Global Catalog Management System Market By Type (Product Catalog and Service Catalog), By Component (Solution, Service (Professional Service, Managed Service)), By Deployment Type (On-Premise and Cloud), By Application (BFSI, IT & Telecom, and Other Applications), By Organization Size(Small & Medium Enterprise, and Large Enterprise), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 65505

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

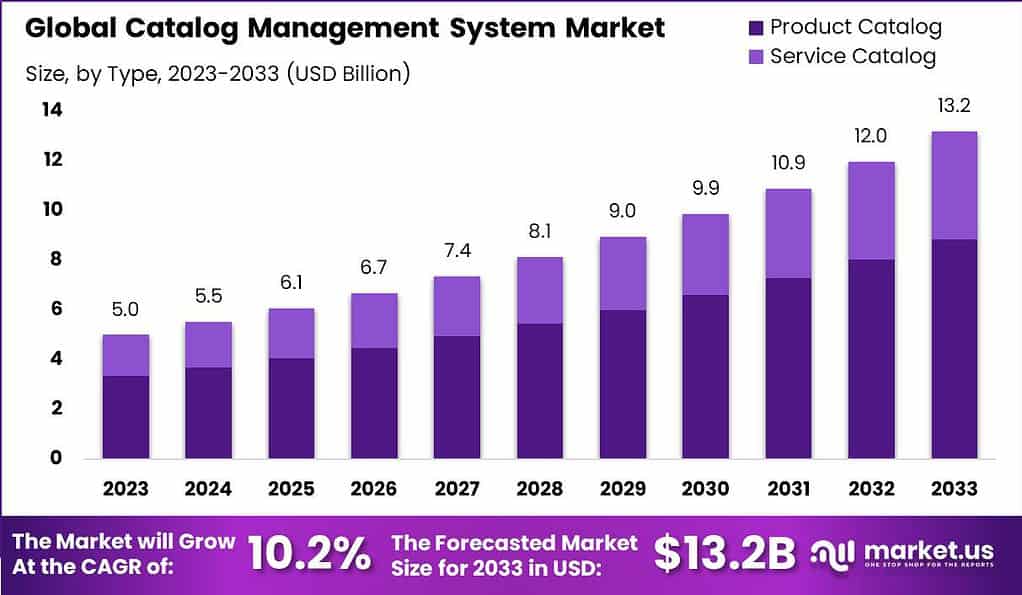

Global Catalog Management System Market size is expected to be worth around USD 13.2 Billion By 2033, from USD 5.0 Billion in 2023, growing at a CAGR of 10.2% during the forecast period from 2024 to 2033.

A Catalog Management System is a software solution that helps businesses organize and manage their product catalogs efficiently. It provides a centralized platform for businesses to create, update, and distribute product information across various channels. With the rise of e-commerce and online shopping, businesses need to ensure accurate and up-to-date product data for their customers. Catalog Management Systems enable businesses to streamline catalog management processes, automate data updates, and improve operational efficiency.

The Catalog Management System market is experiencing significant growth due to the increasing demand for efficient catalog management solutions. As businesses strive to provide better product information and enhance the customer experience, the adoption of Catalog Management Systems becomes crucial. These systems offer features such as bulk product uploads, real-time inventory management, and catalog customization, enabling businesses to effectively manage large volumes of product data.

However, the market faces challenges such as the high initial setup and maintenance costs of advanced catalog management systems, which can deter small and medium-sized enterprises from adoption. Additionally, data security concerns, given the sensitivity of product information, pose significant hurdles. Opportunities in the Catalog Management System market are abundant, especially with the increasing trend towards digital transformation in retail, manufacturing, and other sectors.

Businesses are looking to leverage these systems for better inventory management, cost reduction, and enhanced customer experiences. Furthermore, the expansion of online retail markets in emerging economies presents a lucrative avenue for the growth of catalog management systems, as companies strive to meet the rising demand for streamlined product catalog management.

Key Takeaways

- The Global Catalog Management System Market is projected to reach USD 13.2 billion by 2033, up from USD 5.0 billion in 2023, growing at a CAGR of 10.2% during the forecast period from 2024 to 2033.

