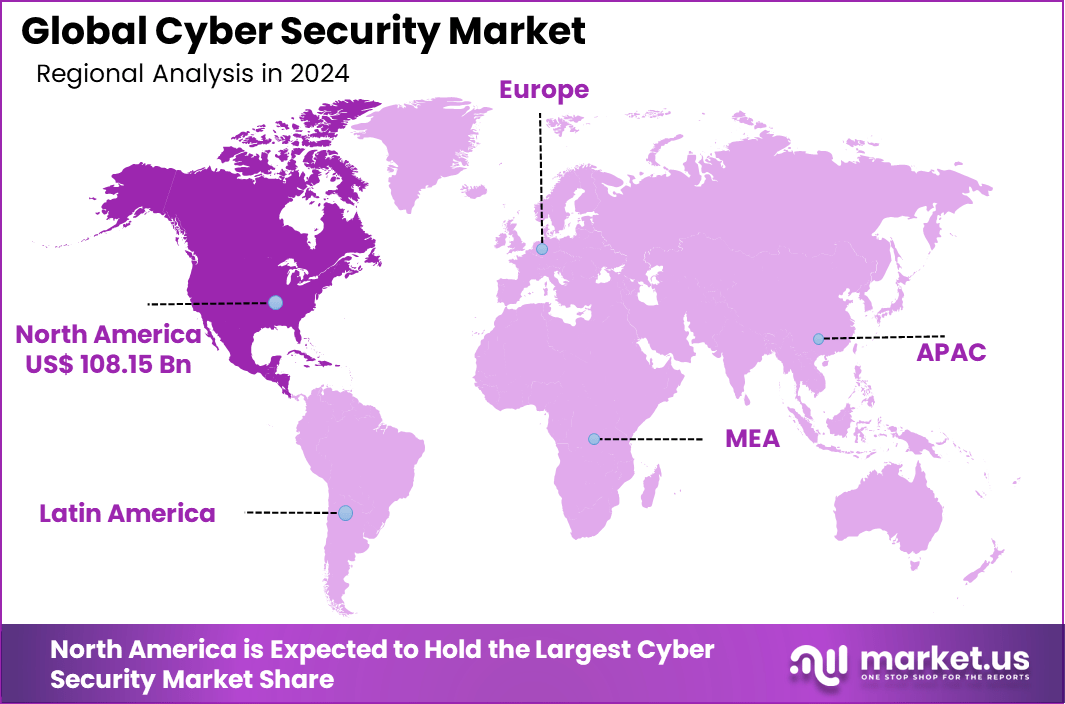

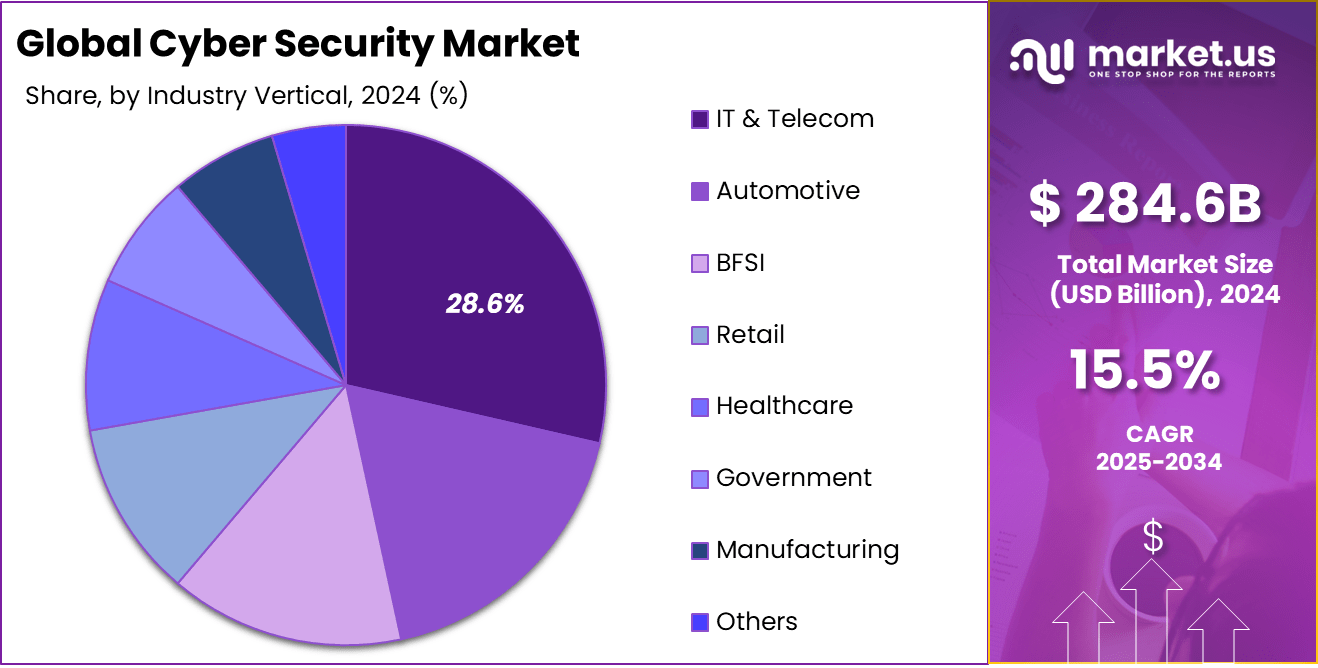

The global Cyber Security market size accounted for USD 284.60 billion in 2024 and is predicted to increase from USD 1,126.36 billion in 2025 to approximately USD 7,473.05 billion by 2034, expanding at a CAGR of 15.50% from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.5% share, holding USD 108.15 Billion revenue.

The cybersecurity market consists of products and services designed to protect digital systems, networks, devices, and data from unauthorized access, attacks, damage, or disruption. It includes security software (firewalls, antivirus, intrusion detection, encryption), security services, identity and access management, cloud security, endpoint security, governance risk and compliance (GRC) tools, and specialized offerings for sectors such as industrial, IoT, OT, and critical infrastructure.

According to VikingCloud, cybercrime could cost businesses $10.5 trillion by 2025 and may rise to $15.63 trillion by 2029. About 72% of business owners are concerned about risks tied to hybrid and remote work. While 74% of businesses feel confident in detecting and responding to attacks in real time, confidence is stronger among 81% of C-suite leaders compared to 66% of front-line managers. Generative AI is reshaping cybersecurity risks, with 97% of companies reporting related issues or breaches.

