Global Coumarin Market By Type (Up To 99% And Above 99%), By End-Use (Pharmaceuticals, Cosmetics and Chemical Synthesis), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 123038

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

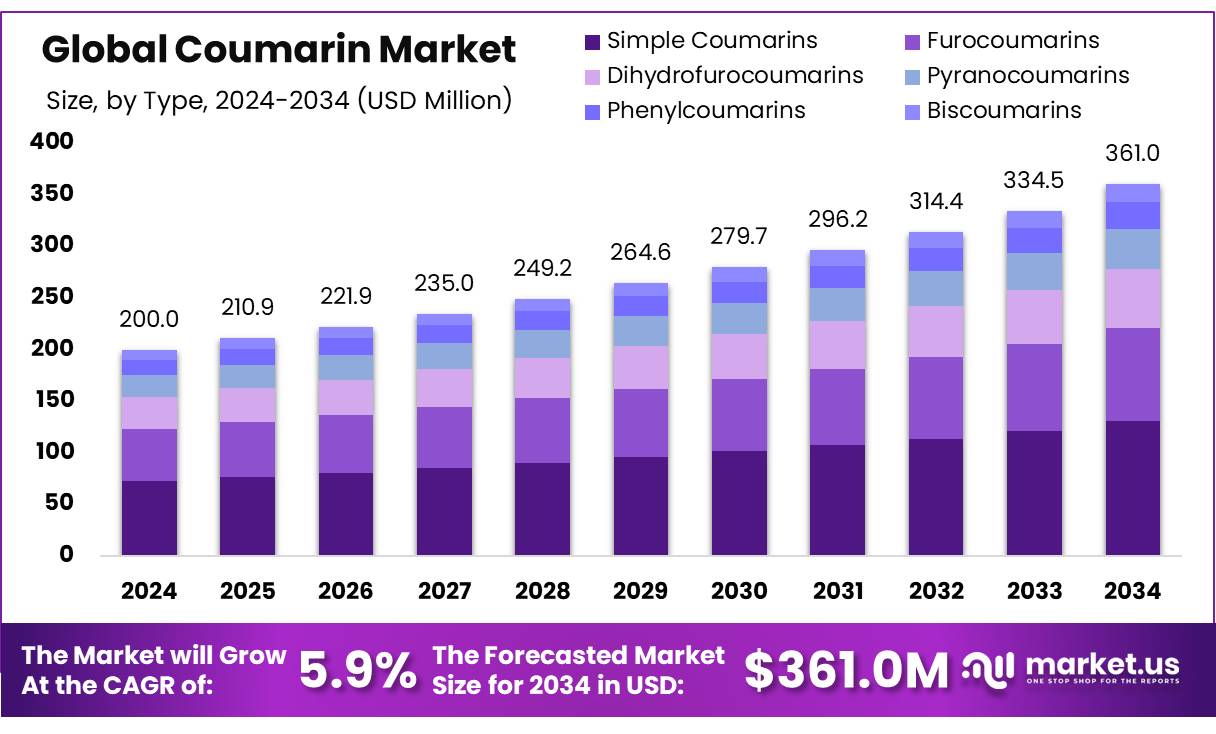

Global Coumarin Market size is expected to be worth around USD 361.0 Mn by 2034, from USD 200.0 Mn in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. Coumarin is a naturally occurring phenolic compound featuring fused benzene and α-pyrone rings. It serves as the core molecule for a group of derivatives known for their diverse biological activities, including anti-inflammatory, antioxidant, and antimicrobial effects. While coumarin is primarily used as a fragrance ingredient, it also functions as a fragrance enhancer and stabilizer in various products. The global coumarin market is experiencing steady growth driven by its widespread applications across various industries, including cosmetics, pharmaceuticals, food & beverages, and personal care.

