Global Creator Economy Market Size, Share, Industry Analysis Report By Platform (Social Media Platforms, Content-Sharing Platforms, Video Streaming Platforms, Audio Platforms, Gaming Platforms, Others (E-commerce Platforms, etc.)), By Content Type (Video, Written, Gaming, Music, Photography, Art, and Memes, Audio, Others (Educational, etc.), By Monetization Method (Advertising Revenue, Subscriptions, Donations and Tips, Affiliate Marketing, Brand Collaborations, Merchandise, Others), By End User (Professional Creator, Armature Creator), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov. 2025

- Report ID: 136026

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Creator Economy Statistics

- Role of Generative AI

- US Creator Economy Market Size

- North America Market Size

- Platform Analysis

- Content Type Analysis

- Monetization Method Analysis

- End User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefit

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

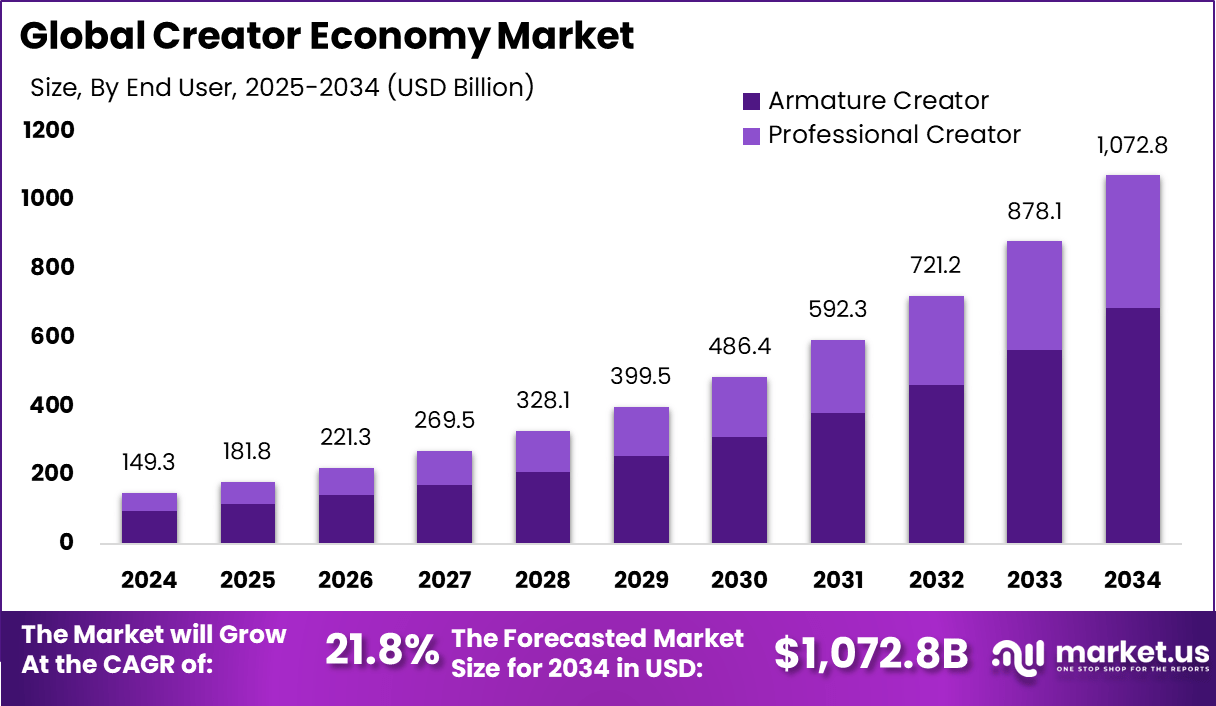

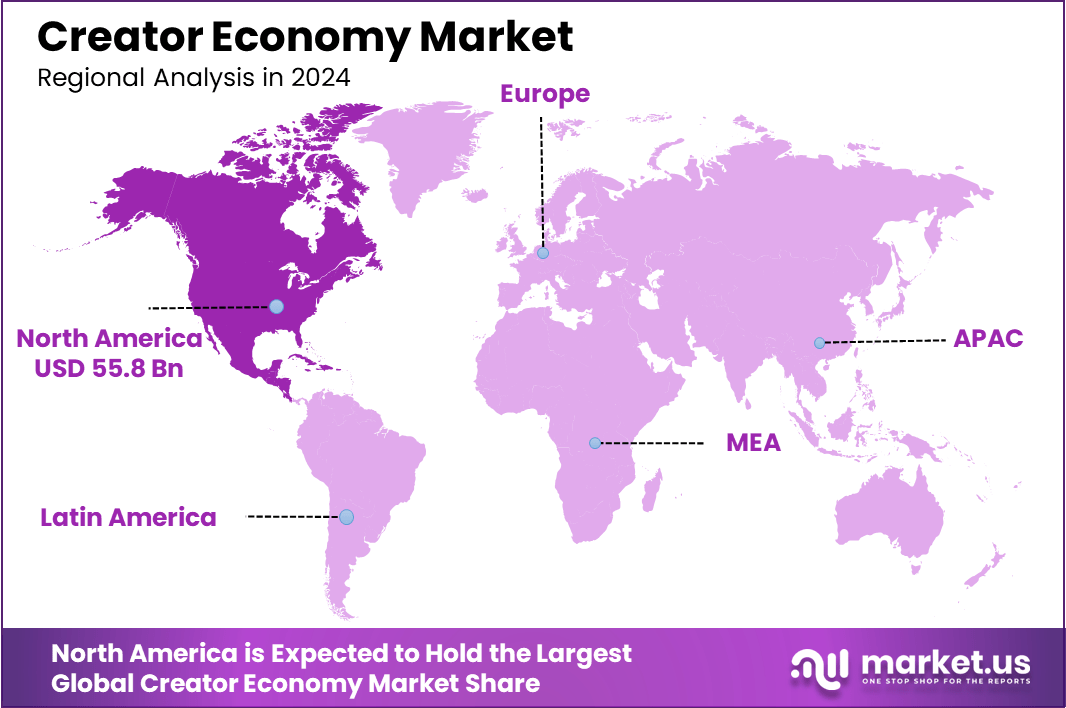

The Global Creator Economy Market size is expected to be worth around USD 1,072.8 Billion By 2034, from USD 149.4 billion in 2024, growing at a CAGR of 21.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.4% share. Within this region, the U.S. Creator Economy market stood out, recording a significant valuation of USD 50.9 billion.

The Creator Economy refers to an ecosystem in which individuals – such as social media influencers, podcasters, YouTubers, artists, writers, and independent professionals – produce and distribute digital content directly to audiences via social platforms, monetizing through advertising, sponsorships, crowdfunding, subscriptions, and product sales. It is characterized by software-driven platforms enabling content creation, distribution, monetization tools, data analytics, and e-commerce integration.