- In 2023, the Product Catalog segment held a dominant position in the market, capturing more than a 67% share.

- In 2023, the Solution segment led the market, accounting for over 70% of the market share.

- The Cloud segment also maintained a strong presence in 2023, securing more than 60% of the market share.

- Large Enterprises dominated the market in 2023, with the Large Enterprise segment capturing over 57% share.

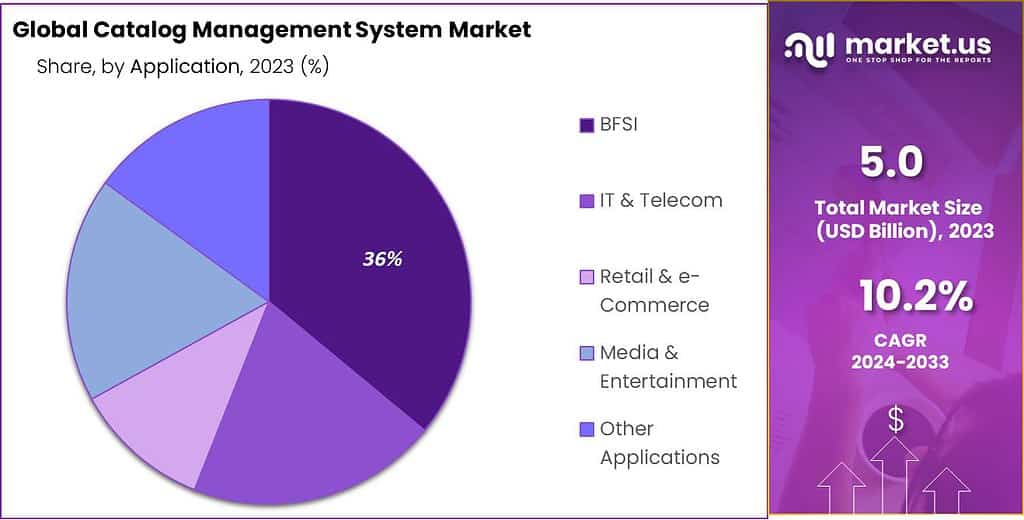

- The BFSI (Banking, Financial Services, and Insurance) segment was the leading vertical in 2023, holding more than a 36% market share.