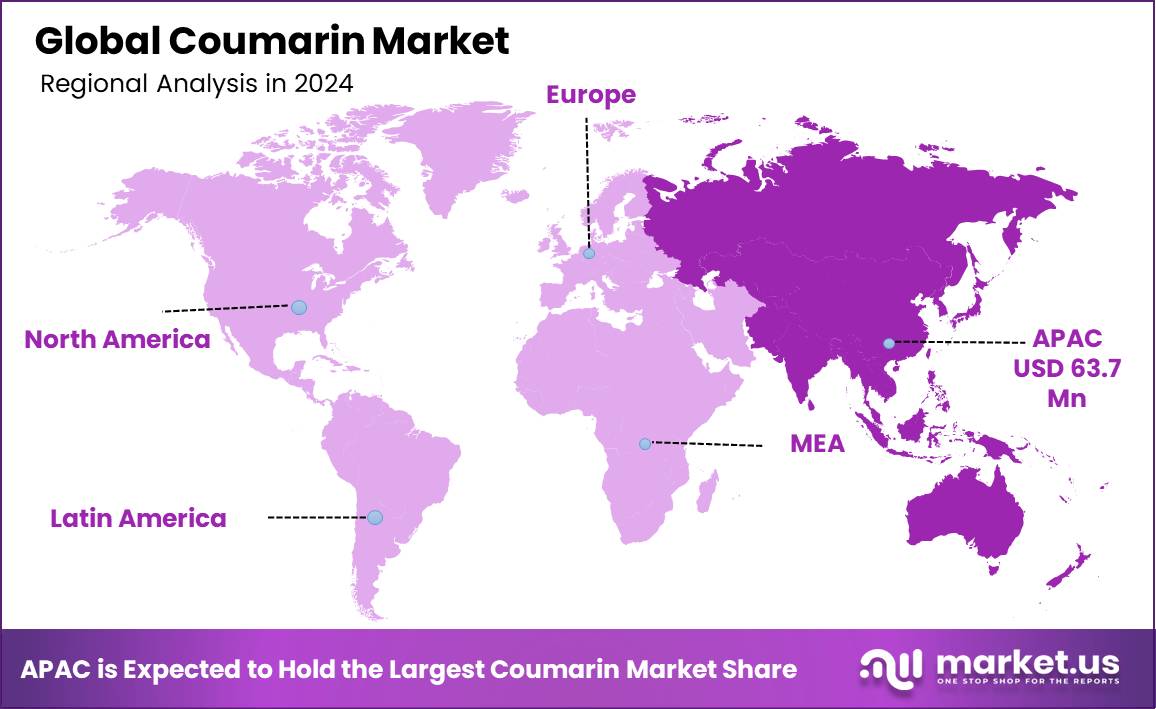

Geographically, Asia-Pacific dominates the market, driven by major manufacturing hubs and increasing consumption in emerging economies such as China and India. North America and Europe are also substantial markets, with stringent regulations ensuring the safe use of coumarin in various applications. The sustainability trend is likely to shape future market developments, with consumers and manufacturers increasingly favoring naturally sourced or synthetically safe coumarin derivatives. Innovations in production methods and the expansion of its applications beyond traditional uses will present opportunities for market growth in the coming years.

Key Takeaways

- The global coumarin market was valued at US$ 200.0 million in 2024.

- The global coumarin market is projected to grow at a CAGR of 5.9% and is estimated to reach US$ 361.0 million by 2034.

- Among types, simple coumarins accounted for the largest market share of 36.2%.

