Global Cyber Risk Quantification And Scoring Platforms Market By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Cyber Insurance Underwriting, Executive & Board Reporting, Others), By End-User Industry (Banking, Financial Services, and Insurance (BFSI), IT & Telecommunications, Healthcare, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171655

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Application Analysis

- End-User Industry Analysis

- Key reasons for adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

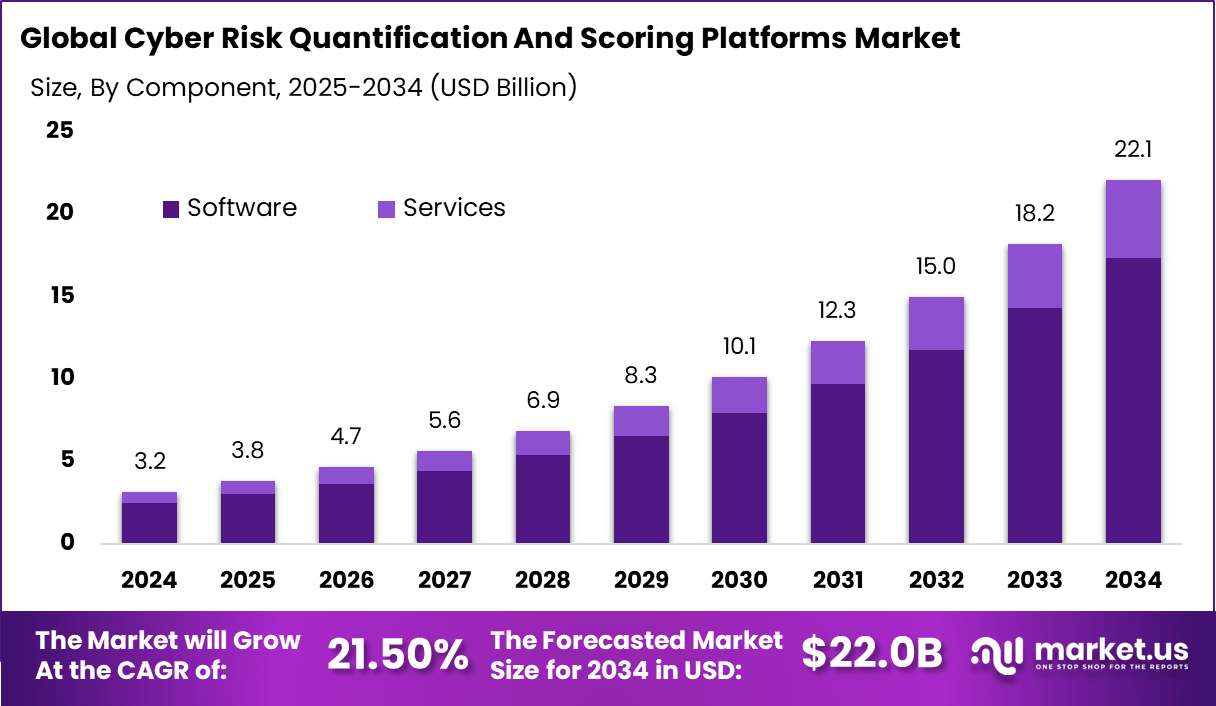

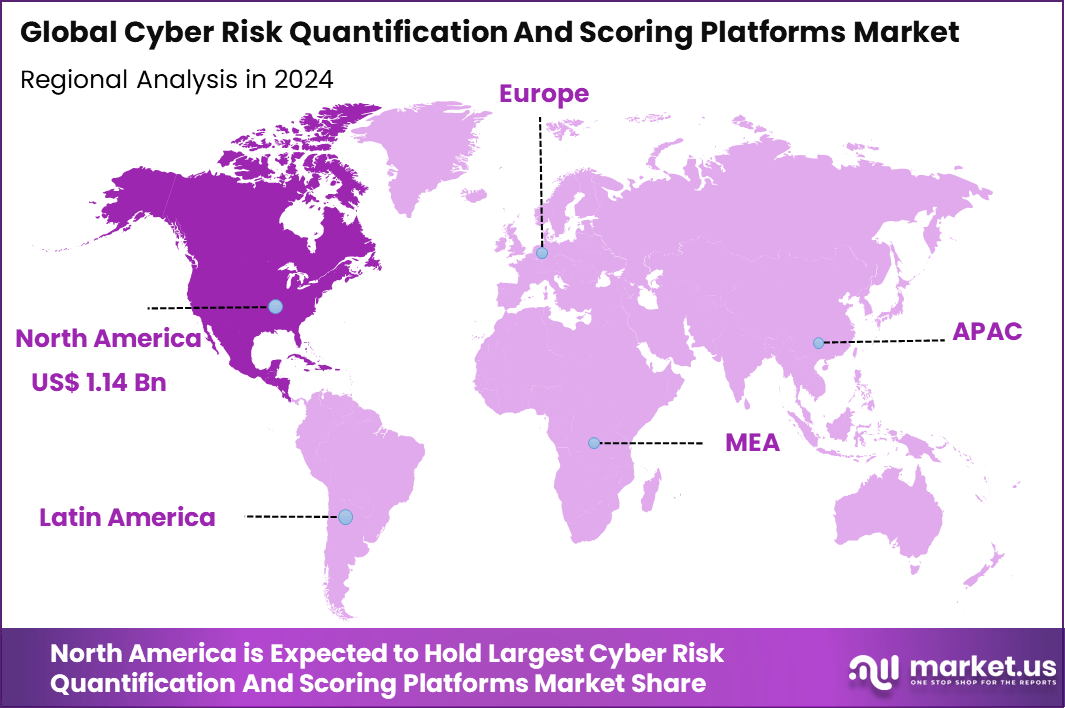

The Global Cyber Risk Quantification And Scoring Platforms Market generated USD 3.2 billion in 2024 and is predicted to register growth from USD 3.8 billion in 2025 to about USD 22.1 billion by 2034, recording a CAGR of 21.50% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.5% share, holding USD 1.14 Billion revenue.

The cyber risk quantification and scoring platforms market refers to solutions that help organizations measure, model, and score their exposure to cyber threats in financial and operational terms. These platforms convert technical security data into standardized risk scores and monetary impact estimates that support decision making by risk, compliance, and executive teams. Quantification tools allow businesses to compare risk levels across assets, scenarios, and threat categories, improving prioritization of security investments.

Growth in this market is supported by the increasing frequency and sophistication of cyber threats and the rising cost of breaches. Organizations seek objective measures of risk that extend beyond traditional checklist-based assessments. Quantification and scoring platforms provide structured frameworks to estimate potential loss, likelihood of events, and the effect of controls. These insights help align cybersecurity efforts with business risk tolerance.