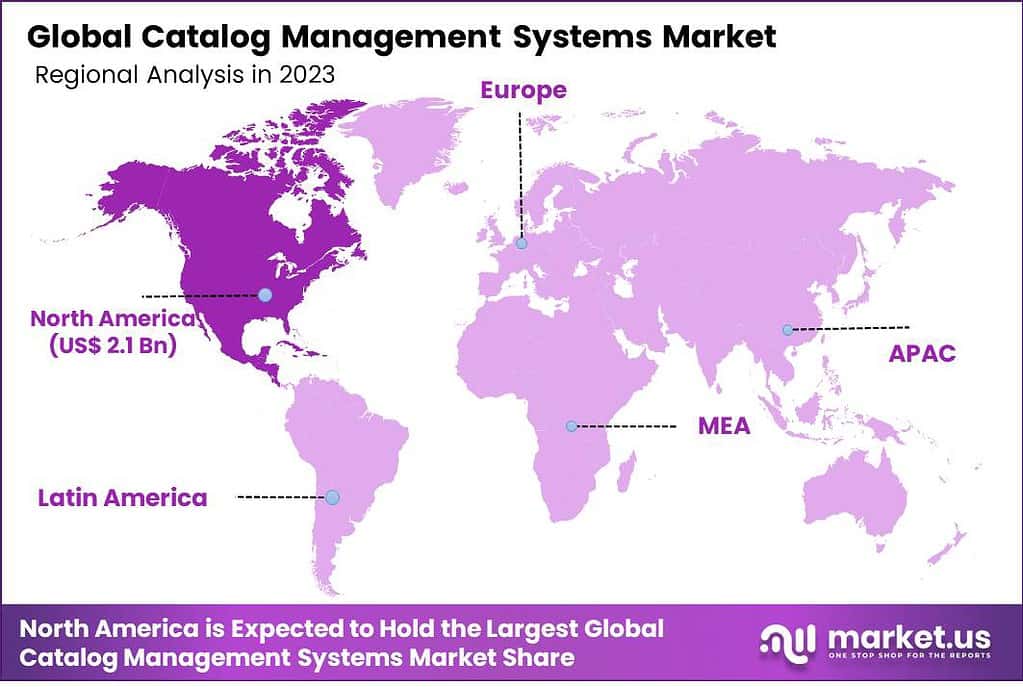

- Geographically, North America dominated the market in 2023, with a market share exceeding 42% and revenues amounting to USD 2.1 billion.

Type Analysis

In 2023, the Product Catalog segment held a dominant position in the Catalog Management System market, capturing more than a 67% share. This segment’s leadership can be attributed to the extensive proliferation of e-commerce and retail sectors, where the need to efficiently manage vast arrays of product data is critical.

Product Catalog systems facilitate the centralized management of product information, enabling businesses to update and disseminate accurate product descriptions, pricing, and availability across various sales channels efficiently. This capability is essential for maintaining competitive advantage in the fast-paced retail environment, where the accuracy and accessibility of product information directly influence purchasing decisions.

The robust growth of the Product Catalog segment is further supported by the integration of advanced technologies such as AI and machine learning. These technologies enhance the functionality of product catalogs by enabling features like personalized recommendations and automated catalog updates, which significantly improve user experience and operational efficiency.

As businesses continue to expand their online presence and seek to cater to a global customer base, the demand for sophisticated product catalog management solutions that can support multilingual content and complex product hierarchies is expected to rise. Moreover, the ongoing trend towards omnichannel retail strategies, where consistency in product information across all platforms is paramount, bolsters the importance of effective product catalog management systems.

This trend highlights the segment’s critical role in enabling seamless customer experiences and operational excellence, ensuring that the Product Catalog segment remains at the forefront of the Catalog Management System market. These factors collectively underscore the segment’s pivotal role in modern business operations, ensuring its continued dominance and growth in the market landscape.

Component Analysis

In 2023, the Solution segment held a dominant market position in the Catalog Management System market, capturing more than a 70% share. This segment’s prominence is primarily due to the increasing need for robust catalog management solutions across various industries, including retail, IT, and telecommunications. These solutions are fundamental in managing product and service information that enhances the accuracy and accessibility of data across multiple sales channels.

As businesses continue to expand their digital footprints, the demand for comprehensive catalog management solutions that can streamline operations and improve customer satisfaction is paramount. The strength of the Solution segment is further augmented by the ongoing digital transformation initiatives in many sectors, where companies are seeking to optimize their product and service offerings.

Advanced catalog management solutions enable organizations to efficiently handle large volumes of data, support complex configurations, and provide detailed insights into catalog performance, driving better decision-making and business agility. Moreover, these solutions often come equipped with features such as AI-driven analytics, real-time data processing, and integration capabilities with other digital platforms, enhancing their appeal to tech-savvy businesses looking to leverage data for competitive advantage.

Additionally, as e-commerce continues to grow, the need for dynamic catalog management solutions that can rapidly adapt to changing market conditions and consumer preferences becomes even more critical. This adaptability ensures that businesses can quickly update and disseminate product information, thus maintaining relevance and responsiveness in a highly competitive market. The Solution segment’s capacity to meet these modern business demands effectively ensures its continued dominance and relevance in the Catalog Management System market.

Deployment Type Analysis

In 2023, the Cloud segment held a dominant market position in the Catalog Management System market, capturing more than a 60% share. This leadership stems from the segment’s flexibility, scalability, and cost-effectiveness, which are highly valued in the rapidly evolving digital landscape. Cloud-based catalog management systems offer businesses the ability to manage and update their catalogs without the need for extensive infrastructure investments, making them particularly attractive to small and medium-sized enterprises.