Based on data from Cybersecurity Ventures, the cost associated with cybercrime reached $8 trillion in 2023, equating to an average of over $250,000 per second. This substantial economic burden is projected to grow further, with annual costs expected to rise to $10.5 trillion by 2025. Concurrently, there is a growing awareness among the public and organizations regarding cybersecurity measures, which is a positive trend amidst the rising threat landscape.

As per Ipsos analysis, cyber fraud remains a significant threat, particularly in the realm of online financial activities. In 2023, nearly one in three Americans reported falling victim to online financial fraud. The incidence of fraud was notably higher among individuals aged 35 to 54, with 36% reporting victimization. This is in stark contrast to younger Americans, aged 18 to 34, among whom only 22% reported such experiences.

Key Takeaways

- The Hardware segment dominated with 58.7% share, reflecting the strong demand for physical security infrastructure.

- Endpoint Security led the security solutions with 33.7% share, showing its critical role in protecting end-user devices.

- By deployment, On-premises solutions accounted for 62.5%, highlighting continued reliance on in-house setups for sensitive data protection.

- By enterprise size, Large Enterprises dominated with 70.3%, underscoring their greater investments in advanced security systems.

- By end-use industry, IT & Telecom led with 28.6%, showcasing its high need for robust cyber protection.

- Regionally, North America captured 39.5% of the market, with the U.S. alone valued at USD 306.46 billion and registering a strong CAGR of 20.2%.

