Global Cross-Device Sync Platform Market Size, Share Report By Component (Software, Services), By Device Type (Smartphones, Tablets, Laptops and Personal Computers (PCs), Smart Televisions (TVs), Wearables, Other Device Types), By Deployment Mode (Cloud-Based, On-Premises), By Application (Personal Use, Enterprise Use, Other Applications), By End-User (BFSI, Healthcare, Retail & E-commerce, IT & Telecommunications, Media & Entertainment, Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169468

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

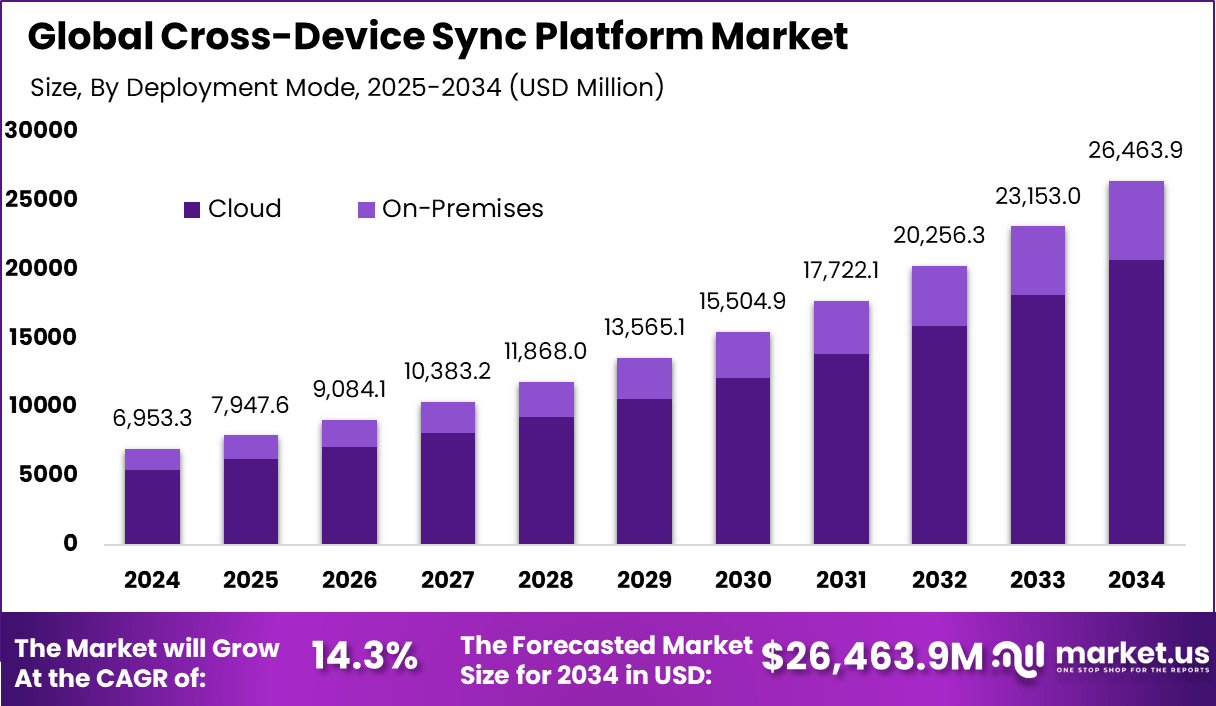

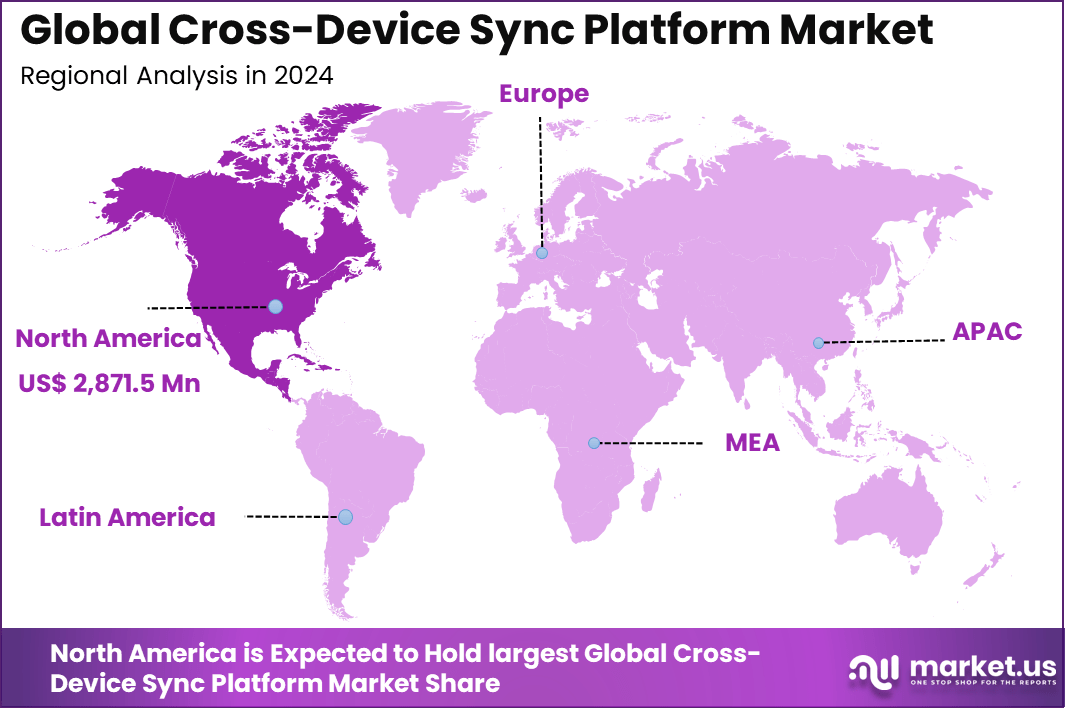

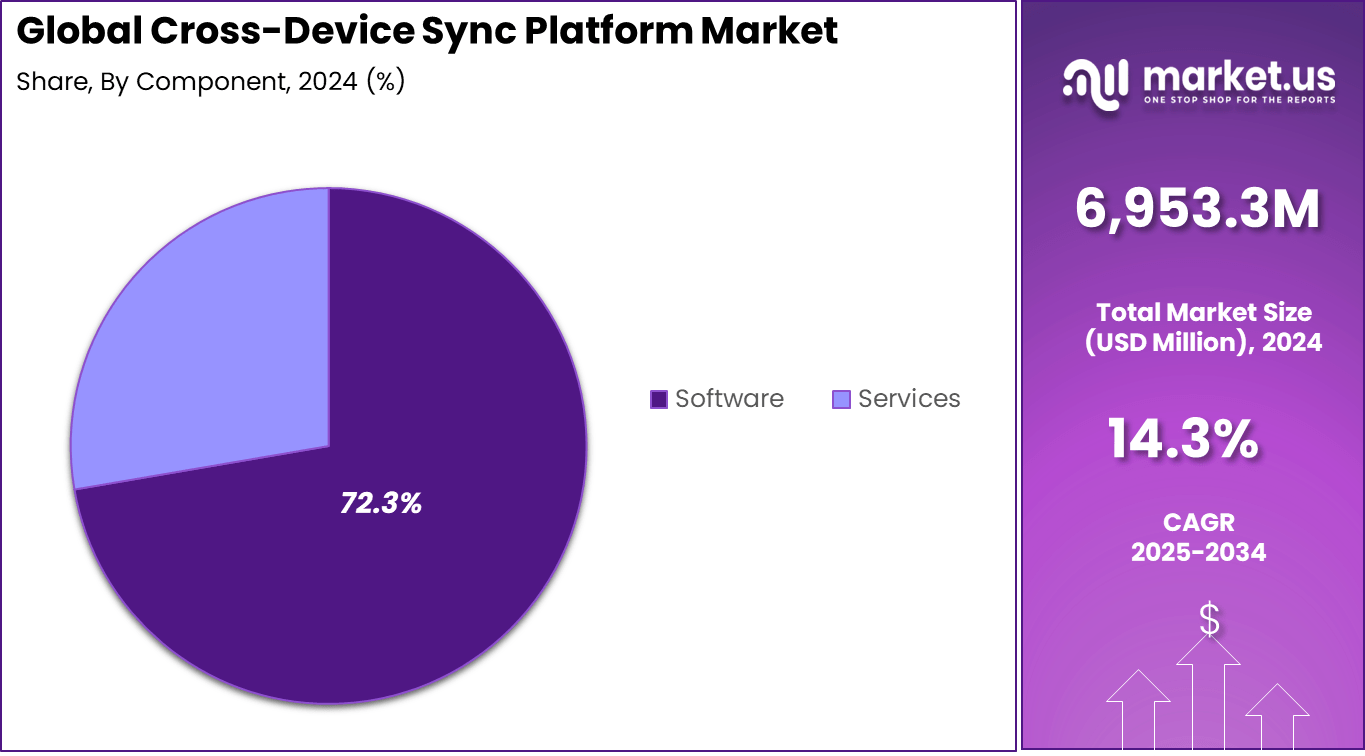

The Global Cross-Device Sync Platform Market generated USD 6,953.3 Million in 2024 and is predicted to register growth from USD 7,947.6 Million in 2025 to about USD 26,463.9 Million by 2034, recording a CAGR of 14.3% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 41.3% share, holding USD 2,871.5 Million revenue.

The cross device sync platform market has expanded as users expect seamless digital experiences across smartphones, tablets, laptops, desktops and smart devices. Growth reflects the rising use of multiple connected devices per user and the need for real time continuity of data, applications and user sessions. These platforms enable automatic synchronisation of files, settings, preferences and activity across different operating systems and device types.

The growth of the market can be attributed to increasing cloud adoption, growth in remote work and higher dependence on digital collaboration tools. Users demand uninterrupted access to files and workflows across personal and professional devices. The rapid expansion of mobile computing, wearable technology and smart home ecosystems further strengthens the need for reliable cross device synchronisation.

Top Market Takeaways

- Software led the market with a 72.3% share, showing that platform-based solutions remain the primary driver of cross-device synchronization.

- Laptops and PCs accounted for 36.5%, reflecting their continued role as the main work hubs for consumers and enterprises.

- Cloud-based deployment dominated with 78.4%, confirming strong reliance on real-time data sync across distributed devices.

- Enterprise use captured 65.7%, highlighting that business workflows depend heavily on seamless file and app synchronization.

- The IT and telecommunications sector held 24.8%, driven by large-scale device ecosystems and network-centric operations.

- North America recorded 41.3%, supported by high device density and advanced cloud adoption across enterprises.

