Global Crusher Parts And Accessories Market Size, Share, And Enhanced Productivity By Material (Metallic Minerals, Non-Metallic Minerals, Coal or Lignite, Industrial Minerals), By Crusher Type (Jaw Crusher, Cone Crusher, Gyratory Crusher, Impact Crusher, Roll Crusher), By Components and Parts (Wear Parts, Spare Parts, Screening Components, Conveyor Parts, Hydraulic Components), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175146

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

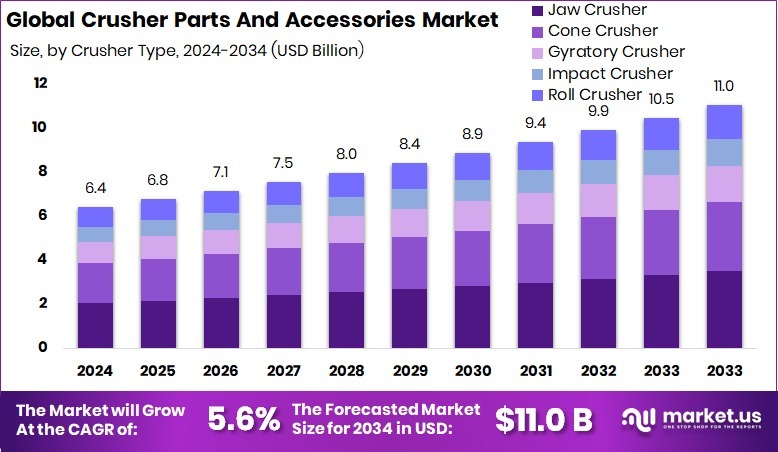

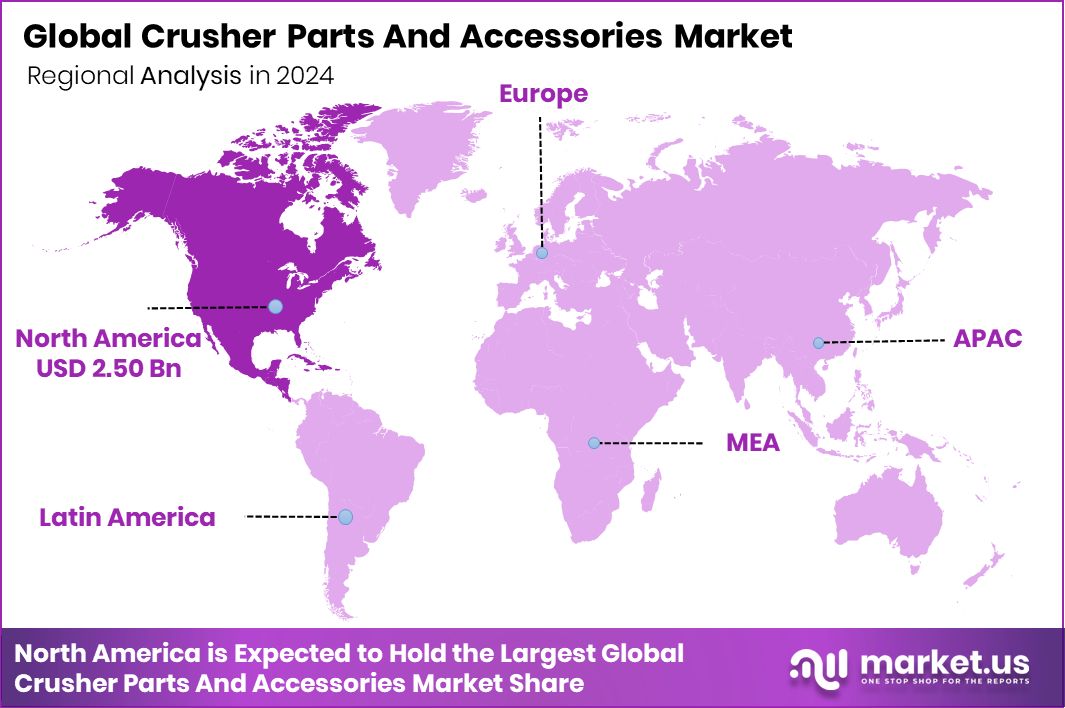

The Global Crusher Parts And Accessories Market is expected to be worth around USD 11.0 billion by 2034, up from USD 6.4 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034. The region of North America accounted for 39.2%, totaling USD 2.50 Bn overall.