The Creator Economy Market encompasses the global economic value generated by creator-driven platforms, tools, services, and monetization models. It includes content production, analytics platforms, creator tools, and supporting infrastructure. The market’s expansion is primarily driven by widespread social media adoption, rising content consumption, mobile internet proliferation, and expanding digital ad expenditures.

Demand is spurred by consumer preferences for authentic, relatable, and niche content. With over 400 million creators estimated globally by 2024 and significant growth in creator employment – U.S. full-time “digital creator” jobs rising from 200,000 in 2020 to 1.5 million in 2024 – the ecosystem evidences sustained expansion

According to Exploding Topics, the global creator economy is currently valued at $191.55 billion, reflecting its significant impact on industries worldwide. Within this ecosystem, merchandise companies alone generate over $500 million in annual revenue. Shopify stands out as a leader in supporting creators, with an impressive $5.2 billion in revenue, solidifying its position as a top player in the space.

A substantial proportion of creators – 68.8%, or roughly 7 in 10 – depend primarily on brand deals as their main source of income. In comparison, only 7.3% of creators cite ad revenue as their top earner. However, the landscape is evolving, with notable growth in income streams such as affiliate marketing (up 9%), advertising (up 15%), and merchandise sales (up 4%).

Technology adoption has been central to market growth. Generative AI tools are now used by approximately 59% of creators to streamline content ideation and production. Augmented reality (AR), virtual reality (VR), and immersive formats are gaining traction. Analytics, performance dashboards, and real‑time insights tools are enabling creators to optimize content and monetization outcomes.