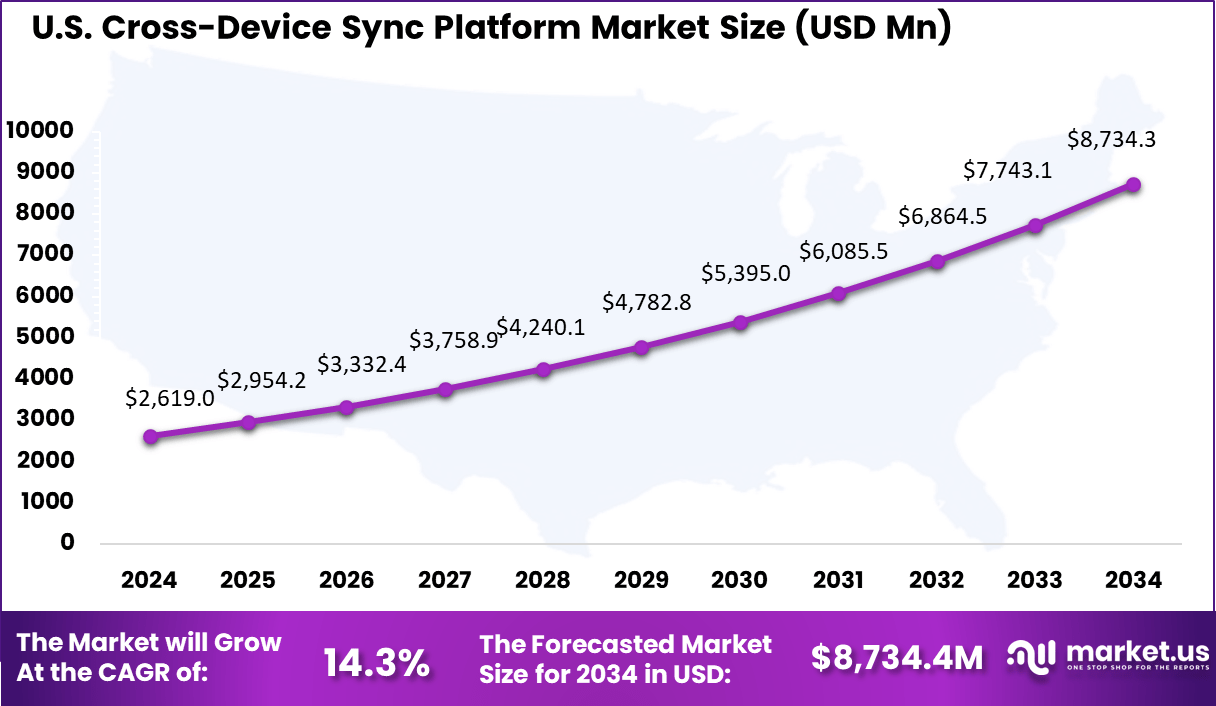

- The U.S. market reached USD 2,619.01 million with a 12.8% CAGR, indicating steady growth in demand for secure, multi-device productivity platforms.

Leading Platforms and User Statistics

- The personal and enterprise cloud sync market in 2025 continues to be led by Google, Microsoft, and Apple, with no major disruption in platform leadership so far.

- Google Drive surpassed 2 billion active users in 2025, making it the most widely used personal cloud storage service worldwide.

- A U.S. survey showed that 40% of users relied on Google Drive as early as 2020, confirming its long-term dominance in everyday cloud usage.

- Microsoft OneDrive remains strongest in enterprise environments due to deep integration with Microsoft 365 and Teams, with about 20% U.S. market share recorded in 2020.

- Apple iCloud leads consumer search interest in 2025 and benefits from tight integration across Apple devices, with a user base of about 850 million reported in 2018.

- Dropbox has more than 700 million registered users globally and is widely valued for reliable file syncing and collaboration performance.

Regional Insights

North America holds a leading 41.3% share, supported by strong cloud adoption, advanced digital infrastructure, and widespread use of enterprise software platforms. The region has a high concentration of remote workers, cloud users, and technology-driven businesses that rely on data synchronization across devices.

The United States alone reached USD 2,619.01 Mn with a steady CAGR of 12.8%, showing continued expansion in enterprise collaboration platforms and remote productivity tools. Growth is supported by increasing adoption of hybrid work models and multi-device work environments.

Ongoing investments in cloud services, data security systems, and enterprise mobility solutions continue to strengthen the regional outlook. Businesses in the region prioritize continuity of operations and workforce flexibility, which directly supports demand for cross-device sync platforms.

By Component

The software segment leads the market with a strong 72.3% share, showing that cross-device sync platforms are mainly delivered through digital software solutions. These platforms allow users to synchronize files, applications, settings, and user activity across multiple devices through a single software layer.

The high share of software is supported by rising demand for automation, remote access, and seamless data continuity. Software-based platforms also offer faster updates, better integration with enterprise systems, and easier scalability compared to hardware-based solutions.

By Device Type

Laptops and personal computers account for 36.5% of total device-based demand, making them the leading device category. These devices remain central to business operations, software development, office productivity, and enterprise data processing.

The dominance of this segment is linked to the continued use of PCs in corporate environments and hybrid work models. Users depend on cross-device sync to move data smoothly between office desktops, home laptops, and portable workstations without manual transfer.

By Deployment Mode

Cloud-based deployment holds a dominant 78.4% share, reflecting the strong reliance on cloud infrastructure for data synchronization. Cloud deployment allows users to access files and applications from any device, anywhere, with real-time updates and centralized security control.

The large share is supported by the growth of remote work, distributed teams, and multi-device usage. Organizations prefer cloud delivery because it reduces local storage dependency and ensures faster recovery during system failures or device loss.

By Application

Enterprise use represents a large 65.7% share, making it the primary application segment. Businesses rely on cross-device sync platforms to maintain workflow continuity, teamwork efficiency, and secure access to shared files across departments.

