Global Cross-species Organ Transplantation Market By Product Type (Xeno Products, Organ Preservation Solution, Transplant Diagnostics and Others), By Application (Kidney, Heart, Lung, Liver and Others), By End-user (Transplant Centers, Hospitals and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171016

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

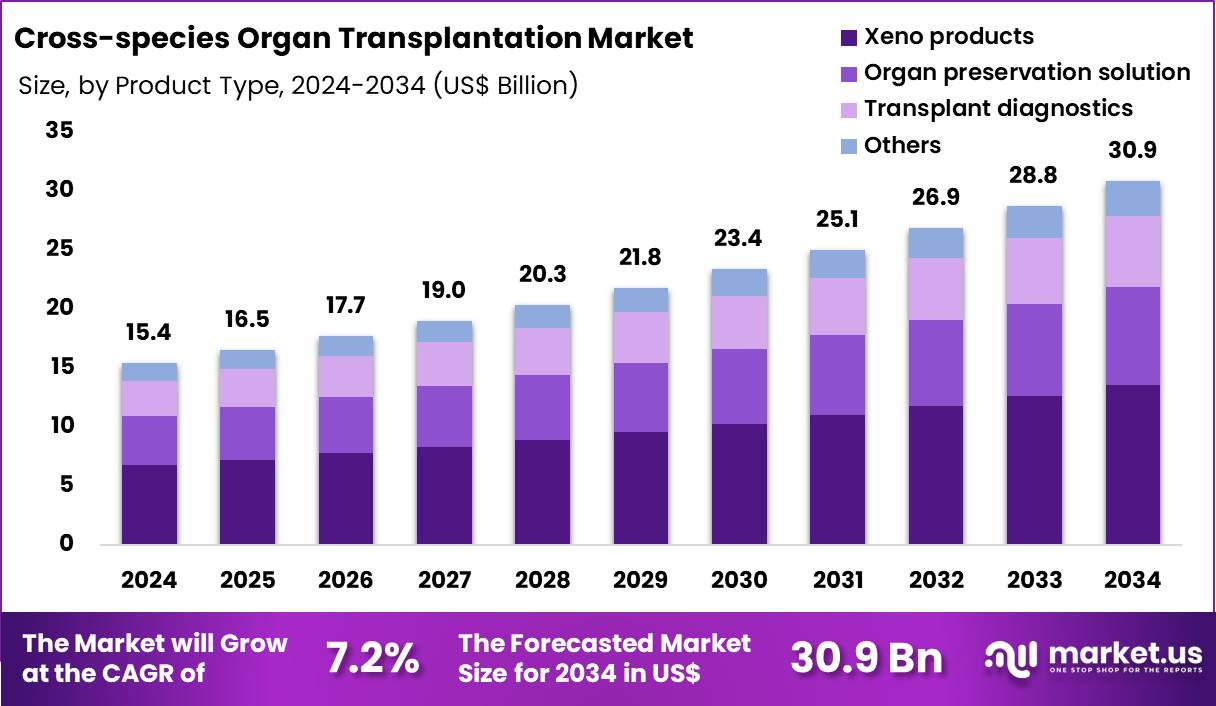

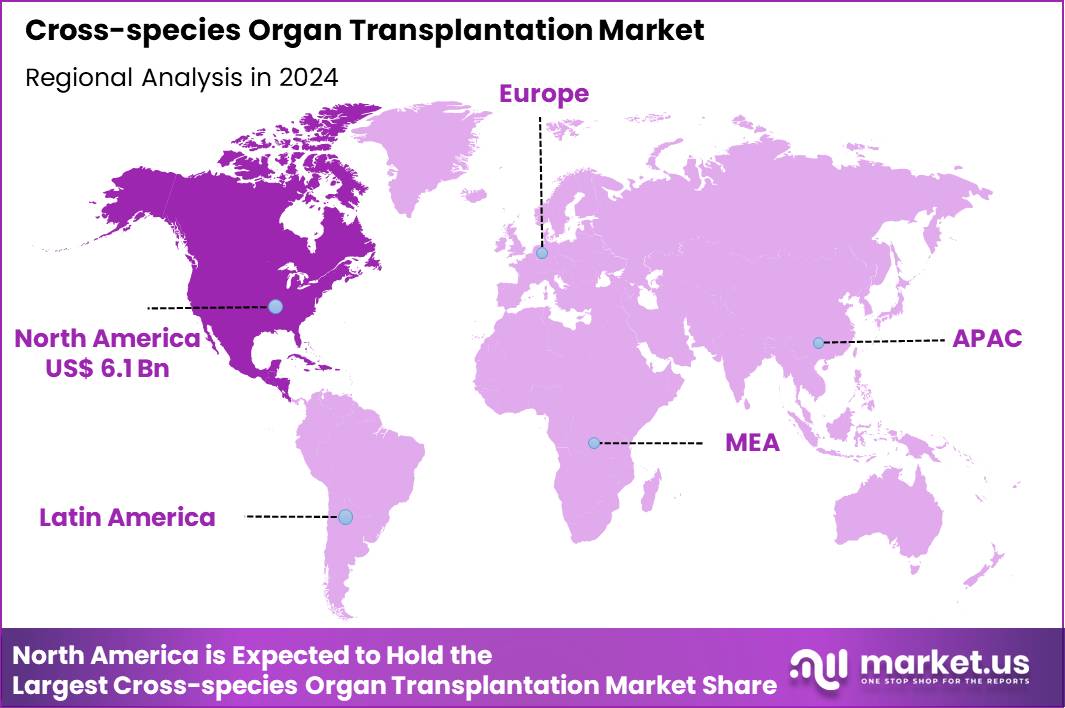

The Global Cross-species Organ Transplantation Market size is expected to be worth around US$ 30.9 Billion by 2034 from US$ 15.4 Billion in 2024, growing at a CAGR of 7.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.7% share with a revenue of US$ 6.1 Billion.

Increasing shortage of human donor organs drives the Cross-species Organ Transplantation market, as medical professionals explore xenotransplantation to bridge critical gaps in life-saving procedures and reduce waitlist mortality. Biotechnology firms genetically modify porcine donors to eliminate hyperacute rejection barriers, enabling viable hearts, kidneys, and livers for human recipients.

These technologies apply in end-stage renal disease management through pig kidney xenografts for dialysis-dependent patients, cardiac failure interventions via orthotopic heart transplants in bridge-to-allograft scenarios, acute liver failure treatments with partial liver grafts, and pulmonary replacement for cystic fibrosis complications.

Collaborative trials create opportunities for scalable donor herds and immunosuppressive regimens tailored to cross-species compatibility. On February 13, 2025, PorMedTec reported the birth of three piglets engineered for human organ transplantation through modified embryos, marking a key step toward clinical kidney trials later that year. This breakthrough accelerates donor preparation and underscores the market’s potential to transform transplant accessibility.

