Global CV Depot Charging Market Size, Share, Growth Analysis By Vehicle (Electric Light Commercial Vehicles (ELCVS), Electric Medium Commercial Vehicles (EMCVS), Electric Heavy Commercial Vehicles (EHCVS), Electric Buses (EBUSES)), By Charging Station (Private Charging Stations, Public Charging Stations), By Power Output (Up to 50 kW, 51-150 kW, Above 150 kW), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156889

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

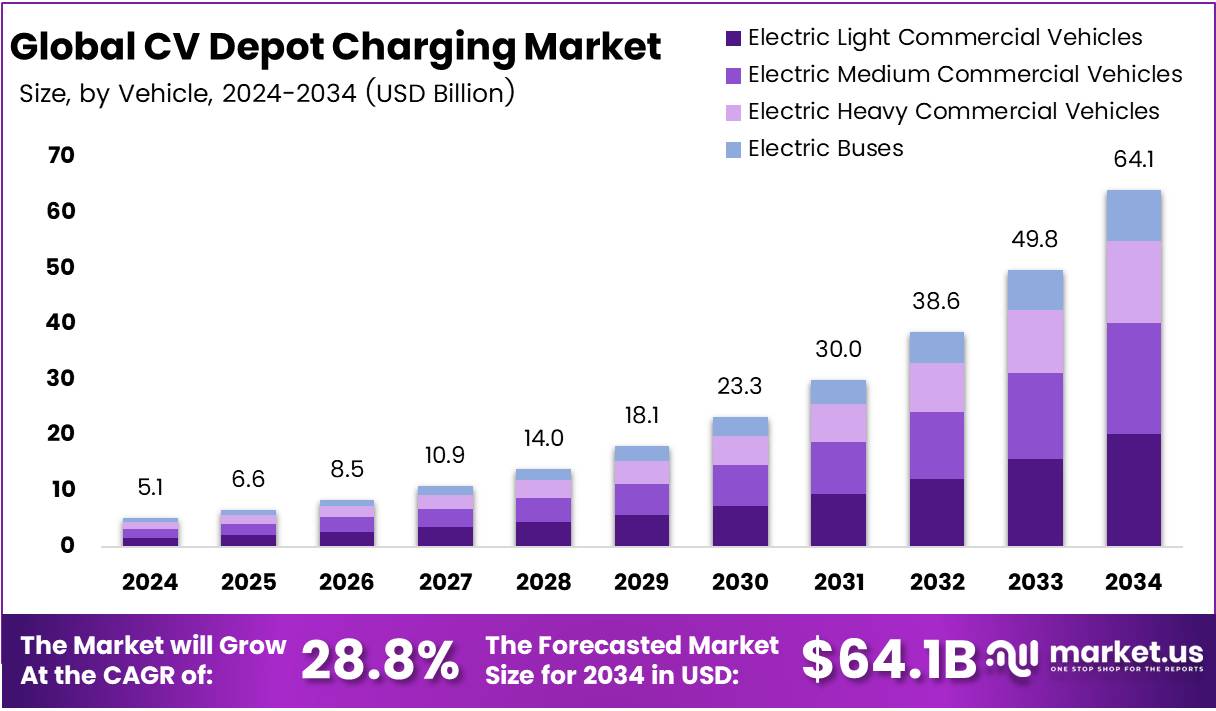

The Global CV Depot Charging Market size is expected to be worth around USD 64.1 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 28.8% during the forecast period from 2025 to 2034.

The Commercial Vehicle (CV) Depot Charging Market is emerging as a critical segment within the global e-mobility ecosystem. It refers to the infrastructure and solutions designed to charge fleets of electric trucks, vans, and buses at centralized depots. These facilities enable fleet operators to optimize schedules, reduce downtime, and ensure reliable electrification of heavy transport operations.

The market is gaining momentum as governments worldwide push stricter emission regulations. Many regions are rolling out incentives, subsidies, and mandates for electrifying commercial fleets. Policies in the US, Europe, and China are creating a strong foundation for depot charging investments. Consequently, stakeholders anticipate steady growth in demand for scalable and high-capacity charging infrastructure.