The primary factors driving growth in this segment are the rising volume and sophistication of cyber threats, growing regulatory expectations, and the need for better alignment between cyber security and business outcomes. Organisations face pressure to demonstrate quantifiable cyber risk posture to boards, auditors, and regulators, particularly as digital transformation expands attack surfaces.

Traditional qualitative risk assessments are often seen as insufficient for making informed investment choices, leading firms to adopt tools that can translate vulnerabilities, threat likelihood, and potential impact into comparable scores. The increasing cost of data breaches and stronger focus on resilience have made measurable risk assessment a priority for risk managers.

Demand for cyber risk quantification and scoring platforms is increasing as businesses seek to improve visibility into risk exposures and support strategic planning. Financial institutions, insurers, technology firms, and large enterprises are among the early adopters because they require robust risk metrics for capital planning, third-party risk management, and operational resilience.

Demand is also shaped by the growing trend of tying cyber risk scores to insurance underwriting and pricing, where more accurate quantification supports cost management. As organisations face constrained security budgets, quantification platforms help prioritise investments that deliver the most risk reduction per dollar spent. The need for consistent, comparable, and business-aligned risk data is expected to sustain interest in these platforms across sectors with significant digital assets.

Top Market Takeaways

- By component, software and platforms took 78.6% of the cyber risk quantification and scoring platforms market, as they provide tools to measure and score cyber threats.

