Global Customer Experience Management Market Size, Share, Trends Analysis Report By Analytical Tools (Speech Analytics, EFM Software, Web Analytics & Content Management, Text Analytics, Other Analytical Tools), By Touch Point Type (Call Centers, Stores/Branches, Email, Social Media Platform, Web Services, Mobile, Other Touch Point Types), By Deployment (On-premise and Cloud), By End-use (IT & Telecommunications, BFSI, Retail, Healthcare, Manufacturing, Construction, Government, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 48207

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

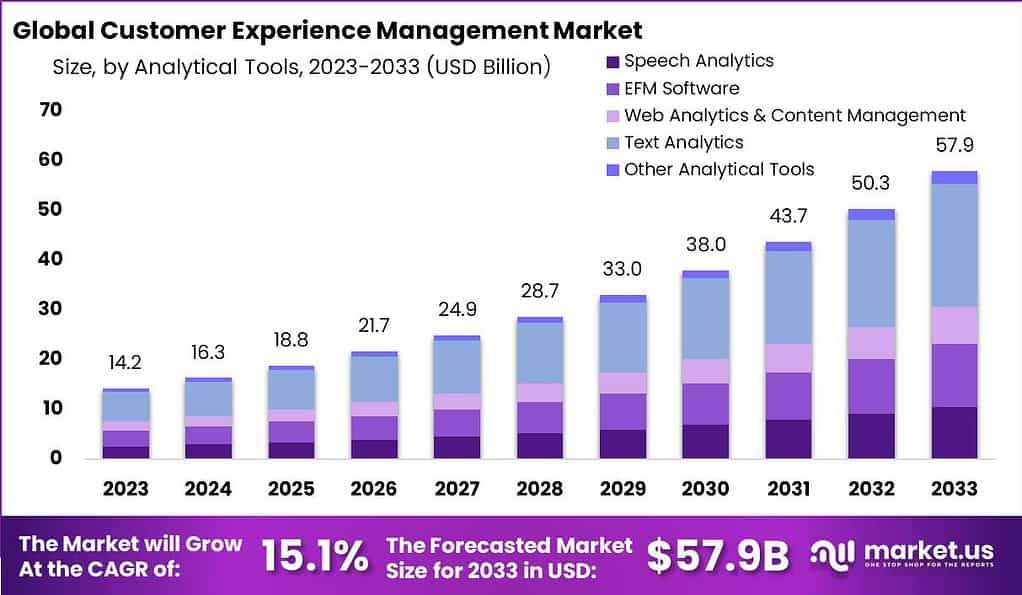

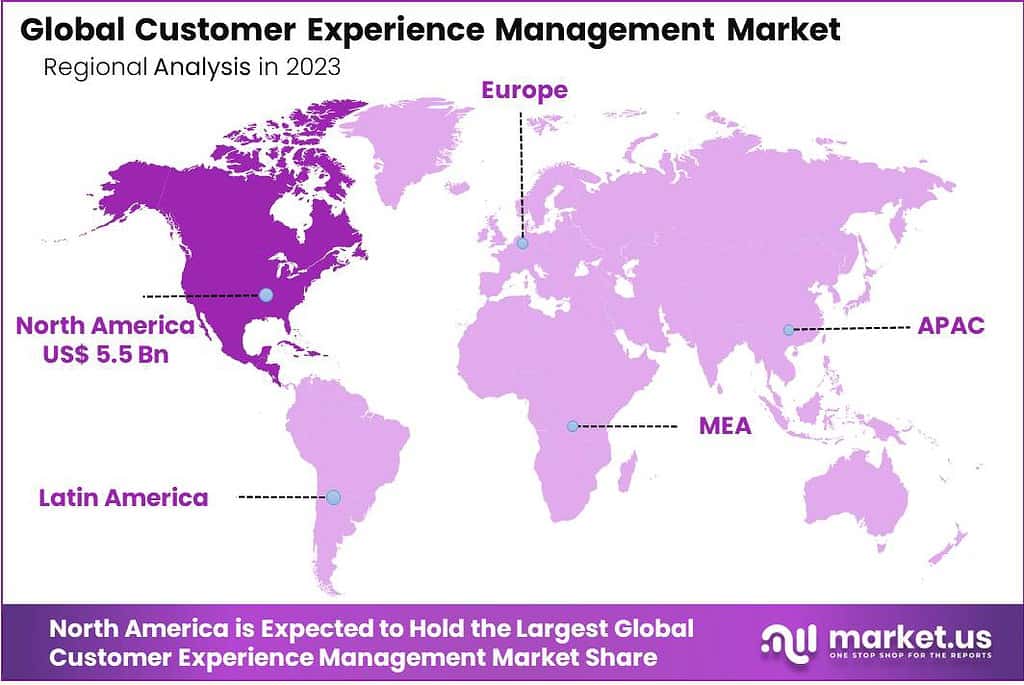

The Global Customer Experience Management Market size is expected to be worth around USD 57.9 Billion By 2033, from USD 14.2 Billion in 2023, growing at a CAGR of 15.1% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38.9% share, holding USD 5.5 Billion revenue.

Customer Experience Management (CEM or CXM) is about understanding and managing customers’ interactions with a company to meet or exceed their expectations. It’s a holistic approach that takes into account every touchpoint between a customer and a company – whether it’s through sales, customer service, or digital engagement. The aim is to create a positive, memorable experience that encourages loyalty and satisfaction, turning customers into advocates for the business.

The market for Customer Experience Management is dynamic and growing as businesses recognize the importance of focusing on customer satisfaction to differentiate themselves in a competitive environment. Companies are investing in CEM technologies and services that help them analyze customer feedback across various channels, personalize customer interactions, and improve customer service.

This market includes software solutions such as data analytics, artificial intelligence, and digital transformation tools designed to enhance the customer journey. Several key factors are driving the growth of the Customer Experience Management market. Firstly, there is an increased emphasis on enhancing customer retention and loyalty in a highly competitive market environment.

Secondly, the integration of machine learning and AI technologies enables deeper insights into customer behaviors and preferences. Lastly, the rise of digital channels has expanded the ways in which customers can interact with businesses, necessitating more comprehensive management tools.

The demand for effective Customer Experience Management solutions is on the rise. Businesses across all industries are seeking ways to improve customer satisfaction and build long-term relationships. This demand is driven by the need to better understand customer expectations and to deliver personalized experiences that attract and retain customers.