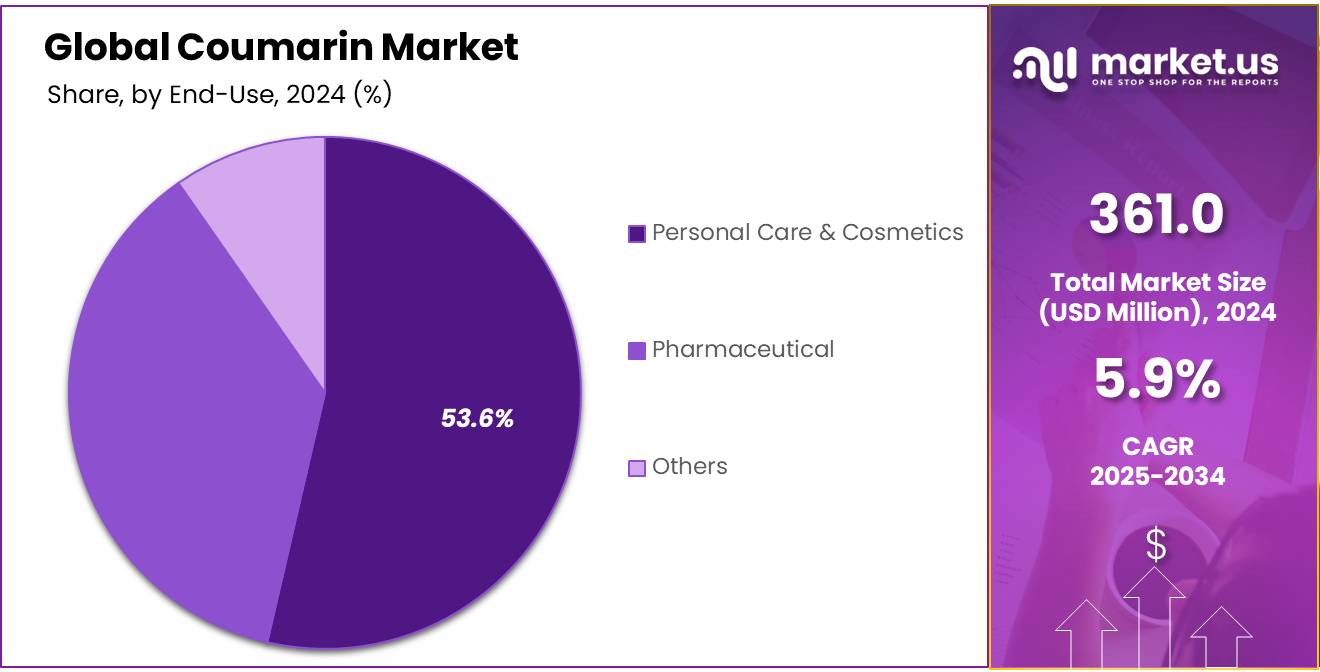

- Among end-use, personal care & cosmetics accounted for the majority of the market share at 53.7%.

- Asia-Pacific is estimated as the largest market for coumarin with a share of 31.8% of the market share.

- North America is anticipated to register the 2nd highest CAGR of 5.9%.

- Europe with a revenue share of 29.3% in 2024 and expected to register a CAGR of 5.5%.

Type Analysis

Simple Coumarins Dominated the Market, Owing to Their Widespread End-Use Across Various Industries

The coumarin market is segmented based on simple coumarins, furocoumarins, dihydrofurocoumarins, pyranocoumarins, phenylcoumarins and biscoumarins. In 2024, the type simple coumarins segment held a significant revenue share of 36.2%. Primarily due to their versatile applications, high availability, and cost-effectiveness compared to other coumarin derivatives. Simple coumarins are widely used in fragrances, cosmetics, pharmaceuticals, and agrochemicals, making them the most commercially viable category in the market.

One of the key factors driving the demand for simple coumarins is their extensive use in the fragrance industry, where they act as essential components in perfumes, air fresheners, and scented personal care products. Their ability to provide a warm, sweet, and vanilla-like aroma makes them highly desirable for both fine and industrial fragrances.

Additionally, simple coumarins serve as fragrance enhancers and stabilizers, further increasing their utility in the sector. Simple coumarins hold the largest revenue share due to their widespread applications, affordability, and functional benefits across multiple industries. With ongoing research and innovation in sustainable sourcing and synthetic alternatives, their demand is expected to remain strong in the coming years.

Global Coumarin Market, By Type, 2020-2024 (USD Mn)

Type 2020 2021 2022 2023 2024 Simple Coumarins 58.6 61.8 65.1 68.5 72.3 Furocoumarins 41.7 43.5 45.5 47.7 50.3 Dihydrofurocoumarins 26.1 27.4 28.7 30.0 31.4 Pyranocoumarins 18.0 18.8 19.6 20.4 21.5 Phenylcoumarins 12.5 12.9 13.4 13.9 14.6 Biscoumarins 8.4 8.8 9.1 9.5 9.9 End-Use Analysis

Coumarin Market Was Dominated By the Personal Care & Cosmetics Industry

Based on end-use, the market is further divided into personal care & cosmetics, pharmaceuticals, and others. The predominance of the personal care & cosmetics sector, commanding a substantial 53.7% market share in 2024. This substantial dominance is primarily driven by the increasing use of coumarin as a fragrance ingredient, stabilizer, and enhancer in perfumes, deodorants, skincare, and grooming products. The growing consumer preference for premium, long-lasting, and nature-inspired fragrances has fueled the demand for coumarin-based formulations, particularly in high-end and mass-market personal care products.

