Global Cyber Insurance Market By Insurance Type (Standalone, Packaged), By Coverage Type (First-Party Coverage Third-Party Coverage), Enterprise Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), Industry Vertical (BFSI, Healthcare and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 19718

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

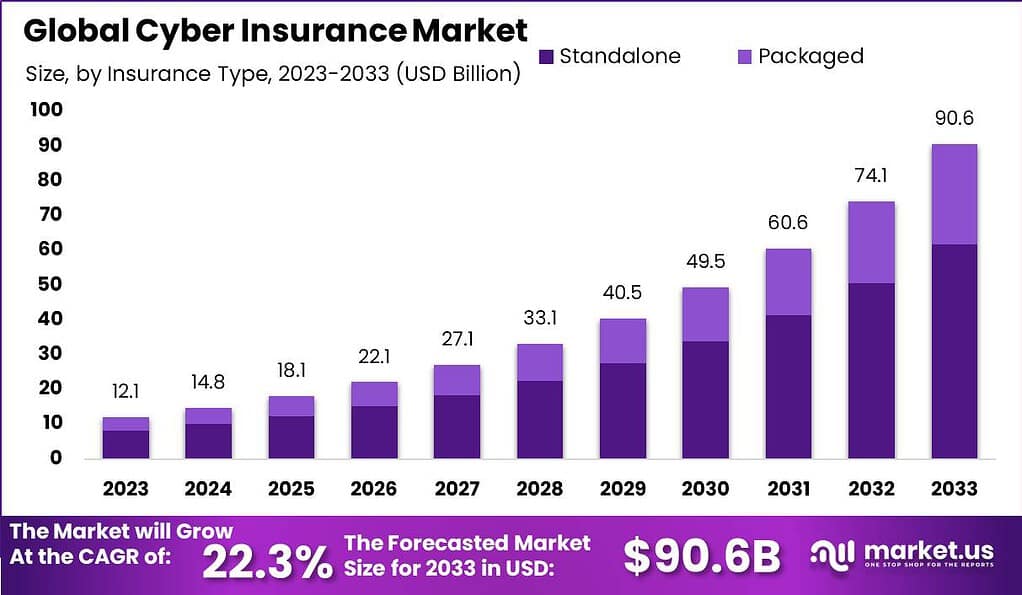

The Global Cyber Insurance Market size is expected to be worth around USD 90.6 Billion By 2033, from USD 12.1 Billion in 2023, growing at a CAGR of 22.3% during the forecast period from 2024 to 2033.

The cyber insurance market refers to the industry that provides insurance coverage against cyber risks and liabilities. As businesses increasingly rely on digital systems and data, the threat of cyber attacks and data breaches has become a significant concern. Cyber insurance offers financial protection and support to organizations in the event of cyber incidents, helping them recover from financial losses and reputational damage. This article provides an overview of the cyber insurance market, including its growth factors, challenges, and opportunities.

The cyber insurance market has experienced substantial growth in recent years due to the rising frequency and sophistication of cyber attacks. Organizations of all sizes and across various industries are recognizing the need for insurance coverage to mitigate the financial impact of cyber incidents. High-profile data breaches and cyber attacks have highlighted the potential costs associated with such incidents, including legal liabilities, regulatory fines, business interruption, and reputational harm.

One of the key growth factors in the cyber insurance market is the increasing awareness of cyber risks among businesses. As organizations become more knowledgeable about the potential consequences of cyber attacks, they are seeking proactive measures to manage and transfer these risks. Cyber insurance provides a means of transferring some of the financial burden associated with cyber incidents to insurance providers, giving businesses a sense of security and peace of mind.

Despite the promising growth prospects, the cyber insurance market faces several challenges. One of the primary challenges is the rapidly evolving nature of cyber threats, making it difficult for insurers to accurately assess risks and set premiums. The lack of historical data on cyber incidents also complicates risk assessment. Moreover, the high cost of premiums and the limited understanding of cyber insurance among small and medium-sized enterprises (SMEs) can hinder market expansion.

However, these challenges present opportunities for innovation and growth within the market. Insurers can leverage advanced technologies such as artificial intelligence and machine learning to improve risk assessment and develop more tailored policies.

Additionally, increasing collaboration between insurers, cybersecurity firms, and regulatory bodies can lead to better risk management practices and more comprehensive coverage options. As cyber threats continue to evolve, the demand for robust cyber insurance solutions is expected to rise, providing ample opportunities for market players to expand their offerings and reach a broader customer base.

