Global Corn and Callus Remover Market By Product Type (Liquid, Gel & Cream, and Pad), By Distribution Channel (Pharmacies, Retail Stores, and Online Platforms), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157310

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

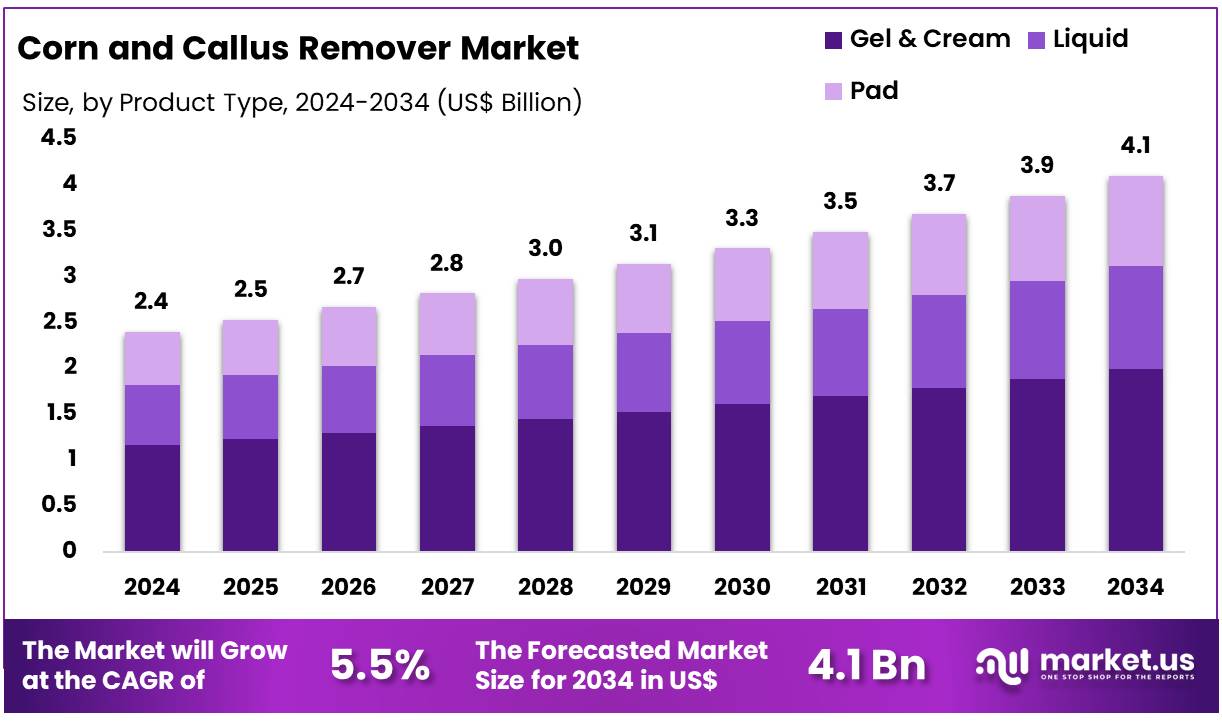

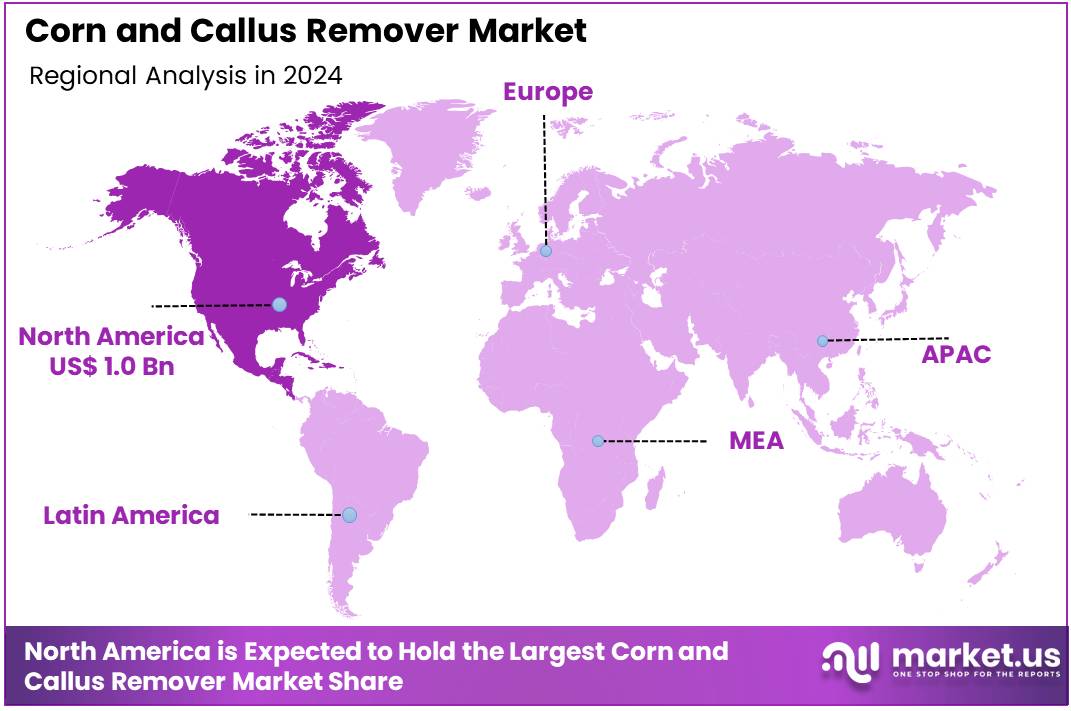

Global Corn and Callus Remover Market size is expected to be worth around US$ 4.1 Billion by 2034 from US$ 2.4 Billion in 2024, growing at a CAGR of 5.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.7% share with a revenue of US$ 1.0 Billion.

Rising incidence of foot-related conditions and a growing focus on personal well-being are key drivers for the corn and callus remover market. Corns and calluses, which are areas of thickened skin caused by pressure and friction, affect a significant portion of the population, particularly older adults and those who are physically active.

The American Podiatric Medical Association (APMA) reports that approximately 5% of the US population has corns or calluses each year, yet many do not seek professional treatment. This high prevalence, combined with a rising preference for accessible, at-home solutions, creates a consistent and growing demand for products that offer effective self-treatment.

Growing consumer awareness and strategic brand positioning are shaping a significant trend in the market. Companies are investing in educational campaigns to highlight the importance of foot health and to reposition their products as a fundamental part of a holistic wellness routine. For example, in September 2022, Scholl’s Wellness Co. collaborated with renowned football coach Rex Ryan to raise awareness about proper foot care. This partnership not only enhanced the company’s global brand visibility but also stimulated market growth by educating consumers on the link between foot health and overall well-being, thereby broadening the appeal and utility of their products.

Increasing demand for non-invasive, over-the-counter solutions is creating new opportunities for market expansion. Consumers are actively seeking products that offer effective relief without requiring a visit to a podiatrist. Many of these products utilize keratolytic agents like salicylic acid to gently soften and remove hardened skin, offering a safe and convenient method for at-home care.

The US National Center for Health Statistics (NCHS) has also documented a substantial number of outpatient visits for foot-related issues, yet many individuals still manage their conditions at home, ensuring a steady demand for these products. This trend, coupled with the rising availability of diverse product forms, including medicated pads, gels, and electronic files, ensures that the market will continue to see strong and sustained growth.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.4 Billion, with a CAGR of 5.5%, and is expected to reach US$ 4.1 Billion by the year 2034.

- The product type segment is divided into liquid, gel & cream, and pad, with gel & cream taking the lead in 2023 with a market share of 48.6%.