Cyber Security Statistics

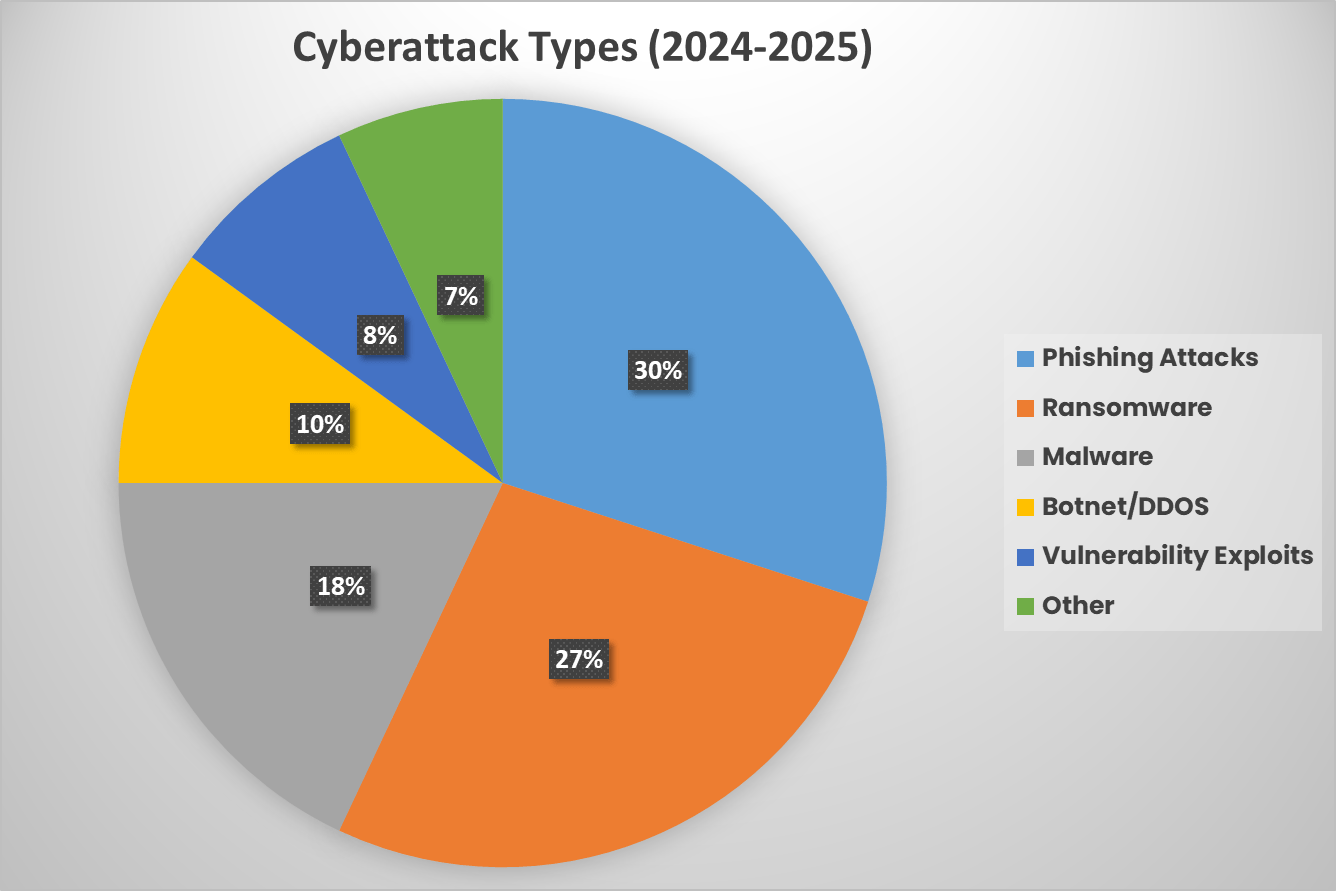

- As per Forbes Advisor report, In 2023, 2,365 cyberattacks were recorded globally, impacting 343,338,964 victims, highlighting the scale of cyber threats worldwide. The average cost of a data breach in 2024 reached $4.88 million, underlining the financial implications of security breaches. Email remained a significant attack vector, with 35% of malware being delivered via email in 2023, and 94% of organizations reported email security incidents.

- According to the IASME report: 76% of organizations that obtained Cyber Essentials certification found it beneficial, with 87% recommending it to others. This certification is particularly crucial for those engaged in UK government contracts. Organizations certified under Cyber Essentials were 60% less likely to file cyber insurance claims, indicating a notable reduction in perceived risk. Over 50% of small enterprises reported no issues implementing the required technical controls for Cyber Essentials, suggesting accessibility for smaller businesses.

- The total cost of cybercrime globally in 2023 was a staggering $8 trillion, with projections suggesting it will reach $10.5 trillion by 2025. On average, businesses lost $1.3 million due to cybercrime in 2023.

- Norton’s Cyber Safety Insights Report also revealed that 77% of Americans have taken steps to protect their personal data online. Phishing remains a key threat, with over 75% of targeted cyberattacks in 2024 originating from emails.

- Additionally, 17% of attacks target vulnerabilities in web applications, with 98% of web applications being vulnerable to attacks that can result in malware or redirection to malicious sites. Notably, 50% of companies outsource their cybersecurity operations to specialized centers.

Role of Generative

Generative AI is reshaping the landscape of cybersecurity by enhancing both defensive capabilities and the potential for new types of cyber threats. In 2024, as the adoption of generative AI in cybersecurity has increased, its role has become more pronounced in several key areas:

- Threat Identification: Generative AI significantly boosts the efficiency of cybersecurity operations, particularly in threat identification. By training on large datasets, these AI models can understand and replicate complex patterns found in cybersecurity threats, enabling them to predict and identify potential security breaches before they occur.

- Enhancing Security Operations: Generative AI models like GPT (Generative Pre-trained Transformer) are also used to streamline the operations of cybersecurity teams. They help in automating routine tasks such as data analysis and summarization, which frees up security analysts to focus on more complex challenges. This can lead to more efficient detection and response processes, and a reduction in the time required to address security incidents.