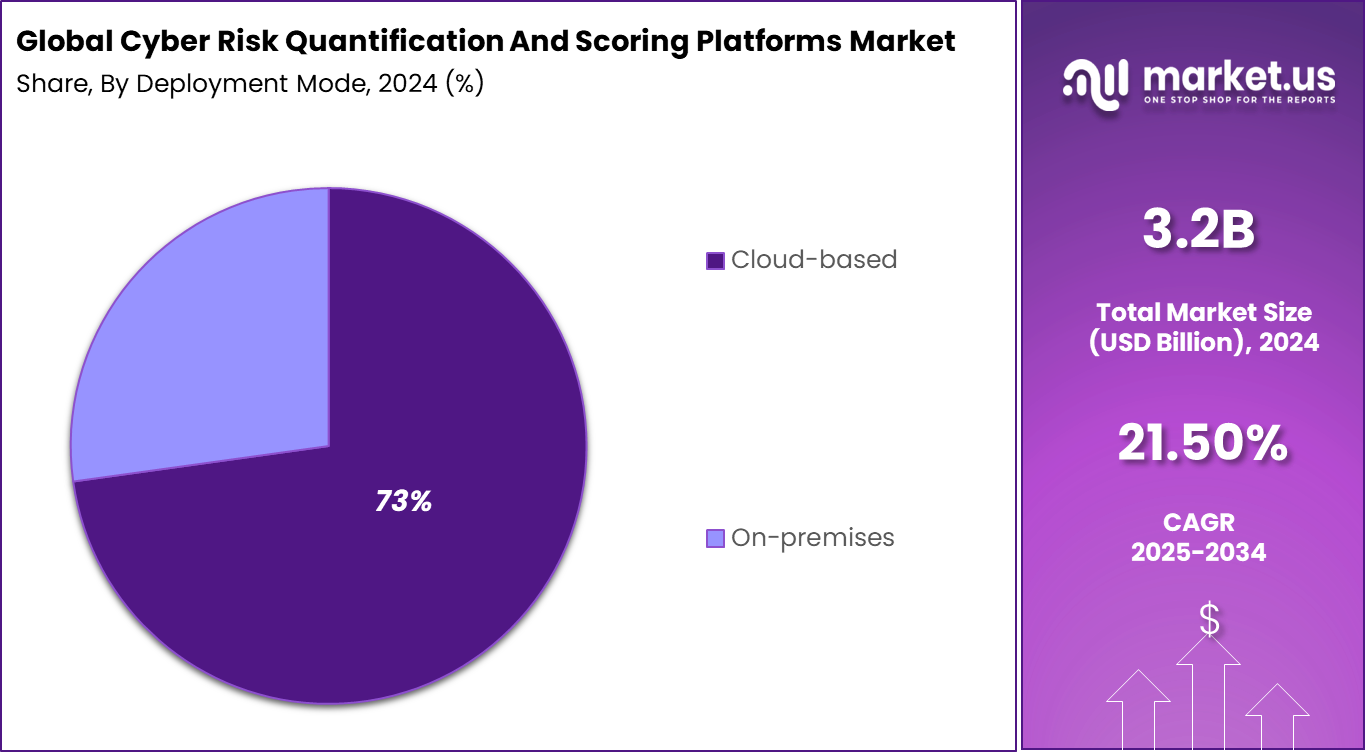

- By deployment mode, cloud-based solutions held 72.8% share, offering easy scaling and access for risk tracking.

- By organization size, large enterprises captured 74.3%, using platforms to handle complex cyber risks across global operations.

- By application, security investment justification led with 33.9%, helping firms show ROI for cyber defenses.

- By end-user industry, BFSI accounted for 47.2%, needing precise risk scoring for compliance and fraud protection.