Additionally, these systems facilitate remote access to catalog data, crucial for companies with geographically dispersed teams and operations. The Cloud segment’s growth is further driven by the increasing adoption of SaaS (Software as a Service) solutions across industries, which align with the move towards more agile and responsive business models. These cloud-based solutions are inherently designed to provide seamless updates and integrations, which are vital for maintaining the relevancy of product information in dynamic markets.

Moreover, the cloud deployment model offers enhanced security features and compliance with data protection regulations, which is a significant consideration for businesses handling sensitive customer and product data. The ongoing shift towards digital transformation and e-commerce accelerates the demand for cloud-based systems that can support online sales platforms efficiently.

The ability of cloud-based catalog management systems to integrate with e-commerce platforms and other digital marketing tools enables businesses to offer a consistent and engaging customer experience, further solidifying the Cloud segment’s position as a leader in the market. As businesses continue to prioritize operational flexibility and cost efficiency, the cloud deployment model is expected to maintain its dominance in the Catalog Management System market.

Organization Size Analysis

In 2023, the Large Enterprise segment held a dominant market position in the Catalog Management System market, capturing more than a 57% share. This dominance is largely due to the complex operational needs and extensive product lines managed by large enterprises, which necessitate robust catalog management systems to ensure efficient data handling and distribution.

Large enterprises typically operate on a global scale, requiring a system that can support multiple languages, currencies, and compliance standards, making advanced catalog management systems indispensable for maintaining operational coherence and market competitiveness. The leadership of the Large Enterprise segment is further reinforced by the increasing focus on digital transformation within these organizations.

Large enterprises are leveraging catalog management systems to integrate disparate data sources, streamline supply chain operations, and enhance customer engagement through accurate, real-time product information. These systems are critical in managing the intricate product hierarchies and diverse customer bases characteristic of large enterprises, enabling them to deliver personalized customer experiences at scale.

Moreover, the financial capability of large enterprises to invest in cutting-edge technology allows them to adopt the most advanced catalog management systems, which include AI and machine learning capabilities for predictive analytics and automated catalog updating. This technological edge helps large enterprises not only to improve operational efficiency but also to gain strategic insights that drive business growth.

Thus, the Large Enterprise segment continues to lead the Catalog Management System market, driven by complex operational requirements, a focus on customer-centric strategies, and substantial investment in technology.

Application Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Catalog Management System market, capturing more than a 36% share. This leading role is attributed to the critical need within the BFSI sector for robust data management systems that ensure accuracy, compliance, and security of extensive product and service information.

Financial institutions are increasingly reliant on catalog management systems to streamline their offerings and enhance customer service by providing clear, concise, and up-to-date information on banking products, insurance policies, and investment options. The dominance of the BFSI segment is also driven by the stringent regulatory requirements in the financial sector, which demand meticulous record-keeping and data integrity.

Catalog management systems in BFSI help institutions manage compliance more effectively by maintaining thorough audit trails, updating terms and conditions seamlessly across all platforms, and ensuring that all offerings are presented accurately to customers. This is crucial in minimizing risk and avoiding regulatory penalties, which can be substantial in this sector.

Furthermore, the rise of digital banking and fintech innovations has propelled the BFSI segment to invest heavily in digital solutions like catalog management systems. These systems support the rapid deployment of new financial products and services, adapt to dynamic market conditions, and personalize customer interactions.

By enabling a more agile and customer-focused approach, catalog management systems are essential for BFSI institutions looking to maintain competitiveness and meet the increasingly digital-first preferences of modern consumers. This strategic emphasis on enhancing digital infrastructure ensures the continued market dominance of the BFSI segment within the catalog management system landscape.

Key Market Segments

Type

- Product Catalog

- Service Catalog

Component

- Solution

- Service

- Professional Service

- Managed Service

Deployment Type

- On-Premise

- Cloud

Organization Size

- Small & Medium Enterprises

- Large Enterprises

Application

- BFSI

- IT & Telecom

- Retail & e-Commerce

- Media & Entertainment

- Other Applications

Driver

Integration of AI and ML in Catalog Management Systems

The Catalog Management System market is experiencing significant growth, primarily driven by the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies. These technologies enhance the functionality of catalog management systems by automating product tagging, content generation, and providing personalized product recommendations.