- Dual-Use Concerns: While generative AI offers substantial benefits, it also presents new challenges. The same technology that can enhance security measures can also be used by cybercriminals to create sophisticated malware and attack strategies. This dual use of generative AI technology necessitates a balanced approach in its deployment, ensuring that cybersecurity defenses evolve in tandem with emerging threats.

- Data Privacy and Ethical Use: The deployment of generative AI in cybersecurity must carefully consider ethical implications, particularly regarding data privacy. Training AI models requires access to vast amounts of data, which must be handled responsibly to avoid privacy violations and ensure that the use of such technologies is compliant with legal and ethical standards.

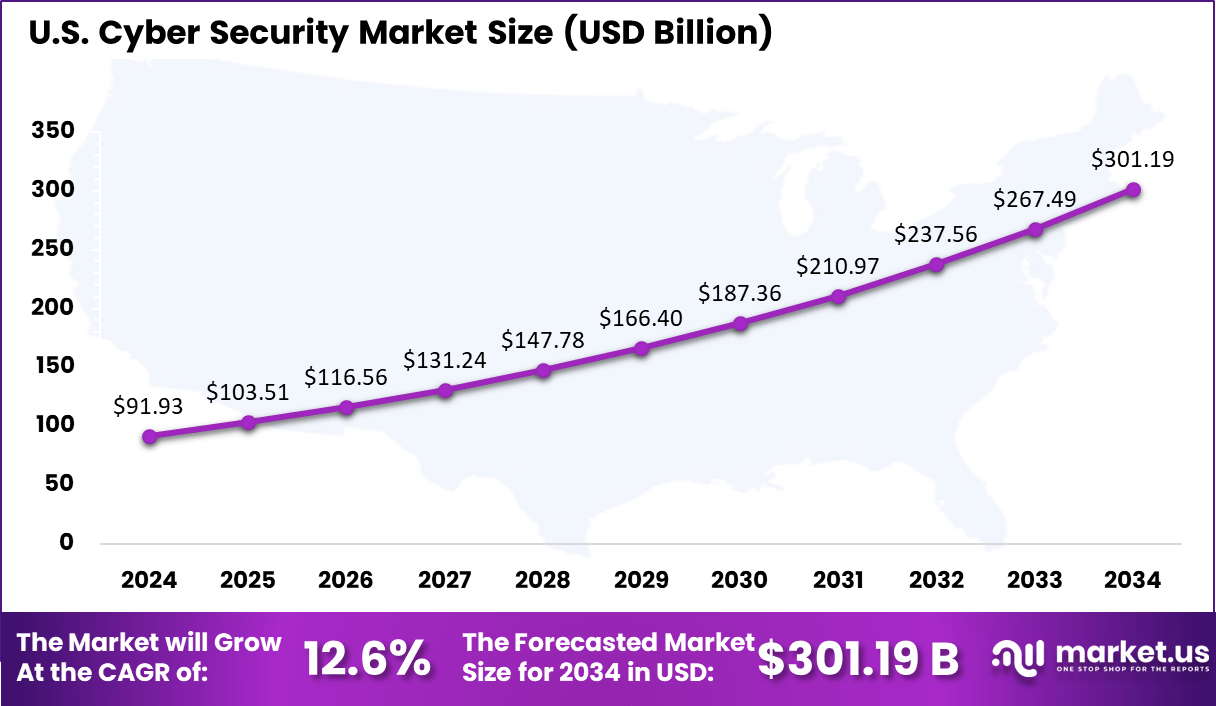

U.S. Cyber Security Market Size

The US Cyber Security Market was valued at USD 91.93 Billion in 2024, with a robust CAGR of 12.6%. The U.S. cybersecurity market is characterized by increasing demand for advanced security solutions due to rising cyber threats and regulatory requirements.

As cyber-attacks become more sophisticated, businesses are investing heavily in cybersecurity measures to protect sensitive data, intellectual property, and infrastructure. Key trends include the growing adoption of Artificial Intelligence (AI) and machine learning (ML) for threat detection, as well as the expansion of cloud security solutions to support remote work environments.

The shift towards Zero Trust Architecture (ZTA), end-point security, and multi-factor authentication (MFA) is accelerating. Additionally, the market is seeing a rise in demand for Managed Security Service Providers (MSSPs) and Security Operations Centers (SOCs) to help businesses mitigate risks. Increasing awareness, regulatory pressures, and the need for stronger defenses against evolving cyber threats are driving growth across industries such as finance, healthcare, and government.