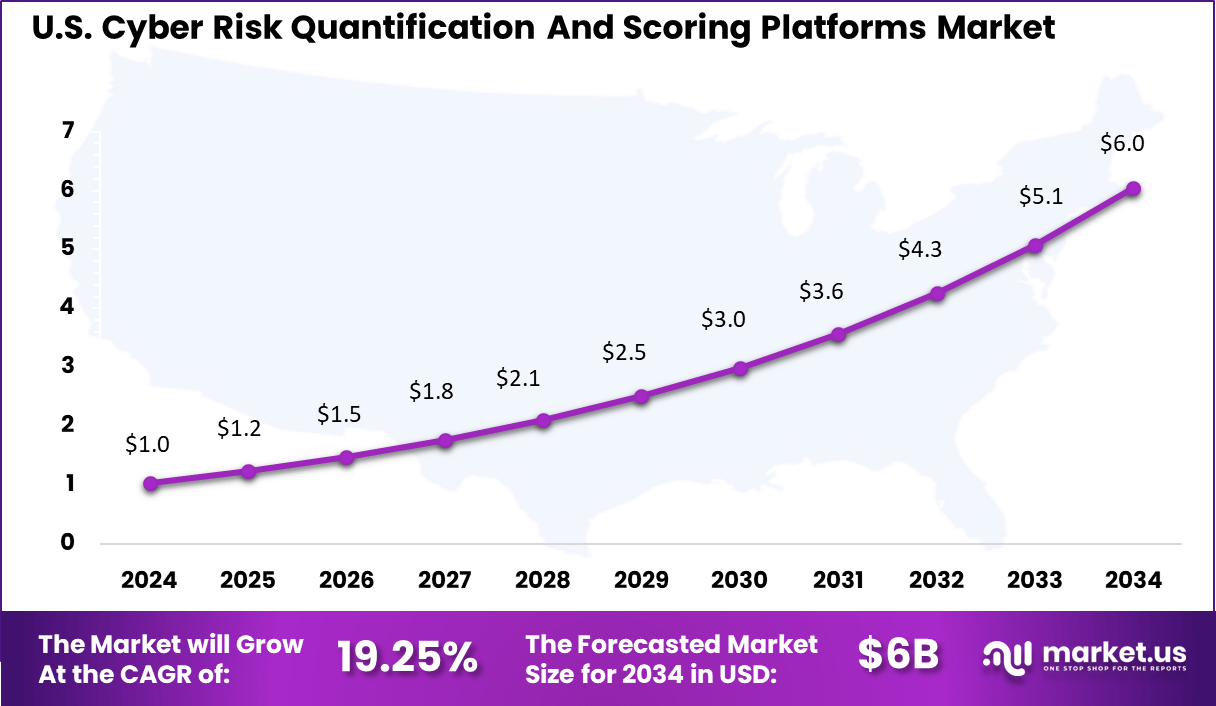

- North America had 36.5% of the global market, with the U.S. at USD 1.04 billion in 2025 and growing at a CAGR of 19.25%.

Quick Market Facts

Core Adoption and Usage Statistics (2025)

- Interest in cyber risk quantification is high, with 95% of senior leaders recognizing its value for investment decisions, yet only 15-20% of organizations have deployed fully automated CRQ methods.

- The FAIR framework is the most widely referenced standard, with about 45% of organizations either using it today or planning adoption.

- Board-level engagement remains limited, as only 29% of boards regularly review executive-level cybersecurity risk metrics, despite growing demand for financial risk visibility.

- Early adopters report strong results, with 90% confirming improved security posture and clearer decision-making after implementing CRQ.

Primary Usage Cases

- Enterprise risk management (32%) is the leading application, used to align cybersecurity exposure with overall business objectives and financial planning.

- Cyber insurance is the fastest-growing use case, expanding at a 19.6% CAGR, as quantified risk data supports underwriting, pricing, and coverage limits.

- Budget and technology decisions increasingly rely on CRQ to balance the benefits of new technologies, including AI, against potential financial impact from breaches or misconfigurations.

Usage by Industry Vertical

- BFSI (28%) represents the largest user segment, supported by established actuarial and financial risk management practices.

- Healthcare is growing rapidly at a 15.9% CAGR, driven by the need to model high-impact ransomware and service disruption events.

- Manufacturing adoption is rising as firms quantify risks across operational technology and supply chains, where OT-related incidents add an average of USD 840,000 to breach costs.

Component Analysis

The software and platform segment accounts for 78.6% of the Cyber Risk Quantification and Scoring Platforms market, indicating that core value creation lies in analytical engines and decision-support tools. These platforms collect security data from multiple sources, model potential cyber loss scenarios, and translate technical risk into financial terms. This capability helps organizations move from qualitative risk discussions to measurable and comparable risk scores that support executive decision-making.

From an operational standpoint, software platforms enable continuous risk assessment and scenario analysis across complex IT environments. They support integration with security tools, asset inventories, and threat intelligence feeds. The strong share of this segment reflects rising demand for centralized, data-driven platforms that provide clear visibility into cyber exposure and help align security priorities with business objectives.