For instance, In March 2024, Adobe Inc. launched an advanced suite of solutions specifically designed to enhance Customer Experience Management (CXM) for enterprises. These new offerings aim to enable brands to deliver personalized experiences at scale by integrating generative AI and real-time insights.

The Customer Experience Management market is ripe with opportunities. One major opportunity lies in the adoption of cloud-based CEM solutions, which offer scalability and accessibility advantages to businesses of all sizes. There is also significant potential in emerging markets, where companies are just beginning to focus on sophisticated customer experience strategies.

Based on data from HubSpot, improving customer retention and loyalty remains a top priority for 31% of customer service leaders. Retaining customers not only boosts revenue but also builds brand loyalty, making it a critical focus area in competitive markets. However, understanding customer needs is one of the most significant hurdles in delivering a standout customer experience, reflecting the complexity of aligning service with evolving expectations.

Artificial intelligence (AI) is widely recognized as a game-changer, with 86% of respondents affirming its transformative impact on customer experience. AI enables faster responses, predictive analytics, and personalized engagement, paving the way for enhanced customer satisfaction. With this in mind, 71% of service leaders plan to increase their investment in AI chatbots, seeking more efficient service channels that provide consistent support around the clock.

The appeal of self-service options is clear, as 55% of customers prefer handling issues on their own over speaking to a support representative, showing a strong demand for intuitive and accessible support tools. AI chatbots and live chat are currently the most popular service channels, providing quick and convenient assistance.

In line with evolving customer preferences, 34% of customer service leaders plan to make their first investment in developing a mobile app dedicated to customer service, enhancing support accessibility. As businesses grow, scaling customer service operations effectively is crucial. 85% of leaders report that their ability to scale operations has significantly or somewhat improved, showing promising progress in adapting to expanding customer bases.

Key Takeaways

- The Global Customer Experience Management Market is anticipated to grow from USD 14.2 billion in 2023 to a projected USD 57.9 billion by 2033, marking a robust CAGR of 15.1%.