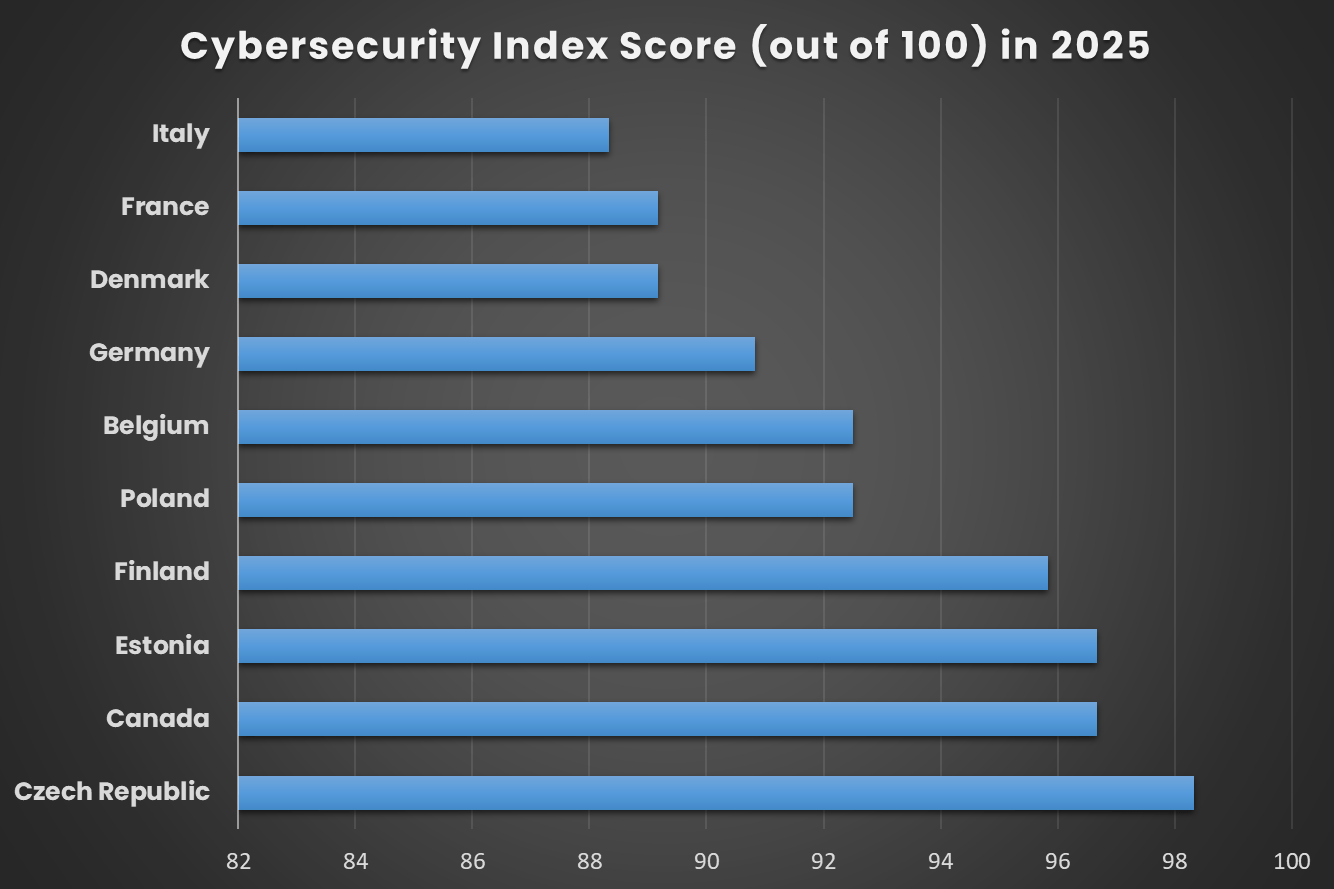

In 2024, North America held a dominant market position in the global Cyber Security Market, capturing more than a 38.0% share. This leadership can be attributed to several factors, including the high concentration of leading cyber security firms headquartered in the region, such as IBM, Symantec, and McAfee, which drive innovation and development in cyber security solutions.

The presence of these industry giants supports a robust cyber security ecosystem, fostering advancements and adoption of cutting-edge technologies. The dominance of North America in the cyber security market is also bolstered by the stringent regulatory framework that governs data protection and privacy in the region.

Laws and regulations such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) mandate businesses to adopt stringent cyber security measures. This regulatory pressure has led to increased investment in cyber security solutions across industries, ensuring the protection of sensitive information against potential cyber threats.

Component Segment Analysis

In 2024, the Hardware segment held a dominant market position, capturing more than a 58.7% share of the Global Cyber Security Market due to its foundational role in ensuring secure infrastructure. Hardware solutions, such as firewalls, intrusion detection systems (IDS), and hardware security modules (HSMs), provide a robust defense mechanism against cyber threats.