Based on data from internet news times, only 4% to 10% of creators earn more than USD 100K annually, indicating that high-income creators remain a small segment even as the ecosystem grows. Platform performance continues to shape creator earnings, with YouTube, Instagram, and TikTok offering the strongest returns for brand campaigns.

The ecosystem is further transformed by rapid AI adoption, as more than 91% of creators now use generative AI to increase output. Participation in the passion economy has reached nearly 500 million people, driven by flexible work models and growing digital monetization opportunities. Demographic patterns show that 52% of creators are men and 46.7% work full-time, although only 13% belong to Gen Z.

Key Takeaways

- Social Media Platforms lead with a 27.8% share, showing they are the most preferred base for creators to build and engage audiences.

- Video Streaming Platforms hold the second-highest platform share at 24.5%, driven by growing demand for long-form and high-quality content.

- Video content dominates in format type with a 23.8% share, reflecting strong consumer preference for visual storytelling.

- Music content follows at 18.3%, boosted by short-form audio, independent artists, and streaming growth.

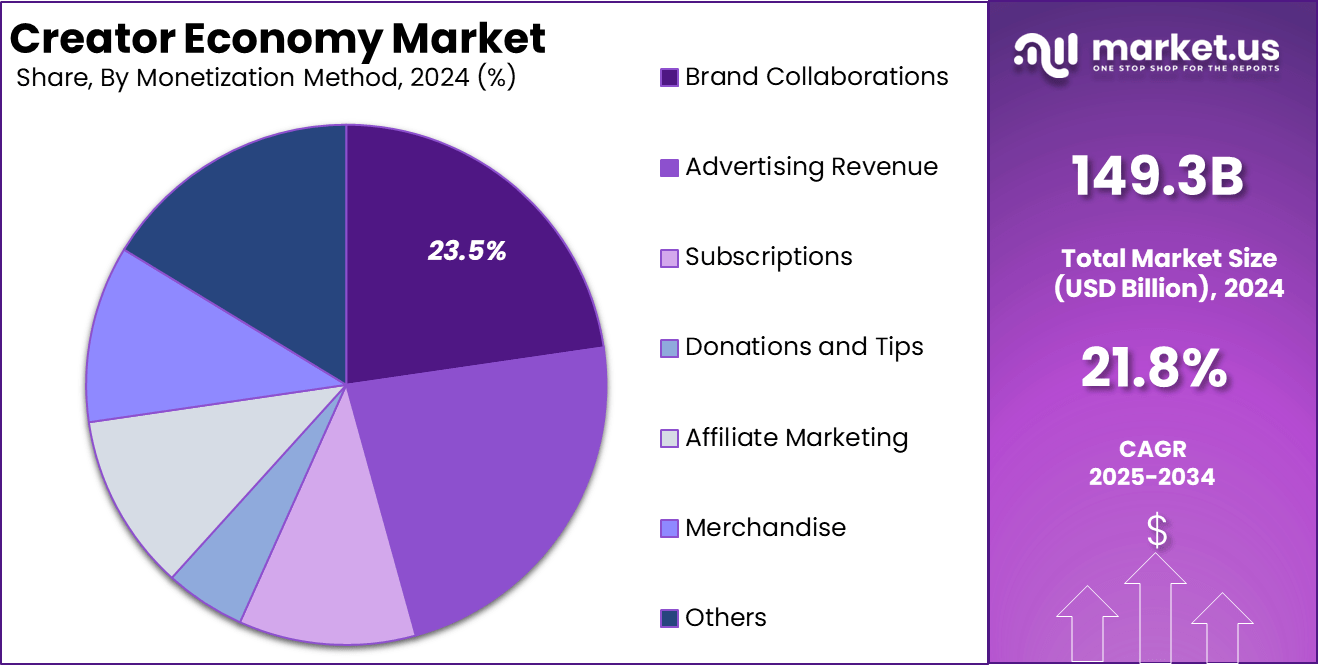

- Brand Collaborations are the top monetization method with 23.5%, as brands increasingly partner with creators for authentic reach.