According to a recent risk and insurance report, a staggering 87% of global decision makers expressed concerns about the adequacy of their companies’ protection against cyberattacks. This finding highlights a significant gap in the level of protection offered by the insurance industry, as indicated by the report.

Over the past year, there has been a significant surge in cyberattacks, with the annual ransom crypto payments skyrocketing to $1.1 billion in 2023, compared to $567 million in 2022. This doubling of ransom payments emphasizes the growing threat that cyberattacks pose to organizations worldwide.

Among various sectors, the manufacturing industry proved to be the most susceptible to ransomware attacks, with a substantial 67% of respondents reporting such incidents. Following closely behind were the business and professional services, retail, and healthcare sectors, each experiencing ransomware attacks at a rate of 61%.

Key Takeaways

- The global cyber insurance market is projected to grow at a CAGR of 22.3%, reaching USD 90.6 billion by 2033, with a recorded value of USD 12.1 billion in 2023.

- Standalone cyber insurance policies dominate the market, accounting for over 68.2% in 2023, indicating the increasing awareness among organizations about the specific risks associated with cyber threats.

- Third-Party Coverage holds a significant share of over 62.1% in the cyber insurance market, emphasizing the importance of protecting businesses against claims from external parties resulting from data breaches or cyber incidents.

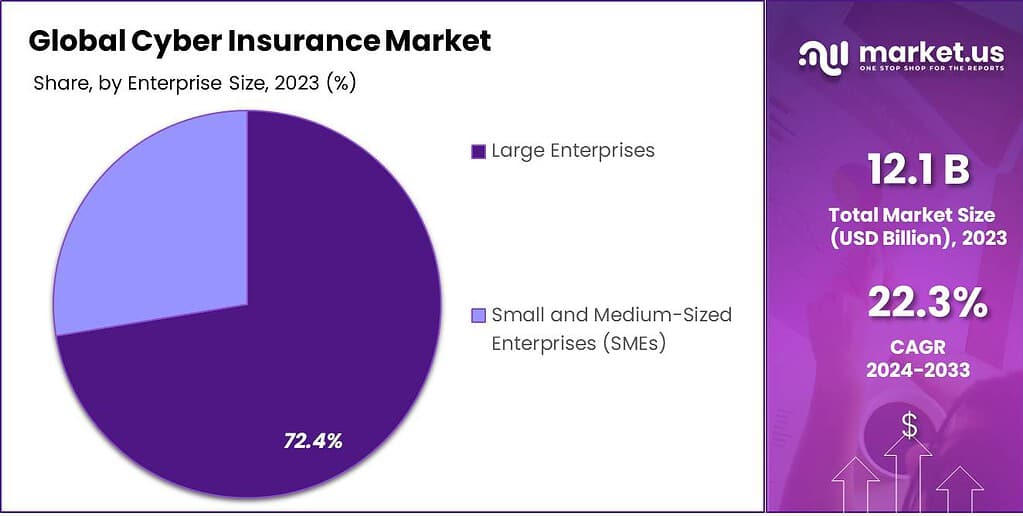

- Large Enterprises constitute a dominant segment with over 72.4% share, highlighting their proactive approach in mitigating the financial risks associated with complex cyber threats, while Small and Medium-Sized Enterprises (SMEs) face challenges in prioritizing comprehensive cyber insurance coverage due to resource constraints.

- The BFSI sector leads the market, capturing over 28.3% share, owing to its extensive handling of sensitive financial data and transactions, making it a prime target for sophisticated cyber threats.