These solutions are essential in protecting sensitive data and securing physical access points in networks, making them a crucial element for enterprises and government agencies. The growing need for advanced threat detection and encryption technologies has also boosted demand for hardware-based security tools. Additionally, hardware security is vital in industries where data integrity is paramount, such as banking, healthcare, and telecommunications.

Hardware devices are often more reliable than software solutions alone because they provide physical isolation from potential breaches, making them harder to manipulate. The increase in cyber-attacks, regulatory pressures, and the adoption of IoT devices and smart technologies are further propelling the demand for hardware-based cybersecurity solutions. This combination of factors has solidified the dominance of the hardware segment in the cybersecurity market.

Security Type Segment Analysis

In 2024, the Endpoint Security segment held a dominant market position, capturing more than a 33.7% share of the Global Cyber Security Market. Endpoint security solutions are designed to protect devices such as laptops, smartphones, desktops, and servers from cyber threats.

This segment is rapidly growing due to the increasing use of remote work, the proliferation of mobile devices, and the rise in endpoint-targeted attacks like malware and ransomware. As organizations adopt digital transformation strategies, the attack surface expands, making endpoint devices prime targets for cybercriminals. The dominance of endpoint security is driven by its effectiveness in preventing unauthorized access, malware infections, and data breaches.

With the rise of the Internet of Things (IoT) and BYOD (Bring Your Own Device) policies, businesses face a higher volume of devices needing protection. Additionally, advanced endpoint protection technologies, such as AI-driven threat detection, behavioral analysis, and real-time monitoring, are making endpoint security solutions more essential for businesses to mitigate risks and ensure comprehensive defense.

Deployment Segment Analysis

In 2024, the On-premises segment held a dominant market position, capturing more than a 62.5% share of the Global Cyber Security Market. The on-premises deployment segment continues to dominate the global cybersecurity market due to several key factors. Organizations often prefer on-premises solutions to maintain complete control over their sensitive data and critical infrastructure.

This setup offers enhanced security as businesses can directly manage and customize their cybersecurity measures to fit unique organizational needs. With rising concerns over data privacy and compliance, industries such as finance, healthcare, and government prioritize on-premises deployments to meet stringent regulations, including GDPR and HIPAA.

Additionally, businesses with legacy systems or complex IT infrastructures may find on-premises cybersecurity solutions more compatible with their existing setups. On-premises deployment allows organizations to have greater visibility and response times in managing security incidents, which is vital for minimizing potential risks.

Organization Size Segment Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing more than a 70.3% share of the Global Cyber Security Market due to their heightened vulnerability to sophisticated cyber-attacks and the significant resources they allocate to protect their complex IT infrastructures.

These organizations often face a greater range of security threats, from ransomware to data breaches, due to their extensive digital footprint and valuable intellectual property. As a result, large enterprises invest heavily in advanced cybersecurity measures such as AI-driven threat detection, intrusion prevention systems (IPS), and multi-layered security frameworks.

Additionally, they must comply with stringent industry regulations, driving the need for comprehensive security strategies. Larger budgets and dedicated cybersecurity teams enable them to adopt cutting-edge technologies, including Zero Trust models, cloud security, and endpoint security solutions. The need to protect vast amounts of data, maintain business continuity, and uphold reputations has made cybersecurity a top priority for large enterprises, further solidifying their market dominance.

Industry Vertical Analysis

In 2024, the IT & Telecom segment held a dominant market position, capturing more than a 28.6% share of the Global Cyber Security Market due to the increasing reliance on digital infrastructure and the growing sophistication of cyber threats targeting these industries.

The sector is highly vulnerable to cyber-attacks, such as Distributed Denial of Service (DDoS) and data breaches, due to its expansive networks and critical role in global communication. As telecom companies transition to 5G networks and expand their digital services, they face heightened risks, prompting significant investments in robust cybersecurity measures.

Additionally, IT companies supporting enterprise software, cloud computing, and data storage are prime targets for cybercriminals. To mitigate these risks, organizations in this sector are adopting advanced cybersecurity technologies such as firewalls, intrusion detection systems (IDS), and artificial intelligence-driven threat monitoring.