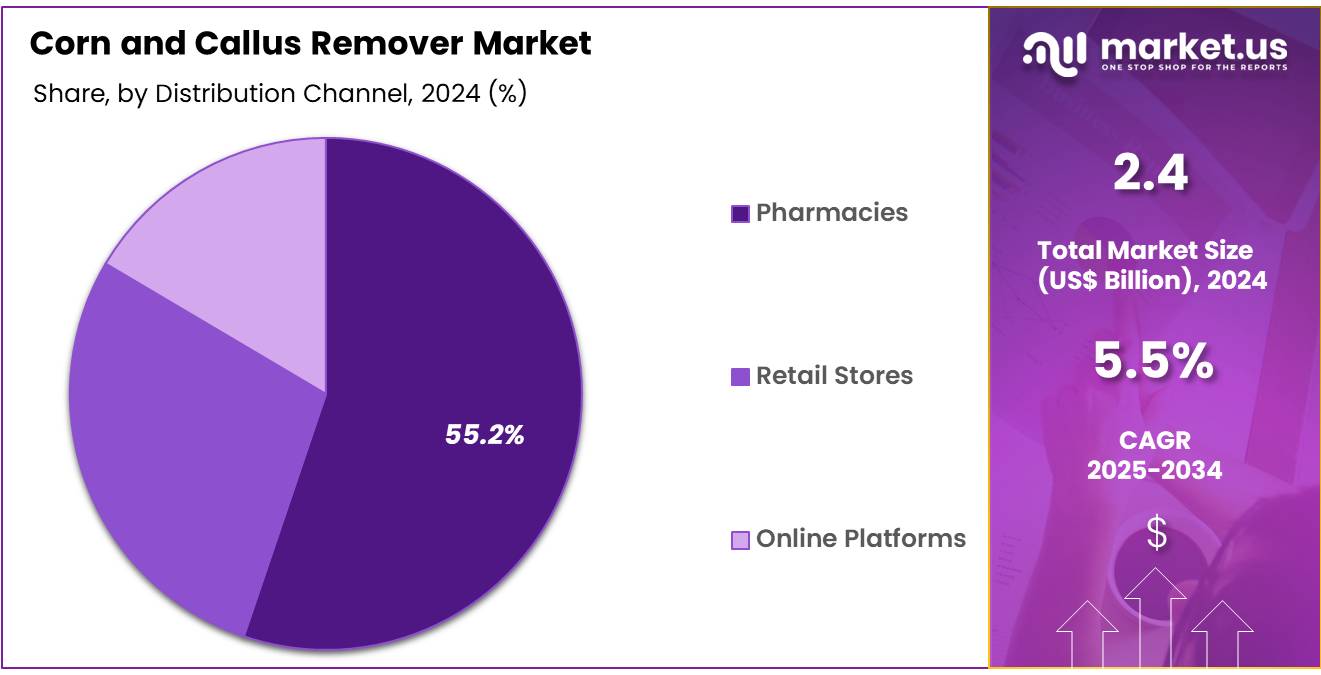

- Considering distribution channel, the market is divided into pharmacies, retail stores, and online platforms. Among these, pharmacies held a significant share of 55.2%.

- North America led the market by securing a market share of 41.7% in 2023.

Product Type Analysis

Gel & cream products dominate with a 48.6% share due to ease of application and fast-acting formula. Consumers are anticipated to prefer these over liquids and pads for precise treatment of corns and calluses. Dermatologists are likely to recommend gels and creams for home use. Formulations enriched with salicylic acid, urea, and natural moisturizers are projected to drive adoption. Major players, including Scholl and Dr. Scholl’s, are expected to launch advanced gels for sensitive skin. Clinical studies are projected to demonstrate higher efficacy of cream-based treatments.

Consumers value products that minimize pain and skin irritation. Packaging innovations, such as airless tubes, are likely to enhance convenience. Pharmacies are expected to promote these products through in-store displays. Regular marketing campaigns are anticipated to boost awareness. The combination of exfoliating and moisturizing properties is projected to attract repeat purchases. Salicylic acid-based gels are likely to be preferred for faster corn removal.

Dermatology clinics are expected to integrate creams in patient care kits. Seasonal foot care demand is projected to increase sales. Consumer reviews and recommendations are anticipated to influence purchasing decisions. Safety certifications and dermatologically tested labels are likely to build trust. Overall, gels and creams are projected to dominate due to convenience, effectiveness, and strong brand presence.

Distribution Channel Analysis

Pharmacies lead the distribution channel with a 55.2% share. Consumers are anticipated to purchase corns and callus removers from pharmacies due to professional guidance availability. Pharmacists are likely to recommend suitable products based on skin type and severity. Pharmacies offer credibility, which drives consumer confidence. Retail displays and promotional campaigns in pharmacies are projected to increase visibility. Pharmacy chains such as Boots and CVS are expected to stock premium and mid-tier products. Local foot care experts are likely to influence repeat purchases. Pharmacies are anticipated to expand product range with seasonal promotions.

Clinical consultations at pharmacies are projected to support product selection. Trust in pharmacist recommendations is likely to drive brand loyalty. Bundling products with foot care accessories is expected to enhance sales. Accessibility of products at neighborhood pharmacies is projected to favor convenience. Health awareness campaigns are likely to increase foot care adoption.

Pharmacies are anticipated to adopt private label corn removers for competitive pricing. Partnerships with dermatology brands are projected to strengthen credibility. Pharmacies are likely to integrate digital catalogs for consumer guidance. Overall, pharmacies are projected to dominate the channel due to professional advice, accessibility, and trust factors.