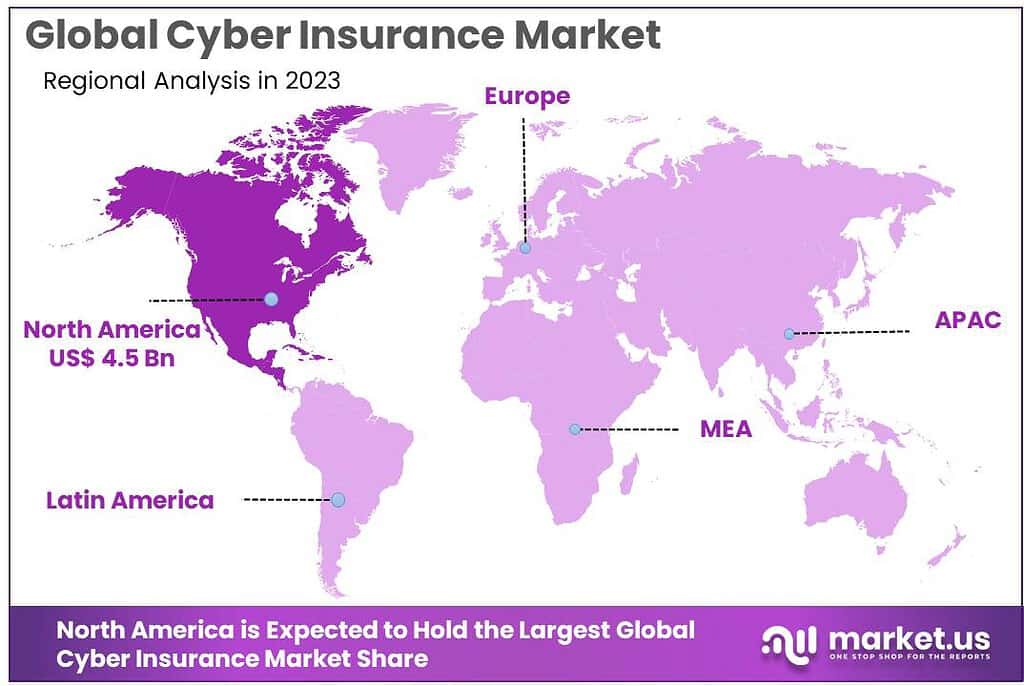

- North America commands a significant revenue share of 37.6%, followed by Europe and the Asia-Pacific region, indicating the regions’ proactive approach in investing in comprehensive cyber insurance solutions to safeguard their operations against potential financial losses and data breaches.

- Challenges in the cyber insurance market include the lack of standardization, limited understanding of risks, and evolving cyber threats, necessitating robust risk assessment models and comprehensive insurance coverage.

- The increasing demand for cyber insurance is driven by the rising frequency of cyber threats, technological advancements, and the emergence of untapped markets, offering growth opportunities for insurers to cater to the specific requirements of SMEs and enhance risk assessment capabilities through technological advancements.

- Market players such as American International Group, Inc., Aon PLC, The Chubb Corporation, and others are developing advanced risk assessment tools and predictive analytics to offer precise and tailored cyber insurance policies, aiming to minimize the impact of successful cyber attacks.

Insurance Type Analysis

In 2023, the Standalone segment held a dominant position in the Cyber Insurance Market, capturing more than 68.2% of the market share. This segment leads primarily because it offers specialized coverage that is not typically included in general policies.

Standalone cyber insurance policies are tailored specifically to address the complex nature of cyber threats, providing comprehensive protection against a wide range of cyber incidents such as data breaches, cyber theft, and ransomware attacks. These policies are highly customizable, allowing businesses to adjust coverages based on their specific risk exposures and security needs.

The appeal of Standalone cyber insurance is also driven by the increasing sophistication of cyber attacks, which often require more detailed and specific risk management strategies than what packaged policies offer. As cyber risks evolve, businesses seek Standalone policies that can be specifically designed to cover unique vulnerabilities, providing a level of assurance that packaged policies may not offer.

This type of coverage is particularly attractive to industries that handle large volumes of sensitive data, such as healthcare, finance, and retail, where the impact of a cyber incident can be particularly severe. Furthermore, the growing regulatory demands for data protection have made Standalone cyber insurance even more essential. Companies are under increasing pressure to comply with legal requirements related to data security and privacy.

Standalone policies often include coverage for regulatory fines and penalties, which adds another layer of protection that can be crucial for maintaining business continuity and safeguarding against financial losses. As awareness of these benefits grows, the Standalone segment is likely to continue leading the market, offering substantial growth opportunities for insurers who can provide tailored and responsive cyber insurance solutions.

Coverage Type Analysis

In 2023, the Third-Party Coverage segment held a dominant market position within the Cyber Insurance Market, capturing more than a 62.1% share. This segment leads primarily due to its critical role in providing liability protection for businesses.

Third-Party Coverage insures against claims made by external parties affected by a cybersecurity incident that originates from the insured entity. This includes legal fees, settlements, and any judgments that may arise from lawsuits filed against a company for breaches of data that affect customers, partners, or other third parties.