In addition, depot charging ensures predictable load management compared to public charging, making it attractive for logistics, last-mile delivery, and transit companies. Operators benefit from planned charging cycles during off-peak hours, lowering electricity costs and reducing strain on the grid. This predictable model enhances efficiency for businesses managing large electric vehicle (EV) fleets.

Opportunities are expanding as utilities, technology providers, and fleet operators collaborate. Energy companies are investing in smart grid integration and renewable power sources for depots. Hardware manufacturers are developing ultra-fast chargers tailored for heavy-duty CVs. These developments are projected to strengthen the ecosystem and unlock cost-saving opportunities for fleet electrification.

Growth is further driven by large-scale fleet electrification commitments. For instance, logistics players and public transit agencies are increasingly shifting to EV fleets to meet sustainability goals. This transition boosts demand for depot charging hubs that can handle simultaneous high-power charging while ensuring safety and reliability. Market participants are leveraging these shifts to secure long-term contracts.

Government investments play a pivotal role in market expansion. Authorities in the European Union and the United States are allocating billions toward charging infrastructure grants. These funds encourage private sector participation and speed up deployment. Regulatory support also ensures interoperability standards and safety compliance, making depot charging systems more secure and future-ready.

Despite high upfront installation costs, the CV Depot Charging Market is expected to grow steadily. The integration of digital energy management, load balancing, and predictive maintenance is reducing operational expenses. As the cost of batteries and charging hardware continues to fall, fleet electrification at depots becomes economically feasible for a wider range of operators.

The market’s future outlook remains highly positive. With rising environmental awareness, stricter CO₂ regulations, and rapid technological innovation, CV depot charging is transitioning from pilot projects to full-scale deployments. This sector is anticipated to remain a cornerstone of the commercial EV ecosystem, supporting both sustainable transport and long-term business efficiency.

Key Takeaways

- The Global CV Depot Charging Market is projected to reach USD 64.1 Billion by 2034, up from USD 5.1 Billion in 2024, at a CAGR of 28.8%.

- In 2024, Electric Light Commercial Vehicles (ELCVS) dominated the vehicle segment with a 31.7% share, supported by logistics adoption in urban deliveries.