- Advertising Revenue stands at 20.9%, still vital but slightly behind direct brand deals.

- Armature Creators form the majority at 64.1%, reflecting low-entry barriers and rising side-hustle culture.

- Professional Creators account for 35.9%, indicating a structured and full-time content creation segment.

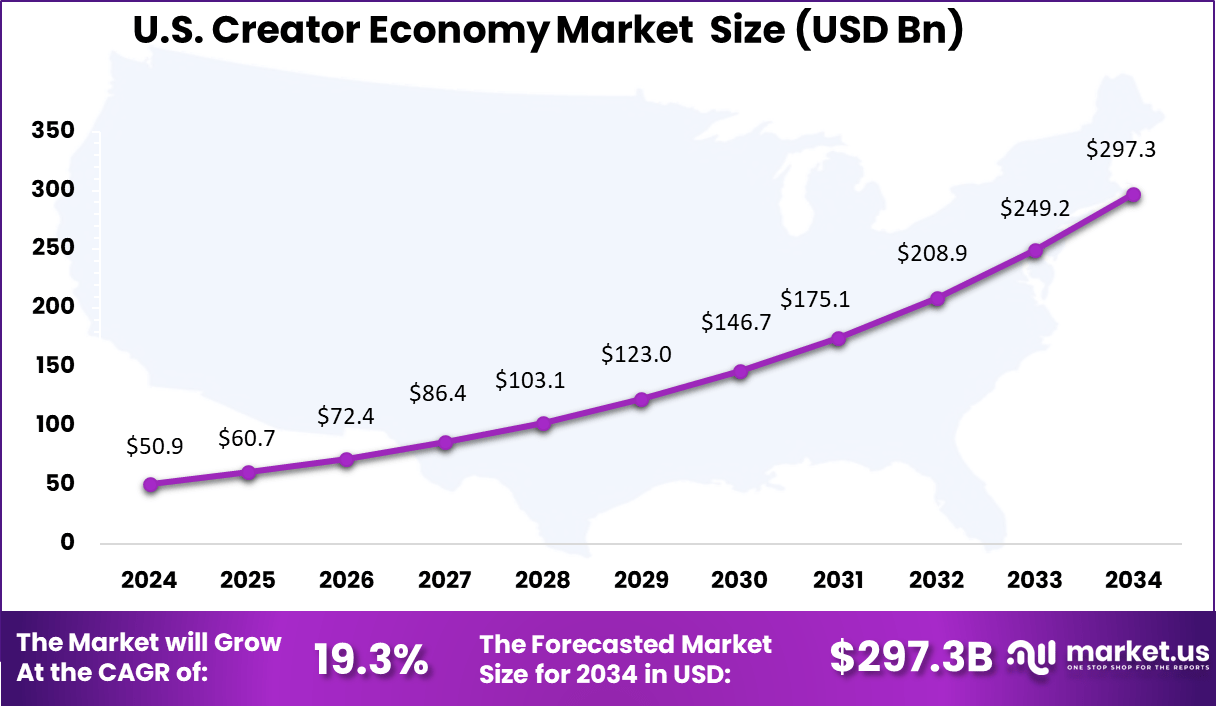

- The U.S. Creator Economy is valued at USD 50.9 billion with a strong CAGR of 19.3%, highlighting significant market momentum.

- North America holds a dominant 37.4% share, led by established platforms, monetization tools, and mature digital infrastructure.

Creator Economy Statistics

- Based on data from theleap, There are over 200 million creators worldwide, highlighting the scale of the global creator economy.

- The ecosystem is fueled by 4.2 billion social media users, providing creators with massive reach.

- Around 500 million people are engaged in the passion economy, turning hobbies and skills into income streams.

- By demographics, 52% of creators are men, while Gen Z makes up only 13% of total creators, showing stronger participation from Millennials and older groups.

- Audience size remains modest for most, with 67% of creators having 1,000-10,000 followers, emphasizing a large base of micro-influencers.

- Nearly one in four people today identifies as a content creator, reflecting mainstream adoption.

- In monetization, 68.8% of creators depend on brand deals as their primary revenue stream.

- By exploding topics, Merchandise is a lucrative area, with merch companies generating over $500 million annually.