Key Market Segments

By Product Type

- Liquid

- Gel & Cream

- Pad

By Distribution Channel

- Pharmacies

- Retail Stores

- Online Platforms

Drivers

The rising prevalence of foot-related conditions and an aging population are driving the market.

The corn and callus remover market is experiencing steady growth, driven by a combination of demographic shifts and a corresponding increase in foot-related ailments. As the global population ages, there is a natural rise in foot issues, which are often exacerbated by chronic conditions such as diabetes and arthritis. Furthermore, lifestyle factors such as increased obesity and professions that require prolonged standing contribute to the formation of corns and calluses due to constant pressure and friction.

These painful skin conditions represent a widespread and recurring problem for a large consumer base, creating a consistent and predictable demand for effective at-home and over-the-counter solutions. According to a 2023 review in the National Center for Biotechnology Information’s (NCBI) StatPearls database, the incidence of corns on the feet has been reported to range anywhere from 14% to 48% in various studies. This high prevalence underscores the foundational and ongoing need for products that offer relief and management for these common foot afflictions.

Restraints

The risk of improper use and potential for adverse events are restraining the market.

A significant restraint on the market is the inherent risk of consumer misuse and the potential for adverse events, which can deter new users and lead to negative publicity. Many corn and callus removers, particularly those with strong medicated ingredients like salicylic acid or sharp tools, can cause irritation, burns, or even infection if not used correctly. This risk is amplified for consumers with underlying health conditions, such as diabetes or poor circulation, who are more susceptible to complications. A single negative outcome, even if user-caused, can undermine consumer confidence in a brand or product category.

The US Food and Drug Administration (FDA)’s Manufacturer and User Facility Device Experience (MAUDE) database, which logs adverse event reports, shows specific instances of serious complications. For example, a 2024 report describes a consumer’s hospitalization due to an infection caused by a callus cushion, highlighting the potential for severe health outcomes from seemingly innocuous products. This data illustrates the critical need for clear instructions and safety warnings, as these risks act as a natural restraint on broader market adoption.

Opportunities

The increasing consumer focus on self-care and home-based treatments is creating growth opportunities.

A significant growth opportunity for this market stems from the global shift towards self-care and the increasing preference for convenient, home-based health solutions. Modern consumers are proactive about managing their health and are looking for accessible, non-invasive ways to address minor ailments without a trip to a doctor or podiatrist. This trend is driven by a desire for convenience, cost-effectiveness, and the empowerment of personal health management. Companies that can develop products that are not only effective but also easy to use and safe for at-home application are well-positioned to capitalize on this opportunity.

While a specific figure on consumer spending on these products is not directly provided by a government body, the US Bureau of Economic Analysis (BEA) reported that personal consumption expenditures for over-the-counter (OTC) drugs, which includes foot care, were a significant component of the overall US$1.85 trillion spent on healthcare services in the US in 2023. This robust consumer spending on self-care products provides a clear indication of a favorable market environment for innovation and growth.

Impact of Macroeconomic / Geopolitical Factors

The corn and callus remover market is navigating a complex macroeconomic and geopolitical landscape that impacts both consumer purchasing power and the stability of its supply chain. In the US, personal care product spending, a key indicator for this sector, increased by 5.9% in 2023, reflecting a continued willingness of consumers to invest in self-care. Geopolitical tensions and trade policies add significant cost pressures on the supply chain.

According to the International Trade Administration, certain podiatric instruments imported from China can be subject to tariffs of 25%, directly increasing the procurement costs for manufacturers and retailers. Despite these headwinds, the market’s fundamental drivers remain strong.

The CDC reports that foot problems affect a significant portion of the population, with over 60 million people in the US alone experiencing foot ailments annually. This high prevalence, combined with manufacturers’ strategic efforts to diversify their supplier bases and innovate their product lines, helps the industry absorb rising costs and ensures a more resilient supply of essential foot care instruments.

Latest Trends

The development of advanced ergonomic and formulation technologies is a recent trend.

A key trend in 2024 is the accelerated innovation in product design, focusing on improved ergonomics, comfort, and efficacy. Manufacturers are moving beyond traditional, rudimentary tools and single-use pads to develop sophisticated solutions that address specific consumer pain points. This includes the introduction of precision-engineered tools with ergonomic handles, electric callus removers with multiple speed settings, and medicated pads with advanced adhesive technologies for better comfort and stability. These innovations are designed to enhance the user experience and reduce the risk of improper application.