AI and ML algorithms help analyze large datasets, making it easier for businesses to organize, categorize, and personalize their product listings. This leads to improved customer experiences and increased sales, reflecting the ongoing adaptation of AI and ML in e-commerce and catalog management practices.

According to IHL Group, retailers leveraging artificial intelligence (AI) and machine learning (ML) technologies experienced significant performance advantages in 2023 and 2024. Companies utilizing these technologies saw double-digit growth in sales compared to previous years, with annual profits increasing by approximately 8%. This growth significantly outpaced that of retailers not employing AI or ML solutions.

Restraint

High Costs and Integration Complexities

One of the main challenges facing the Catalog Management System market is the high costs associated with implementing comprehensive solutions and the complexities of integrating these systems with existing IT infrastructures. These challenges can involve significant upfront investments in software, infrastructure, and training.

Additionally, the integration process can be complex and time-consuming, potentially leading to compatibility issues. This can deter some businesses, especially small and medium-sized enterprises, from adopting these systems, ultimately slowing market growth.

Opportunity

Expanding E-Commerce and Digital Transformation

The Catalog Management System market is poised to capitalize on the expanding e-commerce sector and the broader digital transformation initiatives across various industries. As businesses increasingly shift their operations online, the demand for efficient catalog management solutions has surged.

These systems help businesses organize and update their product listings more efficiently, catering to the online shopping preferences of modern consumers. This trend is particularly pronounced in the context of the COVID-19 pandemic, which has accelerated the shift towards online business operations and e-commerce.

Challenge

Keeping Pace with Rapid Technological Changes

A significant challenge in the Catalog Management System market is keeping pace with rapid technological advancements and changing market demands. As digital platforms and consumer expectations evolve, catalog management systems must continually adapt to incorporate new features and functionalities.

This requires ongoing development and frequent updates, which can strain resources and complicate deployment schedules. Staying current with technological trends while ensuring system reliability and user satisfaction remains a critical challenge for providers in this market.

Growth Factors

- Adoption of AI and ML Technologies: The integration of Artificial Intelligence (AI) and Machine Learning (ML) significantly boosts the capabilities of catalog management systems by automating product tagging and content generation, thereby enhancing accuracy and efficiency.

- Increase in Online Shopping: As consumer inclination towards online shopping grows, there is a heightened demand for robust catalog management systems to manage the surge in product listings and variations across multiple channels.

- Rise in Omnichannel Commerce: The need for consistent and accurate product information across various shopping channels supports the adoption of advanced catalog management systems, facilitating a seamless customer experience.

- Cloud-Based Solutions Growth: There’s an increasing shift towards cloud-based catalog management systems due to their scalability, ease of integration, and cost-effectiveness, making them ideal for businesses of all sizes.

- Digital Transformation Initiatives: Businesses are increasingly digitizing their operations, necessitating efficient catalog management systems to support digital sales and marketing strategies.

Emerging Trends

- Integration with E-Commerce Platforms: Catalog management systems are increasingly being integrated with major e-commerce platforms like Shopify and WooCommerce, simplifying the synchronization of product information across platforms and enhancing inventory management.

- AI-Driven Catalogs: The use of AI in catalog management is transforming how businesses manage product data by enabling automated content generation and personalized product recommendations, which enhance customer engagement and sales conversions.

- Subscription-Based Models: The market is seeing a rise in subscription-based commerce models, where catalog management systems play a crucial role in managing recurring transactions and customer subscriptions.

- Dynamic Pricing Strategies: To respond to market demand and competition effectively, businesses are implementing dynamic pricing strategies within their catalog management systems to adjust prices in real-time.

- Environmental Sustainability Considerations: Companies are increasingly considering the environmental impact of their products and operations, integrating sustainability into their catalog management practices to appeal to eco-conscious consumers.