Deployment Mode Analysis

Cloud-based deployment holds 73% of the market, driven by the need for scalability and rapid implementation. Cloud platforms allow organizations to deploy cyber risk quantification tools quickly without heavy infrastructure investment. They also support frequent updates to risk models and threat data, which is critical in a constantly changing cyber threat landscape.

Cloud deployment also improves accessibility for distributed security and risk teams. Risk data, dashboards, and reports can be accessed securely from different locations, supporting collaboration between IT, security, and finance functions. The strong adoption of cloud-based platforms reflects preference for flexible deployment models that reduce operational complexity and support real-time risk visibility.

Organization Size Analysis

Large enterprises represent 74.3% of the market, reflecting their high exposure to cyber threats and complex digital environments. These organizations operate across multiple business units, geographies, and regulatory frameworks, which increases the need for structured risk quantification. Cyber risk scoring platforms help large enterprises prioritize investments and manage risk consistently across the organization.

Large enterprises also face stronger regulatory and reporting pressures. Quantified cyber risk metrics support board-level discussions and compliance requirements. The strong presence of this segment highlights how cyber risk quantification has become a strategic requirement for enterprises managing large-scale digital operations and sensitive data assets.

Application Analysis

Security investment justification accounts for 33.9% of application demand, making it a key use case for cyber risk quantification platforms. These tools help organizations evaluate the financial impact of cyber risks and compare it against the cost of security controls. By linking risk reduction to monetary outcomes, decision-makers can prioritize investments more effectively.

This application is especially valuable when budgets are limited and competing risks exist. Risk quantification platforms provide clear evidence to support funding requests and strategic security initiatives. The strong adoption of this use case reflects growing demand for accountability and transparency in cyber security spending decisions.

End-User Industry Analysis

The BFSI sector accounts for 47.2% of end-user adoption, making it the largest industry segment in this market. Financial institutions manage high volumes of sensitive data and face constant exposure to cyber threats. Cyber risk quantification platforms help these organizations assess potential financial losses and strengthen risk governance frameworks.

In the BFSI sector, regulatory compliance and risk reporting are critical. Quantified risk scores support internal audits, regulatory discussions, and board oversight. The strong share of this end-user segment reflects the industry’s focus on measurable risk management and proactive cybersecurity planning in a highly regulated environment.

Key reasons for adoption

- Organizations need clearer visibility into cyber risk exposure across digital assets. Quantification platforms translate technical threats into understandable risk levels.

- Executive teams and boards demand measurable insights to support security investment decisions. Risk scoring helps align cybersecurity with business priorities.

- Regulatory and compliance pressure continues to rise across industries. These platforms support structured risk assessment and reporting requirements.

- Growing reliance on third party vendors increases supply chain risk. Quantification tools help assess and monitor external cyber exposure.

- Cyber insurance providers require standardized risk evaluation. Scoring platforms support underwriting, pricing, and policy assessment processes.

Benefits

- Improved decision clarity is achieved by converting cyber threats into financial and operational impact views. This supports stronger governance.

- Better budget allocation becomes possible as security spending is linked to quantified risk reduction. Investments are prioritized more effectively.

- Enhanced communication between technical teams and leadership is supported. Risk metrics create a common language for discussion.

- Reduced uncertainty improves incident preparedness and response planning. Organizations gain confidence in their cyber resilience posture.

- Continuous risk visibility helps track changes in exposure over time. This supports ongoing improvement in security programs.

Usage

- Financial services organizations use these platforms to assess risk across digital banking and payment systems. This supports regulatory alignment.

- Large enterprises apply risk scoring to manage complex IT and cloud environments. Assets and vulnerabilities are evaluated in a consistent manner.

- Insurance firms use quantification tools to evaluate client cyber maturity. Risk scores inform coverage and premium decisions.

- Managed security service providers integrate these platforms into client assessments. This improves advisory and reporting capabilities.

- Government and critical infrastructure operators use risk quantification to protect essential services. Prioritization of controls supports national resilience.