Key Market Segments

By Component

- Hardware

- Software

- Unified Threat Management (UTM)

- Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- Data Loss Prevention (DLP)

- Identity and Access Management (IAM)

- Security Information and Event Management (SIEM)

- Risk and Compliance Management

- Others

- Services

- Professional Services

- Managed Services

By Security Type

- Endpoint Security

- Cloud Security

- Network Security

- Application Security

- Data Security

By Deployment

- Cloud

- On-premises

By Organization Size

- Small & Medium Enterprises

- Large Enterprises

By Industry Vertical

- IT & Telecom

- Automotive

- BFSI

- Retail

- Healthcare

- Government

- Manufacturing

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Driver

Increasing Frequency and Sophistication of Cyberattacks

The rise in cyber threats is one of the key drivers for the global cybersecurity market. With the growing sophistication of cyberattacks, organizations are increasingly vulnerable to data breaches, ransomware, phishing, and denial-of-service attacks. These threats target sensitive data, financial assets, and intellectual property, making cybersecurity solutions essential.

The increasing frequency of high-profile breaches, such as those impacting global corporations and government agencies, underscores the need for robust cybersecurity measures. The demand for solutions that can protect against evolving threats is expected to fuel the market as organizations strive to safeguard their networks, applications, and critical data.

Cloud storage also supports compliance and data residency requirements with configurable access, encryption, and geographic distribution. Moreover, businesses are leveraging cloud-native data lakes and warehouses for real-time insights, feeding dashboards, customer analytics, and operational intelligence. As more devices and digital services come online, the demand for scalable storage and efficient data lifecycle management continues to rise – driving ongoing global investment in cloud platforms.

Restraint

High Costs of Cybersecurity Solutions

The high cost of implementing cybersecurity solutions remains one of the primary restraints for the global cybersecurity market. Advanced tools, hardware, and software necessary for robust cybersecurity systems can be expensive, particularly for small and medium-sized enterprises (SMEs).

Many businesses, especially in developing economies, may struggle to afford the latest security technologies. These high upfront costs, coupled with ongoing maintenance and training expenses, often lead to financial strain for companies.

Additionally, the complexity of managing cybersecurity systems adds to the financial burden, as companies may need specialized talent or third-party services to handle security operations. As a result, many organizations either delay or compromise on cybersecurity investments, increasing their vulnerability to cyber-attacks.

Opportunity

AI and Machine Learning in Cybersecurity

Artificial intelligence (AI) and machine learning (ML) technologies are revolutionizing cybersecurity by enabling predictive threat analysis and automated threat response. AI can analyze vast amounts of data to identify patterns, recognize anomalies, and detect threats faster than human capabilities.

By leveraging AI and ML, cybersecurity solutions can autonomously block cyberattacks, detect vulnerabilities, and adapt to new, evolving threats. As cyber threats become more sophisticated, AI and ML-based tools are essential for enhancing response times and improving overall system resilience.

Challenge

Deployment and Implementation Challenges

One of the main challenges facing the cyber security market is the complexity associated with the deployment and implementation of security solutions. Integrating new security technologies into existing IT systems can be a daunting task, especially for organizations with legacy infrastructure. Compatibility issues, downtime, and the need for employee training are common hurdles that can complicate the implementation process.

Additionally, the fast-paced evolution of cyber threats requires continuous updates and adjustments to security measures, further complicating deployment efforts. Organizations must navigate these challenges effectively to ensure that their cyber defenses remain robust and capable of thwarting potential security breaches.

Emerging Trends

- Generative AI (GenAI) Integration: Generative AI is increasingly being integrated into cybersecurity solutions, enhancing capabilities like threat detection and response by analyzing vast data sets to predict and mitigate potential threats.

- Talent Shortages: The cybersecurity industry continues to face a significant gap between the demand for skilled security professionals and the available talent pool, which impacts the ability to manage security effectively.

- Increased Regulatory Scrutiny: There is a growing focus on regulatory requirements and government oversight in cybersecurity, pushing organizations to comply with stricter data protection and privacy laws.

- Rise in Cloud Security Integration: As more organizations migrate to cloud environments, the need for robust cloud security measures has become more critical, blending traditional cybersecurity approaches with cloud-specific strategies.

- Focus on IoT and Operational Technology (OT) Security: With the expansion of IoT and the increasing connectivity of devices, securing these devices against cyber threats has become a top priority, particularly in industrial and consumer sectors.

Business Benefits

The integration of generative AI into cybersecurity operations brings several business benefits:

- Efficiency and Speed: AI can analyze large datasets rapidly, reducing the time it takes to detect threats and respond to incidents. This speed is crucial in mitigating the impact of attacks.

- Proactivity: Generative AI’s predictive capabilities allow organizations to move from reactive to proactive stances, anticipating and neutralizing threats before they manifest.

- Cost-effectiveness: By automating routine tasks, generative AI reduces the workload on human analysts, which can lead to cost savings on labor and improved allocation of resources.

- Enhanced Accuracy: AI reduces the rate of false positives in threat detection, which can otherwise drain resources and divert attention from real threats.