Coumarin is widely used in perfume and deodorant formulations, thanks to its distinct sweet, vanilla-like, and warm scent that enhances fragrance complexity and longevity. As global demand for luxury and niche perfumes rises, leading fragrance manufacturers are incorporating coumarin in various compositions. Consumers, particularly in Europe and North America, are increasingly investing in high-end fragrances, while emerging markets in Asia-Pacific and the Middle East are witnessing a surge in demand for affordable yet sophisticated perfumes, further strengthening coumarin’s presence in the sector.

Global Coumarin Market, By End-Use, 2020-2024 (USD Mn)

End-Use 2020 2021 2022 2023 2024 Personal Care & Cosmetics 88.4 92.7 97.3 102.0 107.3 Pharmaceutical 60.4 63.1 66.1 69.3 73.2 Others 16.6 17.3 18.0 18.6 19.4 Key Market Segments

By Type

- Simple Coumarins

- Furocoumarins

- Dihydrofurocoumarins

- Pyranocoumarins

- Phenylcoumarins

- Biscoumarins

By End-Use

- Personal Care & Cosmetics

- Pharmaceutical

- Others

Drivers

Rising Demand in the Fragrance and Cosmetics Industry is Estimated to Boost The Coumarin Market

The growing demand in the fragrance and cosmetics industry is a major factor driving the expansion of the global coumarin market. Coumarin, a naturally occurring aromatic compound, is widely used as a fragrance ingredient, stabilizer, and enhancer in perfumes, deodorants, and various personal care products. As consumer preferences shift towards premium, long-lasting, and nature-inspired fragrances, the demand for coumarin-based formulations has surged, positioning it as a key ingredient in the cosmetic and perfumery industries.

The fragrance industry is witnessing a prominent shift towards premium and niche perfumes, where natural and exotic ingredients are highly valued. Coumarin, known for its warm, sweet, and vanilla-like scent, is widely used as a fixative in fine fragrances, enhancing the longevity and depth of perfumes. As global consumers, especially in North America and Europe, show a growing preference for luxury and artisanal perfumes, fragrance manufacturers are incorporating coumarin into their high-end formulations. The ability of coumarin to complement various floral, woody, and oriental notes makes it an essential component in modern perfumery.

Restraints

Stringent Regulatory Restrictions May Hinder The Growth Of The Market For A Certain Extent

Despite the growing demand for coumarin in various industries, stringent regulatory restrictions pose a significant challenge to the market’s expansion. Regulatory bodies such as the European Food Safety Authority (EFSA), the U.S. Food and Drug Administration (FDA), and the International Fragrance Association (IFRA) have imposed strict guidelines on coumarin usage due to potential health concerns, particularly its toxicity at high concentrations. These regulations affect its application in food, pharmaceuticals, and personal care products, leading to limitations that could restrict market growth to a certain extent. The increasing regulatory scrutiny surrounding coumarin has forced manufacturers to invest heavily in compliance and safety assessments, which adds to production costs.

Companies must conduct rigorous testing, quality control measures, and documentation to meet regulatory standards, especially when exporting to regions with strict policies such as the European Union and North America. Additionally, different countries have varying regulatory frameworks, making it challenging for global manufacturers to standardize their production and distribution strategies. This lack of uniformity in regulations can create market entry barriers, limiting the expansion of coumarin-based products across multiple geographies.

While the coumarin market holds significant growth potential, stringent regulatory restrictions act as a limiting factor by curbing its use in food, cosmetics, pharmaceuticals, and fragrances. Concerns over toxicity, allergenic reactions, and liver damage have led to maximum allowable limits, bans in certain applications, and increased compliance costs for manufacturers. Moving forward, the market will likely see a shift towards synthetic and naturally-derived alternatives, as companies seek safer and more regulation-compliant solutions to sustain growth in an increasingly restricted environment.

Opportunity

Expansion in Pharmaceutical Applications

The growing demand for coumarin in pharmaceutical applications is unlocking new opportunities for market expansion, as researchers and manufacturers explore its diverse therapeutic benefits. Coumarin and its derivatives exhibit anticoagulant, anti-inflammatory, antimicrobial, anticancer, and antioxidant properties, making them valuable compounds in modern medicine. With advancements in pharmaceutical research and the increasing prevalence of chronic diseases, the utilization of coumarin in drug formulations is expected to rise, contributing to the overall growth of the global coumarin market. One of the most significant pharmaceutical applications of coumarin is its role in the production of anticoagulant drugs (blood thinners), such as Warfarin and Acenocoumarol. These medications are widely prescribed for preventing blood clots, treating deep vein thrombosis (DVT), and reducing the risk of stroke in patients with cardiovascular diseases.