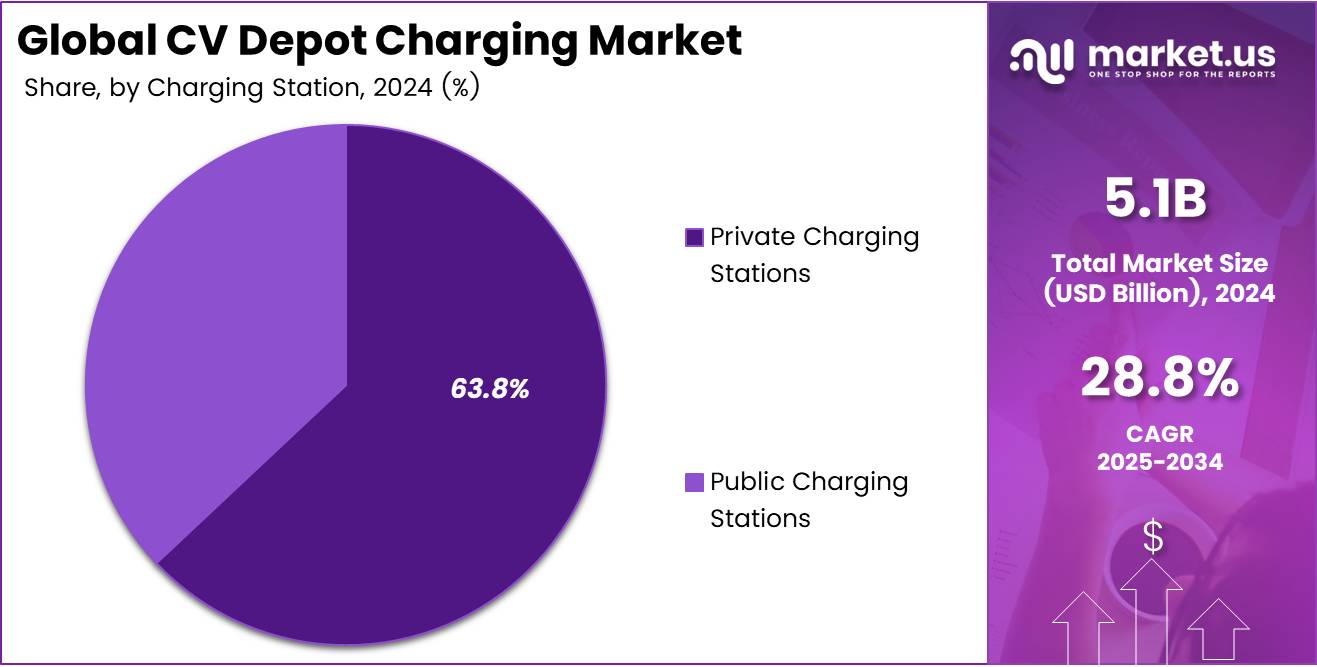

- Private Charging Stations led the charging station segment in 2024, capturing a 63.8% share, favored by fleet operators for reliability and cost efficiency.

- The 51–150 kW power output segment accounted for a 47.3% share in 2024, balancing fast charging needs with manageable grid impact.

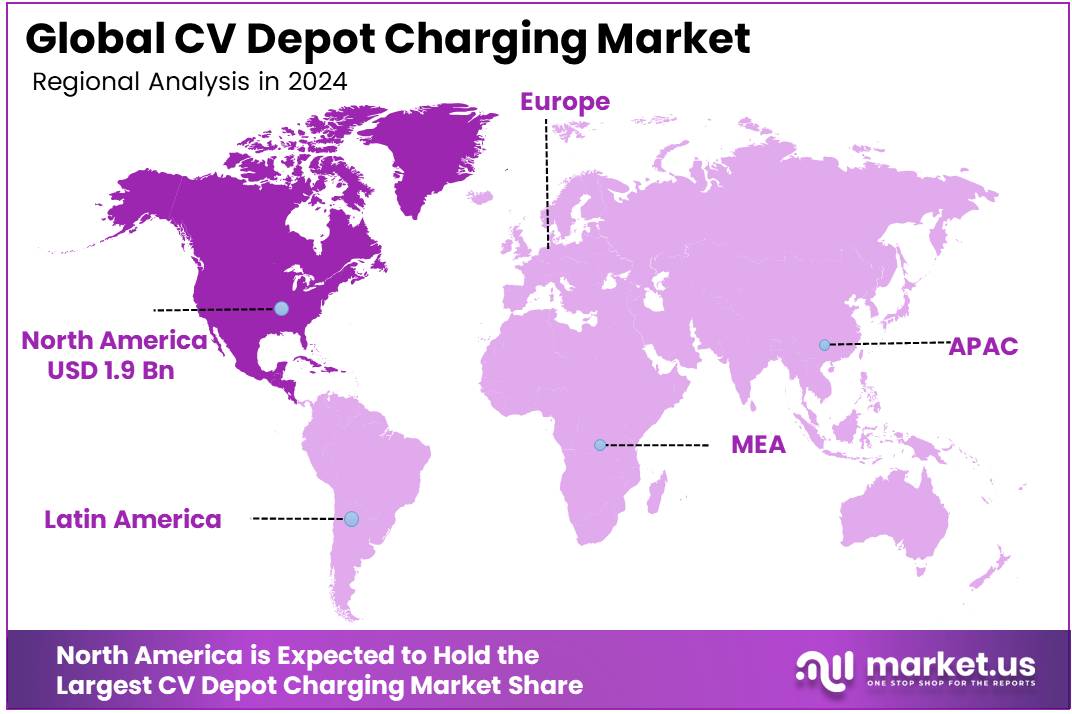

- North America held the largest regional share of 37.9%, valued at USD 1.9 Billion in 2024, driven by government funding and EV fleet electrification.

Vehicle Analysis

Electric Light Commercial Vehicles (ELCVS) dominate with 31.7% due to high demand for last-mile delivery and fleet efficiency.