- Shopify leads the creator support ecosystem with $5.2 billion in revenue, showcasing its dominance in powering creator-led businesses.

Role of Generative AI

Generative AI has emerged as the backbone of creativity and efficiency in the creator economy, with an impressive 91% of creators in the U.S. and UK now using AI tools to support content production, idea generation, and workflow automation.

Across all segments, generative AI is driving massive transformation by enabling creators to produce videos, scripts, and art on-demand, with some creators collaborating directly with AI assistants and chatbots as creative partners rather than seeing them as competition.

The technology also helps brands scale influencer campaigns and vet audience authenticity, with 63% of brands planning to include AI in their marketing efforts in 2025. The combination of human creativity and generative automation is setting the pace for speed, scale, and innovation in content creation for creators worldwide.

US Creator Economy Market Size

The US Creator Economy Market is valued at approximately USD 50.9 Billion in 2024 and is predicted to increase from USD 123 Billion in 2029 to approximately USD 297.3 Billion by 2034, projected at a CAGR of 19.3% from 2025 to 2034.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 37.4% share, holding USD 55.8 billion in revenue in the global creator economy market. This leadership was driven by a mature digital infrastructure, widespread smartphone usage, and a highly engaged social media population.

The presence of top-tier platforms such as YouTube, Instagram, TikTok (US operations), Twitch, and Patreon created a favorable environment for creators to monetize through brand sponsorships, direct fan contributions, and advertising revenues. Furthermore, the United States remains home to a large portion of the world’s most-followed content creators and influencer marketing agencies, which has made the region an innovation hub for monetization strategies.

Creator Economy Market Share by Region (%), 2019-2024

Country 2019 2020 2021 2022 2023 2024 The US 92.2% 92.0% 91.8% 91.6% 91.4% 91.2% Canada 7.8% 8.0% 8.2% 8.4% 8.6% 8.8% The leadership of North America can also be attributed to robust investor interest and the integration of emerging technologies like AI-driven content optimization and NFTs for digital ownership. Increasing partnerships between creators and brands, the adoption of micro-influencer strategies, and the rise in creator-led ventures such as e-commerce or personal media brands further accelerated revenue generation.

Platform Analysis

In 2024, Social Media Platforms segment held a dominant market position, capturing more than a 27.8% share of the global Creator Economy, a trend supported by North American data showing social media commanding roughly 29% of platform-based value in that region. This leadership can be attributed to several reinforcing factors.

High engagement levels resulting from optimized recommendation systems have facilitated content virality and fast community growth. Creators benefit from integrated monetization tools – such as advertisements, brand partnerships, affiliate marketing, tipping, and e‑commerce – further supported by platform enhancements that simplify checkout and fund transfer.

Creator Economy Market Share by Platform Analysis (%), 2019-2024

Platform 2019 2020 2021 2022 2023 2024 Social Media Platforms 31.7% 31.2% 30.6% 30.1% 29.2% 29.0% Content-Sharing Platforms 15.3% 15.2% 15.2% 15.1% 15.1% 15.0% Video Streaming Platforms 22.2% 22.6% 22.9% 23.2% 23.8% 23.9% Audio Platforms 12.0% 12.1% 12.2% 12.4% 12.5% 12.6% Gaming Platforms 10.9% 11.2% 11.5% 11.9% 12.3% 12.5% Others (E-commerce Platforms, etc.) 7.9% 7.7% 7.5% 7.3% 7.1% 7.0% As mobile penetration continues to rise, visual and interactive content formats (stories, reels, live streams) have driven deeper, more spontaneous audience interaction. Consequently, large-scale visibility and diversified revenue sources ensure steady growth and premium return potential, reinforcing social media’s structural dominance in the Creator Economy.

Content Type Analysis

In 2024, the Video held a dominant market position in the Content Type Segment of the Creator Economy Market, and captured more than a 23.8% share. This leadership was strongly driven by the rising demand for short-form and long-form visual content across platforms such as YouTube, TikTok, and Instagram Reels.