Given the increasing incidence of heart diseases, hypertension, and other blood circulation disorders, the demand for anticoagulants is rising, thereby driving the demand for coumarin derivatives in pharmaceutical formulations. Recent pharmaceutical research and clinical studies have shown that coumarin and its derivatives possess anticancer properties, leading to their inclusion in experimental and targeted cancer therapies. Certain coumarin-based compounds have demonstrated the ability to inhibit tumor growth, induce apoptosis in cancer cells, and enhance the effectiveness of chemotherapy drugs. As the prevalence of cancer cases rises globally, pharmaceutical companies are increasingly investing in coumarin-derived drug formulations, creating a lucrative market opportunity.

Trends

Growing Trend of Natural and Organic Shift

The rising consumer preference for natural and organic products is significantly shaping the global coumarin market, as industries increasingly shift towards sustainable, plant-based, and chemical-free formulations. Coumarin, a naturally occurring compound found in plants such as tonka beans, cinnamon, and sweet clover, has gained popularity as a fragrance enhancer, fixative, and stabilizer in the personal care, cosmetics, and pharmaceutical industries. With the clean beauty movement and eco-conscious consumer behavior on the rise, the demand for naturally derived coumarin is witnessing substantial growth.

Consumers today are more aware of the potential risks associated with synthetic chemicals in personal care and cosmetic products. Several artificial fragrance compounds have been linked to skin irritations and health concerns, prompting a shift towards natural alternatives. Coumarin, with its warm, sweet, and vanilla-like aroma, is widely used as a naturally sourced fragrance ingredient, replacing synthetic additives in perfumes, deodorants, and skincare products.

As the demand for plant-based and non-toxic formulations increases, naturally extracted coumarin is becoming a preferred choice in the fragrance and beauty industries. Government agencies and regulatory bodies, especially in Europe and North America, are increasingly imposing restrictions on synthetic fragrance components and artificial additives in cosmetics and personal care products. Regulations on phthalates, parabens, and other synthetic fixatives have led manufacturers to explore natural alternatives such as coumarin, which provides both fragrance enhancement and longevity. The EU’s stringent fragrance regulations and the U.S. FDA’s oversight of synthetic chemicals in skincare are further encouraging brands to shift towards naturally derived coumarin.

Geopolitical Impact Analysis

Disruptions In The Global Supply Chain Owing to Geopolitical Tensions Negatively Impact the Growth of the Coumarin Market

Coumarin is primarily derived from natural plant sources such as tonka beans, cinnamon, and sweet clover, with major production hubs located in Asia-Pacific, Latin America, and Africa. Additionally, synthetic coumarin production relies on key chemical intermediates, which are sourced from major chemical manufacturing nations such as China, India, and Germany. Geopolitical tensions, particularly trade conflicts between the U.S. and China, Russia-Ukraine tensions, and European Union regulatory shifts, have disrupted the availability of essential raw materials, leading to delays in production and increased material costs. For instance, the Russia-Ukraine war resulted in global economic instability, affecting energy prices and raw material transportation costs.

Several chemical plants in Europe faced operational hurdles due to natural gas shortages, as Russia is a key supplier of energy to European industries. The chemical sector, which produces essential precursors for synthetic coumarin, has faced production slowdowns, supply chain blockages, and regulatory uncertainty, ultimately impacting the availability of coumarin-based products. Trade conflicts and geopolitical instability have also led to higher import/export tariffs and supply chain inefficiencies, directly affecting the coumarin market.

Countries similar to China and India, which dominate the production of both natural and synthetic coumarin, have faced export restrictions, supply chain bottlenecks, and increased trade tariffs, making it more expensive and difficult for global buyers to source coumarin. For instance, China’s environmental regulations and trade tensions with the U.S. have led to temporary shutdowns of chemical manufacturing plants, further reducing the supply of synthetic coumarin. Similarly, India, another key player in chemical exports, has faced rising production costs due to currency fluctuations, energy price volatility, and geopolitical instability in the region. These factors have led to higher prices for coumarin and its derivatives, making it less competitive in global markets.