In 2024, Electric Light Commercial Vehicles (ELCVS) held a dominant market position in By Vehicle Analysis segment of the CV Depot Charging Market, with a 31.7% share. The segment benefits from strong adoption by logistics operators seeking cost efficiency and sustainability in urban deliveries. Compact design and operational flexibility make ELCVS attractive for city-based businesses.

Electric Medium Commercial Vehicles (EMCVS) are anticipated to grow steadily as regional transport networks modernize. These vehicles serve intercity logistics, bridging the gap between smaller vans and heavy trucks. Depot charging infrastructure tailored to medium fleets is gaining attention as governments incentivize fleet electrification.

Electric Heavy Commercial Vehicles (EHCVS) are gradually gaining traction, especially in industrial hubs and cross-border freight corridors. Although initial adoption is slower due to infrastructure limitations, investment in high-capacity chargers is expected to support demand for long-haul heavy trucks.

Electric Buses (EBUSES) form a vital part of public transport electrification. Transit agencies are increasingly deploying depot-based charging solutions to support large fleets. Urban air quality policies and emission mandates are driving significant procurement of e-buses, reinforcing their role in mass mobility.

Charging Station Analysis

Private Charging Stations dominate with 63.8% due to strong fleet control, reliability, and cost management advantages.

In 2024, Private Charging Stations held a dominant market position in By Charging Station Analysis segment of the CV Depot Charging Market, with a 63.8% share. Fleet operators prefer private facilities as they ensure uninterrupted access, predictable charging schedules, and lower operational risks. These stations also allow better load management and cost optimization.

Public Charging Stations, although smaller in share, are gaining relevance for long-distance fleet movements and intercity operations. Governments are investing in expanding publicly accessible depots to reduce range anxiety for commercial vehicle operators. Collaboration between municipalities and charging solution providers is accelerating deployment in transport corridors.

Private depots continue to dominate due to the increasing electrification of dedicated fleets, particularly in logistics, retail distribution, and public services. Meanwhile, public networks are anticipated to play a complementary role, supporting occasional and cross-regional charging needs, especially for heavy vehicles and buses.

Power Output Analysis

51-150 kW dominates with 47.3% due to its suitability for balanced charging speed and cost-effective deployment.

In 2024, 51-150 kW held a dominant market position in By Power Output Analysis segment of the CV Depot Charging Market, with a 47.3% share. This range offers an optimal balance between fast charging capability and manageable grid impact, making it a preferred choice for most depots.

Up to 50 kW chargers serve smaller fleets and light commercial vehicles. They are favored by operators focusing on cost efficiency and overnight charging schedules. Their lower installation cost and compatibility with existing power infrastructure enhance adoption in small to medium-scale depots.

Above 150 kW chargers are designed for heavy commercial vehicles and intercity fleets with high energy demands. Although adoption is limited due to cost and infrastructure challenges, investment in high-capacity charging solutions is increasing, particularly in logistics hubs and bus depots.

The dominance of the 51-150 kW segment reflects its broad applicability across vehicle categories, balancing affordability and efficiency, while the growth of high-capacity chargers signals readiness for large-scale heavy fleet electrification.

Key Market Segments

By Vehicle

- Electric Light Commercial Vehicles (ELCVS)

- Electric Medium Commercial Vehicles (EMCVS)

- Electric Heavy Commercial Vehicles (EHCVS)

- Electric Buses (EBUSES)

By Charging Station

- Private Charging Stations

- Public Charging Stations

By Power Output

- Up to 50 kW

- 51-150 kW

- Above 150 kW

Drivers

Expansion of Heavy-Duty Electric Commercial Vehicles Drives Market Growth

The CV depot charging market is gaining momentum due to the rapid expansion of heavy-duty electric commercial vehicles. Logistics operators are increasingly shifting toward electric trucks and buses to reduce emissions and meet sustainability goals. This adoption directly fuels the need for advanced depot charging infrastructure to handle large fleets efficiently.

Rising investments in urban depot electrification are also playing a crucial role. Governments and private players are channeling significant funds into creating charging hubs within cities to reduce air pollution. With urban freight demand increasing, these electrification projects ensure that fleets can recharge conveniently, improving operational reliability and fleet turnaround time.