Growing advancements in gene-editing precision accelerate the Cross-species Organ Transplantation market, as researchers refine CRISPR-based modifications to insert human transgenes and suppress porcine retroviruses for enhanced graft longevity. Pharmaceutical companies develop complementary immunomodulators that target innate immune responses, fostering durable engraftment in preclinical models.

Applications extend to type 1 diabetes therapy with porcine islet cell infusions for insulin independence, corneal xenografts for vision restoration in keratoconus patients, skin substitutes for severe burn coverage, and vascular conduits for peripheral artery disease revascularization. Regulatory pathways open avenues for compassionate-use expansions and multi-center trials evaluating long-term outcomes.

United Therapeutics and eGenesis initiated clinical pig kidney xenotransplant trials in February 2025, demonstrating feasibility in living recipients and propelling the field toward routine solid organ applications. This momentum highlights the market’s trajectory toward integrated xenotransplant ecosystems.

Rising focus on ethical and immunological safeguards invigorates the Cross-species Organ Transplantation market, as stakeholders implement rigorous biosecurity protocols to mitigate zoonotic risks and ensure equitable access to emerging therapies. Innovators establish pathogen-free facilities that monitor donor herds for endogenous retroviruses, supporting reproducible transplant success rates.

These efforts apply in hematopoietic stem cell xenotransplants for leukemia remission induction, bioengineered neural tissues for Parkinson’s disease symptom alleviation, pancreatic beta-cell clusters for gestational diabetes control, and musculoskeletal grafts for orthopedic reconstruction in trauma cases. International guidelines create opportunities for standardized trial designs and public engagement initiatives that address societal concerns.