Video content has become the most effective way to engage audiences due to its visual appeal, storytelling capability, and high shareability. The format also supports monetization models like ads, brand sponsorships, and fan-based contributions more efficiently than other content types. The dominance of video can also be linked to increased smartphone penetration, better mobile internet speeds, and the availability of easy-to-use editing tools.

Creator Economy Market Share by Content Type Analysis (%), 2019-2024

Content Type 2019 2020 2021 2022 2023 2024 Video 21.9% 22.5% 23.0% 23.5% 24.3% 24.4% Written 9.9% 9.7% 9.4% 9.2% 8.9% 8.7% Gaming 17.2% 17.2% 17.2% 17.2% 17.1% 17.2% Music 19.6% 19.4% 19.3% 19.2% 18.9% 19.0% Photography, Art, and Memes 11.2% 11.0% 10.9% 10.7% 10.6% 10.4% Audio 13.3% 13.4% 13.6% 13.7% 13.9% 14.0% Others (Educational, etc.) 6.9% 6.8% 6.6% 6.5% 6.3% 6.2% These factors have empowered individual creators and influencers to produce high-quality content consistently. As viewers continue to prefer visual-first formats, video remains the cornerstone of the creator economy, shaping both consumer attention and creator revenues globally.

Monetization Method Analysis

In 2024, Brand Collaborations segment held a dominant market position in the Monetization Method Segment of the Creator Economy Market, capturing more than a 23.5 % share. This leadership can be attributed to a strategic shift by brands toward influencers and creators, underscored by:

Brand collaborations deliver authentic audience engagement and measurable impact, making them a preferred marketing strategy. Creators and brands benefit from flexible formats – from macro-influencer sponsorships to nano-influencer campaigns – across platforms such as TikTok, Instagram, and YouTube. Such partnerships are reinforced by advances in creator‑brand marketplaces that streamline campaign planning and execution.

Creator Economy Market Share by Monetization Method Analysis (%), 2019-2024

Monetization Method 2019 2020 2021 2022 2023 2024 Advertising Revenue 24.8% 24.3% 23.8% 23.3% 22.4% 22.1% Subscriptions 17.1% 17.7% 18.3% 18.9% 19.8% 20.0% Donations and Tips 7.5% 7.2% 7.0% 6.7% 6.5% 6.3% Affiliate Marketing 12.2% 12.3% 12.3% 12.4% 12.4% 12.5% Brand Collaborations 21.0% 21.3% 21.7% 22.1% 22.6% 22.7% Merchandise 11.6% 11.6% 11.5% 11.5% 11.3% 11.4% Others 5.8% 5.6% 5.4% 5.2% 5.0% 4.9% The growth in Brand Collaborations has been supported by consumer preference for trustworthy recommendations: about 92% of consumers trust influencer endorsements more than traditional ads, driving brands to allocate a growing share of marketing budgets to creators. Platforms and tools facilitating these collaborations – such as Pearpop and creator marketplaces – enable efficient, performance‑based campaigns that align creator incentives with brand outcomes.

End User Analysis

In 2024, the Amateur Creator segment held a dominant market position in the End-User Segment of the Creator Economy Market, capturing more than a 64.1% share. This dominance was largely driven by the explosive rise in individuals creating content for passion, personal branding, or supplemental income rather than as a full-time profession.

The ease of access to smartphones, intuitive video editing apps, and plug-and-play monetization tools on platforms like TikTok, YouTube, and Instagram has made it simple for everyday users to become creators without professional setups or training. The amateur segment’s growth also reflects changing cultural attitudes toward self-expression and digital side incomes.

Creator Economy Market Share by End User Analysis (%), 2019-2024

End User 2019 2020 2021 2022 2023 2024 Professional Creator 65.4% 65.0% 64.5% 64.1% 63.5% 63.3% Armature Creator 34.6% 35.0% 35.5% 35.9% 36.5% 36.7% Millions of users are now casually creating content around lifestyle, hobbies, humor, education, or gaming, often with a strong local or niche community appeal. While not all of them earn large sums, the sheer volume of these creators has made them an essential pillar of the creator economy. Their contribution not only fuels content diversity but also drives platform engagement, making them highly valuable from both a user-retention and platform monetization standpoint.