Supportive government incentives are further accelerating the development of fleet charging hubs. Subsidies for charging infrastructure, tax credits, and grants for fleet operators encourage faster adoption of depot charging solutions. Such financial support reduces upfront costs and strengthens the overall ecosystem for electric commercial vehicles.

The growing logistics demand for overnight depot charging adds another growth layer. Fleet operators require cost-effective and time-efficient solutions to charge multiple vehicles simultaneously during off-peak hours. Overnight depot charging provides reliability, ensures vehicles are fully powered by morning, and reduces downtime, making it a preferred choice in logistics-heavy regions.

Restraints

Complex Land Acquisition for Large-Scale Depots Restrains Market Growth

One of the major restraints for the CV depot charging market is complex land acquisition. Establishing large-scale depots requires significant land in urban and industrial zones, where real estate is expensive and limited. Lengthy approval processes, zoning restrictions, and community concerns often delay projects, creating challenges for operators.

Slow standardization of high-power charging protocols also hinders growth. With various manufacturers adopting different charging technologies, interoperability issues arise. This slows down infrastructure deployment, increases costs, and limits fleet operators’ ability to scale effectively. The lack of universal standards makes investment risky for both depot developers and logistics companies.

Growth Factors

Integration of Renewable Energy with Depot Charging Creates Growth Opportunities

Integrating renewable energy sources with depot charging presents a significant growth opportunity. Solar panels, wind power, and energy storage systems can be combined with depots to reduce grid dependency and lower operational costs. This not only ensures sustainability but also offers long-term energy security for fleet operators.

The development of battery swapping infrastructure for commercial vehicles also unlocks new avenues. Swapping stations reduce downtime by quickly replacing depleted batteries with charged ones, making them highly attractive for time-sensitive logistics and public transport fleets. This model is gaining traction in regions with high commercial vehicle density.

Partnerships between OEMs and energy providers are another key driver of opportunity. Such collaborations ensure shared investments, technological innovation, and smooth integration of depot charging into wider energy networks. By aligning automotive and energy sectors, the industry accelerates the scaling of charging infrastructure.

Emerging demand for rural and semi-urban depot networks further strengthens growth potential. Expanding charging facilities beyond metropolitan areas supports wider EV adoption, connecting supply chains across smaller towns and industrial belts. This expansion ensures equitable electrification and opens up new market segments for depot operators.

Emerging Trends

Adoption of AI-Powered Smart Energy Management at Depots Shapes Market Trends

The adoption of AI-powered smart energy management systems is transforming depot operations. These systems optimize energy use, balance grid loads, and reduce costs by scheduling charging cycles intelligently. Fleet operators benefit from improved efficiency, lower electricity bills, and extended battery life for their vehicles.

Increasing preference for megawatt charging systems (MCS) is another strong trend. MCS technology enables ultra-fast charging for heavy-duty trucks, reducing downtime significantly. As more logistics companies adopt long-haul electric trucks, demand for high-capacity depot chargers continues to grow, pushing the market toward next-generation charging technologies.

The rise of depot-as-a-service business models also reshapes the industry. Instead of building their own infrastructure, fleet operators can rely on third-party providers for charging solutions. This reduces capital expenditure and offers flexibility, making it an attractive option for small and mid-sized logistics players.

Growing use of telematics for optimized fleet charging cycles further drives efficiency. By analyzing real-time data, telematics helps fleets decide when and where to charge vehicles, minimizing congestion at depots. This integration of digital tools ensures smoother operations and aligns with the broader trend of connected mobility.

Regional Analysis

North America Dominates the CV Depot Charging Market with a Market Share of 37.9%, Valued at USD 1.9 Billion

North America accounted for the largest share of the CV depot charging market, with 37.9% share and a market value of USD 1.9 Billion. The region benefits from strong government funding, extensive EV infrastructure projects, and a rapid shift of logistics fleets toward electrification. Growing adoption of electric trucks and buses in the U.S. further drives market expansion.