Emerging Trends

Key Trend Description AI Driven Risk Models AI predicts financial loss from cyber threats in real time. Hybrid Cloud Deployments Organizations combine on site systems with cloud platforms for data control and analytics. FAIR Model Integration Standard risk models convert cyber risks into clear dollar based values. Vendor Risk Scoring Suppliers are automatically rated using continuous cyber risk scoring. Insurance Optimization Risk scores are used to negotiate lower cyber insurance premiums. Growth Factors

Key Factors Description Cyber Attacks Rise Frequent breaches push organizations to measure cyber risk in monetary terms. Board Demands Numbers Executives require cyber risk reporting in dollars rather than technical language. New Rules Like DORA Regulations require financial institutions to demonstrate effective cyber risk control. Cyber Insurance Boom Insurers request detailed risk scores before offering lower policy rates. SME Tools Get Cheap Affordable SaaS tools enable small firms to meet enterprise cyber requirements. Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Cyber Insurance Underwriting

- Executive & Board Reporting

- Security Investment Justification

- Third-Party & Supply Chain Risk Management

- Others

By End-User Industry

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecommunications

- Healthcare

- Government & Defense

- Retail & E-commerce

- Others

Regional Analysis

North America accounted for 36.5% share, supported by high awareness of cyber risk management and strong adoption of advanced security governance frameworks. Organizations across financial services, healthcare, technology, and critical infrastructure have increasingly adopted cyber risk quantification and scoring platforms to translate technical security risks into business relevant financial metrics.

Demand has been driven by rising cyber incidents, regulatory scrutiny, and board level focus on measurable risk exposure. These platforms have helped enterprises prioritize security investments and align cyber risk decisions with overall business strategy.

The U.S. market reached USD 1.04 Bn and is projected to grow at a 19.25% CAGR, reflecting rapid expansion of digital infrastructure and heightened exposure to cyber threats. Large enterprises and regulated industries have adopted cyber risk quantification platforms to meet governance requirements and improve resilience planning. These solutions have been used to model potential financial losses, assess control effectiveness, and support informed risk acceptance decisions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Need for Business-Aligned Risk Insights

A major driver of this market is the need for business-aligned risk insights that connect technical vulnerabilities with financial impact. Security teams often use technical metrics such as patch status or open port counts, which are difficult for executive leadership to interpret in business terms. Quantification and scoring tools translate these technical inputs into business language, enabling executives to compare cyber risk with other enterprise risks.

Another driver is the emphasis on risk prioritization in security operations. Organizations face many potential threats but limited resources. Quantification supports evidence-based decisions about where to apply controls, allocate staff, or invest in mitigation. Prioritizing actions based on estimated risk reduction strengthens operational focus and improves security outcomes.

Restraint Analysis

Data Quality Challenges and Modeling Limitations

A significant restraint is the challenge of data quality and completeness. Cyber risk quantification models depend on accurate input data from asset inventories, vulnerability scanners, threat feeds, and incident logs. Inconsistent or incomplete data reduces the reliability of risk scores and financial estimates. Ensuring high-quality data requires strong asset management practices and continuous data integration.

Another restraint arises from limitations in modeling complex threat scenarios. Cyber events involve many variables that are difficult to quantify precisely, such as attacker motivation, defense effectiveness, and cascading impacts. Models may simplify these factors, which can lead to uncertainty in risk estimates. Organizations must interpret results cautiously and use them alongside expert judgment.

Opportunity Analysis

Expansion of Automated Scenario Analysis and Decision Support

There is strong opportunity in expanding automated scenario analysis capabilities. Platforms that simulate multiple threat scenarios and estimate outcomes help organizations understand risk under varied conditions. These tools support “what-if” analysis that guides mitigation planning, insurance decisions, and contingency budgeting. Vendors offering robust scenario engines can attract customers seeking deeper insights.

Another opportunity lies in alignment with cyber insurance underwriting. Insurers increasingly seek data-driven risk profiles to assess policy terms and premiums. Quantified risk scores and loss estimates can support more objective underwriting and help enterprises negotiate coverage terms. Providers that integrate with insurance risk workflows can expand their market reach.

Challenge Analysis

Integration Complexity and Stakeholder Alignment

A major challenge in this market is integration with existing security and IT systems. Quantification platforms must connect with vulnerability scanners, asset inventories, SIEM systems, and business applications. Ensuring seamless data flow across these systems requires technical expertise and careful configuration. Integration challenges can delay deployment and reduce early value realization.