The International Xenotransplantation Association released updated position papers in early 2025, providing frameworks for clinical translation that emphasize transparent reporting and multidisciplinary oversight. This structured evolution positions the market as a beacon for sustainable, ethical organ augmentation strategies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 15.4 billion, with a CAGR of 7.2%, and is expected to reach US$ 30.9 billion by the year 2034.

- The product type segment is divided into xeno products, organ preservation solution, transplant diagnostics and others, with xeno products taking the lead in 2024 with a market share of 43.8%.

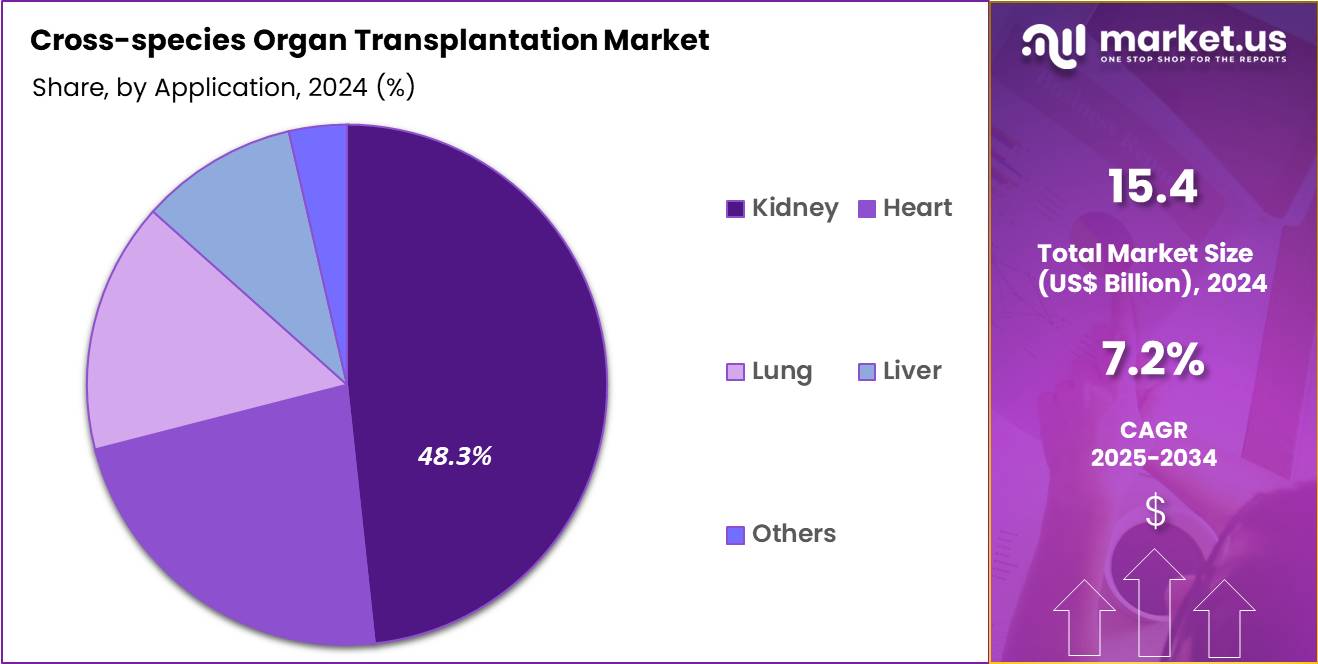

- Considering application, the market is divided into kidney, heart, lung, liver and others. Among these, kidney held a significant share of 48.3%.

- Furthermore, concerning the end-user segment, the market is segregated into transplant centers, hospitals and others. The transplant centers sector stands out as the dominant player, holding the largest revenue share of 54.2% in the market.

- North America led the market by securing a market share of 39.7% in 2024.

Product Type Analysis

Xeno products, holding 43.8%, are expected to dominate because they represent the core of cross-species organ transplantation efforts aimed at addressing severe global organ shortages. Advancements in genetic modification technologies support safer, more compatible animal-derived organs, reducing risks of rejection and infection. Research programs increasingly evaluate porcine-derived grafts due to their physiological compatibility with humans.

Growing ethical acceptance of controlled xenotransplantation trials strengthens momentum for product expansion. Continuous investment in immune-modulating therapies enhances the viability of xenogeneic organs throughout the transplantation process. These developments keep xeno products anticipated to remain the most critical component of this emerging market.