Crusher Parts and Accessories are the essential components used in machines that break rocks, minerals, and construction materials. These parts include wear plates, liners, screens, belts, bearings, and attachments that keep crushing equipment operating safely and efficiently. They help the crusher perform heavy-duty work while reducing downtime and protecting the main machinery from damage. Industries like mining, construction, aggregates, and quarrying rely heavily on these parts to keep production running. As materials get tougher and operations become larger, the demand for stronger, longer-lasting crusher parts continues to rise.

The Crusher Parts and Accessories Market covers the global demand for replacement components used in crushing machines across mining, construction, and material processing industries. This market grows as industries expand mineral extraction, infrastructure projects, and aggregate production. Funding in critical minerals plays a major role, supported by initiatives such as Magna Mining securing CAN$500,000, the U.S. DoE committing over $500 million, and the Pentagon’s $1 billion stockpiling effort, all of which increase mining activity and create higher demand for reliable crusher parts. The market benefits from constant equipment upgrades, rising mineral production, and the need for durable aftermarket components.

Growth is strongly influenced by increasing investment in critical minerals, which directly boosts mining activity and the need for crusher components. Supportive funding, such as Brazil’s $815 million allocation for strategic mineral projects and ChemFinity’s $7 million raised to filter critical minerals, encourages new extraction operations that require high-performance crusher parts. As mines expand, operators look for components that last longer and withstand harsher conditions, driving steady market growth. Continuous improvements in material technology also push the market toward more efficient and durable products.

Demand increases as governments and companies push for secure supplies of key minerals used in energy storage, electronics, and clean technologies. Funding such as Vital Metals securing $1 million and multiple rounds from Metallic Minerals—$2 million and C$4 million—supports exploration and production, which in turn raises the need for crushers and their essential parts. More mining projects mean more wear parts, screen replacements, and mechanical components are required to keep operations running smoothly. This creates a stable, recurring demand cycle for the market.

The market holds strong opportunities as global funding in mineral development accelerates. With critical minerals becoming a strategic priority, countries are expanding exploration, opening new mines, and upgrading old facilities. These actions significantly increase the long-term need for crusher components. Opportunities also grow in aftermarket services, predictive maintenance, and advanced materials that help operators cut downtime and lower operating costs.

Key Takeaways

- The Global Crusher Parts and Accessories Market is expected to be worth around USD 11.0 billion by 2034, up from USD 6.4 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- The Crusher Parts and Accessories Market grows as metallic minerals hold a 39.6% material share.

- Strong demand in the Crusher Parts and Accessories Market arises from jaw crushers dominating 31.8%.