- North America led the Customer Experience Management market in 2023, capturing a significant 38.9% share, translating to about USD 5.5 billion in revenue.

- The Text Analytics segment held a prominent position within the market, securing over 42.7% of the share in 2023.

- The Call Centers segment emerged as a market leader, holding a 33.4% share in 2023.

- The On-Premise deployment model led the market in 2023, accounting for 61.3% of the share.

- Retail dominated with a 26.2% market share in 2023.

Analytical Tool analysis

In 2023, the Text Analytics segment held a dominant market position within the Customer Experience Management market, capturing more than a 42.7% share. This segment leads due to several compelling reasons that resonate across various industries, highlighting the essential nature of textual data in understanding customer interactions and sentiments.

Text Analytics has proven critical in deciphering the vast amounts of unstructured textual data generated through customer feedback, social media conversations, online reviews, and support tickets. By employing text analytics, companies can extract valuable insights about customer preferences, pain points, and overall sentiment towards their products or services. This ability to rapidly analyze and respond to customer feedback enables businesses to tailor their offerings and improve customer satisfaction effectively.

Moreover, the integration of AI and machine learning technologies has significantly enhanced the capabilities of text analytics tools. These advancements allow for more accurate sentiment analysis, trend detection, and even predictive analytics, providing companies with a forward-looking approach to managing customer experiences. As businesses increasingly rely on data-driven strategies to make informed decisions, text analytics becomes indispensable in transforming raw data into actionable intelligence.

The leadership of the Text Analytics segment is also bolstered by its application in regulatory compliance and risk management. Companies in sectors like finance, healthcare, and telecommunications use text analytics to ensure compliance with regulations by monitoring and analyzing customer communications and internal documentation. This dual benefit of enhancing customer experience and ensuring regulatory adherence further solidifies text analytics as a critical component of Customer Experience Management strategies.

Touchpoint Type analysis

In 2023, the Call Centers segment held a dominant market position within the Customer Experience Management market, capturing more than a 33.4% share. This prominence is attributed to several key factors that highlight the integral role call centers play in shaping customer perceptions and satisfaction.

Call centers have traditionally been the backbone of customer service operations, serving as the primary point of contact for customer inquiries, complaints, and support. The ability of call centers to manage large volumes of customer interactions efficiently makes them pivotal in gathering insights into customer needs and expectations. By effectively addressing these interactions, businesses can significantly enhance customer satisfaction and loyalty, which is crucial for retaining customers in competitive markets.

The continued relevance of call centers is further supported by advancements in technology such as the integration of AI, machine learning, and sophisticated data analytics. These technologies have transformed call centers from mere communication hubs into strategic assets capable of providing personalized customer experiences. They enable real-time data processing and feedback, which helps companies to make informed decisions quickly and improve the overall quality of customer interactions.

Additionally, despite the rise of digital communication platforms, many customers still prefer the personal touch and immediacy of voice conversations when resolving complex issues. This preference underscores the continued importance of call centers in the customer service ecosystem. As businesses strive to build stronger relationships with their customers, the role of call centers as a critical touchpoint in the Customer Experience Management landscape remains undiminished.

Deployment analysis

In 2023, the On-Premise segment held a dominant market position within the Customer Experience Management market, capturing more than a 61.3% share. This leadership stems from several core advantages that on-premise solutions offer to organizations, particularly in terms of control, security, and customization.

On-premise deployment of Customer Experience Management solutions provides organizations with full control over their infrastructure and data. Many businesses, especially those in highly regulated industries such as finance, healthcare, and government, prefer on-premise solutions due to the stringent requirements for data security and privacy.

These entities prioritize the ability to maintain and manage their servers and systems internally, minimizing the risk of data breaches and unauthorized access that can be more prevalent in cloud-based environments.

Additionally, on-premise solutions offer organizations the flexibility to customize their software to fit specific business needs without the constraints often imposed by cloud providers. This level of customization is crucial for companies with complex customer interaction processes or those needing to integrate their Customer Experience Management tools with legacy systems.

It enables a tailored approach that aligns more closely with organizational workflows and customer engagement strategies. Moreover, despite the growing trend towards cloud computing, many businesses continue to invest in on-premise solutions due to their predictable cost structure.