Application Analysis

Kidney, holding 48.3%, is projected to dominate because kidney failure represents the most common condition requiring transplantation, yet donor availability remains significantly limited. Xenotransplantation research prioritizes kidneys due to their high clinical demand and manageable immunological challenges compared with more complex organs.

Preclinical trials demonstrate promising outcomes in extending graft survival and improving functional compatibility. Thousands of patients remain on waiting lists, strengthening efforts to deploy alternative sources to reduce mortality rates. Regulatory authorities increasingly support pilot studies focused on kidney xenografts, accelerating advancements. These factors keep kidney applications expected to remain the leading focus in this market.

End-User Analysis

Transplant centers, holding 54.2%, are anticipated to dominate because cross-species organ transplantation requires specialized surgical expertise, controlled environments, and advanced immunological monitoring. These centers conduct rigorously supervised xenotransplantation trials and lead innovation in graft preservation and post-transplant care. Growing collaborations between research laboratories and transplant centers accelerate protocol optimization and clinical readiness.

Patients with end-stage organ failure often receive care directly from transplant centers, concentrating demand within these facilities. Expanding government and private funding for xenotransplantation research strengthens infrastructure development. These drivers keep transplant centers expected to remain the dominant end-user segment in the cross-species organ transplantation market.

Key Market Segments

By Product Type

- Xeno Products

- Organ Preservation Solution

- Transplant Diagnostics

- Others

By Application

- Kidney

- Heart

- Lung

- Liver

- Others

By End-user

- Transplant centers

- Hospitals

- Others

Drivers

Persistent organ shortage in human transplantation is driving the market

The chronic disparity between organ demand and supply has positioned cross-species organ transplantation as a viable alternative to address life-threatening waiting lists for end-stage organ failure patients. In 2023, the number of new adult candidates added to the kidney waiting list reached 46,661, reflecting a recovery from pandemic disruptions and surpassing pre-2020 levels. This escalation underscores the inadequacy of deceased donor organs, with over 141,886 unique adult candidates ever listed for kidney transplantation that year alone.

Similar pressures extend to other organs, where heart and lung transplants set records at 4,111 and 2,692 procedures in 2022, yet waitlist additions continue to outpace removals. Public health agencies emphasize xenotransplantation’s potential to alleviate this bottleneck, prompting investments in preclinical validations. The economic ramifications of prolonged dialysis or mechanical support further incentivize scalable xenogeneic solutions for high-burden indications like kidney failure.

Collaborative frameworks between regulatory bodies and research institutions accelerate pathway developments for clinical translation. As demographic shifts increase chronic disease prevalence, the market benefits from heightened stakeholder urgency for innovative supply augmentation. Ethical endorsements for compassionate use cases reinforce viability, bridging gaps in equitable access. Ultimately, this driver catalyzes interdisciplinary advancements, embedding xenotransplantation within broader organ procurement strategies.

Restraints

Acute and chronic immunological incompatibilities is restraining the market

Interspecies barriers in cross-species organ transplantation provoke hyperacute and antibody-mediated rejections, severely limiting graft longevity despite genetic modifications. Preclinical nonhuman primate studies from 2022-2024 reveal that only 36% of recipients survive one year post-pig xenograft, compared to 95% for allotransplants. Human trials in 2024 documented graft failures within 47 to 52 days, attributed to innate immune activation despite immunosuppression.

These events highlight persistent endothelial injury from complement cascades and natural antibodies, complicating therapeutic regimens. Variability in recipient sensitization exacerbates risks, necessitating intensified monitoring and resource allocation. Regulatory scrutiny intensifies due to such inconsistencies, delaying broader approvals and market maturation. Cost implications of advanced antirejection protocols strain healthcare budgets, deterring routine adoption.

Physiological mismatches, including coagulation dysregulation, compound rejection pathways, undermining confidence in scalability. Longitudinal data indicate adaptive immune responses evolve post-transplant, prolonging vulnerability windows. Collectively, these restraints necessitate refined immunomodulatory strategies to achieve therapeutic parity with conventional transplants.

Opportunities

Advancements in multi-gene CRISPR editing of donor organs is creating growth opportunities

CRISPR-Cas9 technologies enable precise multi-locus modifications in porcine genomes, mitigating immunogenicity and enhancing compatibility for cross-species applications. In 2024, xenografts incorporating 69 edits, including glycan antigen deletions and human transgene insertions, demonstrated immediate functionality in human recipients.