The US Patent and Trademark Office (USPTO) public search database shows a consistent stream of new intellectual property filings in this area. A review of patent application filings for 2023 and 2024 reveals a growing number of patents related to specialized foot care devices, with keywords like “ergonomic,” “electric,” and “medicated patch,” indicating a clear industry focus on advanced product development and technological sophistication to meet consumer demand for a more refined self-care experience.

Regional Analysis

North America is leading the Corn and Callus Remover Market

The North American market for corn and callus removers held a significant 41.7% share of the global market in 2024. This leadership is directly attributed to a high prevalence of foot-related conditions, a large and aging population, and a strong culture of self-care. The aging population in the United States and Canada is a key driver, as older adults are more susceptible to foot health issues. The Centers for Disease Control and Prevention (CDC) notes that a substantial portion of the population over age 65 experiences foot pain, which can lead to the formation of corns and calluses.

Furthermore, the National Safety Council reported that over 4.4 million people received treatment in emergency departments for injuries involving sports and recreational equipment in 2024, highlighting a large demographic that requires products for foot care and minor injury management. The market is also fueled by the widespread availability of these products through a robust retail and e-commerce infrastructure, which makes them highly accessible to a broad consumer base seeking convenient, at-home solutions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific corn and callus remover market is anticipated to experience robust growth during the forecast period. This is largely a result of a rapidly aging population, increasing disposable incomes, and a growing awareness of personal hygiene and health. The region’s dense populations and urbanization contribute to a high incidence of foot conditions that require preventative and corrective care.

The World Health Organization (WHO) highlights that the number of people aged 65 and over in Asia and the Pacific nearly tripled from 168 million in 1990 to 503 million in 2024, creating a substantial and growing demographic with age-related foot issues. Furthermore, the rising prevalence of chronic conditions like diabetes in the region is a major driver, as these conditions often lead to foot complications that require professional and at-home management. The market’s expansion is further supported by a growing consumer base that views foot care as a critical component of overall health, fueling demand for a variety of effective and accessible products.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the foot care products market are primarily focused on product innovation, particularly through the development of electric and mechanical devices that offer enhanced user convenience and at-home efficacy. They are also actively engaged in strategic digital marketing and e-commerce expansion to reach a broader, more tech-savvy audience, leveraging the convenience of online shopping to drive sales.

Additionally, companies are pursuing strategic acquisitions and partnerships to expand their product portfolios and access new technologies. This combination of advanced product development and sophisticated marketing is essential for maintaining a competitive edge and meeting the evolving needs of consumers.

Kenvue, Inc., a major global consumer health company, has a significant presence in this sector through its iconic Dr. Scholl’s brand. The company’s business model is centered on a deep commitment to consumer-focused wellness, offering a wide range of products that promote foot comfort, support, and relief. Kenvue’s strategy involves leveraging its extensive research and development capabilities to create innovative products, while also using its vast global distribution network to ensure widespread product availability. The company’s focus on brand recognition and continuous innovation makes it a key player in the global health and wellness market.

Top Key Players

- Valiant Pharmaceuticals

- Suu Balm

- Scholl’s

- Reckitt Benckiser

- ProFoot

- Medline Industries

- Johnson and Johnson

- CuraSkin

- Blistex

- Bayer

Recent Developments

- In April 2024, Scholl’s Wellness Co. announced an exciting partnership with three-time Olympic gold medalist Gabby Douglas. This collaboration was launched to champion foot health and wellness, with Douglas starring in a new marketing campaign to educate consumers on the importance of proper foot care, a key driver for products that address common ailments like corns and calluses.

- In 2024, Blistex, Inc., a key player in personal care, expanded its foot care product offerings. According to its company website and product catalogs for the year, Blistex introduced a new line of advanced foot balms and creams.

Report Scope

Report Features Description Market Value (2024) US$ 2.4 Billion Forecast Revenue (2034) US$ 4.1 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid, Gel & Cream, and Pad), By Distribution Channel (Pharmacies, Retail Stores, and Online Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Valiant Pharmaceuticals, Suu Balm, Scholl’s, Reckitt Benckiser, ProFoot, Medline Industries, Johnson and Johnson, CuraSkin, Blistex, Bayer. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Corn and Callus Remover MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Corn and Callus Remover MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Valiant Pharmaceuticals

- Suu Balm

- Scholl's

- Reckitt Benckiser

- ProFoot

- Medline Industries

- Johnson and Johnson

- CuraSkin

- Blistex

- Bayer