The strong demand from enterprises is driven by digital transformation, cloud migration, and the need for real-time collaboration. Sync platforms also support version control, secure sharing, and centralized IT administration, which strengthens their relevance in corporate operations.

By End User

The IT and telecommunications sector accounts for 24.8% of total end-user demand. These industries depend heavily on seamless data access across multiple systems, devices, and service platforms to support network operations and customer services.

Telecom operators and IT service providers use cross-device sync tools to support mobile workforce operations, network maintenance teams, and cloud service management. Continuous data flow across devices helps improve response time, service quality, and operational reliability.

Emerging Trends

One major emerging trend is deep integration of cross-device sync platforms with artificial intelligence-based productivity tools. These systems now support automatic file organization, predictive syncing behavior, and intelligent data access based on user activity patterns.

Another visible trend is the rising focus on data security and privacy controls within sync platforms. End users are demanding stronger encryption, multi-factor access control, and regional data storage options to support compliance and protection of sensitive business data.

Growth Factors

The rapid expansion of remote and hybrid work environments is a key growth factor for this market. Employees now use multiple devices across home and office locations, which increases dependence on real-time data synchronization systems.

Rising adoption of cloud computing across enterprises is also supporting strong market growth. As organizations continue to move workloads to the cloud, cross-device sync platforms become essential tools for maintaining workflow continuity and operational efficiency.

Key Market Segments

By Component

- Software

- Application Programming Interface (API) Integration Tools

- Data Management and Backup Software

- Security And Encryption Software

- File Versioning and Conflict Resolution Software

- Mobile Device Management (MDM) Software

- Real-Time Collaboration Software

- Services

- Professional Services

- Implementation and Integration Services

- Consulting Services

- Maintenance and Support Services

- Managed Services

- Professional Services

By Device Type

- Smartphones

- Tablets

- Laptops and Personal Computers (PCs)

- smart Televisions (TVs)

- Wearables

- Other Device Types

By Deployment Mode

- Cloud-Based

- On-Premises

By Application

- Personal Use

- Enterprise Use

- Other Applications

By End-User

- BFSI

- Healthcare

- Retail & E-commerce

- IT & Telecommunications

- Media & Entertainment

- Education

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

A key driver in the cross device sync platform market is the increase in the number of devices used by individuals and organizations. People now move between phones, tablets, laptops, and other connected products throughout the day. They expect their files, settings, and application states to remain consistent across all devices.

Sync platforms support this need by keeping data updated in real time or near real time. This expectation for smooth movement between devices continues to push demand for reliable sync solutions. Another driver comes from the shift toward remote and hybrid work.

Employees often work from different locations and change devices as tasks require. Sync platforms allow them to pick up work on a new device without repeating steps or losing progress. This supports continuity, helps maintain productivity, and reduces delays caused by switching between devices. These advantages encourage adoption across both large and small organizations.

Restraint

A major restraint is the technical difficulty of achieving accurate and consistent synchronization across different operating systems and device types. Each device may process data differently, and users may make changes while offline or under weak network conditions. Providers must manage conflicts, data formats, and timing issues, which increases development effort and slows the rollout of new features.

Another restraint relates to security and privacy. Sync platforms handle information that moves between multiple devices and storage locations. If security controls are weak or inconsistent, data may be exposed to unauthorized access. Organizations that work with sensitive information may hesitate to adopt sync platforms without clear assurances of secure handling and compliance with regulations.

Opportunity

There is a strong opportunity in serving enterprises that depend on digital collaboration. Many companies now rely on shared documents, remote communication, and project tools that must stay updated across locations. Sync platforms that offer stable performance, user control, and clear administrative oversight can attract businesses seeking to simplify device management and support mobile teams.

Another opportunity arises from growing use of cloud based ecosystems. Users increasingly want connected services where settings, files, and applications remain aligned across devices. Platforms that integrate sync with storage, productivity tools, and device controls can provide a unified experience. This creates room for providers to expand their services and strengthen long term customer relationships.

Challenge

A key challenge is avoiding data conflicts when multiple devices update the same information at the same time. Without strong rules for handling changes, users may face lost updates or incomplete files. Ensuring accurate sync under real world conditions requires constant monitoring and careful engineering.