Regional Analysis

In 2023, North America held a dominant market position in the Catalog Management System market, capturing more than a 42% share with revenues amounting to USD 2.1 billion. This region’s leadership is largely due to the high concentration of technology companies and the early adoption of advanced digital solutions across various sectors, including retail, IT, and telecommunications.

The presence of major tech giants and startups in this region drives innovation and implementation of new technologies, such as AI and machine learning, which are increasingly integrated into catalog management systems. The strong economic infrastructure in North America, particularly in the United States and Canada, supports the widespread adoption of these systems.

Companies in this region are keen to leverage catalog management solutions to enhance operational efficiency, improve customer experience, and manage extensive product and service portfolios. Furthermore, North America’s stringent regulatory standards for data management and security push businesses to adopt reliable and sophisticated catalog management systems to ensure compliance and protect customer data effectively.

Additionally, the growing trend of e-commerce and online retailing in North America necessitates robust catalog management systems that can handle large volumes of data and ensure the consistency of product information across multiple platforms. This requirement is further amplified by the consumer expectation for accurate and timely product information, making advanced catalog management systems essential for businesses operating in this digitally savvy market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Catalog Management System market is highly dynamic, with key players actively engaging in strategies such as acquisitions, product launches, and mergers to enhance their market positions. SAP SE has been at the forefront, continuously updating its catalog management offerings to integrate advanced analytics and machine learning, thereby improving user experience and system efficiency.

IBM Corporation recently launched new AI-powered features within its catalog management solutions to provide more personalized and scalable services to large enterprises. Oracle Corporation has expanded its capabilities through strategic acquisitions, aiming to integrate cloud-based data management systems that offer greater security and flexibility for users.

Salsify has consolidated its position by launching innovative product experience management solutions that simplify catalog updates and product content syndication across e-commerce platforms. Akeneo and inRiver have made significant advancements in PIM (Product Information Management) solutions, enhancing their catalog management systems to support multichannel marketing and global product information distribution.

Widen Enterprises and Contentserv have focused on improving the user interface and integration capacities of their systems, making it easier for companies to manage complex product information more efficiently.

Top Key Players in the Market

- SAP SE

- IBM Corporation

- Oracle Corporation

- Salsify

- Akeneo

- inRiver

- Widen Enterprises

- Contentserv

- Stibo Systems

- Plytix

- ServiceNow Inc.

- Other Key Players

Recent Developments

- In June 2024, IBM expanded its cloud and AI capabilities to enhance catalog management systems. This includes integrating AI-driven analytics to improve data accuracy and streamline catalog management processes across various industries.

- In May 2024, Akeneo released version 7.0 of its Product Information Management (PIM) solution, introducing enhanced data governance and workflow automation features. This update aims to improve the efficiency and accuracy of catalog management for users.

- In February 2024, Oracle announced significant upgrades to its Fusion Cloud applications, incorporating advanced AI features for improved catalog management. These upgrades aim to enhance user experience by automating catalog updates and improving data accuracy.

- In April 2023, Salsify launched new features in its Product Experience Management platform to enhance catalog management for e-commerce businesses. These features include automated data validation and improved product information accuracy.

Report Scope

Report Features Description Market Value (2023) US$ 5.0 Bn Forecast Revenue (2033) US$ 13.2 Bn CAGR (2024-2033) 10.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Product Catalog and Service Catalog), By Component (Solution, Service [Professional Service, Managed Service]), By Deployment Type (On-Premise and Cloud), By Application (BFSI, IT & Telecom, and Other Applications), By Organization Size(Small & Medium Enterprise, and Large Enterprise) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape SAP SE, IBM Corporation, Oracle Corporation, Salsify, Akeneo, inRiver, Widen Enterprises, Contentserv, Stibo Systems, Plytix, ServiceNow Inc., Other Key Players, Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Catalog Management System MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Catalog Management System MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- IBM Corporation

- Oracle Corporation

- Salsify

- Akeneo

- inRiver

- Widen Enterprises

- Contentserv

- Stibo Systems

- Plytix

- ServiceNow Inc.

- Other Key Players