The increasing number of high-profile data breaches and stringent regulations regarding consumer data protection have heightened the demand for Third-Party Coverage. Businesses are more vulnerable than ever to litigation costs associated with the misuse or unauthorized access to third-party personal and financial information.

This coverage is crucial for companies that handle large volumes of third-party data, like those in healthcare, retail, and financial services, where the implications of data breaches can be particularly devastating both financially and reputationally.

Moreover, Third-Party Coverage often includes protections against defamation, fraud, and the theft of intellectual property, broadening its appeal. As businesses continue to expand their digital operations and as the regulatory landscape becomes more complex, the need for robust Third-Party Coverage will likely increase. This segment’s prominence is set to grow as companies seek to mitigate the potential legal ramifications and financial losses associated with cyber threats, reinforcing its leading position in the market.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Cyber Insurance Market, capturing more than a 72.4% share. This segment leads primarily due to the high level of cyber risk exposure that large enterprises face, which is significantly greater than that of smaller companies.

Large enterprises often manage vast amounts of data, including sensitive customer and corporate information, making them attractive targets for cybercriminals. This high risk necessitates robust cyber insurance policies to mitigate potential financial and reputational damages from cyber incidents.

Large enterprises are also more likely to invest in comprehensive cyber insurance coverage due to their larger budgets and the greater potential impact of cyber threats on their operations. These organizations are often involved in international business, subjecting them to various regulatory environments which can complicate their risk profiles. As a result, they require tailored insurance solutions that can cover complex and varied risks, including global regulatory penalties and cross-border data breach implications.

Furthermore, large enterprises are increasingly recognizing the importance of cyber insurance as a critical component of their overall risk management strategy. As digital transformation accelerates, these companies continue to adopt advanced technologies, increasing their vulnerability to cyber attacks. The need for extensive coverage to safeguard against a broad spectrum of cyber threats keeps the demand for cyber insurance high within this segment, ensuring its ongoing dominance in the market.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Cyber Insurance Market, capturing more than a 28.3% share. This leading status is driven by the inherently high risk associated with the vast amounts of sensitive financial data these institutions handle. Cyber threats such as data breaches, hacking, and financial fraud are particularly severe in this sector, making comprehensive cyber insurance coverage essential for mitigating potential losses.

The BFSI sector’s reliance on digital technology for operations – from online banking and mobile transactions to automated trading systems – further escalates its vulnerability to cyber-attacks. As financial institutions continue to innovate and integrate advanced technologies like blockchain and artificial intelligence into their services, the complexity and frequency of cyber threats are likely to increase. This evolution necessitates robust cyber insurance solutions tailored to the specific risks faced by the BFSI sector.

Additionally, regulatory requirements for data protection in the financial industry are among the strictest, with heavy penalties for non-compliance. This regulatory environment compels BFSI institutions to adopt cyber insurance policies that not only cover potential financial losses but also help manage the reputational damage that can arise from cyber incidents. As cyber risks continue to evolve, the BFSI sector’s demand for specialized cyber insurance products is expected to grow, maintaining its substantial share of the market.

Key Market Segments

Insurance Type

- Standalone

- Packaged

Coverage Type

- First-Party Coverage

- Third-Party Coverage

Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Industry Vertical

- IT & Telecommunications

- BFSI

- Healthcare

- Retail & E-Commerce

- Government

- Other Industry Verticals

Driver

Increasing Cyber Threats and Regulatory Compliance

The cybersecurity insurance market is experiencing growth driven by the rising frequency and sophistication of cyber threats, such as data breaches and ransomware attacks. As digital transformation deepens across various sectors, organizations face an increased risk of cyber incidents, which can lead to substantial financial losses.

These range from data recovery costs to business interruption, legal expenses, and reputational damage. To mitigate these risks, more organizations are recognizing the necessity of cyber insurance as a protective measure. Additionally, stringent regulatory compliance requirements across different economies further compel businesses to adopt cyber insurance to adhere to legal standards and avoid penalties.

Restraint

High Complexity and Costs of Cyber Risks

One of the major restraints in the cyber insurance market is the increasing complexity of cyber risks, coupled with the high costs associated with claims. The cyber threat landscape is constantly evolving, making it challenging for insurers to accurately assess and price these risks.

Additionally, the high costs related to cyber insurance claims, often stemming from the need to address extensive damages and legal requirements post-incident, pose significant challenges. These factors can deter insurers from offering extensive coverage or lead to higher premiums, impacting the overall growth of the cyber insurance market.