Regional Analysis

North America Held the Largest Share of the Global Coumarin Market

In 2024, North America dominated the global coumarin market, accounting for 39.3% of the total market share, driven by strong demand across multiple industries, including fragrances, personal care, pharmaceuticals, and agrochemicals. The region’s well-established consumer base, high spending capacity, and presence of leading fragrance and pharmaceutical companies have contributed significantly to market growth. North America is home to some of the largest pharmaceutical companies in the world, including Pfizer, Johnson & Johnson, and Merck, which use coumarin derivatives for medical applications. Coumarin-based compounds are widely utilized in anticoagulant medications (e.g., warfarin), anti-inflammatory drugs, and cancer treatments.

The region’s strong focus on research and development (R&D) in pharmaceuticals has led to increased demand for coumarin as a raw material in drug formulations. Additionally, aging populations and rising healthcare expenditures have further fueled market expansion in the pharmaceutical sector. North America’s regulatory agencies, such as the FDA (Food and Drug Administration) and EPA (Environmental Protection Agency), enforce stringent quality and safety standards for chemical and fragrance ingredients. While coumarin is restricted in food applications due to potential health risks at high doses, its regulated use in fragrances, cosmetics, and pharmaceuticals has enabled consistent market growth.

The region’s shift towards sustainable, plant-based, and synthetic bio-derived ingredients has further encouraged the development of eco-friendly coumarin formulations for clean beauty and natural personal care products. With ongoing advancements in clean beauty, sustainable sourcing, and pharmaceutical R&D, the region is expected to maintain its leading position in the coumarin market for the foreseeable future.

Global Coumarin Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 44.3 46.3 48.6 50.9 53.7 Europe 49.0 51.1 53.4 55.8 58.5 Asia Pacific 51.2 54.0 57.0 60.1 63.7 Middle East & Africa 10.0 10.3 10.7 11.1 11.6 Latin America 10.9 11.3 11.7 12.0 12.5 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Industry Leaders Employ Prominent Strategies Such As Product Innovation, Market Expansion, Sustainability Initiatives, And Partnerships And Collaborations.

To maintain a competitive edge, leading players in the global coumarin market adopt several key strategies, including product innovation, expansion into new markets, sustainability initiatives, and strategic partnerships and collaborations. These strategies help companies enhance product offerings, strengthen supply chains, meet evolving consumer demands, and comply with stringent regulatory frameworks. Below is an in-depth analysis of how each of these strategies is shaping the coumarin industry. As demand for high-purity, sustainable, and application-specific coumarin increases, companies are investing in new formulations, improved extraction techniques, and synthetic alternatives to cater to diverse industries such as fragrances, pharmaceuticals, agrochemicals, and food additives.

The major players in the industry

- LGC Standards Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- Chengdu Pukang Biological Technology Co., Ltd

- abcr GmbH

- Shanghai Ruifu Chemical Co., Ltd

- SYinnovation Co., Ltd

- DAYANG CHEM (HANGZHOU) CO., LTD

- Ality Group

- Amadis Chemical Company Limited

- Chemtour Biotech (Suzhou) Co., Ltd

- Others Key Players

Report Scope

Report Features Description Market Value (2024) US$ 200.0 Mn Market Volume (2024) XX Ton Forecast Revenue (2034) US$ 361.0 Mn CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Up To 99% & Above 99%), By End-Use (Pharmaceuticals, Cosmetics and Chemical Synthesis) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape LGC Standards Ltd., FUJIFILM Wako Pure Chemical Corporation, Chengdu Pukang Biological Technology Co., Ltd., abcr GmbH, Shanghai Ruifu Chemical Co., Ltd, SYinnovation Co., Ltd, DAYANG CHEM (HANGZHOU) Co., Ltd, Ality Group, Amadis Chemical Company Limited, Chemtour Biotech (Suzhou) Co., Ltd, Others Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LGC Standards Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- Chengdu Pukang Biological Technology Co., Ltd

- abcr GmbH

- Shanghai Ruifu Chemical Co., Ltd

- SYinnovation Co., Ltd

- DAYANG CHEM (HANGZHOU) CO., LTD

- Ality Group

- Amadis Chemical Company Limited

- Chemtour Biotech (Suzhou) Co., Ltd

- Others Key Players