Another challenge involves meeting different privacy laws across countries. Data that moves between devices may cross borders, and providers must ensure that storage and access rules match local regulations. This increases operational and legal requirements for platform developers and may slow expansion into certain regions.

Competitive Analysis

Amazon, Apple, Google, Microsoft, Huawei, and Lenovo lead the cross-device sync platform market with tightly integrated ecosystems that enable seamless data continuity across smartphones, PCs, tablets, and cloud services. Their platforms focus on real-time synchronization, secure identity-based access, and automatic backup. These companies benefit from large device user bases and deep OS-level integration. Rising use of multiple personal and work devices continues to reinforce their leadership.

IBM, Adobe, Western Digital, Zebra Technologies, Dropbox, and Box strengthen the market with enterprise-grade synchronization platforms designed for secure file sharing and workflow continuity. Their solutions support version control, device-level security, and compliance-ready data management. These providers serve regulated sectors such as BFSI, healthcare, and manufacturing.

Synology, Siber Systems, ASUSTOR, Nextcloud, OpenDrive, CloudMe, and MEGA broaden the market with private cloud, NAS-based sync, and privacy-focused platforms. Their offerings emphasize user-controlled storage, end-to-end encryption, and cross-platform compatibility. These companies attract users seeking data ownership and flexible deployment. Rising concern around data privacy and vendor lock-in continues to drive adoption of alternative cross-device sync platforms.

Top Key Players in the Market

- Amazon.com Inc.

- Apple Inc.

- Google LLC

- Microsoft Corporation

- Huawei Technologies Co Ltd

- Lenovo Group Limited

- IBM Corporation

- Adobe Inc.

- Western Digital Corporation

- Zebra Technologies Corporation

- Dropbox Inc.

- Box Inc.

- Synology Inc.

- Siber Systems Inc.

- ASUSTOR Inc.

- Nextcloud GmbH

- OpenDrive LLC

- CloudMe AB

- MEGA Limited.

- Others

Recent Developments

- July 2024, Google launched Cross-Device Sharing Services for Android devices. This update lets users switch calls, share hotspots, and sync Wi-Fi passwords across phones and tablets signed into the same account, much like Apple’s Continuity features. It works on Android 11 and up with recent Google Play services.

- December 2025, Amazon and Google rolled out a joint multicloud networking service combining AWS Interconnect and Google Cloud Connect. The tool sets up private high-speed links between clouds in minutes, easing data sync for users running apps across both platforms. It tackles downtime issues after outages hit services like Snapchat.

Report Scope

Report Features Description Market Value (2024) USD 6,953.3 Mn Forecast Revenue (2034) USD 26,463.9 Mn CAGR(2025-2034) 14.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Device Type (Smartphones, Tablets, Laptops and Personal Computers (PCs), Smart Televisions (TVs), Wearables, Other Device Types), By Deployment Mode (Cloud-Based, On-Premises), By Application (Personal Use, Enterprise Use, Other Applications), By End-User (BFSI, Healthcare, Retail & E-commerce, IT & Telecommunications, Media & Entertainment, Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon.com Inc., Apple Inc., Google LLC, Microsoft Corporation, Huawei Technologies Co Ltd, Lenovo Group Limited, IBM Corporation, Adobe Inc., Western Digital Corporation, Zebra Technologies Corporation, Dropbox Inc., Box Inc., Synology Inc., Siber Systems Inc., ASUSTOR Inc., Nextcloud GmbH, OpenDrive LLC, CloudMe AB, MEGA Limited, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cross-Device Sync Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Cross-Device Sync Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon.com Inc.

- Apple Inc.

- Google LLC

- Microsoft Corporation

- Huawei Technologies Co Ltd

- Lenovo Group Limited

- IBM Corporation

- Adobe Inc.

- Western Digital Corporation

- Zebra Technologies Corporation

- Dropbox Inc.

- Box Inc.

- Synology Inc.

- Siber Systems Inc.

- ASUSTOR Inc.

- Nextcloud GmbH

- OpenDrive LLC

- CloudMe AB

- MEGA Limited.

- Others