Opportunity

Growing Awareness and Innovation in Cybersecurity Products

There is a significant opportunity in the cyber insurance market due to the growing awareness among businesses about the importance of cybersecurity and the subsequent demand for innovative insurance products.

Insurance companies are increasingly offering cyber risk management services and developing new types of coverage, such as parametric insurance, which provides payouts based on the occurrence of specified events rather than actual losses. This innovation helps meet the evolving needs of businesses and covers a broader range of cyber incidents, thereby attracting more customers and expanding the market.

Challenge

Lack of Standardization and Data Security Concerns

A major challenge facing the cyber insurance market is the lack of standardization in policy offerings, which creates confusion among businesses when comparing and selecting suitable policies. This issue is compounded by concerns over data security, as organizations are wary of sharing sensitive information with insurers.

The absence of standardized policies can hinder the effectiveness and reach of cyber insurance, as potential clients may struggle to find policies that adequately meet their specific needs and provide the necessary level of protection.

Growth Factors

- Increasing Cyber Threats: The growth of the cyber insurance market is significantly driven by the rising frequency and sophistication of cyberattacks, including data breaches and ransomware incidents. As cyber threats become more prevalent, businesses are increasingly seeking cyber insurance to mitigate the financial and operational impacts of such incidents.

- Regulatory Compliance: Stricter data protection regulations globally, such as GDPR in Europe and CCPA in California, are compelling organizations to adopt cyber insurance policies. These regulations often require businesses to maintain a certain level of security and data protection, and cyber insurance helps in complying with these legal requirements.

- Digital Transformation: As more businesses undergo digital transformation, their dependency on digital technologies increases, thereby elevating their risk profile. This transition drives the need for cyber insurance to protect against potential cyber-related losses.

- Awareness and Educational Initiatives: There is a growing awareness among businesses about the risks associated with cyber threats and the benefits of cyber insurance. Educational efforts by governments and private organizations have also helped in understanding the importance of cybersecurity measures and insurance.

- Innovations in Insurance Products: The cyber insurance market is seeing a range of innovations, such as tailored insurance solutions and coverage for emerging risks like IoT and AI-related threats. These developments are making cyber insurance more attractive and applicable to a broader range of businesses.

Emerging Trends

- Tailored Cyber Insurance Solutions: As cyber risks vary greatly across different industries and businesses, insurers are increasingly offering customized insurance solutions that specifically address the unique risks faced by individual businesses.

- Growth of Stand-Alone Policies: There is an increasing preference for stand-alone cyber insurance policies over packaged options. These policies offer comprehensive coverage tailored to the specific needs related to cyber threats, which are not typically covered under general business policies.

- Integration of Cybersecurity Services: Insurers are not only offering financial protection but also integrating risk management services such as cybersecurity assessments, threat monitoring, and incident response services. This trend is enhancing the overall value of cyber insurance policies by helping businesses improve their security postures

- Increased Adoption by Small and Medium Enterprises (SMEs): SMEs are becoming more proactive in purchasing cyber insurance due to their increased vulnerability to cyberattacks and the potentially devastating impact of such incidents. Tailored and affordable policies are now more accessible to SMEs, boosting their uptake in this segment.

- Focus on Preventive Measures and Risk Mitigation: There is a growing emphasis on preventive measures within the cyber insurance industry. Insurers are collaborating with tech firms to offer services that help in identifying vulnerabilities and mitigating risks before they lead to major incidents

Regional Analysis

In 2023, North America held a dominant market position in the cyber insurance market, capturing more than a 37.6% share with revenue amounting to USD 4.5 billion. This leadership can be attributed to the high prevalence of cyber-attacks and data breaches in the region, prompting businesses to prioritize cyber insurance as a critical component of their risk management strategies. The concentration of tech giants and financial institutions, which are frequent targets of cyber-attacks, further underscores the necessity for robust cyber insurance solutions.

Moreover, the regulatory environment in North America has played a pivotal role in the growth of the cyber insurance market. Stringent regulations regarding data protection and privacy, such as the California Consumer Privacy Act (CCPA) and New York’s SHIELD Act, compel companies to adopt cyber insurance policies to comply with legal standards. These regulatory frameworks enforce stringent penalties for data breaches, thereby driving the adoption of cyber insurance as a safeguard against potential financial liabilities.