Key Market Segments

By Platform

- Social Media Platforms

- Content-Sharing Platforms

- Video Streaming Platforms

- Audio Platforms

- Gaming Platforms

- Others (E-commerce Platforms, etc.)

By Content Type

- Video

- Written

- Gaming

- Music

- Photography, Art, and Memes

- Audio

- Others (Educational, etc.)

By Monetization Method

- Advertising Revenue

- Subscriptions

- Donations and Tips

- Affiliate Marketing

- Brand Collaborations

- Merchandise

- Others

By End User

- Professional Creator

- Armature Creator

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Expansion of Niche Platforms & Tools

The emergence of specialized platforms and creator‑centric tools offers targeted monetization and distribution pathways for smaller, interest‑based communities. This supports greater personal branding and niche engagement, leading to stronger fan loyalty and diversified income streams through subscriptions, community micropayments, and affiliate partnerships.

Creators now cross‑leverage platforms – such as integrating live‑stream content from one platform into short videos for a social channel – to optimize reach and revenue. The seamless integration of content workflows has lowered barriers for creators, enhancing both output efficiency and market penetration.

Restraint

Saturation and High Competition

Despite the booming growth of the creator economy, one of its most significant restraints is the intense saturation and competition within the market. As the barriers to entry are low, millions of new creators join platforms each year, making it increasingly challenging to stand out and build a substantial audience.

This saturation not only makes it difficult for new creators to gain visibility but also dilutes the attention span of viewers across a vast array of content options. For creators, this means that despite having the tools and platforms at their disposal, the sheer number of content offerings can prevent them from achieving significant reach or monetization unless they have a unique value proposition or niche.

Opportunity

Web3 & Decentralized Monetization

Web3 technologies – including blockchain, NFTs, and tokenized communities – are enabling creators to establish direct value exchange with audiences without intermediaries. These innovations help maintain creator ownership, provide transparent monetization through smart contracts, and open new funding models via token sales and micro‑patronage.

As subscription fatigue grows and consumer preference for authentic ownership increases, the ability to offer exclusive content, tokenized experiences, or collector assets becomes a compelling route to sustainable income. This signals a transformative shift toward decentralized, creator‑owned ecosystems.

Challenge

Monetization and Economic Viability

The challenge of monetization remains a persistent issue within the creator economy. While there are numerous platforms available to showcase creativity, the majority of creators struggle to generate substantial income from their efforts. This economic viability issue is exacerbated by platform algorithms that prioritize certain types of content over others, making it difficult for many creators to have consistent visibility without continuous optimization of their content strategies.

Additionally, as more platforms introduce monetization features, the policies and revenue-sharing models often favor the platform, leaving creators with a smaller slice of the earnings pie. The challenge for creators is to navigate these monetization hurdles while maintaining their creative integrity and audience engagement.

Growth Factors

The creator economy’s rapid growth is driven by several key factors. Ubiquitous internet access, easy-to-use platforms, and advanced AI workflows have lowered entry barriers, fueling the surge in content creators, including over 4.06 million in India – a 322% jump from just four years earlier.

Diversified revenue streams, including direct-to-fan commerce and platform-sponsored monetization tools, are giving creators new ways to earn, with only 4% of global creators reaching professional income levels. Consumer spending patterns are evolving, as creators now influence more than 30% of purchases in India through original content, tutorials, and live streams.

Emerging Trends

Several trends are reshaping the creator economy this year. The number of active creators globally has passed 207 million, powered by democratized access to platforms and AI-driven workflows. Short-form video continues to dominate online traffic, accounting for nearly 90% of internet activity projected this year.

Micro-creators, often with small but highly loyal audiences, are producing up to 6.7 times higher engagement than large brands, leading to a surge in brand collaborations with niche creators. AI-powered editing, captioning, and scheduling are delivering more polished and frequent outputs, enabling creators to post higher quality content at scale.

New monetization models – such as in-app shops, subscriptions, and virtual gifting – are becoming crucial growth drivers, reinforcing the shift from broad influencer marketing to personalized, creator-led commerce.

Business Benefit

The expansion of the creator economy offers numerous benefits for businesses. By collaborating with creators, businesses can tap into their loyal audiences and leverage creators’ expertise in content creation to enhance brand visibility and authenticity. This collaboration often leads to higher conversion rates as audiences tend to trust recommendations from their favorite creators more than traditional advertising.