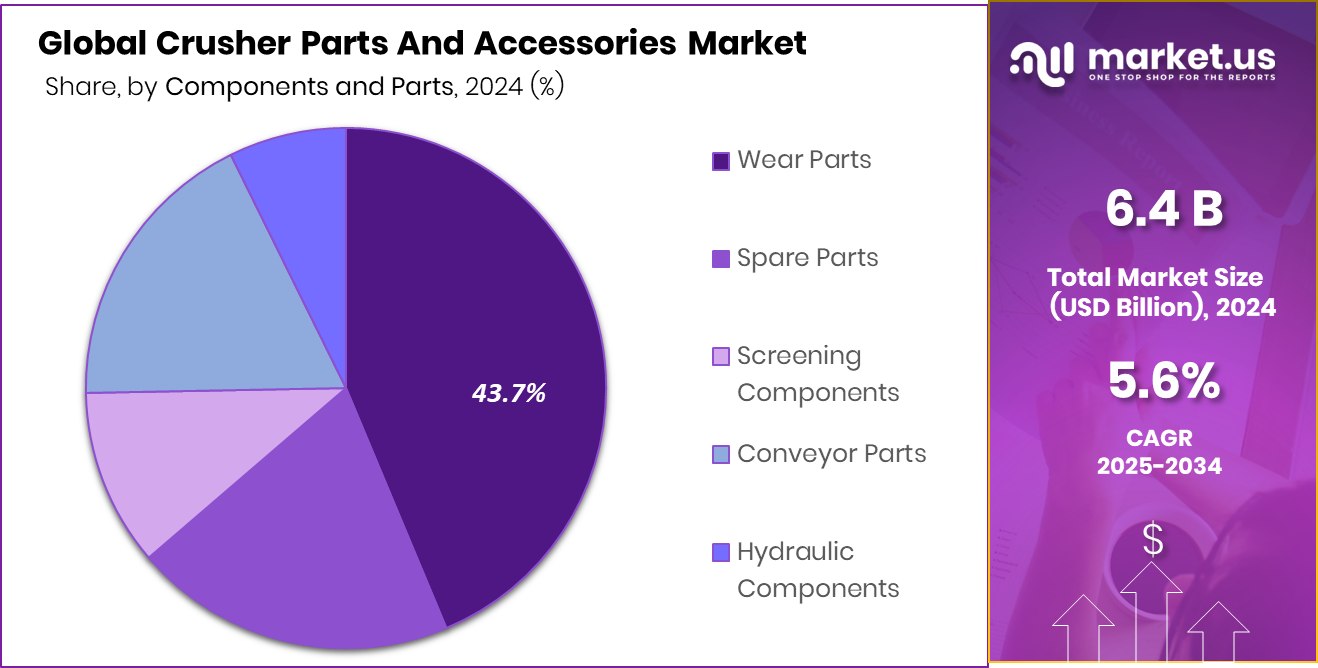

- The Crusher Parts and Accessories Market expands steadily, with wear parts capturing 43.7% overall demand.

- The Crusher Parts and Accessories Market strengthens globally as OEM channels secure 56.9% sales share.

- In North America, the market reached USD 2.50 Bn with a 39.2% share.

By Material Analysis

The Crusher Parts and Accessories Market grows strongly, with metallic minerals dominating 39.6%.

In 2024, the Crusher Parts and Accessories Market saw strong demand driven by the dominance of metallic minerals, which accounted for 39.6% of the material segment. The rising extraction of iron ore, copper, and other high-strength metals increased the need for durable crusher parts that can perform under extreme pressure. Metallic minerals require heavy-duty crushing operations, pushing manufacturers to design wear-resistant components that reduce downtime.

The mining industry’s expansion across Asia-Pacific and Africa further supported this trend, as large-scale mineral projects increasingly adopt technologically advanced crushing systems. With industries prioritizing better output efficiency and operational stability, the demand for strong, corrosion-resistant crusher parts continues to rise, keeping metallic minerals at the forefront of material usage.

By Crusher Type Analysis

Jaw crushers lead performance demand, holding a significant 31.8% global market share.

In 2024, the Jaw Crusher segment held a leading 31.8% share in the Crusher Parts and Accessories Market, driven by its widespread use in mining, construction, and aggregate production. Jaw crushers are preferred for primary crushing because of their simple design, high efficiency, and ability to handle large, hard materials. This dominance boosts the demand for replacement parts such as jaw plates, cheek plates, and toggle assemblies.

Increasing infrastructure development, particularly in developing nations, accelerated the usage of jaw crushers at quarrying sites. Their lower maintenance needs and adaptability to different minerals ensure that jaw crusher components remain a significant revenue generator for manufacturers. The steady rise in mining investments continues to support this strong segment performance.

By Components and Parts Analysis

Wear parts remain essential components, capturing a dominant 43.7% in industry consumption.

In 2024, wear parts emerged as the most crucial category, capturing 43.7% of the Crusher Parts and Accessories Market. These components—such as liners, blow bars, mantles, and hammer heads—experience the highest friction and require frequent replacement. Increased production of aggregates and minerals across global mining operations has heightened the need for reliable wear parts that can extend machine life and minimize operational downtime.