Unlike cloud services, which can vary in cost based on usage, on-premise solutions require an upfront investment but lead to more predictable operating expenses over time. This predictability is especially appealing to organizations with stable and defined requirement patterns, making on-premise solutions a leading choice in the Customer Experience Management market.

End-use analysis

In 2023, the Retail segment held a dominant market position within the Customer Experience Management market, capturing more than a 26.2% share. This leading status can be attributed to several pivotal factors that underscore the critical role of customer experience in the retail industry.

Retailers increasingly recognize that providing a superior customer experience is a key differentiator in a highly competitive market. The focus on enhancing customer interactions at every touchpoint—from in-store service to online shopping platforms – drives the need for robust Customer Experience Management systems. These systems help retailers track and analyze customer behavior, preferences, and feedback, enabling personalized marketing, optimized customer service, and improved customer loyalty.

The integration of advanced technologies such as AI, machine learning, and data analytics into Customer Experience Management solutions also significantly benefits the retail sector. These technologies allow for real-time customer insights, predictive analytics for purchasing behavior, and personalized recommendations, all of which enhance the shopping experience. This tailored approach not only increases customer satisfaction but also drives repeat business, which is crucial for retail success.

Moreover, as the retail landscape evolves with the growth of e-commerce and mobile shopping, the demand for seamless omnichannel experiences has become more pronounced. Retailers are leveraging Customer Experience Management tools to ensure consistency across all platforms, whether the customer shops online from a mobile device, through a web browser, or in a physical store.

Key Market Segments

By Analytical Tools

- Speech Analytics

- EFM Software

- Web Analytics & Content Management

- Text Analytics

- Other Analytical Tools

By Touch Point Type

- Call Centers

- Stores/Branches

- Social Media Platform

- Web Services

- Mobile

- Other Touch Point Types

By Deployment

- On-premise

- Cloud

By End-use

- BFSI

- Healthcare

- Retail

- Manufacturing

- Construction, Real Estate & Property Management

- IT & Telecom

- Government, Energy & Utilities

- Service Business

- Other End-uses

Driver

Increasing Demand for Personalized Customer Experience

One of the primary drivers for the growth of the Customer Experience Management (CEM) market is the escalating demand for personalized customer interactions. As digital technology advances, customers expect not just service but tailored experiences that cater to their individual preferences across various digital platforms.

Businesses are responding by implementing sophisticated analytics and AI technologies to gain deeper insights into customer behaviors and preferences. This not only helps in delivering personalized experiences but also enhances customer satisfaction and loyalty, which are crucial for business growth in today’s competitive landscape.

Restraint

Privacy and Data Security Concerns

A significant restraint in the Customer Experience Management market is the ongoing concerns regarding privacy and data security. As companies collect and analyze vast amounts of customer data to improve their service offerings, they also face the challenge of managing this data responsibly.

Ensuring the security of customer information and maintaining privacy in accordance with global standards and regulations remains a major hurdle. This issue is particularly accentuated with the rapid adoption of cloud technologies, where data breaches can potentially expose sensitive customer information, leading to trust issues and potential legal consequences.

Opportunity

Integration of AI and Analytics

The CEM market is ripe with opportunities, particularly through the integration of AI and advanced analytics. These technologies allow for the automation and enhancement of customer interactions on a large scale, providing businesses with the tools to predict customer needs and offer customized solutions proactively.

The ability to harness real-time data and turn it into actionable insights can significantly improve customer engagement and open new avenues for businesses to innovate their service delivery processes.

Challenge

Aligning Multi-channel Strategies

A major challenge in the CEM market is the effective alignment and integration of multi-channel strategies. Ensuring a consistent and seamless customer experience across all channels – be it online, in-store, or via mobile – requires substantial coordination and integration of various technologies and business processes. This multi-channel approach is essential to meet the modern customer’s expectation for a unified experience regardless of how or where they choose to interact with a brand.

Growth Factors

Rapid Digital Transformation

The rapid pace of digital transformation is a key growth factor for the CEM market. As businesses across industries move towards digitalizing their operations, there is a growing need to manage and enhance customer experiences digitally.

This transformation is driven by the necessity to remain competitive and to cater to the digital-savvy consumer, prompting companies to invest in CEM solutions that offer a more integrated, insightful, and customer-focused approach to business operations.