This precision reduces hyperacute rejection risks, extending preclinical survival beyond historical benchmarks in nonhuman primates. Integration with cloning techniques like somatic cell nuclear transfer facilitates scalable production of edited source animals.

Opportunities arise in multiplexing edits to address retroviral inactivation, broadening safety profiles for clinical deployment. Partnerships between biopharma and academic centers leverage these tools for organ-specific optimizations, such as vascular adaptations. Regulatory pathways increasingly recognize CRISPR’s reproducibility, streamlining investigational new drug submissions.

Cost efficiencies from reduced trial failures position edited xenografts as economically viable alternatives to mechanical bridges. Global consortia promote data sharing on edit efficacy, informing standardized protocols. In essence, these innovations unlock a pipeline for diverse organ types, fostering market diversification and therapeutic equity.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends energize the cross-species organ transplantation market as surging healthcare investments and chronic organ shortages compel biotech firms to advance xenotransplantation technologies like gene-edited pig kidneys for human use. Leading companies aggressively pursue clinical trials and partnerships, capitalizing on the global demand for innovative solutions that address waitlist crises and improve patient survival rates.

Stubborn inflation and economic volatility, however, escalate research costs and strain funding for experimental procedures, pushing smaller innovators to scale back ambitious projects in uncertain times. Geopolitical tensions, particularly U.S.-China trade disputes and regulatory divergences in biotechnology, disrupt cross-border collaborations and limit access to critical gene-editing tools and animal sourcing networks.

Current U.S. tariffs impose broad duties on imported medical devices and pharmaceutical components, driving up procurement expenses for xenotransplant developers and challenging affordability for U.S.-based trials. These tariffs trigger retaliatory restrictions abroad that impede exports of American biotech advancements and complicate international data sharing. Nevertheless, the policies accelerate domestic investments in local biotech manufacturing and research incentives, fostering resilient ecosystems that will unlock greater innovation and market potential for sustainable growth.

Latest Trends

FDA clearance of investigational new drug applications for xenokidney trials is a recent trend

In February 2025, the U.S. Food and Drug Administration cleared United Therapeutics’ investigational new drug application for a phase 1/2 trial of the UKidney, a 10-gene-edited porcine kidney targeting end-stage renal disease patients. This authorization supports enrollment of up to 50 participants, with initial procedures anticipated mid-year to evaluate safety and efficacy endpoints. Concurrently, eGenesis received clearance in September 2025 for its EGEN-2784 kidney trial, featuring 69 genomic edits and focusing on dialysis-dependent adults aged 50 and older.

These approvals mark the inaugural structured clinical evaluations under formal protocols, transitioning from compassionate use paradigms. The trend emphasizes rigorous preclinical data integration, including nonhuman primate outcomes exceeding 500 days graft survival. Multicenter designs enhance generalizability, incorporating diverse recipient profiles to assess immunological tolerance. Post-transplant monitoring frameworks incorporate advanced biomarkers for early rejection detection.

This regulatory momentum aligns with national organ shortage imperatives, prioritizing kidney xenotransplants for high-mortality waitlists. Industry collaborations ensure supply chain robustness for edited organs. Overall, these 2025 clearances herald a pivotal era of evidence-based xenotransplantation integration into standard care.

Regional Analysis

North America is leading the Cross-species Organ Transplantation Market

In 2024, North America maintained a 39.7% share of the global cross-species organ transplantation market, accelerated by pioneering clinical advancements and substantial research investments. Regulatory milestones, including the U.S. Food and Drug Administration’s compassionate use authorizations for genetically modified porcine kidneys, facilitated the first successful human trials, alleviating acute shortages in end-stage renal disease cases.

National Institutes of Health grants exceeding $100 million supported gene-editing innovations like CRISPR to mitigate hyperacute rejection, enhancing organ viability across primate models. Academic-medical partnerships in institutions such as the University of Maryland expanded preclinical validations, integrating immunosuppressive regimens tailored for xenogeneic compatibility.

Heightened public-private collaborations streamlined ethical oversight frameworks, expediting Institutional Review Board approvals for multi-center studies on cardiac xenografts. Escalating chronic comorbidities from aging demographics intensified the push for scalable alternatives, with biotech firms scaling production of alpha-gal knockout pigs for broader applicability. Venture funding surged to optimize perfusion technologies, preserving organ function during extended transport logistics.