Manufacturers are focusing on advanced alloys, carbide inserts, and innovative heat-treatment technologies to create longer-lasting parts. With quarrying and mineral processing plants running continuously, the demand for premium wear parts surged sharply. Their essential role in protecting core crusher machinery ensures they remain the backbone of the aftermarket supply chain.

By Sales Channel Analysis

OEM sales channels strengthen market expansion, driving growth with a leading 56.9% share.

In 2024, the OEM segment dominated the Crusher Parts and Accessories Market with a commanding 56.9% share. Original Equipment Manufacturers provide high-quality, precision-engineered components trusted for performance, compatibility, and long service life. Customers prefer OEM parts to reduce equipment failure risks, maintain warranties, and ensure optimal crushing efficiency.

Mining companies, quarries, and construction firms increasingly rely on OEMs for reliable supply chains and technical support. The expansion of equipment fleets and rising demand for customized solutions have further strengthened OEM dominance. As global mining capacity grows and equipment modernization accelerates, OEM channels continue to lead the market by offering standardized parts and advanced materials that guarantee consistent operational reliability.

Key Market Segments

By Material

- Metallic Minerals

- Non-Metallic Minerals

- Coal or Lignite

- Industrial Minerals

By Crusher Type

- Jaw Crusher

- Cone Crusher

- Gyratory Crusher

- Impact Crusher

- Roll Crusher

By Components and Parts

- Wear Parts

- Spare Parts

- Screening Components

- Conveyor Parts

- Hydraulic Components

By Sales Channel

- OEM

- Aftermarket

Driving Factors

Rising Innovation Supported by Major European Funding

In the Crusher Parts and Accessories Market, one major driving factor is the rapid shift toward smarter, more efficient crushing systems supported by strong investment in technology. A key example is the significant support provided when Sandvik secured €500 million in financing from the European Investment Bank, aimed at advancing new smart EV-related technologies and R&D capabilities. This funding encourages greater innovation across heavy equipment ecosystems, including crushers, as manufacturers adopt improved materials, automation, and smart monitoring systems.

As these advancements move into the broader mining and construction sectors, the demand for high-quality, long-lasting crusher parts increases. The push for advanced machinery naturally boosts the requirement for upgraded wear parts, precision-engineered components, and better aftermarket solutions.

Restraining Factors

Construction Delays Increasing Equipment Replacement Pressure

A key restraining factor in the Crusher Parts and Accessories Market is the impact of construction delays and financial strain across small and medium contractors. A notable example is the $288,444 allocated for Possamai Construction, which reflects the financial adjustments many construction firms must make due to rising material costs and project uncertainties. These budget pressures often lead operators to postpone equipment servicing or delay purchasing new crusher parts, increasing wear and reducing machine efficiency.

When companies push machinery beyond ideal maintenance cycles, equipment reliability drops, and overall productivity decreases. This cautious spending environment limits market expansion, as many firms focus only on essential replacements rather than investing in higher-value upgraded components.

Growth Opportunity

Expanding Projects Boost Demand for Advanced Components

One major growth opportunity for the Crusher Parts and Accessories Market comes from large-scale mining expansions and new equipment introductions. Recently, a mining giant secured funding for a new $2 billion project, signaling substantial future demand for crushers and their replacement parts. Alongside this, product launches such as MAGNA’s MT130J jaw crusher debut at Conexpo-Con/Agg highlight growing interest in stronger, more efficient crushing machines.

New mines require a continuous supply of wear parts, liners, and mechanical components, while new crusher models increase the market for specialized accessories. As investment flows into large mineral projects and advanced machinery becomes more widely adopted, suppliers have strong opportunities to expand their aftermarket and OEM component offerings.

Latest Trends

Large Mine Expansions Increasing Wear Part Needs

A dominant trend shaping the Crusher Parts and Accessories Market is the rapid expansion of major mining operations, which directly increases the demand for high-performance crusher parts. A key example is Artemis Gold approving the $1.44 billion Phase 2 expansion of the Blackwater Mine, a project that will significantly boost ore processing volumes.

As mines scale up production, crushers operate longer hours under heavier loads, causing faster wear on essential components such as liners, blow bars, and jaw plates. This creates a rising need for durable, high-strength aftermarket parts. The trend toward larger, long-term mining investments ensures a continuous replacement cycle, supporting steady demand for reliable crusher accessories across global operations.