Emerging Trends

Omnichannel Engagement and Cloud Adoption

Emerging trends in the CEM market include the expansion of omnichannel engagement and the increased adoption of cloud-based solutions. Omnichannel strategies are becoming essential as customers increasingly expect a seamless experience across all platforms.

Meanwhile, cloud-based CEM solutions are being favored for their scalability, cost-effectiveness, and the ability to remotely manage customer data and interactions. These trends are guiding the future of how businesses interact with their customers, making engagements more fluid and responsive to customer needs.

Regional Analysis

In 2023, North America held a dominant market position in the Customer Experience Management (CEM) market, capturing more than a 38.9% share with revenues amounting to USD 5.5 billion. This leadership can be attributed to several strategic and technological factors that underscore the region’s advanced approach to customer experience management.

North America’s lead in the CEM market is largely driven by the rapid adoption of advanced technologies such as artificial intelligence, machine learning, and data analytics in customer service applications. The region is home to some of the leading technology innovators and adopters, with companies continuously investing in new tools to enhance customer interactions and personalize the customer journey.

Additionally, the presence of a robust digital infrastructure supports the widespread implementation of these technologies, enabling companies to efficiently manage large volumes of customer data and derive actionable insights.

This capability is further enhanced by stringent data protection regulations in North America, which bolster consumer confidence in digital services, encouraging more online interactions and data sharing between customers and businesses.

Moreover, the cultural emphasis on customer service excellence in North America motivates companies across various sectors to prioritize customer experience management as a critical business strategy.

This focus is reflected in higher budget allocations for CEM technologies and services, driving the growth of the market and reinforcing the region’s leading position in the global landscape. These factors combined make North America a pivotal region in the development and advancement of customer experience management practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

A large number of companies hold significant market shares. The companies are launching new services for customer experience management to increase and strengthen their touch point types and gain new customers. To develop touch points that are technologically advanced, companies are engaging in mergers and acquisitions as well as partnerships to gain an edge over their competition.

Top Key Рlауеrѕ

- Adobe Inc.

- SAP SE

- Oracle Corporation

- IBM Corporation

- Salesforce, Inc.

- Avaya LLC

- Genesys Cloud Services, Inc.

- Freshworks, Inc.

- Medallia, Inc.

- OpenText Corporation

- NICE Systems Ltd.

- Zendesk, Inc.

- Other Key Players

Recent Developments

- In November 2023, a significant partnership between International Business Machines Corp. (IBM) and NatWest marked a pivotal advancement in AI-driven customer service. IBM’s prowess in engineering and artificial intelligence is set to amplify the functionality of NatWest’s virtual assistant, Cora. This initiative is a core component of NatWest’s generative AI strategy, which utilizes WatsonX, IBM’s robust enterprise AI platform, aiming to enhance customer interactions and service efficiency.

- In September 2023, Oracle Corp. introduced innovative generative AI features designed to bridge gaps between its Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems. This enhancement focuses on creating a seamless flow of connected customer information, thereby improving overall customer experience.

Report Scope

Report Features Description Market Value (2023) USD 14.2 Bn Forecast Revenue (2033) USD 57.9 Bn CAGR (2024-2033) 15.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Analytical Tools (Speech Analytics, EFM Software, Web Analytics & Content Management, Text Analytics, Other Analytical Tools), By Touch Point Type (Call Centers, Stores/Branches, Email, Social Media Platform, Web Services, Mobile, Other Touch Point Types), By Deployment (On-premise and Cloud), By End-use (IT & Telecommunications, BFSI, Retail, Healthcare, Manufacturing, Construction, Government, Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Adobe Inc., SAP SE, Oracle Corporation, IBM Corporation, Salesforce, Inc., Avaya LLC, Genesys Cloud Services Inc., Freshworks, Inc., Medallia, Inc., OpenText Corporation, NICE Systems Ltd., Zendesk, Inc., Other Key Players Customization Scope Customization for segents, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Customer Experience Management MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Customer Experience Management MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- SAP SE

- Oracle Corporation

- IBM Corporation

- Salesforce, Inc.

- Avaya LLC

- Genesys Cloud Services, Inc.

- Freshworks, Inc.

- Medallia, Inc.

- OpenText Corporation

- NICE Systems Ltd.

- Zendesk, Inc.

- Other Key Players