Europe also demonstrates significant growth in the cyber insurance sector, driven by increasing awareness of cyber threats and supportive legislation such as the General Data Protection Regulation (GDPR). The GDPR has elevated the standards for data protection across Europe, making cyber insurance an essential tool for companies to manage the financial and reputational risks associated with data breaches. With a complex landscape of emerging cyber threats, European companies are increasingly investing in cyber insurance solutions to ensure comprehensive coverage against a wide array of cyber incidents.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global market is still in its infancy and protects organizations against digital cyber threats. Limited established insurance providers increase the market’s competitiveness. Insurers will have a significant opportunity to increase customer trust and cyber insurance developments uptake due to the increasing ransom demands for cybersecurity.

The market players are taking advantage of the changing online threat landscape to offer solutions that minimize the impact of successful attacks. To offer customized terms and conditions for their insurance products, market leaders are developing new ways to assess clients’ cyber risk.

Top Key Players

- American International Group, Inc.

- Aon PLC

- The Chubb Corporation

- Zurich Insurance Group Ltd

- Allianz SE

- AXIS Capital Holdings Limited

- Beazley PLC

- Lockton Companies, Inc.

- Munich Re Group

- The Travelers Companies, Inc.

- CNA Financial Corporation

- Liberty Mutual Group

- Other Key Players

Recent Developments

- Travelers Companies, Inc. completed its acquisition of Corvus Insurance Holdings Inc., a cyber insurance managing general underwriter, for $435 million. This acquisition, announced in November 2023, was finalized in January 2024, and aims to enhance Travelers’ presence in the cyber insurance market.

- Aon PLC completed a significant $13 billion acquisition of the middle-market broker NFP in April 2024. This acquisition involved a mix of cash and Aon stock and is expected to strengthen Aon’s position in the cyber insurance sector.

- Chubb announced the acquisition of Healthy Paws, a managing general agent specializing in pet insurance, from Aon in April 2024. Although primarily focused on pet insurance, this move underscores Chubb’s broader strategy to diversify its insurance portfolio.

- Zurich Insurance Group Ltd. acquired American International Group (AIG)’s global personal travel insurance business for $600 million in June 2024. This acquisition includes a potential additional payment contingent on performance and is part of Zurich’s strategy to expand its specialty insurance offerings.

Report Scope

Report Features Description Market Value (2023) USD 12.1 Bn Forecast Revenue (2033) USD 90.6 Bn CAGR (2024-2033) 22.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Insurance Type (Standalone, Packaged), By Coverage Type (First-Party Coverage Third-Party Coverage), Enterprise Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), Industry Vertical (BFSI, Healthcare and Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape American International Group, Inc., Aon PLC, The Chubb Corporation, Zurich Insurance Group Ltd, Allianz SE, AXIS Capital Holdings Limited, Beazley PLC, Lockton Companies, Inc., Munich Re Group, The Travelers Companies, Inc., CNA Financial Corporation, Liberty Mutual Group, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is cyber insurance?Cyber insurance is a type of insurance that provides financial protection for businesses and organizations against losses resulting from cyber attacks, data breaches, and other cyber incidents. It helps cover the costs associated with recovering from a cyber attack, including legal expenses, customer notification, forensic investigations, and potential financial liabilities.

Why do businesses need cyber insurance?Businesses need cyber insurance because cyber threats are on the rise and can lead to significant financial and reputational damage. Cyber insurance helps organizations manage the risks associated with cyber attacks by providing coverage for expenses related to data breaches, business interruptions, extortion attempts, and third-party liabilities.

What are some challenges faced by the cyber insurance market?Key challenges include affordability, policy variability, quantifying intangible losses, limited historical actuarial data, and profitability pressures from rising claims.

What factors are driving growth in the cyber insurance market?Drivers include high-profile cyberattacks, digital transformation, stricter regulations, insurance channel promotion, and improved, specialized products.

What are some emerging cyber insurance market trends?Trends include usage-based policies, blockchain applications, risk analytics, policy personalization, and consolidation among insurers.

-

-

- American International Group, Inc.

- Aon PLC

- The Chubb Corporation

- Zurich Insurance Group Ltd

- Allianz SE

- AXIS Capital Holdings Limited

- Beazley PLC

- Lockton Companies, Inc.

- Munich Re Group

- The Travelers Companies, Inc.

- CNA Financial Corporation

- Liberty Mutual Group

- Other Key Players