Furthermore, the creator economy fosters innovation in marketing strategies, pushing brands to adapt to new forms of media and audience expectations. As content consumption preferences evolve, businesses that can effectively partner with creators to produce relevant and engaging content are likely to see greater success in reaching their target markets.

Overall, the growth of the creator economy is driven by technological advancements and a shift in consumer behavior, which prioritizes authenticity and engagement. As this sector continues to evolve, it presents ongoing opportunities and challenges for creators and businesses alike, driving further innovation in how content is created and consumed.

Key Player Analysis

Alphabet reinforced its leadership by extending content creator tools. In June 2024, Google confirmed that YouTube is expanding “free games catalog ‘Playables’” to all users. This improvement strengthens monetization avenues for creators, offering interactive content beyond traditional videos. Additionally, Google integrated Stack Overflow’s knowledge base into Gemini for Google Cloud in March 2025.

Amazon expanded its content ecosystem notably with the acquisition of Indian streaming platform MX Player in June 2024. This strategic move extends Amazon’s footprint in creator-driven markets and strengthens regional content supply. Furthermore, Amazon introduced a video generator tailored for ads in September 2024 , empowering creators and brands to produce promotional material quickly, thereby enhancing creator engagement and monetization potential.

ByteDance sustained momentum by launching “TikTok for Artists” in mid‑2025 – a music insights platform enabling musicians to monitor performance metrics. Concurrently, it rolled out advanced features such as “Manage Topics” and “Smart Keyword Filters” to refine content discovery. These innovations enhance creator control over audience targeting and content curation, reinforcing TikTok’s role as a dynamic creator-centric platform.

Top Key Players in the Market

- Alphabet Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Note (*): Similar analysis will be provided for other companies as well.

- Amazon.com, Inc.

- ByteDance

- Meta Platforms

- Spotify AB

- Netflix Inc.

- Snap Inc.

- Pinterest, Inc.

- X Corp.

- Canva

- Roblox Corporation

- Etsy, Inc.

- Patreon, Inc.

- Discord Inc.

- Substack Inc.

Recent Developments

- In March 2025, the Government of India launched a USD 1.0 billion fund and allocated USD 47 million to the Indian Institute of Creative Technology to boost innovation and skills in the creative industries, alongside the WAVES 2025 summit for content creators.

- In March 2025, UNESCO and the Knight Center for Journalism in the Americas organized a training program with over 10,000 participants, focusing on audience trust, ethical influence, and media literacy to strengthen responsible journalism.

- In February 2025, Gushcloud International and Azure Capital Partners introduced the Azure-Gushcloud Entertainment Finance Fund to provide structured financing for creators, enabling global brand collaborations, content monetization, and licensing opportunities in digital entertainment.

Report Scope

Report Features Description Market Value (2024) USD 143 Bn Forecast Revenue (2034) USD 1,487 Bn CAGR (2025-2034) 26.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Platform Type (Video streaming, Live Streaming, Blogging Platform, e-Commerce Platform, Pod-casting Platform, Others), By Creative Service (Arts & Crafts, Digital Content, Written Content, Video Production, Photography, Music Production, Others), By Revenue Channel (Advertising, Subscription, Tips/Donations, Affiliate Marketing, Selling Products/Merchandise, Brand Partnerships, Others), By End User (Armature Creator, Professional Creator) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ByteDance, Meta Platforms Inc., Alphabet Inc., Spotify AB , Netflix Inc., Snap Inc., Twitter Inc., Pinterest Inc., Etsy Inc., Shopify, Patreon, Teespring (Spring Inc.) , Twitch Interactive, Discord Inc., TikTok , YouTube, Instagram , Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alphabet Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Note (*): Similar analysis will be provided for other companies as well.

- Amazon.com, Inc.

- ByteDance

- Meta Platforms

- Spotify AB

- Netflix Inc.

- Snap Inc.

- Pinterest, Inc.

- X Corp.

- Canva

- Roblox Corporation

- Etsy, Inc.

- Patreon, Inc.

- Discord Inc.

- Substack Inc.

- Alphabet Inc.