Europe CV Depot Charging Market Trends

Europe shows robust growth potential driven by stringent emission norms and ambitious EU decarbonization targets. The region is focusing heavily on depot electrification to support long-haul electric trucks. Investment in cross-border charging corridors and subsidies for fleet operators is creating favorable momentum for market penetration.

Asia Pacific CV Depot Charging Market Trends

Asia Pacific is emerging as a high-growth region due to rapid urbanization, increasing adoption of electric buses, and strong government-led electrification policies. China, India, and Japan are pushing large-scale depot charging initiatives to meet rising logistics demand. The expansion of smart city projects further supports infrastructure development in the region.

Middle East and Africa CV Depot Charging Market Trends

The Middle East and Africa are gradually adopting depot charging infrastructure, with early adoption seen in the UAE and South Africa. Government-backed clean transport initiatives and pilot EV fleet projects are contributing to market entry. However, challenges related to grid readiness and investment costs are slowing faster expansion.

Latin America CV Depot Charging Market Trends

Latin America is in the nascent stage of CV depot charging adoption, with progress concentrated in Brazil, Mexico, and Chile. Urban electrification programs and renewable energy integration are driving early deployments. The region holds long-term potential as fleet operators look to reduce dependence on imported fuels and adopt sustainable transport solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key CV Depot Charging Company Insights

In 2024, the global CV Depot Charging Market witnessed strategic advancements from key players shaping the electrification landscape.

ABB maintained its strong presence by leveraging its advanced charging infrastructure and smart energy solutions. Its focus on modular and scalable depot charging systems positioned it as a preferred partner for fleet operators aiming to transition to electric vehicles efficiently.

Shell Recharge Solutions enhanced its market influence by expanding its charging network and offering integrated energy management services. The company’s approach of combining depot charging with renewable energy integration appealed to logistics firms seeking sustainable operations and cost optimization, strengthening its foothold in urban and intercity fleet electrification.

Robert Bosch GmbH contributed significantly by emphasizing its expertise in power electronics and digital solutions. By providing intelligent depot charging management software and hardware integration, Bosch enabled seamless charging operations for fleet depots. Its focus on interoperability and predictive maintenance created added value for fleet managers, improving overall charging efficiency and system reliability.

Siemens reinforced its leadership in electrification by introducing large-scale, high-power depot charging solutions tailored for heavy-duty fleets. Its strong track record in smart grid technology and energy distribution allowed Siemens to provide holistic depot charging ecosystems. With government-backed urban electrification projects, the company played a crucial role in driving large fleet electrification across global transport hubs.

Top Key Players in the Market

- ABB

- Shell Recharge Solutions

- Robert Bosch GmbH

- Siemens

- KEM Power Oyj

Recent Developments

- In Jul 2025, Blink Charging announced the strategic acquisition of Zemetric, Inc. This move enhances its charging technology capabilities and strengthens its position in the EV infrastructure sector.

- In Aug 2025, VIRTA acquired NORTHE Fleet Management, creating Europe’s most comprehensive platform for EV fleet, charging, and energy solutions. The acquisition expands service integration and customer reach across the continent.

- In Sep 2024, Siemens merged its eMobility division with Heliox to form a standalone entity. This restructuring is aimed at driving agility and fostering greater innovation in the rapidly growing EV charging market.

- In Aug 2024, EV charging startup Kazam raised $8 million in funding. The capital will accelerate product development and support the company’s expansion into new urban charging markets.

- In Nov 2024, Relux Electric secured ₹250 crore funding for its highway hyper charging expansion across South India. The investment supports scaling up fast-charging infrastructure to meet rising EV adoption in the region.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 64.1 Billion CAGR (2025-2034) 28.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Electric Light Commercial Vehicles (ELCVS), Electric Medium Commercial Vehicles (EMCVS), Electric Heavy Commercial Vehicles (EHCVS), Electric Buses (EBUSES)), By Charging Station (Private Charging Stations, Public Charging Stations), By Power Output (Up to 50 kW, 51-150 kW, Above 150 kW) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB, Shell Recharge Solutions, Robert Bosch GmbH, Siemens, KEM Power Oyj Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB

- Shell Recharge Solutions

- Robert Bosch GmbH

- Siemens

- KEM Power Oyj