These developments collectively signal a transformative era in transplant medicine, bridging critical gaps in human donor availability. The Organ Procurement and Transplantation Network documented 68,099 new adult and pediatric registrations added to the U.S. solid organ transplant waiting list in 2022, underscoring the pressing imperative for xenotransplantation innovations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts forecast dynamic expansion of the cross-species organ transplantation field in Asia Pacific over the forecast period, as nations prioritize innovative therapies amid surging organ deficits. Health authorities in China and Japan allocate dedicated budgets to xenotransplant research hubs, conducting phase-I trials with porcine livers engineered for human hepatocyte integration.

Pharmaceutical conglomerates forge alliances with universities to refine vascularized composite allografts, targeting facial reconstructions for trauma victims in densely populated urban centers. Regional regulatory bodies harmonize guidelines through ASEAN frameworks, accelerating approvals for islet cell xenografts in diabetes management protocols. Biotech innovators deploy non-human primate models to validate long-term graft tolerance, incorporating microbiome modulation for reduced immunogenicity.

International funding from bodies like the Asia-Pacific Economic Cooperation supports capacity-building workshops, equipping surgeons with simulation tools for heterotopic heart implants. Community advocacy groups promote awareness campaigns, encouraging voluntary donor registries that complement xenotransplant pipelines for pediatric applications.

These initiatives leverage demographic dividends and technological prowess, fortifying healthcare resilience against epidemiological burdens. The Global Observatory on Donation and Transplantation recorded 29,014 solid organ transplants in the Western Pacific Region in 2022, illustrating the vast opportunity for cross-species solutions to augment supply.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading innovators in cross-species organ transplantation drive growth by advancing gene-edited donor animals, refining immunosuppression protocols, and integrating real-time monitoring technologies that improve graft survival and clinical safety. They strengthen their position by forming strategic alliances with academic medical centers and biotech partners to accelerate preclinical and early-human trial pipelines.

Commercial teams expand future market access by building regulatory engagement programs that align emerging xenotransplantation standards with ethical, biosafety, and long-term monitoring requirements. R&D groups scale investment in multi-gene editing, viral-inactivation strategies, and organ-preservation platforms to reduce rejection risk and increase transplant readiness.

They cultivate global visibility through published trial outcomes and collaborative research networks that validate therapeutic potential across cardiac, renal, and hepatic applications. United Therapeutics exemplifies this model through its dedicated xenotransplantation division, Revivicor, which specializes in gene-edited porcine organs, leverages advanced genetic-engineering capabilities, and maintains deep clinical collaborations that position the company at the forefront of next-generation transplant solutions.

Top Key Players

- United Therapeutics Corporation

- Revivicor, Inc.

- eGenesis, Inc.

- Makana Therapeutics

- Qihan Biotech

- Recombinetics, Inc.

- Sangamo Therapeutics

- OrganOx Limited

Recent Developments

- On February 13, 2025, eGenesis, working jointly with Japan’s PorMedTec, announced progress in producing genetically modified pigs intended for xenotransplantation. eGenesis, headquartered in Cambridge, Massachusetts, develops human-compatible organs using its EGEN Platform, which applies targeted genetic engineering to reduce immune incompatibilities and viral transmission risks between species.

- On June 26, 2025, Makana™ was awarded the KidneyX Artificial Kidney Prize for its work on developing genetically engineered pigs designed to serve as organ donors for kidney transplantation, marking a significant step forward for the field of xenotransplant innovation.

Report Scope

Report Features Description Market Value (2024) US$ 15.4 Billion Forecast Revenue (2034) US$ 30.9 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Xeno Products, Organ Preservation Solution, Transplant Diagnostics and Others), By Application (Kidney, Heart, Lung, Liver and Others), By End-user (Transplant Centers, Hospitals and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape United Therapeutics Corporation, Revivicor Inc., eGenesis Inc., Makana Therapeutics, Qihan Biotech, Recombinetics Inc., Sangamo Therapeutics, OrganOx Limited. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cross-species Organ Transplantation MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Cross-species Organ Transplantation MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- United Therapeutics Corporation

- Revivicor, Inc.

- eGenesis, Inc.

- Makana Therapeutics

- Qihan Biotech

- Recombinetics, Inc.

- Sangamo Therapeutics

- OrganOx Limited