Regional Analysis

North America leads the Crusher Parts Market with 39.2%, worth USD 2.50 Bn.

In 2024, North America dominated the Crusher Parts and Accessories Market, accounting for a strong 39.2% share valued at USD 2.50 Bn, supported by extensive mining operations, established aggregates production, and steady equipment replacement cycles across the U.S. and Canada. Europe followed with stable demand shaped by its mature construction sector and ongoing quarrying activities that continue to rely on high-efficiency crushers and aftermarket wear components.

The Asia Pacific region showed steady growth, driven by expanding infrastructure development and rising mineral extraction activities across countries such as China and India, which continue to increase their need for crusher spare parts and accessories. The Middle East & Africa region reflected consistent market progress, supported by mining expansion and construction-led investments that require durable crushing equipment and replacement parts.

Latin America also contributed to overall market momentum, benefiting from active mining projects and quarrying operations across Brazil, Chile, and Mexico. Across all regions, the focus on operational reliability, equipment productivity, and high-performance wear parts supported a balanced demand environment, reinforcing North America’s leadership position within the global market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Metso Corporation continued to strengthen its position by focusing on advanced wear parts, precision-engineered components, and improved service support for mining and aggregates customers. Its emphasis on reliability and equipment optimization helped operators extend machine life and enhance productivity across crushing operations.

Sandvik AB maintained a solid presence with its wide portfolio of crusher spare parts and accessories designed for heavy-duty applications. The company’s approach of integrating material technology with engineering precision enabled customers to achieve reduced downtime and higher operational efficiency.

Thyssenkrupp AG remained influential through its robust industrial engineering capabilities and well-established crushing solutions used across large mining projects. Its strategic focus on durability and high-performance parts supported user needs for long-lasting components in demanding environments. Collectively, these companies contributed to a market environment defined by quality-driven competition, steady aftermarket growth, and rising customer expectations for dependable, cost-efficient crusher components.

Top Key Players in the Market

- Metso Corporation

- Sandvik Ab

- Thyssenkrupp Ag

- Flsmidth A/S

- The Weir Group Plc

- Astec Industries, Inc

- Bradken

- Me Elecmetal

- Cms Cepcor Ltd

- H-E Parts International

Recent Developments

- In February 2025, The Weir Group announced it would acquire Micromine, a leading Australian mining software company that helps miners with planning, design, and operational software tools. The deal closed in April 2025, expanding Weir’s digital offerings for mining operations and adding software strength to its portfolio. This supports better process insights and efficiency for mining customers.

- In September 2024, FLSmidth signed an agreement to acquire TIPCO Tudeshki Industrial Process Control GmbH, a German technology company specializing in advanced sensor technology. This acquisition aims to improve FLSmidth’s technology offerings, especially for hydrocyclones used in mineral processing and other parts of the mining flowsheet, which supports better monitoring and control of processes. Although not directly a crusher part, this strengthens their mining equipment ecosystem.

Report Scope

Report Features Description Market Value (2024) USD 6.4 Billion Forecast Revenue (2034) USD 11.0 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Metallic Minerals, Non-Metallic Minerals, Coal or Lignite, Industrial Minerals), By Crusher Type (Jaw Crusher, Cone Crusher, Gyratory Crusher, Impact Crusher, Roll Crusher), By Components and Parts (Wear Parts, Spare Parts, Screening Components, Conveyor Parts, Hydraulic Components), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Metso Corporation, Sandvik Ab, Thyssenkrupp Ag, Flsmidth A/S, The Weir Group Plc, Astec Industries, Inc, Bradken, Me Elecmetal, Cms Cepcor Ltd, H-E Parts International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Crusher Parts And Accessories MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Crusher Parts And Accessories MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Metso Corporation

- Sandvik Ab

- Thyssenkrupp Ag

- Flsmidth A/S

- The Weir Group Plc

- Astec Industries, Inc

- Bradken

- Me Elecmetal

- Cms Cepcor Ltd

- H-E Parts International