Top Use Cases

The most notable use cases of generative AI in cybersecurity include:

- Automated Threat Detection: AI models can predict and identify novel cyber threats by analyzing patterns in data, significantly improving the timeliness and accuracy of threat detection efforts.

- Security Operations Automation: Generative AI is used to automate various functions within security operations centers (SOCs), such as sorting through alerts and prioritizing responses, which enhances the overall efficiency of cybersecurity teams.

- Vulnerability Management: AI tools can scan code for vulnerabilities more efficiently than traditional methods, often with greater accuracy, thereby helping to secure applications more effectively.

- Incident Response: Generative AI can assist in creating detailed incident reports and maintain logs, which are crucial for understanding attack vectors and improving future security measures.

Key Players Analysis

The Cyber Security Market is dominated by global IT leaders such as IBM Corporation, Accenture plc, and Broadcom Inc. These companies provide end-to-end cybersecurity solutions, including threat detection, incident response, and managed security services. Their strong R&D investments, wide client base, and global presence make them preferred vendors across industries like banking, healthcare, and government.

Indian IT service providers including Infosys, Wipro, Tata Consultancy Services, HCL Technologies, and Tech Mahindra continue to expand their cybersecurity offerings through global partnerships and proprietary platforms. These firms serve enterprise clients with security operations centers (SOCs), data protection tools, and compliance services.

Specialized vendors such as FireEye Inc., F5 Networks Inc., and Fortinet, Inc. focus on advanced threat protection, network security, and firewall solutions. Bishop Fox Inc. provides offensive security services, including penetration testing and red teaming. L&T Technology Services supports OT and IoT security for industrial systems.

Top Key Players in Cyber Security Market

- Accenture plc

- Broadcom Inc.

- Capgemini SE

- Cognizant

- F5 Networks Inc.

- FireEye Inc.

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- LandT Technology Services Limited

- PwC International Limited Broadcom Inc.

- Tata Consultancy Services

- Tech Mahindra Limited

- Wipro Limited

- Bishop Fox Inc.

- Fortinet, Inc.

- Other Key Players

Recent Developments

Acquisitions and Mergers

- Mastercard announced plans to acquire Recorded Future, a threat intelligence company, for $2.6 billion, adding advanced security technologies to its portfolio.

- Salesforce is acquiring Own Company for $1.9 billion, enhancing its data protection solutions.

- CyberArk acquired Venafi, a leader in machine identity management, for $1.54 billion, aiming to strengthen its identity security offerings.

- Palo Alto Networks strengthened its SIEM capabilities through the acquisition of QRadar from IBM.

- Several smaller acquisitions, including Allurity acquiring Lyvoc and GDIT acquiring Iron EagleX, illustrate continued consolidation in the cybersecurity sector.

Funding

- Wiz, a cloud security provider, raised a record-breaking $1 billion in a funding round led by Andreessen Horowitz, reflecting increased demand for cloud security solutions.

- Semperis, focusing on identity security, secured $125 million to expand its infrastructure security capabilities.

- Cyberhaven, a data security startup, raised $88 million to further its mission in protecting sensitive corporate data.

- Investment in Attack Surface Management (ASM) surged, with $233 million raised, showcasing the growing concern over misconfigurations and attacks.

Product Launches

- Akamai introduced new API security features following its acquisition of Noname Security for $450 million, addressing rising concerns in cloud-based environments.

- Various cybersecurity firms have launched solutions aimed at Operational Technology (OT) security and data protection, particularly in response to the increased risks associated with critical infrastructure.

Report Scope

Report Features Description Market Value (2023) USD 192.4 Bn Forecast Revenue (2033) USD 608.3 Bn CAGR (2024-2033) 12.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Deployment (On-premises, Cloud), By Security Type (Data Security, Cloud Security, Network Security, Application Security, Others), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (IT & Telecom, Automotive, BFSI, Retail, Healthcare, Government, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture, Broadcom Inc., Capgemini, Cognizant, F5 Networks Inc., FireEye Inc., HCL Technologies Limited, IBM Corporation, Infosys Limited, LandT Technology Services Limited, PwC International Limited, Broadcom Inc., Tata Consultancy Services, Tech Mahindra Limited, Wipro Limited, Bishop Fox Inc., Fortinet, Inc., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Accenture plc

- Broadcom Inc.

- Capgemini SE

- Cognizant

- F5 Networks Inc.

- FireEye Inc.

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- L&T Technology Services Limited

- PwC International Limited Broadcom Inc.

- Tata Consultancy Services

- Tech Mahindra Limited

- Wipro Limited

- Bishop Fox Inc.

- Fortinet, Inc.

- Other Key Players