Another challenge involves aligning diverse stakeholders on risk interpretation. Cyber risk scores must be understood by security teams, financial officers, and executives. Differences in risk perspective and preferred metrics can complicate agreement on priorities. Organizations must establish communication frameworks and training to ensure that risk scores inform decision making consistently across teams.

Competitive Analysis

The competitive landscape of the cyber risk quantification and scoring platforms market is shaped by specialized cyber risk modeling vendors and broader risk management software providers. Companies such as RiskLens, Inc., Safe Security, Inc., Kovrr, Ltd., Axio Global, Inc., and Balbix, Inc. focus strongly on translating cyber threats into financial risk metrics, which helps executives and boards make informed investment and mitigation decisions.

SecurityScorecard, Bitsight Technologies, Inc., and UpGuard, Inc. hold strong positions in external security ratings and continuous monitoring, which are widely used for vendor risk assessment and third party risk management across large enterprises.

Competition is intensifying as organizations seek platforms that combine accurate risk scoring, real time data ingestion, and alignment with regulatory and insurance requirements. Vendors such as Archer Integrated Risk Management, ServiceNow through its IRM offering, OneTrust, LLC, Panorays, Ltd., and CyberGRX, Inc. compete by integrating cyber risk quantification into wider governance, risk, and compliance workflows.

Top Key Players in the Market

- RiskLens, Inc.

- Safe Security, Inc.

- UpGuard, Inc.

- Kovrr, Ltd.

- Axio Global, Inc.

- Balbix, Inc.

- SecurityScorecard

- Bitsight Technologies, Inc.

- Archer Integrated Risk Management (a RSA company)

- ServiceNow, Inc. (IRM)

- OneTrust, LLC

- Panorays, Ltd.

- CyberGRX, Inc.

- Others

Future Outlook

The future outlook for the Cyber Risk Quantification and Scoring Platforms market is expected to remain strong as organizations seek clearer visibility into cyber exposure. These platforms help translate technical security risks into financial and operational impact, which supports better decision making at the executive level.

Rising frequency of cyber incidents, tighter regulatory oversight, and growing reliance on digital systems are increasing demand for measurable and comparable risk scores. In the coming years, wider integration with security tools, insurance models, and compliance frameworks is likely to improve accuracy and make cyber risk reporting more consistent across industries.

Recent Developments

- SAFE Security grabbed headlines in November 2025 with its acquisition of Balbix. This move combined Balbix’s strengths in spotting vulnerabilities with SAFE’s tools for measuring cyber risks in dollar terms. The result is a single platform that links threats straight to business losses, making it easier for companies to prioritize fixes. Teams can now act faster on real dangers without guessing. Leaders in the space see this as a game-changer for handling complex supply chains.

- UpGuard stepped up its game in December 2025 by launching an AI-powered Cyber Risk Posture Management platform. This tool pulls together vendor checks, attack surface scans, and user behavior into one view using billions of data points. It helps security teams spot hidden weaknesses before attackers do. The platform’s AI engine makes sense of it all without overwhelming users. It even suggests prioritized actions based on potential impact.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 22.1 Bn CAGR(2025-2034) 21.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Cyber Insurance Underwriting, Executive & Board Reporting, Others), By End-User Industry (Banking, Financial Services, and Insurance (BFSI), IT & Telecommunications, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape RiskLens, Inc., Safe Security, Inc., UpGuard, Inc., Kovrr, Ltd., Axio Global, Inc., Balbix, Inc., SecurityScorecard, Bitsight Technologies, Inc., Archer Integrated Risk Management (a RSA company), ServiceNow, Inc. (IRM), OneTrust, LLC, Panorays, Ltd., CyberGRX, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cyber Risk Quantification and Scoring Platforms MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Cyber Risk Quantification and Scoring Platforms MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- RiskLens, Inc.

- Safe Security, Inc.

- UpGuard, Inc.

- Kovrr, Ltd.

- Axio Global, Inc.

- Balbix, Inc.

- SecurityScorecard

- Bitsight Technologies, Inc.

- Archer Integrated Risk Management (a RSA company)

- ServiceNow, Inc. (IRM)

- OneTrust, LLC

- Panorays, Ltd.

- CyberGRX, Inc.

- Others